The topic of the lesson is accounting VAT (value added tax) VAT is regulated by Chapter 21 of the Tax Code of the Russian Federation. When selling goods to us, the buyer pays the price of the goods + VAT, we pay this VAT to the budget. (this is an indirect tax, i.e. we do not pay this VAT from our own pocket). For example, we go to a store and the receipt says VAT, that is, we ordinary buyers pay VAT to the store and the store then transfers this tax to the budget for us. If you look from the buyer’s side, then we pay this VAT to the supplier, and this VAT The budget owes us. (since VAT is paid by the end user, i.e. an individual)

Please note in this article VAT is at the old rate, the current rate is 20%.

Taxpayers of value added tax are:

- -organizations;

- -individual entrepreneurs;

- - persons recognized as taxpayers of value added tax in connection with the movement of goods across the customs border of the Customs Union.

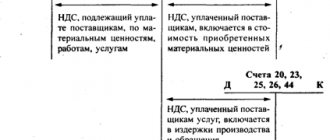

To account for VAT in accounting, the following is provided:

- 19 account “VAT on purchased assets”. This account is intended to reflect VAT on the purchase of material assets and services. The debit reflects input VAT upon receipt of goods on credit, acceptance for deduction of VAT (write-off) debit 68 credit 19.

- 68/VAT “Calculations with the budget” This account is intended to reflect VAT on the sale of goods and services to customers. (This account is also used when deducting VAT debit 68 credit 19) (According to the debit of account 68/VAT, VAT is reflected for deduction on purchases, on the loan VAT is charged on sales)

Let's consider accounting for VAT from the seller, the buyer, and the seller of a retail store (to understand how the budget earns on VAT):

Accounting for VAT at the seller of teapot goods, SCHET LLC:

- Debit 62 Credit 90 in the amount of 118,000 rubles . - Revenue and debt of the buyer are reflected. The price of the product and VAT is 118,000 rubles. on the debit of account 62, a buyer's receivable of 118,000 arose - he owes us for the goods and VAT.

- Debit 90/VAT credit 68/VAT - for the amount of 18,000 VAT on sales is allocated (118,000/118*18). On loan 68/VAT account (in this case, passive) but accounts payable arises, we owe VAT to the budget, from the buyer’s money.

- Debit 68/VAT credit 51 - in the amount of 18,000 rubles , the Seller pays VAT 18,000 rubles. Previously, we wrote invoice 68/VAT for the loan, now we write it as a debit, which means we are paying off accounts payable, the VAT debt has decreased.

From these business transactions it is clear that 18,000 rubles fall into the budget. Fig.1.

"Every Accountant Wants to Know"

Let's start with the balances on account 19, which could not have existed at all if the accountant had taken certain actions in time.

Read in the berator “Practical Encyclopedia of an Accountant”

Line 1220 “Value added tax on acquired assets”

Here are at least four unpleasant situations.

- During the inspection, the inspector canceled the deduction. The accountant, which is absolutely correct, restored it in accounting as a debit to account 19. What next? There is nothing further to wait for: you need to write it off as a debit to account 91. However, this amount cannot be taken into account in tax accounting. But account 19 will not have an unreasonable balance.

- The following situation is when the accounting on account 19 gets clogged: they bought a fixed asset and allocated input tax. But here’s the problem: the property was accounted for on account 08, and an inexperienced accountant decided not to accept it for deduction until the fixed assets were transferred to account 01. This is wrong. The deduction can be claimed without waiting for such a transfer (see, for example, letter of the Ministry of Finance dated February 16, 2021 No. 03-07-11/9875).

- This is another not uncommon situation. It happens to importers. The price of goods (work, services) purchased abroad includes indirect tax. The accountant assigns its amount to account 19. If the purchased assets are intended for transactions subject to VAT, or for resale, VAT is deducted in the quarter when the imported goods were recorded on the company’s balance sheet. And there is no need to wait to see whether the money for the goods has been transferred to the foreign partner by this time or not.

- And finally, the accountant simply forgot to submit a deduction, although all the conditions for it were met. If 3 years have not yet passed from that moment, it doesn’t matter: the deduction can still be claimed.

But if more than 3 years have passed since the end date of the period in which the invoice was issued, there is no right to deduction. Forgotten tax can only be written off to 91 accounts and not taken into account in tax expenses. And in this case, do not forget to take an inventory and reflect the amount written off in the act.

If you refuse the deduction of your own free will (for example, input VAT exceeds the amount of accrued tax), you have the right to do so. But don’t let things get to the point where you lose this right completely. The fact is that you can exercise the right to deduct VAT in cases specified by the Tax Code of the Russian Federation within three years, counting from the end of the quarter in which this right arose. If you miss this deadline, in the future you will have to write off the balance again to 91 accounts without the ability to include it in expenses.

VAT accounting for the buyer of teapots at the retail store "ACTIV" LLC:

- Debit 41 Credit 60,100,000 rubles. -Kettle goods received in the amount of 100,000 rubles. VAT is not included in the price, since the VAT must be returned to us by the budget. On the debit account 41 - on the debit of this account there is an increase in goods, on the credit account 60 - on the credit of this account the occurrence of accounts payable is reflected, i.e. we owe the supplier 100,000 rubles for teapots.

- Debit 19 credit 60 18,000 rubles. -VAT has been allocated on the delivery of goods and we immediately post it so that there is no balance on the 19th VAT account. We reason like this: the debit reflected VAT on the purchase, and the credit 60, i.e. an increase in accounts payable, i.e. we must pay VAT to the supplier.

- Debit 68/VAT credit 19 in the amount of 18,000 rubles. VAT in the amount of 18,000 rubles is accepted for deduction. We write off the purchase VAT to account 68/VAT in debit - debit, since accounts receivable - the budget owes us the VAT that we paid to the supplier.

- Debit 51 credit 68/VAT in the amount of 18,000 rubles. The budget returned 18,000 rubles to our bank account. On debit 51 there is an increase in money. On credit - repayment of receivables, i.e. reduction of budget debt to us. VAT from the 3rd entry is reimbursed to us by the budget. In practice, actual VAT refund to the current account is possible only upon a written application from the organization to the tax authority with the provision of a certain package of documents and after a tax audit. In fact, by the amount of VAT that the budget must return to us, we can reduce the amount of VAT that we ourselves must pay on the sale of purchased goods.

Postings to the account “03/19”

By debit

| Debit | Credit | Content | Document |

| 19.03 | 000 | Entering initial balances: VAT on purchased inventories | Entering balances |

| 19.03 | 60.01 | Reflection of the amount of VAT on purchased inventories (except containers), goods under the contract in rubles. | Receipts (acts, invoices) |

| 19.03 | 60.21 | Reflection of the amount of VAT on purchased inventories (except containers), goods under the contract in foreign currency | Receipts (acts, invoices) |

| 19.03 | 60.31 | Reflection of the amount of VAT on purchased inventories (except containers), goods under the contract in cu. | Receipts (acts, invoices) |

| 19.03 | 68.02 | Reinstatement of VAT on purchased inventories sold for export at a 0% rate | VAT recovery |

| 19.03 | 68.02 | Reinstatement of VAT when adjusting the cost of receipt downward | Adjustment of receipts |

| 19.03 | 76.NA | VAT accrued when performing the duties of a tax agent | Receipts (acts, invoices) |

By loan

| Debit | Credit | Content | Document |

| 10.01 | 19.03 | Inclusion in the cost of raw materials and supplies of the amount of non-refundable VAT paid upon purchase | VAT write-off |

| 10.02 | 19.03 | Inclusion in the price of semi-finished products, components, structures and parts of the amount of non-refundable VAT paid upon purchase | VAT write-off |

| 10.03 | 19.03 | Inclusion in the price of fuel of the amount of non-refundable VAT paid upon purchase | VAT write-off |

| 10.04 | 19.03 | Inclusion in the cost of packaging and packaging materials of the amount of non-refundable VAT paid upon purchase from organizations engaged in production activities or provision of services | VAT write-off |

| 10.05 | 19.03 | Inclusion in the cost of spare parts of the amount of non-refundable VAT paid upon purchase | VAT write-off |

| 10.06 | 19.03 | Inclusion in the cost of other materials of the amount of non-refundable VAT paid upon purchase | VAT write-off |

| 10.08 | 19.03 | Inclusion in the cost of building materials of the amount of non-refundable VAT paid upon purchase | VAT write-off |

| 10.09 | 19.03 | Inclusion in the cost of inventory and household supplies of the amount of non-refundable VAT paid upon purchase | VAT write-off |

| 10.10 | 19.03 | Inclusion in the price of special equipment and special clothing of the amount of non-refundable VAT paid upon purchase | VAT write-off |

| 19.07 | 19.03 | Attribution of VAT on purchased goods to export sales at a rate of 0% | Sales (acts, invoices) |

| 19.07 | 19.03 | Attribution of VAT on purchased materials to export sales at a rate of 0% | VAT distribution |

| 20.01 | 19.03 | Write-off of the amount of non-refundable VAT on material resources used in the main production, exempt from VAT | VAT write-off |

| 23 | 19.03 | Write-off of the amount of non-refundable VAT on material resources used in auxiliary production, exempt from VAT | VAT write-off |

| 25 | 19.03 | Write-off of the amount of non-refundable VAT on material resources written off as general production costs, subject to VAT exemption | VAT write-off |

| 26 | 19.03 | Write-off of the amount of non-refundable VAT on material resources written off as general business expenses, subject to VAT exemption | VAT write-off |

| 44.01 | 19.03 | Write-off of the amount of non-refundable VAT on material resources written off as distribution costs in organizations engaged in trading activities | VAT write-off |

| 44.01 | 19.03 | Write-off of VAT on work performed and services provided for distribution costs in organizations engaged in trading activities | VAT distribution |

| 44.02 | 19.03 | Inclusion in business expenses of the amount of VAT on work performed and services provided in organizations engaged in industrial and other production activities | VAT distribution |

| 44.02 | 19.03 | Write-off of the amount of non-refundable VAT on material resources written off as business expenses in organizations engaged in industrial and other production activities | VAT write-off |

| 68.02 | 19.03 | Acceptance of VAT deduction for downward adjustment of sales | Generating purchase ledger entries |

| 68.02 | 19.03 | Manually reflecting VAT deduction on material resources | Reflection of VAT for deduction |

| 68.02 | 19.03 | VAT deduction on inventories | Generating purchase ledger entries |

| 68.02 | 19.03 | Acceptance for deduction of VAT upon adjustment of receipts upward | Generating purchase ledger entries |

| 91.02 | 19.03 | Write-off of VAT on purchased material assets if, in accordance with current legislation, VAT amounts are not refundable | VAT write-off |

| 91.02 | 19.03 | Write-off of the amount of VAT on material assets paid (payable) but not reimbursed in accordance with current legislation, in connection with the implementation of operating or non-operating activities | VAT write-off |

| 91.02 | 19.03 | Write-off of VAT on acquired material assets lost due to natural disasters or emergency circumstances | VAT write-off |

| 91.02 | 19.03 | Write-off of VAT on work performed and services provided for other expenses not related to core activities | VAT distribution |

| 94 | 19.03 | Write-off of VAT on acquired material assets lost due to theft or damage | VAT write-off |

How the budget earns from VAT.

From the first group of transactions (postings 1-3), 18,000 rubles go to the budget, since the seller transferred VAT from the current account to the budget.

From the second group of transactions (postings 2-4), the budget transfers 18,000 to our current account - VAT, which we paid to the supplier. - The budget's money is reduced by 18,000 rubles.

From the third group of postings (posting 3-3), the budget receives 36,000 rubles.

Let's look at the figure for budget money:

Balance of money in the budget = Income - Expenses = 18000 + 36000-18000 = 36000

During the movement of teapots from the manufacturer to the final buyer, the budget earned 36,000 rubles.

Account 19 with separate accounting

Often, organizations and individual entrepreneurs in the course of their activities are faced with the need to simultaneously apply both taxable and non-taxable transactions. In such cases, in order to reduce the expected tax burden, it is worth using separate VAT accounting. The accounting policy sets out the procedure for application.

Separate accounting is also necessary for those entities that are simultaneously subject to several tax regimes, for example, UTII and the general system.

With separate accounting, depending on the type of goods (products, services), the following sub-accounts are opened to account 19, which make it possible to further classify the input tax into groups.

Table. Subaccounts to account 19, accounting procedure

| Subaccount | Subaccount name | What is it used for? |

| 19 ― 1 | VAT on goods/services for taxable transactions | VAT, which is then deducted in full, is used exclusively in taxable transactions |

| 19 ― 2 | Input VAT on transactions exempt from taxation | VAT not deductible by the taxpayer |

| 19 ― 3 | VAT on acquired assets, subject to subsequent distribution. | Used in cases where it is impossible to immediately determine what type of activity the product or service will take part in |

The third group for VAT accounting appears in cases where expenses are recognized as general, and it is not possible to attribute them to a specific type of activity in the future. When drawing up a proportional ratio for goods used in both types of transactions, all sales are taken into account, including sales of fixed assets, securities and others.

The Tax Code of the Russian Federation also contains provisions that make it possible not to maintain separate records under certain circumstances. They arise if the share of expenses directly involved in future non-VAT-taxable transactions does not exceed the threshold of 5% of the total expenses (Article 170, paragraph 4 of the Tax Code of the Russian Federation). In such situations, it is allowed to deduct the tax in full.

Ignoring the requirements of the law on the need to maintain separate accounting for VAT using accounting account 19 can lead to a refusal to determine tax deductions, in addition to a ban on the subsequent attribution of these amounts as expenses when determining profit (personal income tax).

Calculation for payment of VAT.

In practice, there are usually 2 VATs:

- “incoming” when we buy, the budget must reimburse us for this VAT. Debit 68 credit 19 (previously posted debit 19 credit 60)

- “outgoing” when we sell the goods and receive VAT from the buyer. We must pay this VAT to the budget Debit 90 Credit 68/VAT.

Since when purchasing goods the VAT paid to us is owed by the budget, and when selling VAT we must pay it to the budget, money is not “drove” back and forth, but simply offset based on the results: the budget pays us or we (usually we).

The formula for calculating VAT payable = VAT “outgoing” (amount of transactions dt 90 kt 68) - VAT “incoming” (amount debit 68 credit 19).

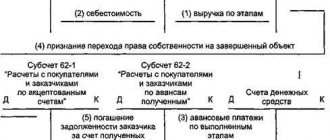

When calculating VAT, it must be accrued from advances received and advances issued - this is a difficult topic we will consider in the following lessons.

Posting examples

Let's look at typical situations using count 19.

VAT deduction

| Debit | Credit | Description |

| 41 | 60 | Purchased goods for resale |

| 19 | 60 | Input VAT taken into account |

| 60 | 51 | Payment for goods has been made to the supplier |

| 68/VAT | 19 | The amount of input tax is presented as a deduction |

Write off VAT on the cost of goods

| Debit | Credit | Description |

| 10 | 60 | Materials for production were purchased |

| 19 | 60 | Input VAT taken into account |

| 10 | 19 | The amount of VAT is included in the cost of materials |

Write off VAT on expenses

| Debit | Credit | Description |

| 41 | 60 | Purchased goods from a supplier |

| 19 | 60 | Input VAT taken into account |

| 91 | 19 | The tax amount is written off as other expenses |

Reflection of VAT when adjusting an invoice

| Debit | Credit | Description |

| 41 | 62 | The buyer returned the goods |

| 19 | 62 | Input VAT on returned goods has been taken into account |

| 68/VAT | 19 | Tax amount accepted for deduction |