The amount of contributions depends on the employee's income. The standard rate for calculation is 22%.

The maximum amount of the calculation base in 2021 is 1021 thousand rubles. If income exceeds this limit, received above is taxed additionally at the rate 10%.

Pension insurance costs are not deducted from the employee's salary. The employer pays them at his own expense.

A citizen can exercise control over his pension contributions through:

- MFC;

- Pension Fund;

- bank;

- customer service;

- Public services;

- non-state pension fund, if it is its client.

Obligations to pay contributions for individual entrepreneurs are regulated by the same legislative acts as for other forms of doing business.

Law

From 01/01/2017, the issue of pension contributions is fully regulated by Art. 34 of the Tax Code of the Russian Federation.

The legislative act stipulates the following points:

- Art. 419 defines the circle of persons who are subject to the obligation to pay contributions.

- Art. 420 clarifies in what cases contributions must or cannot be subject to calculation.

- Art. 421 establishes the procedure for calculating the tax base and its maximum size.

- In Art. 422 approved a list of situations for which payments are not included when calculating the base.

- Art. 423 contains information about the periods in which it is necessary to submit reports and make periodic calculations.

- Art. 425 – 429 provide detailed information on tariffs.

At the moment, the procedure for calculating the base, the circle of persons on whom payment obligations are imposed remain the same as those established in the repealed Law 212 - Federal Law.

Personal income tax - benefits

In 218 art. The Tax Code of the Russian Federation lists persons entitled to certain benefits when transferring this tax. For example, to a group of people with a monthly tax deduction of 3,000 rubles. includes people who became disabled as a result of the Chernobyl accident in 1986. Also on this list there was a place for disabled people of the Second World War. But disabled people of the 1st and 2nd groups, as well as disabled people since childhood, received the right to 500 rubles. tax deduction from salary. The same benefit is provided for relatives of deceased military personnel.

Is personal income tax levied on wages for children in 2021?

It is believed that personal income tax can be withheld from income of any size. However, parents are interested in what amount is not subject to child tax when calculating wages. In Russia there is a benefit according to which from 1000 rubles. There is no monthly personal income tax for one child. From the difference between the salary received and 1000 rubles. the specified amount is collected in the same way - using a 13 percent rate. If the parents are single, then this amount doubles - therefore personal income tax is not withheld from 2000 rubles.

What percentage of salary is PF contributions?

The amount of contributions to the pension fund depends on the income received during the year. To calculate contributions from the salaries of most citizens, a rate of 22% will be applied. It is valid until the annual income exceeds 1021 thousand rubles.

When this milestone is passed, the amount of contributions increases due to the inclusion of a rate of 10%. Additional charges will affect only the excess income. They do not apply to the principal amount within the limit.

22%, as before, is divided into insurance and savings parts.

16% is paid to the state fund. It cannot be seized and disposed of freely. The uniform rules apply to all categories of officially employed citizens. This part is a guarantee of receiving a pension upon reaching a specified age.

6% is transferred there if the citizen has not redirected it to commercial structures. If an agreement with a non-state pension fund has been concluded, the amount of income received in this part will depend on a number of factors. It will be influenced by: the financial results of a number of companies, the economic situation in general, changes in pension reform and others.

How can I view my pension contributions?

It is possible to monitor the fulfillment of the obligation to make payments towards a future pension in a number of institutions.

- MFC;

- a bank, if it has an agreement with the PF and the citizen is its client;

- Pension Fund;

- customer service;

- NPFs, if a person has invested a savings portion in them.

If you are registered on the websites of State Services or the Pension Fund, you can check it via the Internet.

Creating a personal account in State Services automatically entails registration on the Pension Fund website.

The procedure is simple; it consists of entering minimal information about the user and confirmation.

Verification algorithm. Opening tabs:

- pension;

- benefits and allowances;

- notification of the status of the personal account.

On the Pension Fund website like this:

- Ministry of Health and Social Development;

- Pension Fund;

- information about the status of personal accounts;

- notice.

When applying in person, you need to find an authorized department and contact a specialist with documents. Mandatory list:

- SNILS;

- passport;

- statement.

At the bank, an employee will accept and register the application. After this, settings will be made in the client’s personal account to allow requesting data from the pension account.

Having received a coupon at the MFC terminal with a number in the electronic queue, you need to wait for a notification that the specialist is ready to accept the application. The further procedure is carried out similarly.

The customer service provides information in writing within 10 days by registered mail. You can receive an extract in person at the service office.

The procedure for obtaining data from non-state funds is not universal. It depends on the procedure for issuing such information to clients by a specific organization. However, this should not cause any difficulties. By providing the above documents, the client has the right to receive information about the status of his accounts.

Control of accruals in a private fund consists only of familiarizing yourself with the amounts. The client cannot influence their size. The conclusion of an agreement involves the transfer of funds for the full management of the company, freedom in choosing management decisions. Familiarization with the operations being carried out and agreement with the pensioner is not provided.

Who pays: employer or employee?

The employer pays pension contributions to the budget. He calculates them and reports to regulatory authorities. Accruals are calculated and paid every month until the 15th day of the following billing period. Reporting is also due by the 15th, but quarterly.

The percentage is applied to the employee's income. The amount received is not deducted from your salary. The employer pays from his income. Further, contributions to the pension fund for employees can be included as expenses for tax purposes.

What taxes are paid on wages?

Ksenia (KadrofID: 45949)

This is a completely illiterate article!!!! Art. 419 of the Tax Code of the Russian Federation: Payers of insurance premiums (hereinafter in this chapter - payers) are the following persons who are policyholders in accordance with federal laws on specific types of compulsory social insurance: 1) persons making payments and other remuneration to individuals: organizations; individual entrepreneurs; individuals who are not individual entrepreneurs; 2) individual entrepreneurs, lawyers, mediators, notaries engaged in private practice, arbitration managers, appraisers, patent attorneys and other persons engaged in private practice in accordance with the legislation of the Russian Federation (hereinafter referred to as payers who do not make payments and other remuneration to individuals). Individuals working under an employment contract are not payers of contributions to social insurance funds. What you, Sergey, say, that supposedly in practice employers pay these amounts from funds intended to pay salaries to employees, has no legal basis, you are creating legal illiteracy among the population!!! Mandatory inclusion in the employment contract, according to Art. 57 of the Labor Code of the Russian Federation, wage conditions are subject to. An employee’s salary can be indicated both with the deduction of personal income tax, since it is still the employer’s responsibility to transfer personal income tax to the budget (according to Article 226 of the Tax Code of the Russian Federation, the employer is the tax agent for the payment of this tax), and without the deduction. BUT!!! In no case may amounts payable to social security funds be deducted from the salary specified in the employment contract. If the employer deducts more than 13% of the wages (that is, the amount of personal income tax) specified in the employment contract, or in the employment contract itself the amount of wages due to the employee is indicated minus more than 13%, this is a VIOLATION OF LEGISLATION on the part of the employer. Thus, the example given in the article, with a certain employee who has a salary of 30 thousand rubles, is so ridiculous that it plunges me into deep shock. You, Sergey, responding to Anton’s comment, probably meant the desire of employers to minimize costs, I agree that such a trend exists, this leads to the fact that employers do not want to pay high wages, however, wages cannot be below the minimum wage. To summarize, I would like to say that the economic and legal should not be confused. This article is pure nonsense. I ask site visitors not to take the information contained in this article seriously. It's best to consult a legal advisor.

04/18/2018 at 08:07

Contributions to the USSR pension fund for employees

In the USSR, contributions to the pension fund for employees came from two sources. The enterprise transferred from 4 to 12% of wages, a small part was added by the state itself. The percentage depended on the industry in which the person worked. Nothing was deducted from the salary. The worker's income acted only as a calculation base. The budget, which contained contributions until a person retired, was called the public consumption fund. The size of the pension was fixed, set once, and neither changes in working conditions nor the economic situation could influence it. There was no minimum wage, and there were no annual recalculations due to inflation. This system came into force in the 60s of the last century. Observations over the next 20 years show that it did not lead to an increase in the well-being of the majority of the population. Despite the fact that at that time pensioners had benefits for travel, treatment, and utilities, by the 80s the standard of living among adults remained below average.

Contributions to the pension fund of individual entrepreneurs for employees

Contributions to the pension fund for employees and reporting do not depend on the form of business. Payments must also be made by the 15th of each month, reporting is submitted quarterly. An individual entrepreneur is obliged as a tax agent to transfer contributions to the pension fund for an employee. He becomes such after receiving the status of an employer and registering with the pension fund as an insured. The rules regarding the calculation of the base, sizes, and tariffs are general. The size of the pension contribution depends directly on the amount of income, calculated at a rate of 22% for each worker.

The size of the future pension is an unpredictable value. Political and economic changes are prerequisites for making adjustments to the pension reform. Therefore, control and planning of your financial future is only partially possible. What can we do now? Conclude an agreement with the employer, which will indicate the full amount of monthly payments, and periodically check the amount of actually received contributions to the pension account.

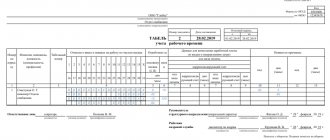

Salary tax table in 2021 in percentage

So, let’s summarize all salary taxes existing in Russia into a single table and find out the minimum and maximum percentage that is withdrawn from our actually earned wages by the state.

| Type of tax | Min. bid | Max. bid |

| Income tax (NDFL) | 13% | 30% (for non-residents) |

| Contributions to pension plans |

| |

| Contributions for temporary disability and maternity |

| |

| Contributions for injuries | 0,2% | 8,5% |

| Health insurance | 5,1% | 5,1% |

Thus, even if the contributions for injuries in your case are minimal, you pay 43.2% of what you earn to the state in the form of salary taxes.

If such contributions in your case are maximum, then you pay in the form of taxes and social contributions more than half of what you actually earned.