The legislative framework

The norms of legal relations between employers of various forms of ownership of enterprises, organizations, individual entrepreneurs and hired workers are regulated by:

- labor legislation;

- other federal laws relating to labor;

- government regulations;

- presidential decrees;

- interdepartmental agreements;

- collective agreement;

- local legal acts of internal effect.

What is “black salary”

“Black salary” is the amount that the employer pays the employee, but it is not stated in official documents, income taxes are not withheld from it and insurance premiums are not charged.

Employers resort to such tricks to achieve the following goals:

- Reducing the tax burden on the company.

- Influencing the employee (you can always threaten with dismissal with payment of only the official part of the salary).

There are also cases when the employee is not registered for work at all and the salary automatically becomes “black”.

These employer actions contradict labor laws in several areas:

- Violation of the procedure for concluding an employment contract (or not concluding a written contract at all);

- Violation of legislation on social and pension insurance of employees.

- The employer, being the employee's tax agent, deliberately fails to fulfill its duties in full.

If the employee can provide compelling evidence that all of the above actually occurs, the employer will face serious penalties, including disqualification and criminal liability.

Duties and responsibilities of the employer

When hiring employees, the employer must formally enter into an employment contract.

In addition to the duties and responsibilities of the parties, it is necessary to document:

- the amount of earnings (based on the current regulations on remuneration);

- specific dates of monthly payments (at least twice, every 15 days worked).

Regardless of how much time remains before the planned salary payment day for the enterprise, settlements are made with the dismissed worker by directly terminating the employment relationship (Article 140 of the Labor Code of the Russian Federation).

In cases provided for by law, upon dismissal, severance pay is paid in addition to the amounts due.

Untimely settlement with a dismissed employee is fraught for the employer not only with additional costs for paying penalties for each day of delay in payments (at least 1/150 of the Central Bank rate), but also with liability.

| Responsibility | Link to legislative acts | Penalties |

| Administrative | clause 6, clause 7 art. 5.27 Code of Administrative Offenses of the Russian Federation | Penalties for guilty officials (taking into account whether they were previously held accountable for similar offenses) – 10-30 thousand rubles. At the same time, an organization acting as a legal entity may suffer losses by paying 30-100 thousand rubles to the state. The director and chief accountant of an organization may be disqualified for 1-3 years. |

| Criminal (if there is criminal intent and acts subject to criminal prosecution) | Art. 145.1 of the Criminal Code of the Russian Federation | Depending on the partial or complete non-payment of the amounts due, the grave consequences that occurred for the former employee due to the lack of earned funds: ∙ the amount of the fine can reach 500 thousand rubles; ∙ faces a ban on engaging in certain types of activities for a period of up to 5 years; ∙ it is possible to serve a sentence in prison for a period of 2-5 years. |

When should full payments be made?

According to the norms of Part 3, 4 Art. 84.1, Art. 140 of the Labor Code of the Russian Federation, the employer must pay the employee in full on the day of his dismissal. In addition to this, the legislation identifies certain cases when deviation from the specified period is possible. List of similar situations:

- If an employee receives a salary in cash and was absent from work on the day of dismissal, the due funds must be given to him the next day after he submits the corresponding request;

- When on vacation with subsequent dismissal, payment for the vacation is made 3 days before its start, and all other amounts are transferred on the day preceding the start of the vacation period;

- If the termination of the employment relationship is associated with the death of an employee, all payments due to him are received by his closest relative within a week after he presents a document certifying the fact of relationship.

In a situation where the employee is not paid upon dismissal within the above deadlines, the employer violates the requirements of the law and may be held liable.

What can an employee expect?

The calculations include:

- wages for the period worked after the last payment;

- compensation payments and additional payments for work in special, harmful working conditions in proportion to the actual time worked;

- the appropriate amount of incentive and incentive bonuses paid in accordance with the current regulations on the remuneration system;

- compensation for unused days of paid leave.

From the amounts accrued during the calculation, the following may be withheld:

- vacation pay paid in advance;

- damage caused by the guilty actions of the employee, if an additional liability agreement has been concluded with him (the amount cannot exceed his average monthly earnings, Article 241 of the Labor Code of the Russian Federation).

A dismissed employee is paid severance pay if:

- he was subject to reduction in staff or numbers;

- the enterprise ceased its activities, was liquidated by decision of the owner, or declared bankrupt by a court decision;

- he was called up for military service;

- according to a medical report, he cannot continue to work under the same conditions, refused to be transferred to light work, or the employer does not have suitable vacancies;

- termination of employment relations is due to other reasons provided for in Art. 178 Labor Code of the Russian Federation.

What compensation is due for delay?

For late payments, the employer faces financial liability (Article 236 of the Labor Code of the Russian Federation). The company is obliged to provide the employee with compensation, the amount of which is at least 1/150 of the key rate of the Central Bank of the Russian Federation of the unpaid amount for each day of delay. If the salary was not transferred in full, compensation is calculated from the funds actually not provided.

The law allows for an increase in interest for late payments if this condition is established in the local regulations of the enterprise.

The obligation to provide compensation arises regardless of the organization's fault for the delay. This payment is not subject to personal income tax (Article 217 of the Tax Code). However, with an increased percentage, income tax is levied on the difference between the amount established by the employer and the amount established by the Labor Code of the Russian Federation.

It is recommended to make insurance contributions from compensation to employers, since it is not clearly indicated in the list of non-taxable income. However, in the practice of the Supreme Court, claims about the illegality of their collections are satisfied. If you do not want to bring the matter to litigation, it is advisable to make contributions.

It should be noted that the former employee has the right to additionally demand indexation of the unpaid amount due to inflation (clause 55 of the resolution of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2). Accordingly, the amount of compensation will also increase.

Where to complain in case of non-payment

You can protect your interests and violated rights by any non-prohibited means. The procedure depends on the choice of method to ensure that the employer repays the amounts due.

We'll tell you what you can do if you haven't paid not only your estimated wages, but also your wages (while you continue to work).

Self-defense and powers of commissions operating at the employer (CTS)

You can try to resolve the conflict on the spot by submitting a written complaint to the employer. The application must be submitted in person or sent by registered mail with notification of its delivery to the addressee.

It is advisable to leave confirmation of your request.

Prepare 2 copies of the application with the requirement to pay the amount of the debt by the specified date with the accrued penalty for late payment.

When contacting in person, the secretary registers incoming correspondence by marking your copy with the date of receipt and registration number.

If the manager ignores legal requirements, a commission created from representatives of the administration and the workforce to resolve disputes can provide assistance.

Currently, CTS has lost its significance and rarely operates in organizations. You can initiate its creation by contacting trade unions designed to defend the interests of workers.

If within 3 days the employer does not voluntarily comply with the decision made by the commission to pay the amounts due, the interested person receives a certificate.

Since the CTS certificate is equivalent to a writ of execution, it is used by bailiffs to force the collection of settlement and accrued penalties for late payments.

Contacting the territorial labor inspectorate

The norms of Art. 2 Federal Law No. 59 (latest current version with amendments and additions dated December 27, 2018), enshrines the right of citizens to contact government bodies authorized to make socially significant decisions.

The fulfillment by employers of guaranteed workers' rights is controlled by the state by the federal labor inspectorate. The supervisory authority performs its functions locally through territorial inspections.

Filing a complaint about non-payment of settlement pay upon dismissal:

- taken personally to the territorial body of Rostrud at the place of registration of the employer acting as a legal entity, or the actual location of the entrepreneur;

- sent by registered mail (it can be simple, but it will not be known when it was delivered and whether it even reached the addressee);

- sent via the Internet by filling out a specially designated form in the “online inspection” section on the official website of Rostrud.

The inspectorate is competent to conduct an unscheduled inspection of the employer by requesting the necessary documents or visiting the place of business. Upon confirmation of the specified facts of non-payment of wages:

- guilty officials will be held accountable;

- the employer will be issued an order setting a deadline for eliminating violations.

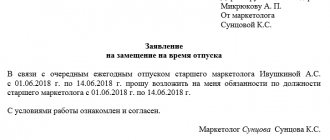

Sample:

Filing a complaint to the prosecutor's office

The prosecutor's office is another government body that can help protect interests and hold the employer accountable.

Having a wider range of powers, the prosecutor's office has the right to monitor the implementation of any laws in force in the country.

Upon application for non-payment upon dismissal of all or part of the funds due:

- a prosecutor's investigation is carried out;

- documents can be forwarded to the territorial inspection that controls the employer to take effective measures to eliminate violations.

An application, similar to an application to the inspectorate, is written arbitrarily. You just need to follow the basic rules of business writing.

Unacceptable:

- use of obscene language;

- insult, threats against officials (or their relatives).

Sample:

Going to court

Any individual conflicts are resolved in court. To file a claim, it is not necessary to present evidence of pre-trial settlement of the dispute or contact the supervisory authorities.

The application is drawn up taking into account the requirements for content and form. As a rule, 3 copies are prepared:

- for court;

- an employer who is a defendant in legal proceedings;

- one copy remains with the plaintiff.

In contrast to appealing violations of legal rights to supervisory authorities, where there is no need to provide evidence of these facts, since they will be verified by a labor inspector or prosecutor when drawing up a statement of claim:

- it is necessary to indicate the rules of law violated by the employer;

- justify the requirements presented;

- attach documents confirming the legal relationship with the employer (their termination) and certificates of arrears in payments.

Sample:

The employer does not give a payment due to a shortage - what to do

Art. 242 of the Labor Code of the Russian Federation allows for full financial liability of an employee for direct actual damage caused to the employer.

What is meant by such damage is listed in clause 15 of the RF PPVS of November 16, 2006 No. 52 (hereinafter referred to as the PPVS No. 52). This:

- real decrease in available assets;

- deterioration of property;

- compensation by the employer for damage caused by the employee to third parties;

- employer's expenses for the acquisition or restoration of property.

Direct actual damage is caused as a result (Article 243 of the Labor Code of the Russian Federation):

- intentional infliction of harm;

- shortage of valuables entrusted under a written agreement;

- disclosure of information, etc.

Full financial liability can be imposed only on employees holding certain positions (or performing certain types of work), with whom a separate written agreement on financial liability is concluded. The list of these positions and works is approved. Resolution of the Ministry of Labor of the Russian Federation dated December 31, 2002 No. 85.

However, deductions from settlement payments will be legal if:

- the amount of deduction did not exceed the average monthly earnings;

- 1 month has not passed since the date of determination of the amount of damage.

The amount in excess of the average monthly earnings is withheld with the consent of the employee. If there is no such consent, the employer recovers it through the court (Part 2 of Article 248 of the Labor Code of the Russian Federation).

State duty on claims for payment of wages

Disputes arising from labor relations are not subject to state duty.

Limitation of actions

With regard to the employer's arrears of wages and other amounts due during employment, claims can be filed in court within 3 years from the date established for payment.

Since we are talking about non-payment of settlement, you need to focus on the date of dismissal, even if some part of the amount due was paid.

Despite the fact that the time frame for contacting the supervisory authorities is not limited by legislative acts, it is accepted by default that the application is considered on its merits if submitted during the period when the conflict can be resolved through the court.

An exception for the consideration of individual disputes by labor dispute commissions operating within organizations. The time limit for resolving CCC disputes is much shorter.

The application can be submitted within 3 months from the day it became known about violations of legal rights by the employer, if there is confirmation that it was not possible to resolve the conflict peacefully.

What to do if you worked without a contract?

Employment without a contract is a fairly common phenomenon in our country, and employees often think that if they have not been paid a salary after dismissal, then no one can help in this matter. But that's not true.

Even if the employee did not have an employment contract, he can still file a claim with his employer or file a complaint with regulatory authorities, including the court. According to Article 61 of the Labor Code of the Russian Federation, the presence of an employment contract is not necessary, since the fact of starting an activity indicates employment.

An employee who worked unofficially has the right to file a complaint against a former manager in the same manner as a regular employee. The only difference is that the fact of employment must be proven. To do this, you need to prepare one of the following evidence :

- Audio, video or photographic evidence of the work;

- Extracts and certificates from the employer, salary statements and payslips;

- Testimony of witnesses.

With the same evidence of employment, you can file a claim in court if the employee is not paid a salary after his dismissal. In this case, the employer will also be required to repay the debt and pay a fine for delayed wages and violation of the procedure for registering employees for work.

General information about where to turn if your salary is not paid without an employment contract is described in this article.

Evidence base

The advantages of contacting supervisory authorities (prosecutor's office or territorial labor inspectorate) with a request to provide assistance in protecting labor rights and receiving the required settlement payments include:

- it is not necessary to present any documents confirming the accuracy of the specified facts of non-payment of wages and other amounts upon dismissal, since they will request documents for verification from the employer on their own;

- there is no need for the personal presence of the interested person when carrying out control activities;

- within a month from the date of application, the applicant will receive a substantiated response.

If conflicts are resolved through court, the plaintiff must provide all evidence of the validity of his claims.

The following can be submitted as documents confirming violation of guaranteed rights:

- a copy of the contract with the employer or work record book;

- copies of written orders, from which it is clear that the person was hired and the employment relationship was terminated (or extracts from orders);

- a certificate from the accounting department about the amount of official salary (or tariff rate):

- a certificate of the amount of debt at the time of filing the claim.

If the employer does not issue orders and certificates at the request of the dismissed employee, when filing a claim, you must apply for the documents necessary to consider the dispute.

How to go to court to resolve a wage dispute

It’s already clear when they don’t give you a salary upon dismissal and where to turn, but the employee is not obliged to go first to the State Labor Inspectorate and the prosecutor’s office before filing a lawsuit. The law does not require pre-trial settlement of labor disputes. Therefore, you can immediately go to court, bypassing the supervisory authorities. However, the procedure for recourse will depend on the amount of debt, the presence of disputes and other requirements of the parties.

Source:

"Accounting Guru"

Heading:

Labor law

dismissal of an employee settlements with employees violation of labor rights

Sign up 6825

9750 ₽

–30%

Criminal penalty

Failure to pay a settlement to a dismissed person is punishable by Article 145 of the Criminal Code of the Russian Federation. This crime has the following elements:

- the official is at fault for causing a delay;

- personal interest or self-interest (the intention to gain benefit or help in a certain matter, the desire to hide professional incompetence).

Both individual employers and legal entities can be held criminally liable.

The heads of the company or structural divisions, as well as chief accountants, are found guilty.

Based on the circumstances that have arisen, an investigation is conducted and evidence of guilt is identified. Punishment may include measures such as removal from office, forced labor, restriction or imprisonment. Some sanctions may be applied in combination by a court decision, for example, a fine along with forced labor. The court almost always takes the side of dismissed employees who were unable to receive all the payments due to them. In some cases, the delay may be due to circumstances beyond the defendant's control. The debt to the employee will still have to be repaid, but the amount of moral compensation can be reviewed and reduced taking into account the circumstances that have arisen.

Features of payment calculation

The amount of all benefits is calculated based on time worked:

- Salary for the current period.

Fact

Salary is calculated using the formula: (salary x number of working days in a month) / number of days actually worked;

- "Thirteenth salary." Possible if such a clause is in the employment contract;

- Severance pay. It is added in the event of liquidation or staff reduction and is paid to employees in the amount of average monthly earnings. In this case, benefits continue to be paid until you start a new job, but no longer than two months after dismissal;

- Premium part. Included in the salary or issued at certain intervals. Quarterly or annual bonuses are recalculated in proportion to the time worked. Holiday bonuses are also added if the employee was on staff for the holiday period.

- Unused vacation. Both the current year and previous years of work are taken into account. The amount of vacation pay depends on the average income in each year. The peculiarity of vacation pay is that the calculation is made by rounding down to whole months.

This is also important to know:

What punishment is provided for absenteeism?

At a minimum, the employee must be paid wages upon dismissal.