What payments are included in the calculation of vacation pay in 2020-2021?

According to the current labor legislation, each employee has the right to use annual leave (Article 114 of the Labor Code of the Russian Federation), which arises no earlier than 6 months after the start of work with a particular employer, which does not prevent its early provision (Article 122 of the Labor Code of the Russian Federation).

This leave time is subject to payment by the employer. The normal duration of vacation is 28 calendar days (Article 115 of the Labor Code of the Russian Federation), but it can be longer due to:

- additional leave given due to special working conditions (Articles 116–119, 348.10 of the Labor Code of the Russian Federation);

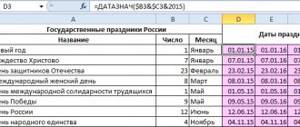

- non-working holidays falling within the vacation period (Article 120 of the Labor Code of the Russian Federation).

It is possible to split the vacation into several parts (Article 125 of the Labor Code of the Russian Federation), with each of them paid separately. If an employee quits without taking advantage of his right to annual leave, he is entitled to compensation for this (Article 127 of the Labor Code of the Russian Federation), the calculation of which is done according to the same rules as the calculation of regular vacation pay.

Payment for the period while on vacation is determined based on average earnings, the uniform general rules for calculating which are contained in Art. 139 Labor Code of the Russian Federation. The rules are as follows:

- The calculation of this earnings includes all payments provided for by the employer’s wage system, regardless of the source from which they are made.

- For the calculation, they take the actually accrued income and the actual work time for the 12 calendar months preceding the month of the event for which the average earnings are calculated. But the employer can approve a different period for calculation if this does not lead to a worsening of the employee’s situation.

- Average daily earnings are defined as the total amount of income for the calculation period (calculation period), divided by 12 months and by the average number of calendar days in a month (29.3).

- The responsibility for establishing the nuances of calculating average earnings is assigned to the Government of the Russian Federation.

Thus, bonuses included in the wage system (Article 129 of the Labor Code of the Russian Federation) are taken into account in income to calculate average earnings when calculating vacation pay. The list of bonuses taken into account in this system must be recorded in at least one of the following documents: (Article 135 of the Labor Code of the Russian Federation):

- contract of employment;

- wage regulations;

- regulations on incentives (bonuses);

- collective agreement.

For more information on the preparation of a document reflecting the remuneration system, read the article “Regulations on remuneration of employees - sample 2020-2021” .

What governs the process of including premiums in the calculation?

The provisions on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 (hereinafter referred to as Regulation No. 922), are devoted to the nuances that are important for calculating average earnings, and it is this that specifically talks about bonuses.

Prizes are mentioned in sub. “n” clause 2 of Regulation No. 922, which notes that these payments must be provided for by the current wage system. But the main points regarding bonuses are set out in paragraph 15 of Regulation No. 922. They prescribe bonus payments accrued:

- Monthly, take into account their actual amount, but not more than one for each month of the calculation period in relation to each of the bonus indicators.

- For a period of work of more than a month, include in the calculation in their actual amount in relation to each of the bonus indicators, if the period of their accrual is not longer than the duration of the calculation period, otherwise - in the amount corresponding to the monthly part of the bonus for each of the months constituting the calculation period.

- For the year preceding the event with which the calculation is associated, take into account their actual amount, regardless of when this payment is actually accrued.

We talk about other types of bonuses in the material “What types of bonuses and employee benefits are there?” .

The general rule for bonuses, established by clause 15 of regulation No. 922, is the need to take into account the amount of the bonus in proportion to the time actually worked in the calculation period, if this period has not been fully worked out or there are periods in it that are not subject to inclusion in the calculation (clause 5 of the regulation No. 922). This rule applies provided that at the time of calculating the bonus, the actual time worked was not taken into account. Bonuses that take into account the share of time worked usually (but not always) include those accrued over a certain period, for example, monthly, quarterly, annual.

The following periods are not subject to consideration when determining average daily earnings (clause 5 of Regulation No. 922):

- maintaining average earnings;

- being on sick leave;

- failure to perform work due to the fault of the employer or for reasons beyond the control of either party;

- use of additional days off intended for caring for disabled children;

- other paid or unpaid periods of release from work.

The proportion taking into account the share of time worked for the distribution of each bonus is calculated as the ratio of working days actually worked in the calculation period to the total number of working days included in this period (letter of the Ministry of Health and Social Development of the Russian Federation dated June 26, 2008 No. 2337-17).

What bonus rules are important for calculating holiday pay?

So, according to the rules stated above, the bonus should be taken into account when calculating vacation pay if it:

- taken into account in the wage system;

- named in the employer’s internal regulations reflecting the bonus procedure;

- accrued in the calculation period or must be taken into account (annual premium) in this period;

- cannot be regarded as a duplicate payment of the same frequency for a similar bonus indicator in the same period;

- recalculated in proportion to the share of time actually worked during the calculation period, if such recalculation is necessary in relation to it.

Of the duplicate payments, the current rules do not prevent the choice of the largest one. The rules for such a choice should be reflected in the internal regulations on bonuses.

The possibility of accepting bonuses in the calculation of average earnings in full or in part depends on three circumstances:

- whether the calculation period has been fully worked out;

- whether the entire period for calculating the premium is included in the calculation period;

- bonuses were calculated in proportion to the share of time worked or without taking this ratio into account.

One-time bonuses

Quite often, bonuses are given to employees, but irregularly, usually these accruals occur in connection with some events and are not of a permanent nature, hence the question: are they taken into account when calculating vacation pay. In fact, such payments are included in the employee's average annual income when reflected in the financial documents and are taken into account when calculating vacation pay. The main condition is that they must be paid during the billing period, that is, the one for which vacation pay is calculated.

Accounting for monthly and quarterly bonuses

Depending on the combination of the three above circumstances, the following options for accounting for both monthly and quarterly bonuses are possible:

- The full amount of the premium will be taken into account if:

- the entire calculation period has been worked out, and neither the period for which the bonus was accrued nor the fact of accounting (non-accounting) of time worked when calculating it will matter;

- the entire calculation period has not been worked out, but the entire period for calculating the bonus falls within it and when calculating the bonus, the actual time worked is taken into account;

- falls entirely into the calculation, but when calculating the bonus, the actual time worked is not taken into account;

- does not fall into the calculated one or is included in it partially, while the fact of accounting (non-accounting) of time worked does not play a role when calculating the bonus.

For more information on calculating quarterly bonuses, see the article “Calculation of quarterly bonuses for actual hours worked .

The total number of bonuses accrued in relation to the same bonus indicator for the entire calculation period cannot exceed:

- for monthly – 12 units;

- quarterly - 4 units;

- semi-annual - 2 units (paragraph 3, clause 15 of regulation No. 922).

Examples of accounting for quarterly and monthly bonuses when calculating vacation pay are available in the ConsultantPlus system. Get trial access to the system for free and proceed to calculations.

How are bonuses taken into account when calculating holiday pay in 2021?

The formula for calculating bonuses is as follows:

- the amount of bonuses in a certain period is divided by the number of working days in the organization;

- the result obtained must be multiplied by the number of days worked by the employee.

The result of the calculations obtained becomes the amount that is included in the calculation of the average level of earnings.

How to reflect vacation pay, bonuses, and carryover wages in the report?

A pressing issue when calculating accruals is the procedure for reflecting them in the report. Filling out form 6-NDFL for vacation pay and bonuses involves the following points:

- the payment day is set to the date on which vacation pay was actually received;

- the procedure for withholding tax from this amount is carried out when it is calculated.

It should be taken into account that if the bonus is one-time, it should be taken into account as additional income. If bonuses are accrued systematically, then they are paid along with the main income.

The carryover salary is taken into account in the month in which it is accrued. All data is presented in lines 020 and 040.

Often, employers have a popular question: whether overpayment of vacation pay can be processed as a bonus. In practice, this option is possible, but only with mutual agreement with the employee. Otherwise, the matter will have to be resolved through court.

How is the annual bonus calculated?

The annual bonus is also included in the calculation, but there are special conditions for its accounting:

- it must relate to the year preceding the year of the event with which the calculation of average earnings is associated, i.e. if vacation pay is calculated in 2021, then the annual bonus for 2019 is taken into account;

- taking it into account is not linked to the actual time of accrual of this bonus, i.e. if at the time of calculating vacation pay the annual bonus has not yet been accrued and therefore cannot be taken into account in income, then after accrual of this bonus the average earnings will have to be recalculated and additional vacation pay will be paid to the employee (letter Rostruda dated 05/03/2007 No. 1253-6-1).

The options for taking the annual bonus into account are as follows:

- it is accepted in full if:

- the entire calculation period has been worked out (letter of Rostrud dated February 13, 2007 No. 317-6-1), while the fact of accounting (non-accounting) of time worked does not play a role when calculating bonuses;

- the calculation period has not been fully worked out, but the period for calculating the bonus absolutely corresponds to the calculation period and the bonus was accrued taking into account the actual time worked;

- absolutely corresponds to the calculated one, but the bonus was awarded without taking into account the actual time worked;

- does not correspond to the calculated one (letter of the Ministry of Health and Social Development of the Russian Federation dated 03/05/2008 No. 535-17), while the fact of accounting (non-accounting) of time worked does not play a role when calculating the bonus.

K+ experts have prepared an example of taking into account the annual bonus when calculating vacation pay. Get free trial access to the system and proceed to recommendations.

We talk about calculating the annual bonus in more detail in the article “How to calculate and account for the annual bonus?” .

One-time and one-time bonuses: accounting features

One-time and one-time bonuses that meet the general necessary requirements for this type of payments (included in the remuneration system, recorded in internal regulations, accrued during the calculation period) are taken into account in the amount of income when calculating average earnings for vacation pay. In particular, it is possible to take into account in the calculation bonuses accrued for unearned achievements (for an anniversary or a holiday), if they meet these general requirements (letter of the Ministry of Finance of the Russian Federation dated March 22, 2012 No. 03-03-06/1/150, Ministry of Health and Social Development of the Russian Federation dated October 13, 2011 No. 22-2/377012-772).

One-time and one-time bonuses usually do not cover any period and therefore do not depend on the fact of coincidence or non-coincidence with the calculation period. In this case, they are confined only to the calculation period and, therefore, are taken into account in this calculation in full.

But if a one-time bonus is paid for the result of work carried out during a certain period, then when accounting for it, one must follow the rules in force for bonuses accrued for the corresponding period. However, for bonuses of this kind, the accrual periods may differ from the usual ones and may be, for example, six months or several years.

For semi-annual bonuses, the rules for taking into account will be similar to the rules applicable for monthly and quarterly bonuses. The difference will be that no more than two semi-annual bonuses can be included in the calculation period for the same bonus indicator.

If the premium is accrued for a period exceeding the value of the calculation period (1 year), then the rule will come into force that in each month of the calculation period it is necessary to take into account the amount of such premium in the amount attributable to its monthly part. Moreover, the premium amount determined in this way will be taken into account:

- in full if the entire calculation period has been completed;

- a volume proportional to the share of time actually worked in the calculation period, if this period is not fully worked.

Is the average salary for vacation included in the calculation?

Often, enterprise management rewards their own employees for special achievements and for successfully completing important tasks.

Such one-time bonus payments are included in the base when calculating the average salary for vacation pay.

However, in order for a one-time bonus to be included in the calculation of average earnings, the following conditions must be met:

- The accrual of bonus funds occurred in the billing period for calculating vacation pay.

- The appointment of a one-time bonus is specified in a special regulation or other internal document.

If a one-time payment is made for a specific period, then the determination of vacation funds is influenced by 2 circumstances:

- whether the bonus period of time is longer than the calculated one;

- whether the employee worked entirely in a given period of time.

Please note that annual bonuses are calculated differently - read here.

Material payments of a social nature should not be taken into account in vacation pay - read more about accounting for material assistance in average earnings.

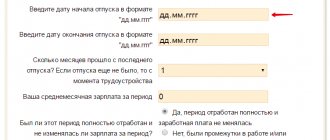

You can calculate your vacation pay using the online calculator here.

Simple, convenient and free calculator.

Example for 2021, when the payment is taken into account in full

Situation 1:

When an employee of an enterprise has worked the entire pay period and the time period for which the one-time bonus was accrued is fully included in it, then the bonus payment must be included in the amount of vacation pay in full.

Example - a one-time amount is included in the calculation of average earnings:

From 01.08 to 14.08. In 2021, the employee goes on annual paid leave.

His monthly salary is 10 thousand rubles.

The calculation period for vacation pay is 01.08.2021 to 31.07. The employee worked out the entire year 2021.

According to the collective agreement with the enterprise for the completion of the construction of the construction site, which lasted from 01.09. until 30.09. 2018, the employee received a one-time bonus payment of 8 thousand rubles on October 1, 2021.

Since the billing period is fully worked out, the one-time payment must be taken into account directly when calculating vacation pay.

Situation 2:

Another possible situation is that the employee has not worked all the days in the pay period. The bonus period of time is included in the period for calculating vacation pay. The lump sum bonus was accrued for the time that was actually worked.

In this case, when vacation pay is calculated, the amount paid must be taken into account in full.

Example when bonuses are not fully included

You can consider another situation when the employee has not fully worked for the last year. The time for which a one-time bonus greater than the calculated one is assigned.

In this case, in order to determine the amount of average earnings for vacation pay, exactly that part of the bonus amount that falls on the calculated period is taken.

The amount that will be received must be recalculated, since the period has not been fully worked out.

Example - a one-time bonus is not fully included in the calculation:

Conditions:

- To the employee from 21.03. to 03.04. In 2021, an annual 14-day vacation was provided.

- The period of time to calculate the amount of vacation pay is from 01.03. 2021 to 28.02. 2021

- The monthly salary of an employee is 10 thousand rubles.

- Along with his salary, he receives a monthly bonus of 5 thousand rubles.

- At the same time, during the calculation period he is entitled to a one-time bonus in connection with the successful completion of the construction of the facility - 50 thousand rubles, which is provided for by the collective agreement.

- From 14.10 to 22.10 the employee missed seven working days due to illness.

- The number of working days in the calculated period is 249, of which, in fact, 242 were worked.

- The employee's earnings for October, taking into account the monthly bonus - 10 thousand. ((10 thousand + 5 thousand) / 21 days x 14 days).

- Earnings for other months are 165 thousand ((10 thousand + 5 thousand) x 11 months).

Calculation:

- The size of the one-time bonus when vacation pay is calculated is not taken into account in full, since the duration of the bonus period is longer than the calculated one.

- Consequently, when calculating vacation pay, it is necessary to take into account only the part of the funds paid that falls within the twelve months of the calculation period. That is, 33,333 (50,000 / 18 months x 12 months).

- In addition, the employee did not complete the entire pay period. Therefore, the amount of the bonus must be recalculated in proportion to the time worked = 33333 / 249 days. x 242 days = 32400.

- The employee’s total income taking into account the recalculated bonus payment = 165,000 + 10,000 + 32,400 = 207,400.

- The average daily salary is = 207400 / (11 months x 29.3 + 29.3 x 14 / 31) = 618.

- Vacation pay = 618 x 14 = 8652.

Is the lump sum payment included for the holiday?

Holidays are one of the most long-awaited days for employees, since in addition to pleasant weekends, employees are often entitled to one-time bonuses.

In particular, bonus payments may be paid for the New Year, March 8, February 23, other holidays and various anniversaries, if this is provided for by the company’s bonus system.

Such one-time payments for holidays can be taken into account when calculating vacation pay if the necessary conditions are met:

- The opportunity to provide bonuses to employees is contained in the labor remuneration system.

- The accrual of funds occurred in the billing period.

The Ministry of Labor set out clarifications on whether it is necessary to include one-time one-time bonuses for holidays when calculating vacation pay in its own letter dated August 3, 2021, number 14 -1 / OOG - 7105.

It may be noted that the amount paid by an employee in connection with a holiday and not related to his work activity should not be included when calculating the average salary.

When determining the amount of average earnings, it is necessary to take into account bonuses that are of a production nature and provided for by the internal document of the institution, in particular, the regulations on bonuses.

That is, when bonuses are a reward for labor merits and work performed and other achievements of an employee, then the lump sum payment is included in the average salary. Such payment must be made on the basis of an order and reflected in the financial documentation of the organization.

Consequences of errors in calculating premiums

Errors in accounting for bonuses when calculating average earnings are divided into 2 types according to their impact on the amount of income determined for the billing period:

- inflating this income and, accordingly, the amount of vacation pay;

- underestimating this income and, accordingly, leading to the accrual of vacation pay in a smaller amount.

Overstatement occurs when the following is included in the calculation of premiums:

- not included in the wage system;

- not reflected in internal regulations;

- accrued outside the calculation period or not related (if the premium is annual) to this period;

- duplicating each other in terms of bonuses at the same frequency;

- not recalculated in proportion to the share of time actually worked in the calculation period, if this had to be done.

An understatement occurs if income does not include any of the premiums accrued during the calculation period. In addition, both overestimation and underestimation may be associated with incorrect calculation of the bonus amount or its incorrect recalculation in proportion to the time actually worked in the calculation period.

In any case, identified errors require corrections, since:

- overstatement unlawfully increases labor costs included in the costs that reduce the profit base;

- understatement infringes on the rights of the employee.

It is quite easy to correct an underestimation of the amount: you need to recalculate and pay the employee the missing amount. Overstatement amounts due to a counting error can be withheld from the employee’s salary (Article 137 of the Labor Code of the Russian Federation). But overstated amounts that are not related to such an error and are essentially explained by the employer’s violation of the law when calculating average earnings are quite difficult to get back from the employee: he may not agree to voluntary deduction and the judicial authorities are unlikely to recognize his obligation to do this , since he is not to blame for the current situation.

Read about what other deductions are possible from an employee’s salary in the material “Art. 137 Labor Code of the Russian Federation: questions and answers" .

Results

Bonuses accrued in the 12-month period preceding the month of calculation of vacation pay must be taken into account when determining the income involved in calculating average earnings, if these bonuses are provided for by the current remuneration system. However, the process of including the entire bonus amount or a certain part of it in the calculation requires compliance with a number of rules, depending on the full (incomplete) working out of the calculation period, the coincidence (non-coincidence) of the bonus accrual period with the calculated one, and the accounting (non-accounting) of time worked when calculating the bonus.

Read the latest news about personal income tax on bonuses in the articles:

- “The Ministry of Finance has returned to the issue of personal income tax on bonuses”;

- “How to correctly reflect a one-time bonus in 6-NDFL (nuances).”

Sources:

- Labor Code of the Russian Federation

- Decree of the Government of the Russian Federation of December 24, 2007 N 922

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is a one-time payment not related to wages included in the average salary calculation base?

Such bonuses are also issued at some enterprises. They are issued by management for the anniversary of a distinguished employee, professional or other holiday. They are accrued irregularly. These payments, which are not included in the calculation of average earnings, are not provided for by the current wage system and are issued in separate orders.

It should be remembered that formulations like “... to award bonuses in connection with the 60th anniversary and for outstanding performance” arouse increased interest of the inspection authorities, especially if the order concerns the managers of the enterprise.

Recalculation of vacation pay in case of payment of a bonus for a holiday or some other significant date (that is, if it is not related to the performance of work duties) is not required.