06.07.2019

0

367

4 min.

The basis of the social insurance system is monthly contributions that working citizens make in the form of contributions. In the future, these amounts will be used to cover the costs of compensation for temporary disability and time spent on maternity leave (BIR). As a rule, this function is performed by the employer, transferring a percentage of employee income (2.9%) to the Social Insurance Fund (SIF) and covering the period of loss of ability to work with compensation from the SIF funds. The amount of maintenance depends on the insurance period - the time intervals during which deductions from wages were made to the Social Insurance Fund accounts.

What does it include?

The main thing here is Federal Law No. 400, or to be more precise, Article 12 of this law.

According to this document, non-insurance periods include:

- The period of removal from office in accordance with the Procedural and Criminal Code. Even if the citizen was later rehabilitated, points are no longer awarded.

- Operational search activities.

- Residence abroad of spouses of those who work as diplomats and ambassadors.

- Care provided for disabled people of group 1, minor children or persons over 80 years of age.

- Detention, even for unjustified reasons.

- Receiving unemployment benefits, participating in paid public works. Relocation periods according to civil service requirements.

- The care of one parent for the children until each reaches one and a half years of age.

- A period of temporary disability during which compulsory social insurance benefits were paid.

- Military and other service with equal values.

More about the concept

In 2007, the legislation related to the procedure for reimbursement of funds for certificates of incapacity for work underwent some changes. In particular, this applies to working time, which is taken into account when deducting the percentage of compensation from daily income. Previously, the total length of service was taken into account, but since the beginning of 2007, insurance experience began to be taken as a basis.

What is insurance and non-insurance experience? The insurance period is all periods of official fulfillment of official obligations at public and private enterprises, from the income received from which deductions were made in favor of the Social Insurance Fund . There are types of activities that exclude mandatory payments to the Social Insurance Fund. These types of employment can be divided into two groups:

- which are not taken into account when compensating for temporary disability (not indicated in the hospital document);

- those that are taken into account in the insurance period and constitute the non-insurance period on the sick leave.

Unpaid periods include:

- availability of official unpaid leave lasting more than two weeks throughout the calendar year;

- maternity leave;

- temporary suspension from performance of official duties due to the fault of the employee himself.

The terms of the above types of work not only do not provide for mandatory payments to the Social Insurance Fund budget, but will also not be considered when determining the percentage of daily compensation. But they will be included in the total length of service without fail.

Non-insurance periods on sick leave - what is it?

Usually this refers to periods when a citizen served in the following structures:

- FSIN.

- FSKN.

- Ministry of Emergency Situations.

- Ministry of Internal Affairs

- RF Armed Forces.

Service in the RF Armed Forces means any type of service - both urgent conscription and contract. During this time, no fees are paid for the citizen.

Moreover, any type of activity must have documentary evidence. This rule applies equally to all structures listed above.

The following are most often used as identification documents:

- Certificates from government agencies.

- Labor contracts.

- Work books.

- Military IDs.

The manager himself must obtain confirmation that during the specified time period the citizen associated his activities with one of these structures. If there is no evidence in writing, then the periods are simply removed from the insurance record. Because of this, temporary disability benefits are smaller.

What should you pay attention to?

What to do if an error was made when filling out?

Letter No. 14-03-11/15-11575 of the Federal Social Insurance Fund of the Russian Federation dated September 30, 2011 explains what to do if an error was made when filling out a sick leave certificate.

According to the text of the Letter, if there are technical defects in the form filled out by hand (in other words, an error or typo), there is no need to reissue the form.

At the same time, it is impossible to refuse to assign and pay benefits if there are errors on the form.

The above rule applies only if all entries on the sheet are clearly legible and readable.

So, non-insurance periods include periods of labor activity in the Ministry of Internal Affairs, the Federal Drug Control Service, the Federal Penitentiary Service and other government agencies, as well as the period of military service or contract service in the army. Only service in the relevant structures starting from January 1, 2007 is recognized as non-insurance periods.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- 8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Sick leave

Additional nuances

If the same time is associated with several places that are being counted, only one is chosen. To do this, the citizen draws up a written application. Breaks in work for calculating sick leave are practically irrelevant.

Any confirmation documents must include the following information:

- Work period.

- Description of the position.

- Address where duties were performed.

- Date of birth of the employee.

- FULL NAME.

- Number and date of issue.

The papers are usually transferred to the accounting department. Or another regulatory authority.

If the exact date is not indicated in the documents, then the countdown starts from the 15th. The average amount of compensation for temporary disability depends on the length of service during previous periods. The higher it is, the larger the payments. The highest rates are among those who, even with non-insurance periods, have worked for 5 years or more.

In any case, 100% will be paid to women who had maternity leave.

The more non-insurance periods, the lower the final amount of compensation will be.

Opening sick leave becomes an important point if your vacation coincides with illness. Without documents, it is impossible to confirm temporary disability. The validity of the documents begins from the first day of contacting doctors. And it doesn’t end until the issue itself is finally resolved.

Payment for sheets involves the following procedure:

- Calculate average earnings per day. We need to take the base for the previous two years, divide by the number 720.

- Next, calculate how much insurance experience you have.

- Benefits are being accrued, in a maximum of 10 days.

Documents confirming insurance experience

The main document confirming periods of work is a work book.

What if the information in the labor record is incorrect and inaccurate, or there are no records at all about individual periods of work? Then, to confirm the periods of work, the following are accepted:

- written employment contracts drawn up in accordance with labor legislation in force on the day the relevant legal relationship arose;

- certificates issued by employers or relevant state (municipal) bodies;

- extracts from orders;

- personal accounts and payroll statements.

If a work record book is not kept, periods of work under an employment contract are confirmed by a written employment contract drawn up in accordance with the labor legislation in force on the day the relevant legal relationship arose.

There are special cases - nannies, entrepreneurs, military personnel, etc.

The list of documents on the basis of which it is possible to confirm the length of service for various cases is given in section II of the Rules for calculating and confirming the insurance period (approved by order of the Ministry of Health and Social Development of Russia dated 02/06/2007 No. 91).

Example

Situation: the employer demanded that the newly hired employee provide documents that can confirm that previous employers paid insurance premiums from payments in favor of this employee. Should an employer really require such documents?

Solution: paragraph 8 of the rules for calculating and confirming insurance experience, approved by order of the Ministry of Health and Social Development of Russia dated 02/06/2007 No. 91, contains a list of documents that can be used to confirm insurance experience. There are no documents listed here that can confirm that previous employers paid insurance premiums for the employee. Accordingly, it is not necessary to require these documents from a new employee.

Employer actions:

- Check the availability of documents that can be used to determine the periods included in the insurance period (work book, employment contracts, etc.).

- Now you can count your insurance period.

When will refusal of payment for disability be legal?

In some situations, there is no payment for disability. usually due to the following situations:

- If the disease appeared during the validity of another document. For example, related to caring for a child or a sick relative.

- When problems arose during a vacation at your own expense.

- When illness coincided with maternity leave.

- When applying for sick leave. Then you can count on compensation in just a couple of days. This also applies if problems arose immediately after completion of training.

The main thing is to fill out all the cells on the sheet without going beyond the boundaries. Start with the first available free space. Use only black ink and block letters, even when filling out by hand. Or you can use modern technology.

Typically, information on non-insurance periods is filled out only by employers or their authorized representatives. It is important to prepare supporting documents correctly. The main requirement is that it can be seen that the information is related specifically to a specific citizen.

Entries in the work book must also comply with the rules and requirements of the law. The condition applies to any securities that continued to be valid for a specific period of time.

Rules for filling out sick leave

To indicate the non-insurance period, a separate column is provided on the certificate of incapacity for work. This information is entered by an authorized representative of the employer. Entries are made in accordance with the general rules:

- in cells, starting from the first, without going beyond the boundaries;

- black ink;

- in block letters or by printing on special devices.

In the designated cells indicate the number of years and months of military service. The countdown has been going on since 2007.

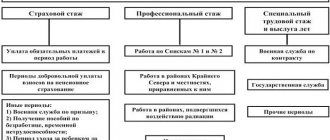

Types of experience

Work experience means the entire period of a person’s official work in the Russian Federation.

Insurance length of service refers to periods of work or other activities performed on the territory of the Russian Federation during which the employer made contributions to the Pension Fund for its employee.

Non-insurance period is the time when a person did not actually fulfill his work duties and deductions were not made for him, but this time is still recorded in the length of service. Such periods include periods of illness, military service, caring for a sick relative, and some other situations.

The value of experience

The main objective of the length of service is to give citizens the opportunity to take advantage of various social guarantees provided by the state. Among such social guarantees are:

- Registration of maternity payments;

- Receiving compensation for time of incapacity;

- Assignment of pension provision.

The calculation of the number of insurance years is carried out both quantitatively and qualitatively. If the quantitative method is used, the worker can retire upon reaching retirement age.

When calculating length of service using the qualitative method, factors of production and working conditions that can reduce the indicators are taken into account. As a result, a person has the right to receive a pension on a preferential basis until he reaches the age specified by law.

Each individual case of applying for a pension on preferential terms has its own criteria regarding the accumulated years of insurance experience.