Home / Labor Law / Labor Code / Work experience

Back

Published: March 18, 2016

Reading time: 8 min

0

1706

In the last decade, a number of changes have been made to Russian legislation that have significantly changed the procedure for calculating pensions.

Coefficients were introduced and the length of service now has special significance - since 2015, it has been the basis for calculating pensions, and not the length of service, as it was before .

- Legislation

- Main types

- What periods are included?

- What periods are not included?

- How is it calculated? Calendar order

- Preferential order

What is special insurance experience?

Special insurance experience - the total duration of all periods of performance of official duties in hazardous production conditions (unfavorable, difficult), in harsh climatic zones, in areas with a special status.

In other words, we can say that special insurance experience is the time that a worker gave during his life, carrying out activities that are of particular importance for the country or associated with the negative impact on the body, health and life of the employee of psychological or physical stress, harmful production conditions , various dangerous factors.

We can talk about taking into account special insurance experience when the chosen type of activity meets special conditions, including:

- civil service under contract;

- specificity of certain types of work;

- special conditions for carrying out labor duties;

- carrying out work in the Far North or equivalent areas.

If an employee has special insurance experience, this fact gives him certain guarantees, namely:

- the right to receive an old-age pension before retirement age;

- the possibility of receiving payments for length of service (applies to military personnel and civilians equivalent to them).

During which periods of work is special work included?

The list of professions and positions in respect of which special seniority may be accrued has legal significance because it is determined by law. Such categories of workers have the legal opportunity to retire early and receive appropriate monetary compensation taking into account their length of service.

The peculiarities of calculating special insurance experience include the fact that it is characterized by two features at once: quantitative (total number of years of working activity) and qualitative (specificity of working conditions, taking into account the type of activity, location and other factors). Qualitative characteristics are an obligatory part of the special insurance period, without which no calculations are possible.

Calculation of special insurance experience: how it is determined

When calculating the duration of the special insurance period, the following periods of labor activity will be taken into account:

- creative work carried out in the state. institutions;

- work in state or municipal medical centers;

- teaching activities on children's profiles in municipal and state institutions;

- work as a geologist, topographer, etc. as part of various expeditions during research;

- work as a truck driver during mining (in quarries, open-pit mines, mines, mines, etc.);

- carrying out work in the subway or on railway tracks;

- in difficult conditions under the influence of certain factors (high temperatures, pressure, radiation, loud sound, vibration, etc.).

What periods are not included?

What is included in the concept of special insurance experience and what is the procedure for calculating it

- Insurance (with the calculation and payment of contributions to the Pension Fund of the Russian Federation).

- Non-insurance (no premiums paid):

- military service;

- time of receipt of social benefits for sick leave;

- maternity leave to care for a child up to one and a half years;

- care for the elderly (over 80 years old), disabled people of the first group, children with disabilities;

- time spent in custody followed by rehabilitation;

- time of receipt of unemployment benefits;

- time spent moving to a destination for the purpose of employment;

- time of cooperation with operational investigative services under contract.

Calculation of special insurance experience: special positions and professions

There are no clear criteria by which one can say with certainty that a profession or position is “harmful”. However, the law prescribes focusing on the following indicators:

- the nature of the work performed;

- production conditions associated with exposure to harmful and life-threatening factors;

- service in the fire department;

- service in the penitentiary system;

- pedagogical activity;

- work in treatment institutions;

- performing work at an enterprise located in the Far North or similar areas.

Calculation of special insurance experience: special working conditions

Non-standard conditions for carrying out activities are considered:

- underground works;

- difficult and dangerous work;

- work in the field of mining production;

- work of high severity and intensity.

Back in 1991, the Government established a list of special working conditions, under which in some cases the retirement age is reduced by 5 years, in others by 10 years. The lists are still taken into account to this day.

How does the calculation work?

The procedure for calculating preferential length of service is determined by the following provisions (we will give only some of them):

- The length of service for citizens whose work involves exposure to harmful conditions should be 20 years for men and 15 years for women. At the same time with this condition, it is necessary that a man has worked in such production for at least 10 years, and a woman for at least 7 years;

- When calculating preferential length of service, the calculation coefficient is important, which is calculated depending on the years of experience. For example, an experience of 25 years is equivalent to a coefficient of 0.55. The more years worked, the greater this coefficient will be (its maximum value can be 0.75);

- Each year of work under harmful or special conditions can be withdrawn in addition to one more, due before the pension is calculated, if the length of service under harmful conditions is more than 5 years for men and more than 3 years and 9 months for women.

The process of calculating preferential length of service itself is quite complicated for people who have never encountered such situations: the presence of a large number of inconsistent coefficients, special conditions that must be observed - all this significantly complicates attempts to independently calculate. In such cases, we recommend that you first seek advice from the local branch of the pension fund, where they will help you accurately calculate your length of service.

How to calculate special insurance experience

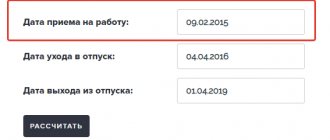

Calculation of special insurance experience is carried out on a calendar basis. That is, 30 days of work under special conditions will be counted as a special month. length of service Months will then be converted to years. However, it should be remembered that there are conditions that must be met in order to qualify for special insurance coverage:

- income from activities must be paid to the Pension Fund;

- the work must be carried out during a full working day (if an employee works part-time, the duration of the shift is important, and for a full work shift, the actual time worked is taken into account);

- work that gives the right to special insurance coverage must be the main type of activity.

In addition to the time actually spent at the workplace, special experience includes:

- periods of temporary disability;

- basic annual leave with pay;

- additional rest time provided to employees working under special conditions.

Confirmation of experience

Documents and witness statements are recognized as evidence of insurance experience.

Data of individual (personalized) accounting in the state pension insurance system in accordance with the Federal Law of April 1, 1996 “On individual (personalized) accounting in the state pension insurance system” are equated to documents. Students need to know the procedure for opening individual pension accounts (IPA) with the Pension Fund of the Russian Federation, the rules for maintaining them, and the list of information stored on them.

Work outside the Russian Federation is confirmed by a document from the territorial body of the Pension Fund of the Russian Federation on the payment of insurance contributions for compulsory pension insurance, unless otherwise provided by law or an international treaty of the Russian Federation. The payment of unified social tax and the single tax on imputed income is equivalent to the payment of insurance premiums.

The periods of work before registration with the Pension Fund as an insured person are established according to documents on work, service, study and other socially useful activities. Documents must be properly executed, have signatures of managers, seals, etc.

The main document for confirming work experience is the work book. In the absence of it or inaccurate records, other documents may be accepted to prove work experience: written employment contracts, certificates, extracts from orders, personal accounts and payroll statements.

The working hours of persons engaged in self-employment on the basis of registration certificates or patents are established according to certificates from financial authorities or archival institutions; and persons who worked under individual or group rental conditions - according to certificates from the state social insurance fund. Since 01/01/1991, the work time of these persons is confirmed by certificates of payment of insurance contributions to the Pension Fund of the Russian Federation.

The time of care for a disabled person of group I, a disabled child or a person who has reached 80 years of age is determined on the basis of: an application, the passport of the person caring for him, documents certifying the duration of disability and age, etc. The time of care for a child under three years of age is established according to birth certificate, passport extract, marriage certificate and other documents.

The detention, stay in places of detention, exile (special settlement) of rehabilitated citizens is confirmed by certificates from the departments of internal affairs.

Periods of creative activity of members of creative unions who are not on staff of organizations are confirmed by a certificate from the organization-customer of the work on the payment of mandatory payments from the amount of the fee to the Pension Fund.

The periods of activity of private detectives, notaries, lawyers and other persons who independently provide themselves with work are established according to documents from the Pension Fund of the Russian Federation or the tax authority on the payment of the unified social tax and contributions to the Pension Fund of the Russian Federation.

In the absence of documents, the insurance period can be determined on the basis of the testimony of two or more witnesses who worked with the applicant for the same employer, if the work documents are lost due to a natural disaster (earthquake, flood, hurricane, fire, etc.) and they cannot be restored . The procedure for establishing work experience in case of loss of documents as a result of emergency situations was approved by Resolution of the Ministry of Labor of the Russian Federation dated June 24, 1994 No. 50.

The following must be attached to the application for establishing insurance experience based on witness testimony:

- a document from a state (municipal) body confirming the date, place and nature of the natural disaster;

- a document from the employer or state (municipal) body confirming the fact of loss of work documents in connection with the specified natural disaster and the impossibility of their restoration;

- a certificate from an archival institution or state (municipal) body confirming the absence of archival data on the period of work established by witness testimony.

If the reason for the loss of work documents is their careless storage, intentional destruction or other similar reasons, then the insurance period is established based on the testimony of two or more witnesses who worked with the applicant for the same employer and have documents about their work for the specified period. The duration of the insurance period in this case cannot exceed half of the length of service required to assign a labor pension.

Who has the right to claim an insurance pension?

For each type of work, a minimum threshold is established that is required to obtain the right to apply for

an insurance pension .

There are the following categories of citizens who are subject to social security legislation:

- persons who were insured and made regular contributions in accordance with Federal Law No. 167-FZ of December 15, 2001;

- military personnel and equivalent civil servants with at least 25 years of service in calendar terms;

- disabled people, subject to the loss of a breadwinner;

- foreigners and stateless persons, if they complied with the requirements of the law on compulsory pension insurance;

- spouses of employees performing their professional duties abroad for up to 5 years;

- disabled people with congenital defects or acquired as a result of professional activities; heroine mothers, with at least 5 years of work experience.

This is interesting! The government has approved lists of professions, according to which their representatives have the right to early retirement while maintaining its amount.

Calculus rules

The calculation of special work experience is carried out on a calendar basis. The period of employment to which special length of service applies is converted into months and years. The conditions under which the period of work may be included in special experience include:

- implementation of labor activity as the main job;

- form of employment - full time;

- making regular contributions to the Pension Fund.

If a citizen worked part-time, then the total duration of his working day is taken into account, and the length of service is calculated according to the time actually worked. In addition, special experience includes: temporary loss of ability to work by an employee, planned and additional leaves. A simple vacation, a period of suspension from work or an employee’s inadmissibility to perform work duties according to the law cannot be included in the special insurance period. If a person alternated hazardous work with regular work, then from the total work experience only periods that meet the conditions necessary for calculating special work experience will be highlighted and summed up.

In some cases, not a calendar, but a preferential procedure may be used for calculation. For example, if a person worked for a certain time in an area with a high level of radiation contamination, his special insurance period will be multiplied by a special coefficient. Knowledge of the basic rules of calculation and the citizen’s personal control over this procedure will prevent possible errors that could significantly affect the amount of pension payments.

The procedure for confirming experience

If personalized accounting information is incomplete or insufficient to take into account all the circumstances relevant to the assignment of a pension, they can be supplemented with documents. In this case, the document may be in electronic form.

The requirements for the preparation of such documents are described in detail in the sections of Government Resolution No. 1015 dated 02.10.2014. These include:

- work books;

- labor and civil contracts;

- certificates from place of work or service;

- certificates from other bodies and persons.

If it is not possible to obtain documents, it is permissible to take into account data on insurance experience based on testimony. However, witnesses do not have the right to evaluate working conditions.

How to find out your length of service and whether you need to calculate it yourself

Data on the insurance experience of persons registered with the Pension Fund comes mainly from employers as part of personalized accounting information. Persons paying fixed contributions are also included in the Pension Fund, so the necessary information about the length of service of most citizens in the Pension Fund is available and can be obtained there:

- or by written request;

- or through an electronic account.

in calculating the insurance period yourself. When all the conditions required for granting a pension are met, the Pension Fund must check, using the documents submitted by the citizen, the correctness of the information he has and, if necessary, make all the necessary adjustments, focusing on the most beneficial option for the pensioner to take into account the insurance period and other circumstances.

Legislative acts on the topic

| Federal Law of December 28, 2013 No. 400-FZ | About insurance pensions |

| Federal Law of December 15, 2001 No. 166-FZ | On state pension provision, on the importance of length of service when assigning pension benefits |

| Resolution of the USSR Cabinet of Ministers of January 26, 1991 No. 10 | On approval of lists of production work, professions, positions and indicators giving the right to preferential pension provision |

Answers to common questions about calculating special insurance experience

Question No. 1: How to prove the presence of special experience if there are no entries in the work book?

Answer: Confirmation of the right to record special insurance experience, in addition to the work book, are employment agreements, extracts from places of work, certificates, and salary accounts.

Question No. 2: I was engaged in entrepreneurial activity, without having a certificate of registration as an individual entrepreneur. I worked under difficult conditions, which could have given me the right to take into account special insurance experience. How can I prove that I have the right to accrue special payments? length of service?

Answer: You will need to present a document confirming the transfer of insurance payments to the Social Insurance Fund employee.

Rate the quality of the article. Your opinion is important to us:

By length of service

If a teacher applies for early retirement, then not only work in the profession is taken into account, but also postgraduate studies, as well as occupation of other positions in the educational field.

- a work book designed to record all places of employment of a citizen;

- salary transfer invoices, which can be replaced by pay slips;

- labor agreements drawn up and signed with employers;

- extracts made from orders of the leadership of various organizations;

- certificates from institutions that contain information about the terms of work, position held and other relevant data.