If negotiations with the employer regarding non-payment or incomplete payment of earned money have reached a dead end, the only option left is to collect wages through the court. This is a fairly effective way to restore violated rights, since the courts in labor disputes most often support the employee’s side. It is only necessary to prepare documents proving the legality of the plaintiff’s claims and send them to the court within the period established by law.

Cases for consideration in court

The problems that the judge considers may be related to both violations of the Labor Code of the Russian Federation and local regulations adopted and in force at the enterprise. Most often, citizens ask to resolve the following issues:

- On the collection of additional payments for overtime and night work.

- On recalculation of payroll due to incorrect indexation and application of coefficients.

- About an unreasonable reduction in the amount of the premium.

- On payment of compensation upon dismissal.

- On the collection of wages during forced absence, which is associated with illegal removal from work, dismissal or delay in issuing a work book.

- On receiving compensation for delayed payment of wages.

When considering disputes, judges do not simply help citizens get money, but consider cases from the point of view of compliance with laws. And if it turns out that the employee deliberately led the employer to violations, a decision may be made in favor of the defendant. So, if upon dismissal of an employee he was not given a work book, the court will check whether everything was done by personnel specialists to notify the dismissed citizen of the need to pick up the document. Deliberate delay by a dismissed employee from receiving a work book with the intention of later receiving payment for forced absence will lead to denial of the claim.

Rules for going to court

First, you need to choose the court to which to send the documents. According to the established rule, all claims are filed in the court located at the location of the defendant. The exception is disputes regarding violations of the labor rights of citizens. In this case, it is possible to appeal to the court at the place of registration of the employee. The time limit within which to seek court assistance is currently one year from the date on which the salary was due to be paid. Collection of wages through the court occurs without payment of state duty. You just need to bring all the prepared documents and write a statement or file a claim. The document that needs to be filed depends on the manner in which the case is handled. It can be by court order or by way of a statement of claim.

Collection of wages by court order

This simplified method of considering a claim is carried out on the basis of an employee’s application. It is used in cases where wages have been accrued, but they do not want to pay them. An example of such a violation is the delay in issuing money. The application must indicate:

- information about the claimant, including place of residence and Taxpayer Identification Number;

- employer details;

- justification of the reason for filing the application;

- list of attached documents.

The court considers the issue without calling the parties, only on the basis of the documents presented. Therefore, you need to try to collect all the facts that prove the employer’s guilt. It should be clear from them that the employee was required to be paid a salary, but this was not done, and the demands for the collection of wages are legitimate. Therefore, the following documents can be attached to the application:

- employment contract;

- identification;

- Act of executed works;

- payslip.

The court has three days to study the information provided and issue an order. A document similar to a writ of execution is mandatory for use in work. But, unlike a writ of execution, an order can be challenged by the employer. The claimant can independently bring the court order to the employer, who must review it and execute it. It is possible to send an order through the bailiff service. If the manager does not agree with the decision made and believes that the employee does not have the right by law to receive the required money, he can file a counter-statement within ten days and cancel the court order. In this case, to restore the violated rights, the employee can only go to court with a statement of claim.

Disputes regarding the collection of severance pay and other payments upon dismissal

Disputes about non-payment of the final payment and severance payments are also rare.

All types of disputes regarding payments upon dismissal (including those not initiated by the employee) are related to conflicts of law, provisions of local acts and requests of employees. There are often cases of employee disagreement with accrued amounts. Practice shows that there are approximately equal numbers of cases where an employer’s refusal to pay severance pay is unfounded and cases where the refusal is legal. The most difficult cases are cases where the application of the provisions of various regulations is controversial. In this case, the dispute that has arisen is referred to the court.

The reason for such disputes is the incorrect understanding and application of the provisions of legislative acts.

The employee must carefully study the legislation and judicial practice in order to prevent unfounded claims. If a dispute arises, it is advisable to resolve it peacefully. A peaceful settlement of the conflict will save both parties to the dispute both the time and the costs of considering the case in court.

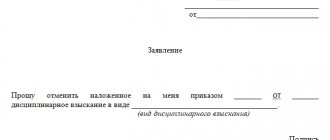

Claim procedure for collection

The statement of claim is drawn up in the same way as a statement considered in a simplified manner by court order. It must be submitted if any payments were not processed and were not accrued. In a labor claim, you need to describe the current situation and set out the requirements for the enterprise. When filing a claim, it is also necessary to collect a package of documents proving the employer’s unlawful actions. But unlike the previous method, if the court considers that the documents do not sufficiently explain the current situation, it can independently request separate certificates from the enterprise. After filing a claim, within 5 days the judge decides to initiate a case. The final consideration of the issue must be within two months. The employer can no longer stop the court's decision in the case with his statement. This can only be done by filing an appeal, for which he is given a period of 15 days. If the decision was not appealed or left in force by the appeal commission, after 15 days it begins to take effect.

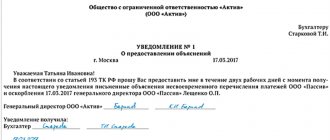

Contact your employer

Of course, at the first delay in earnings, you should not immediately run with complaints to the appropriate authorities or file lawsuits in court. Initially, it would be more appropriate to submit an application to the employer himself. The application must be made in writing and submitted to management against signature.

The application must indicate:

- Employer's name;

- Position and full name of the manager;

- Position and full name of the employee;

- Request to pay payments due to the employee;

- Request to pay compensation under Art. 236 Labor Code of the Russian Federation (optional);

- The condition that if the delay exceeds 15 days, the employee will be forced to suspend work;

- Signature with transcript;

- Date.

Depending on the manager’s reaction to the received statement, the employee will understand how to act further.

Problems with receiving documents from the employer

When going to court, the employee must document that he worked for this employer, he was required to pay wages, but this was not done. Some of the necessary documents a person may have on hand:

- a second copy of the employment contract;

- various certificates issued by the employer and confirming the position, as well as training and certification;

- payslips issued monthly.

But it may be necessary to attach separate certificates and statements that confirm the amount of accrued wages, time worked, and working conditions at the workplace.

Important! Even if, despite a written application requesting the issuance of such certificates, the management of the enterprise refuses to provide them, this must be indicated in the statement of claim. Then the judge will interact with the employer and may request any documents to consider all the nuances of the case.

Labor inspection inspections: how they will be carried out in 2020

New Administrative Regulations on Federal State Supervision of Compliance with Labor Laws, approved. by order of Rostrud dated June 13, 2019 No. 160, came into force on October 22, 2019.

Supervision of compliance with labor legislation is carried out by Rostrud through, in particular, scheduled and unscheduled inspections of employers. As part of such inspections, labor inspectors check the completeness and timeliness of payment of wages, the correctness of calculations for dismissal and payment of vacation pay, compliance with labor protection requirements, etc. (clause 5 of the Regulations).

The new Regulations are brought into compliance with the requirements of labor legislation and other regulations (taking into account recent changes made to them) governing the implementation of federal state supervision over compliance with labor legislation.

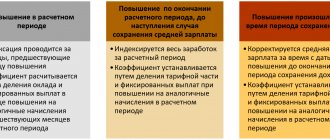

How an inspector will check salary indexation

The new regulations established an exhaustive list of documents and (or) information that a labor inspector may request during an inspection.

In particular, the State Tax Inspectorate can request and check documents on the employer’s indexation of workers’ wages (clause 13 of the Regulations).

In addition, the employer may be required to provide documents confirming compliance with mandatory requirements in the field of protecting personal data of employees, pay slips and orders for approval of their forms, documents confirming compliance with mandatory labor protection requirements and ensuring safe working conditions.

What determines the timing of a labor inspection inspection?

According to the new regulations, verification of the employer cannot exceed 20 working days.

A scheduled on-site inspection of a small business entity cannot exceed 50 hours, and in relation to a micro-enterprise - 15 hours during the year, unless otherwise provided by law.

If an employer operates on the territory of several constituent entities of the Russian Federation, the total period of inspection in relation to it cannot exceed 60 days (clause 24 of the Regulations).

Grounds for terminating a labor inspection

The new regulations expand the list of grounds under which an inspection cannot be started, and an already started inspection must be terminated. Such grounds are (clause 27 of the Regulations):

- lack of grounds for an inspection;

- inconsistency of the subject of inspection with the powers of Rostrud and its territorial bodies;

- gross violations during the organization and conduct of inspections provided for by the legislation on state control (supervision);

- a situation where the inspection contradicts other requirements of federal laws, regulatory legal acts of the President of the Russian Federation or the Government of the Russian Federation;

- identification, after the start of an appropriate verification, of the anonymity of the appeal or statement that was the reason for its organization, or the establishment of knowingly unreliable information contained in the appeal or application.

Application of a risk-based approach to inspections

Following the example of inspections carried out in other areas (for example, during inspections of compliance with fire safety requirements), government inspectors will use a risk-based approach when inspecting employers.

This means that each employer (legal entity and individual entrepreneur) will be assigned to a separate risk category, which determines the frequency and thoroughness of the inspection - see the table.

Table

| No. | Risk category to which the employer is assigned | Carrying out an inspection |

| 1 | High risk | Once every 2 years |

| 2 | Significant risk | Once every 3 years |

| 3 | Medium risk | Once every 5 years |

| 4 | Moderate risk | Once every 6 years |

Risk categories are assigned by Rostrud taking into account departmental reports on injuries and wage arrears from a particular employer, as well as through a system of interdepartmental interaction with the Federal Tax Service of Russia.

If there is no information about the employer’s classification as a risk category, it is considered that it is classified as a low risk category and routine inspections are not carried out in relation to it. At the same time, the possibility of unscheduled inspections remains available.

Checks must be carried out using checklists

The order or order to conduct a scheduled inspection will indicate the details of the checklist that will be used during the inspection. The subject of the check will be limited to the list of questions included in such a checklist (clause 51 of the Regulations). The form of the checklist was approved by order of Rostrud dated November 10, 2017 No. 655. Such a checklist is drawn up by the inspector before the start of the inspection.

Salary "in an envelope"

It is more difficult to collect wages from an employee who receives part of the money “in an envelope” or who works without concluding an employment contract. The employer, realizing that it is very difficult to accuse him of violating the law, can afford to delay payments to employees or, for some reason, reduce their amount. In such a situation, the main task is to collect evidence of the agreement on the amount of wages. Any certificates, statements, coupons will do. Witness testimony may be used. If there are results of audits by the tax inspectorate, the prosecutor's office, or the labor inspectorate, which record the fact of unofficial wage payments at the enterprise, this can serve as a good help in the matter of debt collection. But when making decisions about an individual employee, the court will consider specific facts, and you need to be prepared for the fact that the case may not be won.

Deadlines for payment of wages

Specific terms for payment of wages are established by the labor and (or) collective labor agreement.

The legislator leaves no choice to the employer and indicates the need to pay wages at least every half month . According to amendments to Article 136 of the Labor Code of the Russian Federation, since October 2016, specific payment days are established no later than 15 calendar days from the day the period for calculating payments expired.

For example, an employer pays an advance for the first half of the month on the 20th, then the basic salary should have been paid no later than the 5th of the next month.

The above terms apply to all components of wages .

Execution of a court decision

The amount of debt in the amount of three months' earnings after the court decision is subject to collection immediately. The rest of the money is collected after the court decision comes into force. At the end of the period specified for challenging the document, enforcement proceedings are initiated, and further collection is handled by the bailiff service. An employer can voluntarily comply with a court decision by paying the employee back wages. Documents confirming payment must be brought to the bailiff. All this must be done within five days. If the bailiffs do not see that the defendant has fulfilled the obligations assigned to him, they begin to apply enforcement measures. This may include the seizure of bank accounts and property of the defendant. There are cases when the employer agrees to comply with the court decision and pay the employee money. But large sums are not always in the bank account, and seizure of property can lead to a halt in production. In this regard, the head of the enterprise may file an application with the court with a request to establish a deferment of execution of the decision. It should set out the reasons why execution of the decision is currently impossible and document the receipt of funds over time.

Who should I contact in case of a dispute?

If you need to collect wage arrears, you cannot do without the help of an experienced lawyer. Both a labor lawyer and a labor lawyer have sufficient experience and knowledge to resolve conflict situations between an employer and an employee. Unlike a lawyer, an employment lawyer has the right to represent the interests of the client in criminal cases, which means that he can help bring the employer, if there are grounds, to criminal liability. If the specialist’s task is simply to collect wage debts, then the citizen can contact both a lawyer and an attorney.

If the employer is late in paying wages, the lawyer can recover not only the entire amount of the debt, but also a penalty. According to Article 236 of the Labor Code, for each day of delay the employer is obliged to pay compensation in the amount of 1/150 of the Central Bank key rate. As of September 19, 2021, the Central Bank rate was 10.0. For example, if an employee fails to pay 10,000 rubles, the employer will have to pay 666.67 rubles for each day of delay.

Important:

The maximum amount of the penalty is not limited by law. Accordingly, the amount of the penalty can be many times greater than the amount of the unpaid salary itself if the employer does not pay the employee the money he is entitled to for a long time.

Collection of wages in favor of the employer

If an employee is paid more than the required amount, the employer may demand that it be returned to the company. Please note that this can only be done in cases of overpayment for the following reasons:

- if a counting error occurs;

- if the employee’s fault for downtime is established or the fact of failure to comply with labor protection requirements is recorded;

- if the overpayment was caused by illegal actions of the employee himself.

When the employee is still working, you can issue an order and deduct money monthly from your salary in an amount not exceeding 20% of the accrued amount. But for this it is necessary to obtain written consent from him. If an employee is fired, the only way to get the money back is to go to court. When filing a claim, you must attach:

- a copy of the employment contract;

- calculation of accrued and paid wages;

- act on detected overpayment;

- a copy of the notice to the former employee about the need to return overpaid amounts.

To confirm a counting error or program malfunction, you need to draw up a report with a detailed explanation of the reasons for the incident.

What to do if the statute of limitations has passed

Sometimes, for various reasons, employees forget that there is a specific limitation period for wages to go to court. They believe that they will be able to resolve problems with their former employers amicably. But, as judicial practice shows, organizations sometimes deliberately delay solving financial problems - they promise that they will pay, or even partially repay the debt. This is done in order to notify the court when filing a claim that the deadline has been missed, which usually leads to a refusal to consider the former employee’s complaint.

But the presence of such a petition does not mean that the judge will not study all the materials of the case. If the employee proves that there were valid reasons for missing the submission of the application, the deadline will be restored. Considered respectful:

- the plaintiff's long-term illness;

- registration of disability;

- business trip;

- the influence of force majeure;

- the need to care for a seriously ill family member.

This list of valid reasons is incomplete and is often updated. For example, last year this list included the fact that the plaintiff was expecting a response from the State Tax Inspectorate (see Determination of the RF Armed Forces No. 44-KG18-33 dated February 25, 219), and already this year - the introduction of restrictions on movement in populated areas due to the coronavirus pandemic (see Review of selected issues of judicial practice No. 1, approved by the Presidium of the Supreme Court of the Russian Federation on April 21, 2020).

Of course, the plaintiff will have to prove that there are good reasons for missing the deadline for filing an application. To do this, they prepare a free-form petition to restore the statute of limitations, explaining the situation. Additionally, documents confirming the validity of the reasons are attached - certificates, extracts, tickets. It is permissible to invite witnesses who are willing to corroborate the plaintiff’s statements.

If the judge accepts the facts presented as valid grounds for missing the statute of limitations, he will reinstate the statute of limitations and continue to consider the complaint. If you refuse, don’t be upset; you can always challenge the decision to a higher authority.