What can be dangerous about buying an apartment from heirs? Buying a home is a responsible and important step in the lives of most people; you need to approach it seriously and slowly. Often, buyers are faced with living space that was inherited by sellers.

Buyers are scared off by this fact, but what if they liked the property and are ideal in all respects, the only negative is that it was inherited. Should I stop and look further or take a chance and buy?

Ways to receive an inheritance

First you need to understand what inheritance is. This is property that was the property of a person, and after death passed into the possession of his relatives or other persons.

This transition is possible in two ways:

- According to a will, in this case, property can be transferred both to relatives and to complete strangers.

- Or by law, the legislation provides for the transfer of inheritance in the order of priority, which is formed in connection with the family ties of the testators and successors.

In both cases, receipt of the inheritance occurs after contacting the notary office at the place of residence of the testator. The notary opens the inheritance case and within six months the property is registered in the name of the new owner.

Lawyer's answers to private questions

What is more risky for the buyer: buying an apartment received by the seller by law or by will?

In the first case, legal heirs may appear who missed the deadline for accepting the inheritance. In the second - people who are entitled to a mandatory share, and who also missed the deadline. The risks are approximately the same everywhere.

What are the risks when purchasing an inherited share of ownership?

The buyer risks only if the seller has not provided the pre-emptive right to purchase to the remaining share owners (Article 250 of the Civil Code of the Russian Federation). But then the notary will refuse to certify the DCT, and Rosreestr will not accept the agreement without his signature and seal.

How to prove to the acquirer that he is in good faith?

It all depends on the specific situation. The courts are examining whether the buyer could have found out about the right of third parties to the apartment, whether he knew about it. But in most cases, they are still recognized as bona fide, and compensation is paid by the heirs-sellers.

Do I need my wife's consent to sell real estate that I inherited during marriage?

No. According to Art. 35 of the RF IC, such real estate is considered the personal property of the heir-spouse. Notarial consent is required only for the disposal of a shared apartment.

Can a buyer protect himself from loss of ownership of an apartment inherited by the seller?

Yes, for this it is enough to issue a title insurance contract. Such insurance precisely protects against the risk of loss of property rights, and is usually issued for the statute of limitations for challenging the transaction. But if the risks are minimal, it is not always advisable to buy it.

Risks when buying an inherited apartment

In both cases, when purchasing inherited living space, there is a danger of later encountering claims from relatives of the deceased testator. This happens in cases where their rights are violated as a result of inheritance. In some cases, sophisticated scammers may even go so far as to forge a will.

ATTENTION !!! The sale of housing can be carried out under a general power of attorney. In all these situations, you should contact a notary and a lawyer; they will help you figure out whether the documents are reliable or not. Although turning to these specialists will require some additional costs, you will be protected from large financial losses in the future.

Some insurance organizations offer the opportunity to insure the transaction for the purchase of an inherited apartment from possible consequences, that is, in the event of unexpected heirs, the costs fall on the insurers.

In law

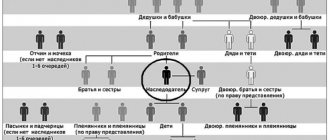

In accordance with the law, there is a hereditary queue, which is built from people who have a blood connection with the deceased.

The order depends on how close the ties are, that is, from close relatives to distant ones. The Civil Code of the Russian Federation provides for 8 stages:

- heirs of the first priority are spouses, if divorced, then they are not considered, natural and adopted children, and parents;

- Second-stage recipients include brothers and sisters, even if they have only one parent in common, as well as grandparents;

- the third is considered to be uncles and aunties;

- 4th and subsequent stages rarely enter into inheritance rights, since they usually find relatives who are closer in ties.

Relatives are invited to inherit in order; if there are no applicants in front, successors from the next line are invited. But there are cases when people do not know that they have become heirs or other relatives hid this fact from them.

ATTENTION !!! Having received an inheritance according to the law, the risks that more heirs will appear are quite large, since notaries do not search for possible applicants for the inheritance.

That is, after the death of the testator, the property may pass to his child from his ex-wife, but it turns out that in addition to this child, he also has a child on the side, whom he did not abandon and gave his last name, which gives him the full right to claim part of the property of the deceased . Or the husband and wife separated, did not divorce, the husband died, but she did not know, the inheritance went to the brother of the deceased, who belongs to the second stage. But six months later the heiress showed up and demanded her property. There can be many situations of this kind and each will lead to legal proceedings.

By will

A will is a document drawn up in good faith and designating one or more claimants to receive property in the possession of the document's originator.

If the buyer is still considering an apartment that the seller received by will, it is worth familiarizing yourself with some possible risks:

- the will can be refuted; any of the heirs in turn can submit documents to challenge the will of the testator;

- the testator could leave additional instructions regarding the heirs fulfilling a number of obligations in relation to other persons. This may be granting the right of residence to third parties in the residential area for a certain period, etc. This expression of will is not canceled in the event of the sale of real estate, and the buyer can also purchase a neighbor along with the housing;

- in accordance with the legislation, in particular the Civil Code of the Russian Federation, Art. in the care of the deceased for at least one year. Regardless of what was in the will, they were not indicated as having the right to receive a part of the inheritance; it is equal to half of the share that could have been received by law in order of priority.

There is also the possibility that the will drawn up will be recognized as invalid, for this there must be grounds:

- if the testator was declared incompetent at the time the document was drawn up;

- at the time of drawing up the will, he was under the influence of alcohol, drugs, etc.

- the testator was under pressure from third parties at the time of drawing up the paper.

It is also possible that the heir under the will will be recognized as unworthy; this is possible if:

- the heir committed unlawful actions against the testator or other possible successors;

- if the receiver did not fulfill obligations to support the deceased.

The presence of a will will not protect against the risks of possible claimants to the inheritance; dissatisfied relatives in this case may also file a challenge to the testamentary document.

Limitation periods

Despite the fact that the law establishes that within six months the heirs must formalize and enter into inheritance rights, in fact everything is a little more complicated. Since the heirs do not always know about the inheritance or have the opportunity to accept it within the established period, the deadline is missed, but the court, if there are serious reasons, can restore it.

IMPORTANT !!! So, in accordance with Article 1155 of the Civil Code of the Russian Federation, which states that an heir who missed the entry deadline for a good reason has the right to restore the deadline in court. You can file a lawsuit within six months from the moment you learned that you were an heir.

And for those heirs whose rights were violated and they were ignored as successors, the law provides for filing a lawsuit within ten years from the date of death of the testator (Article 196 of the Civil Code of the Russian Federation) and it does not matter whether the inherited property was resold or not .

When can a purchase or sale not be challenged?

The buyer will not have to return the money for the apartment or pay part of the share to a sudden heir if he proves that he is a bona fide purchaser. This means a purchaser who did not know and could not know about possible heirs or illegal acquisition of real estate by the seller.

In addition, there is paragraph 42 of the Resolution of the Plenum of the RF Armed Forces dated May 29, 2012 No. 9, which often plays a decisive role in legal proceedings:

“If, when accepting an inheritance after the expiration of the established period in compliance with the rules of Article 1155 of the Civil Code of the Russian Federation, the return of the inherited property in kind is impossible due to the absence of the corresponding property from the heir who accepted the inheritance in a timely manner, regardless of the reasons why it was impossible to return it in kind, the heir, who accepted the inheritance after the expiration of the established period has the right only to monetary compensation for his share in the inheritance (when accepting the inheritance after the expiration of the established period with the consent of other heirs - unless otherwise provided by a written agreement between the heirs). In this case, the actual value of the inherited property is assessed at the time of its acquisition, that is, on the day the inheritance is opened (Article 1105 of the Civil Code of the Russian Federation).”

In other words, after the sale of an inherited apartment to a suddenly appearing heir, the seller, not the buyer, will compensate his share.

Up to 3 years

The sale of housing that was acquired less than three years ago obliges the seller to pay a tax of 13% to the state on the amount received for the sale, and it is not uncommon to receive an offer to indicate in the contract an amount lower than the real one. If new heirs appear and restore their rights, and the court takes their side, the seller must return the amount received for the housing back to the buyer, and the buyer must transfer the apartment. And so the question arises, what amount will the seller return? Naturally, the one that is indicated in the documents and it is unlikely that it will be possible to prove that it actually existed anymore. The buyer loses not only the home, but also part of the money paid for it.

The most common cases that may arise when acquiring inherited property:

- the likelihood that during the first few years after the acquisition of real estate, relatives who did not know about the inheritance may appear and, through legal action, restore the terms of acceptance;

- it is possible that persons who have the right to an obligatory share in the property may appear, but who did not learn about this in a timely manner;

- Also, dishonest sellers may hide the fact that there is an order from the testator giving the right of residence on the territory of the property being sold to an outsider;

- there are risks that the person selling the property may be considered unworthy after the sale transaction has been completed;

- When registering the inheritance, the presence of the second spouse’s share was not taken into account. This is possible if the spouses separated many years ago, but the relationship did not officially end

- revocation of a written will.

The occurrence of any of these circumstances will most likely lead to the fact that the rights of the legal heirs to housing can be restored. Which is the most unpleasant moment for the buyer. In the first years, the risks of challenging the inheritance are the highest.

After 3

Selling an inherited apartment after three years of owning it does not provide complete confidence that unexpected heirs will not appear, but it significantly reduces the risk of their appearance. In accordance with the period established by the Civil Code of the Russian Federation, Article 196, the period for filing a claim on inheritance issues is three years. The beginning is considered the moment from which the plaintiff became aware of the right to inheritance. The maximum established time period during which it is possible to file a claim to challenge the rights to the inherited estate in the form of residential premises is ten years from the date of death of the testator. But despite this, it is still safer to enter into transactions with inherited property if it has been in the seller’s possession for more than three years.

Should I buy an inherited apartment?

You can buy an apartment that was inherited, but after carefully weighing all the pros and cons of the transaction:

This is secondary housing, and it usually costs less than apartments in new buildings

If more than 10 years have passed since the seller accepted the inheritance, the risks for the buyer are reduced to zero

People are wary of buying inherited apartments, and sellers often reduce prices slightly

There is a possibility of challenging the transaction. The apartment and money will most likely not be taken away, but the courts will have to waste time and nerves

If the seller lowers the price too much, this is a reason to be wary: perhaps he wants to get rid of the property as quickly as possible to hide legal flaws

How to avoid possible problems

The buyer can reduce the risk of possible problems by:

- the property will be purchased from an heir who has owned the property for more than 6 years, in which case the appearance of unexpected heirs is minimized;

- study in detail all the papers for the residential premises. You can contact a lawyer who handled the inheritance and clarify the circle of possible heirs. You can also play it safe and ask the seller to draw up a document according to which, in the event of litigation related to the appearance of unexpected heirs, everything will be paid by the seller;

- Do not under any circumstances underestimate the price in the purchase and sale agreement. Since the consequences of such a transaction will backfire on the buyer if the need to return the property suddenly arises.

If you are planning to buy an apartment from your heirs, you should approach the purchase very carefully and carefully study all the documents that will be required for the transaction:

- You should familiarize yourself with the death certificate; it is important that death was established by a medical institution and not by a court. The fact of establishing death through the court is possible only for missing persons, which does not guarantee that such a person will return and claim rights to property;

- It is also worth familiarizing yourself with the range of possible applicants for legal successors; it is advisable that certificates of divorce, birth, marriage, and death of possible heirs be provided;

- if the seller is married, a certified agreement from the second spouse will be required;

- You should also request an extract from the house register, which indicates all the residents ever registered in the area for sale;

- It is important that the apartment being sold belongs to the seller by right of ownership. Registration, which is possible only after the expiration of the established period, which is equal to six months from the date of death of the testator. Registration is carried out in the Unified State Register of Real Estate and then a certificate of ownership is issued;

- if there is a will, it is worth reading it to exclude the possibility of unexpected tenants, etc.

- purchasing only part of the inheritance, that is, a share belonging to one of the heirs, you should make sure that the seller has written refusals from the other owners, since the article of the Civil Code of the Russian Federation states that first of all it is necessary to offer your part to the remaining co-owners of the property;

- sales by multiple heirs require the signing of a sales agreement by all sellers;

- Well, you will need a standard set - this is the apartment owner’s passport, documents from the BTI and the cadastre.

ATTENTION !!! It is important to clarify whether the deceased has close relatives abroad who may simply not know about his death and will appear after the sale transaction has been finalized. In their case, the court will restore the period for entry into the right of inheritance, and the housing will have to be returned to the rightful owners.

In order to protect yourself when conducting a transaction with an apartment received by inheritance, you should seek the help of qualified specialists, a notary or a lawyer. They will help you avoid possible difficulties by studying the documents and will be able to tell you whether it is worth the risk and purchasing such housing or whether it is better to look for another one.

Purchasing real estate from heirs is quite a risky purchase, but if such an apartment has been owned for quite a long time, better if about ten years, then purchasing it is quite safe. In all other cases, you should carefully check the documents for real estate, especially if the acquisition will be carried out through a mortgage. In order to reduce the risk of losing money spent on the purchase, in no case should you indicate in the contract a price lower than the actual price. It is also worth seeking the help of a lawyer; he will help you sort out the documents and prevent fraud on the part of the sellers.

Fraudulent schemes

An unscrupulous seller can use some tricks to pull off a fraudulent scheme, as a result of which the buyer will be left at a severe disadvantage or even lose money without receiving anything in return.

Example. "Concealment of legatees." According to the will, the beneficiary, along with the apartment, also inherited its resident - a friend of the deceased, who has the right to live in the living space for life. By prior agreement with the latter, the successor put the apartment up for sale, and the legatee postponed the registration of his right until the end of the established period (3 years from the date of death of the testator).

The heir sells the apartment and a year later the new owner receives a legatee indicating the registered right of residence in the apartment. He demands a significant amount of compensation from the acquirers, and after refusal, he legally moves in with them. The inconvenience caused by the tenant forces the owners to pay him for a notarized waiver of the rights to reside in the living space.

Example. "Cancellation of power of attorney." The owner of the home issues a power of attorney to sell it to a friend, who then acts on his behalf. When buyers ask questions about the owner of the apartment, the representative informs about his urgent departure abroad. Trusting buyers sign a purchase and sale agreement and transfer money to the attacker. Immediately after this, the real owner of the living space revokes the power of attorney, and the entire transaction is considered invalid due to the lack of authority of the representative.

Then the attacker hides, and the owner calls himself a victim of deception.

Example. "Conspiracy with the heir." The situation unfolds according to a scheme similar to an agreement with the legatee, who in this case is replaced by the priority heir or the legal holder of the compulsory share.

One of the priority successors registers the living space in his own name and after 3 years finds buyers for it. At this time, the accomplice, under the cover of good reasons, allegedly does not know about the opening of the inheritance, and several years later appears in court to restore inheritance rights in court. And, since the statute of limitations begins to count only from the moment when the testator learned or should have learned about the death of the testator, he achieves success in court.

With a court decision to restore the deadline for accepting the inheritance, the fraudster registers his part of the apartment and makes demands for payment of compensation to the new owner of the inherited living space. According to the attackers, buyers had to pay for the apartment twice. But timely contacting a lawyer saved them from unnecessary expenses. The specialist explained to them the position of the law regarding the rights of a bona fide purchaser, according to which all property claims of the emerging heir must be directed to the seller.

Example. "Black realtor." Not only buyers, but also homeowners risk becoming victims of this scheme. Only the last two consequences are much more deplorable. Criminals, the so-called black realtors, fraudulently, under the influence of physical or moral pressure, force the testator to bequeath an apartment to them, and then kill him. The received inheritance is registered and then sold by them according to all the rules.

The consequences of an illegal transaction for buyers occur if the legal successors of the deceased owner of the apartment have doubts. If they can prove a criminal act against a relative, the sale transaction will be invalidated due to the lack of legal force of the will.