Compensation of expenses for traveling and mobile work

Question

Traveling and mobile nature of work: what is the difference between these concepts? What is the best way to compensate the expenses of such an employee: monthly bonuses to the salary, salary, or compensation by checks?

Answer

The Labor Code does not explain the concepts of “traveling nature of work”, “mobile nature of work” (more details in the rationale).

The condition on establishing the traveling (mobile) nature of the work for the employee must be reflected in the employment contract.

The employer independently determines the procedure for reimbursement of expenses.

If an employee’s work function involves constant work on the road, the employer has the right to establish for such an employee a traveling nature of work with reimbursement of expenses provided for in Art. 168.1 Labor Code of the Russian Federation.

Rationale

The legislation does not clarify the concept and does not define what should be understood by the traveling or mobile nature of work.

Relevant definitions are contained in some industry documents. Thus, work has a traveling nature if the performance of job duties involves regular trips within the service territory (areas) with the possibility of daily return to the place of residence.

Such an employee performs all duties stipulated by the employment contract outside a stationary workplace, at facilities located at a considerable distance from the location of the organization.

For example, the work of a courier, insurance agent, sales representative, or postman has a traveling nature.

It is obvious that traveling, as a rule, involves additional costs, primarily associated with paying for travel on public transport or using personal cars for business purposes.

The mobile nature of work is a mode of work with frequent relocation of the organization (movement of workers) or isolation from their permanent place of residence. At the same time, the employee does not always have the opportunity to return to his place of residence every day.

Works with a mobile nature may include work that is performed on the road (conductor, flight attendant, etc.); involve frequent movement of employees (employees of mobile construction organizations).

Employers are given the right to independently establish remuneration systems, including any allowances of a compensatory nature (Article 135 of the Labor Code of the Russian Federation). Corresponding payments due to the special nature of the work can be reflected in the terms of collective agreements, local regulations, employment contracts (see letter of Rostrud dated December 12, 2013 N 4209-TZ).

Article 168.1 of the Labor Code of the Russian Federation establishes that for employees whose permanent work is carried out on the road or has a traveling nature, the employer reimburses the following expenses related to business trips: travel expenses; expenses for renting residential premises; additional expenses associated with living outside the place of permanent residence (daily allowance, field allowance); other expenses incurred by employees with the permission or knowledge of the employer.

The amount and procedure for reimbursement of expenses associated with business trips of employees specified in part one of Article 168.1 of the Labor Code of the Russian Federation, as well as the list of jobs, professions, positions of these employees are established by a collective agreement, agreements, and local regulations. The amount and procedure for reimbursement of these expenses may also be established by an employment contract (Part 2 of Article 168.1 of the Labor Code of the Russian Federation).

clause 2 of the Instructions on the organization of business trips for military personnel of rescue military formations of the Ministry of Emergency Situations of Russia and employees of the state fire service in the system of the Ministry of the Russian Federation for Civil Defense, Emergencies and Disaster Relief, approved by Order of the Ministry of Emergency Situations of Russia dated January 10, 2008 N 3.

clause 1 of the Regulations on the payment of allowances related to the mobile and traveling nature of work in construction, approved by Resolution of the USSR State Committee for Labor, the Secretariat of the All-Union Central Council of Trade Unions dated 01.06.1989 N 169/10-87

| She answered the question: E. A. Karapetyan, leading expert of the Consultant + Askon Information Center |

When it comes to the traveling nature of work, for some reason everyone immediately imagines drivers. Of course, as a rule, this type of work is established for them, but in fact it can be established for absolutely any employee whose work function involves traveling. The specialized literature and legislation say very little about the procedure for establishing the traveling nature of work and the preparation of reports by employees in the specialized literature and in the legislation, and some employers are at a loss in these matters. Let's find out...

Main features of traveling work

The traveling nature of work in the Labor Code is mentioned only in two articles and, apparently, there are no plans to make any changes or additions to them.

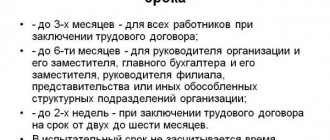

So, in Art. 57 establishes that one of the mandatory conditions to be included in an employment contract is a condition that determines the nature of the work (mobile, traveling, on the road, etc.), and in Art. 168.1 contains an open list of expenses that the employer reimburses to employees with a traveling nature of work (as well as employees whose permanent work is carried out on the road, working in the field or participating in work of an expeditionary nature). Such trips, like business trips, are called business trips.

A business trip is a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. At the same time, business trips of persons whose permanent work is carried out on the road or has a traveling nature are not recognized as business trips (Article 166 of the Labor Code of the Russian Federation).

As well as business travelers, persons whose permanent work is traveling in nature, the employer reimburses expenses for travel, rental of living quarters, etc. However, when an employee is sent on a business trip, his average earnings are retained, and if the work is traveling, the salary is simply paid.