Accounting employees should know how many days of sick leave are paid per year and how accruals are made. Ordinary employees should also understand that if they are constantly on the ballot, they will not receive compensation from the Social Insurance Fund. The law provides for various restrictions within the framework of one disease and during sick leave during the year. Thus, if you know these nuances, you can independently understand whether it is possible to receive compensation payments from the Social Insurance Fund and in what amount.

How many days per year is sick leave paid?

The law determines how many days you have the right to go on sick leave per year

You can use the sick leave form

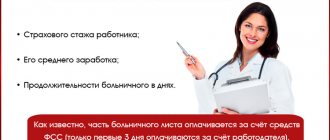

It is necessary to understand that you cannot constantly be on a certificate of incapacity for work. The employer will not want to cooperate with such an employee and will look for a way to fire him. And you won’t be able to receive payments in full if you don’t have the required length of service. Today, the amount of payments directly depends on the number of years worked and average earnings. It is worth considering how many days per year you can be on sick leave.

Table 1. How many days can you stay on a child care notice?

| Child's age | Number of paid days |

| Up to 7 years | 60 per year with an extension to 90 if the disease is from the order of the Ministry of Health and Social Development No. 84N |

| From 7 to 15 years | 15 one time/45 per year |

| Over 15 years old | 7 days per bulletin, 30 per year |

| Disabled people over 18 years old | 120 during the year |

It is worth noting that the time frame for being on the bulletin is relevant for caring for the child and during your own treatment. That is, during the year you can be sick no more than 120 days if you have a disability and no more than 30 days a year if you do not. If the period of time spent on the certificate of incapacity for work exceeds this figure, then you will have to sit without compensation.

Important . There is a list of diseases in the Order of the Ministry of Health and Social Development No. 84N, in the presence of which it is possible not to perform work duties for up to 90 days per year.

How many days a year is paid sick leave for a disabled person?

Disabled people have some preferences outlined in the law

Based on the table above, only 120 days per year are compensated for a disabled person while on sick leave (SL). It should be understood that citizens with limited mobility have a number of preferences that are specified in the Labor Code of the Russian Federation. They can take more administrative days without pay, work from home as agreed with the employer, use shorter working hours, and so on.

Find out how to get help applying for disability in our special article .

Of course, shortened working hours affect wages. But, it allows you to perform the required procedures without going to the BC, if the disease allows it.

Thus, the law clearly regulates how many days a year a disabled person can be on the ballot. It does not matter whether he does this for independent treatment or to care for a minor child under 15 years of age.

The procedure for paying sick leave - step-by-step instructions

The state takes control of the issuance of sick leave

This is an important stage, because the state strictly controls the process of issuing BC. Today they are issued in electronic and paper form. It is necessary to understand how money is received and sick leave registration is carried out in Russia.

Step 1. Closing the BL in the hospital. It must be closed in the same clinic where it opened. Services from private doctors are allowed, but it is important that the company has a license to carry out medical activities. It is possible to receive an electronic newsletter if the employer is registered on the FSS website. Such accounting makes it possible to reduce the likelihood of BL counterfeiting. At the same time, the accountant does not need to fill out documentation for a long time, since everything happens faster online.

First you need to close your sick leave

Step 2. Providing the BC to the accountant. It is recommended to do this immediately upon returning to work. But some companies have service offices in Russia with a center in one of the regions. That is, the document must be sent by mail or courier. However, to speed up the process, it is better to scan the certificate of incapacity for work and send it to an accounting employee.

Submit your sick leave to the accounting department

Step 3. An accounting department employee receives information and enters it into the database. It is necessary to correctly reflect everything in 1C, 3-NDFL and 6-NDFL, otherwise the FSS will not accept the report and refuse to pay the money to the employee

All necessary information is entered into the database

Step 4. Receive payment 10 days after submitting the BC. The first three days are paid by the employer, the rest from the social insurance fund.

After 10 days you will receive payment

Important . Accounting professionals often wonder whether sick leave should be subject to taxes and contributions. These payments are not subject to contributions to the Social Insurance Fund and Pension Fund, but the employee will have to pay income tax on them. If he pays alimony, then from this compensation he will need to send a set amount to the recipient of the alimony.

Rules for paying sick leave for an entrepreneur

Individual entrepreneurs do not need to enter into an agreement with the Social Insurance Fund

The law allows individual entrepreneurs not to enter into an agreement with the Social Insurance Fund if they work independently without hiring employees. This saves on social contributions. But if you get sick, you cannot count on receiving compensation. The same applies to some of the maternity benefits provided by the Social Insurance Fund.

If you want to receive a social package, you need to conclude an agreement. To do this, you will need to collect constituent documents and contact the employees of the regional office of the Social Insurance Fund. After the conclusion of the contract, appropriate notification and details for making payments are provided.

Table 2. Amount of contributions for the Unified Social Tax in 2019

| To the Pension Fund | In the FSS | In FFOMS | ||

| From the amount of payments within the established amount | Exceeding the established value | Within the established value | Over size | |

| 0.22 | 0.1 | 0.029 | — | 0.051 |

It is worth noting that entrepreneurs need to contribute less for themselves. This measure makes it possible to increase the attractiveness of the Social Insurance Fund for them. But you need to take into account that when entering the BS, compensation is calculated based on the funds paid. That is, if an entrepreneur plans to go on maternity leave, it makes sense to increase the amount of contributions voluntarily.

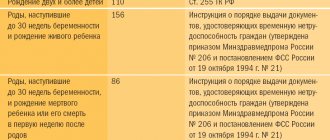

Table 3. Maximum amount of payments for pregnancy and childbirth

| Duration of maternity leave (days) | Minimum payout (RUB) | Maximum payout (RUB) |

| 140 | 51919 | 301000 |

| 156 | 57853 | 335500 |

| 194 | 71945 | 417233 |

Important . It is required to fill out reports in accordance with the requirements of current legislation. If you provide an incorrectly completed report on contributions or payment, you will be charged a fine. Therefore, many turn to accounting outsourcing for help. This allows you not to have a full-time accountant, receive the necessary services and optimize the company’s budget.

Design rules

In order for sick leave to be paid, it must be properly completed when submitted. First of all, there should be no errors in the form of the certificate of incapacity for work, and the certificate itself must be coded correctly so that no errors are made in calculating the amounts for payment.

I said above that in order for sick leave to be paid by the Social Insurance Fund, the employee needs to submit an application to the Social Insurance Fund, in which he will indicate to which account the funds should be transferred.

You can also declare receipt of funds by transfer through Russian Post services. However, despite the fact that the employee submits an application to the Social Insurance Fund, he continues to bring his sick leave to the employer, where the accountant will count the amount of funds to be paid.

But such a rule with calculations will remain in effect until the direct payment system is fully implemented. As soon as this system is fully tested, all calculations will be carried out automatically.

Samples of filling out certificates of incapacity for work in Excel format

- LN - Disease - for the employer

- LN - Disease - primary - clinic

- LN - Disease - primary - with continuation - clinic

- LN – Disease – continuation-polyclinic

- LN - Hospital - primary

- LN - Hospital - continuation

- LN - Clinic - TRAUMA - primary (over time)

- LN - Trauma - primary - alcohol intoxication

- LN - Direction to ITU

- LN - Polyclinic - unemployed

- LN - Polyclinic - violation of the regime when appearing able to work

- LN - Hospital - additional maternity leave

- LN - Maternity consultation - maternity leave

- LN - Caring for patients over 15 years of age

- LN - Care for patients under 15 years of age

- LN - Nursing - hospital - child

- LN - Issuance of a duplicate

- LN – Sanatorium – aftercare

- LN – Sanatorium – continuation for aftercare

- LN - At the Research Institute of Balneology

- LN - After a serious accident at work

How to check the correctness of filling out a sick leave certificate

How many days is paid sick leave after dismissal?

Even after dismissal, you can contact your employer to pay you sick leave.

Citizens can contact their employer to pay for labor costs even after their dismissal, in accordance with the provisions of the Labor Code of the Russian Federation. To receive compensation from the Social Insurance Fund, you must provide the accounting employee with:

- passport;

- work book, which does not contain a note about new employment;

- sick leave.

Important . BCs are accepted for the most dismissed employee. If he cared for the child, then the payment will not be made. You can contact your previous employer before the expiration of 6 months.

Sick leave for pregnancy is also accepted, despite its long-term effect. After the documents are transferred to the FSS employees, payments will be made through them.

What does the law say?

According to Article No. 183 of the Labor Code of Russia (LC), the employer is obliged to pay his subordinate monetary compensation in case of illness.

The amounts and conditions of accrual, features of financial calculations are regulated by a number of regulatory legal acts, these include:

- Federal Law No. 255 of December 29, 2021 . The conditions, procedure for calculating temporary disability benefits, the rights and obligations of the policyholder and the insurer are described. The amount of compensation is given depending on the length of service;

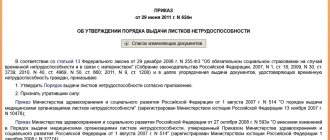

- Order of the Ministry of Health of the Russian Federation No. 624 of June 29, 2011 . It describes the procedure for issuing and filling out sick leave certificates.

To receive payment for sick leave, an employee must bring a bulletin, completed in accordance with all the rules, to the personnel or accounting department of the enterprise.

Payment of sick leave for child care

Payment is also carried out in accordance with the law.

BC for caring for a minor or a relative is also paid if issued by an organization that has the right to do so. It is necessary to understand how payment is made. According to Article 7 of Federal Law-255, payments from the Social Insurance Fund are made based on the employee’s length of service and his average salary based on:

- up to 5 years – 60%;

- from 5 to 8 years – 80%;

- more than 8 years – 100%.

When the experience is less than 5 years, the calculation takes place taking into account data on the actual salary received. The missing months are covered by the minimum wage.

Payment of sick leave for child care

The average monthly salary is calculated by an accounting employee. The formula depends on whether the full billing period has been completed.

Table 4. The formula used to calculate the average monthly earnings of an employee

| Formula | Situation in which it is applied |

| The employee's total salary for 12 months. / 12 / 29.3 | The billing period has been fully worked out |

| The employee’s total salary for the period (calculated) / (29.3 x Number of fully worked months) + Number of days in an incompletely worked month | The billing period has been partially completed |

In this case, you need to know the average daily salary of a specialist in order to make the calculations correctly. To do this, use the formula from Article 139 of the Labor Code of the Russian Federation:

Q=S*T, where Q is the desired value, S is the average daily income of the employee, and T is the number of days for which the average salary of a specialist must be calculated.

Important . Not all income is included in the calculation of the average salary, which you need to know to assign a payment from the Social Insurance Fund. The full list of income that is not taken into account during the calculation is indicated in Decree of the Government of the Russian Federation No. 922.

It is worth noting that in a family with two children, first one and then the second child often gets sick. Having received a BL for the first one, there is no need to apply for the second one when he gets sick. You need to see a doctor to extend your certificate of incapacity for work.

When leaving one maternity leave for another, a woman can independently choose paid periods to receive the maximum payment. If she does not do this, then by default the last 2 years are taken before leaving on the first maternity leave.

Sick leave payment calculator

Go to calculations

How many times a year can you take sick leave?

The doctor extends sick leave in accordance with the indications

The duration of the BL is determined by current legislation. The doctor cannot extend it without appropriate indications. It is worth considering the maximum duration of sick leave for major diseases.

Table 5. Duration of BL for various diseases

| Disease | Duration (days) |

| ARVI, sore throat | 15 |

| Limb fracture | 60 |

| Displaced spinal injuries | 240 |

| Brain concussion | 28 |

| Oncological disease | 120 |

| Tuberculosis | 240 with possible extension for medical reasons |

| Chickenpox, appendectomy, cysts | 21 |

| Tooth extraction with complications | 10 |

| Uterus removal | 100 |

| Gallbladder removal | 48 |

It is worth noting that initially the patient turns to the therapist for BL. He prescribes it for up to two weeks. However, he cannot carry out an extension. To do this, you need to gather a council of doctors who will decide the feasibility of this action. However, it is possible to contact a specialist who can provide a ballot for another 30 days. Thus, it is possible to be on sick leave for 1.5 months. It is required to provide all BC to the accountant after returning to work.

Questions about sick leave

Questions often arise about sick leave

There are always questions about sick leave that interest citizens. It is worth considering the main ones in more detail.

Will sick leave be provided for caring for a child over 15 years old?

No, the doctor is forced to refuse, since such a bulletin will be considered invalid. Information about the patient must be entered there. That is, if for some reason the doctor provides a document, they will not be able to pay for it. The doctor himself will face administrative or criminal punishment for illegally issued BC (the type of punishment is decided based on the purpose of providing it to the patient).

How is BL given by law?

You must receive it in person from a medical facility employee. After discharge, you must close it and put a hospital stamp on it. It must also bear the doctor's signature and seal. All information is filled in according to the wording. Blots and mistakes are not allowed. These are strict reporting forms, so it is important to fill them out carefully. Today it is possible to fill out the electronic version. It is immediately sent to FSS employees, and a copy is provided to the patient. He must provide it to the employer to make payments for the first three days.

A certificate of incapacity for work is not issued to the following citizens (Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N 624n)

Is it possible to check sick leave?

If an employer has questions about the authenticity of the issued bulletin, he requests information from FSS employees whether the particular citizen actually went to the doctor and received a certificate of incapacity for work. When confirming the information, the question of the authenticity of the document disappears.

Is it possible to fire an employee who is constantly on sick leave?

There is a category of workers who often go to the BC. The employer cannot get rid of them and fire them. You need to have a compelling argument for this. This could be a violation of labor discipline. Dismissal by agreement of the parties is also allowed. It is worth noting that the employer is not prohibited from coming to the home of a sick employee. By visiting him, you can understand whether he really has health problems or whether he wanted to rest. If the reason for going on sick leave is the latter, then it is declared invalid and the employee is fired. When the case comes to court, a criminal case is initiated against the doctor and the patient.

Are military personnel given sick leave to care for a child?

They can get this document, but it is not recognized. That is, the absence of a military unit on the territory only because of the presence of a BC is equivalent to the willful abandonment of the unit. It is necessary to write a report for family leave in order to be legally absent from the workplace. At the same time, military men who care for a child are not entitled to payments from the Social Insurance Fund.

What happens if you don’t pay for sick leave on time?

The law requires payment 10 days after receiving the BC. If the employer provides money later than this period, he must additionally pay compensation.

Thus, a certificate of incapacity for work gives the right to receive payments from the Social Insurance Fund during illness or when caring for a child. The amount of payment depends on length of service and average salary. Compensation is calculated based on the official income of the employee. That is, having a high unofficial income does not give the right to high payments. In this way, the state is trying to motivate citizens not to work for employers who offer mediocre salaries.

Recommendations for employers: how to get started with electronic sick leave

In order for an employer to be able to connect to the system for recording and using electronic certificates of incapacity for work, used by the Social Insurance Fund in order to accept such certificates for subsequent payment, he must:

- Connect to the Unified Integrated Information System “Sotsstrakh”. An organization can register in it only if it has registration on the State Services website.

- Register the organization in the Unified IIS “Sotsstrakh” and fill in all the necessary information that must be taken into account for the proper functioning of the organization in this information system;

- Redistribute responsibilities between employees of the financial department and allocate an employee who will directly prepare electronic certificates of incapacity for work and send them to the Social Insurance Fund for subsequent payment;

- Inform all employees of the organization about the emergence of new opportunities in the form of providing electronic sick leave if the need arises to use it.

FSS instructions

- Detailed instructions from the Ministry of Telecom and Mass Communications of the Russian Federation.

- Instructions for registering individuals and legal entities.

- Instructions for registering a legal entity.

Rules for document registration of an employee by the employer

If an employee brings an electronic sick leave, the employer must formalize it correctly. To do this you need:

- receive the actual sick leave from the employee in the form of an assigned number. Also, some medical institutions indicate from what period to what period a given sick leave provided an employee with exemption from performing a labor function. The sick leave number is submitted either to the personnel department or directly to an accountant, who will process it for transfer to the Social Insurance Fund;

- then the accountant finds the sick leave in the FSS registry databases and fills it out by indicating information about the employee’s average earnings and his insurance record;

- after the document has been completed, it must be signed by a qualified digital signature of an enhanced type and sent to the Social Insurance Fund so that its specialists can calculate the payments due.

If the accompanying documents for sick leave included information about how much should be transferred to the employee, FSS employees check the accrual data and, if they are correct, make a payment either directly to the employee (if the region is included in the direct payment system) or to the organization as compensation for benefits paid to the employee.