When buying real estate, the transaction must be registered. Until recently, for this you had to stand in line at Rosreestr, and there, as a rule, the matter was not resolved in one day - they issued a coupon for a specific day. Now this procedure has been simplified and transaction registration can be done via the Internet. So far, this service is provided only by some banking organizations, but their number is steadily growing. But electronic registration of real estate transactions through Sberbank is available today.

The essence of electronic transaction registration

The initiator of this idea was Rosreestr. Now submitting an application has become much easier, and the terms for concluding a purchase and sale agreement have been significantly reduced. Today this service is in great demand among Sberbank clients. It is also used by other banking organizations, but Sberbank is the undisputed leader in this direction.

Rosreestr managers say that now, after filling out an application and submitting all the necessary documents, it will be possible to register a real estate transaction within 24 hours. But statements are statements, but in fact the procedure can take up to a month. Experts explain this by the “dullness” of the system.

Using an electronic signature

One of the main goals of popularizing electronic signatures is to simplify document flow. Having issued an electronic signature, a citizen has the opportunity to:

- participate in real estate transactions in another city;

- sign an employment contract with a remote employer;

- apply for admission to a university anywhere in the country;

- take part in auctions on electronic platforms;

- use the services of the government services portal and so on.

You can use the electronic signature for which the corresponding certificate has been issued for twelve months. After this period, the electronic signature will have to be updated, but documents certified with its help will have legal force for an unlimited amount of time.

From August 13, 2021, it is possible to use an enhanced qualified electronic signature when conducting real estate transactions only with the written consent of its owner . Thanks to the amendments, citizens were able to make an entry in the Unified State Register of Real Estate allowing them to register the transfer of ownership of their apartments and shares in them on the basis of an electronic application certified by electronic signature. If there is no such mark in the Unified State Register, then it will be impossible to conduct the transaction remotely.

Screenshot: rosreestr.ru

The mechanism for selling real estate using an electronic signature is as follows:

- transaction documents are scanned

- scans of a purchase and sale agreement or, for example, a donation agreement are uploaded to the appropriate section on the official portal of Rosreestr;

- the parties to the transaction certify the documents with their electronic signatures : at this moment they can be located not only in different cities, but even in different regions of the Russian Federation;

- After the transfer of ownership is registered by Rosreestr (usually this process takes only two days), the relevant documents will be sent to the buyer of the property by e-mail . The participant in the transaction does not receive any documents confirming ownership of the apartment.

By the way, to use your electronic signature, you will have to download the CryptoPRO and CryptoARM software to your computer. This software is distributed free of charge by the developers.

Why is electronic registration necessary?

Today, the tools for issuing mortgage loans are constantly being modernized. The mortgage business continues to improve its technical equipment. Electronic transaction became a natural extension of this process. Often transactions are carried out in different regions. For example, a family lives and works in the Far North, and their children enter educational institutions in Moscow or Novosibirsk. In this case, parents will have to incur considerable travel costs, but electronic registration solves this problem.

As a rule, a mortgage transaction also requires significant time investment. Even the increased Northern holiday will not be enough. In order to increase the mortgage portfolio at the expense of such clients, Rosreestr initiated the electronic registration procedure. Sberbank was one of the first to support this initiative, and this bank controls more than 50% of the entire mortgage market. It is this banking organization that invests huge amounts of money in Internet banking.

Now the debtor can carry out the transaction in his region. The client will have to come to the bank branch one day to record his consent to the transaction. After this, he can return home without worrying about the legal side of the issue, since the bank takes care of registration with the justice authorities. Thus, the client saves not only money, but also time that he would have to spend on confidentially processing the transaction. When implementing it, you do not need to go to a notary to make a power of attorney, but this action can be very difficult if a person needs to leave for some time.

Electronic registration of a transaction in Sberbank

Sberbank was among the first to decide to conduct mortgage loan transactions electronically. By the way, in addition to mortgage clients, this procedure is also carried out for other debtors. Sberbank willingly cooperated with Rosreestr and signed all the documents necessary for this.

This procedure is paid, and it costs from 7,900 to 10,900 rubles (depending on the type of housing and the region of registration of the transaction). But this price also includes the cost of state duty. For finished housing, the procedure for registering it will cost 8,000 rubles. After the transaction is certified by the owner in the Unified State Register of Real Estate, a corresponding entry will appear in Rosreestr. This procedure has its undoubted advantages, the main one of which is the absence of the need to stand in endless queues. The client will only have to wait until all the documents are provided to him by email.

The cost of the service includes the following:

- Payment of the state fee for registering the transfer of ownership.

- Issuance of an enhanced qualified signature for all parties to the transaction.

- Sending documents electronically to Rosreestr.

- Interaction with Rosreestr and registration support.

- Transaction support by a personal manager.

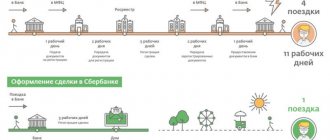

Stages of the transaction:

- The Bank manager or developer will send the documents to Rosreestr electronically.

- Rosreestr receives documents online and begins registration.

- The purchase and sale agreement and an extract from the Unified State Register with an electronic mark on state registration will be sent to your email.

Important! The client will not have physical documentation in hand. All documentation will be submitted electronically. The validity of the agreement can be checked on the official website of Rosreestr. This can be done after registering on the company’s resource by visiting your personal area.

2019 was marked by the digitalization of companies’ business processes and the transfer of services to electronic format. The possibility of obtaining mortgage loans online appeared in 2021, but a large-scale program to introduce electronic transactions has become the leitmotif of 2021.

The Moscow Regional BTI monitors modern technologies that change the very process of providing services. That is why the Moscow Regional BTI is introducing a whole range of electronic services that will save clients’ time and effort.

To optimize the process of registering real estate, a new one has appeared.

When registering ownership of real estate and concluding real estate transactions, the owner usually goes through the state registration procedure. According to Article 131 of the Civil Code of the Russian Federation, ownership and other real rights to immovable things, restrictions on these rights, their emergence, transfer and termination are subject to state registration in the unified state register by bodies carrying out state registration of rights to real estate and transactions with it. The following are subject to registration: the right of ownership, the right of economic management, the right of operational management, the right of lifelong inheritable possession, the right of permanent use, mortgage, easements, as well as other rights in cases provided for by this Code and other laws.

At the moment, for any registration and registration actions, it is necessary to submit documents to Rosreestr through the offices of the MFC or via the Internet. When submitting documents via the Internet, the period for providing public services is reduced by 2 days.

When ordering, employees of the Moscow Regional BTI issue a special cloud digital signature, with the help of which documents are signed and sent electronically to Rosreestr.

Moscow Regional BTI is available in the following cases:

— ordering work related to accounting and registration activities. For example, when ordering a technical plan.

Specialists of the Moscow Regional BTI will prepare all the documents and submit them for property registration to Rosreestr;

— submission of a ready-made set of documents for state registration of a transaction (purchase and sale, lease, pledge, donation) through MOBTI for transfer to the appropriate authority with subsequent registration of real estate.

Advantages of using electronic registration:

— 30% discount when paying state duty

— convenient location of offices - 68 reception points in Moscow and the Moscow region

The pilot project started in Mytishchi and Balashikha. In Mytishchi, documents were submitted to register a real estate property, and in Balashikha, the first land lease transaction and transfer of rights to a municipally owned property were registered.

“In the Moscow region, the first land lease agreement was concluded entirely in electronic form. In the interaction of the Ministry of Transport and Regional Property with the Moscow Regional BTI, the State Public Institution of the Moscow Region "MFC" and the administration of Balashikha, the possibility of concluding an electronic transaction through the MFC with the issuance of an enhanced electronic digital signature has been implemented. We plan to apply this experience to all government services provided in the real estate sector,” said Vladislav Kogan, Minister of Property Relations of the Moscow Region.

Tags: MOBTI, electronic registration, new service, 2019

What will you have to provide to the bank to register your application?

The following documents will have to be provided regardless of whether the apartment was purchased with a mortgage or with cash:

- real estate purchase and sale agreement (apartment)

- consent of a family member, if necessary;

- an application for a transaction completed on the website.

The above documents must be provided to the registrar in full. If at least one of them is missing, registration may be denied.

Transaction without paper

The law states that the expression of a person's will using electronic or other similar technical means is equivalent to a simple written form of a transaction. In this case, the requirement for a signature is considered fulfilled if any method is used that allows one to reliably identify the citizen.

It is also established that a written agreement can be concluded by drawing up one document signed by the parties, for example, only electronically. Or by exchanging letters, telegrams, electronic documents or other data. The possibility of conducting absentee voting using technical means has also been introduced.

Buyers can transact remotely today, but it's quite difficult.

Digital law can certify rights to things, property, results of work, provision of services and exclusive rights. Experts are confident that the law will help spread transactions for the purchase and sale of real estate in electronic form, which are possible today, but are not widespread due to a lack of security. “Digital rights in the real estate market are not a revolutionary solution. And today, buyers can make transactions remotely using an electronic signature. Another thing is that, in principle, clients themselves are very wary of electronic transactions, fearing hacking and forging a signature. Many people still want to have a document with a “living” signature of Rosreestr in their hands,” says Maria Litinetskaya, managing partner. At the same time, experts themselves consider transactions in electronic form to be more reliable. “An electronic document cannot be falsified like a paper document; you can always quickly check its authenticity using databases. Thus, transactions become more transparent and clean,” says Alexander Moor, head of the All-Russian Center for National Construction Policy.

At the same time, there are still obstacles in electronic transactions that force their participants to use paper documents. To open a safe deposit box with money, lenders require a paper purchase and sale agreement stamped by Rosreestr, notes Litinetskaya. The law will help provide citizens and legal entities with protection for transactions concluded using digital rights. According to the amendments and additions to the Civil Code of the Russian Federation, a retail purchase and sale agreement using digital rights will be considered concluded from the moment the seller issues an electronic document confirming payment to the buyer. The bank will no longer be able to demand a paper equivalent. He will have to get all the data from Rosreestr.

At the same time, the convenience and security of electronic transactions depends on the degree of reliability of the databases in which information about transactions and contracts will be stored. “The electronic environment is created by people, and it is also protected by people, and people can hack it. Where there is a human factor, there is also the possibility of error or abuse. If the security system is allowed to be breached or a major failure occurs, this could lead to the shutdown of entire areas of activity,” explains Alexander Moor. Along with new opportunities, attention must also be paid to data protection. Only then will people begin to trust technology.

Conditions for submitting documents

In fact, there are few conditions, but they must be observed, because the applicant will receive title documents only if they fully comply. The list of necessary conditions and documentation is as follows:

- The real estate purchase and sale agreement is the main document.

- The transaction can only be carried out with an individual.

- If equity participation in the ownership of real estate is envisaged, contacting Rosreestr is a necessary condition.

- An application to Rosreestr will also be required if there are minor children in the family.

- Powers of attorney and similar documents are not considered.

- Military mortgage registration is not carried out.

- The agreement stipulates a certain number of persons participating in the procedure, usually 2 people. If the number of sellers or buyers is increased, the transaction will be refused.

The new law on registration of purchase and sale of cars through State Services - is it true?

This is only partly true. Partly because the law is actually not entirely new. It was developed back in October last year, they just started talking about it only now.

Well, by the way, the fact that this is a new law as such is formally untrue. This normative act does not have the status of a federal law - it is an Order of the Ministry of Digital Development of Russia.

And now about the essence! The latest news is full of the introduction of new rules for registering the purchase and sale of vehicles from May 1, 2021 through the State Services portal. And this, too, is only partly true. At the moment there is a draft Order of the Ministry of Digital Development. Here is his official card on the portal of regulatory legal acts of the Russian Federation.

Formally, the new Order puts into effect a list of transactions that will have to begin to be provided on the State Services website in the form, respectively, of government services in electronic form. And the first on the list of such transactions is the opportunity to draw up a purchase and sale agreement (hereinafter also referred to as “SPA”) through the portal completely online.

This is what the official interpretation looks like:

I order... To approve the attached list of legally significant actions carried out using the federal state information system "Unified Portal of State and Municipal Services (Functions)", including transactions carried out by creating electronic documents, signing them using an electronic signature and sending them to third parties, including the possibility of multilateral signing of such electronic documents.

List of...legally significant actions:

1. Registration (conclusion and termination) of contracts for the sale and purchase of vehicles...

Is it true that the new rules will come into effect on May 1, 2021?

This is currently unconfirmed information. And that means it’s still just a fake. In fact, the date itself, May 1, is spelled out in this Order.

But the subtlety is that this document itself does not yet have any legal force. Simply because all regulations in 2021 must undergo certain procedures to enter into force. One such procedure is official publication. However, this has not happened as of June 02, 2021. You can check this by trying to find them on the official publication portal specifically for the regulations of the Ministry of Digital Development. And you won't find it here.

And therefore, the Order we are discussing on purchase and sale transactions through State Services is not yet in effect. Although, legislators assume that it must be adopted before May 1 for it to take effect.

However, what is important here is not only the formal adoption of new rules for issuing electronic monetary policy through State Services, but also the creation of a technical base for this on the portal itself. Simply put, it is not yet known whether they have begun to develop the opportunity on the State Services website to conclude a purchase and sale agreement online. And, if this is not done before May 1, then the Order may be postponed, and more than once, as was the case, for example, with the introduction of new rules for medical examination when obtaining or replacing a license.

You will also be interested in:

- Is it possible to indicate an incomplete amount of the cost of the car in the contract?

- Do I need to have a sales contract certified by a notary?

- Is it possible to get beautiful license plates for a car from the traffic police officially and how?

Carrying out the procedure

Already at the very beginning of the procedure, you should indicate to the manager that the entire procedure will be completed electronically. Then the debtor will have to pay for the procedure, after which a specific date for the transaction will be set. Then the bank manager will send all the documents provided by the client to Rosreestr via a secure channel. Further, the transaction will be carried out or it will be refused - this depends on the quality of the information provided by the client. After this, the documents will be sent to the applicant’s email, and he will become the rightful owner of the declared property.

Important! If you have any doubts regarding the transaction being carried out, the authenticity of the signature can be checked on the State Services portal.

Carrying out the procedure for processing documents via the Internet does not mean that the client will not be able to receive all documents in physical form. Electronic documents are fully capable of confirming the right to own real estate. By the way, when the client receives all the documents necessary to own real estate, he no longer needs to have them notarized.

This service was developed by Sberbank to relieve clients from the need to perform additional steps that lead to a waste of personal time. The maximum period for its implementation is 5 working days. During this time, bank managers must process all documents provided by the applicant. The bank manager may refuse the applicant on the basis of the lack of certain documents, but he is obliged to provide a justification for the refusal.

Disadvantages of electronic registration

The main disadvantages of this system include the fact that only citizens of the Russian Federation can use it. Without Russian citizenship, the transaction cannot be carried out. And with electronic registration, the rate increases by 10%. Only adult citizens can participate in the event. Disabled people cannot participate in the event.

Another disadvantage of electronic registration is its price. It can reach up to 10,000 rubles; of course, it all depends on the region in which the applicant lives.

Is there a benefit and how to track the procedure?

Of course, there is a benefit, because when carrying out this procedure there is no need to visit the office of the credit company, everything is done remotely. And here there is no need to prepare the necessary documents; in the case of electronic registration, this will be handled by the managers of the credit company.

After reviewing the contract, all necessary documentation about it will be sent to the applicant’s email. This service is available not only to “mortgage holders,” but also to those who purchased housing under some other program or simply for cash. All clients have access to the service of a manager who will provide comprehensive information on any issue. Managers can be contacted either by e-mail or by telephone, which are mandatory indicated on the websites of credit institutions.

How is UKEP used when completing a real estate transaction?

The order is:

- The client signs a contract for the provision of . You will need to provide your SNILS, INN, passport, phone number and email address.

- When signing documents with an electronic signature, a unique code is sent to the client’s phone number, which must be communicated to the bank manager to confirm the transaction.

- After reporting the code, a package of documents is sent through a special secure system to Rosreestr for electronic registration of the transfer of ownership.

That's all, the deal is completed.

Please note that the electronic signature is valid for a year. Upon completion, the certificate becomes invalid and a new signature must be obtained.