How do past holidays affect?

To calculate payments for annual leave, a time period of 12 calendar months is taken, the total earnings for this time are calculated, then divided by the time worked and multiplied by the number of days of rest.

Thus, vacation pay is calculated; these rules are spelled out in the Regulations on Average Earnings. Detailed step-by-step calculations with examples can be found here.

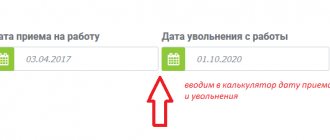

You can do the calculation yourself using an online calculator using this link.

If the annual pay period consists entirely of time worked, then the calculation is greatly simplified. If events other than normal work activities occur at this time, the calculation order changes.

We recommend reading about how it is taken into account when calculating vacation pay:

- sick leave;

- business trips.

If a vacation falls within the billing period, this will also affect the calculation procedure.

How is rest time taken into account when calculating:

- is included in the vacation period, that is, it gives the right to days of annual rest;

- is not included in the billing period, the months in which there was a vacation are considered incompletely worked;

- Past vacation pay accrued to the employee is not included in the average earnings.

Is vacation time included in the experience?

Article 121 of the Labor Code of the Russian Federation determines the procedure for calculating length of service giving the right to annual leave.

In accordance with the provisions of this article, the length of service includes, in addition to actual work, also calendar days off, holidays, up to 14 days of compensatory time off at one’s own expense, as well as granted annual leave.

That is, while on vacation, the employee receives days of annual rest.

Calculate your vacation time using an online calculator.

Are the days included in the billing period?

The answer to this question is contained in the Regulations on Average Earnings, which can be found in the appendix to the Decree of the Government of the Russian Federation No. 922 of December 24, 2007.

According to clause 5 of Regulation No. 922, days when the employee maintained his average earnings are excluded from the calculation period. Since vacation pay is paid based on the employee’s average daily earnings, the time spent on vacation is not included in the calculated period.

If an employee’s rest period falls on any month of the last year, then such a month will be incomplete; only calendar days actually worked will be taken into account.

For the purpose of calculating vacation pay, it is considered that in a full month the employee works 29.3 calendar days (average monthly number of days in a year). If there was an annual vacation in the month, the indicator will be different. It is necessary to determine what part of 29.3 is accounted for by the time actually worked.

To calculate days worked in a month with vacation, the formula is used:

Exhausted days = (Calendar number of days of the month - Days of rest) * 29.3 / Calendar number of days of the month.

A similar procedure applies in cases where the month includes:

- sick leave;

- business trips;

- absenteeism;

- other types of leaves (study, without pay);

- downtime, etc.

Is the payment amount taken into account in average earnings?

Clause 5 of the Regulations also states that not only vacation time is not included in the payroll period, but also payments made are not included in the average earnings.

To pay for annual vacation, payments for the last year are summed up and divided by the time of work in calendar days - the rules for calculating average daily earnings.

The amount of payments can only include those incomes that are associated with the payment of the actual work of the employee. First of all, these are salaries and incentive payments in the form of bonuses.

All other payments (vacation pay, social benefits, financial assistance, compensation) are not taken into account in the total income to determine the average daily earnings.

Example for 2021

Initial data:

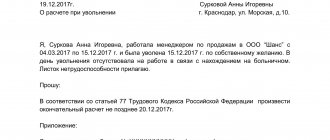

From November 10, 2021, the employee goes on vacation for 14 calendar days.

The previous annual vacation took place from February 1 to February 14, 2019, vacation pay = 14,000, salary in February 14,000.

The monthly salary consists of a salary of 28,000 rubles.

There were no other excluded periods.

Let's summarize the initial data in a table:

| Holiday start date | 11/10/2019 (14 days) |

| Monthly salary | 28,000 rub. |

| Excluded periods | Vacation from 02/01/2019 to 02/14/2019 (vacation pay = 14,000 rubles, salary = 14,000 rubles) |

Calculation:

| Billing period | 01.11.2018 to 31.10.2019 |

| Total income | 28000*11months + 14000 = 322000 (14000 vacation pay is not taken into account) |

| Days worked in February 2019 | (28 — 14) * 29,3 / 28 = 14,65 |

| Days worked in the billing period | 11*29,3 + 14,65 = 336,95 |

| Average daily earnings | 322000 / 336,95 = 955,63 |

| Vacation pay | 955.63*14 days. = 13378.84 |

Which payments are included in the calculation base and which are not?

Certain provisions of the labor code clearly indicate which days and payments are used when calculating vacation pay and which are not. In this regard, we will create a small table:

- employee salary;

- percentage of revenue;

- payment in kind;

- monetary allowances for employees of government agencies and municipalities;

- fees from media and cultural organizations;

- allowances and surcharges.

| Payments that are excluded from the base | Amounts to be taken into account |

|

Sometimes employees are paid bonuses that are permanent and secured by internal regulations. These payments are also subject to accounting when calculating vacation benefits.

This is important to know: What to do if the employer does not pay vacation pay

Questions from our readers

Ask your question in the comments below and get a free answer! |

The procedure for calculating vacation pay in 2019

If the calendar year has been worked in full, the calculation of the average daily earnings for calculating vacation pay is carried out according to the standard formula. The total amount of wages and income included in it for the previous 12 months is divided by 12 and 29.4. The last figure is calculated annually and is included in the Labor Code of the Russian Federation as an amendment.

This is important to know: How many days of vacation do teachers have in Russia?

Since in practice it is rarely possible to fully work out a calendar year, it is necessary to adjust the annual income taking into account available sick leave, financial assistance and bonuses. Additional payments can significantly increase average daily earnings (ADW), and the availability of sick leave benefits can slightly reduce it - this depends on the duration of the certificate of incapacity for work.

The calculation of SDZ for an incompletely worked working month is calculated as the accrued amount of wages without sick leave , divided by days worked according to the calendar and adjusted by a factor of 29.4.

So, the average earnings, subject to the condition that the year has been worked in full, will be:

20000 x 12: (12 x 29.4) = 682.7 rub.

Taking into account sick leave:

From this example it follows that the time spent and the amount of sick leave are not included in the calculation of vacation pay and do not significantly affect the calculation of SDZ.

If during the 12 months of the accounting year there were some months when the employee was absent for some reason or income that was not subject to inclusion in the payroll was deducted, the SDZ calculation is calculated by dividing the total amount of accrued wages for the previous accounting period by the average monthly value of calendar days (29.4), multiplied by the number of full months and calendar days in partially worked months.

Calculation of average daily earnings

Calculate vacation pay in a few clicks in the Kontur.Accounting web service! Get free access for 14 days

Knowing the billing period and the total amount of earnings for this period, you should determine the employee’s average daily earnings:

Average daily earnings = Earnings for the billing period / (Number of full months in the period × 29.3)

29.3 in the formula corresponds to the average monthly number of calendar days. Moreover, the billing period is considered to be fully worked if in each month of this period there are no days excluded from the billing period (days of temporary disability, business trips, vacations, downtime, etc.).

If the billing period is not fully worked out, the formula is applied:

Average daily earnings = Earnings for the billing period / (29.3 × Number of fully worked months in the billing period + Number of calendar days in incompletely worked months of the billing period)

Moreover, for each month that is not fully worked, you need to apply the formula:

The number of calendar days in an incompletely worked month = 29.3 / The number of calendar days of the month × The number of calendar days falling within the time worked in a given month.

Example

The employee has been working for the organization since August 1, 2021. On July 15, 2019, he goes on vacation for 14 calendar days. In this case, the billing period is 11 months - from August 1 to June 30. During the billing period, the amount of earnings for calculating vacation pay amounted to 600,000 rubles. There were no salary increases in the organization during this time.

In March, the employee was on a business trip for 21 calendar days. The remaining days of March are 10 (31 − 21). Accordingly, March is an incomplete month of the billing period, from which only 9.5 days are taken to calculate vacation pay (29.3 × 10 / 31).

In October, the employee was sick for 11 calendar days. The remaining days of October are 20 (31 − 11). Accordingly, October is also an incomplete month, from which only 18.9 days are taken to calculate vacation pay (29.3 × 20 / 31).

There are 9 fully worked months left in the billing period (11 − 2). Accordingly, the average daily earnings of an employee will be:

600,000 rub. / (29.3 days × 9 months + 9.5 days + 18.9 days) = 2,054.09 rubles.

The employee must be paid the amount of vacation pay of RUB 28,757.26. (RUB 2,054.09 × 14 days).

For employees who receive vacation in working days, the average daily earnings are calculated based on the number of working days according to the calendar of a 6-day working week:

Average daily earnings = Salary accrued for the entire period of work / Number of working days according to the calendar of a six-day working week, which falls on the time worked by the employee

If the billing period has not been worked out at all and there was no salary immediately before the vacation (for example, the employee returned from maternity leave or the employee was on a long business trip and immediately goes on vacation), then the formula is applied (clause 8 of the Regulations):

Average daily earnings = Salary (tariff rate) / 29.3

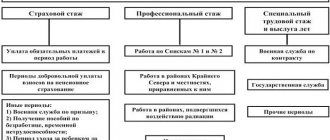

Concept

Vacation experience is generally considered to be the period of time during which an employee worked for a specific employer. The duration of this time is not interrupted.

If an employee was employed in one company, but after some time quit and was hired by another organization, the first day of his work experience is considered the moment of registration of labor relations in the new institution.

At the end of each regular working year, an employee can apply for leave. Its minimum duration is 28 days. For certain categories of employees this figure may be increased.

Every time the specialist responsible for this action—an accountant—faces the calculation of this indicator. Experience allows you to determine the exact number of days an employee is entitled to rest for the purpose of further calculation of vacation pay or compensation upon dismissal.

What periods are not included?

When determining the length of service that gives the right to rest, not all of the official employment time of a working citizen is taken into account. It is for this reason that difficulties may arise with this procedure.

The following time periods are not taken into account in the calculation:

- absence of a citizen from the workplace without good reason;

- unpaid leave lasting more than 2 weeks;

- leave taken due to the need to care for children until they reach a certain age.

Circumstances not taken into account in the calculation are regulated by Article 121 of the Labor Code of the Russian Federation.

It is important that maternity leave is included, while maternity leave is an unaccounted period.

Time that is not included in the length of service for annual leave postpones the end of the working year for the provision of rest by the corresponding number of days.