Insurance experience - what is it?

This indicator represents the sum of the periods of work of a citizen throughout his life for which deductions were made.

It only accumulates when the employer pays the contributions. To do this you need to be officially employed.

If a citizen does not work because he is unemployed, is sick, or is caring for a child, these periods are not counted.

From 01/01/2015, the amount of insurance pension provision depends on the individual pension coefficient (IPC). IPC is the total points that were awarded to a Russian citizen for the entire period of his working activity. The IPC is accrued every year. If the Russian was not employed, then the IPC is not accrued.

Here you can see how production affects pension payments. The greater the output of a Russian, the greater the number of IPCs he will receive. If before 2015, the amount of pension payments depended more heavily on the amount of insurance contributions that employers paid to the Pension Fund for an employee, today the pension depends more on the number of individual industrial complexes. The higher the Russian’s salary and the more years he worked, the more IPC will accumulate.

Which one is needed for retirement?

After the pension reform of 2015, the conditions for registration of old-age pension insurance became more stringent. If before 2002 the registration of pension payments did not depend on production, then when the bill “On Labor Pensions” came into force, insurance pension payments began to be issued only if there was at least five years of production.

To retire in 2021, you need to have accumulated at least ten years of earnings. Once every 12 months, this indicator will increase by one, until 2025.

Kinds

It depends on how actively a citizen was engaged in labor activity before retirement, whether he will be assigned an insurance pension and what the amount of payments will be. At the same time, production is necessary to calculate both pension benefits and disability benefits.

Depending on its duration, the amount of disability benefits may be equal to:

- 60 percent of the average salary;

- 80 percent;

- 100 percent.

The procedure for calculating periods of work activity for both cases differs and depends on the periods under consideration. To register and calculate pension benefits, general and special insurance periods are distinguished.

Special work experience

Speaking about the types of work experience, one cannot fail to mention such a variety as special work experience. Officially (in the regulatory framework) this term is not used, however, some of the provisions of Soviet legislation on special experience are also valid in modern labor law.

Thus, special work experience should be considered the period of work of a citizen in a certain production, in a special industry, climate zone, or associated with professions/positions that give him the right to additional pension benefits (early start of pension payments, their increased amount, etc.) .

Today, such benefits are established in exceptional cases, and the range of grounds for their appointment is narrowed as much as possible in comparison with the Soviet period. According to current legislation, the following can count on special work experience:

- persons with special working conditions, including those who have been diagnosed with disability group 1 or 2, have an injury or illness directly related to their professional activities;

- persons who were employed in underground work or worked in hot shops;

- persons entitled to benefits due to length of service (this category should include members of the armed forces, doctors, teachers, etc.).

Differences between insurance experience and work experience

The general insurance period is also called labor experience. It is equal to the duration of the periods of working activity of Russians, during which the employer made contributions to the Pension Fund. At the same time, the citizen’s work activity must be recorded in a work book issued for each employed employee. Using it, it is possible to calculate the length of work experience to calculate the old-age pension issued.

Work experience differs from insurance in that it includes exclusively those periods during which a person was officially employed. The insurance period also includes periods that differ from official employment.

What length of service is needed for a pension for men?

It is important to keep in mind that if there are no exact dates of entry in the labor record, then the beginning and end of the period is usually considered to be the middle of the month (15th day) or the middle of the year - July 1. Based on the legislation, every citizen needs to have at least five years of work experience to receive a basic old-age pension

If the work activity will be more than five years, then the following formula is used to calculate the pension. The result of the ratio of all payments made by the citizen to the pension fund to the total number of months during which the state undertakes to pay the pension (228 months) is added to the basic pension. Continuous service Continuous service does not have any effect on the size of the pension. But there are cases when, nevertheless, when calculating the total length of service, it becomes necessary to compare the data obtained with continuous experience.

What periods are included?

So, it was established that the insurance period necessarily includes periods of official employment of a citizen. It also includes periods when a Russian:

- served in the army;

- received benefits because he was temporarily disabled;

- looked after a son/daughter, and the child was under one and a half years old;

- received unemployment benefits, performed paid public works, moved to another locality to find a job in the direction of the employment center;

- was in prison, but at the same time managed to prove his own innocence and the fact that he was unjustifiably detained;

- cared for a person with a category 1 disability, a minor with a disability, an elderly person (over 80 years old);

- lived in a locality where he could not find employment for a maximum of 5 years (for military spouses);

- lived in a foreign country for a maximum of 5 years (for husbands/wives of Russians who work in diplomatic missions and embassies of Russia).

- study in higher educational institutions, but there are restrictions.

The listed periods are counted as output if before and after them the citizen was officially employed for at least 1 day.

Basic Concepts

When determining rights to a pension benefit, not only the length of time a person worked officially throughout his life is taken into account, but also the periods when an enterprise or individual entrepreneur paid contributions to the Pension Fund, deducted from his earnings. These periods are called insurance period.

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

The total duration of the insurance period also includes periods when a citizen did not work due to certain circumstances, but received insurance benefits and made contributions to the Pension Fund during:

- military service, this also applies to family members of military personnel, when due to the conditions of being in a military unit they could not work (a period of no more than 5 years can be considered an insurance period);

- temporary disability due to illness;

- maternity leave until the age of 1.5–3 years, and when caring for the third and subsequent children, the length of service will not be considered insurance;

- transfer to a place of work remote from the previous one (another city, region, country);

- participation in public works;

- the period when the citizen(s) were fired or laid off, were temporarily unemployed and were registered as unemployed;

- stay in places of deprivation of liberty;

- cared for disabled people (disabled people, elderly parents, children over 3 years old).

The insurance period also includes a period called special, when citizens work in conditions harmful to health, which is associated with the peculiarities of performing work duties, climatic and other circumstances. In this case, insurance contributions to the Pension Fund must be deducted.

Work experience refers to the period when an individual was officially engaged in labor or social activities. Having official work experience is a necessary condition for receiving social benefits, such as insurance payments and pensions, as provided for by the Labor Code of the Russian Federation. The basis for the beginning and end of work experience is the conclusion between the employer and the employee of a contract or agreement on the basis of which labor duties or public work will be performed.

Despite the fact that there are differences between insurance and work experience, there are exceptions when the period can be called insurance experience, but at the same time the person did not work

The state may consider these reasons valid and will add this period of time to the total length of service if:

- No work was carried out, and contributions to the Pension Fund were deducted.

- The citizen was in public service. This includes the entire period of time when he (s) was actively working in a government agency. In this case, the employee is entitled to a bonus for length of service, as well as additional time for rest and other benefits.

- Special experience, which will be considered insurance and labor at the same time. This is the time when a citizen was engaged in labor activities associated with harmful conditions, which gives them the right by law to retire early.

The legislator believes that a total work experience of 5 years is sufficient to calculate a pension, but you should not count on large pension payments that the Pension Fund will assign. Each subsequent officially worked year of work can potentially increase the amount of pension accruals.

To know exactly how to calculate the length of service for sick leave in 2021, you should decide on the type of length of service, this directly affects the calculations.

You can find out which periods are counted towards the insurance period from this article.

When calculating pension payments, there are still exceptions when continuous and insurance periods are compared with each other, and if it turns out that the insurance period is less than continuous, then the pension benefit will be calculated on a continuous basis.

This is important to know: What is included in the preferential medical experience

This happens in cases where:

- the break period between the new and old place of work is less than 30 days according to the calendar;

- the employee quit of his own free will for no apparent reason and got another job, the break between work activities is no more than 3 weeks;

- the citizen resigned due to the transfer of the spouse to a place of work located in another city, region, or country;

- a woman is forced to care for a disabled child until he reaches the age of 16;

- a woman takes out maternity leave;

- the woman decided to care for the child until he reaches 14 years of age and she has a supporting document in the form of a medical certificate.

How to find out your period using SNILS and the Pension Fund

For people who want to check their insurance record, visiting the Pension Fund office in person seems to be the most difficult method. However, if online services are for some reason unavailable, you will have to go to the Pension Fund. You must take your passport and SNILS with you. Once your identity has been confirmed, a Pension Fund employee will help you draw up a request for information. You will have to wait approximately 10 days for a response.

People who prefer to use the Internet rather than visit government agencies can check their output through the government services website or the website of the Pension Fund of the Russian Federation.

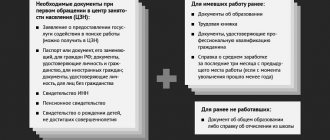

In order to obtain information, you need to register on the government services portal and fill out a form. You will need to write:

- passport data;

- date of birth;

- phone number;

- SNILS.

In addition to filling out the form, you need to complete verification. This can be done at the Pension Fund branch, through the post office, using a universal electronic card. You need to do this once in order to have unhindered access to all government services in the future.

Select the appropriate service and fill out a special form. The information you request is located on the server equipment of the Pension Fund and will be sent to you after verification.

The insurance period according to SNILS can also be checked through the Pension Fund website:

- Log in to your profile using data from the government services website.

- Select a service, after which you will be shown information about the accumulated experience.

In addition, you will see the number of IPCs.

Also, each citizen can obtain information on personal insurance history at their place of work. The HR department or other department issues a document based on data from the work book.

Sample certificate of work experience:

Conversion of periods of labor and insurance experience into full years and months

To convert different types of experience into full years and months, different methods are used. For length of service, a scheme is used for adding up the entire time of work, starting from the date of hiring to the date of dismissal, inclusive. The insurance amount is calculated slightly differently, since the amount of payments covers the entire month, and not a single day. To do this, the specialist must perform several actions:

- Set the number of full years and months of insurance experience. Days in partial months are taken separately.

- Complete years and months are added separately, and partial days - separately.

- Partial months are rounded up - every 30 days, converted into a full month, and 12 months - into an insurance year.

This rule was established in the official letter of the FSS No. 15.03.09 of 2012.

If you find an error, please select a piece of text and press Ctrl+Enter.

How to calculate

The procedure for calculating the insurance period is regulated by Art. 13 Federal Law No. 400. It provides the following:

- calculation is made according to the calendar principle;

- self-employed citizens or citizens working under a contract with an individual accumulate experience if they have paid contributions to the Pension Fund;

- if a citizen has applied for a pension in another country, using certain periods of work, then in Russia these periods can no longer be applied;

- people who have length of service obtained before the 2015 changes have the right to decide how to calculate it - according to the new laws or the old ones.

Periods of work activity after the introduction of individual accounting and SNILS are subject to automatic confirmation based on the information recorded on the Russian’s personal account.

The calculation formula is elementary. All periods that can be counted as production are added up. The result obtained will be the insurance period.

Calculation example

Anna was officially employed for 20 years. During her working life, she gave birth to 2 children, with each of whom she was on maternity leave for 36 months.

After that, Anna became an individual entrepreneur and worked as an individual entrepreneur for 7 years. Moreover, out of these 7 years, she worked part-time for 2 years.

Its output will be calculated as follows:

- The work done while caring for a child is counted only for the first year and a half. During 2 maternity leaves, Anna accumulated 3 years of experience.

- If a person works part-time as an individual entrepreneur, the output is not counted, since there are no transfers to the Pension Fund.

- We sum up the difference of 20 and 3 with the difference of 7 and 2. The result is that Anna has accumulated 22 years of output.

The main document that confirms periods of work is still considered the work book. The information reflected in the document is checked by employees of the Pension Fund of the Russian Federation and taken into account when calculating length of service (if the employer made contributions to the Pension Fund). If a citizen meets the minimum length of service requirements, he is assigned an insurance pension, the amount of which depends on the length of work and earnings.

Definition of continuous service

As a general rule, the indicator does not have any effect on the size of the pension. However, in some cases it may be. So, if the total length of service is less than continuous, the benefit is determined according to the last indicator. The law allows you to maintain continuous service.

This is important to know: Cancellation of work experience for child care

This happens in the following situations:

- the person moved to another place of work, and the break between work activities did not exceed 1 calendar month;

- the person was forced to terminate the employment contract due to the fact that his spouse was transferred to another location for professional work or retired;

- a woman is carrying a child, is the parent of a disabled minor under the age of 16, or has offspring under the age of 14;

- the person terminated the employment contract on his own initiative, and the amount of time that elapsed before employment at another company did not exceed 3 weeks.

In some situations the indicator is not saved. This is possible if a person was fired due to being drunk at work, failure to appear for an unexcused reason, systemic failure to fulfill work duties, or the entry into force of a court verdict on the basis of which the person is deprived of liberty.

How is the insurance period used when calculating sick leave?

Now it’s worth understanding why additional periods are included in the insurance period and what they affect. Based on the length of service, sick leave payments can be divided into periods:

- People with more than 5 years of experience can apply for 60% of the average monthly salary;

- by 80% – with a duration of 5 to 8 years;

- 100% – with more than 10 years of experience;

- if an employee has worked for less than 6 months, then during sick leave he is paid 1 minimum wage, multiplied by the regional coefficient.

In this case, the calculation of the duration of the insurance period occurs on the date of opening of the sick leave. For example, citizen N served in the army for 2 years and worked in different companies for another 2 years, 11 months and 22 days. Under such conditions, he will be assigned a sick leave payment in the amount of 60% of the average monthly salary at his current place of work. If, during the period of searching for a job, this person would register with the labor exchange for at least 10 days, he would already be paid 80% of the average salary. The same percentage would be assigned if he fell ill 9 days later.

Features of accounting for periods of service

Let's look at other features of accounting for the duration of citizens' pension insurance. First of all, you need to understand how periods of army and military service are included in the length of service. To do this, you need to familiarize yourself with the Order of the Ministry of Health and Social Policy from the beginning of 2010. It says that persons who have served in the Armed Forces since the beginning of 2007 have the right to be included in the insurance period of service in the ranks of the Armed Forces. Until this point, no records were kept. This time is taken into account when calculating sick leave payments. Citizens who have served receive a service allowance from state funds.

The period of study is not taken into account when calculating pensions or sick leave. There is only one exception to this rule - those citizens who independently made contributions under the voluntary co-financing program can receive an increased pension while receiving education.

If you go on a long paid vacation every year, then you don’t need to worry about including it in your insurance record. At this time, the employer also pays contributions to the Pension Fund, so accounting for this period is carried out on a general basis. In case of unpaid leave, it is possible to exclude its time from the length of service.

Parental leave is the only period that can be included in the length of service even for unemployed women. For 1.5 years they receive benefits from the Social Insurance Fund, from which they make all the necessary deductions. Currently, the maximum total duration of this period cannot exceed 3 years.