general characteristics

“Goods” is an inventory account for the material assets of an enterprise. Novice auditors ask themselves: “Account 41 in accounting is an asset or a liability of the organization?” The answer is not as complicated as it might seem. It is important to understand that the account itself is not an asset or a liability. But the goods accounted for in account 41 can easily be identified as funds or sources of the organization. An asset is a company's property right, in other words, everything that belongs to it. Goods are tangible property and, therefore, are accounted for as assets.

Based on the answer received, how can you characterize account 41 in accounting? Active or passive? Or maybe active-passive? There should be no doubt, account 41 in accounting is active. Receipt of goods is shown in debit, and their write-off and sale in credit. At the end of the reporting period, only a debit closing balance is formed.

Contribution to capital and transfer of goods for the needs of the enterprise

If one of the founders of an enterprise makes a contribution to the authorized capital in the form of fixed assets or intangible assets, they should be registered based on the following rules:

- The assessment of incoming assets should be carried out in agreement with the participants of the PA or JSC. In this case, the value of the property should not exceed the market value.

- After determining the amount of the initial cost, carry out account assignment Dt 08 Kt 75.

Thus, fixed assets from the founders were accepted for accounting in account 08. The information will be kept in debit until the property is put into operation.

Goods or finished products transferred within the enterprise to fulfill its needs are accounted for at their actual cost, the amount of which can be found in accounts 41 or 43. The posting looks like this: Dt 08 Kt 43 (41).

Accounting on account 41

The “Goods” account is used by trade, supply, and distribution enterprises, as well as those specializing in public catering. In addition to goods, the invoice takes into account containers produced independently or purchased. In industry, invoice is used only when materials or products are purchased for separate sale.

Depending on the company's policy, goods are accounted for at sales, accounting or purchase prices. When using sales prices, the difference between the cost of goods and capes (discounts) is displayed on account 42.

Goods accepted for storage on liability and on commission are accounted for in accounts 002 and 004. Account 41 in accounting has its own subaccounts for grouping goods of similar purposes.

Barter agreement

The registration of property received after barter differs depending on the conditions of its implementation. Thus, if both parties recognize the objects of exchange as equivalent, then they do not undertake any additional obligations. No additional payment is required, but what amount should be entered into the account on 08/08 when the asset is received? In this case, the initial price is the market value of the property being disposed of for exchange. If it is impossible to determine it, use the indicator of the possible purchase price of the incoming property.

After agreeing on the terms of a barter transaction between enterprises, the acquired assets cannot yet be considered their property. The right to ownership passes after the fulfillment of obligations by each of the counterparties. Until this moment, the amounts are registered in off-balance sheet account 002. After all points of the agreement are fulfilled and property rights are received, the accountant writes off the amounts in Kt 002.

Further registration of the receipt is carried out according to the usual procedure for receiving fixed assets or intangible assets:

- Dt 08 Kt 60 – the amount of incoming fixed assets is taken into account (amount excluding VAT).

- Dt 19 Kt 60 – VAT on acquired property is reflected.

- Dt 01 Kt 08 – the object was put into operation and accepted for accounting.

Account 41 in accounting - subaccounts

Analytical accounting accounts facilitate the process of grouping and assessing the results of an organization's financial activities. For the “Goods” account, the accountant uses subaccounts:

- 41.1 – for accounting of goods in warehouses;

- 41.2 – for accounting for goods intended for retail trade;

- 41.3 – for accounting for containers located under goods or empty;

- 41.4 – for accounting for purchased products.

Subaccount 41.1 is used to control the movement of goods inventories in enterprise warehouses. Public catering uses it to account for products located in refrigeration chambers and other food storage facilities.

Subaccount 41.2 is used for accounting for retail trade. Catering chains additionally use it to account for glassware. Subaccount 41.3 helps to count containers under goods and empty ones. Subaccount 41.4 is used to account for the availability of goods and its movement, using an accounting procedure similar to industrial inventories.

Organization of accounting of goods in the warehouse

A warehouse is a room that is specifically designed for storing materials and supplies. An organization's warehouse can be either an integral part of it or act as an independent structural unit. In the first case, the warehouse is used exclusively as one of the stages of the production process; in the second case, the warehouse can act as a separate object (for example, a retail outlet from which goods are sold).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

The technological process in a warehouse consists of several stages:

- acceptance of goods and materials (including preliminary preparation of goods for acceptance).

- placing goods in warehouses and ensuring their storage.

- preparing goods for release from the warehouse and its subsequent release.

Warehouse accounting at an enterprise can be organized using the varietal or batch method. In the first case, each type of product in the warehouse is accounted for separately. The basis for accounting for goods is a quantitative and cost accounting card (form TORG-28), which is drawn up when goods and materials arrive at the warehouse. With the varietal method, it is permissible to record several goods (for example, similar in price) in one TORG-28 card.

If an organization uses the batch method to record inventory in a warehouse, then the arrival and movement of goods is reflected by batch. The basis document for these operations is the batch list (form MX-10), which is drawn up when a batch of goods arrives at the warehouse and is filled in as it is written off.

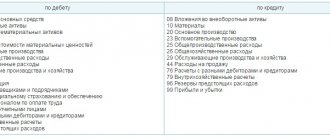

Correspondence

Account 41 in accounting is a method of controlling and describing the process of purchasing and selling goods, which leads to correspondence with most main accounts. Account 41 is debited in the posting with the accounts:

- settlement transactions (60, 63, 68, and 71-78);

- capital funds (80, 88);

- stocks (14);

- production accounting (20, 23, 26, 29, 37);

- goods (42);

- accounting of monetary transactions (50).

The “Goods” account corresponds for the loan with the following accounts:

- assets (06);

- stocks (10, 13, 14);

- production and commodity accounting (20, from 43 to 46);

- accounting of monetary transactions (58);

- accounting for settlements (62, 63, from 76 to 79 except 77);

- capital funds (80, 84, 87, 89)

In the process of compiling quotes, do not forget that account 41 in accounting is active.

Reception at cost

The company determines in its accounting documents the procedure for accounting for received goods. Capitalization at actual cost involves the use of supplier prices indicated in accounting documents. In addition, the cost may include payment for the services of transport companies and the process of procuring goods. The organization itself has the right to determine the nature of accounting for these expenses.

When auditors in practice receive goods for the first time, a serious question arises: “Should I open account 41 in accounting with VAT or without VAT?” Violation of the wiring can lead to problems with the transfer of taxes, it’s worth looking into. If the supplying company issues an invoice, then VAT needs to be allocated, only to a separate invoice. Goods must be received at cost minus tax.

Account 41 is debited in accounting with VAT payable with a credit to the account. 60, after which the tax amount is allocated and transferred to the budget.

Accounting for goods and materials

Goods and materials are often combined into one accounting group and given a general name - inventory assets, abbreviated as goods and materials.

Inventory materials in finished form intended for further sale are goods. And materials are goods and materials that are purchased for use in the manufacture of the company’s products, or for their own needs that affect the overall production process, provision of services or performance of work.

Inventory and materials are taken into account at the actual cost, which consists of the amounts of funds transferred or paid (in cash) to the supplier and other expenses associated with transportation, commission costs, etc.

Enterprise example

You can more clearly trace the sequence of accounting operations by considering a specific case.

We have the following initial data: the company acquired borrowed funds in the amount of 480,000 monetary units (hereinafter referred to as monetary units). All money was spent on the purchase of goods (of which tax is 80,000 units). During the use of the loan, the borrower bank accrued interest in the amount of CU 60,000. The company's accounting policies govern the accounting of interest in the operating expenses account. The entire batch of goods was sold for CU720,000 units. (of which tax is 120,000 units). The procedure for conducting quotes by the accounting department

| Dt | CT | Amount, rub. | Characteristics of the operation |

| 51 | 66 | 480 000 | the loan amount is transferred to the company's bank account |

| 41 | 60 | 400 000 | goods are capitalized (excluding tax) |

| 19 | 60 | 80 000 | VAT has been deducted from the cost of purchased goods |

| 68 | 19 | 80 000 | VAT is transferred to the state budget |

| 91.2 | 66 | 60 000 | The bank charges interest on the loan |

| 90.2 | 41 | 400 000 | the selling price of the item has been written off |

| 62 | 90.1 | 720 000 | revenue from the sale of goods is recognized |

| 90.3 | 68 | 120 000 | tax charged on goods sold |

| 51 | 62 | 720 000 | payment received from the buyer |

A clear example of the process of posting goods at an enterprise clarifies the situation, and there is no need to choose whether to open account 41 in accounting with or without VAT. Regardless of the value at which the goods are recorded, VAT is not taken into account on account 41.

Description of account 20

Account 20, called “Main production” in the chart of accounts, includes all expenses of the organization that are associated with the production of products, performance of work or provision of services.

Production costs are distributed according to the following items:

- Material expenses - expenses for the purchase of raw materials, semi-finished products and components, electricity, water, fuel, tools, production equipment, work and services performed by third parties.

- Labor costs for workers involved in production.

- Expenses for social needs - accrued insurance contributions to extra-budgetary funds.

For more information about accounting entries when calculating insurance premiums, read the article “Insurance premiums have been calculated (accounting entry).”

- Depreciation charges for fixed assets used in production.

Read about the rules for calculating and reflecting depreciation in the article “Calculation of depreciation of fixed assets in 2016.”

- Other expenses - expenses for business trips of employees carried out for production purposes, shortages within the limits of natural loss, expenses for semi-finished products, deferred expenses and other reasonable expenses.

You can learn about writing off deferred expenses in the material “Procedure for writing off deferred expenses (nuances).”

Accounting by sales price

If an organization registers goods at the subsequent sale price, then it becomes necessary to use account 42. Account. “Trade margin” takes into account income from the sale of goods and VAT.

The accountant makes the following quotes with the correspondence of accounts 41 and 42:

- Dt 41 Kt 42 – reflects the markup on the goods received.

- Dt 90.2 Kt 42 - the amount of the markup was deducted when making a sale.

- Dt 41 Kt 42 – write-off of the discounted value of goods due to the previously made markup.

- Dt 91.2 Kt 41 – the difference between the markup and the discounted value is written off (in cases where the markdown exceeds the amount of the markup).

- Dt 44 Kt 41, Dt 44 Kt 42 – goods and their trade margins are written off for the needs of the enterprise.

- Dt 94 Kt 41, Dt 94 Kt 42 – the amount of shortage/damage to the goods and its trade margin are written off.

An example of accounting for sales price at an enterprise

Let’s assume that a fictitious company has carried out the following business transactions: goods worth 12,000 rubles have been purchased (including VAT of 2,000 rubles). The established markup rate is 30%. The accountant makes the following calculations:

- (12,000 – 2000) × 30% = 3000 rub. – the amount of markup on the product has been identified.

- (10,000 + 3000) × 18% = 2340 rub. – VAT is calculated for the sale price at a rate of 18%.

- 3000 + 2340 = 5340 rub. – the total amount of the markup on the product is calculated, including VAT.

The process is described by the following accounting entries:

Quotations at the enterprise when accounting for goods at sales cost

| Dt | CT | Amount, rub. | Characteristics of the operation |

| 41 | 60 | 10 000 | the goods are registered and accepted into the warehouse excluding VAT |

| 19 | 60 | 2 000 | VAT is deducted from the amount of purchased goods |

| 68 | 19 | 2 000 | VAT deduction completed |

| 60 | 51 | 12 000 | the debt to the supplier was repaid from the bank account |

| 41 | 42 | 5 340 | recognized markup on goods |

| 90.2 | 41 | 15 340 | the amount of goods for sale is written off |

| 90.2 | 42 | 5 340 | the markup amount is deducted from the cost of the goods |

| 62 | 90.1 | 15 340 | revenue from the sale of goods is recognized |

| 90.3 | 68 | 2 340 | VAT calculation on goods sold |

| 51 | 62 | 15 340 | the buyer repaid the receivables for the goods |

Expenses for transport and other services incurred during the delivery of goods from the supplier are credited to account 44 (Dt 44 Kt 60). If at the end of the reporting period the goods paid for by the company have still not been delivered, the accountant posts Dt 41 Kt 60, while posting to the warehouse is not carried out. When the goods are at the disposal of the company, the amount of VAT is deducted and the cost of the goods is included in the debit of the account. 60.

Analytical accounting

To combine expenses of a similar nature into groups and systematize accounting, first-level subaccounts are additionally opened, which reflect information about the costs of:

- 08.1 – acquisition of land plots;

- 08.2 – purchase of environmental management facilities;

- 08.3 – construction of environmental facilities;

- 08.4 – purchase of individual OS by category;

- 08.5 – acquisition of intangible assets;

- 08.6 – transfer of livestock from one herd to another;

- 08.7 - purchase of adult livestock;

- 08.8 – carrying out scientific research, conducting experiments, the results of which will be used in the future at the enterprise.

If necessary, other analytical accounts of a similar nature may be opened.

Goods accounting in 1C

Trade and industrial enterprises use commercial accounting programs to simplify the work of auditors. This reduces time and allows you to clearly assess the company's assets and liabilities. Account 41 in 1C accounting corresponds to the same accounts as in the classic version.

To post goods, you must select the “Purchases” item in the main menu, the “Receipts (acts, invoices)” sub-item. A product filling form will open. Let's look at an example of making retail trade transactions through 1C. You must perform the following steps in the program:

- Indicate the date of receipt or the date in the supplier document.

- Select: counterparty – supplier, contract – main, warehouse – retail.

- Fill out the tabular part without nomenclature.

- Indicate the amount of the goods excluding VAT and post the document.

Reflection of revenue and accounting for markups in 1C

After completing all the previous steps, the “Products” account and its quotes will open. To reflect revenue from retail trade, you need to open the “Bank and cash desk” sub-item “Cash documents” in the main menu of the program and create a new receipt order as follows:

- Designate the type of transaction: “retail revenue”.

- Fill in the fields: date, payment amount (select “excluding VAT”).

- Post the document.

After viewing the transactions made on the account, you need to go to the “Operations” item, sub-item “Month closure”. In the menu that opens, select the closing month and the item “Calculation of trade margins on goods sold.” Account entries will show that the markup has been written off. Returning to the “Month Closing” menu, select the “Write off trade margin on goods sold” item, after which the trade margin report on goods sold for the selected month will open.

An example of total accounting of goods was considered using the 1C: Accounting 8.3 (rev. 3.0) program.

Consolidation of knowledge

Having carefully studied all the information presented and summed up, we can outline the key points about the characteristics and accounting of accounts. 41:

- goods are among the assets of the enterprise;

- account 41 - active, inventory;

- upon receipt of goods, the account is debited excluding VAT;

- the sale of goods results in the debiting of amounts from account 41;

- The trade margin is reflected by posting Dt 41 Kt 42.

Regardless of how accounting is kept at the enterprise (in 1C or in writing), knowledge of the properties of account 41 will simplify the work of a novice accountant.