An accountant is perhaps the main specialist of a company. Many of the company’s production processes, as well as, to some extent, financial well-being and stability depend on its work.

It is for this reason that it is important for an accountant not only to understand specific concepts related to work, but also to be able to correctly and accurately apply them in practice. In today's article we will talk about how to correctly create a vacation reserve and enter this information into financial statements.

How to create a vacation reserve

All must create a reserve for vacation pay this year . The only exceptions are those who are allowed to keep simplified records .

The vacation reserve (hereinafter also referred to as RO) shows the amount of obligations to employees to pay for vacations.

Companies themselves decide on which reporting date to form a RO. The following options are acceptable when ROs are created:

- on the last day of each month;

- on the last day of the reporting quarter;

- December 31st every year.

Note that is most preferable , since it shows the complete picture of the current situation with paid vacations. However, this method is more labor-intensive and requires significant accountant time.

The last option is the simplest . It is used by the majority of companies that prepare reports only at the end of the year.

The second option is the golden mean and is considered more optimal in terms of efficiency and labor-intensive costs for its calculation.

The company confirms the chosen method in the order for approval of the accounting policy.

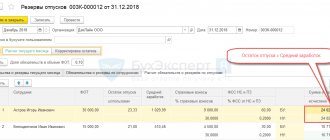

An example of calculating the vacation allowance

LLC "Company" creates an estimated liability for the payment of vacation pay. As of 12/31/2020:

- the balance of the previously accrued estimated liability is RUB 410,000;

- number of employees - 50 people;

- average monthly salary - 25,000 rubles;

- the number of unused vacation days is 450.

Reserve for vacations in accounting and tax accounting with an example of calculation:

The amount in excess of the actually accrued and estimated reservation of vacation amounts is taken into account on December 31, 2020 as part of non-operating income in the amount of:

410000 - 39991.74 = 10068.26 rubles.

Accounting for vacation reserves

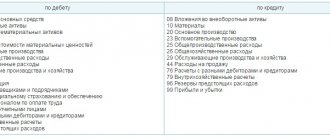

The vacation reserve in accounting for the selected reporting date is formed by the debit of those cost accounts to which salaries and contributions are usually accrued:

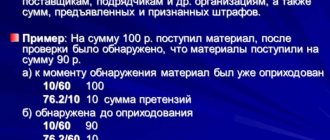

Debit 08, 20, 25, 26, 44, etc. – Credit 96 – accrual of reserve for vacation pay (vacation pay and contributions to extra-budgetary funds).

The credit balance of account 96 “Reserve for vacation pay” as of the reporting date is reflected in the enterprise’s balance sheet in the line “Estimated liabilities”.

The entries for accrual of vacation pay (compensation for unused vacation) and insurance contributions are as follows:

- Debit 96 Credit 70 – vacation pay (compensation for unused vacation) accrued from the reserve;

- Debit 96 Credit 69 – contributions to funds have been accrued from the reserve.

If the company did not have enough previously accrued RO, then vacation pay and contributions in part of the excess are reflected in the general order as a debit to expense accounts.

Features of the formation of an estimated liability in a budgetary institution

When recording transactions, budgetary and autonomous institutions use their own chart of accounts, established by Order of the Ministry of Finance No. 157n dated December 1, 2010. The Ministry of Finance in letter No. 02-07-07/28998 dated May 20, 2015 recommends how to calculate the vacation reserve for 2021 in a budget institution: the estimated liability is determined monthly based on data on unused rest days on the last day of the month.

It is proposed to use one of three methods to calculate the vacation reserve for 2021 in a budgetary institution.

Method 1. Personally for each employee:

Method 2. For the institution as a whole:

Method 3. For individual categories (for example, separately for each structural unit):

where K1, K2, ... Kn are unused rest days for each category of employees,

ZP1, ZP2, ... ZPn - average daily salary for each category of employees.

How to calculate vacation reserve

Legislative acts do not contain a procedure for creating a reserve for vacation pay. Therefore, the company has the right to independently develop this procedure and approve it by order of accounting policy.

For work, you can use several options for calculating RO. These options have one thing in common: all employees are divided into blocks based on the account to which salaries are credited. In other words, employees whose wages are credited to account 20 will be combined into one block, those whose wages are credited to account 25 will be combined into another block, and so on.

Let's take a closer look at the proposed options.

The first option for calculating RO

The reserve for upcoming vacation expenses is formed on the basis of the average daily earnings of each employee. To calculate for each specific employee, the number of unused vacations is determined for each calculation date (month, quarter, year).

To calculate the average daily earnings, a standard formula is used, which you can find in the article “How to correctly calculate vacation pay in 2021.”

So, the RO of each specific employee, taking into account contributions to extra-budgetary funds, is calculated using the formula:

| ROR = Q × SrZP × (1 + TVf / 100%) |

Where:

- РОр – employee’s vacation pay, taking into account the accrual of contributions to extra-budgetary funds;

- Q – number of unused vacation days;

- Average daily wage – average daily earnings of an employee, rub.;

- Твф – tariff of contributions to extra-budgetary funds, %.

Next, add up the RO for all employees. The resulting value will be the vacation reserve.

Second option for calculating RO

If in the first option the average earnings of each individual employee are determined, which is quite labor-intensive, then in the second option it is possible to determine the average daily earnings of workers combined into appropriate blocks (distribution among blocks was discussed above).

Therefore, in this case, the number of days of unused vacation is determined for the corresponding block of employees. Next, you need to calculate the average daily earnings for each block of employees for the reporting period (month, quarter or year). This is done according to the formula:

| SrZPb = ∑ / q / S |

Where:

- SrZPb – average daily wage for a block of employees;

- ∑ – the amount of salary accrued to all employees in the block for the reporting period;

- q – number of days in the reporting period;

- S – number of workers in the block.

Next, you need to determine the amount of RO for each block of employees:

| ROB = (SrZPb + SrZPb × TVf) × Qb |

Where:

- ROB – vacation reserve for a block of employees;

- Qb – the number of unused vacation days for a block of employees.

As a result, the obtained values for all blocks must be added and the sum of RO is obtained.

The third option for calculating RO

In the third option, the RO value is calculated based on the results of the previous year. To do this, it is necessary to determine the standard for the block of employees as of December 31 of last year. They do this according to the formula:

This standard is a constant value. It does not change regardless of how the company adjusts the RO - monthly or every quarter.

Next, for each reporting date (month, quarter or year), the amount of contributions to the RO for a block of employees is calculated as follows:

At the end, it is necessary to add up the found RO values for all blocks of workers.

Other payment methods

Another way to calculate the vacation reserve is to calculate it for each employee separately. For calculations, use the following formula:

At the same time, it is necessary to reserve the funds necessary to pay insurance premiums. Such a reserve is calculated as follows:

Both values (reserve and contribution expense reserve) are summed up. All data is taken on the day of settlement.

Tax accounting

Unlike accounting, in tax accounting the creation of RO is the right of the employer.

Also, a distinctive feature of the formation of RO in tax accounting is the method of creation. It is spelled out in Art. 324.1 Tax Code of the Russian Federation. This method provides:

- determination of the percentage of contributions to the RO;

- calculation of the RO amount monthly on the last date of the month;

- Conducting an inventory of RO at the end of the year.

If a company wants to avoid differences in tax accounting according to RO, it can accrue the reserve in both accounting and tax accounting in the same way :

At the end of the year, an inventory of accrued RO is carried out. To adjust the RO, it is necessary to calculate the actual amount of vacation days not taken off as of December 31. The resulting amount is compared with the calculated amount and, if necessary, adjustments are made.

Methods for creating an estimated liability in accounting

According to paragraph 15 of PBU 8/2010, it is necessary to create an estimated liability at least once a year as of December 31 (that is, the reporting date).

In this case, on December 31, the amount of vacation pay that is expected to be paid next year is reserved in one transaction. For example, it is permissible to take the amount of payments similar to payments for the reporting year.

This formation principle is the simplest for accounting, but is incorrect for recognizing expenses, since at the reporting date the company does not yet have obligations to pay vacation pay to employees: they may quit, the company will hire new employees, and the estimate will be incorrect.

It would be more correct to recognize expenses for creating the reserve evenly throughout the year. If you use this method, you need to estimate the amount of unused vacation days as of December 31 and monthly determine the cost of accumulated vacations and make additional accrual of reserved amounts. You can estimate the possible amount of savings for the next year and include this amount evenly:

- monthly (divided by 12);

- quarterly (divided by 4).

If you haven’t created a vacation reserve: liability, retroactive accrual

security for vacation pay, liability

To begin with, let us recall that the mandatory creation of a vacation reserve is insisted on by the norms of two regulatory documents at once: clause 13 P(S)BU 11

and

clause 7 P(S)BU 26 .

Most enterprises, unfortunately, have no choice: a reserve (security) for vacation pay must be created.

But there are those who, on completely legal grounds, may not bother creating reserves . This is ( clause 8 of section I P(S)BU 25

):

— micro-business entities , i.e. enterprises whose average number of employees per calendar year does not exceed 10 people and whose annual income does not exceed an amount equivalent to 2 million euros , determined at the average annual rate of the NBU ( part 3 of article 55 of the Civil Code of Ukraine

);

— small businesses that maintain simplified accounting of income and expenses in accordance with tax legislation.

Currently, these are

payers of the single tax of group 3 ( clause 44.2 of the Tax Code

).

Responsibility for failure to accrue reserves

In fact, in this case we are dealing with a violation of the accounting procedure. Responsibility for this is established by Art. 1642 KUoAP .

But it is no secret that the penalties established by this

article

apply only to officials of enterprises

associated with budgetary funds . After all, control functions in this case are vested in the bodies of the State Audit Service. But tax officials do not have the right to fine under this article

.

See General tax consultation on ensuring a unified approach to the application of penalties, approved by Order of the State Tax Service of November 22, 2012 No. 1046

.

And yet, do not rush to rejoice! As you remember, today the procedure for calculating income tax is entirely based on accounting data. What follows from this in relation to our situation?

Those taxpayers who, according to the requirements of P(S)BU, are required to keep records of reserves, in fact, can include vacation pay in reducing the object of taxation only through the accrual of a reserve (of course, except for amounts for which the reserve was not enough).

The question arises: will the tax authorities remove such expenses if the company wrote them off not through the vacation reserve, but directly using the entry: Dt 23, 91, 92, 93, 94 - Kt 661, 651?

For example, questions may arise regarding old vacation pay and compensation for 2014 and older. Sometimes, during audits, tax authorities insist that such payments can be taken into account for tax purposes only on the basis of clause 24 of subsection. Section 4 XX NKU .

That is, only on the condition that vacation pay and compensation are paid from reserves formed before 01/01/2015.

Therefore, if you do not want to argue with the tax authorities about your right to reduce the financial result by the amount of old vacation pay, then it will still be safer to add additional reserves for previous years .

As for vacation pay for the period after 01/01/2015, the situation is as follows. In our opinion, the mere fact of non-accrual of the reserve is not yet a basis for excluding vacation pay from the calculation of taxable financial results. We can talk about liability only if there is an underestimation of the amount of income tax . But in what case will tax authorities be able to identify it?

Let's assume that the company does not accrue a vacation reserve. But at the same time you strictly follow the requirements of the Holidays Law

: your employees go on vacation on time, and therefore there are no rolling vacations in accounting.

That is, in 2021 you will pay vacation pay and compensation only for 2021 .

In this case, we can say with confidence that the tax authorities do not have “reinforced concrete” grounds for not recognizing expenses in the form of vacation pay. The reason is simple - when holiday pay is paid “year after year”, the likelihood of underestimating income tax is very low (especially for annual income tax payers). After all, if the amount of paid vacation pay is less than or equal to the amount of the reserve that could be accrued if the requirements of P(S)BU 11

, in principle, there is no need to talk about understating taxes.

If it turns out that the amount of paid vacation pay exceeds the estimated amount of the “potential” reserve, then in this case, in our opinion, the tax authorities do not have the right to deprive you of vacation expenses.

Firstly, in this case you reduce the financial result by the amount of your actual expenses of the reporting period , which, in general, does not contradict the rules for calculating income tax. Secondly, the amount of vacation pay that exceeds the amount of the accrued reserve is included in expenses by direct posting. Why is this not our case?!

Another situation is more dangerous: when an enterprise that does not accrue a reserve pays carryover vacation pay and compensation for previous years (2015 or 2016). In this case, it turns out that without accruing the reserve in previous years (without reducing the financial results of previous years by posting: Dt 23, 91, 92, 93, 94 - Kt 471), you are now overestimating the expenses of the current period. Of course, in a good way, in this case, it would be necessary to compare two errors: overestimation of the object of taxation of previous periods (due to understatement of reserve expenses) and understatement of the object of taxation of the reporting period (accordingly, due to overestimation of current expenses). However, it is unlikely that tax authorities will “dig” so deeply.

In conjunction with the additional assessment of income tax, in this case there will also be an administrative fine for officials of the enterprise under Art. 1631 KUoAP

(Wed. 025069200).

Let us remind you: it provides for liability for violation of tax accounting procedures in the form of a fine in the amount of 85 to 170 UAH. If you are an “experienced” violator and have already been prosecuted under this article

, then you will face a fine of

170 to 255 UAH.

What should those enterprises do that have not created reserves all these years? You can continue to do without accruing a reserve, counting “at random”. Or you can work a little, add additional reserves for previous years and sleep peacefully.

How to additionally accrue reserves for the first quarter of 2021

In this case, we are dealing with a current year , which is quite simple to correct:

1. We prepare an accounting statement. It needs to describe the content of the error (non-accrual of the vacation reserve), indicate the amounts and correspondence of the accounting accounts with which you will correct this error.

2. We create a vacation reserve. The amount of the reserve must be shown by correspondence: Dt 23, 91, 92, 93, 94 - Kt 471.

3. We “withdraw” the amount of vacation pay for the first quarter of 2017. If in the first quarter of 2021 you already managed to accrue vacation pay or compensation for unused vacation directly to your employees by writing: Dt 23, 91, 92, 93, 94 - Kt 661, 651, then now:

— we remove incorrect invoice correspondence using the “red reversal” method: Dt 23, 91, 92, 93, 94 - Kt 661, 651;

- we reflect the correct correspondence of accounts (use of the vacation reserve) with the usual entry: Dt 471 - Kt 661, 651 (within the reserve) and Dt 23, 91, 92, 93, 94 - Kt 661, 651 (above the reserve).

There is no need to make any adjustments/corrections in the financial statements for the first quarter.

How to additionally accrue reserves for previous years

But the procedure for creating a reserve for longer periods (i.e. for 2021 and earlier) differs from the above. Do you want to accrue the old reserve? Then you will have to use the mechanism for correcting last year's mistakes . It is installed by P(S)BU 6

.

In paragraph 4

This

standard

states that the correction of errors made in the preparation of financial statements in previous years is carried out by adjusting the balance of retained earnings at the beginning of the reporting year, if such errors affect the amount of retained earnings (uncovered loss).

In this case, an error in not creating vacation security on time impacted retained earnings. Therefore, in order to acquire a reserve retroactively, it is necessary to adjust the balance of retained earnings at the beginning of the reporting year in the part in which the error actually affected it.

So, what needs to be done to recharge the old reserve?

1. We prepare an accounting statement.

They do this in the month the error is corrected.

The certificate provides information about the cause and content of the error, the amounts and correspondence of the accounting accounts used to make the adjustment.

2. We charge a reserve for each erroneous year. To do this, we will use the posting: Dt 441 “Retained profit” (442 “Uncovered losses”) - Kt 471.

Be careful! If, instead of retained earnings, your financial statements show an uncovered loss, you will have to adjust it.

3. We “remove” vacation expenses accrued in previous periods. We are talking about those vacation pay and compensation that were shown by direct entry: Dt 23, 91, 92, 93, 94 - Kt 661, 651. To do this, you need to use the “red reversal” method: Dt 441 (442) - Kt 661, 651 .

There is one caveat here. Before withdrawing expenses, you need to carefully study the structure of accrual and use of the reserve for each month. After all, it may turn out that the posting: Dt 23, 91, 92, 93, 94 - Kt 661, 651, has the right to life in an amount that exceeded the amount of the reserve subject to accrual.

4. We accrue vacation pay using the vacation reserve for each erroneous year by correspondence: Dt 471 - Kt 661, 651.

5. At the end of each erroneous year, we recalculate (inventory) the vacation reserve. Depending on the result obtained, the reserve will have to:

- or additionally accrue: Dt 441 (442) - Kt 471;

- or reduce: Dt 471 - Kt 441 (442).

6. We prepare correct financial statements. In case of correction of errors of previous years through adjustment of retained earnings, paragraph 5 of P(S)BU 6

requires comparative information to be restated in the financial statements. That is, you will have to re-compile financial statements for those years for which adjustments were made*.

* Details are in the article “Errors in accounting/financial reporting: self-correction-2017” (Accountant 911 magazine, 2021, No. 13).

In addition, the correct indicators must be shown in the current financial statements. To do this, when preparing financial statements in column 3 “At the beginning of the new period” of form No. 1 “Balance sheet (Statement of financial condition)” for the first quarter of 2021 and further until the end of the current year, you should show adjusted data on lines 1420, 1495, 1660 and 1695 .

If the enterprise is a small business entity, then it must make the appropriate amendments to lines 1420, 1495 and 1595, column 3 of form No. 1-m or No. 1-ms.

7. The last thing you have to do, after you have added additional reserves in your accounting, is to self-correct your income tax for the periods from 01/01/2015. Using a clarifying declaration or by submitting the VP application, you should adjust your financial result before tax reflected in declarations for previous years**. In this case you need:

** Read the article “We clarify the income tax with clarification: the subtleties of the process” (Accountant 911 magazine, 2021, No. 14).

— increase it by the amount of the additional accrued vacation reserve

and at the same time

- reduce it by the amount of vacation pay accrued without reserve.

Above we described the “ideal” adjustment option. If such a volume of calculations is not to your liking and you are also not a timid person, then you can extremely reduce the procedure for creating a reserve to a single entry: Dt 441 - Kt 471 for the amount of the balance of unused vacation as of 01/01/2017. Moreover, for To calculate this amount, we recommend using the mechanism for recalculating vacation pay at the end of the year, proposed in paragraphs. 8.2 section III Regulations No. 879 ***

.

*** Regulations on the inventory of assets and liabilities, approved by Order of the Ministry of Finance on September 2, 2014 No. 879.

It is the amount that, after all the manipulations and recalculations, you record as the credit balance in subaccount 471 as of 01/01/2017, and will be the amount of the balance of unused vacations. It is this that you will rely on in the future when calculating vacation pay and compensation for past periods.

But keep in mind: with this self-correction option, you will not be insured against claims from tax authorities during income tax audits for previous years.