What federal payments and benefits can you get for your third child?

At the birth of a third child in the family, parents have the right to the same payments and benefits as for previous children. In particular, these include:

- maternity benefits;

- one-time payment for early pregnancy registration;

- lump sum payment at birth;

- child care allowance up to 1.5 years;

- maternity capital (if the parents did not register it for their second child);

- Putin's payments from 3 to 7 years inclusive - for low-income people.

In addition, at the federal level, the following benefits are also provided for families with three children:

- repayment of part of the mortgage debt in the amount of 450,000 rubles from the federal budget;

- perpetual preferential mortgage rate 6%;

- benefits for paying property and land taxes;

- increased standard tax deductions for the third and subsequent children (summed with deductions for previous children);

- accounting for parental leave in the pension period;

- early retirement at age 57.

Later in the article we will look at them in more detail.

What changes will there be?

Amendments to the bill providing for expanded use of maternity capital are being considered in the State Duma. If they are accepted, the amount allocated by the state can be spent on purchasing a car. For large families this will be a very useful acquisition.

When a baby is born, monthly payments to families will increase in 2021, and paid maternity leave will be extended. The new law was approved by the State Duma of the Russian Federation and will come into force on October 1, 2019.

In addition, every year child benefits are indexed to the level of expected inflation.

Support for a young mother

Today there are the following types of state support:

- If you register your pregnancy with a medical institution in a timely manner – 630 rubles.

- Maternity accruals.

- A one-time payment at the birth of a baby is about 16,750 rubles.

- Maternity leave to care for a baby up to one and a half years old - from 3,150 to 20,000 rubles.

- The next stage (1.5-3 years) was paid 50 rubles/month, however, from January 1, 2019, benefits will be increased to the minimum subsistence level.

- Assistance at the birth of all subsequent children.

- The allowance for a single mother for minor children (under 18 years old) is about 280 rubles.

A separate item is maternity accruals. They depend on the size of the mother’s salary for the last two years in accordance with the minimum wage. In 2021, the mother's salary will also affect the amount of payments, since maternity accruals amount to 40% of the official salary.

Mortgage rate

This year, a state program to subsidize mortgage loans began to operate. This means that thanks to government assistance to families with many children, mortgages, and therefore the opportunity to improve their living conditions, have become more accessible. The rate will be 6%. However, there are a number of conditions for those who want to take advantage of the low interest rate. The apartment must be purchased on the primary market, and the down payment must be paid with personal funds (at least 20%).

Registration of a plot of land

The land plot of a large family in 2021 will not exceed 15 acres. To obtain ownership of a plot of land, the following is taken into account:

- Availability of parents' marriage certificate issued by the relevant authorities.

- Presence/absence of other land in ownership.

- Joint residence of family members in one apartment (i.e. children live with parents).

- Availability of citizenship and residence in the country for at least 5 years.

Maternity benefit for the third child

Maternity benefits are paid exclusively to the mother of the baby . It was specially designed to compensate women for lost earnings, because in the late stages of pregnancy it is already difficult, and sometimes impossible, to work.

In addition, after giving birth, the mother needs time to recover and care for the newborn.

Payments are due to women:

- officially employed;

- full-time students (both on a budgetary and commercial basis);

- serving in law enforcement agencies or in military service under a contract.

As for unemployed women, this benefit is given only to those who were fired due to the liquidation of the organization. But only on the condition that they managed to register as unemployed at the employment center within 1 year after their dismissal.

Maternity benefits are paid to these categories and when adopting a child under three months old. Maternity benefits are paid immediately for the prenatal and postnatal periods in full .

The amount of benefit for each woman is calculated individually.

For workers, the benefit is assigned in the amount of 100% of the average daily earnings for the 2 years preceding the sick leave.

The duration of leave depends on the duration of sick leave for pregnancy and childbirth. In a normal situation, the doctor will issue it for 140 days . If the birth takes place with complications or ahead of schedule, then by 156 days . And if a woman gives birth to twins (triplets, etc.), then paid sick leave will last 194 days .

To calculate the average daily earnings, you need to add up the entire official salary of the maternity leaver for the 2 years preceding the year of maternity leave. Divide the resulting amount by the number of days in past years - usually by 730 or 731 if there was a leap year. However, sick days and previous maternity leave days are not taken into account.

If the current maternity benefit is insignificant due to earlier maternity leave, the earlier years can be used to calculate the new benefit. But only on the condition that the amount of benefits increases from this.

When a woman works part-time for two or more employers for two years, she can receive maternity benefits for all places of work.

If a woman’s work experience is less than 6 months or her average earnings for the billing period are less than the minimum wage (minimum wage) established on the date of maternity leave, benefits are calculated based on the minimum wage.

From January 1, 2021, the minimum wage is 12,130 rubles. Accordingly, the minimum amount of maternity benefits in 2021:

- for workers - 55,830.60 rubles. ;

- for persons who voluntarily insure themselves with the Social Insurance Fund (individual entrepreneurs, lawyers, notaries, etc.) - RUB 54,780.60.

The amount of the minimum benefit may further decrease. For example, if a woman does not fully use maternity leave or has adopted a newborn.

In addition, the law establishes the maximum amount of maternity benefits. In 2021 it is:

- for standard maternity leave - 322,191.80 rubles ;

- for complicated childbirth - 359,013.72 rubles ;

- for multiple pregnancy - 446,465.78 rubles .

Maternity benefits for students, employees and the unemployed are calculated differently.

Students will receive the full amount of the scholarship, and employees will receive the full amount of money in proportion to the length of maternity leave.

The unemployed are paid benefits in a specific amount, which is indexed annually on February 1. In 2021, it amounted to 675.15 rubles per month.

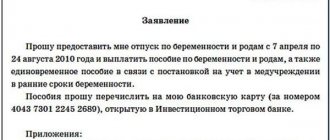

To assign benefits, a woman applies for a sick leave certificate to a doctor. It will indicate the date of maternity leave and its planned duration. This sick leave must be taken to the accounting department for work/study/service, and for the unemployed - to social security, where they fill out the appropriate application.

Benefits for women registered in the early stages of pregnancy

To ensure that pregnant women begin seeing doctors on time, the state has approved a special one-time payment - a benefit for women who register with a medical organization in the early stages of pregnancy.

The following are entitled to it:

- women working under an employment contract;

- unemployed women laid off due to liquidation;

- those who have ceased to operate as individual entrepreneurs;

- full-time students;

- employees in law enforcement agencies or in the army under contract.

To receive benefits, you must register for pregnancy before 12 obstetric weeks .

The lump sum benefit is assigned and paid at the place of assignment and payment of maternity benefits. Accordingly, you must apply for benefits at your place of work, study, service or social protection authorities.

The basis for the appointment is a certificate from the antenatal clinic or other medical organization that registered the woman for pregnancy in the early stages.

This benefit is assigned and paid simultaneously with maternity benefits. That is, this certificate is issued together with sick leave for pregnancy and childbirth.

If the certificate is submitted later, the benefit will be assigned and paid no later than 10 days from the date of registration of this certificate.

Unemployed women are granted benefits no later than 10 days from the date of registration of the application with all the necessary documents. Social security authorities pay benefits by mail or to the woman’s personal account (personal card) no later than the 26th day of the month following the month of registration of the application with all the necessary documents.

The amount of the benefit for registration in the early stages of pregnancy in 2021 is 675.15 rubles.

The benefit is indexed annually along with other social payments.

EDV - regional support for large families

Regional authorities may introduce their own measures to support families with children, which become an addition to the federal program. A similar measure is a monthly cash payment. To understand under what conditions this financial assistance is prescribed to large families and in what volume it can be paid, you can check the regulations of the constituent entity of the Russian Federation. Employees of regional social protection authorities can review applications and check the attached documents in order to make a decision on the accrual of EDV.

Allowance for caring for a third child up to 1.5 years old

A benefit for a third child can be applied for by either the mother or another relative (father, grandmother, aunt, etc.) who is actually caring for him.

Benefits for working citizens are paid only when taking parental leave.

At the same time, the person caring for the child can continue to work only part- time or at home (i.e., remotely).

For workers, this benefit is provided monthly in the amount of 40% of the employee’s average salary for the 2 previous calendar years of work .

At the same time, there is a legal minimum that will be assigned to the employee if his salary was below the established minimum value. Also, the minimum amount of benefits will be received by:

- unemployed persons;

- IP;

- those engaged in private practice (lawyers, notaries, etc.).

From June 1, 2021, the minimum allowance for caring for a third child under 1.5 years old is 6,752 rubles. It is the same for all of the above categories of citizens.

If a person takes care of two or more children under the age of 1.5 years, then the benefits for each of them are summed up . But in the end, the benefit should not exceed 100% of average earnings (for officially employed people).

The maximum amount of benefits for caring for the 3rd child in 2021 for officially employed people who are on parental leave is RUB 27,984.66 . For other recipients, the maximum payment amount is RUB 13,504.00.

How to return from 50 to 90% of the cost of a trip to DOL and get a discounted trip

Which children from the Moscow region are entitled to preferential vouchers to children's health camps (DOL), where to apply for them and how to compensate for the cost of an already paid vacation, read the material mosreg.ru.

Let us help you figure it out: the Family Mortgage program in the Moscow region>>

What benefits are provided?

Source: Ministry of Investment, Industry and Science of the Moscow Region

Measures of social support for certain categories of minor citizens in the Moscow region include the provision of preferential (free) vacation and health vouchers for children, as well as full or partial compensation of the cost of vouchers for children already paid by parents.

You can use the right to receive a free trip or compensation for children's holidays once a year for each child who fits into a preferential category.

Special project of the mosreg.ru portal “We are parents in the Moscow region”>>

Who is eligible for benefits?

The following categories of citizens under 18 years of age and residing in the Moscow region have the right to receive free vouchers for children's recreation and health resorts:

- children with chronic diseases who are in inpatient educational institutions, social services, social rehabilitation centers, shelters;

- disabled children, as well as the person accompanying them;

- orphans and also children who were left without parental care;

- other categories of children in difficult life situations.

The right to full or partial compensation for the cost of a paid trip to the DOL can be exercised by parents or legal representatives of the following categories of minor citizens:

- children from large families;

- children of fallen military personnel;

- disabled children, as well as the person accompanying them;

- children of civil servants;

- other categories of children in difficult life situations.

Let us help you figure it out: annual payment from regional maternity capital>>

Conditions for compensation

Source: , press service of the Commissioner for the Protection of the Rights of Entrepreneurs in the Moscow Region

The amount of compensation is determined taking into account the average per capita income of the child’s family and the per capita subsistence level established for the Moscow region.

Full compensation for the cost of the trip is provided to children from families where the average per capita income does not exceed the subsistence level. In this case, the amount should not exceed the cost of the trip established in the Moscow Region for calculating compensation.

Partial compensation for the cost of the trip is provided to children from families where the average per capita income exceeds the subsistence level. The return can range from 50 to 90% (depending on the size of the family income).

Vouchers lasting no more than 24 days of stay in children's recreation and recreation organizations are subject to compensation.

When calculating compensation, the cost of the trip does not include transportation costs (delivery of the child to the vacation spot and back), as well as the costs of excursion activities organized during the vacation.

How to get a housing subsidy for the birth of triplets in the Moscow region>>

Where and how to get

Source: account of the press service of the governor and government of the Moscow region on the Instagram social network

An application for a discounted voucher or reimbursement of the cost of a paid voucher for a children's holiday, together with a package of necessary documents, can be submitted by a parent or other legal representative of the child through:

- territorial body of social protection of the population;

- any branch of the MFC of the Moscow region;

- in electronic form through the RPGU portal.

The term for queuing for a preferential voucher is no more than 6 working days from the date of registration of the application with the social protection authority. Vouchers are provided based on availability and on a first-come, first-served basis depending on the date of application.

The period for consideration of an application for compensation is no more than 10 days from the date of registration of the application. Compensation is paid to the bank account specified by the applicant within 10 days from the date of the decision on payment.

How can parents in the Moscow region receive compensation for kindergarten fees>>

What documents are needed

Source: Photobank of the Moscow region

Package of documents to receive a free trip:

- application of the established form;

- passport or other identification document of the applicant;

- birth certificate of a child under 14 years of age;

- passport of a minor over 14 years of age;

- a document confirming the child’s place of residence in the Moscow Region;

- documents confirming the right to receive a discounted voucher.

Package of documents for receiving compensation for a trip:

- application of the established form;

- passport or other identification document of the applicant;

- birth certificate of a child under 14 years of age;

- passport of a minor over 14 years of age;

- document confirming place of residence in the Moscow Region;

- contract for the purchase of a voucher;

- check/receipt confirming payment for the trip;

- a coupon confirming the child’s stay in a child care facility or sanatorium;

- documents confirming partial compensation for the cost of the trip from other sources (if available);

- documents confirming the right to receive compensation;

- certificates of family income three months before the month of application

- Bank details of the child's legal representative.

When they can refuse

Source: Ministry of Investment, Industry and Science of the Moscow Region

Queuing up for a discounted voucher or payment of compensation for paid children's holidays may be denied in a number of cases if:

- the package of required documents was not provided in full;

- the child does not have a place of residence in the Moscow region;

- apply for the benefit again within one year;

- documents were provided with corrections, blots, errors, or unreadable text;

- the documents contain unreliable or contradictory information;

- the minor is recognized by law as legally capable.

How to sell an apartment in the Moscow region purchased with the participation of matkapital>>

One-time payment upon birth of a child

The baby who is the third born in the family has the right to receive a one-time birth benefit. This benefit is paid in Russia for each child , excluding :

- family income;

- birth order of children;

- social status of the family.

When two or more children are born in a family, a woman becomes entitled to this payment. Payment is also due if the baby was born alive but died immediately after birth.

From February 1, 2021, the lump sum benefit for the birth of a child is RUB 18,004.12. This amount is the same for all categories of citizens, regardless of the fact of employment.

Like other benefits, the lump sum payment is indexed annually in accordance with the actual level of inflation.

One of the child’s parents (guardian/adoptive parent/adoptive parent) can apply for benefits at their place of work (service - for military personnel) or to the social security authority (if both parents do not work and do not pay contributions to the Social Insurance Fund).

General forms of benefits available to large families

Large families have the right not only to additional support from the country and region, but also to receive general benefits. When a child is born, such a family may qualify for the following additional benefits:

- One-time benefit in connection with the birth of a child. The size of such payment does not depend on the number of children. In 2021, the benefit was indexed. It increased to 1,635 rubles 33 kopecks. Additionally, the region may provide bonuses to the amount of such payment.

- Care allowance for up to 1.5 years. Not only the mother, but also the father can receive such a benefit if he takes appropriate leave. But both parents cannot receive money at the same time. Even the unemployed are entitled to such a payment, but they no longer receive it at their place of work, but through social security. For large families, this payment per month is 6,131 rubles 37 kopecks.

Additionally, some regions set their own allowances and payments to support large families. Here you need to be guided by regional regulations. But such payments are not indexed in accordance with the established federal coefficient. Their size can be increased at the regional level.

Similar articles

- Benefit at the expense of the employer up to 3 years

- Do large families pay transport tax?

- Child benefit up to one and a half years: how to calculate

- Do large families pay transport tax?

- Deduction codes for children 2018

Federal maternity capital for the third child

In general, maternity capital under the federal program is not provided for the third child. It is issued only for the first and second child.

However, if the applicant applying for maternity capital has not applied for it before for some reason, he can receive capital for a third child.

Let us remind you: maternity capital for a child can be obtained only if the applicant and the child are citizens of the Russian Federation.

You can receive federal maternity capital at the birth of your third child if:

- 1. The two older children were born before 2007 (before the adoption of the Law on Maternal Capital).

- 2. The family could not take part in the program.

In this case, the amount of maternity capital will be 466,617 rubles , and 616,617 rubles after 01/01/2020.

If the second child appeared after 01/01/2007, and the third child after 01/01/2020, but the applicant did not apply for maternity capital, he is entitled to it for the second child in the amount of 466,617 rubles . There will be no additional payment of 150,000 rubles for a third child .

Regional benefits and benefits for the third child

There are also regional benefits:

- regional maternity capital (issued in addition to federal);

- free plot of land (in some regions, instead of land, large families are entitled to monetary compensation );

- monthly benefit up to 3 years of age (recommended by Decree of the President of the Russian Federation dated May 7, 2012 No. 606);

- tax benefits;

- priority admission of children to kindergarten;

- free meals for schoolchildren and students of colleges, technical schools, schools;

- free clubs and sections;

- free school and sports uniforms for the entire period of study at school;

- free medicines for children under 6 years old according to doctor's prescriptions;

- free travel on public transport;

- the opportunity to receive a voucher for health improvement;

- free entry to museums, exhibitions, parks 1 day per month;

- discount on utility bills - no less 30%;

- preferential loans, subsidies, interest-free loans for housing construction and the purchase of building materials;

- priority allocation of garden plots;

- employment of parents with many children, taking into account their needs and capabilities.

If parents with many children want to organize a farm, they can count on:

- allocation of land for these purposes;

- land tax benefits;

- financial assistance or interest-free loans to reimburse the costs of running such a household.

If parents with many children want to implement another small business option, they are entitled to:

- rent benefits;

- full and partial exemption from paying registration fees for entrepreneurs.

1.5 million for the third child

Many families in which a third child was born are interested: will the state pay 1,500,000 rubles for him? Answer: no , it won't. Russian legislation does not provide for .

This question arises due to the fact that earlier draft law No. 571638-6 “On Amendments to the Federal Law “On Additional Measures of State Support for Families with Children” was submitted to the State Duma. He proposed to issue maternity capital only for the third child, but in the amount of 1.5 million rubles.

However, this bill was rejected back in 2015, and the maternity capital program was first extended for second children, and then expanded not to third children, but to first children born in 2021.

Who receives targeted assistance?

Benefit categories of Russian families can count on benefits of this type, which include:

- having many children or single parents;

- families with children with disabilities;

- families in which at least one parent is disabled of the 1st or 2nd group;

- unemployed parents in families with minor children.

Preferential categories of Russian citizens classified as low-income, including disabled people of the 1st and 2nd groups, also have the right to apply for benefits from the state. And also with disability of the 3rd group and various physical deviations.

Allowance for a third child under 3 years of age

In accordance with Decree of the President of the Russian Federation dated May 7, 2012 No. 606 “On measures to implement the demographic policy of the Russian Federation,” an allowance is provided for the third child until he reaches 3 years of age.

This payment is not federal, but is only recommended for establishment in the regions. However, in constituent entities of the Russian Federation with a low birth rate (where on average there are less than two children per woman of reproductive age), this payment is co-financed from the federal budget.

The size of the benefit and the frequency of its payment are established by regional legislation. For 2021, 75 regions can participate in this program .

How to get financial assistance

To receive targeted assistance, you must contact the social protection service at your place of residence. Immediately before applying, you need to collect a package of mandatory documents confirming the applicant’s preferential status.

List of documents

- application for assistance;

- copies of passports of all family members (children under 14 years old - copies of birth certificate);

- marriage certificate (if single-parent family, then divorce, death of a spouse, court decision on deprivation of parental rights);

- extract from place of residence;

- certificates of real estate owned by the family;

- certificates of income of employed family members for the last 3 months;

- as well as some other papers, the list of which will be determined by the specific region of residence (to clarify the list of documents, you must contact the social protection service).

Conditions of receipt

This type of material support is provided subject to certain conditions being met by citizens:

- Support ends when the family leaves for permanent residence outside the Russian Federation.

- When family income exceeds the subsistence level established in the region.

- If deliberately false information is found in the provided documents.

In addition to the above conditions, in some regions of the country, including Moscow and the region, in order to receive targeted assistance, it is necessary to have a social contract, which is concluded between a large family and the local municipality. The content of the social contract is described in Article 8.1 of Federal Law No. 178 “On State Social Assistance” dated July 17, 1999.

The indicated documents, together with the application, are submitted to the social authorities. protection at the place of residence. The application indicates the personal information of the beneficiary - passport details with registration, signature and contact information for communication. The processing time for an application takes on average from 3 days to a month.

How regularly is assistance provided?

Targeted assistance for large families can be either regular and paid monthly, or have a one-time basis. In each individual case, the size, type and frequency of financial support payments will depend on a number of factors:

- the region in which a person lives;

- the presence or absence of other benefits and allowances.

In addition, such support is not always expressed in monetary terms, and can have a natural basis - clothes and shoes, school uniforms, as well as basic necessities.

Regional lump sum benefit for the birth of a third child

In a number of regions, upon the birth of a third child, the family is entitled to a lump sum payment. The decision to assign such benefits to families is made based on financial capabilities and priority areas for the development of the region. Payment amounts vary in different regions of the Russian Federation.

The conditions for receiving this benefit are:

- financial well-being of the family;

- family composition;

- the age of the woman who gave birth (for example, up to 30 years).

- This benefit is aimed at stimulating the birth rate in certain regions, reducing the number of abortions and maximizing the reproductive potential of women of childbearing age.