Employee personal account form T-54 is a personnel document containing information about the time worked by each employee in each month, as well as about accruals and deductions for each month.

This personnel document is usually used in large enterprises; a personal account is opened for each employee upon hiring. Data in the T-54 form is entered on the basis of the working time sheet, the same as in the payroll or payroll. payslip T-51 can be found at this link, and payslip T-49 can be found here.

Also, the documents on the basis of which data is entered into the personal account form are various orders (on hiring, on vacation, on transfer, on dismissal, on promotion, on penalties).

Sample filling

Instructions for filling out an employee’s personal account T-54:

Organization: name indicated, OKPO;

Division: name of the structural division to which the employee belongs;

Personal account: document number and date;

Payroll period: write the date of employment in field “C” or another date if a personal account is opened during the work process (usually the beginning of the calendar year).

Employee: his tax identification number, SNILS number, place of residence code, marital status, number of children, date of employment, full name, personnel number and date of birth are registered. All this data is taken from the documents provided by the employee upon hiring, as well as from the employee’s personal card (T-2 form).

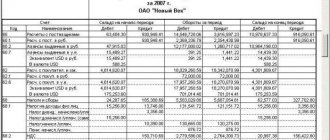

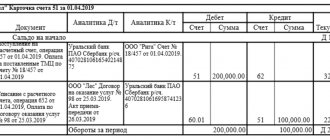

Filling out the table of form T-54:

Columns 1-8 – information about admission, transfer, dismissal, changes in wages.

Data about the order on the basis of which this or that event occurs with the employee is reflected.

Columns 9-16 – information about vacations provided.

All types of leave that are provided to the employee during work (educational, basic paid, without pay, maternity leave, etc.) must be reflected in these columns. The number and date of the leave order, as well as its duration, are indicated.

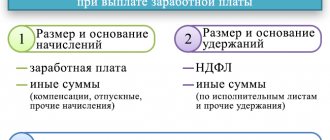

22 – the sum of all standard tax deductions applied to the employee.

23-27 – information about time worked in each month.

28-37 – information on accruals for each month by type of payment; column 37 displays the total amount of accruals.

38-46 – information about deductions for each month; column 46 displays the total amount of deductions.

47, 48 – debt is reflected if it exists (for the employer or the employee).

49 – amount to be paid to the employee. Paid on the basis of a payslip, a sample of which can be downloaded here.

The accountant fills out the personal account and puts his signature at the bottom.

personal account

employee personal account form T-54 – link.

Data to be filled in

Typically, employee payroll accounts are maintained by the company's accountant.

To streamline their management, a unified form T-54 was developed at the legislative level. Thanks to it, the employee’s personal account shows all possible payments to him throughout his entire career with a particular employer.

Example of filling out form T-54

The data that must be entered into Form T-54 and Form T-54a is entered on the basis of the following primary information, supported by documents:

- time sheet;

- sick leave certificates of the established form;

- well-designed waybills that provide reimbursement of expenses for fuel and lubricants;

- various orders, for example, on additional payment for combining positions during an employee’s vacation, etc.;

- confirmations for piecework payment (mostly orders);

- production reports and other documentation.

Important!

After providing such information, analyzing and processing it, a payroll statement is drawn up so that the employee can receive the payments due to him from his employer. The basis for issuing the T-54 form is the fact that the employee has been admitted to the organization. And the end will be dismissal. Only after this the employee’s personal account at the enterprise is closed.

Thus, the T-54 form and personal account are the most important components of the correct and full functioning of an enterprise in the Russian Federation.

Download for viewing and printing:

Resolution No. 1 of 05.01.2004 “On approval of unified forms of primary accounting documentation for accounting of labor and its payment”

Form T-54 - filling out an employee’s personal account

An employee’s personal account in form T-54 is a document used to reflect information about the employee, the time he worked, as well as accruals and deductions for each month of the calendar year. The T-54 unified form can be downloaded from our article.

Below we will discuss the procedure for filling out this form; at the end of the article you can fill out your personal account T-54.

A personal account is opened for an employee, as a rule, upon hiring him. The unified form T-54 is usually used in large enterprises. For the purposes of calculating and calculating wages, small organizations use payroll T51 (download sample T-51) or payroll T-49, a sample of which can be downloaded from the link.

Registration of an employee’s personal account is carried out on the basis of documents such as work time sheets (T-13 forms), work orders, waybills, sick leave, various orders: for hiring, for vacation, for dismissal.

Shelf life

In accordance with current legislation, information containing personal information about accruals and deductions for insured persons (citizens) must be stored for 75 years. The company is obliged to independently ensure the safety of primary documentation.

If the company does not have an archivist position on staff, then assign responsibility for storing and maintaining the archive to a specific specialist. Indicate such responsibilities in the job description, and familiarize the assigned employee with the new instructions against his signature.

Example of filling out form T-54

Maintaining employee payroll accounts is usually carried out by an accountant.

The personal salary account form contains a title section and a large table of 49 columns.

Billing period – in field “from” the date of employment is entered; if a personal account form T-54 is opened for an already working employee, then the beginning of any year.

Next, in the title part of the T-54 form, information about the employee is filled out based on his questionnaire and personal T-2 card.

The T-54 form table contains 49 columns, reflecting information about all stages of the employee’s work activity, time worked in each month and corresponding accruals and deductions.

The first eight columns reflect information about hiring, transfers, and dismissals.

For each of these events, indicates the number and date of the order on the basis of which this event is carried out, the name of the employee’s position and the structural unit in which he works, the working conditions, tariff rate and allowances are indicated.

Columns 9-16 reflect information about all leaves granted to the employee; the type of leave (annual paid, without pay, educational, maternity, child care) is written in column 9. Next is the number and date of the order on the basis of which the employee goes on vacation, as well as its duration.

If any deductions are applied to the employee, then columns 17-21 must be filled out. This includes deductions under writs of execution, collection orders, loan agreements, etc.

If the employee is entitled to any standard deduction (due to disability, for children or for another reason), then its amount is written in column 22 of form T-54.

The second part of the personal account table is devoted to charges and deductions. Here, a separate line is filled in for each calendar month. The month is indicated by the numbers “01”, “02” and further up to “12”.

Based on the working time sheet, which reflects the employee’s attendance and absence during the month, columns 24-27 are filled in.

This is interesting: Certificate of acceptance of transfer of documents sample 2021

Columns 38-46 are devoted to deductions. This includes previously issued advances, personal income tax, etc.

The presence of debt for previous months by the employee or employer is reflected in columns 47, 48.

As an example, we suggest looking at a sample of filling out an employee’s personal account, form T-54, at the link below.

Application of the T-54a form: nuances

So, in form T-54a there is no table, which is present in form T-54, where you can list monthly data on accruals and deductions made in relation to the employee. But this is not a problem because:

- It is assumed that a personal account in form T-54a (as an option - filled out electronically) will be printed monthly on a printer.

Each paper copy, of course, must be signed by an accountant.

- It is assumed that each monthly printout of form T-54a will be accompanied by (pasted in) pay slips that reflect the following data:

- on the composition of wages,

- about deductions;

- about the total amount to be paid.

That is, in general, the same information that is contained in the second table of the T-54 form.

Goskomstat also recommends displaying on the back of the form (or on the pay slip itself, which is attached to it) various codes for the amounts paid or withheld. These can be codes entered by the organization itself or those adopted in relation to income subject to personal income tax - in accordance with the order of the Ministry of Finance of Russia dated September 10, 2015 No. ММВ-7-11 / [email protected] By the way, similar codes are subject to reflection in the second table of the T-54 form.

Note that the company will not violate anything if it prints out the T-54a report not monthly, but, for example, once a year (or at any other frequency, preferable from the point of view of personnel accounting policy). Then he will paste into it all the payslips that were compiled during the year. But it is, of course, advisable to consolidate this approach in the accounting policy in case questions arise from the inspection authorities.

Thus, Form T-54a in combination with sheets (and codes) will be functionally similar to Form No. T-54. But why then use a document with index “a”? Its use may be more preferable in cases where:

- It is more convenient for an enterprise to record wages (deductions) in registers that differ in structure from the second table of the T-54 form (and it is not very convenient for an enterprise to switch to accounting in it).

For example, if the corresponding registers are completely electronic, but are not part of the electronic T-54 (as an option, because the accounting program used does not support it - not all companies can afford expensive 1C).

- One division of the company (HR department) is responsible for recording “conditionally permanent” data - mainly, typically “personnel” (that is, not related to accounting calculations), and another is responsible for recording “non-permanent” data - mainly financial. (actually, accounting).

As a result, the division of competencies may be accompanied by a division of documentation - which is impossible if the T-54 form is used (where both “personnel” and “calculation” data are recorded on one form). When dividing documentation between departments, there will be no disputes about “we fill out this, and you fill out that.” It’s just that everyone will fill out their own type of documentation.

Thus, despite the absence of a ban on using T-54a for “paper” accounting, the form in question is best suited for electronic accounting - and has advantages over T-54 in the form of:

- the absence of a “fixed” second table - instead of which you can use any third-party electronic settlement register that is convenient for the enterprise;

- the ability to keep a document on a computer for the entire year or any other period - and only print it at the end of the period (or if otherwise necessary).

Why do you need a personal account?

The employee’s personal account is used to monthly reflect all types of employee accruals, deductions from wages and payments during the calendar year. In fact, this is the only primary document that is filled out separately for each employee and contains complete information about wage payments made to him. A personal account is maintained on the basis of primary documents recording production and work performed, time worked and documents for various types of payment.

What are personal payroll accounts?

Specialized documents that are used in accounting to reflect information about monthly accruals, deductions and payments due to a specialist.

IMPORTANT!

The use of standardized forms is not necessary. The company has the right to independently develop the structure of the document, which will fully comply with the features and specifics of the organization’s activities, the current remuneration system, conditionally permanent details for calculating wages and other information.

The independently developed form should be approved in the company’s accounting policy. When developing a document, do not forget to take into account the mandatory details of the primary documentation (Article 9 of Law No. 402-FZ).

T 54 personal account

A personal account is an accounting document that reflects all the information about the payroll of a company employee. It opens when an employee is hired. An accounting specialist is responsible for opening and maintaining personal accounts. The document records all types of accruals and deductions from the employee’s salary during the calendar year. Accruals include wages, material incentives and various social benefits. Withholdings include income tax and insurance premiums, alimony and fines, trade union dues, loan payments, etc.

The personal account form (form T-54) consists of a title part and a table. First, fill in the name of the company, its OKPO code and the date of opening the account. Information about the employee is filled in: his full name, date of birth, personnel number, position, marital status, and other information from his personal card (form T-2).

The personal account table consists of 49 columns, which reflect all information about the employee’s work activity, time worked by month, and wages (accruals and deductions). Columns 1-8 indicate information about hiring, transfers and dismissals, place of work, position, salary, allowances with references to dates and order numbers. In columns 9-16, data on the employee’s vacations, their duration and documents regulating this event are filled in. Columns 17 to 21 are filled in in cases where penalties are applied to the employee under writs of execution, orders, deductions under loan agreements, etc. Column 22 contains information about deductions for children, disability, etc.

Salary certificate cards must be kept

→ → Current as of: September 20, 2021

To record labor and pay for it, the legislation provides for unified forms of primary accounting documentation. We will tell you about the personal account in our consultation.

The employee’s personal account is used to monthly reflect all types of employee accruals, deductions from wages and payments during the calendar year.

In fact, this is the only primary document that is filled out separately for each employee and contains complete information about wage payments made to him.

A personal account is maintained on the basis of primary documents recording production and work performed, time worked and documents for various types of payment.

“Personal account” was approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1.

When automated processing of salary data, the specified Resolution proposes a Personal Account (svt), in which the conditionally permanent details necessary for calculating wages are already filled in (name of the organization, full name of the employee, his personnel number, etc.), and Various types of payments and deductions are indicated in the form of codes. Maintaining personal accounts using the specified forms is not mandatory ().

The employer can independently develop a primary form to reflect information about wages paid during the calendar year. It is only necessary that the independently developed forms contain the mandatory details of the primary accounting document (). Nowadays, it is rare that an accountant calculates payroll manually.

Let us give an example approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1.

.

Subscribe to our channel at

Personal account of employees in form T-54

This can happen if the T-51 sheet is to be used. There are strict rules for issuing cards with personal accounts. There are general requirements that these documents must meet.

These include:

- filling out a personal salary account is done using blue or black ink;

- any corrections are not allowed. This also applies to the use of any corrective agents (putties, tapes, etc.);

- The employee's personal account form according to the sample must contain a title page and a standard table of 49 columns.

In addition, the employee’s front card, namely the salary form, has instructions for filling out, which are mandatory for all authorized employees of the enterprise for their maintenance and accounting. The title page is filled out at the very beginning. In this section the following information must be entered:

Blog of a practicing accountant and legal analyst

Data on the number of days (hours) worked, vacations used, transfers, dismissals, changes in wages are transferred from the timesheet to the personal account (form No. T-54) (checked with the data of the relevant orders provided by the personnel service).

2.2.

Deviations are calculated (based on existing data in the employee’s personal account for accruals for previous periods): vacation pay (calculation is carried out in form No. T-60), sick leave (due to the absence of a special document, apparently, it is assumed that the calculation is carried out in the sick leave itself ), average earnings, for example, while on a business trip or in other cases provided for by law (there is also no special form of calculation for this type of calculation; apparently, according to the legislator, the calculation is carried out “on paper”), compensation for unused vacation when dismissal (calculation is carried out in form No. T-61). 2.3.

Primary documents on wages

This report card is kept by the head of the unit or other employees who have been assigned this responsibility. All correctly executed documents go to the accounting department.

There, the employee calculates the amount of salary to be paid. All salary calculations are carried out in the payroll.

In some organizations, two separate payroll documents are drawn up - payroll and payroll.

In the first of them, only the calculation is carried out, and in the second, only the full name, personnel number and the amount to be paid are indicated.

Consulting services accounting and taxation

No. 173n certificate card (f. 0504417) is used to register reference information about the salary of an employee of an institution.

Forms of documents for individual (personalized) accounting in the compulsory pension insurance system Analytical accounting of calculations of wages and scholarships in centralized accounting departments is carried out on separate certificate cards f. No. T-54, which are opened for every employee and scholarship holder.

Analytical accounting for deposit and deposit amounts is kept in the book f. No. 292, in which for Form 0504417 REFERENCE CARD Form 0504421 TABLE OF ACCOUNTING THE USE OF WORKING TIME AND CALCULATION OF WAGES.

What are personal payroll accounts and how are they maintained? a reference card (personal account) is maintained for past periods.

Want to read something new? What we have: the latest literature news, reviews and reviews of popular books. Here

Certificate card f.

0504417

Form 0504417 has been approved for the generation of a certificate card used in budgetary institutions to register information about the salary of each employee. Form 0504417 is filled out on the basis of the payroll and simple payroll.

Application of the reference card f.

Since the certificate card refers to the primary accounting documents, it is filled out by the accountant. This document reflects data on wages accrued to the employee throughout the year.

Such reference information is entered into the card monthly.

The card also contains the employee’s personal data:

- Full name, date of birth, education, length of service;

- department (workshop), qualification, personnel number;

- salary or rate;

- marital status, presence of children and dependents;

- date of hiring, retirement.

For five ways to reduce paperwork on the nomenclature of cases, see. In the reference card f. 0504417 must reflect all accrued and withheld amounts for wages, as well as amounts to be paid for each person.

Information is entered on all types of charges and deductions, as well as on sources of financing.

An organization may, at its discretion, use the certificate form 0504417 to summarize information on the amount of remuneration to an individual who performed work or services in accordance with the concluded agreement between the employee and the institution. Data on additional payments are reflected in the “Notes on hiring and transfers” section.

When filling out this section, you must reflect the following information:

- 1, 2 columns - number and date of the order for the institution, which is the basis for additional payments;

- 3, 4 columns – name of the institution or structural unit, position;

- Column 5 – salary amount;

- Columns 6-13 – amounts and types of wage accruals and additional payments.

It is allowed to enter additional details into the unified form 0504417, but it is prohibited to remove existing ones, so they must also be filled out.

Employee's personal account in form T-54.

Instructions for filling

Let's look at columns 1-22.

- Columns 1 to 8 indicate information about hiring, the number of the employment order, the structural unit to which the employee belongs, working conditions (number of hours per week, schedule, etc.), ( or ), as well as all kinds of allowances and bonuses, if any. If an employee quits, is transferred to another workplace, etc. – this must also be included in these columns with mandatory links to the documents that served as the basis for these actions.

- From columns 9 to 16, information is entered on the number of vacations and their types, indicating management orders and other supporting documents, as well as the exact dates of vacation periods and the total number of calendar vacation days for each vacation.

- Columns 17 to 21 record information about all deductions taken against the employee (including writs of execution)

Personal file and personal account of an employee of the organization

Data entry is carried out on the basis of primary documentation or reporting on the performance of services. Such documents include time sheets and work schedules, orders or instructions, vacation schedules, time worked books, sick leave protocols, acts of work or services performed, orders for allowances and bonuses.

https://www.youtube.com/watch?v=XVTZUy3n6Yk

Personal registers also reflect the deduction of wages with a full breakdown of taxes and contributions.

Like the payslip, the shelf life of accounts in the accounting archive is 75 years.

The register form must be filled out for each employee separately and records must be kept throughout the calendar year.

Large manufacturing companies, having a large staff, are required to maintain personal accounts, and such a document is very convenient for sampling wages specifically for individual employees. After all, when calculating wages monthly, an accountant needs

What does an employee's payroll card look like?

Since only if the statement is compiled according to this database will it be completely correct.

The format of the documentation of this type is fully approved at the legislative level. Each column must contain exactly the information that is required.

Errors in compilation on the part of the employer are punishable by special regulatory authorities.

However, these reporting forms are list-based, i.e.

Source: https://ukpravoedelo.ru/kartochki-spravki-po-zarplate-objazatelno-nuzhno-vesti-ih-74558/

Personal account T-54

The employee's personal account is intended to reflect information about the time worked in each month of the calendar year, as well as about all accruals and deductions of the employee. A personal account is created for each individual employee.

The standard form T-54 can be used to fill out, on the basis of which the amount of wages to be paid is determined. From form T-54, the data is transferred to payroll T-53 or payroll T-49.

Data is entered into the personal account for each month of the calendar year. The document is filled out by the accountant on the basis of the documents provided to him about the time worked - time sheet T-12 or T-13, sick leave, orders for overtime work, waybills and other documents.

If an accountant uses payroll T-51 to calculate an employee’s wages, then a personal account may not be used.

Personal account form T-54 form - download free excel.

As an example, we filled out a personal account; you can fill out T-54 using the link at the bottom of the article.

Who fills out and signs the personal account?

Form T-54a is filled out by an employee of the accounting service. The accountant calculates wages every month based on the available source data.

The document is signed by the chief accountant or the accountant filling out the personal account. If there is no such position at the enterprise, then the right to sign is given to the head of the organization or another employee vested with such right through a trust document or order.

The signature can be affixed manually in blue ink or electronically. Stamping of the document is not required.

Sample filling T-54

At the top of the T-54 form, data is entered about the employee for whom the calculation is being made, indicating his TIN, SNILS, presence of children and marital status, date of hire, full name and personnel number, date of birth.

Next, in the upper table, fill in information about:

- hiring (transfer, dismissal) - on the basis of relevant orders;

- granting leave - also, on the basis of the order, its start and end dates are prescribed;

- deductions and contributions (their type, period for which they are withheld, amount);

- standard personal income tax deductions that an employee can count on.

All this information will be useful for calculating employee salaries. Based on a personal account, you can restore all data about an employee, even if orders for his activities are lost.

This is interesting: Letter of intent to rent premises sample

In the lower table, based on the working time sheet and other documents relating to all appearances and absences, deviations from the normal working day, data on hours (days) worked and all accruals by type of payment are filled in. The total amount of accruals is displayed.

Next, fill out the part of the table devoted to deductions (personal income tax, alimony, writs of execution, advance payment). Based on the results of filling out this part of the table, the total amount of deductions is displayed, which is subject to deduction from the amount of accruals.

If there is a debt for employees or the employer, this is reflected in columns 47 and 48; the data in these columns is taken into account when calculating the total amount of wages payable.

Data is entered into the personal account for each month of the calendar year.

The personal account is filled out by the accountant.

document

Personal account form T-54 form - download.

Personal account T-54 sample filling - download.

A personal account is opened for an employee of the organization at the time of his hiring; this document includes information about hiring, vacations, dismissal, calculation of wages and other payments.

How to fill out form T-54

A personal account is not always opened, not for every employee.

The standard form of a personal account is T-54. To fill out this form, you will need documents such as orders for personnel (on hiring, granting leave, dismissal, transfer), as well as timesheet data. The last document reflects the number of days or hours worked by the employee in the reporting month; this data is useful for calculating wages.

time sheet:

- T-13 for commercial organizations - sample;

- 0504421 for government agencies - sample.

An alternative to a personal account can be the T-51 pay slip or the T-49 pay slip. The difference is that the T-54 form is filled out for a specific employee and reflects, in addition to accruals and deductions, also other information about his work activity. In payslips, salaries are calculated for a group of employees - a department or the entire organization as a whole.

As a rule, personal accounts are opened for representatives of the organization’s management. T-54 and an example can be found on the links below.

Sample of filling out an employee's personal account

At the top of the T-54 form, data from the employee’s personal card is entered:

- department where he works;

- TIN;

- SNILS;

- code of the locality where the employee lives;

- Family status;

- amount of children;

- employment date;

- Full name;

- Personnel Number.

The tabular part of the personal account T-54 includes the following columns:

- on hiring, transfer, dismissal, changes in wages (columns 1-8) - data is entered on the basis of administrative documents;

- on vacations provided - on the basis of an order (columns 9-16);

- deductions and contributions - according to writs of execution, alimony, compensation for damage and others (columns 17-21);

- standard tax deductions - necessary for the correct calculation of income tax (column 22);

- the time worked for each billing month is entered into the personal account on the basis of the working time sheet (columns 24-27);

- accruals - wages, bonuses, compensation, vacation pay, sick leave and others (columns 28-37);

- deductions - advance, personal income tax, others (columns 38-46);

- debt owed to the employer or employee is indicated in form T-54, if any at the time of salary calculation (columns 47-48);

- the total amount to be paid to the employee is entered in the column of the personal account form.

The month for which the salary calculation is carried out is indicated in column 23, the month is indicated by a number from 01 to 12.

The personal account is signed by the accountant responsible for calculating wages to staff.

for free

personal account T-54 in excel - link.

Employee's personal account form T-54 example of filling - download.

How to check and find out your personal account

To carry out a personal verification, you can contact the bank with a request, but the employee will be able to provide information only if the applicant provides a compelling reason. Therefore, it is better to try to find out the account number yourself. This is quite easy to do if you use the State Services website. Step-by-step instruction:

- Visit the resource.

- Log in to your personal account.

- Go to the “services” tab.

- Select the option “find out personal account number” in the housing and communal services section.

- Enter the address of the person whose personal account you want to find out.

After this, the system will display all available information. It is important to accurately enter your residential address, without abbreviations, in order to obtain correct information. You can also find out your personal account number through the Sberbank Online application. The verification and management of functions is very similar to that which can be carried out through the State Services. To do this, after the service is loaded, you need to go to the “information search” tab and enter the address.

Search for drugs through State Services

Build payment type codes

Table 3 – Filling out payment type codes

| Data_Fakt | Vall | Summ_Vall | Cost | Summ_Cost | Summ_S_Vall | Summ_S_Cost | D_Cost |

| 02.06.2001 | |||||||

| 28.11.2002 | |||||||

| 07.01.2003 | |||||||

| 12.08.2009 | |||||||

| 01.02.2009 | |||||||

| 02.02.2009 | |||||||

| 01.02.2009 |

2.4 Describe the list of primary documents and the possibility of changing them in the document “Employee’s Personal Card”

All financial and economic operations of the enterprise, including payroll, must be documented and justified.

The list of primary documents for recording the use of working time and settlements with personnel (wages) and the forms of these documents were approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

The primary accounting of the number of personnel of the organization is carried out on the basis of the following documents:

— order (instruction) on hiring (Form No. T-1), which is the basis for hiring. The person responsible for accounting for the personnel of the organization’s employees, in accordance with this order, fills out a personal card for each newly hired employee, makes an entry in the work book, and opens a personal account in the accounting department;

— personal card (form No. T-2), which is filled out for each employee. It contains general information about the employee (last name, first name, patronymic, date and place of birth, education, etc.), information about military registration, appointment and transfer, advanced training, retraining, leave and other additional information;

— order (instruction) on transfer to another job (Form No. T-5), which is used when registering the transfer of an employee from one structural unit to another;

— order (instruction) on granting leave (Form No. T-6), which is used to formalize annual and other types of leave provided to employees in accordance with the Labor Code of the Russian Federation, current legislative acts and regulations, collective agreements and schedules vacations;

— order (instruction) on termination (termination) of an employment contract with an employee (dismissal) (Form No. T-8), which is used when registering the dismissal of employees. Based on it, the accounting department makes settlements with the employee;

— other unified forms To record working hours and pay wages to personnel, the following unified forms of primary documentation are used:

— a timesheet for recording working hours and calculating wages (Form No. T-12) and a timesheet for recording working hours (Form No. T-13), which records the use of the working time of all employees in a given organization. The report card in form No. T-13 is used in conditions of automated data processing. Form No. T-12 is filled out manually by an accounting employee. The symbols of worked and unworked time presented on the title page of form No. T-12 are also used when filling out form No. T-13. These timesheets are compiled in one copy and submitted to the accounting department. They allow not only to take into account the time worked by all categories of employees, but also to monitor compliance by workers and employees with the established work schedule. Based on the timesheets, wages are calculated, statistical reporting on labor is compiled. The use of working time is recorded in timesheets either by the method of continuous (daily) registration of appearances and absences for work, or by registering only deviations (no-shows, tardiness, etc.). d.). Notes on the reasons for absence from work or for part-time work, for working overtime and other deviations from the established work schedule must be entered into the timesheet only on the basis of documents (certificates of incapacity for work, certificates, orders for the performance of state or public duties and etc.).

This is interesting: Sample protocol of the working inventory commission

Accounting for time spent on overtime work can also be carried out on the basis of lists of persons who performed this work. The lists are compiled and signed by the head of the structural unit. The overtime manager makes a note of the number of overtime hours actually worked. Based on lists with this mark, the data is entered into the timesheet. Downtime can also be taken into account in the timesheet. The relevant data is entered on the basis of downtime sheets issued by the head of the structural unit. The following forms of statements are used for the calculation and payment of wages.

— payroll statement (Form No. T-49), which is recommended for medium and small organizations. When compiling this form, it is permissible not to fill out other payroll and payroll statements;

— payroll (form No. T-51), which is used to calculate wages for all categories of workers. Recommended for use in large organizations;

— payroll (form No. T-53), which is used to record wage payments;

— personal account (forms No. T-54 and No. T-54a), which is filled out by an accountant for each employee on the basis of primary employment documents and which indicates the necessary information: last name, first name, patronymic; workshop, department of an organization; category of personnel; employee personnel number; number of children (to determine deductions when calculating personal income tax); Enrollment Date.

The personal account is filled out throughout the year, and all types of accruals and deductions made are reflected in it on a monthly basis. The data contained in the personal account is the basis for calculating average earnings when paying for vacations, accruals for sick leave, etc. The following year, a new personal account is opened for each employee.

The most important indicators reflecting labor costs are labor standards, which are established for workers in accordance with the achieved level of equipment, technology, organization of production and labor.

Labor legislation provides for the following types of labor standards:

— production rate — the amount of products that a worker (group of workers) of a certain qualification must produce per unit of working time,

- standard time - the amount of working time (in hours, minutes) that an employee (group of employees) of a certain qualification must spend on the production of a unit of product (work, service);

- service rate - the number of objects (equipment units, production areas, workplaces, etc.) that an employee (group of employees) must service per unit of time (per hour, working day, work shift, working month);

— headcount norm — the number of employees with the appropriate qualifications to perform a certain amount of work (production, management functions). Depending on the nature of production, various primary documents are used to record production output - piece work orders, route sheets, production reports, etc. In conditions of mass production, output is taken into account when accepting finished products. The output of each team member is established on the basis of output reports filled out by the foreman.

In mass production, output is taken into account using route sheets in combination with a report from the foreman or foreman, which records the acceptance of work (their volume) per shift. In individual or small-scale production, output is taken into account, as a rule, using piecework orders work. They are prescribed on the basis of technological maps. Work orders can be issued for one shift or for a longer period (up to one month), depending on the time required to complete the production task. After receiving the products from the workers, the foreman signs the work order and transfers it to the accounting department.

Bibliography

1. Andreeva V.I. Samples of documents in office work/ - M.: CJSC "Business School" Intel-Sintez", 2007.

2. Computer Science: Basic Course/Ed. S.V.Simonovich. - St. Petersburg: Peter, 2002. 400 s.

3. Kozharsky V.V., Sushkevich V.N. Accounting in enterprises and organizations: Proc. manual.- Mn.: PKF “Account”, 2005. p.127