As is known, the standard design of a gift transaction is gratuitous and unconditional. Regarding the last characteristic, it should be understood that it does not exclude the possibility of the donor defining certain conditions, but only limits their application to the framework of gratuitousness. Thus, it is obvious that the use of annulling and suspensive conditions , making the emergence and termination of obligations dependent on the circumstances, is quite acceptable.

Attention

The occurrence of annulling or suspensive conditions (Article 157 of the Civil Code) cannot be perceived as a counter-representation by the donee, making the transaction void. They do not give rise to obligations of the donee party, and therefore do not violate the requirement of gratuitousness.

Thus, a transaction is considered completed under one of the specified conditions if, at the conclusion of the contract, the emergence or termination of rights and obligations was made directly dependent on certain circumstances , about which the possibility of their occurrence is not reliably known. In view of this, the application of such conditions is possible only in consensual donation transactions.

According to Art. 157 of the Civil Code, when determining the circumstances depending on which rights and obligations will arise or terminate, the parties cannot reliably know whether they will occur or not. However, this does not mean that such circumstances can only be events - in our opinion, they can also be the actions of the parties and other persons. The law does not prohibit conscientious assistance in the occurrence of these events (clause 3 of Article 157 of the Civil Code), and therefore, the actions of the parties, in a sense, can be given the meaning of a condition.

The same norm prohibits unfair assistance and obstruction of the occurrence of conditional circumstances. This formulation should be understood as the behavior of the person concerned, characterized by illegality and contrary to the principles of morality.

The nature of dispositive and suspensive conditions should be distinguished from each other. Thus, suspensive circumstances are quite often used as an incentive measure - the transfer of a gift after graduation, upon receipt of a driver’s license, etc. The use of cancelatory conditions is a rather controversial issue - they cannot be used after the transfer of a gift and cannot be identical to the grounds for canceling a donation (Article 578 of the Civil Code) and refusal to fulfill an obligation (Article 577 of the Civil Code).

The circumstances on which the emergence or termination of rights and obligations are dependent also cannot be illegal, illegal or immoral.

Example

A consensual agreement for the donation of an apartment was concluded between P. and K., with a severable condition that terminated the obligation of the donor P. if, before the transfer of the said apartment to the donee K., a child appears in P.’s family. In addition, the contract provided for a period of execution of the contract - 2 years after conclusion. So, when there was a week left before the expiration of the contract, the donee K. asked P. if there was a child in his family, to which the donor answered in the negative and asked K. to come to him within the period specified in the contract to complete the documents. Having appeared to P. at the specified time, K. suddenly discovered that the donor had adopted the child. Thus, the annulling condition specified in the contract occurred, which deprived the donee of the right to demand execution of the donation. Considering such an adoption of a child to be unfair assistance, K. went to court in order to oblige P. to hand over the promised apartment to him.

At the court hearing, K. argued his position by the fact that the donor P. adopted the child no earlier than a few days before the need to fulfill his obligation. Thus, when adopting, he was guided by the personal benefit of keeping his apartment, and not at all by the desire to have a child. Thus, in K.’s opinion, he dishonestly contributed to the onset of the annulling condition, which, according to paragraph 3 of Art. 157 of the Civil Code, allows us to consider the condition not to have occurred. Based on this, K. asked the court to oblige P. to fulfill his obligation, as it had not yet been terminated. Defendant P. did not appear in court, however, in his written objections he indicated that the process of adopting a child was started by him about a year ago, for which the relevant documents were provided.

Having heard K.'s arguments, the court could not agree with them. According to the court, in order to recognize the extinguishable condition as not having occurred, there must have been dishonest assistance in the occurrence of the circumstance. Such assistance should be understood as unlawful, illegal and immoral behavior of the donor. Based on the fact that P.’s actions did not contain such behavior, it cannot be called unfair assistance. Moreover, based on the opposite, the court perceived P.’s actions as conscientious assistance in the occurrence of circumstances beneficial to him, which is completely legal. Based on the above, the court rejected K.’s claims.

Concept and parties to the gift agreement

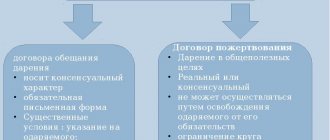

According to Art. 572 of the Civil Code of the Russian Federation, a gift agreement is an agreement on the gratuitous transfer to one party of any property benefits owned by the other party or a promise of such transfer. A similar transaction, conditioned by the generally useful purpose of the gift, is a separate type of gift - a donation (Article 582 of the Civil Code).

Important

Gratuitousness is a characteristic feature of both types of donation, the violation of which is unacceptable. If there is a counter-representation from the person receiving the gift, the gratuitous nature is violated, therefore, the transaction should be considered feigned, which entails its nullity (clause 2 of Article 170 of the Civil Code).

According to generally accepted principles of civil law, the parties to a gift transaction can be any of the legal entities - legal entities and individuals who meet the general requirements of the legislator for participation in the agreement. Thus, the donor should be considered a person endowed with legal capacity who intends to make a gratuitous alienation of the good that belongs to him by right of ownership. The donee is the person who takes ownership of the good transferred by the donor.

The possibility of participation in a gift by an incapacitated or limited recipient of legal capacity deserves special attention. Thus, an incapacitated person can participate in a transaction only through his legal representative . Minors and minors (limited in legal capacity) can participate personally in those gift transactions that do not require notarization and registration of rights; if there is such a need, their interests are represented by legal representatives (Art. Art., Civil Code).

We also note some legislator prohibitions on participation in a gift transaction. So, according to paragraph 1 of Art. 575 of the Civil Code, the legislator excludes donations from incapacitated and minor persons , as well as their representatives. Please note that this rule does not apply to gifts of small value.

Additionally

In addition, as part of the fight against corruption, certain prohibitions have been established for participation as a donee for persons based on their professional characteristics. According to paragraphs 2 and 3 of Art. municipal and government employees, employees of medical, educational and social organizations, etc. cannot accept gifts.

To counter financial abuses in the economic sphere, the legislator has established a ban on donations between commercial structures (clause 4 of Article 575 of the Civil Code). However, such a ban creates certain inconveniences for entrepreneurs, in particular, preventing them from forgiving bad debts to counterparties as part of a donation, etc.

What will the apartment donation agreement lead to?

Concluding a gift agreement leads to significant consequences that both the donor and the recipient need to be aware of.

What rights will the new owner have?

When the donee becomes the owner of the property, he will be able to dispose of it at his own discretion . Namely:

- live in it;

- sell;

- to rent;

- give, etc.

Note! The new owner is not obliged to notify the donor about the actions that he performs with the received property.

However, the new owner should not forget about his obligations:

- Payment of utility services;

- repayment of property taxes;

- use of real estate for its intended purpose.

Is it possible to cancel the donation of an apartment?

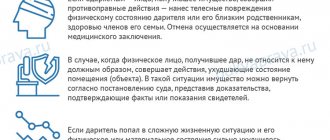

According to current legislation, if registration of rights has been carried out, then canceling the donation of an apartment will be extremely problematic. You must have good reasons, including :

- the donee attempted to take the life of the donor;

- the new owner is using the property for other purposes or there is a threat of destruction of the property;

- the donee died before the donor - this condition must be specified in the contract.

Taxation

When the donee receives ownership of the property, he will have to pay tax . Its size is 13% of the cadastral value of the property.

However, there are citizens who may not repay their personal income tax. These include close relatives of the donor :

- spouse;

- children/grandchildren;

- father mother;

- grandmother grandfather;

- brother/sister.

Contract form

According to the provisions of Art. 574 of the Civil Code, the legislator allows two forms of gift agreement - oral and written . The oral form is applicable to the vast majority of real contracts , with the exception of expressly established exceptions that require written disclosure as one of the factors in the validity of the transaction.

Attention

According to paragraph 2 of Art. 574 of the Civil Code, the execution of gift agreements orally, which require a written nature, entails their nullity.

Thus, the mandatory written form is established for:

- Real estate donation agreements . The main reason requiring written form is the need for state registration of real estate (Article 131 of the Civil Code), registration of the agreement itself has been cancelled. The procedure for carrying out this registration requires providing the registrar with a package of documents, which includes the agreement itself, as the basis for the transfer of rights. According to paragraph 5 of Art. 18 Federal Law No. 122 of July 21, 1997, all submitted documents must be executed on paper, which is impossible without their execution in writing.

- Consensual deed of gift . According to paragraph 2 of Art. 572 of the Civil Code, the promise of donation must be made in the proper form. According to paragraph 2 of Art. 574 of the Civil Code, this form is written . In addition to the form, the legislator requires an indication in this agreement of the specific subject and intention of the donor aimed at transferring the gift in the future.

- Gift agreements, where the donor is a legal entity. person, and the cost of the gift exceeds 3 thousand rubles . Note that if the value of the gift is below 3 thousand, an oral form is acceptable, which, however, diverges from the general rule established by paragraph 1 of Art. 161 of the Civil Code, which requires written registration of all transactions concluded by legal entities. persons.

Another agreement that requires written form is a notarized donation , since certification of oral transactions is impossible. At the same time, the notarial form is not mandatory for any of the gift agreements.

"Anatomy" of a deed of gift

As we have already found out, a gift agreement is concluded with the desire to donate either things or rights to property in favor of a relative or any other person. After the transaction is completed, other heirs will no longer be able to claim the inheritance.

A gift agreement is always unilateral: the person receiving the gift does not bear any obligations to the donor. A donation document can be of two types: consensual and real .

| A real gift agreement is when the recipient immediately receives ownership rights to the gift: real estate or thing. | A consensual gift agreement is an agreement in which the recipient acquires the right to own real estate or an item only in the future. |

Helpful information! Consensual donation can have both a suspensive and an excipient nature. For example, when the deed of gift states that the donor has the right to cancel the transaction if he survives the citizen he is donating. Simply put, when the person receiving the gift dies before the donor, the deed of gift loses its force.

In addition, a gift agreement may be conditional, which means it implies a donation of the donor’s property only if the gift will be used for the benefit of society.

Inadmissibility of counter-obligation in a gift agreement

As is known, the main qualifying characteristic of a gift transaction is its gratuitousness , which means the possibility of determining obligations exclusively on one side - the donor (clause 1 of Article 572 of the Civil Code, clause 2 of Article 423 of the Civil Code). The presence of a counter-property obligation or representation on the part of the donee is unacceptable - their presence inevitably entails the sham of the contract, which, according to clause 2 of Art. 170 of the Civil Code makes the transaction void .

For your information

A symbolic payment transferred by the donee to the donor cannot be taken as a counter-representation or obligation if it is due to local traditions or ethnic customs and folk signs.

Taking into account the above, we note that a donation is a unilaterally binding transaction, due to the inadmissibility of a counter-obligation of the donee arising from the agreement concluded by the parties. The sham of a transaction, arising from the presence of a counter-obligation, is the covering of one transaction by another, in order to disguise the true intentions of the parties, for example, covering a sale and purchase with a gift.

What should be distinguished from such an obligation is the condition that the donor extracts useful properties from the donated good, for example, the donation of real estate with the donor’s right of residence. This condition does not give rise to obligations of the donee, but is only a pre-giving encumbrance of the gift, leading it to such a specific state.

It is also necessary to distinguish from a counter-representation and an obligation the condition of a promise to transfer a gift , conditioned by the occurrence of an event directly dependent on the donee. Such a construction will either be an agreement with a certain period of execution, or concluded under a suspensive condition.

At its core, an agreement can contain any condition, even aimed at the donee performing certain actions - the main thing is that they are not aimed at satisfying the property interest of the donor. Even if their completion will be to some extent beneficial to the donor, this cannot lead to the pretense and insignificance of the transaction.

Donation subject to suspensive condition

According to paragraph 1 of Art. 157 of the Civil Code, a donation made under a suspensive condition is an agreement under which the occurrence of the donor’s obligation to transfer a gift to the donee or to release him from the obligation is made dependent on a specific circumstance , the possibility of which is not reliably known to the parties to the transaction. Simply put, a suspensive condition (circumstance) is a prerequisite for the emergence of the donor’s obligations to transfer the gift.

Additionally

A suspensive condition in the form of a circumstance cannot be illegal, illegal or immoral. If the specified characteristics are met, the suspensive condition may well be used as an encouragement to the recipient or to congratulate him on some celebration (graduation, wedding).

Based on the doctrine of civil law and the very norm governing the suspensive condition, we can conclude that certain requirements are imposed on it. Thus, the condition must provide for a circumstance that may occur in the future. If the origin of the donor's obligations is connected with a circumstance that has already occurred at the time of the transaction, depending on the specific situation, such an agreement will be considered either void or unconditional.

In addition, it cannot be known initially whether such a circumstance will occur or not. In view of this, the promise to make a birthday gift cannot In this case, it is not the condition, but the deadline for the execution of the contract.

In addition, it is also impossible to make the occurrence of the donor’s obligation dependent on a circumstance about which it is reliably known that it will not occur. Similar to a circumstance that has already occurred, depending on the specific situation, such a transaction will be considered either invalid or unconditional.

A donation made under a suspensive condition gives rise to rather specific legal relations between the parties to the transaction. Thus, even after concluding an agreement, the parties are still not bound by the rights and obligations of the concluded transaction, however, they can no longer arbitrarily withdraw from it .

When a suspensive circumstance occurs, the donor has an obligation to transfer the gift to the donee. At the same time, the donee has the right to demand that the donor transfer the gift . If the donor refuses to fulfill it, the donee has the right to oblige him to fulfill it through the court.

What form does it take?

CASE FROM PRACTICE . Childless citizen A. entered into a civil legal relationship with his relative B., pledging to transfer his residential property (apartment) to him as a gift if he does not have a child within 3 years. During this time, the potential recipient of the gift in the future, B., regularly asked his donor if there was a new addition to his family. Since there were no children in A.’s family, B. expected to get an apartment soon.

Giving a gift: what is it and who can act as a party to it

An agreement on the transfer of a thing or property right may contain not only a condition upon the occurrence of which they are transferred, but also a condition under which the rights and obligations of the counterparties in the transaction are terminated. In civil law it is called the term “cancellable condition”.

- The effective date of the contract. In the absence of information about the start of the offer, it comes into force after the state registration of the change of owner and the issuance of a certificate of transfer of ownership from one party to the agreement to another. Sometimes the donor specifies the period during which he undertakes to transfer the gift, or when the contract comes into force. Due to the lack of information about the term, the reality of the contract cannot be challenged in court.

- Inheritance by heirs of the transfer of ownership of real estate from the donor. If the contract does not contain a clearly stated clause on such a right, then, according to the first paragraph of Article 581 of Chapter 32 of the Civil Code, they have no right to claim a gift.

- In the event of the premature death of the donor, his obligation to make the gift passes to his successors. If such instructions are not specified in the contract, then the heirs are released from this promise.

You may be interested in:: Changes to Article 228

Donation subject to cancellation condition

According to paragraph 2 of Art. 157 of the Civil Code, a donation made under a resolute condition is an agreement on the gratuitous transfer of property, according to which the termination of the donor’s already existing obligations to transfer the gift to the donee is made dependent on circumstances regarding which the possibility of their occurrence is unknown. Thus, the occurrence of a cancellation condition gives the donor the right to refuse to fulfill his obligation to transfer the gift to the donee. The right of the parties to independently determine such conditions in the provisions of the contract is based on the norms of paragraph 1 of Art. 407 Civil Code.

For your information

Cancellable conditions should not be confused with the grounds for canceling a donation, defined by Art. 578 Civil Code. The fact is that such grounds are related to the donor’s right to demand the cancellation of an already executed donation (deprivation of the donee’s right of ownership), when the obligations themselves have already been terminated by proper execution. Thus, they have no bearing on the obligations of the donor.

Based on the fact that annulling conditions are aimed at terminating the obligations of the donor and the rights of the donee, it is quite obvious that they can be applied exclusively before their fulfillment. Based on this, it can be confidently stated that the use of conditions that cancel obligations is permissible exclusively in contracts of promise of gift .

In this regard, one should not confuse the conditions with the basis for refusal to fulfill the donation established by Art. 577 of the Civil Code, which also cannot be considered an extenuating circumstance.

Thus, the cancellation conditions determined by the parties cannot repeat the grounds for cancellation (Article 578 of the Civil Code) or refusal to fulfill the donation (Article 577). This is not only meaningless, since their use is possible without being specified in the contract, but is also unacceptable, judging by the fact that cancelable conditions and legal reasons for cancellation and refusal to perform have different legal grounds for terminating the obligations of the donor.

Like suspensive conditions, dispensatory conditions cannot be unlawful, illegal or immoral . At the same time, they can be of any nature - from an increase in the recipient’s salary to the appearance of children by the donor.

When the donor fulfills the contract, i.e. transfer of the gift from the donee, his obligations as a party to the transaction are terminated . Thus, the possibility of applying severable conditions defined by the parties to the contract also ceases. After the transfer of the gift, cancellation of the gift is permissible only on legal grounds defined in Art. 578 Civil Code.

What is meant by essential conditions?

When drawing up a document for donating an apartment, you should take into account such important points as the conditions provided for by law; they can be divided into essential and additional.

Essential information should include mandatory information about the donor, the recipient, the property that is being transferred, the rights to dispose of the property (for the donor), information that the apartment is transferred to the recipient without imposing financial or property obligations on him.

Reference!!! In the document for the gratuitous transfer of an apartment, all this data is recorded in separate paragraphs and confirmed by the presence of relevant documentation (Chapter 32 of the Civil Code of the Russian Federation).

Additional conditions are not so strictly regulated, the main thing is that they do not violate current legislation . These conditions may include a certain period, after which the recipient can enter into ownership rights, rules for using the donated property, as well as any other nuances.