What's new in TC? Changes in labor legislation in 2021

Changes in labor legislation 2020: bills

The year 2019 turned out to be fruitful for legislative initiatives in the field of labor law. Some of them have already been implemented, and some continue to remain in the status of bills at various stages of consideration. Here are the most significant:

№748788-7. Amendments to the law on personalized accounting in the insurance pension system. Concerns the introduction of electronic work books.

№736455-7. Electronic document management with personnel. Provides the ability to submit job applications and conclude employment contracts digitally. Possible changes to the Labor Code of the Russian Federation for 2021 - the introduction of new articles 15.1–15.3.

№722526-7. Changes to the Labor Code of Articles 133 and 133.1 regarding the inclusion of certain payments in wages when applying the minimum wage.

№755304-7. Concerns the employer's obligations to pay wages and other amounts. Affects articles TC 357 and 360.

Reducing the variable part

Reducing bonuses is the most obvious way to cut salaries

If it is necessary to reduce personnel costs, the first step is to consider the possibility of reducing the non-fixed part of remuneration. The bonus regulations should be changed and additional payments to the basic salary should be reduced.

The employer has the right to approve acts establishing the variable part of the salary (Articles 8 and 22 of the Labor Code of the Russian Federation). To do this, the manager must issue an order to change the bonus regulations and submit the amended document for consideration by the employees. After reading it, employees must sign.

In some cases, a local act can only be enforced with the consent of the representative body of employees (Article 8 of the Labor Code of the Russian Federation).

Labor Code of the Russian Federation for 2021: new minimum wage

From January 1, 2021, the federal minimum wage was 11,280 rubles.

For 2020, the Ministry of Labor decided to increase it to 12,130 rubles. Reason: Order No. 561n dated 08/09/2019. This indicator is important: after the New Year, do not forget to take it into account when calculating sick leave, B&R payments and other benefits.

This also means that from the beginning of 2021, employers cannot pay their employees less than 12,130 rubles. Otherwise - a fine according to the Code of Administrative Offences. By the way, there is also a lot of new stuff in the Code of Administrative Violations.

| Important! Remember that there are regions with regional coefficients. For example, for the Novosibirsk region the minimum wage = 12,130 x 1.25 = 15,162.5 rubles. |

A significant change in the Labor Code from 2021 concerns the inclusion of compensation payments in the minimum wage. If bill No. 722526-7 is adopted, it will be necessary to compare the net salary with the minimum wage, excluding compensation.

Documenting

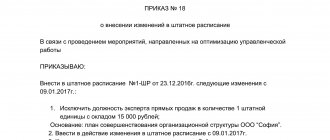

If the company has undergone reorganization changes, as a result of which there is a need to reduce employee salaries, the entire process should be documented.

Required documents:

- Order on organizational and technological changes in working conditions.

- Order on changes to the terms of the employment contract.

- Notice to employees about upcoming changes.

If the employee agrees to the new conditions, an additional agreement on changes in wages is concluded with him. In case of refusal, he is subject to dismissal (clause 7, part 1, article 77 of the Labor Code of the Russian Federation).

If the salary is reduced by agreement of the parties, the following documents will need to be completed:

- additional agreement to the employment contract;

- order to change wages and staffing.

When changing the variable part of the salary:

- order to change the bonus regulations;

- new version of the provision with changed conditions.

Changes to the Labor Code in 2021: new report to the Pension Fund and electronic work books

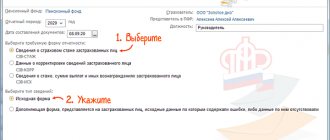

Replacing paper work books with electronic ones is one of the hottest topics of 2021. Now we can say with confidence that we are in the midst of a transition period. Starting in 2021, the Pension Fund of Russia begins to collect electronic information about the labor activities of citizens. It is the responsibility of employers to submit a new report every month.

As of November 2019, bill No. 748744-7 was only approved in the first reading, but there are already changes in the Labor Code of the Russian Federation in connection with it. From January 1, 2021, employers must submit a new SZV-TD report to the Pension Fund on the 15th of each month - for the previous one. The first report on the new form must be submitted on February 17, 2020, since the 15th is a Saturday. Upon dismissal, employees should be given an SZI-TD certificate - with all changes in their working life during their work with a particular employer.

Throughout 2021, employee activity will be recorded in a dual format: in standard labor reports and in electronic reports to the pension fund. Starting from 2021, new paper work permits will no longer be issued. The existing ones will continue to be maintained only for those who write a statement about this in 2020.

There are already fines for violations.

New "children's" benefits

Important changes to the 2021 Labor Code of the Russian Federation will occur on January 1, 2021 and with the entry into force of Law No. 305-FZ of 08/02/2019 . This act amends the law on monthly payments to families with children. Now a parent who cares for a child under 3 years old can count on a benefit in the amount of the subsistence minimum for a child. Previously, they were limited to one and a half years.

The rule applies to socially vulnerable families whose income per person does not exceed two subsistence minimums.

Final transition to direct payments

From 01/01/2021, the FSS credit system of payments ceases to operate; all regions of the Russian Federation, without exception, will switch to direct payments:

- employers accept applications and supporting documents from employees for payment of benefits and pay for the first 3 days of illness;

- The Social Insurance Fund transfers the remaining benefit amount directly to the employee.

Basis - Federal Law of July 3, 2016 No. 243-FZ.

We also recommend reading about changes in the work of an accountant: Tax and accounting changes from 2021: a detailed overview .

You can learn about other important changes in 2021 from ConsultantPlus materials.

Full and free access to the system for 2 days.

Changes regarding scheduled inspections

Law No. 130-FZ of June 6, 2019 added to the list of enterprises that are not subject to the small business moratorium, and to which government agencies can conduct inspections more often than once every three years.

Now this list also includes companies involved in the production, use or circulation of precious metals and precious stones.

| Important! The schedule of scheduled inspections is approved by the Prosecutor General's Office. It becomes open at the end of each year. You can check whether you can expect a state inspection in 2020 here. |

New fines under the Code of Administrative Offenses

Law No. 221-FZ of July 26, 2019 amended Article 5.27 of the Code of Administrative Offences, the main section of administrative fines relating to labor legislation. Starting from 2021, employers who do not allow their employees to change payroll organizations face a fine of up to 50,000 rubles.

Article 11.23 has been revised . New fines have been introduced for violating work and rest hours and driving certain vehicles without a tachograph. Now drivers and officials responsible for equipping cars with tachographs and maintaining operating conditions are subject to punishment separately. Reason: Law No. 216-FZ of July 26, 2019. It also provides for penalties for employers whose drivers do not rest properly.

Changes to labor legislation - what needs to be done before the end of 2021

The main feature of work in the field of personnel is that one change in labor legislation entails numerous changes in practical work. Here's what it's advisable to do before 2021:

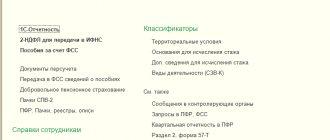

- Change LNA and job descriptions () of personnel officers - due to the need to submit a new report to the Pension Fund.

- Prepare application templates for maintaining work books on paper - in connection with the transition to electronic work books.

- Make changes to the DI of drivers and technical service workers - in connection with new fines for violating labor regulations and traveling without tachographs.

- Prepare a vacation schedule taking into account new benefits for parents with many children.

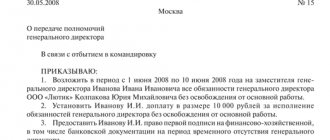

During reorganization

According to Art. 74 of the Labor Code of the Russian Federation, acceptable reasons for unilaterally reducing an employee’s salary may be organizational and technological changes in the structure of the labor process at the enterprise.

Organizational changes include:

- Changes in the enterprise management system.

- Introduction of new forms of labor relationships (tenant, contract, team).

- Switching to a different work schedule.

- Revision of the labor standardization system.

- Redistribution of production tasks and areas of responsibility between the structural units of the company.

Technological changes include:

- transition to more efficient production technologies;

- introduction of improved equipment;

- reorganization of workplaces;

- development of new products;

- innovations in technological regulations.

If organizational and technological changes actually took place, then the employer must notify the employee in writing of his intention to reduce wages in advance, no later than 2 months.

Changes in the labor code from 2021: we remind you of the most important

The past year has made many amendments to the work of personnel officers. Let us recall the main points related to changes and additions to the Labor Code of the Russian Federation in 2021.

New rules for vacation distribution

Previously, parents with many children did not have an unconditional right to leave at any convenient time.

Starting from 2019, it is necessary to take into account the family status of employees when drawing up an annual vacation schedule: the updated version of the Labor Code of the Russian Federation has come into force. New Article 262.2 aims to protect workers with family responsibilities. It allows parents of three or more children under the age of 12 to take annual paid leave at a time convenient for them, and not for the employer.

Additional days off for regular medical examinations

A healthy worker is an effective worker. This formula best describes changes in labor legislation in 2021 aimed at protecting the life and health of working citizens. Law No. 353-FZ of October 3, 2018, which entered into force, obligated all employers, without exception, to provide and pay each employee an additional day off for medical examination (at least once every three years).

A special medical examination procedure is provided for working pensioners and pre-retirees. The older a person is, the higher the risk of developing acute and chronic diseases. Therefore, if the organization has employees of retirement or pre-retirement age, provide them with at least two days annually for routine medical examinations.

Fines for special assessment and completion of the transition period

In 2019, the transition period ended, during which some companies and individual entrepreneurs that did not carry out special assessments were not threatened with penalties. But from January 1, 2021, jobs left without a special assessment will come under the close attention of GIT inspectors. And an employer who violates the law may be fined.

Fines:

- From 60,000 to 80,000 rubles - for a legal entity.

- From 5,000 to 10,000 rubles - for an official or individual entrepreneur.

| Important! The requirement for mandatory special assessment does not apply to remote and home-based jobs. |

Latest changes in labor legislation related to foreigners

The tightening of migration legislation also affected the sphere of hired labor. Until January 16, 2021, employers hiring foreigners were not responsible to the state for them.

Now, when hiring a foreign worker, a company or individual entrepreneur is obliged to ensure that his occupation corresponds to the purpose of entry, and to control the timeliness of leaving the country.

Fines for non-compliance with the new standards:

- Up to 500,000 rubles - to legal entities.

- Up to 50,000 rubles - for officials and individual entrepreneurs.

Thus, the illegal stay of a foreign worker on the territory of the Russian Federation can result in large financial losses for the employer who invited him.

The Pension Fund no longer issues SNILS

From April 1, 2021, the pension fund stopped issuing the usual yellow SNILS cards.

Instead of them - electronic extracts from the Pension Fund . When drawing up a contract with a new employee, accept them without requiring a paper version. But if a person brings an old SNILS, accept it too, it has power.

What's planned

Several bills are still at various stages of development. If they are approved at the end of 2019 or the beginning of 2020, several more innovations await us.

New deadlines for vacation pay

Employers may have even less time to pay holiday pay. Now this must be done no less than 3 calendar days. If the amendment to Article 136 of the Labor Code of the Russian Federation passes, the deadline will change by 3 working days.

That is, if a person goes on vacation on Monday, vacation pay will have to be paid not on Thursday, as now, but on Tuesday.

The bill was ready at the beginning of 2019, but has not yet even been included in the plan for consideration by the State Duma. This means that from the beginning of 2020 we are paying holiday pay in the old way.

Postponement of Russia Day

Rumors about a new date for the state holiday have been circulating for a long time. Bill No. 304843-7 proposes a postponement from June 12 to September 12.

In 2019, the act was adopted for consideration in the first reading, but the decision on it was postponed several times.

Enforcement of obligations to pay wages

In November 2019, bill No. 755304-7 was approved by the State Duma in the second reading. This means that in 2020, Article 357 will undergo changes to the Labor Code. A new one will also appear - 360.

The essence of the adjustments is that if the employer does not comply with the order to pay delayed wages, the State Tax Inspectorate can transfer the case to the bailiffs. The money will be forcibly confiscated.

How can you reduce your salary?

ConsultantPlus has many ready-made solutions, including details on the procedure for reducing an employee’s salary for various reasons. If you don't have access yet, get it for free on a temporary basis! You can also get the current K+ price list.

An employee's salary can be reduced in one of the following ways:

- Salary reduction.

- Reducing the premium.

- Reduced working hours.

Each of the above ways to reduce labor costs is detailed below.

Salary reduction

The head of a company (enterprise) has the right to reduce an employee’s salary in the cases specified above, but not always.

For example, this is only possible with the written consent of the employee. In this case, the manager is obliged to conclude an additional agreement with him (Article 72 of the Labor Code of the Russian Federation). Accordingly, if an employee does not sign the agreement, his salary cannot be reduced by agreement of the parties.

In addition, a reduction in an employee’s official salary is permissible if there is one of the following legal grounds for this:

- Changes in working conditions established by Art. 74 of the Labor Code of the Russian Federation (technological or organizational conditions). It is important to note that in view of such a change, many terms of the employment contract that do not relate to the employee’s labor function can be changed. Before reducing an employee's salary, the head of the organization is obliged to notify the employee about this two months in advance.

- Reduction of working hours when transferring an employee to part-time work. In this case, the salary is reduced by a multiple of the reduced amount of working time.

Reduced premiums

It happens that in the employment contract (agreement) or in the local act of the organization a separate clause is indicated that bonuses to employees are the responsibility of the head of the company (enterprise).

Based on the meaning of sub. “n” clause 2 of the Decree of the Government of the Russian Federation “On the peculiarities of the procedure...” dated December 24, 2007 No. 922, bonus payments are also taken into account when calculating average monthly earnings. Also on the basis of Art. 57 of the Labor Code of the Russian Federation, bonuses are part of wages.

The possibility of reducing the bonus depends on whether the specific amount that is paid to employees is specified in any act. If the size of the bonus is determined by the management of the company, then it has the right to independently decide whether to leave the amount paid at the same level or reduce it.

In addition, the employment contract or local regulations may contain a clause stating that the bonus is paid only under certain circumstances, for example, when the organization is in a good financial position or when the employee meets production standards. In such a situation, management may decide to refuse the bonus, citing a poor financial situation. However, the employee has the right to challenge such a decision in court, and the employer will have to prove that the financial situation of the organization has really changed for the worse.

Reduced working hours

The head of an organization can reduce wages by reducing working hours. In such a situation, the enterprise (company) establishes a part-time working regime.

For example, if an enterprise has a 40-hour work week, then the head of the organization can reduce the number of working hours to 20. In this case, the salary is calculated in proportion to the number of hours worked.

However, the head of the organization has the right to reduce working hours only in connection with a change in working conditions established by Art. 74 Labor Code of the Russian Federation. Also, the transition to part-time work is permissible by agreement of the parties to the employment contract (Article 93 of the Labor Code of the Russian Federation).