Employer's burden

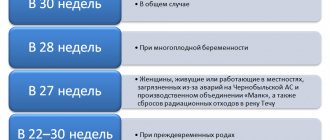

Order of the Ministry of Health of Russia dated June 29, 2011 No. 624n regulates the period of sick leave for pregnancy and childbirth. It lasts 140 calendar days if the employee gives birth to one child, and 194 calendar days if two or more babies are born at once.

Situations arise when it is necessary to extend sick leave for pregnancy and childbirth. Then the employer is obliged to pay for vacation and its extension in the amount of 100% of the average daily earnings multiplied by the number of days of sick leave. Also see “Sick leave during holidays”.

How can an expectant mother arrange maternity leave for her relatives?

Gone are the days when only the father of the family had the responsibility to earn money and support the family, and when only the mother had the responsibility to look after the child. In the modern world, these issues are resolved on a rational basis. And if it becomes advisable to arrange maternity leave not for the mother, but for another family member, the law now allows this. Current legislation allows that a close relative of the mother or her husband will directly care for the child, and in this case this care will be paid for due maternity payments and other social benefits, as in the case of the mother’s maternity leave.

Article 256 of the Labor Code provides a list of those persons who have the right to maternity leave. These are the grandmother on one of the sides, the child’s natural father or his guardian.

If the family decides that the child will be cared for by the child’s father or grandmother, then one of them should fill out a corresponding application at the place of their work. At the same time, no employer has the right to refuse such an application.

Important! In the event of an unlawful refusal by the head of an enterprise to provide maternity leave to a close relative or the father of a young mother, a claim should be immediately filed in court. Judicial practice in such disputes indicates positive decisions of judicial authorities in favor of the plaintiffs.

In addition, they do not have the right to fire a close relative or husband who is on maternity leave in place of the mother; they are obliged to retain his position or workplace until the end of the maternity leave, with the exception of the option of liquidating the enterprise.

To apply for parental leave for a husband, the latter at the place of work provides: a child’s birth certificate, an application for parental leave and a certificate stating that the child’s mother is not on maternity leave at the same time, but has begun performing her duties at the place of work your work.

Important! In the case of taking leave for the child's father, social benefits are similar to those provided for maternity leave for mothers. If the child’s mother is not employed, the father can be granted maternity leave with a family benefit in the amount of 40 percent of his average salary.

If the child’s mother decides to take maternity leave for one of the baby’s grandmothers, then at the grandmother’s place of work the same documents are provided as in the case of the father, but in addition, doctors must make sure that the grandmother is physically able to care for the small child. If the grandmother does not have a permanent job, then social benefits and child care payments will not be preserved in full. She is also entitled to vacation pay at the rate of 40% of her salary. If the grandmother does not have a job and is a pensioner, then the issue of providing social benefits will be decided by the social protection authority, taking into account the possible financial situation of the baby’s parents. The grandmother must submit to her place of work the child’s birth certificate, a certificate from the mother’s place of work and an application for maternity leave for the grandmother.

When a newborn is adopted, the adoptive parent must provide an application for parental leave, a birth certificate and an adoption certificate at the place of work.

Important! The adoptive parent may, for ethical reasons, not provide the employer with an adoption document, but then his leave will be limited to only 1.5 years. When extending parental leave to 3 years, the employer has the right to request an adoption certificate.

In another family, on the contrary, after the birth of a child, the mother no longer thinks about any previous work, her attachment to the new little person is stronger than the desire for career growth and the desire to make money, her desire is only one thing - to be with the baby constantly and for as long as possible. The imminent end of maternity leave weighs heavily on her, and she increasingly thinks about how to prolong this state longer.

In the previous article “Maternity leave. Early termination” we answered the following questions: what is maternity leave; how long does maternity leave last? how to interrupt maternity leave and leave maternity leave early and how to formalize leaving maternity leave ahead of schedule.

Now, in continuation of the topic, we will talk about changing the timing of maternity leave and consider the situation related to the extension of maternity leave after the child reaches 3 years of age. After all, it often happens that the time allotted by law for pregnancy, subsequent childbirth and improvement of health after the birth of the baby is clearly not enough. And then the question arises about extending the maternity leave.

This may be due to both the health of the baby and the physical condition of the mother after childbirth.

In the Russian Federation, the law sets the duration of maternity leave equal to 3 calendar years. Moreover, as we already noted in the previous article, this vacation consists of two parts: prenatal and postnatal. It is more correct to divide maternity leave into its three components: this is a sick leave issued to a woman on the basis of an existing pregnancy and in connection with childbirth; leave provided after childbirth to care for a child until he reaches 1.5 years of age and leave provided to care for a child until he reaches 3 years of age.

According to Article 11 of the Federal Law “On Labor Pensions in the Russian Federation”, if a woman gives birth to two babies, she can be on maternity leave until he turns 3 years old while maintaining his seniority and job.

The state is obliged to constantly take care of the health of mothers and their children. The obligation to provide them with maternity leave and pay compensation for the entire period while the young mother is on maternity leave must be strictly observed by all employers.

Reasons for delaying the deadline

A woman in labor can receive an extended sick leave certificate at the antenatal clinic, clinic or hospital where the birth took place. This procedure is necessary if:

- only during childbirth it became clear that there were several children (sick leave was extended by 54 calendar days);

- complications arose during childbirth (the duration of sick leave increases by 16 calendar days).

When extending sick leave for pregnancy and childbirth, a new sheet is issued. In the column for reasons of incapacity, enter “05” with the decoding “Maternity leave”. An additional code “020” is also used - “Additional maternity leave”.

At the bottom of the next sick leave, they indicate which sheet it is a continuation of. According to the rules, additional vacation days provided are not a new insured event, so the document should not be the primary one.

If the sick leave does not indicate that it is a continuation of another, the employer will still have to accept it. And if difficulties arise with the Social Insurance Fund, it is allowed not to oblige, but only to ask the employee to apply for a new certificate of incapacity for work at the maternity hospital.

Features of calculating monetary compensation

Compensation for maternity leave is calculated on the same principle as regular sick leave benefits (defined by Article 14 of Federal Law No. 255 of 2006). To do this, the employer calculates the woman’s average earnings for the previous 2 years, which preceded the year in which the employee went on vacation. That is, if a woman received maternity leave on July 12, 2021, then the period from 2014 to 2015 will be taken to calculate her average salary. If a woman did not work during this period and (or) did not receive official income, the minimum wage established on the day of calculation must be taken as a basis.

To calculate average earnings, a woman’s income for the specified two years is summed up and divided by 730 (the total number of days for 2 years) or 731 (taking into account leap years). As a result, your daily earnings will be withdrawn. This earnings must be multiplied by the total number of days (including weekends and holidays) spent by the employee on sick leave, which will be the amount of compensation. In this case, it is necessary to take into account the employee’s insurance length (the total time during which contributions to the Social Insurance Fund were paid for the employee is calculated in whole years). There are 3 options: less than 5 years - the employee is entitled to only 60% of the calculated benefit amount; from 5 to 8 years - the employee is entitled to 80% of the calculated benefit amount; over 8 years - the employee is entitled to 100% of the calculated benefit.

Benefit calculation examples

1. Citizen Ivanova went on maternity leave in August 2018.

In the previous 2 years, she earned 900,000 rubles. Considering that 2021 was a leap year, her daily earnings amounted to 1,231 rubles 19 kopecks (900,000 / 731). Initially, Ivanova’s sick leave was issued for 140 days, but during childbirth a multiple pregnancy was discovered, which is why the sick leave was extended for another 56 days, issuing it as a continuation of the main sheet. The total was 196 days. Accordingly, the amount of the benefit was 241,313 rubles 24 kopecks. Ivanova’s insurance experience is 7 years, which means she is entitled to only 80% of the total amount. 241,313.24 x 80% = 193,050 rubles 59 kopecks. 2. Citizen Sidorova went on vacation on November 5, 2021. In the previous 2 years, she worked for less than six months, which means that her benefit will be calculated depending on the established minimum wage. The time spent on sick leave was 156 days (including an extension of 16 days due to complications). Accordingly, the last day of validity of the sick leave is April 9, 2021. For each full month of vacation, Sidorova will receive 9,489 rubles (minimum wage as of April 2021). To calculate benefits for November and April, you need to divide the minimum wage by the number of days in the month and multiply by the number of days that the employee spent on sick leave in that particular month. So, for November Sidorova will receive 8,223 rubles 8 kopecks, and for April 2,846 rubles 7 kopecks. The total amount of sick leave is 49,026 rubles 5 kopecks. This amount is fully accrued to Sidorova, regardless of her insurance experience, since no one can receive less than the established level of benefits.

When calculating the benefit, you must take into account that it is subject to a personal income tax of 13%, which will be collected regardless of the calculated amount. If a medical institution has extended sick leave due to pregnancy without linking the additional certificate of incapacity to the main one, the employer must separately calculate 2 benefits: for the main certificate and for the additional one. If the additional sheet was issued as a continuation of the main one, only one total benefit amount is calculated, without dividing it into 2 parts.

Receiving benefits on an extended sheet

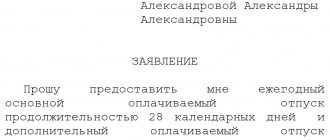

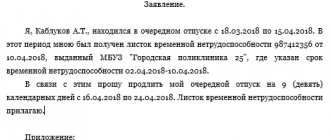

To receive benefits for additional days of sick leave for pregnancy and childbirth, a woman in labor must write an application in any form and attach a certificate of incapacity to work. The application must indicate:

- period of additional rest;

- information about sick leave: number, date, who issued it;

- FULL NAME. employees.

The woman in labor puts her signature on the application. After submitting all documents, benefits are calculated. Then it is paid to the employee or transferred to her account.

Calculation of benefits on an extended sheet

If the employee has provided a correctly completed sick leave certificate ( extension of sick leave for maternity leave has ), then the amount of payment is calculated based on standard maternity leave indicators.

The calculation is based on the average daily earnings used to pay basic sick leave. No additional calculations are required.

If additional vacation days were provided to the woman on the basis of the initial sick leave, then the calculation of the period and average daily earnings will have to be done again. Also see “How sick leave is paid in 2021.”

Let's sum it up

- Additional leave for labor and labor is provided to the employee in connection with complications that arose during childbirth.

- Birth and labor leave is extended by 16 days during pregnancy with one child and complicated childbirth. It increases by 54 days with multiple births established at birth.

- Extension of maternity leave occurs on the basis of an application from the employee and a certificate of incapacity for work issued by the institution where the birth took place.

- In addition to additional allowance, the employee must be paid an appropriate allowance, calculated based on average earnings.

Employer's actions

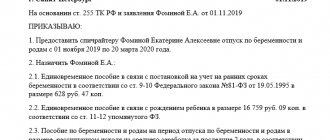

If situations arise that require the extension of sick leave for pregnancy and childbirth, the employer must act in the following sequence:

- Accept documents (application and sick leave).

- Create an order for additional leave (usually using the standard T-6 form).

- Enter information about the extension of rest into the employee’s personal card.

- Display information about additional vacation days on the time sheet.

- Calculate the benefit amount, enter data on the sick leave sheet and transfer or issue the funds to the employee.

Read also

12.07.2016