What is a reserve for vacation pay?

The vacation reserve in accounting is an obligation that allows one to evaluate and confirm the actual existence of the institution’s responsibility for fulfilling labor guarantees to employees on the reporting day in the period. The rules are established in PBU 8/2010, approved by Order of the Ministry of Finance dated December 13, 2010 No. 167n and the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ.

Who is obliged to create

All existing institutions are required to accrue reserves for vacation pay. The exceptions are organizations that are allowed to maintain simplified accounting:

- small businesses;

- non-profit organizations;

- participants of the Skolkovo project.

This means that such companies do not have the right to create a financial reserve for vacation pay in accounting, but can attribute finance directly to accounts for current costs.

How often to form

The created cash reserve reflects obligations to employees regarding payment for rest as of the reporting date (clause 15 of PBU 8/2010). It must be formed at least once a year (on the final day - December 31). If you provide both annual and quarterly reports, create an inventory for the closing day of each quarter.

In general, it is acceptable to form it on the final day:

- months (labor-intensive, but accurate);

- quarter (for many the most acceptable option);

- year (for institutions with annual reporting).

The specific day is established by the enterprise itself in its accounting policies, which must be approved by the administrative document of the organization.

The vacation reserve for 2021 is formed taking into account previously established rules, since no changes have been made to the legislation regarding accruals for rest days.

Reserve in accounting and reporting

Enterprises that form obligations regarding payment for vacations must record this fact in their accounting policies for accounting purposes. The calculation algorithm should also be explained there.

Postings for use

The formed reserve of funds is subject to reflection in the subaccount “Reserve for vacation pay” to account 96 “Reserves for upcoming expenses”.

When creating it, you need to make a posting to the credit of this subaccount for the amount of deductions. It should be such that the balance of the subaccount becomes identical to the calculated stock.

The reserve for vacation pay (entries are given below) is used when calculating funds for vacation pay and contributions throughout the year.

| date of creation | |

| Reflection in accounting | Operation |

| Dt 20 (26, 44) Kt 96 - reserve for vacation pay | Accrued |

| Accrual date | |

| Dt 96 Kt 70 | Vacation pay accrued from funds |

| Dt 96 Kt 69 | Holiday pay contributions accrued |

Considering that the calculation of the reserved amounts is approximate, these funds may not be enough for the year. With this option, vacation amounts should be credited to the debit of expense accounts. Identical to how salaries are calculated.

Accounting: no reserve is created

If a reserve is not created in accounting, then reflect the accrual and payment of vacation pay as follows:

Debit 20 (23, 25, 26, 29, 44...) Credit 70

- vacation pay accrued.

Debit 70 Credit 50 (51)

- vacation pay was paid.

This procedure follows from the Instructions for the chart of accounts (account 70).

Make similar entries if the vacation is rolling (that is, it begins in one month and ends in another). In this case, the accountant will not have to distribute vacation pay by month.

This is explained as follows.

Since 2011, expenses incurred by the organization in the reporting period, but relating to subsequent reporting periods, may not be reflected in the balance sheet as deferred expenses (in a separate line). They are shown in the balance sheet in accordance with the conditions for asset recognition established by accounting regulations. And they are subject to write-off in the manner established for writing off the value of assets of this type.

Such rules are established by paragraph 65 of the Accounting Regulations, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n.

In this regard, account 97 “Deferred expenses” is not used in all cases in which it was used previously. This account can be used provided that the corresponding amounts are expressly named as deferred expenses in the current accounting regulations. Or amounts are accounted for in account 97 if they meet the following criteria:

- the organization incurred expenses, while the counterparty did not have counter-obligations to it (otherwise a receivable is recognized, not an expense);

- these expenses do not form the value of tangible or intangible assets;

- expenses determine the receipt of income over several reporting periods.

Vacation pay accrued in the current month for the next month are not considered deferred expenses, since such expenses do not lead to the receipt of income in several reporting periods (clause 19 of PBU 10/99) and affect the financial result of the period in which they were incurred . Consequently, in accounting, vacation pay does not need to be distributed between the months in which the vacation fell, that is, they should be taken into account at a time upon accrual.

An example of how vacation pay is reflected in accounting. Vacation starts in one month and ends in another. The organization is a small business entity and does not create a reserve for vacation pay.

In June 2015, the manager of Torgovaya LLC A.S. Kondratiev was given basic paid leave. Duration of vacation - 28 calendar days: from June 16 to July 13, 2015. Vacation pay was paid to the employee on June 11, 2015.

For the billing period - from June 1, 2014 to May 31, 2015 - Kondratiev received a salary in the amount of 360,000 rubles. The billing period has been fully worked out.

Kondratiev’s average daily earnings were: 360,000 rubles. : 12 months : 29.3 days/month = 1024 rub./day.

The accountant accrued vacation pay in the amount of: 1024 rubles/day. × 28 days = 28,672 rub.

including:

- for June: 1024 rub./day. × 15 days = 15,360 rub.;

- for July: 1024 rub./day. × 13 days = 13,312 rub.

The accountant of the organization reflected the accrual of vacation pay in the accounting records with the following entries.

In June 2015:

Debit 44 Credit 70 – 28,672 rub. – vacation pay was accrued to Kondratiev for June and July.

Reserve for vacations in tax accounting

Creating an estimated liability in tax accounting is a right, not an obligation, of the taxpayer. This is the main difference from accounting. In addition, the algorithm for calculating and reflecting the reserve for the purpose of calculating income tax does not provide for variability. Article 324.1 of the Tax Code of the Russian Federation prescribes a clear algorithm for its formation. It provides:

- determining the percentage of contributions to the reserve;

- determination of the reserved amount at the end of each month;

- Conducting inventory on December 31 of each year.

We will consider the methodology for creating a reserve in tax accounting in more detail below (option 3).

How to calculate vacation reserve

The enterprise chooses the calculation algorithm independently and approves it in its accounting policy. It is necessary to provide:

- frequency of reflecting the formation of the reserve (once a year, quarterly, monthly);

- procedure for calculating the reserve amount.

Separately, the accounting policy for tax accounting must reflect the organization’s decision to create (or not create) a reserve. And reflect the rules for its calculation for the purpose of calculating income tax.

Thus, the institution needs to strictly adhere to the established rules and regulations in order to determine the required funds for payment of vacation pay.

Let us next consider the most commonly used methods for creating reserve amounts for vacation pay. And the examples given will help you understand how to implement their application in practice.

Option 1: the simplest

The simplest option is to plan an amount similar to that spent on vacation and insurance premiums for the current year. With this method, a reserve is created once—December 31. True, the obligation in this option will be exceeded, since the employer does not yet owe the employees that much money.

Example.

LLC "Company" generates an estimated liability for vacation amounts once a year. For 2021, vacation pay in the amount of 100,000 rubles was paid, and insurance premiums in the amount of 30,200 rubles were also accrued. (100,000 × 30.2%). On December 31, 2018, the accountant made the following entry:

| Debit | Credit | Sum | Operation |

| 44 | 96 | 130 200 | A vacation reserve has been formed for 2021 |

When an employee goes on another vacation and vacation pay is accrued to him, the following entries will need to be made:

| Debit | Credit | Sum | Operation |

| 96 | 70 | 10 000 | Vacation pay accrued |

| 96 | 69 | 3020 | Insurance premiums have been calculated from vacation pay amounts |

This method is not very correct, since it does not reflect the real obligations of the enterprise to employees regarding vacation payments. Also, since it is generated only once a year, changes in staffing are not taken into account. In the middle of the year, a decision may be made to reduce the number of staff or, on the contrary, to sharply increase it.

The procedure for paying vacation pay

Pay for your vacation no later than three days before it starts.

At the same time, the Labor Code does not prohibit paying vacation pay earlier (Part 9 of Article 136 of the Labor Code of the Russian Federation). Situation: on which days should the three-day period for payment of vacation pay be counted - calendar or working days?

Calculate the deadline for payment of vacation pay based on calendar days.

After all, if the Labor Code does not directly indicate which days to count for a particular period, it is necessary to proceed from the calendar.

This procedure also applies to the deadline for the payment of vacation pay, since Article 136 of the Labor Code of the Russian Federation does not directly indicate which days to take into account. Therefore, count both working and non-working days - holidays, weekends. That is, all calendar days. Moreover, if the end of the term falls on a non-working day, then make the payment the day before - on the last working day.

This procedure is provided for in Article 14 of the Labor Code of the Russian Federation, similar conclusions are expressed in the letter of Rostrud dated July 30, 2014 No. 1693-6-1.

Situation: is it possible, at the request of an employee, to pay him vacation pay after he returns from vacation?

Answer: no, you can't.

Labor legislation does not allow this. The organization is obliged to pay vacation pay to the employee no later than three days before the start of the vacation (Part 9 of Article 136 of the Labor Code of the Russian Federation). And the Labor Code of the Russian Federation does not contain any exceptions to this provision related to the desire of the employee.

Option 2: more accurate

The second way is as follows:

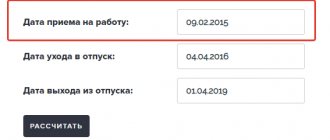

- count the number of unused days for all employees on the date the reserve is reflected;

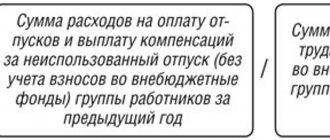

- calculate the average daily salary in the institution. For example, according to the formula:

- derive buffer funds using the formula = SDZ × (1 + total contribution rate) × number of unused rest days as of the reporting date. The tariff of total contributions represents the sum of the tariffs of those contributions that are calculated on the salary.

The frequency of calculation can also be provided once a year, but with this method it is better to recalculate more often: once a quarter or even monthly.

Example.

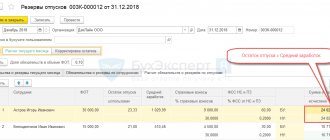

LLC "Company" calculates the estimated liability for vacations on the last day of each quarter.

The number of employees (has not changed) is 10 people.

The salary amount for 2021 is 2 million rubles.

Number of vacation days not taken:

- as of December 31, 2018 – 50;

- as of March 31, 2019 – 60;

- as of 06/30/2019 - 40.

Vacation pay paid:

- for the 1st quarter of 2021 - 20,000;

- for the 2nd quarter of 2021 - 40,000.

First, let's determine the calculation of average earnings:

Average daily earnings = 2,000,000 / 12 × 29.3 × 10 = 568.83 rubles.

The remaining calculations and transactions are given in the table:

| Debit | Credit | Sum | Operation (calculation) |

| as of 12/31/2018 | |||

| 44 | 96 | 37 030,83 | A reserve has been formed of 568.83 × 1.302 × 50 = 37,030.83. |

| For 1 quarter | |||

| 96 | 70 | 20 000,00 | Vacation pay accrued for the 1st quarter. |

| 96 | 69 | 6040,00 | Insurance premiums charged are 20,000.00 × 0.302 = 6040.00. |

| 44 | 96 | 33 447,00 | As of 03/31/2019:

|

| For the 2nd quarter | |||

| 96 | 70 | 30 000,00 | Vacation pay accrued for the 2nd quarter. |

| 96 | 69 | 9060,00 | Insurance premiums charged are 30,000.00 × 0.302 = 9060.00. |

| 44 | 96 | 24 250,67 | As of 06/30/2019:

|

Responsibility for late payment of vacation pay

Attention: failure to comply with the payment deadline for vacation pay may be regarded as a violation of labor law requirements. For this violation, the labor inspectorate may fine the organization or its officials.

The responsibility is as follows:

- for officials of the organization (for example, a manager) - a warning or a fine from 1000 to 5000 rubles;

- for entrepreneurs – a fine from 1000 to 5000 rubles;

- for an organization – a fine from 30,000 to 50,000 rubles.

Repeated violation entails:

- for officials of the organization (for example, a manager) - a fine of 10,000 to 20,000 rubles. or disqualification for a period of one to three years);

- for entrepreneurs – a fine from 10,000 to 20,000 rubles;

- for an organization – a fine from 50,000 to 70,000 rubles.

Such liability measures are established in parts 1 and 4 of Article 5.27 of the Code of the Russian Federation on Administrative Offenses.

An employee who has not been paid vacation pay in a timely manner may request that annual leave be postponed to another time (Part 2 of Article 124 of the Labor Code of the Russian Federation, Clause 2 of the ruling of the Constitutional Court of the Russian Federation dated June 23, 2005 No. 230-O).

If vacation pay has been calculated and paid, but the employee cannot go on vacation due to an emergency situation at work, issue a recall from vacation (Part 2 of Article 125 of the Labor Code of the Russian Federation).