The main document of a working person has been and remains a work book. No matter how heated the debate about the abolition of this document may be, it remains one of the most important documents for confirming work experience. In addition, the work book is used by the accounting department when calculating the percentage of sick leave payments, since it is impossible to quickly obtain such information from other sources. Whatever innovations await us in terms of work records and in whatever form this document is maintained, it is unlikely that they will be canceled in the near future.

What is work experience in a specialty?

Within the framework of the current legislation of the Russian Federation, the term is not disclosed, however, there are several regulations in which it is mentioned, for example, Art. 256 Labor Code of the Russian Federation. It says that accrual is carried out while on leave to care for a minor child.

Regarding military personnel, the term is mentioned in Part 3 of Art. 10 Federal Law No. 76 dated May 27, 1998. According to this norm, the period of contract service is calculated 1 to 1, and conscription - 1 to 2. Alternative service is also included during work in the specialty (Part 2 of Article 19 Federal Law No. 113 dated July 25 .2002).

Experience is required in order to obtain a certificate of admission to SRO (to perform certain types of construction work). In accordance with Part 8 of Art. 55.5 of the Town Planning Code of the Russian Federation, to obtain a certificate, the duration of work must be 5 years or more.

If we are talking about qualification requirements regarding work experience, they are indicated for employees individually, depending on the nature of their activities. These standards are determined within the framework of current federal and regional legislation and contain a whole list of nuances.

Types of total length of service that affect the calculation of pensions

Differences in establishing the estimated size of a labor pension are not limited to the difference in the formulas for their calculation: the lists of periods that form the total length of service involved in them also differ.

For calculations according to clause 3 of Art. 30 of the law of December 17, 2001 No. 173-FZ, the total length of service consists of the periods:

- any types of work (including creative activities) in the Russian Federation or abroad;

- military service;

- illness that occurred during work, or disability of 1-2 groups related to work;

- unjustified excessive detention;

- registration with the employment service in connection with unemployment.

For calculations according to clause 4 of Art. 30 of Law No. 173-FZ of December 17, 2001, the total length of service, in addition to the above periods, additionally includes the time:

- vocational training;

- caring for a disabled person;

- maternity leave and child care up to 3 years (but not more than 9 years);

- lack of opportunity to work for the wives of military personnel staying with their husbands at the place of service, and the wives of persons sent to work abroad. In the latter case, this period should not exceed 10 years;

- being in the occupied territories, in concentration camps or in besieged Leningrad during the Second World War.

See also “Is military service included in seniority (nuances)?”

How to calculate

There are two opinions regarding the conduct of settlement activities for special experience. This situation has arisen due to the fact that there is no legislative regulation of this issue. As a result, several relevant positions have emerged in practice:

- In the area of special experience, only periods of work in a specific profession in a specific position are taken into account. It does not matter whether there is confirmation of education and qualification level.

- It is permissible to include in the special factor the time period of work in which it was performed in accordance with qualification training and corresponds to the received educational document (certificate, diploma). It turns out that the absence of a provided education document equals the impossibility of employment.

The second position is considered more controversial, since in practice, candidates are mainly required to have practical work experience. In order to accurately determine the procedure for calculating the SS (based on the number of years worked or from the moment of acquiring education), the employer has the right to develop its own LNA in the form of an instruction or standard. The document will specify the time periods that are definitely counted.

It turns out that the period of time of a special nature includes the period of work of an employee in a certain position or within a specific area. There is no legislative framework on which specific areas are included in the SS. This only means that the institutions themselves can prescribe this aspect in their internal rules.

Coaching - what is it

In a broad sense, coaching is a technique for teaching a person independence in achieving goals and finding optimal solutions that will lead to set goals.

A coach is a kind of trainer and mentor, however, unlike most existing motivation methods, he does not focus his ward on previous, most often negative, experiences, but directs him to the future.

The coach only pushes the person in the right direction, offering to see not problems, but situations from different sides. The effectiveness of this motivation technique is based on revealing the internal potential of the individual, following the already established successful experience.

There are several types of coaching:

- Management (business) coaching - the audience for this type of training is the management and personnel of companies. They learn to see a specific goal for the continued existence of the business and build feedback connections between management and employees. After applying coaching methods, the company’s team forms a team of like-minded people who together strive to achieve their goal.

- Career coaching is aimed at identifying a person’s potential in building their own career.

- Life coaching helps the client cope with various situations in the personal sphere and achieve what they want.

Coaching is carried out in the form of an individual or group conversation. As a rule, there are two methods of leading a client to a goal: mentoring and partnership.

The mentoring (mentoring) method consists of training a client by a specialist who has some authority and experience in the area where the student wants to achieve a certain result. With this type of motivation, the specialist sets an example for his ward and becomes a guide to his goal.

Affiliate is that the coach learns simultaneously with the client, draws his attention to those shortcomings that delay the moment of achieving the goal.

For example, when learning to drive a car, classes with an instructor who shows how to drive a car correctly, suggests possible ways out of controversial situations, is a mentoring method.

The partner method is that the coach knows the methodology for teaching effective driving, however, he is not an instructor.

Here the student is told what to pay attention to in order to better learn how to drive a car, and how to organize the stages of training and training.

Civil servant experience

In accordance with paragraph 2 of Art. 14 Federal Law No. 58 of May 27, 2003, the period of public service related to one type includes the time spent working in it within another direction, as well as the period of public service. In accordance with the norms of clause 3, part 1, art. 6 Federal Law No. 79 of July 27, 2004, accounting is carried out during the calculation of the duration of work of a civilian specialist.

In the calculation process, the period of work represented by a municipal employee is taken into account. This phenomenon can be explained by the unity of qualification requirements for both types of services.

In accordance with paragraph 1 of Art. 12 Federal Law No. 79 and clause 3 of Art. 5 of Federal Law No. 58, for a candidate for a filling civil servant position, compliance with the requirements of a civil servant performing duties within a particular subject of the Russian Federation is mandatory. In particular, experience in the civil service or specialty is required. As for a municipal employee, he is usually subject to an identical set of requirements (Clause 1, Article 9 of Federal Law No. 25).

Have at least 1 year of experience in management positions

Home Favorites Random article Educational New additions Feedback FAQ⇐ PreviousPage 7 of 10Next ⇒

Work in leadership positions is considered to be: work as the head of a legal entity, his deputy, filling the highest and main positions of the state civil service, work as the head of a local government body or his deputy.

+ Completion of an internship as an AU assistant for a period of at least 6 months

If there is no work experience in management positions, then the internship period is extended to 2 years.

Decree of the Government of the Russian Federation dated July 9, 2003 No. 414 - approved the rules for conducting an internship as an assistant to an administrative assistant.

Passing the theory exam

Decree of the Government of the Russian Federation dated May 28, 2003 No. 308 establishes the rules for conducting and passing this exam. These rules determine the composition of the commission that will take the exam.

Persons who have a higher education in economics, law or in the field of crisis management are allowed to take the theoretical exam; if there is no such education - ???

The composition of the commission is approved by the registration service (cadastre and cartography)

No punishment in the form of disqualification for committing an administrative offense, no deprivation of the right to engage in certain activities

If the right has been limited or deprived, the subject must retake the theoretical exam.

An administrator who has not performed functions for more than 3 years in a row is required to retake the theoretical exam.

They say that it is necessary to evaluate the exam differently for people who are taking the exam for the first time and for people who have not taken it for 3 years.

No criminal record for committing an intentional crime

Availability of a compulsory liability insurance agreement

The rules for concluding such an agreement are contained in Article 24.1 of the law “On N/B”. This article establishes: an insured event under the contract is the onset of liability of the AU to the persons participating in the bankruptcy case in the event that the AU has not fulfilled or improperly performed its duties. The onset of liability must be confirmed by a court decision.

The contract is concluded for at least 1 year with the condition of its extension for the same period. The law determines the minimum insurance amount of the contract - 3 million rubles per year. Moreover, if the AU is approved as an external or bankruptcy manager, the AU is obliged to additionally conclude an agreement for a larger amount. The amount is calculated as a percentage of the book value of the debtor’s assets (Article 24.1 - more details).

Other requirements may be established by the SRO; these requirements may affect competence, integrity and independence (marital status, etc.).

A SRO member must meet mandatory and additional requirements throughout the entire period of membership; subject to exclusion from the SRO within 1 month from the moment of detection of non-compliance.

If a citizen wishes to become a member of the SRO, he sends an application to the organization, to which is attached all documents confirming compliance with these requirements. The application is reviewed and a decision is made on inclusion or refusal. Refusal by the SRO, as well as avoidance of making a decision, can be appealed to the Court of Justice within 6 months.

Additional requirements may be established by the authorized body, bankruptcy creditor or applicant. Additional requirements of these subjects are established when assigning an AU to a specific procedure. The law establishes a list of such additional requirements :

1) Having a higher legal or economic education or education in a certain field of activity

2) Availability of work experience in management positions in a certain sector of the economy

3) Can be set as additional - the number of procedures in which the person participated as an AU

The law obliges the agency to act in good faith and reasonably in the interests of the debtor, creditor and society. Article 45 of the Law “On N/B” determines the procedure for appointing an AU to a specific procedure. Since 2008, significant changes have been made to the appointment procedure.

Previously valid edition:

The bankruptcy creditors could only indirectly influence the election of the AU candidate. According to the previous version, the SRO sent to the court a list of candidates who agreed with the article of the AU. The list included 3 candidates.

Bankruptcy creditors and authorized bodies and the debtor could select one candidate each (i.e., say who is definitely not suitable for the position). The candidate who remained, or the one who was first on the list, was appointed by the court as the AU.

Current edition:

The applicant, bankruptcy creditors, and authorized bodies received the right to independently select a candidate for the AU.

You can also indicate the SRO, of which the AU should be a member (it is not the person who is selected, but the organization in which he should be). The SRO must confirm that a specific entity meets the requirements for an AC. The AU is appointed by the arbitration court. The applicant or creditors can only apply for an appointment.

Rights and obligations of the AU

Article 20.3

Rights:

1) Convene meetings of creditors

2) Apply to the court with appropriate petitions

3) Receive rewards

Article 20.6 regulates the procedure for determining the size of the AU. The reward consists of 2 elements:

1. Fixed amount

Defined by law: temporary manager – 30 thousand rubles per month

2. Interest amount

The interest amount is paid in one lump sum.

Remuneration is paid as a general rule from the debtor’s funds; Meetings of creditors have the right to determine another source of payment of remuneration and establish additional remuneration for the AC.

4) The right to attract other persons on a contractual basis to ensure the performance of the functions assigned to him

Clause 10 of the resolution of the Plenum of the Supreme Arbitration Court No. 60 of July 23, 2009

The Law “On N/B” contains 2 norms that at first glance contradict each other. Clause 5 of Article 20.3 secures the powers of the AU cannot be transferred to other persons. Clause 1 of Article 20.3 provides for the right of the AU to attract other persons to exercise its powers.

What should I do? Clause 5 of Article 20.3 does not prohibit the AU from transferring to third parties the powers that belong to it as the management body of the debtor. According to this provision, it is prohibited to transfer to third parties the exclusive powers of the AU, which are granted to it as a special participant in bankruptcy procedures.

The authority to make decisions on inclusion in the register of requirements cannot be transferred. Decisions on the approval of the debtor's transactions cannot be delegated if such approval is required.

The authority to issue an opinion regarding the financial condition of the debtor cannot be delegated. It is prohibited to transfer the right to convene a meeting of creditors and the authority to maintain the register (also cannot be transferred); an exception is when the register is maintained by the registrar.

The Law “On N/B” does not exclude the possibility of material and procedural representation of the AU; authority must be formalized accordingly.

What other rights does the AU have?

5) Request information about the debtor

Persons from whom this information is requested are required to provide the information within 7 days without charge. For example, when requesting information about real estate from the register, the AU has the right to receive information free of charge.

6) Submit an application for release from assigned duties

The literature says that those powers that are enshrined in law as rights are responsibilities. He not only has the right to file petitions, but is also obliged; therefore, the right as such is the right to receive remuneration and the right to voluntary release from authority.

Responsibilities of the AU:

1) Take measures to protect the debtor’s property

2) Analyze the financial condition of the debtor

3) Maintain a register of creditors’ claims (except when it is maintained by the registrar)

4) Provide information from the register to those persons who have the right to request this information

5) Reasonably and justifiably carry out expenses that are associated with the exercise of his powers

Unreasonableness and groundlessness are proven by the person who challenges the actions.

6) Maintain confidential information that constitutes a commercial and/or official secret

7) Identify signs of deliberate and fictitious bankruptcy

Report these facts to the authorized body

Other duties provided for by law

Other duties provided for by law

The AU is appointed by the AC and retains its powers throughout the duration of the procedure. The powers of the AC are terminated due to the expiration of the procedure from the moment the AC adopts the relevant act.

The powers of the AC may be terminated early. Early termination may be voluntary or involuntary .

Voluntary termination of powers is carried out upon the application of the AC, which is submitted to the AC. Forced termination of powers is associated with the violation of the AU’s duties. As an example, we can cite clause 3 of Article 65 of the law “on n/b” - a temporary manager can be removed from office if duties were performed improperly or were not performed, provided that this resulted in losses for the debtor.

If the fact of improper execution of the powers of the AU is revealed, the creditor applies to the CA with a petition to remove the AU from its powers. The AC reviews and makes a decision.

The functions of the AC differ depending on the procedure to which the AC is assigned. In each of the procedures, the AC is called differently.

1) In the observation procedure, the AC is called a temporary manager

2) In the financial recovery procedure - administrative manager

3) In the procedure of external control - external manager

4) In the bankruptcy procedure - the bankruptcy trustee

Register of creditors' claims

The law provides the opportunity to maintain a register for 2 entities:

1) AU

2) Registrar

Involvement of the registrar is mandatory if exceeds 500 entities

The registrar is a professional participant in the securities market who maintains a register of securities owners.

The registrar is engaged on the basis of a decision of the meeting of creditors and carries out its activities on the basis of an agreement. The contract is signed by the AU; As a general rule, the services of the registrar are paid for at the expense of the debtor.

The AU or the registrar is responsible for the correct maintenance of the register; they are obliged to compensate for losses (by law) caused by improper performance of their duties. If the maintenance of the register of creditors is transferred to the registrar, the AU is exempt from liability.

Contents of the registry

The register includes the claims of creditors; These requirements are taken into account in Russian rubles. There may be cases where claims are expressed in foreign currencies. The law provides that claims expressed in foreign currency are recalculated at the exchange rate of the Central Bank of the Russian Federation on the date of introduction of the bankruptcy procedure. Recalculation is carried out once, then the size of the requirements does not change.

The register contains information:

1) About each creditor

2) About the amount of his claims against the debtor

3) The order of satisfaction of these requirements is indicated

4) Reasons for these requirements

Interested parties have the right to obtain information contained in the register. Information is provided in the form of an extract from the register; Each creditor has the right to request such an extract based on its own requirements included in the register. Creditors whose claims amount to 1% or more of accounts payable have the right to receive a copy of the register of claims. Disputes regarding the inclusion of requirements in the register are considered by the AC.

NEW TOPIC

Article 27 of the Law on Bankruptcy establishes the procedures used in bankruptcy cases. 5 procedures apply to the debtor-legal entity :

1) Observation

2) Financial recovery

3) External control

4) Bankruptcy proceedings

5) Settlement agreement (don't forget)

Procedures applied to a citizen debtor:

1) Bankruptcy proceedings

2) Settlement agreement

The literature notes that the term bankruptcy procedure is used conditionally in the law. In the strict sense of the word, the bankruptcy procedure according to the law is only bankruptcy proceedings, as well as simplified procedures - bankruptcy of a liquidated or absent debtor. These procedures can be called bankruptcy procedures, since they apply to a debtor who has already been declared bankrupt by the court.

The remaining procedures: financial recovery, external management, supervision, apply to a debtor who is not declared bankrupt. But according to the law, in the broad sense of the term “bankruptcy procedures,” all these procedures are included in bankruptcy.

The law gives preference to rehabilitation procedures: financial recovery and external management. Why? The court makes a decision to declare a debtor bankrupt and to open bankruptcy proceedings in cases where signs of bankruptcy have been established and there are no grounds for introducing rehabilitation procedures. Since the introduction of rehabilitation procedures is mandatory if there are grounds established by law, we conclude that they are given preference.

Lecture from 3.5.11

The application may be based on the creditor's debt under one or more obligations; creditors also have the right to combine their claims in one application.

Such a statement is signed by each creditor who joins such a statement. The application is accompanied by documents confirming the debtor's obligations (invoices, waybills, etc.). The debtor, having received a copy of the application within 10 days, is obliged to provide a response.

The debtor in the response indicates his objections regarding the circumstances; the total amount of debt for mandatory payments, wages and obligations to creditors. Information about the accounts of credit institutions is indicated in the review; if the debtor does not agree with the facts that are indicated, then the evidence is unreasonable.

Initially, the application to declare the debtor bankrupt is reviewed by the court for validity. As a result of checking the validity of the application, the court makes 1 of 3 determinations:

1) The application is recognized as justified, an observation procedure is introduced

2) The introduction of surveillance is refused, the application is left without consideration

3) Surveillance is refused, proceedings on the case are terminated

Each of these determinations can be appealed.

Observation procedure

Supervision is a bankruptcy procedure applied to the debtor in order to ensure the safety of the debtor’s property, conducting an analysis of the debtor’s financial condition; compiling a register of creditors' claims; holding the first meeting of creditors. The observation procedure is introduced unless otherwise provided by law. This procedure does not apply to credit institutions if we are talking about a legal entity being liquidated or an absent debtor.

Article 63 of the Law defines the consequences that occur for the debtor with the introduction of surveillance:

1) Claims of creditors for monetary obligations and payment of obligatory payments can be presented only in the manner prescribed by the law on insolvency and bankruptcy (except for claims for current payments)

2) Proceedings in cases related to the collection of funds from the debtor are suspended

3) The suspension of enforcement documents on property penalties is suspended, arrests imposed on the debtor’s property are lifted

Prohibitions of the law:

— The debtor cannot satisfy the demands of the founders for the allocation of a share in connection with the exit; The law also prohibits the repurchase and acquisition by the debtor of outstanding shares

— Payment of the actual value of the share is also not allowed

— Prohibition of closing monetary obligations by offset; offset is impossible if its implementation violates the procedure for satisfying the requirements provided for in paragraph 4 of Article 134 of the law “on n/b”

With the introduction of surveillance, the owner of the property of a unitary enterprise does not have the right to seize this property. Payment of dividends and income by shares (i.e. distribution of profits between participants) is not allowed.

Conducting surveillance does not lead to the removal of the debtor's managers from their powers. Non-removal of managers from management is a general rule. In accordance with Article 9 of the Law “On N/B”, there is an exception - the head of the debtor can be removed at the supervision stage. The grounds for removal are violation of insolvency laws. The decision is made by the AC, and the temporary manager petitions for removal.

If the CA removes a manager, his powers are transferred to the candidate proposed by the debtor, i.e. creditors do not participate in the selection. All management issues remain in the area of debtor selection. If a candidate is not proposed, responsibilities are assigned to one of the deputy managers; if there are no deputies, then to the debtor’s employee.

Violation of insolvency laws means failure to comply with the restrictions that, according to the law, come with the introduction of supervision. The restrictions are stated in Article 64.

Such restrictions include:

⇐ Previous7Next ⇒

Legal

Legal experience includes temporary periods of performing duties within the walls of various government bodies.

This is an activity in any legal office in positions that require a mandatory legal education. It also includes the time interval for performing work functions in other positions related to the sphere of maintaining the rights of citizens and business entities. Women have the right to expect that the period of maternity leave will also be included.

As a basis for establishing this parameter, it is customary to use the marks written in the specialist’s work book. Other aspects of accrual depend on specific positions:

- Bailiffs. Persons who have the appropriate educational level, professional and personal qualities, and proper physical condition are eligible for such a position.

- Judges. To hold this position, a specialist must meet two requirements, in particular, age (from 25 years) and experience (from 5 years). Sometimes, to carry out settlement activities, special documentation may be required in the form of instructions, orders, etc., which can confirm information about the fact that a person has performed certain labor actions. If controversial issues arise, the resolution of issues falls on the shoulders of the panel of judges, whose representatives have the proper level of competence.

- Lawyers. To obtain status along with a legal education, you will need at least two years of work experience or an academic degree. It is also necessary to confirm that you have completed an internship course.

- Representatives of the Ministry of Internal Affairs. The total duration provides for the employee's right to receive a pension on preferential terms. Length of service includes the time interval for filling a position, being on business trips, in military service, registration, and a probationary period within the Department of Internal Affairs.

Determination of length of service for representatives of different positions is carried out in accordance with qualification standards.

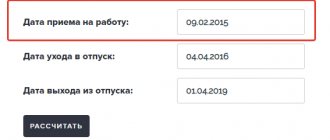

Examples of calculating work experience

Currently, manual calculation of length of service is used extremely rarely. The process is labor-intensive and very responsible. The Internet is now available in almost every corner of the country, and in extreme cases, you can download special programs that are installed directly on your computer and help with calculations. However, sometimes this procedure is carried out the old fashioned way. If there is not much information about the employee’s places of work in the work book, then this method can be used at any enterprise.

So, you can calculate experience in two ways:

- According to a special formula. In this case, from the value of the work end dates, we subtract the value of the work start dates

- Doing arithmetic calculations

For use in the example, we will use the following initial data.

| Reception | Dismissal |

| 01.02.2006 | 13.08.2010 |

| 01.09.2010 | 30.06.2013 |

| 07.03.2014 | 15.01.2020 |

Let's look at how you can calculate length of service using the 1st method.

- We add together all the start dates: 02/01/2016 + 09/01/2010 + 03/07/2014 = 14/09/6030

- Add up the work completion dates: 08/13/2010 + 06/30/2013 + 01/15/2020 = 58.15.6042

- Subtract the total sum of work start dates from the total sum of work end dates: 58.15.6042 – 09.14.6030 = 49.01.0012

- We present the result in a digestible form: 49 days = 1 month and 19 days. Thus we get 12 years 2 months 19 days

- Since 3 periods are taken into account, the employee was fired 3 times, which means you need to add 3 more days (days of dismissal).

The length of service will be 12 years 2 months 22 days.

Now let's look at the 2nd method of calculating length of service. The initial data is still the same.

Period No. 1.

| Term | How do we count? |

| Day | 13-1+1(day of dismissal)=13 |

| Month | 8-2=6 |

| Year | 2010-2006=4 |

| Total | 4 years 6 months 13 days |

Period No. 2.

| Term | How do we count? |

| Day | 30-1+1(day of dismissal)=30 |

| Month | 6-9=-3 Since the result is a negative value, you need to “borrow” one year (in months). We get the following: 12+6-9=9 |

| Year | 2013-2010-1 (taking into account the “busy” year) = 2 |

| Total | 2 years 9 months 30 days |

Period No. 3.

| Term | How do we count? |

| Day | 15-7+1(day of dismissal)=9 |

| Month | 1-3=-2 Since the result is a negative value, you need to “borrow” one year (in months). We get the following: 12+1-3=10 |

| Year | 2020-2014-1 (taking into account the “busy” year) = 4 |

| Total | 4 years 10 months 9 days |

Now you need to add up the data for all three periods.

| Period | Year | Month | Day |

| 1 | 4 | 6 | 13 |

| 2 | 2 | 9 | 30 |

| 3 | 4 | 10 | 9 |

| 10 | 25 | 52 |

25 months = 2 years 1 month

52 days = 1 month 22 days

After conversion we get 12 years 2 months 22 days.

The result coincides with the calculations using the first method.

Difference from experience

Many hired employees confuse the concepts of “experience” and “length of service.” Despite the similar essence, there are colossal differences between them.

Experience is a special case of the previous concept. For example, throughout his life a person has worked as an accountant, a senior sales specialist, a secretary, a security guard and a manager. The total duration of holding these positions is the length of service. Time spent in individual positions is experience.

Experience is the total time worked, i.e. the interval from the first to the last day of work activity, the time period is counted, days that are not related to length of service are subtracted from it. The rest is included in the length of service, on the basis of which pension amounts, sick leave amounts, etc. are paid.

Thus, it turns out that the second indicator is the total time worked, and experience is specific knowledge, skills and practical abilities acquired in the course of performing work duties in a particular field. Work experience is important in the hiring process. The first factor is important when calculating social government payments - subsidies, benefits, preferences.

Accounting for general experience in the 1C: Salary and Personnel Management program 8 (revision 2.5)

General experience 2. In the tabular part of the General experience form, enter information about the employee’s length of service.

From the draft document published on the official website of the Eurasian Economic Union, it follows that a citizen will be able to apply for a pension when he reaches the age of retirement both in his country of residence and in the state where he works. He will be able to receive money from both states for the time actually worked. That is, the length of service gained while working in the Russian Federation is taken into account by the Pension Fund, and the period when he had work experience for a pension in his homeland will be taken into account by the competent authorities in the field of pensions in another country.

What is specialized experience?

Professional experience is the period of time during which an employee worked in accordance with his profile. Requirements for it are specified in professional standards, job descriptions, specialized reference books and other acts. The system of professional standards has been used in practice since mid-2021, and within their framework, 9 skill levels have been allocated for representatives of all types of professions.

Accounting for the profile element is carried out in accordance with the regulatory framework developed by the government:

- Art. and 195.3 Labor Code of the Russian Federation;

- Federal Law No. 122 of May 2, 2015;

- Order of the Ministry of Labor of Russia No. 147n dated April 12, 2013;

- Order of the Ministry of Labor of Russia No. 148n dated April 12, 2013;

- Federal Law No. 273 dated December 29, 2012;

- Art. 5.27 Code of Administrative Offenses of the Russian Federation.

These acts use the concepts of professional retraining, advanced training, and certification. Experience does not affect these aspects in any way, however, the time spent in training is included in it. Along with this concept, the term special length of service is considered, which implies a time period during which the employee performed official duties under special conditions.

Administrative and managerial personnel - what is it?

Before considering the very concept of AUP and its interpretation as administrative and managerial personnel, you should familiarize yourself with the basic principles of forming the personnel structure in the organization. Thus, despite the fact that the personnel structure in many cases is developed individually, taking into account the characteristics of a particular business entity, the employees of an enterprise can often be divided according to various criteria. The most popular separation technique now is to divide employees into two fundamental groups:

- Administrative and management personnel. It includes employees who are engaged in management activities or ensure the existence of the enterprise itself by solving key administrative functions within the framework of their work activities.

- Production personnel. This category includes the line personnel of the organization - both qualified specialists who are performers and ordinary employees with a minimum level of qualifications. At the same time, production personnel mainly include employees who ensure the direct receipt of profit by the enterprise, but lower-level service employees can also be classified as such.

From the point of view of Russian legislation, such a division of employees is not reflected in regulatory documents in any way. The only documents that indirectly address this issue can be unified qualification directories of professions - they are divided into a directory of blue-collar professions and a directory of employees. And administrative and managerial personnel in most situations belong specifically to the category of employees.

Legal regulation of the activities of administrative and managerial personnel, accordingly, remains under the jurisdiction of the employer himself. It is he who can regulate the division of employees into various groups, the procedure for applying various remuneration systems in relation to employees, as well as establish rules of subordination in the enterprise, which are quite important for the administrative and managerial staff of the organization.

Managerial

Managerial experience is usually understood as the time interval during which an employee held leadership positions. For example, if throughout your career you have held the positions of general director, head of department, and individual entrepreneur, the total duration of these time periods constitutes management experience.

Thus, work experience within a specialty is a generalized concept that requires detailed study.

Whether it is possible to get a job without work experience in your specialty is discussed in this news release.

What is included in the length of service and how to calculate the periods?

The periods included in the total length of service are taken into account in this calculation according to their actual calendar duration by summation (clauses 3–4 of Article 30 of Law No. 173-FZ of December 17, 2001). However, there are a number of exceptions, according to which the corresponding intervals are taken into account in an increased amount. For example, for both options for determining the total length of service for a full year, the time worked during a full season in seasonal industries is taken.

In calculating the length of service under clause 4 of Art. 30 of the Law of December 17, 2001 No. 173-FZ additionally increases the time:

- work in the Far North, in areas equivalent to it, in the zone of the Chernobyl accident - 1.5 times;

- conscript service in the army, work in leper colonies, anti-plague institutions, work during the Second World War (except for areas of occupation), living in besieged Leningrad, being in a concentration camp - 2 times;

- participation in hostilities and service in the zone of the Chernobyl accident, treatment of war injuries, work in besieged Leningrad, unjustified detention in places of detention - 3 times.

Explanations from officials about the order in which periods of conscription service in the army and periods of study at universities are included in the general length of service and insurance experience are available in the ConsultantPlus system. Get trial access to K+ for free and proceed to conclusions.

The right to choose a calculation formula and, accordingly, to evaluate the total length of service is reserved by law to the insured person. However, in practice, such a calculation is made by the Pension Fund based on the documents it has, choosing from 2 options the most profitable for the pensioner.

The length of service is assessed in years, months and days. In this case, 30 calendar days are taken for a full month, and 12 months for a year (clause 47 of the Government of the Russian Federation Resolution No. 1015 of October 2, 2014 and clause 35 of the previous Government Resolution of the Russian Federation dated July 24, 2002 No. 555).

Work experience - how does it affect the size of your pension?

According to the law, length of service has a direct impact on the size of the future pension. For the period before January 1, 2002, the pension depends on the length of your work experience and salary, for the period after - on the amount of insurance contributions that were sent to your account in the Pension Fund from employers.

Full work experience will be 25 years for men, 20 for women. With this length of service, the pension will be 55% of average earnings. For years worked beyond these years, the length of service coefficient increases (1 year - by 1%, but not more than 20%). That is, working pensioners have their length of service coefficient adjusted every year, starting in August.

How to calculate length of service

It’s easy to confirm your work experience; all you need to do is make entries in your work book. If this document is lost, it can be replaced by an employment contract, an order for employment, statements, as well as statements of deductions made from salaries. Most often, reconciliation of personalized registration data of citizens is carried out as insured persons. Similar records are maintained at all local pension fund offices for each employed person. Sometimes, testimony in court may be sufficient to prove the work experience of a person who, for various reasons, has lost documents indicating the period of his work activity.

Length of work is often calculated during the period of granting a pension, when paying sick leave or when calculating various benefits. This calculation is the labor responsibility of personnel officers, but sometimes it happens that you have to carry out reconciliation and figure out how to calculate length of service yourself.

How is work experience considered: methods and examples of calculation

Before starting work (November 12, 2005) at Siyanie LLC, Sergei Vladimirov Ivanov was an employee of two more enterprises with which he signed an employment contract. This is evidenced by the entries in the work book:

For those for whom such work will be too difficult or boring, and they are looking for how work experience is considered easier, there is a method for calculating work experience using a computer program. This can be either a 1C program installed on a computer or simple online services that offer such a service.