What conditions for compensation are established by Art. 188 Labor Code of the Russian Federation?

Labor legislation allows for the possibility of an employee using his own property when performing his labor functions. Art. 188 of the Labor Code of the Russian Federation for such situations provides for payment of the employee’s expenses by the employer if the employer is aware of the use of the employee’s property and he does not object to it. The conditions for payment of compensation are:

- fixing the obligation to pay it and the amount in a written agreement;

- determining the amount of compensation based on the amount of depreciation (depreciation) of the property and the costs of its use.

Such an agreement may include:

- to the instrument;

- equipment;

- transport;

- materials.

The costs of its use (maintenance), depending on the type of property, will include the following costs:

- on fuels and lubricants;

- maintenance;

- current repairs.

The amount of compensation will be determined by the intensity of use of the property owned by the employee and can be set not only as a fixed value, but also as a complex amount consisting of two components: constant (depreciation) and variable (expenses of use). For the second option, the text of the compensation agreement includes description of the calculation algorithm.

A compensation agreement can be either a stand-alone document or an integral part of an employment agreement.

Article 188 of the Labor Code of the Russian Federation. Reimbursement of expenses when using an employee’s personal property

1. Reimbursement of expenses when using an employee’s personal property is made by the employer if the use of the property was determined by the interests of the organization.

2. An employee may use personal property with the consent of the employer (this presupposes a prior written agreement between the employee and the employer on the use of the employee’s property); with the knowledge of the employer, when a written agreement was not previously reached between the parties, but the employer knew that the employee, when performing a job function, was placed in conditions under which he was forced to use his property, and allowed this.

3. Reimbursement of expenses associated with the use of employee property entails payment of compensation for use, wear and tear (depreciation); expenses associated with its use are also reimbursed.

The amount of reimbursement of expenses is determined by agreement of the parties to the employment contract, concluded in writing, regardless of whether the employee’s property was used with the consent or knowledge of the employer. In this case, the degree of depreciation of tools, personal vehicles, equipment and other technical means and materials is determined as a percentage of the established shelf life. The amount of compensation depends on the amount of depreciation. Expenses incurred by the employee for repairs due to a malfunction or breakdown of the property being used are subject to reimbursement, since it becomes partially or completely unusable.

4. The Government of the Russian Federation, by Resolution No. 414 of June 20, 1992 “On the standards of compensation for the use of personal cars for business purposes” (RV. 1992. No. 24), provided that enterprises and organizations include costs in the cost of products (works, services) to compensate their employees for the use of their personal cars for business trips. Organizations located in the Far North and equivalent areas are allowed to apply these standards with an increase of up to 10%, depending on the specific operating conditions of passenger cars.

Letter No. 57 of the Ministry of Finance of Russia dated July 21, 1992 defines the conditions for paying compensation to employees for the use of personal cars for business trips (BNA RF. 1992. No. 11 - 12). Payment of compensation is made when work by type of production (official) activity is associated with constant official travel (in accordance with job responsibilities). The amount of compensation for the use of a personal car of a foreign brand depends on what class of cars it can be equated to in terms of its technical parameters.

The basis for payment is the order of the head of the organization. The specific amount of compensation is determined depending on the intensity of use of a personal car for business trips. This takes into account the reimbursement of vehicle operating costs (the amount of wear and tear, costs of fuels and lubricants, maintenance and repairs). To receive compensation, employees submit to the organization’s accounting department a copy of the technical passport of their personal vehicle, certified in the prescribed manner. An employee who uses a personal car under the power of attorney of its owner is paid compensation in a similar manner. Compensation is paid once a month, regardless of the number of calendar days. During the time an employee is on vacation, a business trip, absenteeism from work due to temporary disability, as well as for other reasons, when a personal car is not in use, it is not paid.

Expenses for paying compensation to employees of budgetary institutions and organizations who use personal cars for business trips are made within the limits of allocations for the maintenance of cars provided for these purposes according to the estimates of the relevant institutions and organizations.

Payment of compensation to the heads of budgetary institutions and organizations is made with the permission of higher management bodies (organizations).

Decree of the Government of the Russian Federation of February 8, 2002 N 92 (SZ RF. 2002. N 7. Art. 691) established the following standards for the expenses of organizations for the payment of compensation for the use of personal cars and motorcycles for business trips, within which when determining the tax base For corporate income tax, such expenses relate to other expenses associated with production and sales: passenger cars with an engine capacity of up to 2000 cubic meters. cm inclusive - 1200 rub. per month; over 2000 cubic meters cm - 1500 rub. per month; motorcycles - 600 rub. per month.

Bailiffs using personal transport for official purposes are paid monetary compensation in the amounts established by the legislation of the Russian Federation (clause 3 of Article 21 of the Federal Law of July 21, 1997 N 118-FZ “On Bailiffs” // SZ RF. 1997. N 30. Art. 3590).

Employees and military personnel of the federal fire service who use personal vehicles for official purposes are paid monetary compensation in the established amounts (Article 8 of the Federal Law of December 21, 1994 N 69-FZ “On Fire Safety” // SZ RF. 1994. N 35 3649).

Collective bargaining agreements, agreements, local regulations, and employment contracts may provide for compensation of travel expenses for athletes and coaches (see commentary to Article 348.10 of the Labor Code).

5. In accordance with Art. 55 of the Law on Education, teaching staff of federal state educational institutions (including senior staff whose activities are related to the educational process), in order to facilitate their provision of book publishing products and periodicals, are paid a monthly monetary compensation in the amount of 150 rubles. in federal state educational institutions of higher professional education and corresponding additional professional education, in the amount of 100 rubles. — in other federal state educational institutions. For teaching staff of state educational institutions under the jurisdiction of constituent entities of the Russian Federation, the specified monetary compensation is paid by decision of the state authority of the constituent entity of the Russian Federation in the amount established by the specified body; teaching staff of municipal educational institutions - by decision of the local government in the amount established by the specified body.

Monthly monetary compensation is paid to teaching staff of educational institutions who are in an employment relationship with the educational institution (including while on regular, additional and other vacations, while receiving temporary disability benefits, etc.), as well as working on a part-time basis, provided that they do not have the right to receive it at their main place of work. The presentation of any receipts or receipts for the purchase of book publishing products or subscriptions to periodicals is not required. The amount of monetary compensation paid is not subject to taxation. The regional coefficient for monetary compensation for the purchase of book publishing products and periodicals is not calculated (letter of the Ministry of Education of Russia dated November 25, 1998 N 20-58-4046/20-4 // Bulletin of Education. 2000. N 2).

Departmental regulations have approved lists of teaching staff of educational institutions, who are provided with monthly monetary compensation for the purchase of book publishing products and periodicals (Order of the GUSP dated November 14, 2000 N 71 // BNA RF. 2000. N 52; Order of the Ministry of Emergency Situations of Russia dated July 23, 2001 N 331 // BNA RF. 2001. N 35; FSNP Order dated September 24, 2001 N 416 // BNA RF. 2001. N 47; FAPSI Order dated December 6, 2001 N 354 // BNA RF. 2002 . N 1; Order of the Russian Ministry of Defense dated October 4, 2002 N 401 // BNA RF. 2002. N 50; Order of the Federal Drug Control Service dated February 25, 2005 N 51 // BNA RF. 2005. N 14).

Decree of the Government of the Russian Federation of May 7, 1997 N 543 “On urgent measures to strengthen state support for science in the Russian Federation” (SZ RF. 1997. N 20. Art. 2292) for scientific workers who have an academic degree and work on a permanent basis in Scientific organizations subordinate to the federal executive authorities, the Russian Academy of Sciences and branch academies of sciences have established an annual compensation of 1000 rubles. for the purchase of scientific literature and payment for scientific and information services.

For what property are compensation established by law?

The employer and employee can agree on any amount of compensation that mutually suits them. However, for the purposes of calculating income tax, the amount of compensation for the use of transport is limited, as established by regulations of the Government of the Russian Federation:

- dated 02/08/2002 No. 92—for employees of ordinary taxpayers using OSNO, simplified tax system or unified agricultural tax;

- dated 07/02/2013 No. 563 - for civil servants working in government organizations of federal significance;

- dated January 17, 2013 No. 14 - for employees of the state fire service, institutions of the penal system, drug control authorities, customs authorities;

- dated December 30, 2011 No. 1199 - for employees of internal affairs bodies.

Another document (Order of the Investigative Committee of Russia dated November 10, 2015 No. 103) defines standards for employees of organizations of the Investigative Committee.

Since the payment of compensation is related to the employee’s performance of his direct labor duties, its amounts, regardless of whether they are included in expenses for the purpose of calculating income tax, will not be subject to personal income tax (letter of the Ministry of Finance of Russia dated April 20, 2015 No. 03-04-06/22274 ).

For information about what other compensations are not subject to personal income tax, read the material “Art. 217 Tax Code of the Russian Federation (2015): questions and answers" .

What are the features of compensation for transport?

Own transport is most often used by employees working in a traveling mode.

In terms of cost, transportation is usually the most expensive of the employee-owned assets that can be used for business purposes. The most comprehensive is the corresponding list of expenses, the value of which is also higher than when using other property for work. Therefore, there are legislatively approved standards for classifying compensation according to this list as expenses for accounting in the calculation of income tax.

It is assumed that the amount of compensation determined at the legislative level fully covers all costs of the property: depreciation, fuel and lubricants, and costs of maintenance and repairs (letter of the Ministry of Finance of Russia dated May 16, 2005 No. 03-03-01-02/ 140). Therefore, in addition to the total amount of compensation specified in the compensation agreement, other expenses for the purposes of calculating income tax, even if they significantly exceed the agreed amount of compensation, cannot be taken into account (letters from the Federal Tax Service in Moscow dated September 20, 2005 No. 20-12/66690 and from 02/22/2007 No. 20-12/016776).

What documents will be needed for compensation?

The basis for receiving compensation is a document confirming the employee’s ownership of the property used in the process of work (letter of the Ministry of Finance of Russia dated April 20, 2015 No. 03-04-06/22274). For transport, this will be a copy of the PTS. The fact of travel on it will be confirmed by waybills (letter from the Federal Tax Service in Moscow dated 03/04/2011 No. 16‑15/ [email protected] ).

It is possible to use the property by proxy. In this case, a copy of this document will be necessary. However, the use of property by proxy (i.e., not one’s own) will lead to the taxation of personal income tax compensation for it (letter of the Ministry of Finance of Russia dated February 21, 2012 No. 03-04-06/3-42).

For information about what other points of view exist on the withholding of personal income tax when paying compensation, read the article “Is compensation for the car used by an employee subject to personal income tax?” .

Thus, the complete set of documents that makes it possible to pay compensation for the use of personal property at work will be as follows:

- compensation agreement;

- an employment agreement or job description, from the text of which it follows that the work is carried out by the employee on a traveling basis;

- document on ownership of property or power of attorney for its use;

- technical passport for the property (for transport - PTS);

- documents confirming the actual use of property in the interests of the employer (for transport - waybills).

Compensation is paid monthly in the amount fixed as payment for a full month in the compensation agreement.

When an employee is absent from work and does not use his own transport for work at this time (vacation, sick leave, business trip), compensation is not accrued for the period of his absence (letter of the Ministry of Finance of Russia dated May 16, 2005 No. 03-03-01-02/140). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Article 186. Guarantees and compensation to employees in case they donate blood and its components

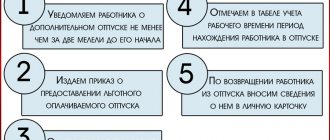

On the day of donation of blood and its components, as well as on the day of the associated medical examination, the employee is released from work.

If, by agreement with the employer, the employee went to work on the day of donating blood and its components (with the exception of work with harmful and (or) dangerous working conditions, when the employee’s going to work on this day is impossible), he is provided, at his request, with another day of rest.

In the case of donating blood and its components during the period of annual paid leave, on a day off or a non-working holiday, the employee is given another day of rest at his request.

After each day of donating blood and its components, the employee is given an additional day of rest. The specified day of rest, at the request of the employee, can be added to the annual paid leave or used at other times within a year after the day of donation of blood and its components.

When donating blood and its components, the employer retains for the employee his average earnings for the days of donation and the days of rest provided in connection with this.

back to contents