How to calculate experience?

You can use a special calculator on the PF website.

You can do the math yourself.

What will we count?

Let's take a work book and write down all the periods of our work.

Among them will be “useful” for the length of service (contributions were received to the Pension Fund, the length of service will be counted):

- They worked officially at an enterprise, in an organization, or for an individual entrepreneur. They received a “white” salary, the employer paid insurance premiums.

- They worked on a collective farm, a farm, or under a contract with an individual.

- We completed the author's order and received a reward for the created work.

- They provided themselves with work (private notaries, detectives, lawyers). In the first two cases, we calculate the length of service using the calendar method: subtract the start date of work from the end date and add one day.

Start of work – 07/16/1998. End date: 10/23/2001. 2001 – 1998 = 3 years. 10 – 7 = 3 months. 23 – 16 = 7 days. Result: 3 years 3 months 8 days.

Using the same algorithm, we calculate all periods. We summarize the results by year, month and day. Every 30 days will be converted into 1 month. Every 12 months – every 1 year. Let's get the final result. In the third case, the year will be counted if the transferred contribution was not less than the fixed amount established for that period. If there were several works or contracts and a larger amount was paid into the fund than the minimum required, no more than a year is counted. In the fourth case, those periods for which insurance premiums have been paid will be taken into account.

There will also be “useless” ones (there were no transfers, length of service does not count).

- Study time.

- The time spent caring for each child is more than 1.5 years.

- Caring for the fifth and subsequent children.

- They were sick, but did not receive social assistance.

- We took vacation at our own expense.

- They were unemployed and did not receive benefits.

- They were in custody and in prison.

- Have not worked for more than five years while living with a spouse abroad or at the place of military service.

There will also be very pleasant “gifts” from the state (“other periods”)

That is, no one contributed money to the Pension Fund, but this time is counted towards our length of service.

This applies in cases where we:

- served in the military, or the police, or the fire service, or the drug enforcement agency, or the criminal justice system;

- were on “maternity leave” 4 times for 1.5 years;

- looked after a disabled person of the first group, a disabled person since childhood, a person over 80 years old;

- during military service, the spouse (or spouses) lived in an area where it was impossible to find work;

- lived with your spouse during his or her employment or government service abroad;

- were sick but received disability benefits;

- we received unemployment benefits, the employment center paid us for community service and travel to our new place of work;

- were imprisoned, but later rehabilitated.

Important! These special (“other”) periods will be counted toward the length of service if before or after .

Part-time work

You are allowed to choose the most profitable period.

For example:

Main work: from December 20, 1986 to April 13, 1997.

Part-time: from 05/16/1995 to 07/10/1998.

- 1st option. The salary was higher at the main job. We take into account the entire period for the main job and from 04/14/1997 to 07/10/1998 part-time.

- 2nd option. They paid more for part-time work. We count the period for the main work until May 15, 1995 and the entire period of combination work.

Seasonal work

Seasons or navigations may vary in length. For example: 6 or 4 months. If this period is fully worked out, the entire calendar year is counted towards the length of service.

Work on the collective farm

If a collective farmer’s work book for a calendar year indicates at least one trip to work, that entire year is counted.

You cannot count your experience twice! The second time, the length of service obtained and taken into account abroad, and that taken into account for the assignment of disability or long-service pensions, are not counted.

Calculation example

Ivanova L.I., born in 1959 I applied to the Pension Fund on January 20, 2015.

The following periods of work are documented:

- From 09/01/1977 to 09/01/1979 she worked as a secretary. 1979-1977=2 years+1 day.

- From 09/01/1979 to 07/01/1984 she studied at the institute. Not taken into account.

- From 08/15/1984 to 03/26/1996 she worked at the plant. 1996 – 1984 = 12 years. 3 – 8 = minus 5 months. 26 – 15= 11 days. Maternity leave lasted 2 years. One and a half years are included in the length of service, and 6 months will have to be crossed out. (12 years – 5 months) = 11 years + 7 months + 11 days + 1 day – 6 months = 11 years + 1 month + 12 days.

- From 03/26/1996 to 08/21/2003 she worked in a construction organization. 2003 – 1996 = 7 years. 8 – 3 = 5 months. 21 – 26 = minus 5 days. 7 years + 5 months – 5 days + 1 day = 7 years + 4 months + 26 days.

- From October 24, 2001 until the day of application, he is an individual entrepreneur.

It is impossible to take into account the length of service twice, so Lyudmila Ivanovna wrote a statement indicating that she wanted to take into account work in a construction organization. For the period from October 24, 2001, a certificate from the tax authorities was provided.

The length of service from 08/22/2003 to 01/19/2015 is taken into account.

- 2015 – 2003 = 12 years

- 01 – 08 = minus 7 months.

- 19 – 22 = minus 3 days.

- 12 years – 7 months – 3 days + 1 day = 11 years + 4 months + 28 days.

- Let's sum up the years: 2 + 11 +7 +11 = 31 years.

- Let's sum up the months: 1 + 4 + 4 = 9 months.

- Let's sum up the days: 1 +12 +26 + 28 = 67 days.

- Converting days to months = 2 months and 7 days.

- Convert months to years = 1 year and 1 month.

Experience: 31 years, 11 months and 7 days.

Calculation of payments for citizens born before 1967, rules for processing payments

How are pension payments calculated? Based on the rules, you need to calculate the pensioner’s work experience coefficient, and then multiply the resulting number by the one that comes out as a result of dividing the average salary of a citizen (the salary must be divided by 60 months) by the average salary in the country, and then multiply the result by 1,671 rubles. We get the size of the pension (RP) and put PC = (RP - BC) x T into the formula, where we already know the numbers.

As a result, we receive pension capital. We calculate the insurance part (using the above formula). We add it to the main part and get a pension. The calculations also include a savings portion, but this does not apply to everyone.

Using a special formula, you can calculate the size of the pension for citizens born before 1967

Other special cases and answers to questions

Continuity of experience.

It doesn't matter for retirement. If there are several periods, they are counted separately, then the total is summed up.

What documents confirm the experience:

- Employment history.

- For individual entrepreneurs: certificate of income from the tax authorities;

- certificate of payment of single tax;

- PF certificate confirming payment of contributions.

What to do if your work book is lost?

Contact archival and financial authorities for information recovery. Obtain certificates from the employer. You can submit any documents confirming employment and payment of wages. It is even possible to confirm the experience with the testimony of two or more people. But only in cases where it is proven that the original documents were destroyed due to circumstances beyond a person’s control (natural disaster, fire, intent or careless storage by another person).

Is the work book or certificate drawn up correctly?

Entries are subject to the labor legislation requirements in force at the time they were made. If only the year is indicated in the document, July 1 is taken as the date. If the day of the month is not specified, the 15th is accepted. All documents received to confirm experience must contain the number, date of issue, last name, first name and patronymic, date, month and year of birth, place and period of work, profession or position. It is mandatory to indicate the basis for issuance: orders, personal accounts and other documents. The document issued upon dismissal may not contain grounds for issuance.

What additional documents may be needed?

- Passport.

- Certificate of birth, marriage, divorce, change of last name, first name, patronymic.

- Military ID.

- Certificates from the relevant authorities for all “other periods”: certificate from the military unit, military registration and enlistment office or institution where it took place;

- child's birth certificate;

- certificate from housing authorities about cohabitation;

- employer's certificate confirming the provision of care leave;

- documents confirming disability, cohabitation and care;

- a certificate from the military registration and enlistment office confirming that one of the spouses has completed military service and lives together with the second spouse, confirmation that there were no conditions for employment in this area;

- a certificate from a government body or institution about the work of one of the spouses abroad and about the residence of the second spouse in the same place and at the same time;

- a certificate from the employment service confirming receipt of unemployment benefits, paid public works and relocation to a place of work in the direction of this service;

- document on serving the sentence and a court decision on rehabilitation.

How many years of service (minimum) do you need to receive a pension?

In 2015 – at least 6 years.

In each subsequent year, the required period is increased by 1 year until it reaches 15 years. This will happen in 2024.

At what age can you retire?

Women - at 55, men - at 65 years old.

Will the retirement age increase?

No. At the moment there are only discussions of this possibility. There are no real projects at the legislative level yet.

Is it possible to retire earlier?

Yes. A number of categories of persons are granted this right. There are currently 30 such categories defined. This benefit is provided for several reasons.

- Due to the characteristics of the profession (actor, ballerina, children's teacher, doctor).

- Special working conditions (cosmonaut, pilot, geologist, sailor, rescuer).

- Harmful conditions (miner, metallurgist, firefighter, mine rescuer).

- Work and living in the Far North.

- Birth of 5 or more children.

- Disability of the first group due to vision and as a result of military trauma.

What is special experience?

This is the experience that was obtained:

- when working in difficult, dangerous or harmful conditions;

- in special professions;

- when working in the Far North or equivalent areas.

This length of service provides benefits in the form of a reduction in the retirement age and an increase in the fixed payment to the insurance pension. Since 2014, a law on special assessment of working conditions came into force. Before its adoption, there was certification of workplaces. Special experience can be calculated under both new and old legislation.

No experience or less than 6 years. Will there be a pension?

Will. A social pension will be assigned to a disabled person from childhood, to a woman from 60 years old, to a man from 65 years of age.

Accrual years

When a citizen goes to the Pension Fund of the Russian Federation, it is not for nothing that he is required to present, along with the rest of the papers, a personal accounting card, which was provided in the state pension insurance system. Information is taken into account for 2000-2001 or for five years that ended on December 31, 2001. The information is subject to confirmation by state or municipal authorities, which in turn take data from accounting reports.

When calculating the pension, information for 2000-2001 or 5 years before December 31, 2001 is taken into account.

If the citizen was a hired worker, then you need a contract of the appropriate form and data from two witnesses that the person carried out labor activities at this job. This will be the average salary, on the basis of which the Pension Fund of the Russian Federation calculates pensions. However, that's not all that matters.

The calculation of an old-age insurance pension involves four components, and each of them has its own meaning:

- income for the period before the beginning of 2002;

- income received by a citizen during the period of work for 2002-2014 at the time of the beginning of cuts and reforms of several payments due to the unstable economic situation in the state;

- a small part that was developed from 2015 to the year when you need to retire;

- personal types of SP accrual for non-insurance periods (sometimes this happens).

When calculating the insurance pension, income for various periods is taken into account

Deputy Minister of the Ministry of Labor and Social Protection Pudov did not just say about the old-age pension that a citizen’s retirement means fifteen years of work. However, according to him, thirty-five years of work experience should also be encouraged. Most likely, this moment is the reason for most of the rumors, which are often cited in the media and arouse strong interest among the population - about the bonus that is due for thirty-five years of work experience.

Important ! There is no increase yet - this is only a promise to take into account all four parts in due order for those times when changes in the laws on pension payments took place.

The government plans to reward citizens for long work experience

What are the main results of changes in pension legislation?

- Pensions that have already been granted will not decrease. They will even increase, as they will be constantly indexed.

- The importance of length of service has increased. More experience means more pension.

- Receiving an official salary became more important. The higher the salary, the higher the insurance contributions, the higher the pension.

- Voluntary increase in insurance period is encouraged. The longer a person works, the greater the increase in pension he will receive.

- The future pensioner can choose the most profitable period for calculating the length of service and the amount of pension.

- Documents can be provided on paper and in the form of an electronic document.

Since 2002, all information about the length of service and received contributions is contained on the ILS - the individual personal account of the insured person. Using the electronic services of the Pension Fund, you can order a certificate or document or make an appointment. On the PF website in the Personal Account of the insured person, you can obtain information about your length of service, pension points, places of work, and earnings. The service allows you to generate and print a “Notice on the status of the HUD”.

The existing accrual system and possible changes

Old-age pension payments were previously made based on the old-style system, where the initial information was based on the size of a citizen’s salary.

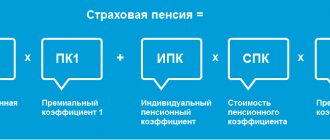

The calculation method itself plays an important role here. Now, when pension payments are calculated, they use a formula where they take the initial information SP = IPK+SIPC+FV.

In simple terms, the insurance pension consists of the following parts:

- IPC is the number of pension points that a citizen received, including through the calculation of average wages;

- SIPC is the price for one of the pension points for the period of calculations;

- PV is a fixed payment also for the accrual period, since due to indexing it changes every year.

The insurance pension is calculated taking into account the number of pension points, their value, as well as a fixed payment

In a situation where a citizen received a good salary, such information in the formula does not always lead to a large amount that the government is willing to pay to a person who has worked most of his life and expects to receive good amounts in retirement. This year the elements of the formula will not change.

Important ! Only their quantitative values will undergo changes.