What do they reflect?

According to the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for its application (approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n), as part of synthetic accounting, account 60 summarizes information on settlements with suppliers and contractors for:

- inventory items received, work performed accepted and services consumed, incl. provision of electricity, gas, steam, water, etc., as well as for the delivery or processing of material assets, payment documents for which are accepted and subject to payment through the bank;

- inventory items, works and services for which payment documents have not been received from suppliers or contractors (these are so-called uninvoiced deliveries);

- surplus inventory items identified during their acceptance;

- transportation services received, including settlements for shortfalls and overcharges of the tariff (freight), as well as for all types of communication services, etc.

Organizations performing the functions of a general contractor under construction contracts, R&D and other contracts also reflect settlements with their subcontractors on account 60.

Account 60 “Settlements with suppliers and contractors”

Account 60 “Settlements with suppliers and contractors” is intended to summarize information on settlements with suppliers and contractors for:

received inventory, accepted work performed and services consumed, including the provision of electricity, gas, steam, water, etc., and also for the delivery or processing of material assets, payment documents for which have been accepted and are subject to payment through the bank;

inventory items, works and services for which payment documents were not received from suppliers or contractors (so-called uninvoiced deliveries);

surplus inventory items identified during their acceptance;

transportation services received, including calculations for shortfalls and overcharges of the tariff (freight), as well as for all types of communication services, etc.

Organizations that perform the functions of a general contractor during the execution of a construction contract, a contract for the performance of research, development and technological work and other contracts, also reflect settlements with their subcontractors on account 60 “Settlements with suppliers and contractors”.

All transactions related to settlements for acquired material assets, accepted work or consumed services are reflected in account 60 “Settlements with suppliers and contractors”, regardless of the time of payment.

Account 60 “Settlements with suppliers and contractors” is credited for the cost of inventory, work, and services accepted for accounting in correspondence with the accounts for these values (or account 15 “Procurement and acquisition of material assets”) or accounts for the corresponding costs. For services for the delivery of material assets (goods), as well as for the processing of materials on the side of the credit entry, account 60 “Settlements with suppliers and contractors” are made in correspondence with the accounts for inventory, goods, production costs, etc.

Regardless of the assessment of inventory items in analytical accounting, account 60 “Settlements with suppliers and contractors” in synthetic accounting is credited according to the supplier’s settlement documents. When the supplier's invoice was accepted and paid before the cargo arrived, and upon acceptance of the incoming inventory items into the warehouse, a shortage was discovered in excess of the amounts stipulated in the contract against the invoiced quantity, and also if, when checking the supplier's or contractor's invoice (after the invoice was accepted ) discrepancies in prices stipulated by the contract, as well as arithmetic errors were discovered, account 60 “Settlements with suppliers and contractors” is credited for the corresponding amount in correspondence with account 76 “Settlements with various debtors and creditors” (sub-account “Settlements for claims”).

For uninvoiced deliveries, account 60 “Settlements with suppliers and contractors” is credited for the cost of incoming valuables, determined based on the price and conditions stipulated in the contracts.

Account 60 “Settlements with suppliers and contractors” is debited for the amounts of fulfillment of obligations (payment of bills), including advances and prepayments, in correspondence with cash accounts, etc. In this case, the amounts of advances issued and prepayments are accounted for separately. Amounts of debt to suppliers and contractors, secured by bills of exchange issued by the organization, are not written off from account 60 “Settlements with suppliers and contractors”, but are taken into account separately in analytical accounting.

Analytical accounting for account 60 “Settlements with suppliers and contractors” is maintained for each submitted invoice, and settlements in the order of scheduled payments are maintained for each supplier and contractor. At the same time, the construction of analytical accounting should ensure the possibility of obtaining the necessary data on: suppliers on accepted and other payment documents for which the payment period has not yet arrived; to suppliers for payment documents not paid on time; to suppliers for uninvoiced deliveries; advances issued; to suppliers on bills issued, the payment period of which has not yet arrived; to suppliers for overdue bills of exchange; to suppliers for received commercial loans, etc.

Accounting for settlements with suppliers and contractors within a group of interrelated organizations, about the activities of which consolidated financial statements are prepared, is maintained on account 60 “Settlements with suppliers and contractors” separately.

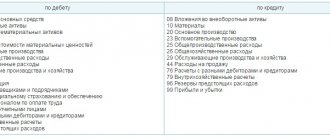

Account 60 “Settlements with suppliers and contractors” corresponds with the accounts:

| by debit | on loan |

| 50 Cash desk 51 Current accounts 52 Currency accounts 55 Special accounts in banks 60 Settlements with suppliers and contractors 62 Settlements with buyers and customers 66 Settlements for short-term loans and borrowings 67 Settlements for long-term loans and borrowings 76 Settlements with various debtors and creditors 79 On-farm settlements 91 Other income and expenses 99 Profits and losses | 07 Equipment for installation 08 Investments in non-current assets 10 Materials 11 Animals for growing and fattening 15 Procurement and acquisition of material assets 19 Value added tax on acquired assets 20 Main production 23 Auxiliary production 25 General production expenses 26 General business expenses 28 Defects in production 29 Service production and households 41 Goods 44 Selling expenses 50 Cash register 51 Current accounts 52 Currency accounts 55 Special bank accounts 60 Settlements with suppliers and contractors 76 Settlements with various debtors and creditors 79 On-farm settlements 91 Other income and expenses 94 Shortages and losses from damage to valuables 97 Future expenses |

How to take into account calculations

As for the subaccounts of the 60th accounting account, the rules here do not contain strict requirements. At the same time, practice shows that you need to open at least 2 sub-accounts for it:

- to account for debt to the supplier;

- for advances issued.

When accounting for settlements on account 60 for purchased materials, accepted work or consumed services, all transactions are reflected regardless of the time of payment.

Account 60 is credited for the cost of inventory, work, and services accepted for accounting in correspondence with the accounts for accounting for these assets:

- account 15 “Procurement and acquisition of material assets”;

- or relevant cost accounts.

For services for the delivery of valuables (goods), as well as for the processing of materials on the side, entries according to Kt 60 are made in correspondence with the accounting accounts:

- industrial stocks;

- goods;

- production costs, etc.

Regardless of the assessment of inventory items in analytical accounting, account 60 in synthetic accounting is credited according to the supplier’s settlement documents.

HIGHLIGHTS OF THE WEEK

01/30/20216:18 Special modes

Answers to questions from the Federal Tax Service for individual entrepreneurs on a patent

01.02.202112:00

Personnel

Amounts of child benefits for 2021. Table

02.02.202110:57

Checks

Consolidated inspection plan for 2021 published

01.02.202110:01

Special modes

Reduce the patent for contributions: a notification form has appeared

03.02.202115:11

Personnel

A new “coronavirus” payment has been established

PODCAST 4.12.2020

What has changed in taxes and reporting since 2021?

All episodes

Comments on documents for an accountant

Workers in “harmful” jobs are idle: should they pay additional tariff contributions?

02/05/2021 If employees performing work under dangerous and difficult conditions are idle, payments for this…

Payment for employee meals is free of insurance premiums

02/05/2021 If subsidies for employee meals are of a social nature, insurance premiums need not be paid...

Is it possible to apply NAP when assembling and selling computer systems?

02.02.2021 Federal legislation establishes a list of types of activities for which it is permitted to use...

‹Previous›Next All comments

By loan

Account 60 is credited for the corresponding amount in correspondence with account 76 “Settlements with various debtors and creditors” (sub-account “Settlements for claims”), when:

- the supplier's invoice was accepted and paid before the cargo arrived, and upon acceptance of the received goods and materials into the warehouse, a shortage was discovered in excess of the amounts stipulated in the contract against the invoiced quantity;

- when checking the supplier's or contractor's invoice (after the invoice has been accepted), discrepancies between the prices stipulated by the contract are discovered;

- there are arithmetic errors.

For uninvoiced deliveries, account 60 is credited for the cost of the valuables received, at the price and conditions stipulated in the contracts.

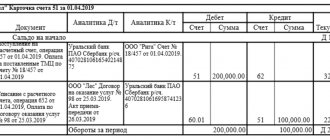

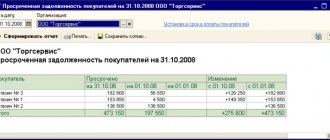

Working with 1C

In the 1C: Accounting program, all amounts of payments from counterparties are transferred to account 60 in accounting. Videos on using the program show how to correctly enter data into the database, so at this stage we will not go into detail, but will pay attention to the main points.

The account statement can be generated from the reports at the top of the tabs. In the new window, you should indicate the period for which the data will be provided, the account number, the name of the organization and click the “Generate report” button. Settings can be adjusted. On the right is a panel of basic and additional options. In the first paragraph, you select on the basis of which indicators the statement will be formed: accounting, accounting, permanent (temporary) differences, balance. Next, the subconto is indicated. Typically these are counterparties, contracts and settlement documents. An active checkmark means that the subconto will be taken into account when generating the report. In the second tab, you can select additional data, the order in which they will be placed (in separate columns), sorting, and design options.

All these settings can be saved so as not to make them next time. To do this, use the button of the same name in the form of an icon on the right above the window with bookmarks. By double-clicking with the left mouse button, you can get from the back to the detailed “Account Card” report.

Posting examples

Here are a few typical entries for account 60 of accounting.

For accounting of settlements with suppliers on subaccount 60.01:

| Dt 08 (10, 41) – Kt 60.01 | Received OS, MPZ |

| Dt 20 (26, 44, 91) – Kt 60.01 | Services provided, work completed |

| Dt 19 – Kt 60.01 | Input VAT |

| Dt 60.01 – Kt 51 | The debt to the supplier has been repaid |

For accounting for advances issued on subaccount 60.02:

| Dt 60.02 – Kt 51 | Advance transferred |

| Dt 60.01 – Kt 60.02 | Advance credited |

Also see "Analysis of Count 51".

Read also

28.05.2019

Purchase of equipment

The company acquired the OS. Delivery and installation are carried out by two different organizations. All suppliers are subject to a common taxation system. Let’s display through account 60 in the accounting “Settlements with counterparties”:

- DT08 KT60 – equipment has been capitalized (excluding VAT);

- DT19 KT60 – VAT charged;

- DT68 KT19 - reflect the VAT deduction based on the invoice;

- DT60 KT51 - payment to the supplier;

- DT08 KT60 — payment for transport services (excluding VAT);

- DT19 KT60 - VAT on motor transport services;

- DT68 KT19 - reflect the VAT deduction based on the invoice;

- DT60 KT51 - payment to the trucking company;

- DT08 KT60 – the cost of installation and adjustment services is taken into account (excluding VAT);

- DT19 KT60 - VAT on installation services;

- DT68 KT19 - reflect the VAT deduction based on the invoice;

- DT60 KT51 - payment for equipment installation services.

- DT01 KT08 - putting the OS into operation.