What is more important in a family – living together, love, common life or obligations? No matter what atmosphere the spouses build in marriage, when the union breaks up, emotions and misunderstanding of each other are inevitable. One of the pressing issues during a divorce is alimony, and if there are two children, difficulties may arise in providing for them.

2. The right to education is at the same time a duty and includes concern for the comprehensive development of the child (physical, mental, spiritual and moral). According to paragraph 2 of Art. 6 of the UN Convention on the Rights of the Child, states parties ensure to the maximum extent possible the survival and healthy development of the child.

Source – Chapter 12 “Rights and Responsibilities of Parents”, Art. 63, clause 2 of the Family Code of the Russian Federation

Regardless of the number, one child or two children, they must be cared for by both parents, regardless of the presence/absence of their own attachments and any other subjective circumstances.

Therefore, child support is a necessity, an obligation, and also a right: neither parent has the opportunity to prohibit the other from taking care of the children until they reach adulthood. Rare cases, but the judicial system is also aware of them. More often, one of the spouses files a claim for forced collection of monetary support, in which case alimony is paid in an amount determined by a number of parameters. We will talk about the principles for determining the amount of alimony in 2021 in this article.

Amount of child support for 2 children

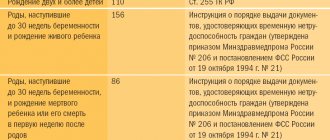

The amount of payments always depends on the level of income of the parent from whom funds will be deducted, but cannot be less than 33% of the minimum wage for two children. From May 1, 2021, the minimum wage increases to 11,163 rubles, according to updates to the Federal Law dated December 28, 2017. No. 421-FZ. Some other factors are also taken into account:

- whether the collection occurs by court decision or mutual agreement of the former spouses;

- parent’s employment status (unemployed, officially employed, individual entrepreneurship);

- number of children (both in one marriage and in several).

Provided that the parents were able to agree and independently determine the parameters of joint support for children, a written, notarized agreement is drawn up, which indicates the amount of payments. If reaching consensus is impossible, alimony and the terms of its payments are assigned in court.

How is the amount of alimony calculated and determined?

No matter how trusting the relationship between spouses remains after a divorce, the amount of alimony, even in the presence of a notarial agreement, cannot be lower than what the court can assign.

1. The amount of alimony paid under an agreement on the payment of alimony is determined by the parties to this agreement.

2. The amount of alimony established under an agreement on the payment of alimony for minor children cannot be lower than the amount of alimony that they could receive if alimony was collected in court.

Source – Section V “Alimony obligations of family members”, Chapter 16 “Agreement on payment of alimony” Art. 103 of the Family Code of the Russian Federation

The amount may well exceed the minimum, it depends on what decision the ex-spouses come to. Such an agreement must be drawn up in the presence of a notary; if the parties consider it possible to terminate the agreement (to conclude a new one, if there is no need, for other reasons), this will also need to be done in front of a notary.

If the agreement is refused, the parent entitled to receive child support may file a lawsuit. Moreover, the period after the divorce or termination of family relationships does not matter. Alimony is awarded for the last three years from the date of non-payment.

The above-mentioned 33% for two children is assigned if the spouse has official earnings; the percentage of alimony in this case is a third of the salary. However, the amount of alimony may change in accordance with changes related to the spouse's employment.

How does the father's/mother's earnings affect child support?

When calculating the amount, all official types of earnings of the parent paying sums of money for the maintenance of children are taken into account. The list can be quite lengthy:

- from the salary at the main place of work

- from the income of a part-time job

- from one-time fees

- allowances, bonuses, pensions

- from financial assistance and all other types of income

The calculation of the final amount of alimony directly depends on the financial situation of the payer. In situations where the parent paying the money has only temporary part-time work or is in unemployed status, the court makes decisions on the payment of a fixed amount - either the minimum wage, or a share of the minimum wage, or a multiple of the established denomination.

“The amount of a fixed sum of money is determined by the court based on the maximum possible preservation of the child’s previous level of support, taking into account the financial and marital status of the parties and other noteworthy circumstances,” explains the RF IC in Article 83.

If a parent is officially unemployed and receives appropriate benefits, he is obliged to pay alimony, including from it. The calculation follows a similar principle when there is unstable income - according to the minimum wage. The same applies to receiving salary in the form of foreign currency or natural products (for example, for owners of farms, production, etc.).

A special case is the individual entrepreneurship of a parent. In such circumstances, payments for two children will depend on the type of taxation adopted by the company. The simplified system involves calculation based on the average salary in the country, and UTII - payments based on the total profit of the enterprise.

The legislative framework

Calculation of alimony is carried out on the basis of Chapter 16 of the Family Code of the Russian Federation (FC). This section of the legislation specifies the methods and amounts of required payments, as well as the logic for their purpose. Several calculation methods are usually used:

- share;

- in a fixed amount;

- natural;

- property.

Download for viewing and printing:

Family Code of the Russian Federation

The first method is considered the most common in Russia.

The maximum percentage of child support when used is assigned to three or more children. This norm is laid down in Article 81 of the UK. At this point, the share of participation in the material support of minors is associated with their number. Namely:

- one quarter of the income is withheld (25%);

- for two – a third (33%);

- for three or more - half (50%).

Important!

In this case, the maximum is important for the payer. But it may not suit the recipient. When calculating alimony, the norm of Art. 99 of the Federal Law “On Enforcement Proceedings”. It strictly limits the redistribution of earnings in favor of others. The maximum threshold for such an operation is 70% of the amounts determined for calculating alimony.

Attention! The alimony holder can pay under several writs of execution. This limits the specific amounts received by each person to whom they are assigned.

Does the calculation method affect the restrictions?

When assigning alimony, the following parameters are taken into account:

- financial situation of the parties;

- children's needs;

- their health status and age;

- property status of the plaintiff and defendant;

- the presence of a second family and minor dependents of the defendant;

- his state of health;

- something else that affects the matter.

Attention!

The court considers the preservation of the children's previous standard of living as a priority goal. If the departed father earned 10 thousand rubles, then 20 thousand rubles. he will not be forced to pay. Download for viewing and printing: Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”

Calculation methods do not affect the amount of payments in any way. To a greater extent, they depend on the payer’s ability to earn and transfer money. In addition, the desire of the person to fulfill his duties cannot be ignored.

How is child support distributed among several children?

If we are talking about the number of children 2, 3 or more, such payments are also regulated by the provisions of the Family Code of the Russian Federation: “In the absence of an agreement on the payment of alimony, alimony for minor children is collected by the court from their parents monthly in the amount of: for one child - one quarter, for two children - one third, for three or more children - half of the earnings and (or) other income of the parents.” Cash compensation may be increased or decreased due to circumstances of income or marital status.

According to the terms of deductions, amounting to 33% of wages and/or any other source of income for 2 children, alimony in 2018 is 16.5% for each child. In the same way, income is distributed among children from different marriages. The parent is required to pay as much alimony as the number of children recognized by the court or agreement as recipients of funds.

Terms and methods of paying child support for 2 children

Under the terms of a notarial agreement or a court decision, collection can occur contactlessly. There is no need to meet your ex-marital partner in person, especially if there are reasons to avoid contact. Funds are transferred to the card of the parent who currently has custody of the child within the period specified by the Family Code of the Russian Federation.

The administration of the organization at the place of work of the person obligated to pay alimony on the basis of a notarized agreement on the payment of alimony or on the basis of a writ of execution is obliged to withhold alimony monthly from the salary and (or) other income of the person obligated to pay alimony, and pay or transfer it at the expense of a person obligated to pay alimony to a person receiving alimony no later than three days from the date of payment of wages and (or) other income to the person obligated to pay alimony.

Source – Section V “Alimony obligations of family members”, Chapter 17 “Procedure for payment and collection of alimony” Art. 103 of the Family Code of the Russian Federation

Maximum for share settlement

In this case, much will depend on the payer’s earnings.

The court will establish payment in accordance with Article 81 of the Criminal Code. However, the law does not prohibit increasing the percentage of income if necessary. The conditions for making such a decision are as follows:

- a minor is required:

- expensive treatment;

- purchase of drugs;

- a trip to a hospital medical facility.

However, when considering the issue, it is taken into account that the payer must remain 30% of earnings. After all, he also needs to live off something. The court takes into account not only the percentage of the salary, but also its cash equivalent. The payer is left with a subsistence minimum as a last resort.

Download for viewing and printing:

Article No. 81 of the Family Code of the Russian Federation “Amount of alimony collected from minor children in court”

Attention! An increase in payment to the maximum by court decision is possible only if there are appropriate proven conditions.

Example of alimony collection

- The administration of the enterprise received a writ of execution against the employee, which determined the amount of alimony at 25%. The document indicates that payments should begin on March 15, 2021.

- The accounting department accrued the following amounts to him this month: Salary - 40,000 rubles.

- Annual bonus 140,000 rubles.

- Quarterly bonus 30,000 rubles.

- Salary: 40,000 rub. / 20 working days x 11 working days days = 22,000 rubles.

Important! The maximum amount of alimony is obtained when the payer does not hide income.

Conditions for paying alimony in 2018

To receive child support for two children, the following conditions must be met:

- both are minors, and if they reach 18 years of age - incapacity due to disability;

- recognition of the legality of birth or adoption

After providing documents that prove these factors, you can draw up a notarized agreement on the payment of alimony or file a lawsuit against the evading parent.

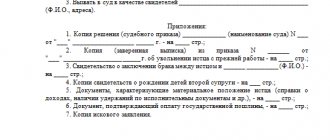

The algorithm for filing a claim is quite simple:

- Applying to the court at your place of residence with a request to issue a court order;

- Transferring the order to the bailiff, who initiates the proceedings;

- Receiving the number of the outgoing sending by the court of a copy of the order to the obligated person - the defendant has the right to appeal it.

Required documents:

- passports of both spouses;

- marriage registration certificate;

- birth certificates for each child of the two;

- documents confirming family ties between parents and children;

- an agreement certified by a notary or a claim drawn up by a bailiff.

The legislation of the Russian Federation provides for cases when there was no claim for divorce or the marriage was not registered by the registry office. The first situation assumes that the spouse is avoiding obligations to support the child. In this case, the debt is collected through coercion.

If the marriage was not officially registered, you will need to provide documents confirming paternity - usually a birth certificate. In a situation where the father does not recognize the child as his own, evidence is needed that he is wrong: for example, the results of a medical examination.

What to do if alimony is not paid?

Despite the validity of the notarial agreement, the parent may evade paying child support. In this case, not only civil liability comes into play, but also criminal liability. The Criminal Code of the Russian Federation provides for the maximum punishment for persistent defaulters - imprisonment in various formats for a period of up to one year.

Failure by a parent to pay, without good reason, in violation of a court decision or a notarized agreement, funds for the maintenance of minor children, as well as disabled children who have reached the age of eighteen, if this act is committed repeatedly, is punishable by correctional labor for up to one year, or forced labor for the same period. , or arrest for a term of up to three months, or imprisonment for a term of up to one year.

Source – Special Part of the Criminal Code of the Russian Federation, Section VII, “Crimes against the Person”, Chapter 20, “Crimes against the Family of Minors”, Art. 157.

Usually the court orders the payment of penalties. The charge of malicious evasion of payment is justified if the payer hides his income, changes his place of residence without warning, refuses to financially help the child in any way and rejects the job offered by the labor exchange.

No matter how confusing the situation may seem when it arises, the Constitution of the Russian Federation, Family, Civil and Criminal Codes already have solutions for any conflicts between parents. Turn to professionals - especially when the well-being of children is at stake.

New in legislation

Work to improve the principles of assigning, withholding and collecting alimony amounts is ongoing. For several years now, deputies of the State Duma have been considering proposals to fix the maximum and minimum amounts of alimony.

- It is proposed to set a threshold value of 10 or 15 thousand rubles. However, this will lead to the fact that: payers with low incomes will not be able to cope with expenses;

- if a person's income is significantly above average, then his children will suffer.

- to an increase in costly budget items;

Attention: currently there are several methods of influencing defaulters. According to the court decision of such a person:

- deprived of driver's license;

- restrict travel outside the country;

- initiate criminal prosecution.