Free legal consultation by phone:

8

In an organization, any actions aimed at changing the mode or working conditions (including the balance of working hours) are accompanied by the preparation of appropriate documentation. Orders serve as their main models. Depending on the specifics of such acts, separate documents and resolutions may be attached to it. In other cases, all adjustments made may be reflected in the order itself, indicating in which documents they are made. The introduction of summarized working time recording is also accompanied by the issuance of a separate order.

How an order to change the working hours is drawn up, and a sample of how to fill it out, can be found in the article at the link.

In what cases is summarized accounting used?

In most enterprises and organizations, working hours are recorded according to a standard scheme - daily and amount to an 8-hour working day or a 40-hour working week, respectively.

But in some cases, the length of the working day is determined individually, depending on a variety of factors: the workload of the enterprise, the characteristics of the employee’s working conditions, etc. With such a flexible schedule, when it is impractical to set the exact duration of the shift, management decides on cumulative recording of working hours .

In other words, an employee works according to his own schedule: for example, on Monday he works 6 hours, on Tuesday - 9, on Wednesday - 10, and so on until the end of the week. As a result, his working hours at the end of the weekly period should be equal to the standard 40 hours, as required by law. In the example given, the summarized accounting of working hours equal to one week was considered.

Similarly, a month, quarter, half-year or year can be selected as the accounting period (with a year being the maximum accounting period).

General information about summarized working time recording

What does it represent?

The summation of working time implies such a procedure for accounting for it, in which the employer, when forming an employment schedule, reserves the right to deviate from the work duration framework defined by the legislator, defining an individually selected period of time as the accounting period. In other words, if, as a general rule, a week is used as an accounting period (Article 91 of the Labor Code obliges not to exceed the norm of 40 working hours), then with summarized accounting for this period of time, any other period can be accepted, but not more than 12 months ( for people working in harmful or unsafe conditions - 3 months). Employers most often choose a month, quarter or six months as the accounting period.

The concept and principles of maintaining summarized records of working time are contained in Article 104 of the Labor Code of the Russian Federation.

In all calculations for summary accounting, hours are used as a unit of measurement. Their standard quantity for a specified accounting period is determined by summing up labor hours for the time periods included in it (according to the production calendar).

An example of conducting according to the rules of Art. 104 Labor Code of the Russian Federation

Cashier S.P. Vashinko was given a summarized accounting of working time. The company uses a quarter as a billing period. According to the production calendar of the five-day work week for 2021, the fourth quarter accounts for 511 labor hours (of which 168 in October, 167 in November and 176 in December). The cash register manager drew up a schedule for Vashinko, according to which she must work 147 hours in October and 184 in November. Accordingly, the schedule for December should be drawn up in such a way that the amount of working time for the quarter does not exceed 511 hours, but is not less than this value. The optimal option would be a regime involving 180 hours of work in December.

For what purpose is it used, are there any restrictions regarding the introduction for certain categories of workers?

Summarized accounting of labor time allows the employer to solve two important problems:

- establish continuous and high-quality work necessary to achieve the goals set for the organization;

- respect the right of workers to normal work and rest by compensating for more intense periods with less intense ones.

The situation in which the law obliges the employer to introduce summarized accounting is the work of employees on a rotational basis (Chapter 47 of the Labor Code). In practice, this method of accounting and payment is convenient when organizing work in shifts or on a flexible schedule.

In labor relations with citizens working on a rotational basis, summary accounting is mandatory.

The law does not limit employers in terms of establishing summary accounting either by preferential treatment for certain categories of workers, or by any special requirements for circumstances requiring its introduction . There are only a few accounting features for those individuals working in unsafe or hazardous conditions:

- the maximum duration of the billing period for such employees is three months;

- in the case of seasonal or technological reasons that do not allow labor to be properly rationed within one quarter, it can be increased by a collective or industry agreement (but not more than 1 year).

To whom can a summarized accounting measure be assigned?

Summarized accounting can be assigned to a specific employee of the enterprise, or to a group of employees, a structural unit or the company as a whole. Management makes decisions based on the capabilities and needs of the organization.

There is only one important condition - the total amount of time spent by employees at work should not exceed or be lower than the usual working hours established by law, i.e. reworking or under-processing is unacceptable.

It should be noted that summation cannot be entered without the employee’s consent. In order for everything to be carried out according to the law, an additional agreement to the employment contract (unless, of course, there was such a clause in it initially).

To introduce summarized accounting in an organization, a corresponding order is issued.

How to install - step-by-step instructions and translation procedure

The technology for introducing RMS is reflected in the labor documentation of the Russian Federation.

In particular, information of this nature is present in Article 104 of the Labor Code of the Russian Federation. When establishing a summary schedule, it is important to adhere to a certain sequence of actions and take into account the rules of labor legislation.

Each organization must have a document that reflects information about internal regulations. The same paper should reflect the procedure for introducing summarized recording of working time, if any.

Before establishing non-standard working hours, the employer must coordinate this action with a trade union or other body representing the interests of workers.

This need is regulated by Article 372 of the Labor Code of the Russian Federation. The decision of the union representatives must be made within 5 working days.

The summarized working time recording technology can be introduced both for one employee and for the entire enterprise at once. It all depends on the nature of the production need.

The introduction of RAS should occur in several stages. Each of these includes a specific action.

Step-by-step instructions for establishing this procedure in an organization are as follows:

- Step 1. Deciding on the introduction of summarized working hours.

- Step 2. Determination of the category of workers or persons for whom the introduction of RMS is planned.

A list of specialties is approved for which a specific work schedule will be established.

- Step 3. Coordination of the employer’s decision with the opinion of a trade union or other similar body.

In the absence of controversial issues, appropriate changes are made to the company’s regulatory internal documentation regarding the working hours and schedule of specific workers or employees of the enterprise as a whole.

- Step 4. Issuing an order from the employer -.

- Step 5. Notify employees about upcoming changes.

This action must be carried out no later than 2 months before the introduction of the RMS.

- Step 6. Approval of the work schedule with employees.

- Step 7. Notifying employees that the changes have taken effect.

- Step 8. Making changes to internal documentation, concluding additional agreements with employees.

Responsibility for competent implementation of all stages of introducing a new working time regime rests with the management of the company.

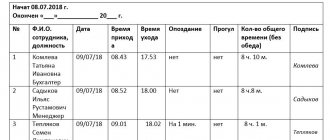

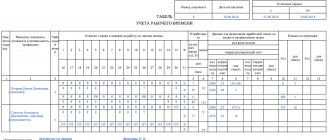

Information about the time worked by each specialist must be entered into the appropriate timesheet.

Features of establishing RMS for drivers.

How to properly prepare documents for the transition?

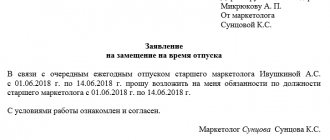

The procedure for establishing summarized accounting requires appropriate documentary support. In particular, the following papers are drawn up:

- an order according to which changes are made to the internal documentation of the company;

- notifications about the implementation of a new system;

- order for the changes to come into force;

- additional agreements to the main employment contracts;

- new work schedule;

- time sheet.

Documents are personally signed by persons who are affected by the topic.

For example, the presence of an employee’s signature in the employer’s order indicates that the latter is familiar with the contents of the order.

Example of an order

The main document on the basis of which changes regarding the working hours of workers come into force is the order of management. It is drawn up in free form; there is no unified form for filling it out.

The order should reflect the following points:

- duration of work shifts;

- exact start and end time of the work shift/day;

- shift rotation technology and other nuances.

Due to the fact that the Labor Code of the Russian Federation does not establish a mandatory form of order, the employer has the right to approve its own sample.

In almost all cases, the contents of the order are approximately the same.

The structure of the order can be drawn up as follows:

- name and civil form of the employing organization;

- name and serial number assigned to the order;

- date and region of publication of the document;

- link to the article according to which changes are being introduced (104 Labor Code of the Russian Federation);

- the circumstance that led to the need to introduce summarized technology for recording working hours;

- Full name of the employee, name of the structural unit, company. This paragraph specifies who is subject to this order;

- duration of the accounting period;

- date of entry into force of the new type of working time recording;

- Full name and position of the person responsible for communicating the order data to employees and drawing up a new schedule;

- payroll technology;

- signature and initials of the chief executive of the company;

- signatures and initials of persons familiar with the order.

If the order applies to a group of persons, then to confirm the fact of familiarization with the order, a special document is drawn up, in which employees put their personal signatures.

order on the introduction of summarized accounting in the organization - word.

Sample notification

A mandatory stage of introducing RMS is notification of the implementation of changes to employees. For this purpose, the relevant paper is drawn up and sent to the workers.

Please note that each employee must receive it at least 2 months before the changes come into force.

The notification is issued in free form. The basic rule that must be observed when compiling it is a clear statement of the essence of the summarized accounting.

The notice must contain the following information:

- Business name;

- recipient's address, position and initials;

- date and place of the notification;

- document's name;

- basic information about the summarized operating mode - the date of implementation of the changes, their specifics, the duration of the accounting period and other nuances;

- consequences of failure;

- consequences of ignoring the notice;

- sender's signature and initials.

Upon receipt of the notification, the employee must put the appropriate mark in it. In the same document, the worker signs a visa with his decision - he agrees/disagrees with the changed working conditions.

notifications to the employee about transfer to summarized working hours - word.

Who creates the document

An order on the summary recording of working time is written on behalf of the head of the enterprise by any of his subordinates authorized to draw up administrative documentation. Usually this is the head or HR specialist, secretary, legal adviser, etc.

It is important that after drawing up the order is submitted to the director of the company for approval - without his personal signature it will not be valid and in which case it can easily be challenged in court or with the help of the labor inspectorate.

conclusions

HRMS can be introduced at enterprises where, due to the peculiarities of production, it is problematic to establish a different schedule.

The procedure for establishing a working time recording system of this type requires documentation. Detailed information on this topic is reflected in Article 104 of the Labor Code of the Russian Federation.

The employer must notify employees of upcoming changes 2 months in advance. An employee has the right to refuse new working conditions by resigning from the enterprise.

An equally important stage in the implementation of changes is the issuance of a management order, which should describe the details of the updated schedule and other nuances of this issue.

Important points when drawing up an order

At the moment, there is no standard, uniform sample of this order for everyone, so employers can write it the way they imagine it. A template approved within the company can also be used.

The document must contain a number of specific data:

- date, number, place of creation;

- full name of the enterprise;

- the very essence of the order, i.e. information about the period of summarized accounting;

- list who exactly this measure will concern;

- indicate the basis for its writing and justification (reason for compilation);

- appoint employees responsible for executing the order (indicate their positions and full names).

In cases where some additional papers are attached to the document, they also need to be noted. If necessary, you can include other information in the form.

Summarized accounting: concept and application features

As you know, under a standard operating mode (that is, with a five-day working week), the maximum working day allowed by law is 8 hours (in this case, time is calculated on a daily basis). For the entire week, this figure is forty hours (for weekly accounting).

Cumulative accounting is a method of establishing and calculating working hours for employees in which compliance with the maximum working day or week is not mandatory. It is established in cases where the enterprise, due to the specifics of its activities, cannot use the daily or weekly method.

The main condition for the application of such a regime is compliance with the maximum possible length of time during which labor activity is carried out during the accounting period. The duration of this period can be:

In this case, when calculating the total time worked during the accounting period, the maximum weekly duration established by law, that is, 40 hours, is taken into account.

Examples of professions where this type of accounting may be required are:

This may also be required in enterprises with a seasonal nature or continuous production, as well as those that operate around the clock or in multiple shifts.

If you have a minor child who does not live with you, then it will be useful for you to know when child support is transferred from vacation pay.

Did you get a job, but already during the probationary period you realized that it was “not for you”? Then read how you can quit in this case. Read more here.

A sample application for voluntary resignation can be found here.

Main design nuances

The execution of the document, as well as its informational part, is entirely at the discretion of the director of the enterprise. It is acceptable to write an order either on a simple blank sheet of A4 or A5 format, or on the organization’s letterhead, printed or by hand (with a blue, purple or black ballpoint pen, but in no case with a pencil).

You only need to ensure that the order is endorsed by the original signature of the head of the organization or a person authorized to certify such papers (in this case, the use of facsimile signatures, i.e. printed in any way, is unacceptable). In addition, the employees responsible for its execution and those in respect of whom it was written must be familiarized with the order - their signatures indicate that they are familiar with the order.

Today there is no strict need to stamp the order form with a seal: stamped products can only be used when this rule is stated in the local regulations of the organization. In the general procedure, which also applies to legal entities, seals and stamps are no longer required for use.

The order is usually written in one original copy, but if necessary, additional copies can be made (for example, for a personnel officer and an accountant).

Payroll calculation in terms of summarized labor accounting

Methods of calculating wages

Payment for the work of citizens working under the conditions of summarized accounting can be made in two ways (this must be mentioned in the employment agreement):

- Using a tariff hourly rate. The calculation of payments due to a citizen in such a situation is simple - the hourly rate is multiplied by the number of hours worked during the estimated time.

- Indicating the salary amount. In this case, if the hours actually worked during the accounting period exactly coincide with the standard, the worker must be paid a salary; if the standard has been reduced or it is necessary to calculate overtime or underproduction, an hourly tariff rate is applied, calculated from the amount of the salary.

When working in shifts, the contract may specify both a monthly official salary and an hourly tariff rate.

The rate calculated from the salary can be calculated in one of three ways:

- dividing the annual salary by the annual standard number of hours;

- dividing the salary for the quarter by the quarterly standard number of hours;

- dividing the monthly salary by the standard number of hours per month.

The employer chooses the specific calculation method independently and enshrines it in the local regulations of the organization.

Payroll calculation for summary accounting can be done in several ways.

Examples of calculating earnings using an hourly rate and salary

Crane operator I.P. Stepanov works in shifts under conditions of summarized labor accounting. The estimated period of time is a quarter. The employment contract concluded with Stepanov determined the hourly wage rate - 305 rubles.

In the first quarter of 2021, Stepanov worked 447 hours, which corresponds to the standard for this period according to the production calendar. Subject to accrual: 447 hours × 305 rubles. = 136335 rub.

In the second quarter, Stepanov has one period of incapacity for work - 14 days (from May 16 to May 29, 2021). This period of time accounts for 10 working days (80 hours). The standard for the second quarter is 438 hours, for Stepanov it is reduced by 80 hours (438 – 80 = 358). During the designated period, Stepanov worked 358 hours. Subject to accrual: 358 hours × 305 rubles. = 109190 rub.

Storekeeper M.I. Ilyin works in shifts under conditions of summarized labor accounting. The billing period for it is 1 month. The employment contract specifies a monthly salary of 32,000 rubles as the unit of account for remuneration. In September 2021, Ilyin worked 176 hours (the standard for September is 176 hours). The salary is subject to accrual - 32,000 rubles.

In October 2021, Ilyin was on vacation for 2 days—October 3–4. The standard for October - 168 hours - is reduced by 16 (this is exactly the amount for 2 working days). 168 hours - 16 hours = 152 hours during which Ilyin was busy.

To pay for a partially worked month, an hourly rate must be determined. The accounting policy of the enterprise implies its calculation for a monthly period: 32,000 rubles. / 168 hours = 190 rub. Calculation of Ilyin’s earnings for October: 190 rubles. × 152 hours = 28880 rub.

Payment for processing and defects

Overtime is the presence of a certain number of hours in excess of the standard by the end of the accounting period. Art. 152 of the Labor Code obliges employers to pay overtime as follows:

- the initial two hours - increased by one and a half times;

- those following them are doubled.

Shortage - a situation where a person actually worked less than the standard amount during the accounting period - is paid according to the following rules:

- if the defect arose through the fault of the employer - in the amount of the average salary calculated in proportion to the time worked;

- if the situation is due to vacation or the employee being on sick leave - according to the rules of payment for such periods.

Hours not worked due to the employee’s fault (for example, due to absenteeism) are not subject to payment.

An example of calculating earnings for overwork and underwork

Waiter T.N. Egorov works under the terms of summed labor. The estimated period of time is one month. Egorov’s hourly tariff rate is 250 rubles. In September 2021, Egorov worked 179 hours, while the norm for this month is 176 hours. The processing time was 3 hours, 2 of which should be paid at one and a half times, 1 - at double. Salary calculation for September 2016 for Egorov: (176 hours × 250 rub.) + (2 hours × 250 rub. × 1.5) + (1 hour × 250 rub. × 2) = 44,000 rub. + 750 rub. + 500 rub. = 45250 rub.

In October, Egorov’s work schedule was designed in such a way that he did not work 1 hour (with the standard of 168 hours, 167 hours were actually spent). Since this is not the worker’s fault, the employer is obliged to pay the hour at the average salary calculated for the period worked, that is, at the usual rate. Calculation for October 2016 for Egorov: 168 hours × 250 rubles. = 42,000 rub.

Payment for weekends, holidays, night work

Working on generally accepted days off - Saturday and Sunday - for an employee working on a consolidated basis is the norm and is not subject to increased pay.

Since summarized accounting initially implies deviations from the usual schedule of a five- or six-day work week, the rule of double payment for days falling on weekends does not apply in this case. However, if a certain number of hours fall on a holiday, then they are subject to payment at double the rate (Article 153 of the Labor Code of the Russian Federation).

Additional payments for work at night (from 22:00 to 6:00) are made in accordance with Art. 154 TK. For some specialties, the percentage is determined by law, in other cases it is determined by a collective or labor agreement. The minimum increase in earnings for working at night - 20% - is established by Decree of the Government of the Russian Federation No. 554 of July 22, 2008.

An example of calculating additional payments when working on holidays and at night

Leading specialist of the automation department S.P. Grishaev works on the basis of summarized labor accounting. The billing period for it is one month, the hourly tariff rate is 240 rubles. The employment contract for Grishaev provides for a 30% increase in wages for night work. In November 2021, Grishaev worked 167 hours, which corresponds to the norm, 10 of which were on a holiday (November 4, 2016), 16 at night. Calculation of wages for November 2016 for Grishaev: (141 hours × 240 rubles) + (10 hours × 240 rubles × 2) + (16 hours × 240 rubles × 130%) = 33840 rubles. + 4800 rub. + 4992 rub. = 43632 rub.

How are vacation pay, vacation pay, travel pay and severance pay calculated?

Determination of the required vacation days for a person working under the conditions of summarized accounting occurs in the general manner - based on the number of fully worked months in the individual pay period. Their payment and compensation for unused vacation are also calculated according to general rules - using average daily earnings, calculated in proportion to the calendar days worked over the previous 12 months.

The calculation of payments, the basis of which is the average salary of a worker (except for payment for vacation days) - travel allowances, severance pay, and so on - has some peculiarities in the summary accounting of labor. Clause 13 of the Regulations on the peculiarities of calculating the average salary (approved by Decree of the Government of the Russian Federation No. 922 of December 24, 2007) prescribes their calculation based on average hourly earnings.

Average hourly salary = the amount of income (excluding social and one-time payments) for the previous 12-month period of calculation / the number of hours actually worked for the same period of time. The result obtained is multiplied by the number of scheduled labor hours falling within the period to be paid.

Example of calculating travel allowances

Mechanic S.V. Stankevich works on the basis of summarized accounting. The employment agreement sets him a pay period of 1 month, an hourly wage rate of 200 rubles. From October 3 to October 7, 2016, Stankevich will be sent on a business trip to a neighboring town. For the period from November 2015 to October 2021, Stankevich earned 403,000 rubles. (excluding payment for vacations, sick leave and one-time bonuses). During the same period of time, he had 1832 actual working hours. Calculation of average hourly earnings: 403,000 rubles. / 1832 hours = 220 rub.

For the period from 10/03/2016 to 10/07/2016, Stankevich’s work schedule accounts for 45 working hours. Calculation of payment for business trip days for Stankevich: 220 rubles. × 45 hours = 9900 rub.

After the order is issued

After the order is issued and all the employees mentioned in it have become familiar with it, a new summarized recording of working time begins on the basis of it.

For the entire period of validity, the order must be filed with the rest of the administrative documentation in a separate folder, which must be kept in a place with limited access. After the relevance of the document has passed, it should be given to the archive of the organization, where it should be stored for the period established by law (but not less than three years) or for the period prescribed in the internal regulations of the company.

What it is?

The presented working time method is quite often used when an enterprise constantly uses overtime working conditions. There may be cases when the employer cannot qualitatively establish the work process in such a way that a pure regime of daily or weekly labor time is used. The most common example is companies that employ a continuous production process with two or even three shifts. An employee can work more than 8 hours in one day, and more than 40 in a whole week. Summarized frequency accounting is designed to protect the rights of the company’s employees.

Filling out a sample for sellers

As a common example, consider the delicate work of doctors and other medical professionals. They are provided with a short duration of labor time, which, when summed up, should not exceed 39 hours. However, doctors often remain on daily duty. When a doctor is on duty twice in one week, he exceeds the individual standard of working time that is intended for him. The annual schedule will also exceed the required duration. The employer will be able to see the result of summarized accounting, which involves calculating the duration for an employee not for one shift, day or week, but for a certain, longer period (a year or another established one).

Note! The number of hours that an employee works in excess of the normal number of hours will be considered overtime.

If an employee falls under the definition of summarized accounting, then overtime activities will initially be included in his shift schedule. This provision could mean that an employee could take the March 2021 schedule and calculate that they worked 184 hours. This amount of time exceeds the allowed amount of 151 hours, so 33 overtime hours are already in his schedule.

Summation in the 1C program

The employer has the right and can plan time at the workplace in such a way that the normal number of working hours is not exceeded. However, such a case does not guarantee that the employee will not be required to work overtime. This may be necessary if one person remains after the end of his own shift to wait for a colleague to change.