I worked for the company for more than two years, and now it’s time for another vacation. Last year I “went” on vacation in March, and now, a little later. When they calculated my due payment, it turned out that the amount of vacation pay for last year was not taken into account.

I doubted whether vacation pay for the previous period was taken into account when calculating vacation pay next year, and decided to ask the chief accountant this question. Unfortunately, it was not possible to obtain any explanations, so I wrote to the labor inspectorate and finally received an explanation. I would like to talk about what I was able to learn from specialists in my article.

What is included in the average salary?

First of all, we are talking about wages. This applies to any of its manifestations.

That is, they take into account the reward for the following fulfilled conditions and actions:

- Commissions and percentages of revenue after products are sold. Such transfers come after the work is completed.

- With piece rates.

- With tariff rates, salaries.

- Separate accounting is required for wages that are not in cash.

This basis is introduced when calculating the average salary:

- Bonus payments, standard remuneration.

- Compensation for labor conditions.

- Additional payments with allowances to salaries, tariff rates. This is usually associated with leading teams, difficult conditions, and so on.

Article 139 of the Labor Code of the Russian Federation is one of the documents devoted to just such a calculation. In daily activities, any company encounters this indicator. But most often it remains relevant for managers and accountants, and other employees associated with the field of finance.

Which payments are taken into account and which are excluded?

Three days before the actual release from work due to annual rest, the subordinate is accrued vacation pay.

The size of the payment depends on the employee’s income, and the amount is calculated by the accounting department based on the average salary of a vacationer. Therefore, specialists in this department need to understand which payments are taken into account and which are not when determining average earnings. This knowledge is also useful for employees: it will help to control the correctness of the accrual of funds.

To understand which payments should be taken into account and which should be excluded, you need to know the current labor legislation (LC). In particular, such information can be found in the Regulations approved by Decree of the Government of Russia No. 922 of December 24, 2007.

The second paragraph of this regulatory document states that the average earnings take into account all payments related to the wage system. This is, first of all, a salary for work performed at separate rates, as a percentage of revenue from sales of products, as well as for time worked at tariff rates and salaries.

Wages paid in non-monetary form are also taken into account.

Secondly, when calculating the average income of a subordinate, one should take into account additional payments and allowances to tariff rates, salaries (for length of service, length of service, team management, combination of professions, etc.), payments for night work in difficult conditions, as well as annual and quarterly bonuses and remuneration.

When determining the average salary of an employee, accruals that do not correspond to the concept of salary prescribed in Article No. 129 of the Labor Code are not taken into account. The list of such payments is given in the third paragraph of Regulation No. 922, as well as in Letter of the Ministry of Labor No. 14-1 / OOG-7105 dated August 3, 2021.

Not included in average earnings:

- one-time bonuses;

- temporary disability benefits due to one’s own illness or the need to care for a child or close relative;

- payment for travel, food, training, recreation, utilities;

- material aid;

- business trips;

- other types of compensation paid by the employer that are not related to work activity.

Vacation is a release from work while maintaining your position and average earnings. This is stated in Article No. 114 of the Labor Code of the Russian Federation.

Are vacation pay included in the calculation of average earnings?

Vacation pay is not included in the formula for calculating such earnings. We're talking about annual vacations. The same rules apply to business trips. Payment for time while the citizen was on a business trip is excluded.

How vacation pay affects the calculation of average earnings for various payments is illustrated in the table:

| Type of payment | Impact of vacation pay |

| Are vacation pay included in the calculation of earnings for the employment center? | Vacation pay when calculating benefits from the Employment Center is excluded from any formulas in this case. Only amounts received in connection with the performance of primary duties are taken into account. Other indicators are not important for determining the result. |

| How do vacation pay affect the calculation of sick leave? | There is nothing complicated here either. Records are kept only for those amounts from which insurance premiums were transferred. When calculating vacation pay, you cannot do without transfers to the tax service. Therefore they are included in the calculation. |

What is taken into account when calculating vacation pay

In some cases, by agreement between the employee and the employer, the employee may be assigned a part-time or part-time week. In this case, the amount of vacation pay is taken into account based on the time worked during the month.

The main points for calculating vacation pay include:

- Wages calculated based on salary and tariff rate for hours worked.

- Wages accrued to an employee for work at piece rates.

- Wages accrued to an employee based on a percentage of sales of goods or work to provide any services (including commissions).

- Salary increments based on promotion, length of service, length of service, personal excellence, academic degree or title, knowledge of a foreign language, working with information included in state secrets, combining main professions and positions, increasing the area of work or its quality, management other employees, departments and divisions.

- Remunerations and bonuses provided for by the remuneration system.

Cases of calculating average earnings do not include social benefits and other payments that are not related to the basic salary (travel, financial assistance, payment for utilities, food costs, etc.).

General procedure for calculating vacation pay

The first important step is to accurately determine the period that will be considered calculated. Labor legislation defines it as standard - before taking leave it is at least 12 months according to the calendar. Next, calculate the amount of payments accrued during this time. Accounting is carried out for any concepts, according to the current system introduced by employers. It doesn't matter where the money comes from.

Additional factors are taken into account along with the main part:

- Regional coefficients.

- Combined positions.

- Night work.

- Overtime work.

- Additional payment for going on site on holidays and weekends.

And so on. The final figure is divided by 12, then by 29.4. The result is the average reward throughout the day. The amount of vacation pay is determined after multiplying the previous number by the days according to the calendar that make up the vacation.

For example, a break from work for an employee will be 14 calendar days. Start – 05.04. For each of the 12 months preceding the vacation, the amount of accrued salary is 30 thousand rubles.

The benefit amount is calculated as follows: multiply 30 thousand by 12, then divide by 12, divide by 29.4, multiply by 14 days. The result is 14 thousand rubles.

The calculation is associated with certain difficulties in case of one or several months with incomplete work. The same applies to situations where a citizen was absent from work for some time.

Difficulties arise when at least one condition is met in the billing period:

- Exemption from work in various situations, with or without pay.

- Lack of work due to downtime caused by the employer. Or when the reasons do not depend on either party.

- Vacation or business trip.

- Caring for disabled people since childhood, disabled children, requiring additional paid days off.

- Strikes without the participation of citizens, preventing them from fulfilling their duties.

- Benefits for temporary disability, pregnancy and childbirth.

Calculations do not include the periods indicated above. The same applies to payments accrued for such time.

How do past holidays affect?

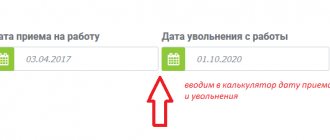

To calculate payments for annual leave, a time period of 12 calendar months is taken, the total earnings for this time are calculated, then divided by the time worked and multiplied by the number of days of rest.

Thus, vacation pay is calculated; these rules are spelled out in the Regulations on Average Earnings. Detailed step-by-step calculations with examples can be found here.

You can do the calculation yourself using an online calculator using this link.

If the annual pay period consists entirely of time worked, then the calculation is greatly simplified. If events other than normal work activities occur at this time, the calculation order changes.

We recommend reading about how it is taken into account when calculating vacation pay:

- sick leave;

- business trips.

If a vacation falls within the billing period, this will also affect the calculation procedure.

How is rest time taken into account when calculating:

- is included in the vacation period, that is, it gives the right to days of annual rest;

- is not included in the billing period, the months in which there was a vacation are considered incompletely worked;

- Past vacation pay accrued to the employee is not included in the average earnings.

Is vacation time included in the experience?

Article 121 of the Labor Code of the Russian Federation determines the procedure for calculating length of service giving the right to annual leave.

In accordance with the provisions of this article, the length of service includes, in addition to actual work, also calendar days off, holidays, up to 14 days of compensatory time off at one’s own expense, as well as granted annual leave.

That is, while on vacation, the employee receives days of annual rest.

Calculate your vacation time using an online calculator.

Are the days included in the billing period?

The answer to this question is contained in the Regulations on Average Earnings, which can be found in the appendix to the Decree of the Government of the Russian Federation No. 922 of December 24, 2007.

According to clause 5 of Regulation No. 922, days when the employee maintained his average earnings are excluded from the calculation period. Since vacation pay is paid based on the employee’s average daily earnings, the time spent on vacation is not included in the calculated period.

If an employee’s rest period falls on any month of the last year, then such a month will be incomplete; only calendar days actually worked will be taken into account.

For the purpose of calculating vacation pay, it is considered that in a full month the employee works 29.3 calendar days (average monthly number of days in a year). If there was an annual vacation in the month, the indicator will be different. It is necessary to determine what part of 29.3 is accounted for by the time actually worked.

To calculate days worked in a month with vacation, the formula is used:

Exhausted days = (Calendar number of days of the month - Days of rest) * 29.3 / Calendar number of days of the month.

A similar procedure applies in cases where the month includes:

- sick leave;

- business trips;

- absenteeism;

- other types of leaves (study, without pay);

- downtime, etc.

Is the payment amount taken into account in average earnings?

Clause 5 of the Regulations also states that not only vacation time is not included in the payroll period, but also payments made are not included in the average earnings.

To pay for annual vacation, payments for the last year are summed up and divided by the time of work in calendar days - the rules for calculating average daily earnings.

The amount of payments can only include those incomes that are associated with the payment of the actual work of the employee. First of all, these are salaries and incentive payments in the form of bonuses.

All other payments (vacation pay, social benefits, financial assistance, compensation) are not taken into account in the total income to determine the average daily earnings.

Example for 2021

Initial data:

From November 10, 2021, the employee goes on vacation for 14 calendar days.

The previous annual vacation took place from February 1 to February 14, 2019, vacation pay = 14,000, salary in February 14,000.

The monthly salary consists of a salary of 28,000 rubles.

There were no other excluded periods.

Let's summarize the initial data in a table:

| Holiday start date | 11/10/2019 (14 days) |

| Monthly salary | 28,000 rub. |

| Excluded periods | Vacation from 02/01/2019 to 02/14/2019 (vacation pay = 14,000 rubles, salary = 14,000 rubles) |

Calculation:

| Billing period | 01.11.2018 to 31.10.2019 |

| Total income | 28000*11months + 14000 = 322000 (14000 vacation pay is not taken into account) |

| Days worked in February 2019 | (28 — 14) * 29,3 / 28 = 14,65 |

| Days worked in the billing period | 11*29,3 + 14,65 = 336,95 |

| Average daily earnings | 322000 / 336,95 = 955,63 |

| Vacation pay | 955.63*14 days. = 13378.84 |

About other features of accrual of vacation pay

Fulfillment of such conditions leads to the appearance of some nuances in the calculation of earnings:

- Payment of bonuses.

- Salaries increased.

An increase in average earnings is inevitable with an increase in enterprise rates, tariffs, and other remunerations. The exception is situations when this happens due to bonuses or allowances, although the main indicator remains the same.

Indexation is determined by the coefficient under such circumstances related to average earnings. The calculation of the relationship between salaries for the pay period and the amount of remuneration after promotions is individual for each employee.

With repeated increases in coefficients, you end up with several. If necessary, monthly benefits are also taken into account, the amount of which has also increased.

The order of indexation is determined by the period in which the increase occurred. There are three main options:

- During vacation.

- Before the holiday begins, but after the end of the settlement period.

- During the billing period.

Calculation of sick leave if there was a vacation (example)

Staff employee Emelyanov A. A. submitted a sick leave note to the economic service of the organization with a mark of the period of incapacity for work from February 6 to February 20, 2021 (15 calendar days). The employee's insurance coverage as of the onset of illness is 10 years. During the billing period, payments were made to A. A. Emelyanov:

| year | Salary, rub. | Vacation, rub. | Total |

| 2018 | 605 000 | 55 000 | 660 000 |

| 2019 | 660 000 | 58 000 | 718 000 |

Sick leave accruals

| No. | Contents of operation | Indicators |

| 1 | Payments for temporary disability are made in the amount of 100% (insurance period more than 8 years) | 100% |

| 2 | The basis for calculation is determined: — for 2021 equals 660,000 rubles. — for 2021 equals 718,000 rubles. (For the calculation, the actual amount of accruals is taken, since it does not exceed the maximum level) 660 000 + 718 000 = 1 378 000 | RUB 1,378,000 |

| 3 | The average daily earnings are found 1 378 000 / 730 = 1 887,67 | RUB 1,887.67 |

| 4 | The benefit for the time of illness was accrued to the employee in the amount of RUB 1,887.67 × 15 days × 100% = RUB 28,315.05 | RUB 28,276.35 |

The rules for calculating payment for sick leave can be found in the article “Maximum amount of sick leave in 2019 - 2021”.

About the procedure for granting leave

Taking into account the following nuances is important for the second party when issuing regular paid vacations to subordinates:

- Vacation cannot be less than 28 days in the calendar. Holidays and weekends are excluded from the scheme.

- During dismissal, you cannot do without compensation for vacation not used previously.

- The right to leave is given to any employees with one year of continuous service.

- Three days before the start of the holiday is the maximum time for which citizens should receive the compensation due.

- If a subordinate himself refuses to rest, additional compensation is due. Money is issued after sending a corresponding application from the employee in writing.

- It is permissible to accrue such compensation for several calendar periods. It is prohibited to replace the main regular vacation with cash transfers; this is only possible for additional periods of rest.

There are three cases when the ban applies to any type of vacation:

- Harmful, dangerous working conditions.

- Interaction with minors.

- Pregnant women.

Providing vacations every six months is the responsibility of managers, but upon written requests. We allow transfers, but a maximum of 2 times in a row. There is no prohibition regarding the division of rest into several parts. 14 days according to the calendar is the minimum duration of one part under any circumstances.

At a new workplace, the right to annual leave appears after at least six months of continuous service. But it is permissible to use advances if the issue is agreed upon in advance with management.

Employees receive compensation for unused vacations after dismissal. The following information makes it easier to accurately determine unused days:

- Days used by employees.

- Vacation days earned during the period of holding a position in the organization.

- Duration of vacation period, in days or months, years.

Calculation of vacation pay: examples of calculation in 2021 and calculator

Please tell me)))! I work two jobs, one is full-time and the other is part-time (the salary is 6,000). Before going on vacation for 14 calendar days from work, where I was not full-time, I worked for a month and received vacation pay of 2800 rubles. The actual question is, how much should I receive in salary and vacation pay? I started working on August 2, 2013. I went on vacation from June 2, 2014 for 56 days. How should vacation pay be calculated? Salary in May is also included in vacation pay or should it be given to me separately from vacation pay, and vacation pay will be calculated from June 2 to July 28?

22 Dec 2021 marketur 132

Share this post

- Related Posts

- Land tax benefit in Omsk

- Fraud in the Russian Federation, scientific article in a magazine

- Plan for renovation of local areas in 2021

- Children of war, what are the benefits?

Features related to sick leave

Childbirth or pregnancy, temporary disability - situations that anyone can face. For these cases, the state introduced certain payments guaranteed to employees. These are the so-called benefits. Produced at the expense of the enterprise’s own funds, or money from the Social Insurance Fund. Government Decree No. 375 and Article 14 of the Federal Law are the main materials from which information is taken in such cases.

The average salary is also taken into account when determining such benefits. The following conditions assume a basis in the form of a minimum amount of remuneration:

- Lack of income for employees two years before the occurrence of an insured event.

- The average profit level is less than the minimum wage.

- Short insurance period, up to 6 months or less.

- There are reasons to reduce benefits.

Average earnings in case of business trips

Often employers agree to pay something like moral compensation for the inconvenience caused by the business trips themselves. In addition, the days themselves spent on such travel are considered irregular. This means that it is impossible to accurately calculate the number of hours.

There are situations when a citizen is assigned to an area for which increased coefficients are applied.

For such periods, the accountant carries out calculations using the following scheme:

- The daily earnings for a subordinate are multiplied with a bonus coefficient. It depends on the rules established specifically for a particular organization.

- If a business trip involves an increased locality coefficient, the result is multiplied by this coefficient.

- The result is multiplied with the exact number of days spent on a business trip. The indicator can be easily found out by studying the detailed report provided by the employee. Arrival and departure notes are carefully studied. Weekends and holidays that fall within this period are also subject to accounting.

- The last step involves deducting the amount of taxes levied on such payments.

Designation in the time sheet for which average earnings are calculated

The average salary is paid for the time the citizen was released from duties. The indicator must be present in the form T12 or T-13.

Special codes help to understand the situation:

- BUT – removal from work for reasons specified in the text of the current legislation. Payment has been saved.

- RP or NP. Downtime for which the employer is to blame. Or when reasons appeared beyond the control of the parties.

- OV - Additional days off if the salary was retained for them.

- D – Public, government responsibilities that led to absence from work.

- U – designation of study leaves.

- OT, OD – annual leave. Main or additional.

- PC OR PM - advanced training, which requires a break from production.

- K - for business trips.

Should previous vacation pay be included in the calculation of vacation pay?

There are full months in the billing period. These include August and September 2021. These months are not excluded from the calculation of “current” holiday pay (for the period of leave granted in August 2019). This takes into account both payments accrued for time worked and vacation pay accruing during these months (for August and September 2021). To determine hourly wages, payments accrued for time worked or work performed in a pay period are divided by the hours actually worked during that period. Thus, vacation pay accrued in the billing period (average earnings saved for time not worked) is not taken into account in this procedure for calculating vacation pay.

About other additional nuances

The main thing is to take into account only income associated with a person’s main job.

The following types of payments are not added to wages:

- Inheritance.

- Income from business activities.

- Deposit interest.

- Dividends, and so on.

You cannot use profits earned at another workplace; they are accounted for separately. The prohibition also applies to any transfers received illegally.

The calculation includes all payments of a regular nature. One-time or regular bonuses are not added to the total amount of the wage fund. But the funds must be counted if such types of payments are monthly.

Calculation is carried out two working weeks in the case of employees who are hired only for a certain season.