Regulatory regulation

Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 “On the specifics of the procedure for calculating average wages”

Letter of the Ministry of Health and Social Development of the Russian Federation dated December 7, 2005 No. 4334-17 “On the procedure for determining the number of calendar days of unused vacation”

Letter of Rostrud dated July 22, 2010 No. 2184-6-1

Regardless of the grounds for termination of the contract, even for guilty actions, the employee upon leaving the company must be paid money for all unclaimed vacation days (see letter of Rostrud dated July 2, 2009 No. 1917-6-1). How to calculate compensation upon dismissal, see the instructions below.

When else do you need to calculate your average daily earnings?

Average earnings are calculated according to the rules established by Decree No. 922 of December 24, 2007. The Labor Code lists several cases when the average salary should be calculated:

- employee leave (regular, educational);

- temporary disability, maternity leave, child care;

- business trip;

- calculation of compensation upon dismissal;

- downtime due to the fault of the employer;

- other paid absences from the workplace (donor days, suspension of work due to non-payment of wages for more than 15 days, undergoing a mandatory medical examination, etc.).

Instructions on how to calculate compensation for vacation upon dismissal

The general formula for calculating money: the number of unused vacation days should be multiplied by average earnings. We will show you how to calculate compensation upon dismissal in 2021.

Step 1. Determine the number of unused days

Option 1.

We calculate the vacation period - how many years and months the worker has worked for the company. The last month is calculated as follows:

- if 15 or more days are worked, it is counted as full;

- if less than 15 are worked, it is not taken into account completely.

For each year, a person is entitled to 28 calendar days of vacation (this is in general, but we must not forget that there are categories that are entitled to extended paid vacations, for example, for irregular working hours).

Naturally, when calculating length of service, round numbers will not work. There will be days remaining, which are taken into account in the calculation as follows: the number of remaining days (which are converted into full months) is multiplied by vacation days. The resulting figure is divided by 12. When receiving a fractional number, it is rounded up (see letter of the Ministry of Health and Social Development dated December 7, 2005 No. 4334-17).

Then from the resulting figure we subtract what the employee had already taken off by the date of dismissal. What remains is subject to compensation: the number of days is multiplied by the average daily income.

Option 2.

How is compensation calculated when dismissing an employee if the person worked for less than or a little more than one year and did not take vacation?

In this case, the following indicators are used in the calculation: for each month worked, 2.3 calendar days of vacation are due. But this is true only for those categories of employees whose paid annual rest is equal to 28 calendar days.

For teachers, for example, whose paid vacation period varies from 42 to 56 calendar days, this figure is 3.5 and 4.6, respectively.

For workers with whom they have entered into fixed-term employment contracts for a period of up to 2 months, this figure will be 2 days for each month of work.

Therefore, we take the number of months worked by a person and multiply by the required figure. What comes out is rounded according to the above rule. We multiply the resulting figure by the average daily earnings.

Nuances of calculations

If a person works for at least 11 months, the number of days of rest is equal to the annual one, as if he had worked for a whole year.

This rule also applies to personnel who have worked from 5.5 to 11 months if:

- liquidation of the enterprise or individual divisions has begun;

- the company's workforce is being reduced;

- the employee is drafted into the army.

If a person has worked for less than 11 months, the calculation is proportional to how much work has been done.

Step 2. Calculate average daily earnings

To do this, we take the amount that the worker earned in the 12 calendar months before dismissal and divide it by the number of days worked during this period:

- if the day of dismissal fell on the last day of the month, this period is included in the calculation period. If on any other day this monthly period is not taken into account, the 12 previous months are taken for the calculation period (see letter of Rostrud dated July 22, 2010 No. 2184-6-1);

- if a month is worked in full, it is considered equal to 29.3 days. If not, the number of days worked in this period is divided by the number of calendar days and multiplied by 29.3.

Step 3. Determine the payment amount

Average daily earnings are multiplied by the number of unused days of annual paid leave.

Step 4. Calculate taxes

Leave compensation upon dismissal is subject to personal income tax and insurance contributions in full. Personal income tax is due to be transferred the next day after the final payment is made.

Step 5. Pay out money

Money for unscheduled and unrealized vacations must be paid on the person’s last day of work. Late payment will result in penalties plus interest for each day of delay.

Step 6. Enter the necessary information into the 2-NDFL certificate

Cash compensation for unused vacation is entered into a certificate with income code 4800 (see letter of the Federal Tax Service dated September 19, 2016 No. BS-4-11/17537) and is given to the departing person along with other required documents.

ConsultantPlus experts sorted out what documents and within what time frame should be given to an employee upon dismissal. Use these instructions for free.

Why do you need to calculate the average monthly salary?

Sometimes it is necessary to provide a certificate of average monthly earnings. It may be required by social protection services or at the employment center when registering an individual for payment of benefits due to temporary unemployment. Also, determining the exact amount is necessary when applying for loans in banking institutions and for courts.

These are the most common cases in which you need to know the average salary. The coefficient is usually calculated for three months or six months. Calculating average earnings is most often necessary not for personal needs, but for an urgent situation. Dismissed workers often cannot find a new suitable position, so they come to the employment center. A certificate of average salary is one of the documents required for calculating financial assistance.

The principle of calculating average daily earnings

The Tax Code of Russia establishes a clear procedure and sequence for determining the average salary. The following calculation principles exist:

- During the calculation, you need to take into account annual and monthly bonuses, advances and all incentives from management in the form of cash increases.

- Salary increases for each quarter are taken into account.

- Any accruals that are provided for by the company’s collective agreements are also taken into account.

The calculation period is 3 months before dismissal or voluntary resignation from a position. All payments until the termination of the employment relationship and from the last three months are counted and also used in the average daily earnings formula.

However, there are some exceptions to the income required for accounting. All social assistance payments are not taken into account. These include anniversary bonuses and one-time financial assistance. Compensation for leave for pregnancy and childcare is not included in the calculation of the average salary. In the event that work experienced downtime for corporate reasons, the employee is not responsible for this. The billing period does not include:

- the date when the employee was temporarily disabled due to pregnancy or caring for children under 3 years of age;

- period of compulsory leave (study, paid, free);

- days of temporary care for persons with disabilities;

- the time an employee is absent from the company is not his fault.

These factors should be included in the average salary calculator. It facilitates the calculation of the ratio of wages actually worked for the days actually worked for the established pay period.

Calculation of average earnings for 3 months at the employment center

Before bringing a certificate to the employment exchange to register the applicant as unemployed, it is necessary to use a clear calculation formula. To receive unemployment benefits, you need to know your average daily earnings. The amount of all payments for the billing period should be divided by the days actually worked. The estimated time is taken over a 3-month period.

After determining the average daily salary, you can calculate the total average salary for the month - this is done either independently or using a calculator, using a certain formula:

- Average salary = Total number of working days* Average daily earnings

This algorithm is constant and has not changed for many years. There is no need to constantly look for new calculation formulas, because they are always relevant. To facilitate the process, an average earnings calculator was created. It applies this algorithm and produces accurate results in a short time.

Calculation of average earnings for accrual of vacation pay

Obtaining the average monthly salary for holiday pay is slightly different. In this case, the billing period includes vacation time, which is thirty calendar days. The following formula is used:

Average salary = Number of days worked / Number of calendar days* 29.3

Every employee needs annual leave, so everyone who works officially will be faced with calculating the average salary.

Calculator for calculating compensation upon dismissal

How to calculate vacation compensation upon dismissal in 2020 online using a calculator.

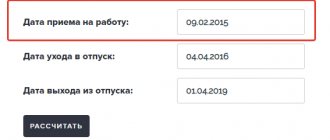

Step 1. Enter the hiring date and dismissal date into the calculator in the format XXXX-XX-XX (year-month-date) or select from the calendar.

Step 2. We indicate the number of vacation days the employee is entitled to per year.

The number of such days must be selected from the list. If you click on the arrow in the calculator, the following list will become visible:

- 28 - in most cases;

- 30 - disabled workers;

- 31 - minors with irregular working hours;

- 35 - employed in work with harmful (2, 3 and 4 degrees) and (or) dangerous working conditions;

- 44 - workers in areas equated to regions of the Far North;

- 52 - workers in the Far North;

- other.

If the category of employee does not fall into the proposed list (for example, teachers who are entitled to 42 or 56 days of rest), then select the last item “other” from the list of the calculator for calculating vacation pay upon dismissal in 2021 and indicate the number of days in the window that appears.

Step 3. Add to the calculator periods that are not included in the vacation period.

Please note the periods that are excluded from the calculation. If there were such, we note this in the calculator.

These periods include:

- vacation time at your own expense, if it exceeds 14 calendar days per year;

- child care time up to 3 years;

- time away from work without good reason;

- time of suspension from work due to the fault of the employee.

To mark a period in the calculator for calculating compensation for unused vacation upon dismissal in 2021, click the “Add period” button and enter the dates in the same format as you did in the first step.

Step 4. We indicate the number of vacation days for the entire period of work and SDZ and make a calculation.

Download the settlement note upon dismissal (form and sample T-61)

Calculation note upon dismissal (form T-61)

Calculation note upon dismissal (sample for filling out form T-61)

| ★ Collection and directory of all personnel documents (forms and documents in word format) > 1200 books purchased |

To organize personnel records in a company, beginner HR officers and accountants are perfectly suited to the author’s course by Olga Likina (accountant M.Video management) ⇓

| ★ Author's course “Automation of personnel records using 1C Enterprise 8” (more than 30 step-by-step video lessons for beginners with instructions) purchased > 2000 practical courses |

Download samples of the organization's personnel documents : Form T-1 and T-1a. Employment orderForm T-2. Employee personal card Form T-3. Staffing table of the organizationForm T-6 and T6a. Vacation orderForm T-7. We draw up a vacation scheduleForm T-8. Order of dismissalForm T-9 and T-9a. Business trip orderForm T-10. Travel certificateForm T-10a. Business trip assignmentForm T-13. Working time sheetForm T-49. Payroll Form T-51. Payroll for calculating and calculating wagesForm T-53. Payroll for salary paymentsForm T-53a. Payroll register Form T-54. Employee's personal account Form T-60. Note-calculation on granting leave

Taxation issues

Cash compensation for unused vacation is subject to taxes. Personal income tax is accrued, according to Article 219 of the Tax Code of the Russian Federation, in the following cases:

- compensation payments are made to the employee directly on the last working day;

- compensation is paid on the day the salary is received, but the employee is not fired.

In other cases, personal income tax is not charged. Insurance contributions for pension, social and health insurance and against industrial accidents are not paid.

How to calculate severance pay during layoffs

In addition to compensation for unused vacation and salary, the employee is also entitled to payments in the event of staff reduction or in the event of liquidation of the company or closure of the individual entrepreneur:. At the same time, the parties can agree that the employee will not work the required two months, but will quit earlier.

An article of the Labor Code of the Russian Federation allows you to do this. In this case, the employee is entitled to additional compensation.

It is paid for the period from the date of dismissal until the date when two months expire from the date of warning. Let us emphasize: dismissing an employee with his consent before the two-month period has passed is the right of the administration, and not an obligation.

Expert opinion

Zakharov Nikita Evgenievich

Practicing lawyer with 7 years of experience. Specialization: family law. Member of the Bar Association.

Average earnings are maintained for no more than two months from the date of dismissal. Moreover, already paid severance pay is deducted from this amount.

Special cases of compensation calculation

Dismissal of an employee on maternity leave

The issue of providing monetary compensation for women on maternity leave is regulated by:

- Article No. 127 of the Labor Code of the Russian Federation;

- rules on additional leaves, in particular, paragraphs 28 and 29.

For calculation use:

- the total number of vacation days for which accrual is made;

- daily average earnings of a pregnant woman.

Compensation for a part-time employee

The calculation procedure is the same as for regular employees.

Compensation for additional leave

The process of calculating monetary compensation, according to the Labor Code of the Russian Federation, is completely standard, as for regular main leave. The compensation payment is calculated as follows: the number of days of additional leave is multiplied by the average daily earnings.

Types of funds due to a redundant person

- Remuneration for the period preceding dismissal;

- Severance pay;

- Compensation for unused vacation.

Severance pay

This payment is due to everyone, including persons employed part-time. The statement that they are already employed and are not entitled to severance pay is erroneous. The calculation for reducing this payment for such persons is carried out on a general basis. Depriving part-time employees of severance pay is illegal.

Vacation amounts

We are talking about compensation for unused vacation. It is due to all those who never rested before dismissal or did not fully use the days provided for this by law.

The calculation for reducing vacation pay is carried out using the formula SDN × Nday, where the last value is the number of unused vacation days. This payment is due to all laid-off employees who have worked at the enterprise for at least 5.5 months.

Average monthly earnings

If severance pay is due to everyone and is paid on the day of termination of the employment agreement, then the average monthly earnings for the 2nd and 3rd months of unemployment are issued later and are not due to everyone. They will not receive it:

- Part-timers;

- Persons who abuse their rights.

The latter include those who deliberately do not officially register for another job, working part-time somewhere without an entry in the work book. But it is difficult to prove this; in the second month, the average monthly salary is paid in most cases.

It’s more difficult to pay for the next month. It is issued on the basis of a certificate from the social service and provided that the laid-off employee has registered with it in the first 14 days.

The service employee may refuse to issue a certificate, without which the average monthly salary for the third month will not be paid. In all cases, these amounts are calculated in the same way as severance pay.

Other compensations according to the Labor Code

In addition to the amounts that are additionally provided for in the agreement between the employee and the enterprise, the law also provides for compensation for early dismissal during layoffs. After notification, management may consider it unnecessary to keep the laid-off personnel at the enterprise and invite them to leave early.

For the remainder before the scheduled day of dismissal, compensation in the amount of the average monthly salary must be paid.

Non-payment or underpayment of compensation

It must be remembered that for non-payment or underpayment of the final payment to an employee on the day of dismissal, the following sanctions are possible:

- an administrative fine in the amount of 120,000 rubles or in the amount of the employee’s average annual earnings;

- deprivation of the right to hold leadership positions for a period of 1 year;

- the court may decide on forced labor for up to several years; prison term up to 1 year;

- a fine of 100,000 to 500,000 rubles if the employer refuses to pay the final payment.