The performance of any work by an employee is not always carried out on the basis of a concluded employment contract.

In some cases, the legal basis is a social tenancy agreement, which is also called a civil contract. How is such an agreement used in regulating labor relations? Dear readers! To solve your specific problem, call the hotline or visit the website. It's free.

8 (800) 350-31-84

What is the difference between a employment contract and an employment contract?

Recently, employers have begun to more often employ employees under an employment contract rather than under an employment contract. Workers, in turn, began to feel less protected. The absence of an entry in the employment record raises doubts about the employer and does not give confidence in the future. When an employment contract is concluded without a work book, such relationships can hardly be called working.

The main difference between such a contract and an employment contract is that these documents are regulated by different laws. The employment contract is the Labor Code, while the employment contract is the Civil Code of the Russian Federation. Both documents have legal force.

Many people worry about pension contributions, that if an entry is not made in the work book, then there will be no pension. The employer undertakes to make pension contributions under any terms of the contract. This is a mandatory clause; without it, employment will be illegal.

Why employers prefer this type of contract:

Lease agreement

- Place of work, materials and daily routine are established by agreement with the employee

- There is no need to pay social tax for the employee

- There is no need to pay the employee for sick leave and vacation

- You may miss out on bonus points

- It is possible to be exempt from contributions to the employee’s social insurance

However, not everything is so smooth for the employer; there are also disadvantages:

- The employer does not have the right to punish the performer of the work for violating the regulations.

- The contractor has the right to recognize the employment contract through the court as labor

- The tenancy agreement assumes equality of the parties. And they are called “Contractor” and “Customer”

- It is impossible to bring an employee to administrative liability with a contract of employment

As for the employee, there are still disadvantages for him that are provided for by the Labor Code of the Russian Federation, but are not mentioned in the Civil Code. These include:

- There is no provision for vacation paid by the employer.

- The contract is concluded for a certain period, after which the employer has the right to remove the contractor from business. Also, the employer unilaterally has the right to terminate the contract at any time without warning.

- When going on maternity leave, an employee will not receive benefits.

- If an employee does not submit work on time, the employer has the right to deprive him of his salary.

- If you are injured at work, the employer is not liable. There will be no payments. Moreover, sick leave will not be paid either.

- There will be no additional payments beyond what is specified in the contract.

- No benefits will be paid upon termination.

- Experience is not taken into account.

For these reasons, workers do not seek to get a job under such an agreement. With a full social package, there is confidence that one day the employee will not be left without work and a penny in his pocket. The employment agreement is aimed at providing the employee with activities, and the employment agreement is aimed at obtaining the result of the performer’s work.

Working under a contract without a work book - pros and cons

If you decide to get a job under an employment contract, but without a work book, you first need to familiarize yourself with the nuances of such a service. The positive aspects of this work include:

- Exemption of the worker from compliance with the rules of the work schedule, which means there is no possibility of bringing the subordinate to disciplinary liability;

- Such an agreement is equivalent in strength to a traditional contract;

- An employer may be exempt from certain privileges regarding an employee. We are talking about additional allowances, vacation;

- There is no need to provide the employee with expenses that he may incur.

The negative aspects are:

- The worker is deprived of the privileges and benefits that are guaranteed to him by the work contract;

- The period of work under such an agreement is not counted towards the length of service;

- If an employee decides to officially find a job in a new place, then he will not be able to confirm his experience;

- A woman on maternity leave cannot count on receiving appropriate benefits;

- Disability leave is not paid.

Contents of the contract and its structure

Like any document, an agreement on employment without registration has its own structure:

Document structure

- At the top is the name and number, the place in which it is located, and the exact date.

- Next comes the preamble. It specifies the main aspects of the contract, provides information about the parties and the purposes of concluding the contract.

- The validity period of the document must be indicated.

- Then the types, volumes of work provided, and working conditions are prescribed.

- The next paragraph specifies the amount and terms of payment.

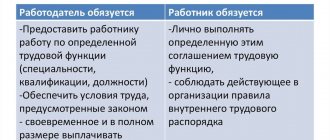

- The following describes the obligations of the parties.

- Indication of the conditions under which the contract is terminated unilaterally.

- The amounts and conditions of penalties are prescribed.

- Information of the contractor and the customer indicating contact details.

- At the bottom of the document, the parties put their signatures and seals.

In all of the above points, you need to describe each point in detail. Thus, the working conditions clause specifically indicates working hours, place, conditions of internships, training and training, the duration of the probationary period, and the nature of payment for the duration of the training. The payment clause must clearly indicate the payment procedure, frequency, quantity, possible incentive payments, etc.

The responsibilities of the parties involved must take into account all aspects, from presence at the workplace to the respectful attitude of superiors towards subordinates.

In addition to the listed points, the employer and employee can add additional sections as agreed upon by each other. This could be, for example, issues of providing workwear. If this document is executed incorrectly in any of the points, it will lose legal force.

To draw up an employment contract without applying for a job, the form can be downloaded on the Internet. Then it needs to be edited according to the wishes of the contractor and the customer, insert the data of the parties, print it out, put signatures, stamps and that’s it. Within three days after the conclusion of such a contract, the employer is forced to draw up an order for employment and provide it to the employee for signature.

Employment for hire from an individual without individual entrepreneur status

A person who is not an individual entrepreneur, according to Article 309 of the Labor Code of the Russian Federation, has no right to either create a new Labor Code or make entries into an existing one. Therefore, an agreement is concluded with the employee without completing additional documents. This is usually an offer of work under an employment contract as a gardener, nanny or housekeeper.

Article 303 requires the employer to notify the local government authorities at the place of his residence about the hiring and dismissal of employees. He is also obliged:

- make mandatory contributions and payments to the pension fund, social insurance fund and compulsory health insurance fund;

- register each employee in the personalized accounting system if the employee does not have SNILS or a registration document with the system.

We offer a sample contract with an employee without drawing up a Labor Code.

This is important to know: You can go on maternity leave from your maternity place

Agreement between individuals

In some cases, there is a moment when work will be performed by an individual for an individual. The law does not prohibit the conclusion of documents of this kind. Most often, employees encounter this type of contract when working temporarily or casually. The document must indicate exact numbers: the date and duration of the agreement.

In the case where the contract is concluded by individuals, then it must be registered with the executive committee.

As much contact information as possible between the customer and the contractor should also be indicated. This is necessary so that if something happens, you can find an employee or employer.

To protect yourself on the part of the employee, it is necessary to enter into an agreement with a legal entity. Then, in the event of a conflict situation, it will be easier to achieve justice. A contract for the performance of work between individuals is least protected from the legal side. Because everyone is responsible for themselves.

Taxes

According to the Tax Code of the Russian Federation, a single tax (personal income tax) is deducted from a citizen receiving income, regardless of whether he works under a TD or GPA, by the enterprise’s accounting department - in the amount of 13% of the amount earned. For foreigners working in the Russian Federation – 30%.

The employer pays insurance contributions to the pension fund and social insurance fund.

Thus, the following conclusions can be drawn:

- When applying for a job, find out whether the job is one-time or permanent, whether the employee is hired on staff or hired as an order executor.

- If the work is permanent, an entry in the work book must be made in order to be able to prove in the future that work took place at this enterprise. (Article 65 of the Labor Code of the Russian Federation)

- Conclude an employment contract with the director of the enterprise, which stipulates the main labor functions, obligations of the parties, social insurance conditions, tax deductions and the duration of the contract.

- If the work is one-time or a specialist is hired to complete the final task, a civil law agreement is concluded (Article 420 of the Civil Code of the Russian Federation).

- The GPC agreement provides the following benefits for the employee: optional submission to the disciplinary rules of the enterprise, independent performance of work, and the impossibility of imposing a disciplinary sanction.

- The advantages of the GPA for the employer are as follows: social insurance and vacation pay are not paid. There is no need to provide the contractor with a workplace and materials for work.

- If necessary, the GPA can be re-qualified in court as an employment contract with the possibility of providing the employee with social guarantees, accrual of length of service and provision of a job.

Employment agreement between an individual entrepreneur and an individual. face

When an agreement is concluded between an individual entrepreneur and an individual, where the individual entrepreneur is the customer, there are also some nuances:

Types of agreement

- The customer may refuse to pay pension and insurance contributions

- The customer may also not pay sick leave and vacation pay.

- An individual entrepreneur can legally withhold wages

- An employee who has gone on maternity leave is not retained a position and, accordingly, maternity benefits are not paid.

- The customer is not obliged to provide an equipped workplace to the contractor

This document regulates the work activity of the performer for the remuneration specified in it. An individual entrepreneur reserves the right to pay additional bonuses and other incentives or not. An employer entering into an agreement with an individual is required to make tax payments on the individual’s income.

On the other hand, no one guarantees that the contractor will perform the work properly and will not unilaterally terminate the contract at any time. The employee sets his own hours and place of work. Therefore, the customer has no right to demand his presence in the office at a certain time.

In the case where the entrepreneur acts as a performer of work, the employment contract for an individual entrepreneur implies the absence of tax payments. An individual entrepreneur hired as a performer pays his taxes to the state himself. In this case, the customer exempts himself from additional deductions.

Dismissal without a work book under an employment contract

If you are dismissed without a work book under an employment contract, some rules apply for terminating the work agreement. They are as follows:

- If a person does not agree with the dismissal, then the other party has the right to apply to the court;

- Dismissal occurs from the day the court decision was made public;

- The parties to the agreement do not have the right to demand the return of what has already been performed under the agreement;

- If the dismissal occurred due to a gross violation of the provisions of the agreement by one of the participants, then the other has the opportunity to receive compensation for damages;

- In addition, it is possible to carry out dismissal by agreement of the parties.

Statement of claim for recovery of wages without a work book

When terminating a relationship that was concluded under a contract without a work book, you may encounter problems with collecting wages. Since in most cases such an agreement is terminated due to the desire of one of the parties (usually the employer), the employer may refuse to pay you money. You can appeal such a decision by sending a statement of claim to the court. There is no standard form for such a statement. However, when designing it, you need to take into account some requirements:

- Please indicate the name of the authority and address where you are sending the application.

- It is necessary to note your personal data and information about the employer;

- Indicate the contract on the basis of which you worked;

- Clarify your desire to receive a salary and present arguments in your favor;

- The claim should be supplemented with the necessary documents that confirm your professional activities;

- Make references to specific articles of the law;

- Add date and signature.

Since a standard form for such an appeal has not been developed, based on the example presented, you can write a letter to the court. In this case, it is necessary to replace unnecessary provisions.

The law provides for the right of every working citizen to be provided with all conditions for carrying out work. Therefore, when drawing up any working document, it is necessary to be guided by the provisions of this legislation. Compliance with all standards will ensure the preservation of the interests of all participants in professional relations.

Is a working relationship valid without an entry in the work book?

The law of the Russian Federation provides that labor relations can only be established if this is indicated in the official document of each employee - in the labor contract. In the case where it is the main place of employment for the employee, he performs more than one-time work, then such labor relations are illegal without proper marks in the book. If an employee is hired under a contract to perform temporary or one-time work, or hired part-time with the main place of work, then no entry is made in the employment record.

If an employee is employed full-time, even under a temporary contract, the employer is required to make an entry in the work book. If he has not done this, then the employee can safely go to the labor inspectorate with complaints about the employer’s illegal actions.

An employment contract does not provide social guarantees to the employee, but is very economical for the employer. On the other hand, in this case, no one gives the employer guarantees that the employee will properly perform his duties. Legally, such a document is valid, but does not provide labor freedom and security.

Top

Write your question in the form below

Retraining of GPA into an employment contract

A civil law contract can be reclassified into an employment contract in court.

In this case, the court evaluates the presence of the following conditions:

- The nature of the assigned work (what kind of work the employee did: performing independent work or performing a certain job function within the framework of subordination to the internal regulations of the enterprise);

- Specific working conditions (the employer provides a workplace, materials for work, compliance with safety regulations);

- Payment procedure (in the employment contract, the payment procedure is established in an amount not lower than the minimum wage and is paid regularly, 2 times a month);

- Formulation of the subject of the contract (description of the labor function in accordance with the staffing table of the enterprise);

- Social guarantees (the employer undertakes to pay social benefits to the employee: sick leave, vacation pay, etc.)

Part-time employment

According to the Labor Code of the Russian Federation (Article 66), the employer is obliged to make entries in employee books after 5 days from the date of commencement of work, but only on condition that this work is the main one for this employee. If an employee works part-time, the employer does not have such an obligation.

In this case, work is performed under a contract without a work book. But part-time employment is included in the length of service, and payments to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund are made by the employer.

Part-time employment presupposes all the guarantees provided for in the Labor Code of the Russian Federation (vacation, sick leave, benefits). For this purpose, an agreement is concluded with the employee, but without entries in the book.

Differences from labor relations

An employee employment agreement has a number of significant differences from an employment agreement.

| Index | Civil agreement | Employment contract |

| Contracting parties | Both legal entities and individuals | Concluded only with individuals |

| Validity | Limited | Unlimited or renewable |

| An object | Result of work or service | Employee's personal activities |

| Form of payment | Reward | Wage |

| Social guarantees for employees | Not provided unless expressly stated in the contract | Guaranteed by the Labor Code of the Russian Federation |

| Payment of taxes and insurance premiums | No remuneration will be made until transfer | Performed by the employer monthly/quarterly |

| Providing a workplace | Not provided unless specified in the agreement | Provided by employer |

Thus, the employee employment agreement allows the company to recruit performers for certain orders without paying taxes and insurance premiums. The financial benefit for both parties is offset by a reduced level of control over the progress of the project.

A temporary civil contract is partially beneficial not only to the enterprise, but also to the employee. It is important that its form is drawn up legally, and in case of disagreement, the document is not interpreted by the court as a contract falling under the Labor Code of the Russian Federation.

Distinctive features of an employee employment agreement

The main differences between a employment contract and an employment contract are as follows:

- the employee who signed the employment agreement performs clearly regulated job duties, while the hired employee only performs certain ones and is not subject to the provisions of the internal regulations;

- legally established relationships oblige the employee to submit to higher management, the parties to the employment contract are conditionally equal;

- wages to an employee are paid by agreement of the acting parties. The employment relationship obliges the employer to pay remuneration twice a week or more often. What are the rules for calculating payroll tax - read the link;

- a contract of employment provides for the performance of a specific task or work. An employee with a formalized employment relationship undertakes to perform the functions provided for by job obligations;

- The “expiration” period of an employment contract is indicated only in rare cases, while hiring presupposes a clearly defined duration.

It is important to know! An employment contract provides for the protection of the employee’s rights, but hiring deprives the citizen of certain social guarantees.

Strengths and weaknesses of the contract

Why is it beneficial for an employer to have an employee?

- The employee is responsible for organizing the required conditions to complete the assigned task. The duration and place of execution are also chosen by the “mercenary”.

- The manager is exempt from paying taxes to the Social Insurance Fund.

- The employer does not comply with the guarantees provided for by the provisions of the Labor Code of the Russian Federation.

- The manager is exempt from paying social insurance contributions.

- Material remuneration is paid after completion of the work, and the amount is fixed at the stage of drawing up the relevant paper.

Disadvantages for a manager

- The performer is not subject to internal regulations. There are no clear regulations for the work carried out, since the final result is important.

- The result of the trial is the reclassification of the contract into an employment contract if the relationship between the employee and senior management is determined.

- Illegal business activity threatens an employer who has signed an employment agreement with an individual.

It is important to know! The activities of the contractor, in the majority, are regarded by regulatory authorities as entrepreneurial.

Registration for work

Labor relations in the Russian Federation are regulated and regulated by the Labor Code of the Russian Federation. It describes all the features and nuances of the relationship between the boss and subordinates.

It is mandatory for a citizen to have a work book. It contains data on official employment and dismissals. The document is extremely important when assigning a pension.

But more and more often in practice we find work under a contract without a work book. What advantages and disadvantages does this scenario have?

Sample civil contract

The Civil Code of the Russian Federation offers another version of the document regulating labor relations: a civil law contract (CLA). (Article 420 of the Civil Code of the Russian Federation) In such an agreement, the parties are the customer and the contractor. The task, terms of payment and deadlines for completing the work are clearly stated.

Consists in the following cases:

- contract;

- carrying out research, development and technological work;

- Paid provision of services;

- transportation, transport expeditions;

- agency;

Agreement conditions:

According to the GPA, the employee is engaged exclusively in the activities and the amount of work that are prescribed in the GPA, he cannot be subject to disciplinary liability, does not obey the work schedule, does not endure a probationary period, but immediately starts work. If an employee has doubts about the fairness of remuneration, his interests can be appealed in court, based on the terms of the document signed by both parties. It is convenient for the employer to enter into such an agreement in that he is exempt from the need to pay benefits, sick leave, vacation pay, and reserves the right not to retain the job of a temporarily disabled employee.

One-time job

A one-time job is convenient because it does not force you to submit to work discipline. The employee is required to perform high-quality assignments, the terms of which are discussed in the employment contract. The TD must be filled out for the purpose that if there is a violation of labor relations on the part of the employee or employer (poor quality, untimely completion of assigned work or late payment, etc.), the interests of one of the parties have been protected in court.

This is important to know: Work 2 through 2 under an employment contract: sample 2021