Domestic tax legislation changes frequently. One of the key innovations in recent years has been the linking of the amount of property tax for individuals to the cadastral value of the real estate they own. It is determined based on the results of the state cadastral assessment, which in the vast majority of cases are greatly inflated. The consequence of this is an increase in the amount of property tax. Therefore, there is nothing surprising in the relevance of the question of how to challenge the cadastral value of an apartment in order to reduce the amount of mandatory payments to the budget.

Why is cadastral value needed?

According to the Tax Code of the Russian Federation, this type of value is recognized as the basis for calculating tax. Accordingly, a decrease in cadastral value will lead to a decrease in tax. Similarly to calculating the tax from the cadastral value, the rent for land is also determined, where the cadastral value can also serve as the base.

What affects the recalculation of the cadastral value? So, the cadastral value has a direct impact on the determination of land tax and rent. For most individuals and firms, this cost item was insignificant, however, after the revaluation of the cadastral value, it increased significantly, and in a large number of cases its increase is not justified, since the acquired cadastral value is significantly higher than the market value.

Find out for free how to act correctly!

We will tell you for free how to act correctly in your situation.

Call us daily from 9:00 to 21:00 Moscow time

Definition and legal regulation

The cadastral value refers to the value of a real estate property, which is included in the Unified State Register of Real Estate. It is determined on the basis of the provisions of No. 273-FZ, adopted on July 3, 2021. Currently, the current version of the document was approved on July 29, 2017.

The value obtained as a result of the state assessment serves as the basis for determining the amount of tax on property owned by an individual. The following objects are subject to inclusion in the Unified State Register and, as a result, the establishment of cadastral value and subsequent taxation:

- privately owned plots of land;

- apartments, private residential buildings or premises;

- non-residential capital structures and buildings, as well as complexes of buildings, including commercial real estate;

- garden and country houses, outbuildings erected on land intended for personal and subsidiary farming, gardening or vegetable gardening.

An exhaustive list of such objects is given in Part 2 of the Tax Code of the Russian Federation (Article 378.2). The document came into force after the adoption of No. 117-FZ, signed by the President of the country on August 5, 2000. The current version of the Tax Code of the Russian Federation was approved on January 28, 2020.

Why change the cadastral value?

Challenging the cadastral value of a land plot is often of interest to aggrieved taxpayers. If the cadastral value is more than 30% separated from the market value, then there is every reason to start fighting for its reduction and, accordingly, a reduction in the tax base. For some property owners, the tax savings can be significant and amount to millions. If you are an ordinary owner of a small summer cottage in the Moscow region or beyond its territories, then it is better not to delay and also enter into battle. Having achieved the truth once, you will not have to pay increased tax on the cadastral value annually.

The need and grounds for challenging the state cadastral valuation

The cadastral value of the property was introduced in order to bring the tax base closer to the real value of the property. In practice, real estate valuations carried out under the control of government agencies often turn out to be significantly higher than the market price of an apartment, house or plot. The result of such an overstatement is an overpayment of property taxes.

The current legislation gives a positive answer to the quite logical question of taxpayers, whether it is possible to challenge the cadastral value of an object obtained as a result of a state assessment. The need for such an event does not raise any questions, since practice shows: a correctly conducted challenge to the cadastral value of a commercial property or apartment often allows one to reduce the tax by 2-3 times.

The procedure for challenging the value of a real estate property according to the cadastre is regulated by the provisions of No. 135-FZ, approved on July 29, 1998. Federal law defines the rules for valuation activities in Russia. The current version of the document was adopted on November 28, 2018.

The legal grounds for challenging the results of a state assessment are:

- inaccuracies or errors made in the calculations;

- lack of consideration of important features and characteristics of real estate;

- a decrease in the real value of a property due to changes in market conditions.

Important

. The current dispute procedure allows not only to reduce upcoming tax payments, but also to return part of previously made payments. As a result, the funds invested in the implementation of the event, for example, for an independent assessment of an individual’s real estate, can pay off within one to two years.

Required documents

Regardless of the chosen method of challenging the cadastral value of commercial real estate or housing, the property owner needs to prepare approximately the same set of documents. It includes:

- an extract from the Unified State Register of Real Estate on the current cadastral valuation of the property;

- documentary evidence of the unreliability of the state assessment;

- title documentation for property;

- expert report of an independent appraiser.

When going to court, you will need to additionally complete or obtain two types of documentation. The first is a receipt for payment of state duty. The second is notification of service of the statement of claim to all interested parties.

Procedure for challenging the cadastral value in 2021

Current legislation provides two ways to challenge the cadastral value of real estate to reduce tax. The first involves applying to the regional commission under Rosreestr, and the second - to the judicial authorities.

When deciding to challenge the cadastral value results, the first step is to obtain all the necessary background information. The easiest way to do this is to use the services of the official website of Rosreestr. Information about all objects included in the Unified State Register of Real Estate has been compiled into a single database. To search for the desired property, basic details are used in the form of a cadastral number or even part of it.

In the Rosreestr commission

Pre-trial contestation of the value of an apartment or other real estate item indicated in the Unified State Register of Real Estate requires an appeal to the Rosreestr commission. Similar bodies have been created in each region of Russia specifically to consider such issues.

Advantages of pre-trial settlement

Challenging the cadastral value of commercial real estate or housing in pre-trial proceedings has several significant advantages compared to going to court. Among them:

- prompt consideration of the case, which takes no more than a month;

- minimum level of associated costs. In fact, the property owner only needs to pay for an independent assessment, saving on state fees and legal costs;

- the possibility of subsequently challenging the value of the property according to the cadastre in court. An appeal to the territorial commission of Rosreestr does not deprive the owner of the right to file a claim with the judicial authorities.

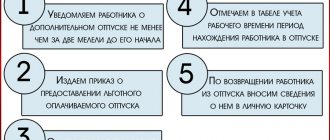

The procedure for challenging the Rosreestr commission

The legislation provides for a relatively simple and understandable procedure for considering the issue in pre-trial proceedings. It involves several sequentially implemented stages:

- collection of initial information about the property;

- conducting an independent assessment of the value of property;

- registration and submission to the commission of an application with attached title documents for real estate and a report of an expert appraiser;

- notification of interested parties about the date of consideration of the issue (carried out by commission employees within 7 working days from the date of receipt of the application);

- consideration of the issue on its merits;

- making a decision by the commission based on the results of the proceedings (the deadline for sending the decision is 5 days after the meeting).

Important

. Despite the apparent simplicity of the procedure described above, obtaining a favorable final result requires competent preparation of a set of documents and a professional assessment of the property. Therefore, it is advisable to invite qualified specialists, whose costs will be repaid by a guaranteed and maximum possible reduction in the cadastral value.

In a court

When deciding to challenge the cadastral value of an object in court, you need to understand that this is a noticeably longer, more labor-intensive and costly undertaking. Its procedure is regulated by the provisions of the CAS of the Russian Federation (Chapter 25), which came into force after the approval of No. 21-FZ of March 8, 2015.

The statement of claim, drawn up by the property owner or his lawyers, includes one of three possible demands:

- challenging a previous decision of the Rosreestr commission;

- use as cadastral real or market value;

- recalculating the cadastral price to eliminate errors or inaccuracies made during the state assessment of property.

Cases challenging cadastral values are considered by the Supreme Courts of the constituent entities of the Russian Federation. The standard period for administrative proceedings is 2 months. If necessary, it can be extended for another 1 month.

Final real estate assessment: changes

By another order, the government agency introduced some important aspects of the project's compliance with the final assessment of real estate.

Now one of these aspects has become the independent provision of a choice of appropriate methods in order to identify the value of real estate.

The authority noted that from now on, information is subject to analysis that in itself does not relate to the property, but has a significant impact on the potential value of such a property.

In particular, such factors include: environmental or economic.

Indirectly, these factors have a systematic impact on the pricing of such objects. The list of the mentioned influencing factors is not closed. In general, this is done for a more rational analysis of the value of such real estate.

If there is a market value, why do we need a cadastral register?

Initially, BTI data was used to evaluate real estate, including apartments. However, these data in no way reflected the market value. It is precisely in order to base taxation on the real price that the state regularly makes revaluations.

The cadastral value is the results of the revaluation; they are recorded in the Unified State Register of Real Estate and the State Cadastral Valuation Data Fund. In each region, the frequency of assessment may be different. In most of them - no more than once every 3 years, but no later than 5 years from the date of the last assessment. For Moscow, St. Petersburg and Sevastopol, other requirements are established: no more than once every 2 years.

You can find out about changes in the cadastral value of real estate yourself using the online service of Rosreestr. Otherwise, you may be in for a surprise when the tax is recalculated at the new value.

Article 24.20

Federal Law of July 29, 1998 N 135-FZ “On Valuation Activities in the Russian Federation”:

Article 24.20. Entering the results of determining the cadastral value into the Unified State Register of Real Estate

Within ten working days from the date of completion of the consideration of disputes about the results of determining the cadastral value, the body performing the functions of state cadastral valuation sends information about the cadastral value to the rights registration authority.

Within ten working days from the date of receipt of information on the cadastral value, the rights registration authority shall enter them into the Unified State Register of Real Estate, unless otherwise provided by the legislation of the Russian Federation.

Information on cadastral value is used for the purposes provided for by the legislation of the Russian Federation from the date of its entry into the Unified State Register of Real Estate, except for the cases provided for in this article.

In case of correction of a technical error in the information of the Unified State Register of Real Estate on the value of the cadastral value, information on the cadastral value is used for the purposes provided for by the legislation of the Russian Federation, from the date of entry into the Unified State Register of Real Estate of the relevant information containing the technical error.

In the event of a change in the cadastral value by decision of a commission or court in the manner established by Article 24.18 of this Federal Law, information on the cadastral value established by a decision of the commission or court is applied for the purposes provided for by the legislation of the Russian Federation from January 1 of the calendar year in which the corresponding an application for revision of the cadastral value, but not earlier than the date of entry into the Unified State Register of Real Estate of the cadastral value, which was the subject of a challenge.

Information on changes in cadastral value based on a decision of a commission or court, including the date of filing the corresponding application for revision of cadastral value, is subject to entry into the Unified State Register of Real Estate in accordance with Federal Law of July 13, 2015 N 218-FZ “On State Registration of Real Estate”.

Return to the table of contents of the document: Law on valuation activities in the Russian Federation N 135-FZ

Consultation on services

The company's managers will be happy to answer your questions, calculate the cost of services and prepare an individual commercial offer.