The concept of total experience

What is total work experience and what does it include

Total work experience is the amount of time that a person actually spent on work or socially useful activities. It is important to understand that, from the point of view of legislation, only an employment contract is the basis for counting a period of time into length of service.

Otherwise, the length of service will not be counted, and the citizen will not be able to count on a number of required measures and protections.

Lawyer for inclusion of work experience in Yekaterinburg

The main requirements from the social security authorities are that a person has a certain amount of work experience, incl. regarding the appointment of a preferential pension. Based on deductions made during labor functions, a person can receive any social benefits. That is why there may be a need to include periods of work in the insurance period.

Since a person submits an appeal on the basis of his disagreement with the decision of the pension authority, he must argue that the reason for the refusal is not legal, provide additional evidence, certificates, and witness testimony.

A pension lawyer from the Law Office “Katsailidi and Partners” will help you do everything: professionally, on favorable terms of the agreement for the provision of legal assistance and on time. Call today!

Periods and types of activities that are included in the length of service

The legislation provides for the following types of activities, which are included in the general period :

- work on the territory of the Russian Federation under a contract;

- outside the country in exceptional cases (embassy, business trips, etc.);

- period of work as an individual entrepreneur;

- registering with the labor exchange and receiving payments;

- completion of compulsory military service;

- the period of detention of innocent persons;

- the period of caring for a disabled person of the first group, a child with a disability, a person aged 80 or more;

- the period when the spouse of a serviceman under a contract was with him and could not work for reasons beyond his control;

- maternity leave to care for a child up to 1.5 years. There is a total time limit of 4.5 years per parent regardless of the number of children.

The number of years worked is equally important. The period of experience is required for:

- to receive a minimum pension of 10 years;

- Sick leave is paid in full upon reaching more than 8 years of work experience;

- some categories of employees are guaranteed payment for length of service;

- For each month worked, the employee is entitled to 2 days of paid leave.

We will answer the most frequently asked questions.

Is tuition included?

No, the time spent completing full-time or part-time training is not included in the length of service.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

The exception is working students and citizens who independently make contributions to the Pension Fund.

Is military service included?

Yes, it does. The period of military service or contract service is included in a person’s length of service and is regulated by the military pension law.

Northern experience

Time spent working in the regions of the Far North (FN) and territories equivalent to it gives a citizen the right to receive an early pension if he or she has the required number of years worked there.

For example, a woman will have the right to a pension at age 50 if she has a total length of service of at least 20 years, of which 15 were worked in the RKS or 20 in the ISS*. A man will be able to apply for a pension at the age of 55 with a total insurance period of at least 25 years and 15 years of work in the ISS or 20 years in the ISS.

ISS is an area of the far north.

Calculation of total work experience

It is important for young people to know the number of years worked and credited to their length of service in order to receive sick leave benefits. It will be useful for older people to calculate their length of service to understand what they can expect in terms of pension payments and their amount.

To calculate your length of service, use a special calculator on our website. It is recommended to enter the data according to the data specified in the work book. If you don't have it, you can fill it in from memory, but the calculation will not be accurate.

You can also find out information about the length of service in your personal account on the website of the Russian Pension Fund.

What is included in the general experience?

When calculating, include in your work experience:

- the period of years worked in each place of work in general;

- 1.5 years of maternity leave for each child, but not more than 4.5 years;

- men should include military service in the overall calculation;

- period of temporary incapacity for work;

- receiving unemployment payments;

- caring for an adult or child with a disability;

- facial care for people over 80 years of age.

When calculating pension

When paying a pension, both the period of work and the salary received are important. You can increase your pension by making voluntary contributions personally or entrusting it to your employer. As an incentive, many firms offer additional deductions above the 22% (standard rate).

The first condition for receiving payments at the lower limit is minimum length of service. Currently 10 years, until 2025 the value will gradually increase, one year at a time up to 15 years. To calculate your pension amount, you need to know the number of your pension points.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

1 point has a cash equivalent, currently it is equal to 87 rubles.

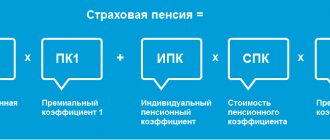

Your monthly pension will be equal to:

Monthly pension = A*B+C+d

Where A is a point, B is the price of a point, C is a fixed premium, d is voluntary contributions.

People who served in the following institutions can count on additional payment for achieving the minimum required length of service:

- military establishment;

- general education;

- medical;

- theatrical and others.

This is guaranteed despite the increase in the age for applying for payment.

Government representatives are concerned about the constant increase in the amount of payments and their mandatory indexation. For example, in 2021, payments for current pensioners increased by 6.3%. This is a necessary measure in conditions of inflation and rising food prices.

The pension cannot be less than the established minimum subsistence level for pensioners. The size is set depending on the region, due to difficult climatic and social conditions.

If the amount of the pension due does not reach the guaranteed level, the citizen has the right to apply to the social service or pension fund. After writing the application, a social supplement will be guaranteed up to the guaranteed minimum.

When calculating sick leave

Length of service and salary affect the receipt of sick pay.

| Length of years worked | Sick leave for yourself, % | Sick leave to care for a child under 14 years of age (no more than 60 days a year), % |

| 6 months | – | in the amount of minimum wage |

| less than 5 | 60 | 60 |

| 5-8 | 80 | 80 |

| more than 8 | 100 | 100 |

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Both parents can take sick leave to care for a child, but each of them cannot be absent from work for more than 60 days a year. In this case, dismissal does not occur, but insurance payments are stopped. You can continue to contribute voluntarily.

How is work experience formed before 2002 taken into account?

It is impossible to get by with simply summing up periods of service separated by the border of 2001-2002, since the adoption of Law No. 173-FZ changed not only the procedure for calculating pensions, but also the list of periods taken into account for this purpose. Therefore, pension rights accumulated before 2002 are recalculated in a special manner into an amount that will form part of the total estimated pension capital (Clause 1, Article 29.1 of Law No. 173-FZ).

There are two recalculation formulas (subclauses 3 and 4 of Article 30 of Law No. 173-FZ). The right to make a choice from them is given to the person in respect of whom the calculation is made. Both formulas involve:

- average monthly earnings, determined either according to the Pension Fund of Russia for 2000-2001, or for any 5 consecutive years according to employers;

- a coefficient that takes into account the presence of a total work experience of 25 and 20 years for men and women, respectively.

However, in the first of the formulas (reflected in paragraph 3 of Article 30 of Law No. 173-FZ), the average monthly salary is correlated with the average monthly salary in the Russian Federation for the same period and is reduced to the average monthly salary for Russia established for the 3rd quarter of 2001, taking into account regional coefficient. In the second formula, such a recalculation of average monthly earnings is not done.

The coefficient taking into account the length of service is determined differently for each of the formulas, since different lists of periods included in this length of service are valid for them.

Continuous total work experience

The concept of continuous service includes a period when a person worked without significant interruptions. In some cases, the period of unemployment should be no more than 1-3 months.

Continuous service is maintained if:

- the person cared for a child with a disability until he turned 16 years old;

- in connection with the reduction or closure of a company, a person is entitled to a 3-month deferment, otherwise the length of service will be interrupted;

- forced relocation for a spouse who is transferred to another city from the enterprise;

- for residents of the North who work abroad and for foreign citizens working in the Russian Federation, a deferment of 2 months is provided.

What you need to know about internship

During his working life, every person is faced with the need to receive benefits for temporary disability, and over the years - to receive an old-age or long-service pension. Modern legal relations in the field of social security are based on such a concept as work experience, the absence of which deprives the right to receive social benefits.

Dictionary of labor law. Work experience represents certain periods (duration) of labor or other socially useful activities, as well as other periods that make it possible to exercise the right to social security.

Work experience includes the duration of all labor or other socially useful activities and is determined by documents issued from the place of work, as well as service or study, if they are included in the work experience.

Work experience can also be qualified as a legal fact, as a result of which most pension legal relations arise, as well as legal relations relating to certain types of benefits and social benefits. The length of work experience largely determines the scope of the applicant’s powers to implement a particular social security regulation, including the amount of labor pensions and benefits, as well as other social benefits. Work experience includes the duration of all labor or other socially useful activities and is determined by documents issued from the place of work, as well as service or study, if they are included in the work experience.

The main document for confirming work experience is a work book, which contains information about the employee, the job duties he performs, as well as incentives for success in work (if for some reason there is no work book, extracts from orders can serve as confirmation of work experience on appointment and dismissal, salary slips, employment contracts, witness statements, etc.).

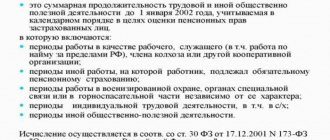

The concept of total length of service is currently used when calculating a labor pension only to assess the pension rights of insured persons (to determine the size of the insurance part of a labor pension) and is taken into account for the period before January 1, 2002.

Total work experience

The total length of service represents the quantitatively (totally) taken into account periods of all labor and other social activities, as well as other periods, regardless of whether there were or were not breaks in work or other activities included in the length of service in question. Total length of service as a legal fact is one of the grounds for assigning labor pensions in old age, in case of disability or loss of a breadwinner, as well as for the implementation of certain other types of social security.

In pension provision, the total length of service is taken into account when determining the amount of pensions mainly for working pensioners according to the rules that were provided for in Art. 16 of the Law of the Russian Federation of November 20, 1990 N 340-1 “On state pensions in the Russian Federation” (lost force) 10 years ago (i.e., until the moment when the option of calculating pensions using the individual pensioner coefficient was established). This is the so-called first option for calculating pensions.

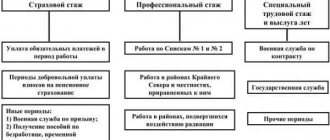

The concept of length of service is generalized, since there are the following types of it: insurance length of service, general and special length of service and continuous work experience.

Dictionary of labor law. Continuous work experience is determined by the duration of the last continuous work with one or more employers.

Dictionary of labor law. Special length of service is calculated based on the duration of labor or other socially useful activity in specific conditions. This is, for example, work in hazardous industries, in harsh natural and climatic conditions, in areas exposed to radioactive radiation. Based on special work experience, an old-age pension is established in connection with special working conditions, work in the Far North, as well as a long-service pension.

The procedure for calculating length of service is established by current legislation, according to which there are general and separate calculation rules for different types of work experience.

The length of service is calculated in calendar order: every 30 days are converted into months, and every 12 months into full years.

There is, in particular, a list of industries in which work for a full season is counted towards the pension for a year of work (peat, logging, fishing, fruit and vegetable industry, forestry, etc.).

To qualify for an old-age pension, the length of work experience for men is 25 years, for women - 20 years. The list of periods of labor and other socially useful activities included in the total length of service is set out in paragraph 3 of Art. 30 of the Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation” (as amended on December 27, 2009, hereinafter referred to as the Law on Labor Pensions).

The total work experience includes:

1) periods of work as a worker, employee (including hired work outside the territory of the Russian Federation), member of a collective farm or other cooperative organization; periods of other work in which the employee, not being a worker or employee, was subject to compulsory pension insurance; periods of work (service) in paramilitary security, special communications agencies or in a mine rescue unit, regardless of its nature; periods of individual labor activity, including in agriculture;

2) periods of creative activity of members of creative unions - writers, artists, composers, cinematographers, theater workers, as well as writers and artists who are not members of the relevant creative unions;

3) service in the Armed Forces of the Russian Federation and other military formations created in accordance with the legislation of the Russian Federation, the United Armed Forces of the Commonwealth of Independent States, the Armed Forces of the former USSR, internal affairs bodies of the Russian Federation, foreign intelligence agencies, federal security service agencies, federal executive authorities , which provide for military service, the former state security bodies of the Russian Federation, as well as in the state security bodies and internal affairs bodies of the former USSR (including during periods when these bodies were called differently), stay in partisan detachments during the period civil war and the Great Patriotic War;

4) periods of temporary disability that began during the period of work, and the period of being on disability of groups I and II, received as a result of an injury associated with production or an occupational disease;

5) the period of stay in places of detention beyond the period appointed during the review of the case;

6) periods of receiving unemployment benefits, participating in paid public works, moving in the direction of the employment service to another area and finding employment.

Calculation of the duration of periods of labor and other socially useful activities, until January 1, 2002, included in the total length of service in accordance with this paragraph, is carried out in calendar order according to their actual duration, with the exception of periods of work during the full navigation period on water transport and periods work for a full season in seasonal industry organizations.

Periods of work during a full navigation period in water transport and during a full season in organizations of seasonal industries are included in the total length of service as a full year of work, regardless of the actual duration of these periods.

The following periods are not included in the total length of service:

1) training in colleges, schools and courses for personnel training, advanced training and retraining, in secondary specialized and higher educational institutions, postgraduate studies, doctoral studies, clinical residency, internship;

2) residence of citizens living in areas temporarily occupied by the enemy during the Great Patriotic War, aged 16 years and older, in the occupied territory of the USSR or other states, as well as in the territory of states that were at war with the USSR;

3) being in fascist concentration camps during the Great Patriotic War;

4) residence in Leningrad during its siege (from September 8, 1941 to January 27, 1944);

5) permanent care upon conclusion of a medical institution;

6) care of a non-working mother for each child under the age of three years and 70 days before his birth;

7) care of parents and other legal representatives for HIV-infected minor children;

residence of wives (husbands) of military personnel performing military service under a contract together with their husbands (wives) in areas where they could not find employment in their specialty due to lack of employment opportunities;

residence of wives (husbands) of military personnel performing military service under a contract together with their husbands (wives) in areas where they could not find employment in their specialty due to lack of employment opportunities;

9) residence abroad of wives (husbands) of employees of Soviet institutions and international organizations.

Periods of work or military service in Afghanistan are counted towards the length of service and insurance, depending on the category of insured persons or citizens who are assigned a pension, taking into account the submitted documents, in accordance with the Law on Labor Pensions and Federal Law of December 15, 2001 N 166-FZ " On state pension provision in the Russian Federation" (as amended on December 25, 2009, hereinafter referred to as the Law on Pension Security), Law of the Russian Federation dated February 12, 1993 N 4468-1 "On pension provision for persons who served in military service or service in internal affairs bodies , State Fire Service, authorities for control over the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families” (as amended on 09.11.2009).

Studying, including at a university, is not included in the insurance and general work experience from 01/01/2002.

Insurance experience

The insurance period is calculated based on the duration of periods of activity during which insurance premiums were paid.

The total insurance period is needed to determine whether a person has earned the right to an old-age pension or not. Moreover, it is needed both for assigning a pension on a general basis, and for early reasons. The general grounds are reaching age: 60 years for men and 55 years for women. For general purposes, you need at least 5 years of insurance experience. Early grounds are the appointment of pensions in connection with harmful working conditions, as well as when working in a number of professions (for example, doctors, teachers, professional rescuers, etc.). For each reason, a special insurance period of a certain duration is required.

These types of activities include any work under employment contracts, military or civil service, work as an individual entrepreneur, etc. By virtue of clause 1 of Art. 10 of the Law on Labor Pensions, the insurance period includes periods of work and (or) other activities that were performed on the territory of the Russian Federation by the persons specified in Part 1 of Art. 3 of the same Law, provided that during these periods insurance contributions were paid to the Pension Fund of the Russian Federation.

Example. By Resolution of the Constitutional Court of the Russian Federation dated July 10, 2007 No. 9-P, the provisions of paragraph 1 of Art. 10 of the Law on Labor Pensions are recognized as contradicting the Constitution of the Russian Federation to the extent that they allow periods of work for which insurance contributions have not been paid in full or in part not to be included in the insurance period taken into account when determining the right to a labor pension, and to be reduced when assigning (recalculation) of the labor pension, the amount of its insurance part.

Pending the establishment by the federal legislator of the appropriate legal regulation, the Constitutional Court of the Russian Federation has established a legal mechanism for the implementation of pension rights of the specified category of citizens (see the above Resolution).

At the same time, the provisions of paragraph 1 of this article mentioned in the Resolution to the extent that they establish the unconditional obligation of all policyholders (employers) to pay insurance premiums in a timely manner and in full and are aimed at ensuring the normal functioning of the financial system of compulsory pension insurance based on insurance principles and fulfillment of obligations of the Pension Fund of the Russian Federation to insured persons are recognized as not contradicting the Constitution of the Russian Federation.

On the application of paragraph 1 of Art. 10 the Decree of the Constitutional Court of the Russian Federation dated November 20, 2007 N 798-О-О was published.

Clause 2 of Art. 10 in a systematic relationship with legal provisions establishing the unconditional obligation of all insurers (employers) to pay insurance premiums for their employees on time and in full, cannot be interpreted as excluding the possibility of counting into the insurance period periods of work of citizens of the Russian Federation employed under an employment contract in civil positions personnel of the Armed Forces of the Russian Federation in military units stationed on the territory of foreign states - regardless of whether the military units paid insurance contributions to the Pension Fund of the Russian Federation for them during these periods (Determination of the Constitutional Court of the Russian Federation dated January 15, 2009 N 188-O- P).

From January 1, 2007, the amount of benefits for temporary disability and pregnancy and childbirth depends not on continuous work experience, as was previously the case, but on the insurance period. The insurance period is the total duration of payment of insurance premiums. In accordance with Art. 16 of the Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity” (as amended on July 24, 2009, hereinafter referred to as Law N 255-FZ) this length of service includes:

— periods of work of the insured person under an employment contract, state civil or municipal service;

- periods of other activities during which a citizen was subject to compulsory social insurance in case of temporary disability and in connection with maternity.

The insurance period is calculated in calendar days, and if several periods counted in the insurance period coincide in time, one of such periods is taken into account at the choice of the insured person.

Relationship between insurance and continuous work experience

Please note that Art. 17 of Law N 255-FZ establishes that if the duration of the insurance period for the period before January 1, 2007 is less than the duration of his continuous work experience used when assigning benefits for the same period, the length of the continuous work experience is taken as the duration of the insurance period .

Continuous length of service may exceed insurance coverage in a number of cases. Thus, in accordance with clause 8 of the Rules for calculating the continuous work experience of employees when assigning benefits for state social insurance, approved by Resolution of the Council of Ministers of the USSR dated April 13, 1973 N 252, and taking into account the provisions of the Letter of the Federal Social Insurance Fund of the Russian Federation dated October 25, 2002 N 02-18/ 05-7418, in addition to work time, the following were counted in continuous work experience:

— service in the Armed Forces of the USSR and the Russian Federation;

- service in the KGB of the USSR, the FSB of Russia and the Ministry of Internal Affairs of the USSR and Russia, in the people's militia and partisan detachments, if there is a break between the day of release from service and the day of admission to work or study at a higher or secondary specialized educational institution (including preparatory department ), to graduate school, clinical residency, courses, college or school for advanced training, retraining and training did not exceed three months;

- time of work or practical training in paid jobs and positions during the period of study at a higher or secondary specialized educational institution, postgraduate study and clinical residency, regardless of the duration of breaks caused by training;

- time of study in colleges and schools of vocational education (technical, vocational schools, maritime schools, factory training schools, etc.), if the break between the day of graduation from college or school and the day of entry to work did not exceed three months;

- time of study in courses and schools for advanced training, retraining and training, if the direction to courses or school was immediately preceded by work or admission to these courses or school was preceded by service in the Armed Forces of the USSR and the Russian Federation, in the KGB, FSB of Russia and the Ministry of Internal Affairs of the USSR and Russia, people's militia and partisan detachments.

In accordance with Art. 51 Regulations on service in the tax police of the Russian Federation, approved. By Resolution of the Supreme Council of the Russian Federation dated May 20, 1993 N 4991-1 (currently no longer in force, with the exception of clause 1), employees dismissed from service in the tax police and who entered work or study within three months (not counting the time travel to their permanent place of residence in the event of a change), their time of service in the tax police was counted as continuous work experience.

Based on Art. 64 of the Regulations on service in the internal affairs bodies of the Russian Federation (approved by Resolution of the Supreme Council of the Russian Federation dated December 23, 1992 N 4202-1, as amended on December 17, 2009), the time employees spent in service in the internal affairs bodies was counted towards their total and continuous work experience for the following preferential conditions: one year of service for one and a half years of work experience.

According to clauses 13, 14 and 16 of the Regulations on the organization of public works, approved. By Decree of the Government of the Russian Federation of July 14, 1997 N 875 (as amended on January 11, 2007), the time during which a citizen takes part in paid public works was counted towards the total length of service.

In accordance with paragraph 3 of Art. 10 and paragraph 5 of Art. 23 of the Federal Law of May 27, 1998 N 76-FZ “On the status of military personnel” (as amended on December 25, 2009), the time spent by citizens in military service under a contract was counted as continuous work experience at the rate of one day of military service for one day of work, and the time when citizens are in military service by conscription - one day of military service for two days of work.

According to Art. 25 of the Federal Law of 05/08/1994 N 3-FZ “On the status of a member of the Federation Council and the status of a deputy of the State Duma of the Federal Assembly of the Russian Federation” (as amended on 05/12/2009), the term of office of a deputy is counted towards the total and continuous length of service or service life, work experience in the specialty. The spouse of a State Duma deputy (on the basis of clause 5 of Article 25 of the said Law), who was dismissed in connection with the deputy’s relocation to exercise his powers in the State Duma, the break in work is counted towards the total continuous length of service (service).

In accordance with Art. 256 of the Labor Code of the Russian Federation, a woman’s leave to care for a child until the child reaches the age of three is counted as continuous work experience.

Parental leave is included in the general insurance period, but there are also some special features.

In paragraphs 3 p. 1 art. 11 of the Law on Labor Pensions it is determined that the total period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than three years in total, must be included in the insurance period.

So, here we are talking exclusively about parents, and not about other relatives who actually provide care. This period should be counted toward the length of service for only one of them, and if part of the leave was used by the child’s mother, and part by the father, then each of them should be credited with their own part of the leave. In addition, leave is limited to a maximum limit - until the child reaches one and a half years old. Even if a woman has cared for more than one child in her life, no more than three years will be counted in total.

Child care leave is included in the special insurance period if it took place before October 6, 1992 (the time of entry into force of the Law of the Russian Federation of September 25, 1992 N 3543-1, with the adoption of which the said leave ceased to be included in the special work experience in the event granting a pension on preferential terms). This explanation was given by the Supreme Court of the Russian Federation in paragraph 15 of the Resolution of the Plenum of December 20, 2005 N 25 “On some issues that arose in the courts when considering cases related to the exercise by citizens of the right to labor pensions.” If this condition is met, then parental leave must be included in the length of service in the specialty, regardless of the time the woman applied for a pension and regardless of the time the right to early assignment of an old-age pension arose.

Maternity leave is included in the special insurance period based on the clarification of the Ministry of Labor and Social Development of the Russian Federation and the Pension Fund of the Russian Federation (Letter dated November 4, 2002 N 7392-YuL/LCh-25-25/10067). This Letter clarifies that Art. Art. 27 and 28 of the Law on Labor Pensions are implemented through resolutions of the Government of the Russian Federation and other by-laws. The Government of the Russian Federation, by its Resolution No. 516 dated July 11, 2002 (as amended on May 26, 2009), approved the Rules for calculating periods of work that give the right to early assignment of an old-age pension (hereinafter referred to as the Rules). According to clause 5 of these Rules, the length of service that gives the right to early assignment of an old-age labor pension for workers who are constantly employed full-time in this work includes periods of receiving state social insurance benefits during a period of temporary disability, and also periods of annual paid leave, including additional ones. Again, strictly speaking, maternity leave does not refer to either temporary disability or annual paid leave. But the Ministry of Labor and the Pension Fund of the Russian Federation made one assumption in their Letter in favor of workers, based on the fact that maternity leave is granted on the basis of a temporary disability certificate. Therefore, they explained that “the period a woman is on maternity leave should be considered as the period of receiving maternity benefits during a period of temporary disability and include it in the length of service that gives the right to early assignment of an old-age pension in accordance with Articles 27 and 28 of the Law on Labor Pensions.”

In addition, when calculating continuous length of service, the length of service of citizens of Russia and the CIS who were previously employed in labor activities in the territory of the following CIS member states was taken into account: Belarus, Kazakhstan, Tajikistan, Kyrgyzstan (according to Article 40 of the Treaty of February 26, 1999 “On the Customs Union” and a single economic space").

For these categories of workers, these periods, which were previously included in the continuous work experience, are not included in the insurance period. For this reason, they should compare continuous work experience and insurance.

We should not forget about citizens who entered work before January 1, 2007 and had the right to temporary disability benefits in an amount exceeding the amount of benefits due under currently applicable standards (as a percentage of average earnings) - now it is paid in the same higher amount, since Art. 17 of Law N 255-ФЗ for these persons, the previously established benefits for the payment of temporary disability benefits in the amount of 100% of earnings are preserved, regardless of the length of insurance or work experience.

The replacement of continuous work experience with insurance experience affected the amount of benefits issued, since the insurance experience does not include all periods of work, but only those during which insurance premiums were paid.

Temporary disability benefits are paid in the amount of 100% of earnings - if the insurance period is 8 years or more; in the amount of 80% - with an insurance period of 5 to 8 years; in the amount of 60% - if the insurance period is less than 5 years. The monthly child care benefit is currently 40% of average earnings for the last 12 calendar months before going on parental leave.

In the case of caring for a sick child (during outpatient treatment) aged 3 to 15 years, from the 10th calendar day, the benefit is paid in the amount of 50% of average earnings.

If illness or injury occurs within 30 days after dismissal, then, regardless of the length of the insurance period, benefits are paid in the amount of 60% of average earnings.

Order of the Ministry of Health and Social Development of Russia dated 02/06/2007 N 91 approved the Rules for calculating and confirming the insurance period for determining the amount of benefits for temporary disability, pregnancy and childbirth (as amended on 09/11/2009).

Continuous work experience differs from insurance and special work experience in that:

— when determining the size of the pension and the moment of its payment, continuity of service is not taken into account;

— the periods of time during which an able-bodied employee was not engaged in labor activity are limited.

Continuous work experience is maintained if, when moving from one place of work to another, the break in work activity does not exceed one month. If there is a voluntary dismissal without good reason, then in order to maintain continuous work experience, the break in work should not exceed 3 weeks.

Continuous work experience can be maintained if the break in work reaches 2 or 3 months. Upon termination of the employment contract, the length of service is retained for pregnant women and mothers with children under the age of 14 or a disabled child under the age of 16, until the child reaches the specified age.

Regardless of the duration of the break in work, continuous work experience is maintained in case of voluntary dismissal due to the transfer of one of the spouses to another locality, as well as due to retirement. For employees who quit due to old-age retirement, when they subsequently start working, the duration of the break in their work experience is not taken into account when calculating their continuous work experience.

When entering a job after termination of an employment contract, continuous work experience is not maintained due to the commission of guilty actions, for which, according to existing legislation, dismissal from work is provided. Such actions are considered repeated failure to fulfill labor duties without good reason and a single gross violation of labor duties by an employee. Managers and chief accountants of organizations and enterprises can be fired for causing financial damage to the organization and for making incorrect or illegal financial decisions. Rules for calculating the continuous work experience of employees when assigning benefits for state social insurance, approved. Resolution of the Council of Ministers of the USSR dated April 13, 1973 N 252, are valid to the extent that they do not contradict current legislation.

Military service and length of service

Any service in the army is counted towards the total length of service due to the provisions of Part 3, Clause 4, Art. 30 of the Law on Labor Pensions.

According to the general rules, which are legally defined in Art. 30 of the Law on Labor Pensions, military service is counted towards the total length of service in a single amount. According to another calculation formula (the assessment is made based on the size of the pension calculated according to the old pension legislation) - in double.

If we are talking about insurance experience, then there are two types of insurance experience - for labor pension (to determine the right to receive a pension) and for temporary disability benefits (sick leave).

To calculate your pension:

- according to general rules, military service is included in a single rate due to the provisions of Art. 11 of the Law on Labor Pensions. At the same time, to be included in the length of service, it is necessary that before or after the army (the break between the army and work is not important) there was work under an employment contract or other activity for which the person was subject to compulsory pension insurance (for reference, for a regular old-age pension a total of 5 years of insurance is needed length of service, and for a disability retirement pension, all you need is the fact of work (while the duration of work itself does not matter));

- if a person does not have enough length of service to acquire the right to a pension, then military service for the period before 01/01/2002 should be counted into the insurance period in double amount (for example, this follows from the Resolution of the Constitutional Court of the Russian Federation dated 01/29/2004 N 2-P) .

To calculate benefits for temporary disability, military service is included in the insurance period on the basis of Order of the Ministry of Health and Social Development of Russia dated 02/06/2007 N 91 “On approval of the Rules for calculating and confirming insurance experience for determining the amount of benefits for temporary disability, pregnancy and childbirth” (as amended by 09/11/2009).

Bibliography

1. Rogachev D.I. Continuous work experience // Personnel decisions. 2004. N 11.

T. Savina Advisor to the State Civil Service of the Russian Federation, 3rd class Signed for publication on April 22, 2010 “Personnel officer. Labor law for personnel officers", 2010, N 5

break in employment

Comment from our participant

In your article, in my opinion, there is an error about the periods of total work experience, in the sentence “The following periods are not included in the total work experience: 1) training in colleges, schools and personnel training courses,...” below are the listed periods indicated in the article on the basis clause 4 art. 30 of the Federal Law of December 17, 2001. No. 173-FZ is precisely included in the total length of service until January 1, 2002, about which there is also an article on the website of the Pension Fund of the Russian Federation.

I did not find any indication in the article that these periods are not included in the length of service after 01/01/2002, and in general, after this date, not the total length of service, but the insurance period is used to calculate the pension.

Will you edit the article so as not to do any harm with this article, so that when calculating the total length of service based on the article, the personnel officer does not make a mistake, or I would like to receive a refutation, maybe I’m wrong about something? Please send a refutation by email