Types of survivor's pensions

Benefits for the loss of a breadwinner in Russia are paid through the Pension Fund or the law enforcement agency. There are several types of payments:

- Insurance pension. Appointed if the deceased had work experience.

- Social pension. Paid if the breadwinner was not employed.

- State pension. It is assumed if the deceased was a military serviceman (not to be confused with a military pension!), an astronaut, or a victim of man-made or radiation disasters.

- Child benefit through the Ministry of Internal Affairs, if the breadwinner served in the Ministry of Internal Affairs.

- Military pension if the deceased was a contract soldier.

Who is entitled to

Survivor benefits are available only to disabled citizens.

Recipients of the state (if the deceased was a military serviceman or astronaut) or insurance pension are:

- Children, sisters, brothers and grandchildren of the deceased, if they are under 18 years of age or have not reached 23 years of age and are studying full-time in educational institutions, or have been assigned a disability before the age of 18. Please note that brothers, sisters and grandchildren can count on pension payments if they do not have able-bodied parents.

- A grandmother who has reached 55 years of age, or has a disability if there is no one to support her.

- A grandfather who has reached the age of 60, or is disabled if there is no one to support him.

- Mother or spouse who has reached the age of 55 or has a disability.

- The spouse, one of the parents, sister, brother, grandfather, grandmother of the deceased, regardless of age and employment, if they are caring for children and sisters under 14 years of age, but entitled to receive a survivor's insurance pension , brothers, grandchildren of the deceased.

- Father or spouse who has reached 60 years of age or is disabled.

In addition, a disabled mother, father, or spouse has the right to apply for an insurance pension if they have lost their source of income. The appointment is made regardless of whether they were dependent on the deceased or not.

If the deceased was a military serviceman, his widow can apply for a state one, but subject to two conditions: she is 55 years old and has not remarried.

If the breadwinner died during compulsory military service or died after dismissal due to a military injury, pension benefits are assigned to his mother after 50 years of age and to his father over 55 years of age.

- 8 Easy Ways to Save Money in 2021

- Vegetable stew with chicken

- Social tax deduction in 2021

The state pension, if the breadwinner was a Chernobyl survivor, is assigned:

- A grandmother who has reached the age of 55 or is disabled if there is no one to support her.

- A grandfather who has reached the age of 60 or is disabled if there is no one to support him.

- Children under 18 or 25 years of age if they are studying full-time.

- To a husband or wife, regardless of employment and age, if they are raising a deceased child under 14 years of age.

- Husband reaching 55 years of age or disabled.

- Wife over 50 years old or disabled.

- Disabled parents.

Social pension and survivor benefits are assigned only to the children of the deceased until they reach the age of majority or 23 years old if they are full-time students.

The survivor's benefit, which is paid through the internal affairs bodies, is:

- Parent, guardian, adoptive parent, trustee for the maintenance of a minor child.

- A guardian or trustee for the maintenance of a child over 18 years of age, if the latter became disabled before reaching the age of majority and the court limited his legal capacity or declared him incompetent.

- An adult child if he was assigned a disability before the age of 18 or if he is a student or full-time student until he graduates or reaches 23 years of age while continuing his education.

Please note that survivors' pensions are granted for life or for a specified period. The grounds for termination of payments may include:

- the child reaches adulthood;

- the child reaches the age of 14, if the money was accrued to the citizen who provided care;

- deprivation of parental rights;

- death of the recipient.

Supplement to the pension for a child after the loss of a breadwinner

“FACTS” have already written how, due to the increase in the cost of living, salaries, pensions and some types of payments to families with children will increase this year. There is another type of state assistance, which also depends on this social standard and will increase throughout the year - payments to disabled children and people with disabilities since childhood. Currently, more than 393 thousand people receive such benefits.

In the event that the main breadwinner of the family dies, the state guarantees monthly payments, but to whom, how much and under what circumstances is due, we will figure it out in order in our article. Any disabled family member who was dependent on the breadwinner can be applicants for benefits in connection with the loss of a breadwinner. Only persons who committed an intentional criminal act that led to the death of the breadwinner, established by the court, are excluded. Minor children with brothers, sisters and grandchildren of the deceased breadwinner; including if these relatives are studying full-time in an educational institution of any type and type, including foreign educational institutions located outside the Russian Federation (if the referral for training is made in accordance with international treaties of the Russian Federation) , excluding educational institutions of additional education, until they complete their studies, but no longer than until they turn 23 years old.

We recommend reading: Benefits for pensioners of St. Petersburg for travel on electric trains

Survivor's pension amount

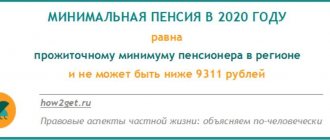

The amount of accrued pension benefits is subject to annual indexation. The size of the payments themselves depends on their type:

- Insurance pension. It consists of an insurance part, which is calculated individually, and a fixed amount. The size of the PV is established by decree of the Government of the Russian Federation. For orphans – 4,982.90 rubles, other applicants – 2,491.45 rubles.

- Social. For children who have lost one parent - 5,180.24 rubles, for the death of two parents or children of a single mother - 10,360.52 rubles.

- Monthly child benefit through the Ministry of Internal Affairs - 2,321.11 rubles.

- Military pension - 50% of pay if death is caused by injury and 40% by illness acquired during service.

The state pension has an expanded scale of accrual:

- if the breadwinner died due to a military injury - 200% of the minimum social pension;

- if the deceased died due to an illness acquired during military service - 150% of the social pension;

- if the deceased was one of the victims of the accident at the Chernobyl nuclear power plant - 125% of the social pension, children of a deceased single mother or those who lost two parents - 250% of the social pension;

- if the deceased was listed as an astronaut - 40% of the deceased’s allowance as of the date of death.

Grounds for recalculating payments

Issues of assignment, accrual and procedure for recalculating pensions are regulated by law. The main acts are:

- Federal Law No. 400-FZ (December 28, 2013) “On insurance pensions”;

- Federal Law No. 166-FZ (12/15/2001) “On state pension provision in the Russian Federation.”

Recalculation may be carried out in connection with changes in legislation or for other reasons, if there is documentary justification. Adjustment of the size of a social or state pension occurs only on the condition that minor children receive it. This option is only possible upon the death of the second parent.

- 8 worst things for your health, according to doctors

- Which years are subject to medical examination in 2021?

- 6 ways to keep cockroaches and other insects out of your home

Increase in fixed part

Recalculation of insurance pension benefits is carried out only after the death of the second parent, when the child becomes an orphan. The increase occurs only upon application. In a non-declaration procedure, not a recalculation is carried out, but an indexation of the fixed payment.

Recalculation of the insurance part

The increase in the insurance part of the pension is made taking into account the change in the value of the individual pension coefficient (IPC) of the deceased for the year preceding the assignment of the pension, and is a one-time increase. For recalculation the formula is used:

SPPK = USPPK + (IPK / K / KNCh x SPC), where:

- SPPK – the amount of insurance pension for the loss of a breadwinner;

- USPPK - the established amount of insurance pension for the loss of a breadwinner;

- IPC – the number of points determined based on the amount of insurance contributions to the Pension Fund of the Russian Federation, which were not taken into account as of the day of the citizen’s death;

- K – coefficient of the ratio of the standard duration of the breadwinner’s insurance period, calculated in months, to 180 months;

- KNC – the number of disabled family members as of August 1 of the year in which the recalculation is made;

- SPB – the value of the pension point established on the day of recalculation.

Supplement to disability pension in case of loss of a breadwinner

A child and a non-working mother caring for a child of a deceased breadwinner who has not reached the age of 14 years may be granted a survivor's pension. But you can only receive one pension of your choice.

In your case, you need to choose a more profitable option for your child. If you do not work, then you should be paid an allowance for caring for your child’s pension (5,500 rubles with the regional coefficient), but provided that there is no other income (unemployment benefits, pension). There are no pension supplements; you need to seek advice and choose the most profitable option.

We recommend reading: Benefits for honorary donors in Tatarstan

How to recalculate your pension after registration

The increase in the survivor's pension occurs from the first day of the month following the submission of the application. To recalculate you need:

- Prepare documents that serve as the basis for receiving an increased pension.

- Contact the Pension Fund or the Multifunctional Center in person or through a legal representative, if the latter has a notarized power of attorney.

- Submit an application in the prescribed form. This can also be done through your personal account on the Pension Fund website, after pre-registration on the State Services portal.

- Provide prepared papers. It is allowed to send the entire package of documents by mail.

- Wait for an answer. If the verdict is positive, begin receiving monthly payments taking into account the recalculation made. If you refuse, receive a written justification.

Documents for adjusting pension payments

Recalculation of the survivor's pension occurs on the basis of an application submitted by the citizen. It must be accompanied by:

- personal passport (for persons over 14 years old);

- residence permit (for foreigners and stateless persons);

- birth certificate (for citizens under 14 years of age);

- death certificate of the breadwinner;

- confirmation of family ties with the deceased (birth certificate, marriage certificate);

- a certificate from the educational institution confirming full-time study;

- other documents to confirm additional circumstances (for example, a guardian’s certificate, a medical and social examination report establishing disability).

Social pension for children

- in person or through a legal representative to the Pension Fund or MFC, in this case the day of application will be considered the date of receipt of the application;

- by mail to the Pension Fund of Russia - the day of application is the date indicated on the postmark;

- through your personal account on the official website of the Pension Fund of the Russian Federation - the day of application will be considered the date of submission of the electronic application.

We recommend reading: Payment of accumulated vacation upon dismissal

federal MSE (medical and social examination) can recognize a citizen as disabled, including a minor, and assign him a group However, disabled children constitute a separate category; they are not assigned a group until they reach 18 years of age.