Application of count 46

The cost of the work stages completed and accepted by the customer according to the approved rules is reflected in the invoice.

Upon completion of the work, the amounts from the account are debited to Account 62. Analytics on the account is carried out by type of work.

The account is a calculation account, that is, used to calculate the cost of manufactured products (services) for the reporting period of time.

To determine the financial result of intermediate types of work, two methods are used:

- for the construction project;

- according to the type of work performed.

In the first case, the financial result is determined only after the completion of construction of the facility. In the second case - after completion of certain types of work; This is only possible if the work performed can be reliably assessed.

Specifics of using account 46 in accounting

Account 46 is active. Like other active accounts, it reflects the organization’s property. But the organization ceases to own this property immediately after the completion and transfer of work. Thus, account 46 reflects information about fulfilled contractual obligations, and not about one’s own tangible assets.

According to PBU 2/94, the following methods are used to determine the total amount of a particular stage:

- on the construction site;

- depending on the type of order completed.

In the first case, the total amount of each stage will be determined only after the project is completed. In the second, the customer has the opportunity to pay for each stage of the project, but only after its reliable cost has been determined.

The debit of account 46 reflects the amounts for work performed that were accepted by the customer. Most often, transactions with a score of 46 involve the following accounts: 62, 90, 20.

After the completion of the next stage of work and its payment by the customer, the amount of funds for a specific stage is taken into account on the debit of account 46 in correspondence with account 90 “Sales”. In this case, the amount of money spent in completing the work stage is transferred from the credit of account 20 “Main production” to the debit of account 90 “Sales”.

Amounts received from the customer for the accepted stages of work are reflected in correspondence with account 62 “Settlements with buyers and customers”, which are recorded on its debit. The debit of the same account will reflect the total amount of the project after delivery and payment of all its stages.

Procedure for using the account

Etalon M LLC is a construction contractor. According to the contract, two stages of work must be completed.

The customer, Orbita LLC, signed an acceptance certificate for the work performed for the first stage in the amount of 65 million rubles on September 9, for the second stage - in the amount of 90 million rubles in October.

On July 14, Orbita transferred an advance towards the contract in the amount of 80 million rubles. The remaining amount was transferred to the contractor on October 24.

The accountant of Etalon M LLC reflects these transactions:

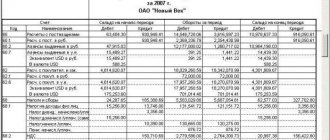

| Month | Dt | CT | Operation description | Sum |

| July | 62.2 | Reflection of advance payment from the customer | 80000000 | |

| August | 20 | 10,,69, etc. | Reflection of the contractor's costs for performing work | 48000000 |

| September | 20 | 10,,69, etc. | Reflection of the contractor's costs for performing work | 45000000 |

| 90.1 | Completion of the first stage of work | 65000000 | ||

| 90.2 | 20 | The write-off of the cost of work is reflected | 45000000 | |

| 90.9 | 99 | The financial result from the completion of the first stage is reflected | 20000000 | |

| October | 90.1 | Completion of the second stage of work | 90000000 | |

| 20 | 10,,69, etc. | Reflection of the costs of fulfilling the contract | 38000000 | |

| 90.2 | 20 | Reflection of write-off of the cost of work on the second stage | 38000000 | |

| 90.9 | 99 | The financial result from the completion of the second stage is reflected | 52000000 | |

| 62.1 | Write-off of the cost of work accepted by the customer on the project (65 million + 90 million) | 155000000 | ||

| 62.1 | Reflection of receipt of final payment from the customer | 75000000 |

The financial result must be determined every month. But the profit reflected as a result of these operations is not taken into account when calculating the amount of tax to the budget.

The remaining amount in account 62.1 is closed with the advance received earlier:

| Dt | CT | Operation description | Sum | Document |

| 62.1 | 62.2 | The offset of the advance is reflected | 80000000 | Accounting information |

Account 46 in accounting

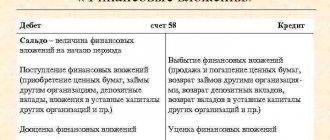

The debit of account 46 “Completed stages of work in progress” takes into account the cost of completed stages of work (according to the established procedure) paid by the customer, and on the credit - funds received to the organization’s account from this customer:

Analytical accounting for account 46 is carried out by the organization by type of work.

The need to use account 46

As can be seen from the example, this account reflects exclusively the contractual cost of the construction project. Since amounts are reflected in this account only after payment by the customer, maintaining it allows you to clearly see the cost of the contract. At the same time, these operations increase the complexity of accounting.

The use of counting has supporters and opponents. The feasibility and necessity of its use for construction organizations has not been approved by any legislative act. Existing regulatory documents are in the nature of recommendations.

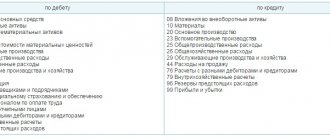

Postings to account 46 “Completed stages of work in progress”

The main transactions for account 46 are presented in the table:

| Account Dt | Kt account | Wiring Description | A document base |

| 46 | 90 | The cost of the completed stage of work is reflected | Bank account statement, Certificate of acceptance of work performed and services rendered |

| 62 | 46 | Write-off of the cost of stages of work paid by the customer (after completion of all work as a whole) | Accounting information |

| 62 | 46 | Repayment of the cost of fully completed work using advances received from the customer. | Bank statement |

Using account 46

EXAMPLE In January, Stroytrest JSC received an advance in the amount of 41,300 rubles. to pay for the construction of the building. Construction must be carried out within a year in three stages. According to the agreement, the cost of stage I is 17,700 rubles, stage II – 23,600 rubles, stage III – 47,200 rubles. Each stage is handed over to the customer monthly (stage I - in February, stage II - in March and stage III - in April). Stroytrest's expenses for stage I of work amounted to 7,000 rubles, stage II - 17,000 rubles, III - 30,000 rubles. The final payment for the work was made in May. The accountant must make the following entries: in January DEBIT 51 CREDIT 62 subaccount “Calculations for advances received”

- 41,300 rubles.

– an advance was received from the customer; DEBIT 62 subaccount “Calculations for advances received” CREDIT 68 subaccount “Calculations for VAT”

- 6300 rubles.

(RUB 41,300 × 18%: 118%) – VAT is charged on the advance received; in February DEBIT 46 CREDIT 90-1

– 17,700 rubles.

– reflects the cost of the first stage of work handed over to the customer; DEBIT 90-2 CREDIT 20

– 7000 rub.

– expenses for the implementation of the first stage of work were written off; DEBIT 90-3 CREDIT 68 subaccount “VAT calculations”

– 2700 rubles.

(RUB 17,700 × 18%: 118%) – VAT is charged on the volume of work for stage I; DEBIT 68 subaccount “Calculations for VAT” CREDIT 62 subaccount “Calculations for advances received”

– 2700 rubles.

– part of the amount of VAT previously accrued on the advance received is offset; at the end of February DEBIT 90-9 CREDIT 99

- 8000 rub.

(17,700 – 7000 – 2700) – financial result is reflected; in March DEBIT 46 CREDIT 90-1

– 23,600 rubles.

– reflects the cost of stage II of work handed over to the customer; DEBIT 90-2 CREDIT 20

– 17,000 rub.

– expenses for the implementation of stage II of work were written off; DEBIT 90-3 CREDIT 68 subaccount “VAT calculations”

– 3600 rubles.

(RUB 23,600 × 18%: 118%) – VAT is charged on the volume of work for stage II; DEBIT 68 subaccount “Calculations for VAT” CREDIT 62 subaccount “Calculations for advances received”

– 3600 rubles.

– part of the amount of VAT previously accrued on the advance received is offset; at the end of March DEBIT 90-9 CREDIT 99

- 3000 rubles.

(23,600 – 17,000 – 3600) – financial result is reflected; in April DEBIT 62 subaccount “Settlements with customers” CREDIT 90-1

– 47,200 rubles.

– reflects the cost of stage III of work, accepted but not paid by the customer; DEBIT 90-2 CREDIT 20

– 30,000 rub.

– expenses for the implementation of stage III of work were written off; DEBIT 90-3 CREDIT 68 subaccount “VAT calculations”

– 7200 rubles.

(RUB 47,200 × 18%: 118%) – VAT is charged on the volume of work for stage III; DEBIT 62 subaccount “Settlements with customers” CREDIT 46

– 41,300 rub.

– the cost of stages I and II of work was written off; DEBIT 62 subaccount “Settlements on advances received” CREDIT 62 subaccount “Settlements with customers”

– 41,300 rubles.

– the advance amount received from the customer is credited; at the end of April DEBIT 90-9 CREDIT 99

- 10,000 rubles.

(47,200 – 30,000 – 7200) – financial result is reflected; in May DEBIT 51 CREDIT 62 subaccount “Settlements with customers” – 47,200 rubles. – funds were received from the customer to pay for the third stage of work.

Brief description of account 46

For developers, research centers, design organizations, geological services, etc., account 46 is the need for accounting for interim calculation of completed stages of work under long-term contracts.

Account 46 is used in cases of a long production cycle, when the start and end dates of work specified in the contract refer to different reporting periods. It is customary to divide such work into several independent stages for gradual reflection in the accounting of completed and accepted work and costs under the contract.

The use of account 46 in accounting is regulated by the Chart of Accounts and Instructions for its application (Order of the Ministry of Finance dated October 31, 2000 No. 94n), as well as PBU 2/2008 “Accounting for construction contracts” and other industry accounting standards.

Account 46 is active. On the debit side of the account, the cost of paid completed stages of work is taken into account in correspondence with Kt 90, on the credit - funds received to the organization’s account from this customer in correspondence with Dt 62. Accounting conditions: work performed must be paid for; It is possible to reliably estimate both the work performed and the production costs for it.

During the stage-by-stage delivery of the object, there is no transfer of ownership; these operations cannot be recognized as sales. The contract amount accounted for under Dt 46 is revenue not presented to the customer. Therefore, the data on the debit balance on account 46 falls into inventory on line 1210 of the balance sheet.

Account calculation procedure 46

The debit of account 46 takes into account the cost of stages of work completed by the organization, paid by the customer, accepted in the prescribed manner, in correspondence with account 90 “Sales”.

At the same time, the amount of costs for completed and accepted stages of work is written off from the credit of account 20 “Main production” to the debit of account 90 “Sales”. The amounts of funds received from customers in payment for completed and accepted stages are reflected in the debit of cash accounts in correspondence with account 62 “Settlements with buyers and customers”.

Also see "".

The procedure for closing account 46 is as follows: upon completion of all work as a whole, the cost of the stages paid by the customer, recorded on account 46, is written off as a debit to account 62.

If at the time of completion of all work the stages were fully paid, account 62 for a specific customer is also closed.

When, as a result of final settlements, the customer overpaid for the work, the difference is returned to the contractor by posting:

Dt 62 – Kt 51, 52

The cost of fully completed work, recorded on account 62, is repaid from previously received advances and amounts received from the customer in final settlement in correspondence with the debit of cash accounts.

In the bay. On balance sheet 46, the account is reflected in line 1210 “Inventories,” i.e., costs of work in progress.

Also see “Work in Process: Line on the Balance Sheet.”

Count 46 – characteristic

The financial nature of the register is ambiguous. It refers to active, inventory accounts, that is, taking into account information about the organization’s property. But the company ceases to own the property after signing the acceptance certificate. It turns out that the account collects information about fulfilled obligations, and not about material objects.

A similar dispute is caused by the reflection in the balance sheet. Standard accounting programs generate line 520 “Other long-term liabilities” for the advance received. And the cost of work performed is included in line 213 “Costs in work in progress.” There is no separate column provided.

According to PBU 4/99, financial statements must be reliable (clause 6), indicators are expressed in a net estimate (clause 35). Consequently, the advance received from the customer must be reduced after partial delivery. The conclusion is also confirmed by the fact that account 46 in accounting contains information about the cost of paid work (Chart of Accounts), that is, about revenue. Work in progress is formed from the expenses of the enterprise - this results in unreliable information. Based on the above arguments, it is more correct to show 62 invoices minus completed stages in the balance sheet.

When to use account 46

According to the Chart of Accounts, account 46 is called “Completed stages of work in progress” (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n). Therefore, score 46 is most in demand in construction.

Thus, accounting entries for account 46 are made to summarize information about stages of work completed in accordance with concluded contracts that have independent significance.

By virtue of the official instructions for account 46, it is, if necessary, used by organizations performing long-term work, the initial and final deadlines for which usually relate to different reporting periods.

For example, entries in accounting account 46 in construction can directly reflect construction, as well as scientific, design, geological, etc. work.

The accounting department maintains analytical accounting for account 46 by type of work.

KEEP IN MIND

Completed stages of work can be reflected on account 46 only if they are paid for by the customer.

The use of account 46 must be specified in the organization’s accounting policies.

Necessity and significance of position 46

Account 46 is intended to summarize information about the completed stage of unfinished work in accordance with concluded contracts for the execution of orders in the long term. This invoice reflects the completed stages of the entire process that were accepted and paid for by the customer. Account analytics is carried out by project or by type of work performed.

The debit part of the account shows the amounts received as payment for the completed order and the accepted stage of order execution. In this case, you can see correspondence with positions such as 90, 20 or 62.

After all stages are completed and paid, the amount reflected in account 46 is debited by the accountant in 62 positions.

In this case, to determine the intermediate stage, the following methods are used:

- on the construction site;

- depending on the type of order completed.

If we talk about the first method, then the financial result of each stage will be determined only after the entire object is completed. In the second case, the customer can pay for the completion of certain types of activities within the framework of one project, but only when it is possible to adequately assess their cost.

Basic account transactions $46$

The debit of the account $46$ reflects the cost of the stages of work that were paid by customers and completed. The following works were also accepted:

- Dt $46$ – Ct $90$.

- Dt $90$ – Kt $20$ (simultaneously with the previous one) – for the amount of costs.

- Dt $50, 51$ – Kt $62$ – receipt of funds from the customer for accepted work, goods, services.

Upon completion of all work, the entire cost of the stages paid by the customer, which was collected on the account $46$, is written off as a debit to the account $62$.

- Dt $62$ – Ct $46$

The cost of fully completed work, which was invoiced at $62, is offset by previously received advances and the amount received in final payment from the customer.

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

Analytical accounting is carried out by type of work.

The account is used to calculate intermediate stages of work performed. According to the accounting regulations, the contractor can use two methods for determining income from the delivery of construction work :

- Income based on the cost of the construction project

- Income based on the cost of work as it is completed.

In the first case, the financial result is determined after the complete completion of construction of the facility. Production costs are reflected in the debit of the account $20$, from the beginning of construction to its completion.

In the second case, the financial result is determined upon completion of individual works, according to the design stages provided for by the project, and the costs associated with them. The use of this method is used if the work performed and costs can be estimated. The costs of the work are taken into account by the contractor on an accrual basis. Same as work in progress.