Home / Labor Law / Payment and benefits / Wages

Back

Published: 03/03/2016

Reading time: 7 min

0

3450

The main legislative act of Russia regulating the issues of changing the terms of an employment contract and other related matters is the Labor Code of the Russian Federation.

It contains provisions that determine the procedure for reducing wages, the rules for registration and documenting this fact.

Below we will look at legal and illegal ways to reduce wages, as well as what liability an employer who has broken the law may incur.

- Unilateral salary reduction

- By agreement of the parties

Salary reduction at the initiative of the employer

In a difficult economic situation, when organizations have to take measures to increase operational efficiency, including those related to reducing costs (including costs for employees), the question of how to legally reduce an employee’s salary becomes particularly relevant. Current labor legislation primarily protects the interests of employees, who rarely agree to a salary reduction.

However, even in difficult situations, the employer has the opportunity to reduce wage costs and reduce the employee’s salary. There are few options, each of them represents a special process that should be properly documented.

Reducing wages

Unilaterally

The employer has the right to reduce wages without the employee’s consent in a narrowly limited number of cases:

- transformation of working conditions in terms of technology;

- transformation of organizational conditions.

Exclusively these provisions can be considered legal and applicable to reduce the level of wages by unilateral decision. (Article 74 of the Labor Code of the Russian Federation). Moreover, the legislation does not clearly define an exhaustive list of such conditions.

The reasons given in the law, which can undoubtedly be considered applicable for reducing wages at the request of one party, are the transformation of the technological principle of production, the reorganization of its general structure.

In general, if reasons arise that allow a reduction in the level of remuneration, the employer undertakes to notify the employee affected by such changes at least 2 months in advance . Moreover, the employee has the right to receive an explanation from the employer of the reasons for the upcoming changes. If the employee does not want to agree to the proposed conditions, he has the right to alternative positions, in accordance with the skills and qualifications of the employee.

By agreement of the parties

If, at the request of only one party, it is practically impossible to legally reduce wages - there are too few reasons, then by agreement of the parties it is somewhat more realistic.

However, even if the employee agreed to such a change, it must be motivated and associated with certain reasons.

Otherwise, it can easily be classified as illegal.

By mutual agreement between the employee and the employer, wages may be reduced due to:

- Translation. For example, when an employee is transferred to a position that is paid lower than the one occupied. In this case, his labor function, the amount of work performed and other important criteria on the basis of which wages are calculated most often change;

- Establishing a part-time work schedule. An employee who does not work full time or a full week will receive pay commensurate with the time worked.

When transferring an employee to another job, medical contraindications, if any, must be taken into account.

Normative base

To answer the question whether the employer can reduce the salary, one must keep in mind that the amount of the salary is necessarily fixed in the employment contract. Labor Code of the Russian Federation in Art. 57 directly provides for the mandatory indication of the conditions for remuneration of the employee in this document. And here is Art. 135 of the Labor Code of the Russian Federation specifies that the salary is set by the employer in accordance with its current remuneration system. In this case, the fixed component (salary, rate) is reflected in the staffing table of the institution. The variable part of income (incentive payments in the form of bonuses, etc.) is regulated by local acts of the employer, that is, the provision on bonuses, for example.

Change of bonus regulations

The employer may not have a local bonus document. In this case, you can change or cancel the internal rules at your discretion. This right also applies to the provisions on bonuses. It is enough for the head of the organization to draw up an appropriate order. Employees must be familiarized with all changes made: ask them to mark this.

Please note: in an organization that has a trade union cell, such changes, including salary reductions at the initiative of the employer , are previously agreed upon with its members.

Agreement of the parties

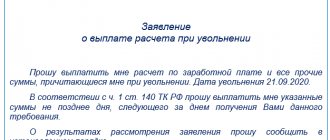

Drawing up an agreement gives the employer the opportunity to reduce the amount of income of the employee. The steps are as follows:

- oral conversation with the employee;

- reaching an agreement on a salary reduction;

- signing an additional agreement to the employment contract to change the amount.

Regardless of which component of the salary is to be reduced (fixed in the form of a rate, salary or variable in the form of allowances), the document stipulates the final amount based on the results of the agreement reached.

Consequences of illegal salary reduction

An illegal salary reduction is a reduction in an employee’s monthly earnings by amending an employment contract (agreement) in violation of the procedure established in the Labor Code of the Russian Federation, or paying a smaller salary without changing the provisions of the employment contract.

For an illegal salary reduction by prescribing new conditions in an employment contract without the knowledge or consent of the employee, the head of the organization may be held administratively liable under Art. 5.27 Code of Administrative Offenses of the Russian Federation. Then, in accordance with this article and the provisions of Art. 2.4 of the Code of Administrative Offenses of the Russian Federation, the guilty person is subject to the following punishment:

- official - warning or imposition of a fine in the amount of 1,000-5,000 rubles;

- Individual entrepreneur - 1,000-5,000 rubles;

- legal entity - 30,000-50,000 rubles.

For failure to pay wages in full, the employer faces liability under Part 6 of Art. 5.27 Code of Administrative Offenses of the Russian Federation. Responsibility is as follows:

- for officials - a warning or a fine in the amount of 10,000-20,000 rubles;

- Individual entrepreneur - 1,000-5,000 rubles;

- legal entity - 30,000-50,000 rubles.

In ch. 38 of the Labor Code of the Russian Federation regulates the financial liability of the employer and the employee, but it does not establish the financial liability that awaits the employer in the event of an illegal reduction in the employee’s salary. In particular, according to Art. 236 of the Labor Code of the Russian Federation, the head of an organization is found guilty only in case of violation of the terms of payment of wages, and not of its reduction. Criminal and civil liability for illegal salary reductions are also not provided.

Employer initiative

A common reason for salary reductions is the reorganization of an institution. Income also decreases in the event of organizational or technical changes in the enterprise.

To legally reduce your salary, the employer must meet a number of requirements.

Step 1. Notify employees in writing about the upcoming salary reduction at least 2 months in advance.

Option of step 1. Draw up a notice (in 2 copies) about the changes, indicating their reasons and nature in free form, hand one copy to the employee against signature (if he refuses to sign, issue a report), leave the second copy with the employer.

There is no set notification template, so a custom format is possible, including:

- name of the institution;

- location address;

- details of the manager;

- information about the need to reduce the employee’s income;

- detailed information about the employees who will be affected by the reduction, indicating their full name. and positions;

- reasons for the decline;

- director's signature and seal.

Step 2. Issue an order to amend the employment agreement indicating the reasons and familiarize with the order to amend in writing.

There is no established sample, it can be prepared in the form including:

- full and abbreviated details of the organization;

- number, date of the document;

- administrative part indicating the reasons that forced management to reduce wages, detailed information about the employee;

- signature of the manager with transcript.

Step 3. Obtain written confirmation (signature) of the employee of familiarization with the notice and expression of the employee’s decision.

Step 3 options:

- directly in the notice or order;

- in a separate document (for example, a log of notifications).

Subject to consent

If the employee agrees, he must sign an additional agreement (in 2 copies) to the employment contract, establishing updated conditions.

The document includes:

- information about the place and date of signing;

- information about the employee and employer indicating the full name. and positions;

- number and date of execution of the employment contract.

Both copies must contain the signature of the manager, the seal of the organization, and the signature of the employee.

Based on the additional agreement, the employer needs to issue an order to change working conditions (the document is signed by the head of the institution, the employee gets acquainted with it in writing). There is no unified form.

In the absence of consent to work under new conditions

Option 1. If the employee does not agree with the employer’s decision to reduce his salary, but is not against the transfer, the employer:

- signs an additional agreement to the labor agreement on transferring the employee to a position from the proposed list;

- issues a transfer order;

- enters information into the personal T-2 card.

Option 2. If an employee refuses to change working conditions and transfer, the employer must perform a number of actions:

- obtain the employee’s refusal (in writing) to work under the new conditions;

- register a document;

- offer another position in the same area and corresponding qualifications;

- get rejected;

- draw up and register a notice of termination of the employment agreement;

- issue and register an administrative document on dismissal in form T-8 with reference to clause 7, part 1, art. 77 of the Labor Code of the Russian Federation (indicating full name, last day of work) and signed by the manager. The employee is familiarized with the order to terminate the employment agreement against his signature. If it is not possible to bring the contents of the paper to the attention of the employee or he refuses to sign the order, an appropriate entry must be made in it;

- familiarize the employee with it in writing;

- draw up and issue a work book;

- make due payments (final payment, compensation for vacation that was not used, severance pay - two-week average earnings (part 3 of article 178 of the Labor Code of the Russian Federation)).

Notification

Order to amend the staffing table

Additional agreement

Does an employer have the right to reduce wages?

Many people reasonably perceive a reduction in wages as an infringement of rights, but this is not always the case. In order to recognize a downward change in wages as legal, the basic norms of labor legislation must be observed, namely:

- Art. 21-22, describing the labor relationship between the organization and hired personnel;

- Chapter 21 defines the conditions for the formation and processing of wages.

The amount that the employer guarantees to be paid must be fixed in the contract at a level not less than the minimum wage in force at the time the contract is concluded in a particular region.

Since tax deductions are tied to the amount of deducted earnings, employers often underestimate real indicators, trying to maintain profits, and hired employees sign contracts agreeing to an official salary reduction at the initiative of the employer, believing the promises of management.

However, the transition to a “gray” salary is completely unprofitable for hired personnel, since their savings from the amounts underestimated in the contract are minimal, and the risks of deception on the part of the employer are high. At the same time, without agreement with the employee, it is very doubtful whether the employer will be able to reduce wages on his own.

If the employee agrees to deception, nothing will prevent the administration from reducing wages to the minimum value under the contract. Typically, this happens when management is no longer interested in collaborating with a particular employee. With such a reduction in wages at the initiative of the employer, attempts to further challenge the actions of the administration in court have little chance of restoring justice.

On the other hand, when applying, employees are initially told about the use of “gray” payments, and the person has to decide whether to agree to such employment. If you have doubts about the integrity of the employer, you should not agree to such conditions, because in this case the employee may be left without bonuses, additional payments, or interest.

Reducing working hours as a basis for reducing earnings

The employer also has the right to establish a part-time working schedule for the employee. In this case, remuneration is made in proportion to the time worked or for the actual amount of work. According to Art. 93 of the Labor Code, when changing the employee’s work schedule, work will be paid in proportion to the time worked based on the fact of work performed. As a result, the employer has the opportunity to legally reduce the employee’s earnings.

A part-time day (shift or week) can be established for any employees upon reaching an agreement with them. Labor legislation does not contain norms that would specify information about the minimum or maximum working hours when introducing a part-time regime.

It emphasizes that shift lengths should be shorter than normal. The normal standard duration is from 40 working hours per week according to Part 2 of Art. 91 of the Labor Code. Thus, anything less than 40 weekly hours (or 8 hours per day) can be considered part-time. Confirmation of this position is contained in the explanatory letter of Rostrud No. 1378-6-1 of 2011.

An employee is allowed to establish a short working day (less than 8 hours) or agree on a four-day working week . But since such changes will concern the essential terms of the employment contract, they must be drawn up in the form of an additional agreement to the employment contract (according to Article 72 of the Labor Code).

Special Issues

Is indexing carried out?

Salary indexation involves its gradual increase in accordance with Article 134 of the Labor Code of the Russian Federation.

The employer may increase wages at its own discretion for one, several, or all employees.

It is not established by law when and by what percentage the increase will be made, therefore, if the employer does not have the opportunity to implement it, he can refuse it altogether, specifically forgetting to mention it in the employment contract, which is not a legal way.

In the event that wages are reduced to the minimum possible due to the reorganization of the enterprise, mass layoffs, or economic instability, it must still be indexed.

Refusal to increase wages following an increase in inflationary processes may expose the employer to administrative and criminal liability.

Is it possible to apply retroactively?

In order to avoid unnecessary questions and conflict situations, some employers forced to reduce wages make this reduction retroactively.

In this case, when the next payment of wages is made, employees are informed that bonuses and various types of payments will be waived. A net salary is issued, the amount of which may be several times less than expected.

The employer has no legal right to do this.

If a difficult economic situation arises, leading to the impossibility of paying wages in the same amount, the employer is obliged to gather the entire team of employees and notify about it no later than 2 months before the reduction.

Employees must decide for themselves whether they agree to such actions or are ready to leave their jobs and quit.

Thus, they will have quite a lot of time to find a new job with a suitable salary.

How to apply to the director?

The procedure for registering a reduction in the director’s salary depends on whether he is an employee or directly involved in the establishment of the enterprise.

If the director came to work as a regular person hired for the position, the salary reduction is formalized on the usual basis, with mandatory warning 2 months in advance.

If the director is the head of the company’s shareholders and its founder, then such formalities are not required; he can lower his own rate independently.

Moreover, in the first case, it is also not necessary to wait for the allotted time; upon receipt of the director’s consent to the actions taken, his salary can be reduced immediately after the issuance of the corresponding order.

Is it possible to reduce the salary of a pregnant woman or a woman on maternity leave?

In principle, a pregnant woman or a woman on maternity leave is no different from other workers.

If it is planned to reduce wages for all employees, the salary of a pregnant woman can be reduced on a general basis with mandatory warning 2 months in advance. The only advantage of a pregnant woman or a woman on maternity leave in this regard is that the employer does not have the legal opportunity to fire her.

Knowing this, a pregnant woman can refuse to sign an agreement to reduce wages and continue to work in her current position without any consequences for herself.

Is it possible to change the terms of the contract if the employee is on sick leave?

An employment contract is concluded and signed by the two parties involved in it, therefore its terms can be changed only after obtaining their consent to such a change.

Thus, if an employee is on sick leave, but at the same time expresses written consent to make such changes, nothing illegal can be seen in this.

If such consent was not received from the employee due to his serious condition or lack of information about the upcoming change, the employment contract must remain as is until the employee returns from sick leave.

Is it possible to reduce the minimum wage?

As an employee works, his salary may change up or down.

Bringing wages to the minimum level is a completely legal and acceptable action on the part of the employer in conditions of a financial and economic crisis.

Before recalculating wages towards a significant reduction, the employee must receive a corresponding notice, after which he has the right to agree to the conditions set, or to begin looking for another job.

How do you pay at night? Information is in our article.

What is hourly wage? See.

How to write a power of attorney to receive a salary? Find out .

What is the employer's responsibility if the payment falls below the minimum wage?

The amount of wages is established by the Labor Code. According to Art. 129 of the Labor Code of the Russian Federation, regular wages consist of salary, compensation and incentive payments.

In Art. 133 of the code in question states that wages cannot be less than the minimum wage provided by law. Moreover, in order to achieve this level of wages, the employee is obliged to work a full working month in full accordance with his work responsibilities.

An employee’s wages accrued to him without taking into account all required deductions are recognized as his income.

From the full salary, the employer has the right to withhold part of the funds to pay personal income tax, after which it is slightly reduced, which leads to the phenomenon of the employee receiving wages below the minimum wage.

The employer does not bear any responsibility for such low wages, but can increase it through bonuses and benefits.

Employees working part-time may also find themselves in a situation where wages do not reach the established minimum wage level.

The employer is not obliged to compensate part-time workers for arrears if the salary did not reach the minimum level at the time of concluding the employment contract.

The employer does not bear any responsibility in this case.

In the event that we are talking about a deliberate understatement of wages, the employer may face:

- Material liability. Based on Art. 236 of the Labor Code of the Russian Federation, the employer is obliged to reimburse wages with interest in case of delay. The same rule applies to wages reduced illegally.

- Disciplinary responsibility. An employer, if he is not the owner of the enterprise where the employee works, may face reprimand, reprimand and even dismissal.

- Civil law. An unscrupulous employer is obliged to compensate for moral and material damage caused to the employee. The amount of compensation is determined by the court.

- Administrative responsibility. An unscrupulous employer faces a fine or warning, and the entrepreneur’s activities may be suspended. Disqualification may be applied as a penalty. The amount of the fine cannot exceed 5 thousand rubles.

- Criminal liability. Criminal liability for the employer comes in accordance with Article 145.1 of the Criminal Code of the Russian Federation. Criminal prosecution for non-payment of wages may occur in exceptional cases; usually the court decision is limited to a warning and a fine.

An example is the following situation:

An employee of Zvezda LLC Kuibyshev L.L. contacted the accounting department in connection with the difference he discovered between the wages received over the last two months. He received a response from the accounting department that his wages had been reduced due to the company's lack of financial resources. No one responded to the employee’s attempts to meet with the director and clarify the situation in a personal conversation.

As a result, this citizen was forced to go to court. By a court decision, the actions of the director of the enterprise were recognized as unfounded and illegal. The employee was returned his wages, and a fine of 3 thousand rubles was imposed on the employer.

Can an employee challenge an employer's decision?

An employer's decision to reduce wages cannot be made unilaterally.

Before removing allowances and bonuses, the employer must consult with the employee.

If he did not do this, it makes sense to contact a trade union organization or labor inspectorate to challenge such a decision. The last and final authority is the court.

An employee has the right to file a lawsuit against the employer in the event that:

- the employer arbitrarily reduced the salary without bothering with explanations;

- the employer made changes to the employment or collective agreement with which the employee does not agree;

- the employer did not comply with the deadline for notifying employees about the reduction in earnings.

Arbitrage practice

Unfortunately, judicial practice shows that cases in which an employee makes claims against an employer who has illegally reduced wages are limited to a warning or administrative punishment.

Fines and other sanctions are not provided for in the legislation.

Criminal liability may arise for the employer if his unlawful actions caused harm to the health and life of both the employee and his family members.

Salary composition

Remuneration for the work of an employee consists of a fixed and variable part.

The constant part is the one that appears in the internal documents of the enterprise under the term “wages”. This is the component of the salary that is regulated by all legislative documents, and the amount of which the employer does not have the right to arbitrarily encroach on. It depends on those elements that were included in the company’s local acts at the stage of documentation generation. Most often, this is a salary in accordance with the staffing table, from which income tax and possible social payments (for example, alimony) will also be withheld, plus special payments that depend on various factors:

- additional payments for degree, title, qualification;

- coefficient characterizing the region of the country;

- bonus for length of service;

- compensation for late payments;

- sick leave and vacation pay.

Is it legal to reduce an employee’s salary if his position remains unchanged ?

The variable part is the one that the employer can vary depending on the conditions specified in the documents, for example, the results of the employee’s work. This part includes, first of all, bonuses based on performance, which can be:

- monthly;

- quarterly;

- at the end of the year;

- 13 salary, etc.

This part may also include “health” financial resources if the employer allocates such for its employees.

All provisions relating to the conditions for payment of the variable part of the salary. They must be recorded in the internal documents of the organization; unfounded deviations from them are illegal.

NOTE! If a bonus or salary, according to the internal documents of the organization, is included in the main part of the remuneration for labor, then management has no right to reduce or not pay it.

How to reduce salary in staffing table

Important

There is no single form of the decree; it is drawn up as is customary in each company, but in compliance with the document flow requirements for administrative documents. The decree must contain:

- Full legal name of the company;

- Date of compilation;

- Registration number of the decree;

- Mandatory - indication of the reasons for changes in the rate;

- Full names of employees, positions, new rate;

- Date of introduction of the updated staffing schedule;

- Full name of the person responsible for re-signing employment contracts;

- Oblige the chief accountant to calculate salaries at the new rate from the specified date;

- Full name of the person responsible for the execution of the decree.

Increase in salaries in the staffing table An order to increase salaries in the staffing table is drawn up according to the general rules of document flow. This is as mandatory as registering a bet reduction.

How to draw up an order or notice

As already noted, changes in earnings can be recorded in writing in the form of a notification to the employee or an official order. If the employer has chosen a notification nature, then the following information should be displayed here:

- The reasons that determined the need to change working conditions and reduce pay.

- What terms of the employment contract will be changed and the content of these changes.

- Time frame for implementing changes.

- The timing of the decision to continue working in changed conditions or to terminate.

In order for the employee to express his consent or disagreement with the changes, it is necessary to provide a corresponding column in the notification. It is recommended to prepare the notification in two copies, one of which should be given to the employee, and the second with his written resolution should be kept by the employer. This is necessary in case the employer will be checked for compliance with the rules for changing working conditions (according to Part 2 of Article 74 of the Labor Code). If the employee refuses to receive the notification, then a report on this is drawn up with the signature of two witnesses.

When writing an order to reduce wages, the employer has the right to use the free format of this document. Its unified form has not been developed to this day. A sample order to reduce wages can be viewed here.

When drawing up an order, it is necessary to take into account that it must contain information about the employee (his full name, personnel number, etc.), a list of his job duties, position and reason for the change in salary.

The order is assigned its own unique number, according to the current numbering system, and the seal of the head is affixed.

Salary reduction

It is necessary to notify the employee of upcoming changes two months in advance. If the employee does not agree to work under the changed conditions, send him a written offer of another job that matches his qualifications and health status. If there is no such job, offer a vacant lower-level position or lower-paid job.

If the employee refuses all offers or you do not have a suitable job, formalize your dismissal under clause 7 of part 1 of Article 77 of the Labor Code of the Russian Federation (refusal to continue working due to a change in the terms of the employment contract determined by the parties). This procedure is provided for in Article 74 of the Labor Code of the Russian Federation. At the end of the procedure, make appropriate changes to the staffing schedule approved in the organization (section 1 of the instructions approved by the Decree of the State Statistics Committee of Russia dated January 5, 2004 No. № 1).

Additional payment up to the minimum wage

The administration is obliged to pay the employee a salary no less than the established minimum wage each month. However, some employers had a question: is it possible to pay an employee a salary below the minimum wage for two months, and then in the third month, by charging an additional bonus or a special surcharge, to compensate for the missing amount for the quarter (i.e., the difference between the paid salary and the minimum wage).

You might be interested in:

Dismissal under the article: how and for what you can terminate a relationship, consequences when this is not possible

The Ministry of Labor issued a letter stating that this cannot be done. Salaries must be checked monthly for compliance with the minimum wage, and the quarterly bonus paid will be taken into account only in the month in which it was actually issued.

Important! Thus, the employer must pay the employee monthly the difference between his salary and the current minimum wage.