Grounds for terminating an employment contract

The Labor Code of the Russian Federation states that a proposal to terminate a work contract can come from both the employee and his employer. If any reason for dismissal is acceptable for an employee, ranging from the objective impossibility of continuing to work and ending with a banal reluctance to work in a specific company in a specific position, then the employer must approach the issue of dismissal more carefully and justify his desire to part with the employee documented and very carefully. The law protects the rights of working citizens, so it is not enough for an employer to just want to get rid of an unwanted employee. Unlawful dismissal or violation of a worker's rights during the dismissal process may result in lawsuits and proceedings.

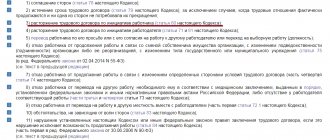

Article 77 of Chapter 13 of the Labor Code of the Russian Federation states that general grounds for termination of an employment contract include:

- agreement of the parties (Article 78 of the Code);

- expiration of the employment contract (Article 79 of the Code), except for cases where the employment relationship actually continues and neither party has demanded its termination;

- termination of an employment contract at the initiative of the employee (Article 80 of the Code);

- termination of an employment contract at the initiative of the employer (Articles 71 and 81 of the Code);

- transfer of an employee, at his request or with his consent, to work for another employer or transfer to an elective job (position);

- the employee’s refusal to continue working in connection with a change in the owner of the organization’s property, a change in the jurisdiction (subordination) of the organization or its reorganization (Article 75 of the Code);

- the employee’s refusal to continue working due to a change in the terms of the employment contract determined by the parties (part four of Article 74 of the Code);

- the employee’s refusal to transfer to another job, required for him in accordance with a medical certificate issued in the manner established by federal laws and other regulatory legal acts of the Russian Federation, or the employer’s lack of relevant work (parts three and four of Article 73 of the Code);

- the employee’s refusal to be transferred to work in another location together with the employer (part one of Article 72.1 of the Code);

- circumstances beyond the control of the parties (Article 83 of the Code);

- violation of the rules for concluding an employment contract established by this Code or other federal law, if this violation excludes the possibility of continuing work (Article 84 of the Code).

The Labor Code of the Russian Federation also contains other reasons for early termination of a contract (see Chapter 13 of the Labor Code of the Russian Federation).

Video: grounds for termination of an employment contract

How to formalize the termination of an employment contract if its validity period has expired

Termination of an employment contract: schematically

All the subtleties of the process of dismissing an employee related to the expiration of the employment contract are set out in paragraph 2 of Art. 77 TK. If the labor relationship was not actually terminated, and neither one nor the other party demands that it be terminated, the grounds for dismissal lose legal force.

Important! Dismissal after the expiration of the period for which the contract was drawn up is permitted only in situations where such a document is of an urgent nature. The following reasons may serve as grounds for termination:

- the return to work of the employee in whose place the employee was hired.

- completion of the work for which the employee was hired.

- if the period during the performance of seasonal or other labor duties has expired.

It is the employer's responsibility to notify the employee of dismissal at least three days before the date on which the employment contract expires. In the event that an employee has been hired to fill the position of someone who is temporarily absent, the employer retains the right not to notify of the upcoming dismissal.

If a notice of termination of an employment agreement is issued, then this should be done in writing with the obligatory signature of the employer and the employee himself. if the employee is not on site, then the notification is sent to him by registered mail, which must also include a list of the contents.

In this situation, it is necessary to confirm the expiration of the document. So, for example, if an employee was hired temporarily to replace another employee, then any document indicating that the absent employee has returned to his place can serve as a confirming factor. If the validity period of the contract is stated directly in the document itself, then it can become the necessary confirmation.

After notifying the employee and expiration of the contract, the dismissal should be properly formalized. This is done according to the same rules as dismissal by agreement of the parties.

Guarantees for an employee upon termination of an employment contract

The guarantees and compensation to which every working Russian is entitled upon termination of an employment contract are regulated by Chapter 27 and Articles 178–181 of the Labor Code of the Russian Federation. By guarantees we mean a set of opportunities for the implementation of labor rights available to an employee. Compensation refers to financial payments that are designed to reimburse an employee for the costs caused by his employment or other obligations in accordance with the Labor Code of the Russian Federation.

The main guarantees are determined by the fact that the Labor Code clearly regulates the list of grounds and rules for terminating an employment contract. Article 178 determines the right of a resigning employee to receive severance pay. In case of layoffs due to the liquidation of a company or staff reduction, the employer is obliged to pay severance pay (average monthly salary), as well as provide payments while looking for another job (no more than two average monthly salaries). The employer is obliged to pay severance pay equal to two weeks' average earnings when the contract is terminated under the following circumstances:

- non-compliance of the employee with fulfilled obligations in terms of medical indicators;

- conscription of an employee to military or civilian alternative service;

- the need to reinstate the employee who previously performed these duties;

- disagreement of the employee to move for the employer to another area.

The amount of severance compensation and cases of their payment can be adjusted directly in the contract concluded with the employee. In addition to benefits, if provided, the dismissed person has the right to receive full salary for the days worked before dismissal, as well as payments for accrued vacation days that he did not have time to take off.

Article 179 regulates the rights of working citizens in case of staff reduction and states that the greatest chances of retaining their jobs are guaranteed to the most qualified specialists who ensure maximum productivity. Under other identical circumstances, preference is given to:

- family workers who care for at least two dependents;

- employees who provide the only source of income in the family;

- employees who received an occupational disease or injury while working for the company;

- WWII veterans and disabled combat veterans;

- employees who improve their skills in the employer’s profile without interrupting their work activities.

The collective agreement often designates other groups of people who benefit from dismissal due to staff reduction.

When reducing staff, the employer is obliged (see Article 180):

- notify the employee personally and against signature no later than two months in advance about upcoming changes;

- offer the dismissed employee an alternative position that corresponds to the professional competencies of the laid-off employee.

The employer has the authority to terminate the contract without notice two months in advance with payment of two average earnings and dismiss the employee if he has the latter’s written consent.

Article 181 of Chapter 27 of the Labor Code of the Russian Federation protects the rights of top management upon dismissal due to a change in the owner of the organization. According to this article, a dismissed top manager must receive a benefit of at least three monthly salaries.

There are also some special guarantees that apply to certain categories of workers, which include, for example, pregnant women, women with children, minors, disabled people, and so on. Thus, an employer does not have the legal ability to fire a woman expecting the birth of a child or a working mother against their will, except in the event of liquidation of the company. If the employment contract with an employee in an interesting position expires, the employer is obliged to extend its term before the start of maternity leave.

An employer may dismiss a minor employee (not older than 18 years) only if this action is approved by social services responsible for protecting the rights of minors. In addition, the employer is, in principle, deprived of the opportunity to fire anyone while on vacation or sick leave. The only exception is the case of liquidation of the enterprise.

It is important to understand that the listed guarantees are available for implementation only if the employee conscientiously performs his job duties. An employee must not abuse labor rights, hide significant information about his health, membership in trade unions and other circumstances that are significant when terminating a work contract.

Video: guarantees for minors upon termination of an employment contract

Rules for terminating an employment contract

Termination of an employment contract is a standard bureaucratic procedure, the implementation of which is the responsibility of HR department specialists. Depending on what exactly was the basis for dismissal, this procedure will consist of various stages. For an employee leaving the company of his own free will, the dismissal process includes several stages:

- notifying the company management of the planned departure by submitting an application;

- working off the deadline set before leaving (the maximum duration of work is fourteen days);

- On the final day of work, you will receive a complete financial statement, as well as a work book and other documents.

The dismissal procedure initiated by the employer looks a little different:

- warning the employee that the company would like to say goodbye to him;

- coordination of dismissal with special bodies;

- preparation of a document that will be the basis for dismissal;

- preparation of documents in the personnel service and performing financial calculations;

- issuing to the employee all required documents and compensation.

From the point of view of the HR department, in order to correctly formalize the dismissal, it is required:

- receive a properly drawn up resignation letter or other basis for registration of dismissal;

- issue an appropriate order;

- calculate the due financial compensation and complete the full calculation;

- add the required entry to the work record;

- issue the employee with the required documents.

The day the contract ends is the day specified in the resignation letter or other document that will be accepted as the basis for dismissal. In case of early termination of the working relationship, at the request of the employee, the final working day is named in his application; in case of dismissal by mutual agreement of the parties, the final day is indicated in the relevant agreement; in case of termination of the contract, at the request of the employer, the date is stated in the notice of dismissal. The date of dismissal is always identical to the date of the final working day. The only exception is dismissal for absenteeism. In this case, the employee’s final day of work is considered to be the day on which he last visited his workplace. The employer does not have the authority to independently change the date of the final day of work specified in the document grounds for dismissal, since thereby he violates the rights of the employee. If the named date falls on a weekend or a public holiday, the final working day will be the first working day following this weekend.

Video: termination of an employment contract

Application for termination of contract at the request of the employee

The dismissal process initiated by an employee starts with the submission of a letter of resignation from the company. There are certain requirements for the content of this document, as well as for the methods of its registration. In addition, the law provides for the possibility of withdrawing an application when appropriate circumstances arise.

How to make an application

The Labor Code of the Russian Federation does not dictate clear requirements for the preparation of an application for termination of an employment contract, and a resignation letter can be drawn up in any form, but it must always include the following information:

- Full name and position of the person leaving;

- Company name;

- a clear date of dismissal.

The document must be drawn up personally by the employee leaving the company and written by hand. The application is usually addressed to the person authorized in the given company to make decisions on the dismissal of employees. Most often, such documents are addressed to the general director of the enterprise.

Experts advise avoiding using the preposition “from” when indicating the date of dismissal. In other words, instead of the words “I ask you to fire me on October 15,” it is recommended to write “I ask you to fire me on October 15.”

The photo gallery below shows templates for filling out resignation letters.

Photo gallery: samples of resignation letters on various grounds

Moving a spouse to another area for work is grounds for dismissal without service.

Medical certificates may be required as supporting documents for such an application.

The application must indicate the date of dismissal

Reaching retirement age is the basis for dismissal of an employee at his request without service

The author’s personal practice shows that there is no particular need to worry too much about what format to write the application in and what should or should not be included in it. Monitoring the correctness of execution of such documents is the responsibility of the company’s personnel service, and the specialists of this service are directly interested in ensuring that everything is done correctly. The author of this material had to go through the dismissal procedure several times in various organizations, and each time the HR department staff kindly provided the necessary templates and consultations in order to prevent errors and minimize the time spent on this work.

How to apply

The completed application must be submitted to the manager for signature or transferred to personnel officers. In a standard situation, the application is supposed to be submitted to superiors fourteen days before the desired date of dismissal. This two-week period is called working off. Workout is necessary for the company to find a new candidate for the vacant position, and also so that the employee leaving the company can calmly and plannedly complete the projects he has started or transfer them to colleagues. There are a number of situations when an application can be submitted three days before departure or even one day.

You can submit your application personally to your manager or HR specialist. In some cases, it is recommended to follow a more formal procedure in order to protect yourself from possible problems in the future. Often, managers are not ready to let a specialist leave the workplace for various reasons. Such situations arise when we are talking, for example, about a valuable, proven employee or a specialist with rare qualifications. The reasons why an employer is not ready to part with an employee can be very different, but the methods that the employer resorts to to force the employee to stay are almost always the same, from persuasion and promises of promotion and salary increases to blackmail and threats to fire under the article, if the employee does not withdraw his resignation letter.

If the employee is ready to accept the promotion offer, the issue is resolved to the mutual benefit of the parties, but if the employee still intends to leave the company, it is important to know that management’s threats to “expel him under the article” are groundless. Firstly, according to the law, the employer does not have permission to retain an employee against the latter’s will. Secondly, dismissal under the article is impossible after registering an application of one’s own free will. If the manager still refuses to sign the application, it is recommended to register it in the office of the company or with the secretary. It is required to prepare a duplicate of the application in advance and ask a colleague working in the office to put on it the date and number under which the new incoming document is registered. This duplicate will confirm that management is aware of the employee’s intention to leave the company.

When a resigning citizen does not have the opportunity to personally register his application, it is possible to resort to the services of postal services and send a notice of dismissal by telegram or registered mail with a list of the contents and with a notification of delivery to the manager personally. The day of notification will be the day the correspondence is delivered to the addressee. Then the employee can count the required period of work from the day of notification and, on the final day of work, demand a full payment be made, as well as issue a work permit and other documents.

When planning to leave a company, it is useful to remember that the mandatory service period, which in standard cases lasts fourteen days, also includes weekends and holidays. The author of this article once managed to take advantage of this fact in order to minimize the period of service upon dismissal. A small trick was that the application for dismissal was submitted on December 28, on the eve of the long New Year and Christmas holidays. With the help of this maneuver, the author was able to not work for most of the working period. Of course, the employer may not like such a technique and complicate the transfer of work to colleagues remaining in the company, however, if you approach the dismissal process systematically, you can plan the completion of work projects in advance and have time to quickly resolve all work issues.

Video: form and registration of resignation letter

How to withdraw an application

The legislation leaves working citizens the opportunity to withdraw their resignation at their own request. You don’t need any special reasons for this; it’s enough to simply change your mind and no longer want to leave the company. To realize this opportunity, the employee only needs to verbally or in writing inform his superiors about his desire to stay. When making an oral communication (in a personal meeting or in a telephone conversation), it is advisable to ensure that there are witnesses who, if necessary, can confirm in court or other authorities the fact that the resignation letter was withdrawn by the employee. Unfortunately, it is not always possible to find witnesses, so the most preferable option is still a written notification (an official statement through the office, an e-mail message, a telegram or a registered letter with return receipt sent via the postal service).

Video: withdrawal of resignation letter

Notice of termination of an employment contract at the initiative of the employer

There are no requirements in the law to use a standardized form for issuing a notice of termination of a contract, therefore it is possible to issue this document in a free format. However, the notice must reflect some points:

- reason for dismissal;

- details of the contract to be terminated;

- information about the persons who entered into the terminated contract.

The notice must be signed by the head of the company, the personnel officer and the dismissed employee. By signing, the employee confirms that he was familiarized with this document in a timely manner.

The notice is drawn up in two copies, one of which remains with the employer, and the other is given to the dismissed employee. The illustration below shows a sample of such a notice.

There is no standardized form for compiling a notification

There are various ways to familiarize an employee with a document:

- hand over personally against signature;

- if the employee is absent from work, send a notification by registered mail with a list of the contents and return receipt requested.

Many experts recommend using the second option, since it allows you to obtain documented confirmation of the fact that you received a message about the termination of the contract. If an employee refuses to receive a notice, it is necessary to draw up a document recording this.

The notice period for an employee may vary depending on the reasons leading to dismissal. Thus, when reducing staff, it is necessary to give notice to employees at least two months before the date of separation, and dismissal for misconduct or absenteeism can be done even the very next day.

Video: dismissal at the initiative of the employer

Order to terminate the employment contract

The law does not dictate specific requirements for drawing up an order to terminate a contract. Nevertheless, there is a standardized form of the T8 order, which is preferred to be used in many companies, since this form is easily available in various accounting and personnel document management programs. The order must reflect the following information:

- Company name;

- registration number and date of publication of the document;

- details of the contract to be terminated;

- Full name and position of the dismissed employee, as well as the structural unit to which he belongs;

- grounds for termination of the contract with reference to the paragraph and article of the Labor Code of the Russian Federation corresponding to this ground;

- signature of the director of the enterprise.

The order is dated the employee’s final day of work. The illustration below shows a template of an order filled out in the T8 form.

The dismissal order can be drawn up using other templates

It is not necessary to certify the document with the organization's seal. However, it is imperative to familiarize the dismissed specialist with the order. After reviewing the document, the person resigning must leave his signature on it as a sign of confirmation of this fact. If for some reason it is not possible to familiarize the employee with the order (for example, the employee is absent from work or refuses to familiarize himself with the document), the HR specialist makes a note about this on the document. The person resigning has the right to request a certified duplicate of the order regarding his or her dismissal.

Personal observations of the author of this material show that you should never neglect the opportunity to obtain a duplicate of the dismissal order. One of the author's former colleagues had the habit of always requesting a copy of the dismissal order when parting with the organization. Thanks to this habit, the named colleague was able to confirm his work experience when, by coincidence, his work record book was irretrievably lost. The colleague acted very wisely by receiving duplicate orders immediately upon dismissal. In fact, it turned out that some of the enterprises in which he worked during his career were simply liquidated, reorganized, or moved to other cities at the time his work record was restored.

Work book upon dismissal

When leaving an enterprise, an employee is supposed to receive, among other documents, a work book. The entry of any marks into the labor record is carried out in strict accordance with the requirements of Section 5 of Instruction No. 69, approved by the Resolution of the Ministry of Labor of the Russian Federation of October 10, 2003. In accordance with the above instructions, the labor document must indicate:

- record number in order;

- date of departure;

- reason for leaving;

- details of the document providing grounds for leaving.

The newly completed employment page is certified by the company seal, the signature of the person leaving, as well as the signature of the specialist responsible for completing the record, or the signature of the head of the company. The following is an example of making an entry in a work record.

All entries in the labor record must be made in strict accordance with legal requirements.

Upon written request of the employee, he is also provided with the following documents:

- salary certificate for the current and two previous years (for calculating social insurance benefits);

- certificate of average earnings (to calculate the amount of unemployment benefits);

- a certificate in form 2-NDFL with information about the employee’s income from the beginning of the year until the moment of dismissal.

Upon dismissal, the following documents must also be issued:

- section 3 “Personalized information about insured persons” of the calculation of insurance premiums (Appendix No. 1 to the Order of the Federal Tax Service of October 10, 2016 N ММВ-7–11 / [email protected] ) with individual information of the employee for the period from the beginning of the quarter to the date of his dismissal;

- form SZV-M (approved by Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 N 83p) for the month of dismissal of the employee, containing information only about him;

- form SZV-STAZH.

An employee who leaves the company for the purpose of retirement, upon request, also receives information about his work experience in the form of a copy of the SPV-2 form sent to the pension fund.

The employee's employment certificate is supposed to be handed out to the person resigning on his/her final working day. If the employee does not show up at the workplace on this day, the personnel service has the right to send him a notice to his home address asking him to appear to receive a work permit. From the day this notice is sent, the employer ceases to be responsible for the delay in issuing the work permit. Similarly, with the permission of the person who resigned, personnel officers can send him a work book via postal or courier service.

If the work book is not handed over to the person resigning on the final working day due to the fault of the employer, the latter will bear financial responsibility. The law obliges the employer to pay the employee the earnings not received due to his deprivation of the opportunity to work (see Article 234 of the Labor Code of the Russian Federation).

Registration procedure

Regardless of the initiator of the procedure, the general procedure for terminating an employment contract consists of several stages (Article 84.1 of the Labor Code), proceeding in the following order:

- Initiation of the procedure by the employer, employee or jointly.

- Carrying out actions required by law depending on the grounds for dismissal (for example, an employee notifying the employer when terminating the contract at his own request).

- Issuance of a dismissal order by the manager.

- Payment to the dismissed person of all amounts due by law, labor or collective agreement or agreement on the last day of work.

- Issuing, at the request of the employee, on the day of dismissal, a work book and other documents or duly certified copies of them related to work.

Final payment upon dismissal

Upon separation from the company, the employee is entitled to the following payments:

- salaries for days worked before leaving;

- compensation for days of vacation not taken;

- severance pay (if provided for by agreement of the parties or employment contract).

Funds accrued for the performance of labor duties are subject to personal income tax; payments for unused vacation days in 2018 are also taxed at a rate of 13% for residents of the Russian Federation and at a rate of 30% for non-residents. Insurance premiums are paid in full.

Upon separation by agreement of the parties, funds paid under the termination agreement are subject to personal income tax only to the extent that it exceeds three times (six times for enterprises operating in the Far North) the average monthly salary of the employee (see Letter of the Ministry of Finance of Russia dated February 13, 2015 No. 03–04– 06/6531). A similar situation is true for the payment of severance pay to employees resigning for other reasons (see paragraphs 1, 6, 8, paragraph 3, Article 217 of the Tax Code of the Russian Federation). In these cases, there is also no need to pay insurance premiums.

The total amount of compensation to be paid is indicated in a special document called a note-calculation. The form of primary documentation for accounting of labor and its payment T-61 for drawing up a note-calculation was approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1, but the law does not require its mandatory use. Many companies choose to use this form as a template for creating their own document form that needs to be drawn up in similar situations.

Responsibility for drawing up the calculation note lies on the shoulders of the HR employee, but the direct calculations for payments are carried out by the accountant. Form NoT-61 provides a calculation of average monthly earnings for payment of compensation for unused vacation or deduction for vacation used in advance. The columns of this document are filled out as follows:

- in column 3 “Payments taken into account when calculating average earnings, rubles.” the total amount of payments accrued to the employee for the billing period is displayed in accordance with the rules for calculating average earnings;

- columns 4 and 5 display the number of calendar (working) days and hours per hour worked in the billing period;

- the column “Number of hours of the billing period” is filled in when calculating the payment of compensation for unused vacation to an employee for whom summarized recording of working time is assigned;

- Column 19 displays the total amount of payments due to the employee upon dismissal.

The settlement note must be printed on one sheet of paper with a reverse side. The illustration below shows the form T-61.

A HR specialist is responsible for compiling this form, but all calculations are performed by an accountant