Home / Labor Law / Employment / Hiring

Back

Published: 02.11.2018

Reading time: 6 min

2

639

In some cases, an employee is required to undergo a medical examination before employment. The list of such situations is prescribed in Article 214 of the Labor Code.

- How can an employer pay for a medical examination?

- Procedure and terms for payment of compensation

- Documents for refund

- Where to file a complaint about refusal to pay compensation

The purpose of such an examination is to determine the professional suitability of the applicant to occupy the given position.

Who needs to undergo a medical examination when applying for employment?

There are certain categories of employees for whom undergoing a medical examination is predetermined by current legislation, for example, for the following:

- Drivers must undergo a drug addiction treatment and a psychologist;

- personnel employed in enterprises with harmful and dangerous working conditions (Part 1 of Article 213 of the Labor Code of the Russian Federation) - the harmfulness factor is determined by a special assessment. At the same time, the lists of harmful and dangerous work are indicated in the Order of the Ministry of Health and Social Development of Russia dated April 12, 2011 No. 302n;

- office workers forced to spend more than half of their working time at the computer - annually;

- employees of catering establishments - registration of a medical book (Part 2 of Article 213 of the Labor Code of the Russian Federation);

- employees of food enterprises - registration of a medical book (Part 2 of Article 213 of the Labor Code of the Russian Federation);

- personnel working in direct contact with children - teaching staff of preschool and school institutions, including temporary groups (Part 2 of Article 213 of the Labor Code of the Russian Federation);

- employees of consumer services - bath and laundry complexes, hairdressers, beauty salons, etc. (Part 2 of Article 213 of the Labor Code of the Russian Federation);

- medical staff - clinics, laboratories, hospitals (Part 2 of Article 213 of the Labor Code of the Russian Federation).

In addition, minor employees and personnel seconded to the Far North and areas with similar conditions undergo medical examinations.

Important! Territorial self-government bodies may establish additional conditions for undergoing a medical examination for certain categories of employees. If an applicant refuses to undergo a medical examination, the employer has the right to refuse employment, because

a medical examination is preliminary and is carried out upon concluding an employment contract (Article 69 of the Labor Code of the Russian Federation)

If an applicant refuses to undergo a medical examination, the employer has the right to refuse employment, because The medical examination is preliminary and is carried out upon concluding an employment contract (Article 69 of the Labor Code of the Russian Federation).

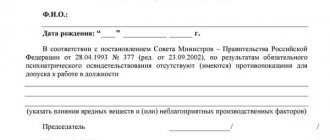

To refer an applicant for a preliminary medical examination, the organization issues an individual referral in a form approved by the organization itself. The referral contains the following data: full name of the person, place of work, place in the list of places and professions for which a medical examination is required, if necessary, harmful and hazardous production factors are indicated.

Payment for medical examinations of employees of organizations

The court decided to oblige the company to pay compensation to the employee for a medical examination upon hiring (Determination of the Smolensk Regional Court No. 33-3776 of November 22, 2011). Particular attention should be paid to areas of activity where workers are subject to daily medical examinations.

This, for example, includes passenger and cargo transportation, where vehicle drivers must be examined according to a certain scheme before setting out on a route. In such cases, the employer also provides for the payment of a medical examination, and it is extremely important for workers in this field to know that under no circumstances can funds be withdrawn from them, for example, from their salaries or bonuses for such checks.

Penalties For intentional evasion of payment of compensation, Part 1, Art.

Hiring expenses

The costs of medical examination of candidates are taken into account in accounting as normal expenses for core activities, in the corresponding accounting accounts:

D 20 (26,23,25,44) K 76(60)

In tax accounting (for the purposes of calculating income tax or single tax under the simplified tax system), expenses are also accepted (see paragraphs 7 and 8, paragraph 1, Article 264 of the Tax Code of the Russian Federation and paragraph 5, paragraph 1, Article 346.16 of the Tax Code of the Russian Federation). In particular, according to the simplified tax system, according to the explanations of the Ministry of Finance, these costs are included in material costs, as part of the production process.

It doesn’t matter whether the candidate was selected or not, even if the results of the medical examination turned out to be unacceptable for hiring, they can be taken into account. Although some controversy is caused by the situation when a potential employee independently enters into an agreement for a medical examination and then presents documents to reimburse him for such costs

In most cases, tax authorities and courts recognize that the employer is required by law to bear these costs, so reimbursing the employee for expenses does not lead to the formation of income subject to personal income tax and contributions. I note that compensation is possible if the employee himself applies for it. The main thing is that the organization conducting the medical examination has a license, and the employee provides an agreement, documents on payment and provision of services. For an organization, expenses can be accepted into accounting on the basis of acts of services rendered, but for tax accounting using the simplified tax system, the fact of payment is important.

Note! From July 1, 2021, the cash receipt must indicate the name of the buyer (customer), his TIN and some other details (clause 6.1 of Art.

4.7 of Law 54-FZ), if the settlement is made with an organization (IP), including through an accountable person.

Another reason not to pay fees for a candidate is the lack of an employment relationship. Since an individual is not an insured person, there is no need to pay contributions.

Procedure and terms for payment of compensation

The current legislation does not indicate the timing of payment to an employee of compensation for undergoing a mandatory medical examination. That is, the payment of compensation is unlimited.

Established judicial practice indicates that the employer must compensate the employee’s expenses for undergoing a medical examination as soon as possible after submitting the necessary documents and application. Usually the payment is made on the first payment.

The procedure for receiving payment will be as follows:

- The employee undergoes a medical examination and receives an official conclusion , which confirms that his state of health corresponds to his position.

- Payment of compensation is of a declarative nature and is made on the basis of an application received from the employee.

- Then management is given a certain period of time to review it , after which it instructs the accountant to include compensation in the amount of the next payment.

Documents for refund

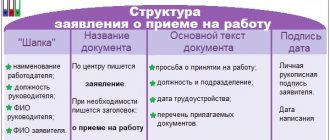

In order for the employer to transfer compensation for the completed medical examination, you need to submit an application to him. The application is drawn up in any order and contains the following information:

- Full name of the manager to whose address it is submitted;

- name of the employing company;

- Full name of the applicant employee and his position;

- document title : “Application”;

- essence of the request : to pay compensation for the costs of a medical examination;

- amount of compensation;

- date of application;

- applicant's signature with transcript.

The following must be attached to the return application:

- previously received referral for examination;

- original payment document (sales or cash receipt), indicating payment for medical services;

- conclusion of the medical commission (or medical book and certificate in form 086);

- work book (usually it is already kept by the employer).

The company's secretariat, human resources department or accounting department may be responsible for receiving and processing such applications.

Who accepts documents

All financial issues are managed by the company's accounting department. However, to receive compensation, the signature of the head of the company or the person replacing him in this position will be required.

Therefore, first a statement is written, which must be endorsed by the manager. Then, the application with the package of documents listed above is sent to the accounting department.

How is reimbursement of medical examination expenses processed in accounting?

Many employers and accounting employees of enterprises are concerned not only with the practical assignment of compensation for medical examinations to employees, but also with the correct indication of the costs of medical examinations and compensation issued to employees in the organization’s financial statements. In particular, every accountant and HR specialist should know how a medical examination is recorded in accounting. First of all, in this context, attention should be paid to the provisions of the following regulations of the Tax Code of the Russian Federation:

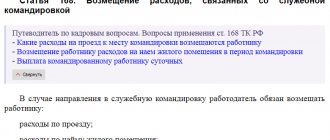

- Clause 7, clause 1, art. 264 of the Tax Code of the Russian Federation indicates that expenses for ensuring safety measures and labor protection, the elements of which include medical examinations, are included in the number of expenses calculated for profit taxation.

- pp. 8, clause 1, art. 264 of the Tax Code of the Russian Federation also ensures the right of the employer to include in the cost base all expenses associated with the employment of employees, which allows you to pay for a medical examination when hiring an employee and include these costs among the expenses of the enterprise.

If a medical examination for an organization, a specific position or an individual employee is not mandatory from the point of view of law, then the entrepreneur does not have the right to include the costs of it in the expense base - they will not reduce the income tax in this case.

The cost of a medical examination is not subject to personal income tax and insurance fees. But also - only on the condition that these procedures were carried out when a medical examination was mandatory. Otherwise, the employer will have to calculate personal income tax when paying compensation and pay the necessary insurance fees.

Where to file a complaint about refusal to pay compensation

If the employer refuses to compensate the employee for expenses on a voluntary basis, the employee has the right to go to court. According to Art. 392 of the Labor Code, the statute of limitations for such cases is established within 3 months from the moment the employee learned of the violation of his rights.

In addition to the court, the employee has the right to appeal the employer’s actions to the labor dispute commission or to the trade union (if his work is organized on the basis of the company) or to the labor inspectorate. Based on the consideration of a complaint against the employer, the labor inspectorate may issue an order requiring the employer to eliminate shortcomings and pay compensation to the employee. This order will be mandatory for consideration.

According to the definition of the Supreme Court, failure by the employer to reimburse the costs of a medical examination is grounds for bringing him or responsible employees to punishment in the form of a fine. The fine for officials is 1-5 thousand rubles, for legal entities - 30-50 thousand rubles.

Thus, the employer is obliged to compensate the employee for the expenses incurred for undergoing a medical examination during employment. This responsibility is assigned to them regardless of their time in the company. Compensation is paid based on the application received from the employee and supporting documents attached by him. If the employer refuses to comply with the employee’s legal requirement, the employee may complain to the labor inspectorate or court. This threatens to bring the employer to administrative liability.

Answers to frequently asked questions

Question No. 1: What are the fines for failure to pay the required compensation for a medical examination?

The penalty is imposed in accordance with Art. 5.27 Code of Administrative Offenses of the Russian Federation.

| Responsible persons | Amount of fine for violation |

| Official or individual entrepreneur | From 1,000 to 5,000 rubles. |

| Legal entity | 30,000 - 50,000 rub. |

Question No. 2: When hiring a potential employee, the employer sent him for a medical examination, but this is not required by law. Should the employer reimburse expenses for a medical examination completed under such circumstances?

Yes, the employee must be reimbursed at work for all expenses related to the medical examination, since the initiative to undergo it comes from the employer.

An applicant applying for a job must undergo a medical examination even when local regulations of the organization provide for this, despite the fact that the law does not oblige this. Well, in such situations, the employer is obliged to reimburse him for all expenses associated with the medical examination.

Who pays the applicant's expenses in case of refusal to sign an employment contract?

If the initiator of a medical examination during employment is the employee himself, but this is not prescribed by law and the employer does not require a certificate of health, then the money for the examination is not reimbursed to the employee. Payment for the examination falls on the shoulders of the employee himself, both in the case of signing an employment contract and in the event of a refusal to hire.

If the case of undergoing a pre-employment examination at a medical institution complies with legal requirements, or the employer insists on undergoing it, then the employee does not bear any costs.

Passing a medical examination during employment has advantages for both the employer and the employee. The manager will be confident that the health status of the employee hired has no contraindications to the existing working conditions, and the employee himself will have the opportunity to identify possible problems in the early stages.

Refund for passing a medical examination when applying for a job

Who needs to undergo a medical examination when applying for employment?

There are certain categories of employees for whom undergoing a medical examination is predetermined by current legislation:

- Drivers must undergo a drug addiction treatment and a psychologist;

- personnel involved in enterprises with harmful and dangerous working conditions - the harmfulness factor is determined by a special assessment;

- office workers forced to spend more than half of their working time at the computer - annually;

- employees of catering establishments - registration of a medical book;

- workers of food enterprises - registration of a medical book;

- personnel working in direct contact with children - teaching staff of preschool and school institutions, including temporary groups;

- employees of consumer services - bath and laundry complexes, hairdressers, beauty salons, etc.;

- medical staff - clinics, laboratories, hospitals.

In addition, minor employees and personnel seconded to the Far North and areas with similar conditions undergo medical examinations.

Important! Territorial self-government bodies may establish additional conditions for undergoing a medical examination for certain categories of employees

FSS: how to report and receive compensation

The special assessment is reflected not only in the declaration submitted to Rostrud, but also in the 4-FSS report (Table 5), starting from the first quarter of 2021. Medical examinations are shown in a separate row in the same table. Until the new year, this data remains unchanged, because... values are set at the beginning of the year. When sending the calculation for the 1st quarter of 2021, do not forget to check whether changes have occurred and fill out the table.

In order to reimburse its costs for mandatory medical examinations, the employer applies to the Social Insurance Fund for appropriate funding (the Rules were approved by Order of the Ministry of Labor No. 580n dated December 10, 2012).

Important! The application must be submitted this year before August 1 (i.e., July 31 inclusive)

The deadline for 2021 has already expired, now you can use the benefit only in 2021 and the sooner the better, because the Fund may refuse to provide funding if budget funds are exhausted.

The calculation of the amount that the Social Insurance Fund will reimburse (allocate) is made based on data from the previous calendar year using the formula:

(Accrued contributions for injuries - expenses for paying for “accidental” sick leave and vacations for the period of treatment and travel to the place of treatment in addition to regular annual leave) x 20%

An insured who takes care of pre-retirees and allocates additional funds for their sanatorium-resort treatment can count on 30%.

For enterprises that did not apply for financing in the previous two years and whose staff does not exceed one hundred people, more favorable conditions have been established. They can make calculations not from one previous year, but from three previous years at once. However, the amount of assistance should not be higher than the amount of contributions for the current year.

For reimbursement you will need (the list is relevant for financing for medical examinations): an application, a plan for preventive measures and their financing for the current year (originals), lists of measures to improve working conditions and labor protection (based on the results of the special assessment of labor protection) and a list of employees subject to medical examinations in the current year year in the form of copies, an agreement with a licensed medical organization and its license (copies).

Note! Some branches will ask you to duplicate certain documents electronically by email or through informal correspondence via TKS. When the FSS gives the go-ahead, the policyholder will have to submit a quarterly report on the use of contribution amounts in addition to the 4-FSS calculation

Additionally, you will need copies of reports from medical commissions and information from them, as well as copies of payment and other documents confirming payment for medical examinations and actual receipt of services (invoices, payment orders, cash receipts, acts)

When the FSS gives the go-ahead, the policyholder will have to submit a quarterly report on the use of contribution amounts in addition to the 4-FSS calculation. Additionally, you will need copies of reports from medical commissions and information from them, as well as copies of payment and other documents confirming payment for medical examinations and actual receipt of services (invoices, payment orders, cash receipts, acts).

So far, interaction with the FSS via telecommunication channels, excluding reporting submission, has not been established, so most of the documents will have to be carried personally (if you are sending a representative or a responsible person - not a manager, then do not forget to give him a power of attorney). You can also use the State Services website.

How does the organization reimburse fees for the examination?

Below we will look at what documents are needed and who to provide them to.

Documentation

One of the documents that an employee must present to the accounting department in order to receive reimbursement for a medical examination is a statement. As a rule, the organization has samples of such documents that employees can use.

The application is written to the director of the enterprise, which is indicated in the “header of the document” . In addition, it is necessary to indicate from whom the request is being sent (position and full name of the employee).

The text of the document indicates a request for reimbursement of the cost of undergoing a medical examination, indicating the amount spent, which is confirmed by a receipt from a medical institution attached to the application. At the end, the applicant puts the date the document was drawn up and a personal signature.

The employee submits the application together with the referral that was issued to him before undergoing the medical examination.

The direction must include the following items:

- The name of the organization that sends the employee to undergo a medical examination.

- Type of activity and form of ownership of the organization, indicating the OKVED code.

- The name of the medical organization and its address.

- Type of medical examination (preliminary).

- Full name and date of birth of the candidate.

- The name of the department where the employee will work.

- The position and types of work that the employee will perform.

- directions for a medical examination upon hiring

- directions for a medical examination upon hiring

If an enterprise does not transfer funds by bank transfer to a medical institution for employees to undergo medical examinations, then the employee pays for the preliminary examination himself.

Based on the information in the referral, he goes through a certain list of doctors whose services are paid at the cash desk of the medical institution. The fact of payment is confirmed by a check or receipt.

The receipt serves as confirmation of the amount of compensation indicated in the application.

Reception of papers by the accounting department

The employee submits all documents to the organization’s accounting department. The manager must indicate his visa on the application. If all documents are collected in full, the accountant accrues funds.

An employee’s claim for reimbursement of expenses for a medical examination must be considered within a period not exceeding 10 days (Article 235 of the Labor Code of the Russian Federation). As a rule, funds are transferred to the employee along with the first salary or advance payment.

Reimbursement through compensation

In the event that an applicant for a position independently pays for examination, diagnostics and tests at the clinic, he is obliged to provide supporting and payment documents to the organization for reimbursement of expenses. An applicant for a vacant position contacts the accounting department, regardless of the result of the inspection, with the following list:

- an application addressed to the director with a request to compensate for expenses;

- referral for a medical examination;

- agreement with a medical institution;

- receipts, checks, payment orders for payment for medical services;

- conclusion of the medical commission;

- passport;

- employment history;

- details for transferring funds.

After reviewing the documents and the management’s approval visa, the accounting department transfers the money to the specified details. Although the payment period is not regulated by law, it is recommended to make transfers to the next salary or advance payment to avoid labor conflicts.

The employee has every right to sue the employer if the latter refuses to reimburse the costs of the medical examination. At the same time, the management of the organization does not have the right to refer to a lack of funds in the budget. The injured party has the right to sue 3 months after the refusal to pay or at any time when it becomes obvious that labor rights have been violated.

What to do if the organization refuses to pay

If a person is faced with an unscrupulous employer, the question arises about protecting the rights of the worker.

Where to contact

The legislator provides for appeals to supervisory authorities and the court. Compliance with laws related to labor issues is monitored by state labor inspectorates. They are in every region and city.

You can go to court immediately upon discovering a violation, or after special authorities refuse to consider the complaint.

What and how to write

The inspection and the court work only with written claims. In the first case, a complaint is drawn up, in the second - a statement of claim. Anonymous requests will not be considered.

When describing the essence of the employer’s violations, it is necessary to indicate:

- the name of the body to which the person applies;

- last name, first name, patronymic, address, telephone - this information will be needed to send the results of the check or clarify details;

- describe the situation in detail, including the date and time of application for reimbursement of expenses, the manager’s response;

- express a request: bring the employer to justice, return the money spent.

Important: the labor inspectorate can work with violators without disclosing the applicant’s data.

If the issue cannot be resolved, you should go to court, then you will need a statement of claim to recover money. A sample can be found at the courthouse. The principle of such treatment is the same; it is necessary to correctly describe the problem, indicating:

- Name of the court.

- Personal data of the applicant - full name, residential address and contacts that are needed to clarify the circumstances or call the person.

- List of violations. It should be detailed, but you should not express your attitude to the situation, insult the manager, and so on.

- The essence of the request: to return the money spent on passing the commission.

In both cases, applications are supplemented with copies of documents confirming the examination. Only those whose rights have been violated can file a complaint.

The labor inspectorate, at the request of the person, may not refer to him when considering the application. The employer will not be provided with information about the complaining employee. When resolving the issue in court, this option is impossible.

Example 1. Preliminary medical examination for taxi drivers (ambulance and other emergency services)

Citizens who are going to get a job that involves driving ground vehicles are required to first undergo a medical examination.

The examination of the future driver includes visits to several doctors: an ophthalmologist, a neurologist, a surgeon, an endocrinologist, and a dermatovenerologist. The subject's height, weight, blood type, Rh factor are determined, visual acuity, color perception are determined, the vestibular analyzer is examined, etc.

If at least one contraindication is identified, the examinee will not be allowed to work. So, for example, a driver of a passenger vehicle (category D1) with severe stuttering (or other speech defects) is allowed to work individually.

The procedure for undergoing a preliminary medical examination established by law

The employer’s obligation to organize a preliminary medical examination for applicants is enshrined in Art. 212 Labor Code of the Russian Federation. The procedure for its implementation is regulated by the above-mentioned Order of the Ministry of Health and Social Development of the Russian Federation No. 302n. According to Part II of the applicable Procedure, the procedure is as simple as possible and does not require any expenses from the applicant.

| Procedure for undergoing a medical examination upon employment | ||

| What does it include | What does it mean (description) | What to pay attention to |

| Issuing a referral for a medical examination to an applicant | This direction is filled out and signed by the authorized person of the employer. The form indicates: details of the employer and medical organization; Full name, personal data of the applicant; harmful (hazardous) factors, types of work on the basis of which the applicant will be examined | The referral is issued to the applicant with a personal signature |

| Submission of documents during medical examination | The applicant must present at least his civil passport and a letter of reference issued by the employer | A health passport is attached if available. In some cases, the decision of the medical commission on the completed psychiatric examination is presented |

| Preparation of documents for the person being examined at the medical center. organization that conducts medical examinations | The person being examined is assigned: honey. card in form No. 025/u-04; health passport (if you don’t have one), which, among other things, indicates doctors’ conclusions on a medical examination | Honey. the card remains stored in the medical office. organization, and a health passport is issued to the examined person after a medical examination |

| Conducting a medical examination | The procedure involves performing the necessary laboratory and functional studies. Upon completion of the examination, a medical certificate is issued. a conclusion that contains: date of issue; information about the person examined and his employer; harmful factors (types of work); medical examination results (contraindications to work, etc.) | The conclusion is certified by the signature of the chairman of the medical department. commission and medical seal. organizations. One copy of the conclusion is given to the examined applicant. One copy of honey. the conclusion remains in the medical organization and is filed with the outpatient card of the examined person. |

List of honey contraindications, in the presence of which the examined person should not be allowed to work, are determined by Part IV of the Procedure, approved. Order No. 302n. These include, for example: ischemic heart disease, active forms of tuberculosis, chronic skin diseases, glaucoma, substance abuse, mental illnesses with persistent, worsening manifestations, and other diseases.

BASIC

When calculating income tax, take into account the amount of salary during the mandatory medical examination as part of labor costs (clause 7 of Article 255 of the Tax Code of the Russian Federation).

An example of how wages accrued during a mandatory medical examination are reflected in accounting and taxation. The organization applies a general taxation system

Worker of LLC “Production Company “Master”” A.I. Ivanov was sent for periodic mandatory medical examination from April 22 to April 24, 2015 inclusive (3 days). During this time, he retains his average earnings. Ivanov's working hours are recorded in days.

Ivanov worked in full for the entire billing period (from April 1, 2014 to March 31, 2015 inclusive). The billing period is 245 working days. During this time, Ivanov was credited with 120,000 rubles.

Ivanov’s average daily earnings are: 120,000 rubles. : 245 days = 489.80 rub./day.

The salary due to the employee during the mandatory medical examination is equal to: 489.80 rubles/day. × 3 days = 1469.70 rub.

From this amount, Master’s accountant withheld personal income tax, and also assessed contributions for mandatory pension (social, medical) insurance and insurance against industrial accidents. Ivanov has no rights to deductions for personal income tax.

Insurance contributions for pension (social, medical) insurance are calculated by “Master” at general rates. The contribution rate for insurance against accidents and occupational diseases is 0.2 percent.

The organization’s accountant made the following entries in the accounting:

Debit 20 Credit 70 – 1469.70 rub. – Ivanov’s salary was accrued for the period of undergoing a mandatory medical examination;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 191 rubles. (RUB 1,469.70 × 13%) – personal income tax withheld;

Debit 20 Credit 69 subaccount “Settlements with the Pension Fund” – 323.33 rubles. (RUB 1,469.70 × 22%) – pension contributions have been accrued;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 42.62 rubles. (RUB 1,469.70 × 2.9%) – compulsory social insurance contributions have been assessed;

Debit 20 Credit 69 subaccount “Settlements with FFOMS” – 74.95 rubles. (RUB 1,469.70 × 5.1%) – contributions for health insurance to the Federal Compulsory Medical Insurance Fund have been accrued;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 2.94 rubles. (RUB 1,469.70 × 0.2%) – premiums for insurance against accidents and occupational diseases are accrued.

When calculating the income tax, the Master's accountant included 1,469.70 rubles in expenses, as well as insurance premiums accrued on this amount in the amount of 443.84 rubles. (323.33 rubles + 42.62 rubles + 74.95 rubles + 2.94 rubles).

Payment for primary medical examination upon employment

Depending on the nature of the medical examination, it can be completed in different ways.

For example, you can go to a regular free city clinic, or you can go to a paid one.

The queues there will be much shorter, and therefore the examination will be completed much faster. Read about how to pass a medical examination when applying for a job.

Who pays for the initial medical examination when applying for a job?

There are indeed legal grounds for the employer to pay for the initial medical examination, since such an examination is related to labor protection and is a guarantee that the employer will not have to create special conditions for people with serious health problems.

In order to receive the due compensation, you need to know all the nuances of the Labor Code.

It should be noted that the certificate is valid only for an extremely short period of time, therefore, after passing a medical examination, it is not advisable to delay employment.

The list of doctors that need to be seen can vary significantly in different cases. Usually they are examined by an ENT specialist, a surgeon, a neurologist, an ophthalmologist, and a therapist.

Some positions also require a psychiatrist. Women need to see a gynecologist, and those over 40 need to change their blood pressure. In special cases there may be other options.

If a medical examination is provided and not provided

In addition, those who move to the Far North, those whose activities will involve frequent business trips, as well as minors are required to undergo a mandatory preliminary medical examination. The list also includes hard work.

Sometimes additional indications for conducting a medical examination are introduced. These could be, for example, epidemics or special climatic conditions in a certain region.

If a medical examination is required by law, it is paid for from the employer’s funds.

There are situations when a medical examination is not provided for by law, but the employer requires it. For example, people with poor vision cannot work with optical instruments, and therefore an employer may require examinations from applicants.

When an employer insists on undergoing a medical examination, he can choose the medical facility himself.

In this case, falsification of testimony, which may occur when the applicant turns to familiar doctors, will be excluded. This will greatly protect the employer, as he will protect himself from the possibility of discovering occupational diseases, due to which he could incur significant expenses in the future.

If the employer did not insist on a medical examination and it is not provided for by law (for example, when starting an office job), the employee himself will pay for it.

As you know, work and work are different. Even an office environment, which has almost home-like conditions, can pose a threat, for example, to vision if the employee spends a lot of time at the computer or is a computer operator. Therefore, regular medical examinations are provided for such employees.

If an employee works part-time and a medical examination is required by law, the employer is also obliged to pay for it.

Reimbursement of expenses to the applicant for undergoing a preliminary medical examination

This scenario is also not excluded. If the employer has medical the organization did not enter into an agreement, and for other justified reasons, the applicant may complete it at his own expense. Although this option is not clearly stated in the law, as is the procedure for reimbursement of funds for examinations. Compensation for a medical examination upon entry to work is paid upon receipt. Conventionally, the whole process can be displayed like this:

- The applicant undergoes an examination and receives the necessary documents. Among them, in addition to honey. conclusions, there must be documents confirming payment for the relevant medical services. services.

- Then he presents to the employer all the documents issued to him after passing the medical examination.

- Next, he writes an application for compensation, attaches documents confirming payment and leaves everything in the accounting department.

Based on this, he is reimbursed for expenses for undergoing a medical examination. It should be noted once again that the employer reimburses expenses only for the mandatory preliminary medical examination provided for the profession in which the applicant intends to work.

Such compensation is not subject to personal income tax. The basis is clause 3 of Art. 217 of the Tax Code of the Russian Federation, which clearly states that tax is not withheld from all types of compensation payments related to the performance of labor duties.

There is also no need to withhold insurance premiums from her. Although the compensation payment is made in favor of the employee, it is again related to the performance of labor duties by the individual. On this basis, all compensations within the limits established by law are not subject to generally obligatory insurance contributions. Moreover, contributions “for injuries” are no exception and they are also not deducted from compensation amounts.

Costs depending on types

There are three types of medical examinations: for employed citizens – periodic and extraordinary; for applicants – preliminary.

An employee undergoes a preliminary examination upon joining the organization; periodic – at regular intervals; extraordinary – for medical reasons. Employees and applicants for the following types of economic activities are required to undergo a medical examination:

- industry with hazardous/harmful working conditions;

- transport;

- trade;

- catering;

- medicine;

- education.

The cost of a medical examination varies depending on the field in which the citizen works. A professional examination by doctors, tests and diagnostics costs from 1,500 to 3,000 rubles. You will have to pay separately for a narcologist and a psychiatrist (from 200 rubles for one specialist).

Workers with hazardous working conditions, irregular working hours, and shift work require additional clinical examinations.

Combination of OSNO and UTII

Expenses related to the organization's activities on UTII are not taken into account when calculating income tax (clause 9, article 274, clause 7, article 346.26 of the Tax Code of the Russian Federation). Therefore, the costs (reimbursement of expenses) for undergoing a mandatory medical examination by employees who are simultaneously engaged in activities subject to UTII and in activities subject to the general taxation system must be distributed.

The costs (reimbursement of expenses) for undergoing a mandatory medical examination by employees engaged in only one type of activity do not need to be distributed.

An example of the distribution of costs for a mandatory medical examination at the expense of the organization. The organization applies a general taxation system and pays UTII

LLC Trading Company Hermes sells food products wholesale and retail. For wholesale transactions, the organization applies a general taxation system. Retail trade has been transferred to UTII.

Hermes accrues income tax on a monthly basis.

The accounting policy of the organization states that general business expenses are distributed in proportion to income for each month of the reporting (tax) period.

The amounts of income received by Hermes from various activities in May are:

- for wholesale trade (excluding VAT) – RUB 10,500,000;

- for retail trade – 6,000,000 rubles.

The organization had no other income.

In May N.I. Korovina (employed in two types of activities) was sent to the clinic for a mandatory periodic medical examination. The cost of a medical examination under the contract is 12,000 rubles. (without VAT).

To distribute this amount between expenses for different types of activities, the Hermes accountant compared the income from wholesale trade with the total income of the organization.

The share of income from wholesale trade in total income for May is: RUB 10,500,000. : (RUB 10,500,000 + RUB 6,000,000) = 0.636.

The amount of expenses for a medical examination, which can be taken into account when calculating income tax for May, is equal to:

12,000 rub. × 0.636 = 7632 rub.

The accountant took this amount into account when calculating income tax for January–May.

The amount of expenses for a medical examination, which relates to the activities of an organization subject to UTII, is: 12,000 rubles. – 7632 rub. = 4368 rub.

How can an employer pay for a medical examination?

The list of employees who are required to undergo a medical examination is prescribed in Art. 213 Labor Code. In addition, the employer’s responsibilities should include organizing inspections for other categories of employees, if this is mentioned in federal and regional laws.

In Art. 212 of the Labor Code provides for the employer’s obligation to organize and pay for preliminary and periodic medical examinations. Moreover, in Part 2 of Art. 212 and part 8 of Art. 213 of the Labor Code stipulates that mandatory medical examinations must be carried out at the expense of the employer.

Therefore, if an employee himself has undergone a medical examination, the employer is obliged to compensate him for all expenses incurred for undergoing a medical examination. This is confirmed by numerous judicial practices.

Moreover, the obligation to compensate for these costs arises regardless of how much time the employee works in the future. Labor legislation does not contain any special exceptions in this regard.

Even if the employee turns out to be unsuitable for the position, is hired as a part-time worker, or has not completed the probationary period, the employer is not relieved of the obligation to pay compensation.

Employers have the right to pay employees for medical examinations in one of the following ways:

- Based on a statement received from an employee who had previously undergone a medical examination.

- Send the applicant for a medical examination and then pay him compensation. This is drawn up in the form of an act that contains information about the future employee as the payer, as well as about the employer as the person who undertakes to compensate for all expenses.

- Conclude an agreement with a medical organization. As a result, the costs of the examination will be paid by the employer using invoices from the clinic.

The last option is most preferable for the employer, since applicants will not be able to choose overly expensive clinics for examination. And the agreement with the medical center will allow the employer to receive discounts for this type of service.

Compensation for medical examination

According to the provisions of Articles 212 and 213 of the Labor Code of the Russian Federation, the employer is obliged to compensate the employee for the costs of conducting a medical examination in full. This practice is used in cases where the applicant has passed a medical examination on his own or has received a referral for a medical examination through the human resources department.

Reimbursement is made on the basis of an employee’s application, which is certified by the head of the enterprise or another authorized person.

What to do if payment for a medical examination is not provided

The list of professions for which passing a medical commission is mandatory is determined by labor legislation. However, this legal act provides that self-government bodies may introduce additional conditions for undergoing a medical examination.

If the position for which the applicant is applying requires passing a medical commission, this will have to be done in any case. It does not matter that this requirement is not spelled out in labor legislation, but is provided for by the internal charter of the enterprise.

In any case, if the employer insists on undergoing a medical examination, he is obliged to reimburse the expenses incurred. Let us note that if the profession is not included in the list, is not specified in the company’s internal documents for passing a medical examination, and the employer does not insist on an examination, he is released from the obligation to compensate for expenses. This happens if a future employee undergoes a medical examination on his own.

Payment Methods

The law does not regulate how expenses are reimbursed, so compensation for a pre-employment medical examination is usually made as follows:

- In fact. The employee passes the commission independently, after which he submits to the accounting department of the enterprise an application certified by the employer for reimbursement of the specified amount;

- Preliminary agreement. The employer sends the applicant to undergo a medical examination, drawing up a statement of subsequent reimbursement of expenses;

- Agreement. Here, an agreement is concluded between the company and the medical institution, on the basis of which referred employees undergo medical examinations free of charge (Clause 2.3 of the Methodological Basis for Preliminary and Periodic Medical Examinations of Persons Working in Harmful and (or) Dangerous Working Conditions, approved by the Ministry of Health and Social Development of Russia on December 14, 2005) .. This option is preferred for job seekers and employers. The former do not incur financial costs during employment, the latter receive a discount.

Important! The law does not provide for reimbursement periods, so it is a mistake to assume that the employer will reimburse the costs immediately after hiring a new employee. Typically, accounting includes this amount in the first payment due to the employee: advance or salary.

The employee underwent a medical examination on his day off

It is possible that according to the calendar plan for a medical examination, the employee needs to undergo it on his day off.

Holiday status

A day off refers to a period of rest during which an employee is free from performing work duties and which he can use at his own discretion (Articles 106 and 107 of the Labor Code of the Russian Federation).

As a general rule, work on weekends and non-working holidays is prohibited (Part 1 of Article 113 of the Labor Code of the Russian Federation). To be hired to work on a day off, you must obtain written consent from the employee in advance.

Payment for medical examination on a day off

Passing a medical examination on a day off means an employee fulfills the employer’s instructions on his day of rest.

Order. The basis for payment is an order from the head of the company to conduct a medical examination.

The order should indicate on what day the employee must go to the doctor, how many hours are allocated for the medical examination, and how payment will be made for that day. See below for a sample order.

Entry in the report card. If an employee works on his day off, the code “RV” must be entered on the timesheet. To indicate on the time sheet the time of a medical examination on a day off, you can use an arbitrary code, for example “VMO”.

How to determine the number of hours spent by an employee on a day off for a medical examination?

In agreement with the medical organization, in the calendar plan for the medical examination, indicate the hours when doctors see you. This will help determine the number of hours of medical examination per day off, paid based on average earnings.

Payment amount. On a day off, the employee does not work and is not paid. When carrying out an order from the employer on his day off, the employee does not lose his salary, as happens on a working day. Accordingly, the employer has no reason to compensate the employee for the loss of wages by paying average earnings. This means that when undergoing a medical examination on a day off, the employee must be paid double salary in accordance with the provisions of Article 153 of the Labor Code, and not the average salary.

Example 3 An employee underwent a medical examination on his day off. Daily working time recording

Reagent production operator E.P. Mosquitoes must undergo periodic medical examinations. According to the calendar plan for the medical examination, the employee must undergo a medical examination on August 16, 2014 from 9.00 to 12.00. This day is a day off for E.P. Komarova.

The employee has a daily recording of working hours, a five-day 36-hour work week, and a salary of 45,000 rubles.

How to draw up an order to carry out the employer’s instructions on a day off and calculate payment for the duration of the medical examination?

Solution

We draw up an order

In our case, only one employee must undergo a medical examination, so we will draw up an individual order.

Sample 2 Order to undergo a medical examination on a day off

Hourly rate calculation

In this situation, it is necessary to pay for several hours of work duties on a day off. To do this, you need to determine the hourly rate.

You can calculate the hourly rate as follows: divide the salary amount by the standard number of working hours in the billing month. The option for determining the hourly rate should be approved in the wage regulations.

The hourly rate will be 297.62 rubles. (RUB 45,000: 151.2 hours), where 151.2 hours is the number of working hours in August with a 36-hour work week.

Calculation of payment for a medical examination on a day off

The employee spent three hours undergoing a medical examination. Payment for this time will be 1785.72 rubles. (RUB 297.62 × 3 hours × 2).

Personal income tax

When determining the tax base for personal income tax, all income of the taxpayer received by him both in cash and in kind, or the right to dispose of which he has acquired, is taken into account (Clause 1 of Article 210 of the Tax Code of the Russian Federation).

Article 41 of the Tax Code defines income as an economic benefit in monetary or in-kind form, taken into account when it is possible to assess it and to the extent that such benefit can be assessed.

However, the Ministry of Finance clarified that payment by the employer for mandatory medical examinations of employees, stipulated by the requirements of the Labor Code, cannot be recognized as an economic benefit for the employees, since it is necessary to ensure the activities of the company.

Therefore, this reimbursement by the employer for the cost of mandatory medical examinations of employees is not subject to personal income tax.