Recalculations of employees' salaries after dismissal occur frequently, and for an accountant this is always associated with a whole range of problems: postings, adjustments for insurance premiums and personal income tax, “clarifications” and others. All this happens both in the case of overpayment and underpayment of wages, allowed before the dismissal of the employee.

Overpayment of wages

Most often, overpayment of wages is caused by:

- vacation overexpenditure;

- unpaid advances.

In the first case, the employee was granted leave for the unworked period. At the time of dismissal, the period for which vacation pay was paid remained unworked, and vacation pay became an excessively issued salary.

The second case is when an employee received money in the middle of the month, after which he quit, and the actual accrued salary for a given month turned out to be less than the advance received.

There are three ways to get out of the situation with overpayment of wages:

- ask the employee to voluntarily repay the debt;

- if you refuse to voluntarily repay the debt, file a lawsuit;

- forgive the debt.

When should wages be paid if the employee was absent from work on the last day?

Recently, more and more employers are switching to a non-cash method of transferring salaries and other payments to their employees. In this situation, the transfer of money on the day of the employee’s dismissal is carried out without hindrance, even if the resigning employee is absent from his place on the last working day.

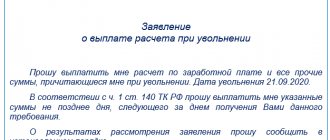

But what should an employer do when paying cash? When should he make the payment? The Labor Code of the Russian Federation establishes that management is obliged to pay such an employee no later than the day before which the corresponding request was received from him.

Example:

Last working day of Skvortsova A.U. - January 17. However, on the date of dismissal she was not at work, and therefore the employer was unable to pay her the due payment.

January 20 Skvortsova A.U. appealed to the employer with a demand for payment of the settlement.

The deadline for payment of funds to a dismissed employee is January 21.

Voluntary debt repayment

If the advance payment is returned, there will be no need to make adjustments to insurance premiums, since insurance premiums are not charged from the advance amounts. The same applies to personal income tax, if the employer does not withhold tax from advances paid. If it is withheld, then the transferred tax will have to be returned to the current account or counted against future payments to the budget, and an updated 2-NDFL certificate will be issued for the employee if the tax period in which the overpayment occurred has expired.

note

If you voluntarily return the overpayment, there is no need to make any mutual settlements with the personal income tax officer, since he returns the money from which personal income tax has already been withheld, that is, minus tax.

When returning vacation pay, the accountant must reverse the accrual entry and cancel expenses in the form of accrued vacation pay in tax accounting.

There is an overpayment of insurance premiums. For the current period, it is necessary to take into account the adjustments for their accrual, and the overpayment should be adjusted with further payments.

If, in connection with the deletion of accrual of vacation pay, negative values are formed in the personalized accounting in the Pension Fund of the Russian Federation for an employee, the company’s report will not be accepted. Therefore, you will have to adjust not the current period, but the previous period.

An overpayment of personal income tax is formed, withheld from the amount of vacation pay and transferred to the budget. If Certificate 2-NDFL for the corresponding year has been submitted, you need to make an updated certificate - the current date with the old number.

The posting for accrual of personal income tax on vacation pay is reversed. The resulting tax overpayment can be returned to your current account or offset against future payments to the budget.

EXAMPLE 1. HOW TO REFLECT OVEREXPENDITURE OF VACATION PAY AND THEIR VOLUNTARY REFUND

At the beginning of the reporting year, employee Belov was granted early leave for the unworked period. The amount of accrued vacation pay is 20,000 rubles, personal income tax is 2,600 rubles. (RUB 20,000 × 13%) was withheld and transferred to the budget. Belov received 17,400 rubles. (RUB 20,000 – RUB 2,600). The accountant made the following entries:

DEBIT 20 CREDIT 70

— 20,000 rub. – vacation pay was accrued to Belov;

DEBIT 70 CREDIT 68

— 2600 rub. – personal income tax accrued;

DEBIT 68 CREDIT 51

— 2600 rub. – personal income tax is transferred;

DEBIT 70 CREDIT 50

— 17,400 rub. - vacation pay was issued to Belov.

Returning from vacation, Belov resigned. Vacation pay was returned to the cash register.

The accountant made the following entries:

DEBIT 20 CREDIT 70

— 20,000 rub. – Belov’s vacation pay was reversed;

DEBIT 70 CREDIT 68

— 2600 rub. – personal income tax accrual was reversed;

DEBIT 50 CREDIT 70

— 17,400 rub. – Belov returned the overpaid vacation pay.

In tax accounting, wage expenses in the amount of 20,000 rubles. cancelled. Overpayment of personal income tax in the amount of 2600 rubles. will be counted against upcoming payments to the budget after the tax inspectorate makes an appropriate decision based on an application from the tax agent.

Calculation procedure

The procedure for calculating compensation for unused vacation upon dismissal, taking into account the conversion factor, depends on when the increase in salaries (tariff rates, monetary remuneration) took place: within the billing period or after its expiration.

If salaries (tariff rates, monetary remuneration) were increased within the billing period, payments taken into account when determining the average salary that preceded the change must be multiplied by a conversion factor. This is stated in paragraph 2 of clause 16 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

Determine the conversion factor by which payments for the billing period (average earnings) need to be adjusted using the formula:

| Conversion factor | = | The new salary (tariff rate, monetary remuneration) of the employee in the month when the last increase occurred | : | The previously established salary (tariff rate, monetary remuneration) of the employee |

Moreover, if an increase in salary (tariff rate, monetary remuneration) in an organization was accompanied by a change in the composition and (or) amount of monthly payments, which directly depend on its size (additional payments, allowances), then calculate the conversion factor using the formula:

| Conversion factor | = | The new salary (tariff rate, monetary remuneration) of the employee and monthly additional payments (allowances) in the month when the last increase occurred | : | The previously established salary (tariff rate, monetary remuneration) of the employee and monthly additional payments (allowances) |

This procedure for determining the conversion factor is established in paragraphs 2 and 5 of clause 16 of Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

Situation: when calculating compensation for unused vacation upon dismissal, is it necessary to take into account a salary increase if certain months of the pay period are not fully worked by the employee (for example, due to illness)?

Answer: yes, it is necessary.

When increasing salaries in an organization, compensation must be calculated (recalculated) taking into account the increase factor (conversion factor). This must be done in one case: if the promotion affected all employees of the organization (branch, structural unit). This follows from paragraph 16 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922. Moreover, the provisions of this paragraph do not contain restrictions regarding the completeness of working out the billing period.

Therefore, when increasing wages, payments preceding the change must be multiplied by the conversion factor. Increase by the conversion factor the payments actually accrued to the employee for those months of the billing period that were not affected by the increase. Including for months not fully worked.

An example of accounting for an employee’s salary increase when calculating compensation for unused vacation associated with dismissal. The salary was increased in one of the months of the billing period

Employee of the organization V.K. Volkov wrote a letter of resignation effective July 17, 2015. He is entitled to compensation for unused vacation for 4.66 calendar days.

For calculating compensation, the estimated period is from July 1, 2014 to June 30, 2015. Volkov worked out his entire billing period.

In July 2014, his salary was 3,000 rubles, from October 1, 2014, his salary was 4,000 rubles, and from January 1, 2015 – 6,000 rubles. In subsequent months, the salary did not increase.

The increase in Volkov’s salary is associated with an increase in salaries throughout the organization as a whole.

Along with his salary, Volkov is given a monthly bonus for production results in the amount of 50 percent of the salary. The bonus is included in the calculation of compensation in full.

The increase factors will be:

– in July–September 2014: 6,000 rubles. : 3000 rub. = 2;

– in October–December 2014: 6,000 rubles. : 4000 rub. = 1.5;

– in January–June 2015: 6,000 rubles. : 6000 rub. = 1.

The accountant adjusted earnings for the billing period taking into account the salary increase: (3,000 rubles/month + 3,000 rubles/month × 50%) × 2 × 3 months. + (4000 rub./month + 4000 rub./month × 50%) × 1.5 × 3 months. + (6000 rub./month + 6000 rub./month × 50%) × 1 × 6 months. = 108,000 rub.

The accountant calculated the average daily earnings as follows: 108,000 rubles. :12 months : 29.3 days/month = 307 rub./day.

Compensation for unused vacation associated with dismissal was: 307 rubles/day. × 4.66 days = 1431 rub.

Filing a lawsuit

If the issue of returning overpaid amounts is resolved through the court, these amounts (without personal income tax) must be transferred from account 70 to account 73. If the outcome is successful for the employer and the former employee returns the money, the amount should be written off in correspondence with accounts 50 or 51. If the employee wins, the amount will need to be returned from account 73 to account 70.

If the employee wins, expenses in the form of vacation pay must be reflected in account 91, and these expenses must be canceled in tax accounting. If the employer wins, the expenses should be canceled in both accounting and tax accounting.

As for insurance premiums, they will be considered legally paid if the former employee wins and the overpaid amount is not returned. No accounting adjustments will be required.

If the former employer wins and the debt is returned, the contributions will be an overpayment, and they will need to be reflected in the current statements as a debt of the fund.

As for personal income tax, if the company wins, the accounting decision is similar to the case of the voluntary return of money by the employee. If the employee wins, the tax is considered to have been withheld and paid legally, and no adjustments are necessary.

EXAMPLE 2. HOW TO REFLECT OVEREXPENDITURE OF VACATION PAY AND THEIR REFUND BY COURT

At the beginning of the reporting year, employee Belov was granted early leave for the unworked period. The amount of accrued vacation pay is 20,000 rubles, personal income tax is 2,600 rubles. (RUB 10,000 × 13%) was withheld and transferred to the budget. Belov received 17,400 rubles. (RUB 20,000 – RUB 2,300).

The accountant made the following entries:

DEBIT 20 CREDIT 70

— 20,000 rub. – vacation pay was accrued to Belov;

DEBIT 70 CREDIT 68

— 2600 rub. – personal income tax accrued;

DEBIT 68 CREDIT 51

— 2600 rub. – personal income tax is transferred;

DEBIT 70 CREDIT 50

— 17,400 rub. – vacation pay was paid to Belov.

Returning from vacation, Belov resigned. He refused to return vacation pay. The company filed a lawsuit.

The accountant made the following entry:

DEBIT 73 CREDIT 70

- 17,400 rubles (20,000 rubles - 2,600 rubles) - a claim for overpaid vacation pay is reflected.

Option 1

Belov won the case.

The accountant made the following entries:

DEBIT 70 CREDIT 73

— 17,400 rub. – the claim is rejected;

DEBIT 20 CREDIT 70

— 20,000 rub. – Belov’s vacation pay was reversed;

DEBIT 91 CREDIT 70

— 20,000 rub. – Belov’s vacation pay was written off as other expenses;

In tax accounting, the amount of 20,000 rubles is excluded from expenses.

Option 2

The company won the case.

The accountant made the following entries:

DEBIT 50 CREDIT 73

— 17,400 rub. – vacation pay was returned by Belov by court decision;

DEBIT 20 CREDIT 70

— 20,000 rub. – Belov’s vacation pay was reversed;

DEBIT 68 CREDIT 70

— 2600 rub. – personal income tax accrual has been reversed.

In tax accounting, the amount of 20,000 rubles is excluded from expenses.

Debt forgiveness

This is the easiest way out. If the debt arose due to an unpaid advance, the debit balance on account 70 will remain until written off. If the debt arose due to overspending on vacation, you need to reverse the accrual of vacation pay and exclude the amount from tax expenses. The debit balance on account 70 will also remain “hanging” until it is written off.

Insurance premiums from the amount of vacation pay are legally paid. No adjustments in accounting and reporting are needed (letter of the Ministry of Finance of Russia dated July 26, 2021 No. 03-15-06/52554).

Personal income tax is withheld from the amount of vacation pay and transferred to the budget on a reasonable basis. Therefore, there is no need to re-calculate and withhold personal income tax when forgiving debts for unworked vacation days (letter of the Federal Tax Service of Russia for Moscow dated June 28, 2021 No. 20-15/138129). No need to make any adjustments.

If the company did not withhold personal income tax from the unpaid advance, after writing off the debt, you need to inform the tax office about the impossibility of withholding tax by providing a certificate in form 2-NDFL with sign “2”.

Note! The debt must be written off after the expiration of the three-year limitation period (Article 196 of the Civil Code of the Russian Federation). When writing off, the accountant must make the following entry:

DEBIT 91 CREDIT 70

— the debt is written off due to the expiration of the statute of limitations.

Salary increase

When calculating compensation for unused vacation related to dismissal, take into account the increase in salary (tariff rate, monetary remuneration) of the employee (do not take into account the decrease).

When an organization increases salaries (tariff rates, monetary rewards), compensation must be calculated (recalculated) taking into account the increase factor (conversion factor). This must be done in one case: if the increase affected all employees of the organization (branch, structural unit) (paragraph 1 of clause 16 of the Regulations approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922).