Insurance experience - what is it?

This indicator represents the sum of the periods of work of a citizen throughout his life for which deductions were made.

It only accumulates when the employer pays the contributions. To do this you need to be officially employed.

If a citizen does not work because he is unemployed, is sick, or is caring for a child, these periods are not counted.

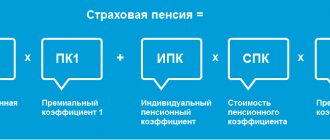

From 01/01/2015, the amount of insurance pension provision depends on the individual pension coefficient (IPC). IPC is the total points that were awarded to a Russian citizen for the entire period of his working activity. The IPC is accrued every year. If the Russian was not employed, then the IPC is not accrued.

Here you can see how production affects pension payments. The greater the output of a Russian, the greater the number of IPCs he will receive. If before 2015, the amount of pension payments depended more heavily on the amount of insurance contributions that employers paid to the Pension Fund for an employee, today the pension depends more on the number of individual industrial complexes. The higher the Russian’s salary and the more years he worked, the more IPC will accumulate.

Which one is needed for retirement?

After the pension reform of 2015, the conditions for registration of old-age pension insurance became more stringent. If before 2002 the registration of pension payments did not depend on production, then when the bill “On Labor Pensions” came into force, insurance pension payments began to be issued only if there was at least five years of production.

To retire in 2021, you need to have accumulated at least ten years of earnings. Once every 12 months, this indicator will increase by one, until 2025.

Kinds

It depends on how actively a citizen was engaged in labor activity before retirement, whether he will be assigned an insurance pension and what the amount of payments will be. At the same time, production is necessary to calculate both pension benefits and disability benefits.

Depending on its duration, the amount of disability benefits may be equal to:

- 60 percent of the average salary;

- 80 percent;

- 100 percent.

The procedure for calculating periods of work activity for both cases differs and depends on the periods under consideration. To register and calculate pension benefits, general and special insurance periods are distinguished.

The general rules for calculating the insurance period are established by Art. 13 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”.

From the previous material “The concept and types of insurance experience under the new pension legislation,” we learned that

the presence of insurance experience is a necessary condition for the emergence of the right to pension provision in the form of compulsory pension insurance.

We also now know that the new pension legislation since 2015 distinguishes between two types of insurance coverage:

- insurance period , which gives the right to assign an insurance pension and

- special insurance experience - insurance experience that gives the right to assign an early old-age insurance pension.

In this material you will get acquainted with the procedure for calculating the insurance period.

The insurance period is always calculated in calendar order, i.e. according to the actual duration of work or other activities included in the insurance period.

In other words, one year of labor or other socially useful activity is counted as one year of insurance experience (unless other rules are provided by law).

Additionally, Federal Law No. 400-FZ “On Insurance Pensions” establishes a number of special rules for calculating the insurance period:

Rule No. 1 for calculating the insurance period

If a citizen has been granted a pension by another state in accordance with its legislation,

- then the periods that were taken into account in the length of service when assigning such a pension,

are not included in the insurance period when assigning an insurance pension in accordance with Russian legislation.

Rule No. 2 for calculating the insurance period

Periods of activity of persons

- who independently provide themselves with work (individual entrepreneurs, lawyers, arbitration managers, notaries engaged in private practice, and other persons engaged in private practice and who are not individual entrepreneurs),

- heads and members of peasant (farm) households,

- members of family (tribal) communities of indigenous peoples of the North, Siberia and the Far East of the Russian Federation, engaged in traditional economic sectors,

- periods of work for individuals (groups of individuals) under contracts

are included in the insurance period strictly on the condition that during these periods insurance contributions were paid to the Pension Fund of the Russian Federation.

Rule No. 3 for calculating the insurance period

Citizens who receive a long service pension or a disability pension in accordance with the Law of the Russian Federation of February 12, 1993 No. 4468-1 “On Military Pensions”,

- when determining their right to an insurance pension

are not included in the insurance period

- periods of service preceding the assignment of a disability pension, or periods of service, work and (or) other activities taken into account when determining the amount of a long service pension in accordance with this Law.

In this case, the following are considered included in the insurance period:

- all periods that were counted towards length of service, including periods that do not affect the amount of long service pension or disability pension, in accordance with the specified Law “On Military Pensions”.

Rule No. 4 for calculating the insurance period

Citizens from among the astronauts,

- who receive a long service pension or a disability pension in accordance with Federal Law of December 15, 2001 No. 166-FZ “On State Pension Provision in the Russian Federation”,

- when determining their right to an insurance pension

are not included in the insurance period

- periods of work (service) and (or) other activities preceding the assignment of a disability pension, or periods of work (service) and other activities taken into account when determining the amount of the long-service pension in accordance with the specified Law No. 166-FZ “On State Pension Provision” In Russian federation",

unless otherwise established by an international treaty of the Russian Federation.

Rule No. 5 for calculating the insurance period

Periods of work during the full navigation period on water transport and during the full season in organizations of seasonal industries, determined by the Government of the Russian Federation1,

taken into account when calculating the insurance period

- in such a way that the duration of the insurance period in the corresponding calendar year is a full year.

That is, one full navigation period or full season worked is counted as one calendar year of insurance experience (from January 1 to December 31).

If the full navigation period or full season has not been completed,

- then this period is taken into account in the insurance period based on the time actually worked.

Rule No. 6 for calculating the insurance period

Persons who

- in the corresponding calendar year they performed work under copyright contracts,

- as well as to authors of works who, in the corresponding calendar year, received payments and other remuneration under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, art,

this period is counted towards the insurance period

- for one full calendar year (from January 1 to December 31)

- provided that the total amount of insurance contributions paid to the Pension Fund of the Russian Federation from payments and other remuneration received under these agreements during a given calendar year

- amounted to at least the fixed amount of the insurance contribution for compulsory pension insurance 2.

If the total amount of insurance premiums paid during a calendar year for these persons is less than the fixed amount of the insurance contribution for compulsory pension insurance,

- The insurance period includes a period (in months) of duration calculated in proportion to the insurance premiums paid,

- but not less than one calendar month (30 days).

If there are other periods of work and (or) other activities in the corresponding calendar year, the period counted towards the insurance period in connection with the payment of insurance contributions to the Pension Fund of the Russian Federation from payments and other remunerations under these contracts,

- is taken into account in such a way that the insurance period for the corresponding calendar year does not exceed one year (12 months).

Rule No. 7 for calculating the insurance period

When calculating the insurance period in order to determine the right to an insurance pension

- periods of work and (or) other activities that took place before January 1, 2015 and

- counted towards the length of service when assigning a pension in accordance with the legislation in force during the period of performance of work (activity),

may be included in the insurance period

- using the rules for calculating the relevant length of service provided for by the specified legislation (including taking into account the preferential procedure for calculating length of service), at the choice of the insured person 3.

1 Decree of the Government of the Russian Federation of July 4, 2002 No. 498 “On approval of the list of seasonal industries, work in organizations for which during the full season when calculating the insurance period is taken into account in such a way that its duration in the corresponding calendar year is a full year”; Resolution of the Council of Ministers of the RSFSR dated July 4, 1991 No. 381 “On approval of the List of seasonal work and seasonal industries, work in enterprises and organizations of which, regardless of their departmental affiliation, for a full season is counted towards the length of service for granting a pension for a year of work.”

2 The fixed amount of the insurance premium is determined in accordance with Art. 14 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund.” For 2015, the fixed amount of the insurance premium is 18,610.80 rubles.

3 This norm expresses the position of the Constitutional Court of the Russian Federation (Resolution No. 2-P of January 29, 2004 “On the case of verifying the constitutionality of certain provisions of Article 30 of the Federal Law “On Labor Pensions in the Russian Federation” in connection with requests from groups of deputies of the State Duma, as well as the State Assembly (Il Tumen) of the Republic of Sakha (Yakutia), the Duma of the Chukotka Autonomous Okrug and complaints from a number of citizens") that in connection with changes in pension legislation, the deterioration of the conditions for the implementation of citizens’ rights to pension provision is not allowed, incl. in terms of calculating length of service and the amount of pension according to the norms of previously existing legislation.

If you have any questions about your work experience, or you find yourself in a difficult situation, then an online duty lawyer is ready to advise you on this issue for free.

If you have any questions about the violation of your rights, or you find yourself in a difficult life situation, then an online duty lawyer is ready to advise you on this issue for free.

INSURANCE EXPERIENCE

Differences between insurance experience and work experience

The general insurance period is also called labor experience. It is equal to the duration of the periods of working activity of Russians, during which the employer made contributions to the Pension Fund. At the same time, the citizen’s work activity must be recorded in a work book issued for each employed employee. Using it, it is possible to calculate the length of work experience to calculate the old-age pension issued.

Work experience differs from insurance in that it includes exclusively those periods during which a person was officially employed. The insurance period also includes periods that differ from official employment.

What does general experience include?

All periods when insurance premiums were paid for the worker are considered insurance coverage. But if we consider the concept of total work experience, then it is somewhat broader. After all, here, in addition to the periods “paid” to the Pension Fund, other useful activities for the benefit of society are also taken into account. In particular, the general period will also take into account:

- being in active military service;

- an employee being on sick leave when he was paid for his disability;

- caring for a baby who is under 1.5 years old (in some cases this period can be extended, but not more than up to 6 years);

- being on the labor exchange and receiving unemployment benefits, as well as time spent moving for a new job;

- caring for a disabled person of group 1, a disabled child, or a person over 80 years old;

- if the spouse of an active military personnel lived in places where there was no opportunity to find a job;

- living with a spouse working in a diplomatic or international organization;

- carrying out operational investigative work in the manner prescribed by special law;

- being in prison due to an illegal sentence;

- performance by the judge of his judicial duties.

What periods are included?

So, it was established that the insurance period necessarily includes periods of official employment of a citizen. It also includes periods when a Russian:

- served in the army;

- received benefits because he was temporarily disabled;

- looked after a son/daughter, and the child was under one and a half years old;

- received unemployment benefits, performed paid public works, moved to another locality to find a job in the direction of the employment center;

- was in prison, but at the same time managed to prove his own innocence and the fact that he was unjustifiably detained;

- cared for a person with a category 1 disability, a minor with a disability, an elderly person (over 80 years old);

- lived in a locality where he could not find employment for a maximum of 5 years (for military spouses);

- lived in a foreign country for a maximum of 5 years (for husbands/wives of Russians who work in diplomatic missions and embassies of Russia).

- study in higher educational institutions, but there are restrictions.

The listed periods are counted as output if before and after them the citizen was officially employed for at least 1 day.

Converting periods to full years and months

There is another way to calculate insurance experience - allocating entire periods. For clarification, an example is below:

- first period – 17 months and 25 days (calculation of whole days: 17x30+25=535);

- the second period of time is 30 months and 11 days (30x30+11=911);

- the third period is 21 months and 22 days (21x30+22=652).

Amount: (535+911+652)30=69.93 months, which are divided by 12 and we get an approximate figure of 5.82. The approximate length of service is 5 years and 8-9 months.

But this method does not have accuracy, so addition of periods is more often used.

How to find out your period using SNILS and the Pension Fund

For people who want to check their insurance record, visiting the Pension Fund office in person seems to be the most difficult method. However, if online services are for some reason unavailable, you will have to go to the Pension Fund. You must take your passport and SNILS with you. Once your identity has been confirmed, a Pension Fund employee will help you draw up a request for information. You will have to wait approximately 10 days for a response.

People who prefer to use the Internet rather than visit government agencies can check their output through the government services website or the website of the Pension Fund of the Russian Federation.

In order to obtain information, you need to register on the government services portal and fill out a form. You will need to write:

- passport data;

- date of birth;

- phone number;

- SNILS.

In addition to filling out the form, you need to complete verification. This can be done at the Pension Fund branch, through the post office, using a universal electronic card. You need to do this once in order to have unhindered access to all government services in the future.

Select the appropriate service and fill out a special form. The information you request is located on the server equipment of the Pension Fund and will be sent to you after verification.

The insurance period according to SNILS can also be checked through the Pension Fund website:

- Log in to your profile using data from the government services website.

- Select a service, after which you will be shown information about the accumulated experience.

In addition, you will see the number of IPCs.

Also, each citizen can obtain information on personal insurance history at their place of work. The HR department or other department issues a document based on data from the work book.

Sample certificate of work experience:

Documents for confirmation

The basic document used to confirm work experience is the work book. If filled out correctly and in a timely manner, it can confirm up to 100% of the future pensioner’s work activity. But in some cases this may not be enough. Then the following types of documents can come to the rescue:

- certificates from official institutions (archives, government agencies);

- personal accounts from the place of work (duly certified);

- extracts from orders for the enterprise;

- job characteristics, identity cards;

- statements confirming the fact of payment of wages;

- service records, forms, labor lists;

- written employment contracts;

- military tickets;

- Red Army soldier's book;

- archival certificates from hospitals, military hospitals;

- certificates from military units, army headquarters, commissariats;

- a medical certificate confirming that the person requires special care or has a disability;

- certificate for the recipient of social benefits;

- passport with registration (to confirm the fact of cohabitation with a person requiring constant care);

- extracts from VTEC inspection reports.

Remember, to confirm your length of service in a specific period, you need to find any written document with your last name. It is optimal if it is issued by an organization or an archival institution and certified by an official’s signature and seal. Otherwise, the authenticity of the document will have to be proven in court.

How to calculate

The procedure for calculating the insurance period is regulated by Art. 13 Federal Law No. 400. It provides the following:

- calculation is made according to the calendar principle;

- self-employed citizens or citizens working under a contract with an individual accumulate experience if they have paid contributions to the Pension Fund;

- if a citizen has applied for a pension in another country, using certain periods of work, then in Russia these periods can no longer be applied;

- people who have length of service obtained before the 2015 changes have the right to decide how to calculate it - according to the new laws or the old ones.

Periods of work activity after the introduction of individual accounting and SNILS are subject to automatic confirmation based on the information recorded on the Russian’s personal account.

The calculation formula is elementary. All periods that can be counted as production are added up. The result obtained will be the insurance period.

Calculation example

Anna was officially employed for 20 years. During her working life, she gave birth to 2 children, with each of whom she was on maternity leave for 36 months.

After that, Anna became an individual entrepreneur and worked as an individual entrepreneur for 7 years. Moreover, out of these 7 years, she worked part-time for 2 years.

Its output will be calculated as follows:

- The work done while caring for a child is counted only for the first year and a half. During 2 maternity leaves, Anna accumulated 3 years of experience.

- If a person works part-time as an individual entrepreneur, the output is not counted, since there are no transfers to the Pension Fund.

- We sum up the difference of 20 and 3 with the difference of 7 and 2. The result is that Anna has accumulated 22 years of output.

The main document that confirms periods of work is still considered the work book. The information reflected in the document is checked by employees of the Pension Fund of the Russian Federation and taken into account when calculating length of service (if the employer made contributions to the Pension Fund). If a citizen meets the minimum length of service requirements, he is assigned an insurance pension, the amount of which depends on the length of work and earnings.

Differences from special

Special length of service is the time spent performing work under certain conditions, as a result of which the employee receives the right to early retirement. Among these categories of citizens are:

- workers performing labor functions in hazardous or hazardous industries;

- medical staff;

- teaching staff;

- military personnel;

- trade union (exempt) workers;

- certain categories of civil servants (police, rescuers, testers);

- civil servants;

- any activity in the Far North.

The activities of each of the listed groups are determined by a separate Federal Law, which establishes clear criteria for accounting for periods of work, benefits, compensation, positions, conditions for calculating pension benefits, periods for ending work, as well as the procedure for old-age retirement. As a rule, these categories of citizens have the opportunity to become pensioners earlier than the national line.

Confirmation of experience

How can you prove that you actually worked the required amount of time? To confirm your experience you must:

- A work book containing the relevant entries (date of hire and date of dismissal).

- If you worked part-time or under a temporary employment contract - a certificate from the employer, which will indicate the timing and nature of the work performed (position).

- An employment contract and any other documents regulating your relationship with the employer may be useful to confirm your work experience if you do not have other certificates.

- In the worst case scenario, you may need witnesses (at least two) who can confirm that you were actually employed at this place of work. In this case, it is desirable that they be from among your former colleagues.

Always monitor the quality of the work record. Blots, abbreviations, and illegible handwriting are not allowed. If your organization has changed its name since you were hired, be sure to ensure that this is reflected as well. This will significantly reduce the risk of conflicts with the pension fund.

Calculation methods

Working periods are calculated on a calendar basis (full months are taken into account - 30 days, full years - 12 months). The difference from the usual monthly calculation here is that only 30 days will be considered a full month. If it turns out that the working periods coincide in time, then only one of them is taken into account (a participant in the pension insurance system can independently choose which one by writing an application).

To calculate the total length of service in detail, you can use a simple example: an employee of an enterprise, Ivan Ivanov, provided a sick leave valid from September 20 to September 30, 2021 to the accounting department of the enterprise. An accountant needs to find work. employee book.

The following information is taken from it:

- from 01/01/14 to 07/20/14 Ivanov worked at the Kristall enterprise;

- from 07/22/14 to 08/25/16 – at Spectr LLC;

- from 08/26/16 to 08/29/16 – on .

- from 01.09.16 to 09.08.19 - at the ZRK enterprise.

As a result of calculating the insurance period for sick leave payment, the result is 5 years 7 months and 7 days. Therefore, the amount of sick leave for Ivan Ivanov will be: the level of average daily earnings * 80%. You can read more about calculating the insurance period for sick leave here.