Survivor's pension in 2021

The social pension in 2021 is paid to children who do not have one or both parents, if it is known for sure that none of them had officially worked years, months or at least days. Full orphans are paid 10 thousand rubles, those who have lost one parent are due monthly half of this amount - 5034.25 rubles.

In 2021, the Moscow mayor's office decided not to increase social benefits for the loss of a person who acted as a source of support. The social pension is established at the federal level. It is paid from the state treasury, since the deceased did not make contributions to the Russian Pension Fund.

There are several varieties in this category. For example, if the breadwinner was an astronaut, 40% of the salary is due, a Chernobyl survivor - 260%, a security officer - 66%.

It’s difficult to calculate on your own here, since in each case you need to take into account the decreasing and increasing coefficients.

The Moscow region has established benefits for the children of security forces and military personnel who died on duty. Regions may have their own specific destinations, which you need to inquire about at your place of residence. Regional compensation can be awarded not only to those whose parents served in law enforcement agencies and the army, but also to orphans.

To determine the amount of payments, several legally established figures are used - the cost of the individual pension coefficient determined for the current year, the amount of the basic payment after annual indexation.

To calculate it, you need to know the size of the regional and federal subsistence minimum. They also change annually. The minimum depends on the subsistence minimum for the country, but the size may depend on what category the applicant belongs to and who the lost breadwinner was. These two circumstances determine which type of pension someone who is left without a source of income can count on.

The state has provided several ways to apply for payment. A person representing the interests of an orphaned child, a widow or his elderly parents can contact directly the nearest branch of the Pension Fund. Under quarantine conditions, it is better to do this remotely - through the State Services website or through your personal account on the Pension Fund website, if you already have one.

After the easing of the high-alert regime, the MFC will also be available to users. You can find out about the necessary documents in each specific case through the same electronic sources.

It is impossible to give a definite answer on the amount of the survivor's pension, since the calculation is made individually. Even if we are talking about the widow of a serviceman or security officer, much depends on his position, salary and circumstances of death. If any questions or complaints arise, you can find out by what criteria the size was determined.

In 2021, pensions and other types of social benefits will be indexed by 2.6% . In addition, the minimum amount of payments to pensioners and the level of the State Insurance Fund will be increased.

According to the information received, the minimum fixed payment for pensioners in Moscow will be 13,496 rubles. At the same time, all citizens whose payments are below the established level will be able to receive the bonus.

The amount of payments under the State Social Insurance Fund will also be increased; in 2021 it will be 20,220 rubles . The State Social Insurance Fund in Moscow sets the amount of payments for pensioners who have lived in Moscow for 10 years or more.

Survivor's pension amount

Pension payments vary depending on the types of pensions and categories of recipients.

The basic amounts of social payments are regulated by Federal Laws No. 166, 400 and some other regulations and are annually indexed taking into account inflation processes.

—>

At the same time, minimum social payments should not be below the subsistence level - in this case, the difference is necessarily compensated by the state in the form of federal or regional surcharges.

If we talk about individual types of pensions, the following picture emerges:

- for an insurance pension, the smallest base value is 2,402.56 rubles and its double amount - if the deceased was the sole breadwinner or the children were raised by a single mother or they were left orphans;

- when assigning a social pension, they operate with figures of 5034.25 rubles and 10068.53, respectively;

- certain bonuses characterize payments for groups falling under the category of government payments.

For your information! In April 2021, social pensions are expected to increase by more than 4 percent.

You should also know that in the Far North and other territories with an unfavorable climatic background, regional coefficients established at the government level apply.

What is the survivor's pension in 2021 from the Pension Fund of Russia?

Additionally, all types of social assistance, benefits and allowances for citizens living and registered in Moscow will be indexed. Next year the amount of payments will be increased by 2.6%. At the same time, all pensioners who fall under special conditions will be able to receive the bonus.

Since December 1, 2020, on the State Services information portal indicating all types of social payments and allowances. Pensioners can view the list of possible additional payments. According to Sergei Sobyanin, the average allowance will be 1,500 rubles.

A separate decision was made regarding payments for the period of self-isolation in Moscow due to the pandemic caused by the new coronavirus infection. Working pensioners will receive assistance; all payments will be made from funds from the Social Insurance Fund. To receive payments, pensioners will need to provide a sick leave certificate, which is issued to form a salary for the period of illness.

To receive bonuses, citizens will not have to do anything; all payments will be provided from the regional fund. To obtain information about additional payments and indexation of pensions, you can visit the single information portal of the State Services. The website contains a list of possible benefits for pensioners in Moscow.

If you find an error

Please select a piece of text and press Ctrl + Enter

CTRL + ENTER

As a result, the amount of the social pension is set by the state as a fixed amount and will increase as follows.

| Type of pension | until April 2021, rub. | from April 2021, rub. |

| Lost one breadwinner | 5 606,17 | 5 751,93 |

| • Those who have lost both breadwinners • Children of a deceased single mother • Children whose parents are unknown | 11 212,36 | 11 503,88 |

For citizens living in the Far North and equivalent areas, these amounts are increased by the corresponding regional coefficient.

Amount of social pension in 2021

› savings accounts

› with replenishment

› with partial removal

› with capitalization

› with monthly interest payment

› for pensioners

If you take the specific size in Tatarstan and Moscow, it will be different. Since a specific region may have its own coefficient. For example, in the Perm Territory, the amount in 2021 was 10,057.43 rubles, it all depends on the region.

There are some peculiarities in the calculation. In the situation of the loss of a breadwinner who paid military debt to his homeland, the benefit is calculated as a percentage of the amount of social pension remuneration.

On a note!

200% died in the war. 150% - death from disease as a result of military service.

When the breadwinner is included in the category of those who died from disasters (radiation, for example), his relatives (when actual dependency is confirmed) are given an increase in pension benefits: 250% for the children of a single parent or completely orphaned and 125% for the rest.

In the coming year, pension benefits for the loss of a breadwinner were indexed. The size of the increase and the period of increase will be different, depending on what pension is determined. There are 3 types:

- Insurance. It is prescribed to those whose breadwinner has an insurance record, namely, has officially worked for at least a day. It was increased in January of this year.

- Social. Prescribed to those whose breadwinner did not have work experience, or to children whose father and mother are unknown.

- State. Assigned to disabled relatives of deceased military personnel or people affected by disasters.

On a note!

Social and state pensions will be increased in April 2021.

The pension increase will be carried out in parallel with the increase in pension insurance in January 2021. According to the law, in the next 2 years, 6.3% will be added to the pension.

The payment amount from 02/01/2020 to the end of 2021 is 2457 rubles. The benefit is issued in a situation where the deceased was a military serviceman or served in the police department, a firefighter, a participant in emergency situations, liquidated disasters, or an employee of the penal system when he served in the Federal Tax Service. Funds are transferred to the account until the child turns 18 years old.

On a note!

Moreover, in case of disability, age does not matter.

Also, money is transferred until the age of 23, when persons dependent on the deceased study full-time.

Benefits due to a child upon loss of a breadwinner 2021

In different pension categories, it will take place within the usual time frame, according to the percentages included in the plan for the next three years, or determined according to Rosstat data:

- Insurance provided to those whose breadwinner had work experience. It will be indexed from the beginning of the year. It will grow by 6.3%.

- Social (for orphans who have lost their parents, if they do not have even the minimum work experience). It will be indexed from April 1, 2021. Presumably, indexation will be 1.5%, but it will be finally known at the end of the first quarter.

- State (dependants left after the death of liquidators, cosmonauts and military personnel). It will also increase by indexation by 1.5% (or by the amount determined before April).

Recipients of a survivor's insurance pension will receive increases due to an increase in the value of the pension coefficient, provided that they had earned IPC. Their number is multiplied by 5.86 rubles. (this is exactly how much the revaluation occurred).

The fixed payment will also increase, amounting to half the size of the regular insurance. Another 29 rubles will be added. All accruals are made automatically; there is no need to write an application or personally visit the nearest Pension Fund branch. The final amount depends on the amount already available and the availability of pension points for the breadwinner.

The state is not limited to assigning a pension, its annual indexation, or increasing individual components. Beneficial changes can occur both in 2021 and in subsequent years. In addition to state benefits, survivors' pension recipients are provided with benefits determined by dependent status:

- children are entitled to free travel on public transport, school meals and textbooks, medicines and dairy products (up to a certain age), and attendance at cultural events;

- dependents of a serviceman receive a one-time payment, the right to treatment in a sanatorium and free home repairs, and benefits for housing and communal services;

- Orphans are provided with funds to pay for clothes, shoes, stationery, trips to health camps, benefits for food and treatment, and education.

- Microloan

- Consumer loan

- Credit cards

- Business loan

- Mortgage

- Deposits

- Car loan

- Trade loans

- Webmoney loan

Disabled family members of the deceased can apply for benefits:

- Minor children

- Adult children under 23 years of age studying full-time

- Adult children who have become disabled under 18 years of age

- Grandchildren, brothers and sisters, if they do not have able-bodied parents (along with the children of the deceased)

- Spouse

- Parents

- Grandfather, grandmother (if they do not have relatives obligated to support them).

A prerequisite for receiving benefits is being a dependent of the deceased, but the law provides exceptions:

- Children

- An unemployed father (mother, spouse, grandfather, grandmother, brother or sister) of a deceased serviceman, caring for his children, brothers or sisters under the age of 14 (regardless of his age and ability to work)

- Parents of the deceased conscript

- Widow of a conscript who has not remarried

- Disabled parents and spouse of a deceased contract worker who have lost their source of livelihood

The size of the survivor's pension depends on several factors:

- Service by conscription or contract

- Cause of death

- For insurance or social security

- Some categories of recipients are entitled to: early retirement

- pension supplements

- receiving two types of payments at once

Survivor's pension in 2021

The parents of a deceased conscript serving have the right to receive two pensions at the same time. In addition to survivor benefits, they can receive payment:

- Old age (insurance or social)

- For disability (any type)

- For length of service in government support

- Cumulative

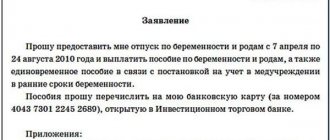

To receive a survivor's pension, you must contact: the Pension Fund, MFC, by sending documents by Russian Post or through the Pension Fund website, providing:

- Statement

- Passport (copy)

- Death certificate (or court decision) (copy)

- Birth or adoption certificate (copy)

- Depending on the recipient, provide other documents, such as a certificate from an educational institution. If documents are submitted by an authorized person, then you need to show a passport and a notarized power of attorney (original)

When making a payment, you need to select your preferred method of receiving funds:

- Via Russian Post (at the branch or at home)

- At a bank branch (to an account or bank card)

- Through a delivery organization (to your home or at the cash register) At any time, the recipient can change the method of receiving funds; you just need to write an application to the Pension Fund.

For disabled parents, a pension is assigned for the entire period of their incapacity, and for those who have reached retirement age - for an indefinite period.

If the application for a pension did not occur immediately after the death of a military man, then the payment of funds occurs for the entire period from the date of the citizen’s death, but no more than a year.

Payment of funds may be terminated if:

- Death of the recipient

- Recognition of ability to work (removal of disability)

- Official employment

There are several options for government assistance to people who have lost their breadwinner. Among them are:

- a pension assigned if the deceased (former civil servants, military personnel, testers, astronauts) died as a result of eliminating the consequences of a man-made disaster or while performing official duties;

- the insurance part, in which payments are made in any case. Its size is calculated based on the amount of contributions to the pension fund. If the deceased did not work or did not have official employment, the insurance pension will be considered social, and its size will be determined within the acceptable minimum;

- state guarantees. Provided to persons who have lost their breadwinner as various privileges and benefits. Their list is determined at the federal level. This may include free treatment, discounted travel, tuition fees at universities, etc.

In accordance with the law, children belong to a socially vulnerable group that is provided with government guarantees. In the event of the loss of the person providing for them, they are entitled to additional financial assistance. In addition to pensions, children are provided with benefits:

- free 2 meals a day in schools and preschool institutions;

- dairy kitchens until children reach three years of age;

- benefits for the purchase of medicines, children under 3 years old free of charge;

- travel on public transport;

- provision of textbooks and school supplies;

- free assistance in preparing for admission to universities;

- provision of budget places for full-time training (if available). In the absence of such places, training will take place as usual;

- admission to college on a preferential basis. First of all, children who do not have parents or have one of them are admitted;

- organization of cultural events: free visits to theaters, cinemas, museums, exhibitions.

Benefits for children in case of loss of a breadwinner

Certain benefits and survivor benefits are provided to his children.

In 2021, assistance includes several important points:

- children under two years of age have the right to receive milk from the dairy kitchen free of charge;

- schoolchildren can eat in the canteen twice every day at the expense of government funds;

- Schoolchildren are entitled to textbooks purchased at state expense;

- applicants are entitled to certain benefits upon admission to or during their studies at a university;

- children under 3 years of age have the right to free medicines;

- Children, among other things, are entitled to free visits to exhibitions and theaters.

If the child of the deceased was under 23 years of age at the time of the breadwinner’s death, he will be paid compensation in the amount of 1,500 rubles.

February 1, 2021 How much will be added for the loss of a breadwinner?

During the period of self-isolation in 2021, during which pensioners were forced to stay at home, the mayor of Moscow determined one-time payments of 4 thousand rubles to each pensioner who faithfully complied with quarantine measures.

Given a 30% increase in hospitalizations since the end of September 2020, restrictive measures were already introduced at the beginning of 2021, as a result of which citizens over 65 years of age must comply with the self-isolation regime. It is likely that during this self-isolation period , pensioners who comply with quarantine rules will also receive one-time payments in the amount of 4 thousand rubles or more.

Pension benefits are provided to the breadwinner's children under 18 years of age. If they are full-time students, financial assistance is paid to them by the state until they are 23 years old. Payment is not due if a citizen studies at an institution where he receives additional education.

Until adulthood, the pension is paid monthly. Upon reaching 18 years of age, you need to take a certificate from a higher educational institution to confirm the fact of your studies and take it to the Pension Fund of the Russian Federation at your place of residence. If a relative is studying part-time at a university or specialized institution, he is not paid a pension. If a son or daughter interrupts their studies for any reason, payments stop. The Pension Fund must be notified in a timely manner about early completion of studies, otherwise all money will have to be returned to the state.

There are state and social financial assistance. They pay money to disabled people who have lost a relative in military conflicts or during man-made disasters. State payments are received by the relatives of a soldier after his death during conscript military service or as a result of illness or injury in service.

Monthly funding is prescribed if death was associated with radiation exposure or disability for another reason. The pension is granted to the relatives of a pilot or cosmonaut who died during testing of an aircraft or a candidate for cosmonaut during space flights. The monthly payment from February 1, 2020 to January 31, 2021 is 2,457.6 rubles, if the breadwinner was a military serviceman, served in the tax police, was an employee of the Ministry of Emergency Situations, the Penitentiary Service, the Department of Internal Affairs, or a firefighter.

Amount of social support from April 1, 2021 to March 31, 2021 per child:

- Loss of one parent – RUB 5,653.72.

- Loss of two parents, if the deceased mother raised the child alone or if the parents were unknown - 11,307.47 rubles.

The social pension for the loss of a breadwinner in 2021 in Russia after the death of a citizen without work experience is 5034.25 rubles. If both parents are lost, the state pays orphans 10 thousand rubles monthly.

The size of the pension is affected by the cause of death, official position, social security and more. The applications and documents submitted are the same as when applying for an insurance pension.

There are a number of subjects in the Russian Federation in which the legislation provides for more difficult living and working conditions. There, the pension increases by the coefficient established for them.

The amount of the survivor's benefit in Moscow in 2021 is on average 10,068 rubles, but this figure is relevant for orphans, if the child has only one parent, the benefit is 5,034 rubles.

In other regions the averages are:

- in Bashkiria – 10,229 rubles;

- in Nizhny Novgorod – 11,212 rubles;

- in the Moscow region - 10,500 rubles.

In St. Petersburg, on the basis of the city’s Social Code, additional payments have been established for survivor benefits for recipients in need of outside care. An additional payment is assigned to citizens living in St. Petersburg based on an application (submitted to the Social Security Department).

The payment is determined by the pension fund. In order for the payment to be assigned, it is necessary to submit the appropriate application and package of documents, namely:

- passport or other identification document of the applicant or his representative;

- death certificate of the breadwinner;

- document on the breadwinner's work experience;

- certificates or other documents confirming relationship.

If the document is submitted not by the applicant himself, but by his representative, then the Pension Fund will require a power of attorney or other document confirming the person’s authority.

If a minor has lost one breadwinner, then the payment of a social pension will be 5,606.15 rubles, while the insurance pension will be slightly higher than 5,686.25 rubles. When both parents are lost or in the case of an incomplete family, the payment amount increases to 11,212.36 rubles. When living in certain regions, increasing coefficients may be applied, which will affect the increase in the amount of payment received.

The assignment of pension benefits in case of loss of a breadwinner, both in Moscow and in Russia as a whole, is a federal support measure and primarily depends on the following factors:

- what length of service did the breadwinner have;

- where he worked.

By answering the above questions, appropriate payments are assigned. If the deceased had work experience, an insurance pension will be paid. If there is no guard, a social pension will be assigned. If the breadwinner serves in the security forces, then it is possible to receive a state pension (this rule also applies to the liquidators of the Chernobyl accident).

Moscow is also characterized by the presence of additional benefits for pensioners receiving a survivor's pension. Persons have the right to free travel on public transport. Certain categories of minors (disabled children and people with disabilities since childhood) receive monthly compensation. When children attend school, they are guaranteed free hot meals 2 times a day.

In March 2021, the Government of the Russian Federation decided to index the paid social pensions. The relevant resolution defines an indexation coefficient of 1.061, which begins to be applied from 04/01/2020.

The period of the fight against Covid has introduced additional concessions for survivors' pension recipients. Such citizens can count on receiving installment plans with a maximum period of up to 07/01/2022 upon presentation of enforcement documents (loan debt and other payments).

The latest news from the State Duma allows us to predict, albeit a small, further increase in payments for the loss of a breadwinner.

Knowing your rights and observing the necessary conditions, you can and should receive the necessary support from the state. There is nothing wrong with support measures; on the contrary, these mechanisms help to cope with a difficult life situation.

List of required documents to receive a survivor's pension

When applying for a social pension, in addition to the application, you must submit the following documentation package:

- certificate of death that befell the breadwinner;

- all the “papers” indicating a relationship with him - birth certificates, adoption certificates, certificates of residence, and so on;

- for 18-23 year old full-time students - relevant certificates from higher educational institutions;

- if necessary, documents authorizing the authorized representative.

If the applicant is not a citizen of Russia, a residence permit or temporary registration from the place of stay will be required.

If the submitted package was not complete, the applicant can take advantage of additional time, the length of which cannot exceed three months: in this case, the start of pension payments will be the time specified in the application.

When it comes to an insurance pension, you will need to provide documents confirming the work experience of the deceased.

Will there be an increase in survivor pensions from 2021?

Social supplement is part of the benefit that the state provides to a person who has lost a breadwinner. It is accrued monthly and only to disabled citizens who, for various reasons, cannot go to work to support themselves. The additional payment is given regardless of whether the recipient has insurance experience or whether he has previously transferred contributions to the Pension Fund.

Important! If the applicant is an adult, able-bodied person, then upon his official employment, the survivor’s pension is withdrawn. Until the child reaches 18 years of age, state subsidies will be accrued in full.

The size of the social pension directly depends on the territory of the Russian Federation in which the deceased lived and on the value of the subsistence minimum (hereinafter referred to as the subsistence level) established in this region. Dependents of the deceased who live in the capital regions of the country and where the local budget is good are in a more advantageous position.

If the amount of the assigned social pension is less than the minimum wage, then the applicant has the right to submit documents to the Pension Fund and receive the missing amount in the form of a social supplement.

The largest increase awaits the children and widows of Interior Ministry employees and military personnel who died in the line of duty. You can submit documents in the same way as when calculating your pension initially.

If the applicant is initially savvy in the law and knows that he is entitled to a certain amount of pension (at least PM), then the paperwork can be completed with a one-time application to the Pension Fund. In order to arrange everything correctly, you need:

- an application requesting additional social benefits to the existing survivor’s pension (this is done for the child by his representative);

- confirmation of the status of the deceased (death certificate of the breadwinner);

- a document confirming marriage with the deceased or another degree of relationship (children, parents, etc.);

- adoption status if the deceased had an adopted child;

- certificates of full-time study at a university (if the recipient child is still studying, although he is 18 years old).

Many people in 2021 are interested in the question: how much is such an important benefit in monetary terms? Today, the social pension, which is due in the event of the loss of a breadwinner, is experiencing an increase compared to last year. So, the minimum amount that a survivor can actually receive today is 8,700 rubles. If there is a death in the family of a serviceman, the pension increases by another thousand. Many regions introduce their own correction factor when calculating pension accruals. Therefore, it is better to check with the Pension Fund at your place of residence to find out exactly what amount is required in a particular city. In general, separate conditions apply for residents of the Far North, and in Moscow a special allowance is also being introduced for residents who have been in the city for more than 10 years.

The survivor pension in 2021 has the following types:

- insurance;

- social;

- state

Insurance compensation is provided if the person has no work experience. Its period is not important. State payments are made to the relatives of a military man or to the widow of Chernobyl victims. This category includes victims of a radiation disaster. Social assistance is established if the citizen did not have a job.

The following categories of citizens apply for registration:

- minor citizens without official parents;

- children of single mothers;

- people who are on welfare and have committed the murder of a relative;

- children of military personnel who took part in hostilities and died.

The procedure for calculating and terminating a survivor's pension

How is the survivor's pension calculated? Regardless of its type, processing payments is the prerogative of the local branch of the Pension Fund or the Multifunctional Center (if there is an appropriate agreement with the Pension Fund) and is not limited by any period: an application can be submitted at any time after the death of the breadwinner, but if this period exceeds 12 months, then payments are accrued a year before the application is received.

Another important point: if the recipient of the benefit is permanently disabled, the pension will be paid to him until the end of his life, in other cases - only for the period of incapacity.

In addition, it should be borne in mind that once one of the compensations is received, the second cannot be assigned. Instead, the amount of the second benefit may be increased.

The procedure is as follows:

—>

- The applicant for pension provision or his official representative collects the necessary documents. This package, together with the application, is submitted to one of the above authorities in any convenient way - personal visit, registered postal order, e-mail;

- within ten days, an appropriate decision is made and the amount of the EDV is calculated;

- The pensioner agrees on an acceptable option for receiving benefits: bank card, current account, cash - to the house.

Let's talk now about stopping payments. This happens in the same cases as with disability or old age pensions, and also when there are additional grounds, such as:

- the person receiving compensation benefits has reached the age of majority, acquired the ability to work, or is officially employed;

- the recipient has lost his disability status;

- the child, whether in care or adopted, has reached his fourteenth birthday.

Another case when the provision of benefits is terminated: the recipient was the widow of a military man in military service who decided to tie the knot again.

In addition, the procedure involves a six-month suspension of compensation payments in the following cases:

- there are no documents confirming the fact of study at the relevant institution - as mentioned above;

- the pensioner can no longer legally reside in the territory of the Russian Federation or has left its borders by changing his place of permanent residence

- the citizen did not receive financial support for six months.

Further course of action: after the interested party (his legal representative) submits the necessary documents to the authorized body, which it must consider within five days, compensation payments can be resumed. Of course, if a positive decision is made.

By the way! In this case, indexation with recalculation will be taken into account, and the shortfall can be paid in a lump sum!

The formulas for calculating the amount of insurance payments are somewhat different depending on whether the person was retired at the time of his death or not?

In the first case, the numerical expression of the benefit will be equal to the product of the independent pension rate and the tariff applied on the day the benefit is assigned; in the second, its value will depend on the individual pension coefficient applied to the deceased, its currency equivalent and the number of people dependent on the deceased.

Payment of child benefit and survivor's pension

A relative is deprived of the right to receive money if he lives abroad. This also applies to children under the age of majority.

The size of the survivor's pension in 2021

The amount of the survivor's pension in 2021 is set by the state. Its size varies depending on the type obtained. Since 2018, the minimum amount in Moscow is 11,815 rubles. In 2021, pension benefits were changed to 17,400 rubles for special categories of people. This list includes incompetent citizens who have lost their breadwinner. Orphans without parents are entitled to 10,068.53 rubles.

Every 12 months, the ministry adds pension benefits throughout the country. In regions they also add a premium based on local coefficients.

The amount of the survivor's pension changes annually. From April 2021, indexation and an increase in payments by 4% are provided. If a person has lost a parent, he is entitled to 5,230 rubles. Full orphans will receive 10,480 rubles. For residents of distant regions, pensions are recalculated by the local government.

A survivor's pension is established for the following reasons:

- due to the death of the breadwinner, which is confirmed by a certificate;

- according to the testimony of the trial and the announcement of the death of a person due to his disappearance.

A person who applies for benefits provides personal documents. It is necessary to bring certificates of place of registration and residence. In addition, you need the child’s documents and his place of registration.

Further instructions:

- prepare a list of documents.

- visit the Pension Fund;

- write an application manually or online;

- collect documents and submit them to the company office.

For a child under 14 years of age, documents are prepared by guardians. The list also includes parents or adoptive parents. After 15 years, a person can independently use the money provided by the state as assistance.

If parents are divorced

According to the law, divorced people are not considered an obstacle to receiving money. Despite this, it is possible to receive a pension for a common child.

To apply for an insurance pension in the event of the loss of a breadwinner, you must make a request to the pension fund department. An application can be submitted at any time after the death of a relative. Payments are provided from the day the user applies. Submit your application online through the official website or your personal account on the platform. Funds are received at the post office or sent to a bank card. Minor citizens cannot receive money on their own. Parents are responsible for them. For registration, they provide a passport and a death certificate of a relative. In addition, they bring an act of communication with the deceased person.

Budget money is sent to the user's current account. They use the Mir payment system.

How is it calculated?

The survivor's pension in 2021 is accrued to the local post office, which is located at the place of residence or to the balance of organizations involved in organizing the delivery of pension payments to your home. In the case of mail, delivery of benefits to the apartment is carried out on the basis of a schedule according to which an individual date of receipt is assigned, while payments can be transferred within the delivery period.

It can be transferred to a bank account or a card issued to it for the convenience of withdrawing funds. The pension is delivered on the day the funds are received, transferred by the territorial representative office of the pension fund. Money is available for daily withdrawal, but after it is credited. Financial receipts coming to a pensioner’s account at a credit institution are not subject to a commission fee.

The choice of the method of calculating benefits or changing it is carried out by notifying the Pension Fund (PFR) using two methods:

- by writing a request to the territorial body of the Pension Fund that assigned the pension and filling out a form to choose the method of calculating funds;

- electronic notification sent through your personal account on the pension fund website.

If the recipient of the pension is a minor child, then the pension under 18 years of age can be transferred both to his personal bank account, registered by an official representative (adoptive parent or trustee), and to the balance of the guardian’s card. Upon reaching 14 years of age, he has the right to independently receive the established pension at the post office or to a bank account.

- Treatment of dysentery in adults at home. Drug and alternative treatment of dysentery in adults

- What are the benefits and how to use grape oil for facial skin?

- Vitamin B1 - instructions for use in tablets and ampoules. What foods contain thiamine and why is it needed?

Additional payments up to the cost of living

This type of compensation is provided to pensioners who are disabled and whose total financial support is below the level of the subsistence level (SMP) or (SMG) - a citizen and the average salary in the region of residence. There are two types of surcharges:

- federal surcharge. It is accrued by local branches of the pension fund when the amount of total material support is below the subsistence level, which is established in the region and does not reach the PMP (the subsistence level of a pensioner) in the country.

- regional. Accrued by a representative of the social protection committee with a slight increase in the PMP in a constituent entity of Russia compared to the same indicator for the country, but in total lower than the regional PMP.

For the working-age population who is eligible to receive benefits, adjustments to additional payments are made based on the average salary.