In accordance with Art. 402 list of Rosarkhiv, approved. By order of December 20, 2019 No. 236 (valid from February 18, 2020), the employing company must store personnel sheets that reflect information about working hours in its archives:

- for 5 years - under standard operating conditions;

and if working conditions in the company are difficult, harmful or dangerous:

- 50 years - if the documents were completed after 01/01/2003;

- 75 years - if documents were completed before 01/01/2003.

The company's accounting department or personnel department is usually responsible for storing timesheets. It is compiled, as a rule, according to forms T-12 or T-13. They can be either paper or electronic.

The retention period for time sheets specified above must be respected, even if the documents are electronic. Moreover, in order to start using the T-12 or T-13 file form, the employer needs:

- consolidate the procedure for applying this form in the accounting policy;

- establish in local regulations the procedure for certifying forms T-12 or T-13 using an electronic signature.

Regulatory regulations regarding timesheets

Federal Law dated December 6, 2011 N 402-FZ defines the requirements for maintaining primary documentation

Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1 developed forms of primary documentation

Order of the Ministry of Finance of Russia dated March 30, 2015 N 52n determines the form of the report card for government organizations

Article 22.1. Federal Law of October 22, 2004 N 125-FZ determines the storage periods for documents on personnel

Order of the Ministry of Culture of Russia dated August 25, 2010 N 558 determines the storage period for archival documents of the organization

About personnel documentation

On the one hand, personnel document flow is quite simple: most forms are approved by the State Statistics Committee, and the procedure for filling out and storing them is clearly regulated.

On the other hand, the number of these forms is so large that only a specialist can remember them all. Moreover, each omission, each missing form can cost the organization at least 30 thousand rubles (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

This article is a kind of cheat sheet on personnel documents that should be in any organization.

In this article, we will talk about documents that companies often forget about. Especially in those organizations where personnel records are maintained not by an employee specializing in this type of accounting, but by a person who combines the work of an accountant and a personnel officer. So, what personnel documents (in addition to work books, contracts and orders) must an organization have? Here is their list:

- Time sheet

- Vacation schedule

- Staffing table

- Internal labor regulations

- Pay slip

- Labor records books

- Employee personal card

The first document we will talk about today is the time sheet. The fact that any organization must have such a document is stated in Article 91 of the Labor Code, which establishes the general obligation of the employer to keep records of working hours.

The forms for such accounting - T-12 and T-13 - were approved by Decree of the State Statistics Committee of Russia dated 01/05/04 No. 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment” (hereinafter referred to as Resolution No. 1).

DETAILS: Employment Center registration for unemployment

Please note that you only need to enter one (any) of them.

They differ in that the T-12 form contains columns for calculating wages, and the T-13 is exclusively a personnel form, which takes into account only the attendance of employees and the time they work.

Working time sheets must be stored for five years after the end of the year for which they were filled out (Order of the Ministry of Culture of Russia dated August 25, 2010 No. 558*; hereinafter referred to as Order No. 558). Please note: in enterprises with harmful, dangerous or difficult working conditions, the storage period for time sheets is 75 years, since the data contained in them may be necessary for calculating length of service and pensions.

Vacation schedule

The next document, which accountants who perform the functions of a personnel officer do not always remember, is related to employee vacations. We are talking about the vacation schedule. Article 123 of the Labor Code of the Russian Federation directly states that the organization must have a vacation schedule. This document is drawn up according to the unified form T-7, approved by Resolution of the State Statistics Committee No. 1.

Please note: the vacation schedule must be approved at a strictly defined time - no later than two weeks before the start of the calendar year (Article 123 of the Labor Code of the Russian Federation). In addition, any deviations of actual vacations from this schedule must be formalized in separate orders amending the schedule.

And one more important note. The storage period for the vacation schedule is one year (see order No. 558), which is calculated from January 1 of the year following the one for which the schedule was drawn up.

As you can see, the organization is not obliged to store vacation schedules for all previous years.

Staffing table

Go ahead. Among the documents already announced, the staffing table stands apart. The fact is that the Labor Code does not directly say about the need to have a staffing table in every organization.

But at the same time, the Code contains a rule according to which the employment contract must indicate the position in accordance with the staffing table (Article 57 of the Labor Code of the Russian Federation).

So it turns out that the organization must have a document indicating the names of positions, salaries and other conditions.

The form according to which the staffing table is drawn up (form T-3) is also approved by Resolution of the State Statistics Committee No. 1. At the same time, the staffing schedule (like the vacation schedule) is a document that does not have to be static. The company can quickly add or reduce positions, rename them, etc.

But any action must find official confirmation in orders amending the staffing table.

It is also necessary to ensure that the names of positions in the staffing table (in its latest, current version) coincide with the names of positions in employment contracts and work books.

The need to have a document called “Internal Labor Regulations” directly follows from Article 189 of the Labor Code of the Russian Federation. It says that “the labor regulations are determined by the internal labor regulations” and provides a brief description of this document.

Do not forget that these rules are approved by order of the manager. Each employee must be familiarized with them and signed. In case of changes or adoption of new rules, the previous version must be stored for one year (see order No. 558).

Basis for keeping timesheets

Today there are 22 unified report forms: T-12 and T-13. Also, the organization may not use these forms from 01/01/2013, but develop a convenient one for use depending on the specifics of the activity. But before using it, the enterprise must formalize its own forms with local documents: an order (instruction) and attach the developed form as an appendix.

Important! State and government institutions are required to use a unified report card form (Form according to OKUD 0504421). Commercial organizations have the right to develop and accept for use independently developed forms.

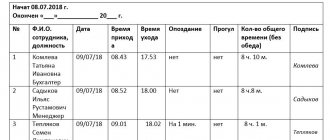

The employee appointed responsible for maintaining the timesheet records in this document attendances or absences from work, their reasons, overtime, etc. At the end of the month (15th - for advance payment), based on the time sheet, the accountant calculates wages and other payments.

Information reflected in the report card

The report card is the primary document that is subject to the following general requirements for details:

| Props | The timesheet reflects |

| Name | time sheet |

| date | the date of the last day for payment or advance must be indicated |

| name of company | full or abbreviated |

| content of the fact of the organization's activities | marks of attendance and absence from work on specific dates of the month |

| fact measurement value indicating units of measurement | hours, days |

| names of positions (signing the timesheet) | person responsible for drawing up the time sheet, head of a structural unit, HR employee |

| signatures of persons, indicating last names and initials, to identify these persons | signed by the relevant person |

The timesheet records the hours worked for each employee directly:

- reporting period

- Full name, his position

- Personnel Number

- number of hours worked (not worked) for each calendar day

- total hours and days worked during the reporting period

- correspondent account for wages

- number and reasons for absenteeism

- number of weekends and holidays

How long should you keep a timesheet?

A time sheet is a mandatory form that must be kept at the enterprise and may be required by the following categories of persons:

- primarily to accountants for calculating wages, vacation pay and other benefits due to the employee;

- tax authorities have the right to check the availability and correctness of information; if documents are missing or filled out improperly, the company will have to pay fines;

- employees of the social insurance fund when checking the correct reflection of taxes when calculating wages;

- During the inspection, labor inspectors will ensure that the rights of all employees are respected.

The time sheet must be kept at the company for 1 year; after this period, the documents are handed over to the archive, where they are subject to storage for a period of 5 years.

If work activity at a company is associated with dangerous or harmful conditions, then documents on hours worked are stored for 75 years. In certain cases, internal documents can be used to increase storage periods.

The importance of maintaining - the time sheet determines how much hours and days are worked by each employee of the enterprise; on the basis of this, payments to employees are calculated, and reporting is compiled at the enterprise. This document is filled out in a single copy and signed by the head of the enterprise and the responsible person.

According to the law, if paperwork at an enterprise is impossible without the use of specific documents, then these documents must be stored in the archive for a certain time.

Retention periods vary depending on their need for inspections; clear retention periods are not specified in the law.

Under the previous legislation, the time sheet had to be kept for a year, but partly this remains the case, because the accountant needs this document during the reporting year to reconcile data and verify the correctness of the reflection of transactions.

The order of the Ministry of Culture states that the shelf life of the report card must be at least 5 years, and for harmful and dangerous industries - 75 years.

The manager, by order, appoints a person responsible for filling out the time sheet; as a rule, he is an employee of the human resources department. But there may be several people responsible for performing this work if the enterprise is large and contains many divisions.

Document form

The timesheet form is unified and contains the following fields:

- document header;

- Date of preparation;

- information on the company, if information is collected by department, then the specific department for which the document was made is indicated;

- Full name of employees indicating position, personnel number;

- the number of days or hours worked by each employee;

- the person responsible for filling it out.

Information must be collected gradually; it is advisable to enter information about employees’ hours worked once a week. Information about visiting the workplace can be obtained from the security staff or you can enter an electronic program that will record the employee’s arrival by attaching a personal card to a validator or taking fingerprints.

If the employee’s job is hourly, then using the data on the employee’s presence at the workplace, you don’t have to worry about being overpaid for missed hours or being late.

Shelf life of the report card

The accounting sheet, on the one hand, belongs to the group of labor organization documents as part of personnel documents. In general, all such documents should be kept:

- 75 years before January 1, 2003

- 50 years if issued after January 1, 2003

But these requirements do not directly apply to the report card and it must be stored (in accordance with the lists of archival documents) for 5 years.

Time sheets at enterprises where there are difficult, harmful and dangerous working conditions must be stored for 75 years.

Economic entities may, but are not obligated to, transfer documents for storage to state and municipal archives by concluding appropriate reimbursable agreements with them.

Expert of the Legal Consulting Service GARANT, professional accountant E. Lazukova

How and where to organize storage space

Each enterprise must develop its own document flow schedule , which specifies how and where to store each document, indicating the number of copies and accountable persons.

But not only the storage period is important, but also the timing of submission to the accounting department ; there must be a clear framework for the possibility of entering information. As a rule, the accounting department calculates salaries for the previous period by the 10th day of the month, and by the 15th the accountant is obliged to pay all taxes.

If there is a delay in transmitting the time sheet to the accounting department, then there may be delays in paying taxes, which will immediately lead to the accrual of penalties.

After the reporting period, documents for the previous year can be gradually transferred to the archive . The law does not regulate the mandatory storage of time sheets in the archive; management has the right to independently decide where and how to store documents. But this does not mean that the forms can be disposed of; they must be kept safe and access to them must be organized in the event of an audit.

The accountant is responsible for storing the timesheets , since he is the final authority for receiving these documents. When submitting to the archive, an inventory must be drawn up so that when searching for documents it is possible to immediately find the necessary information. The archivist will now be responsible for safety and transportation. If the time sheet must be stored for 75 years, then after the expiration of the 5-year period, these documents can be transferred to archival warehouses, if an agreement has been concluded with them or such warehouses are owned by the enterprise.

Procedure for storing time sheets

Creating conditions for the protection of documents is the responsibility of an economic entity in an organization . In the office work of any organization, a nomenclature of files of the appropriate form must be drawn up, drawn up in accordance with the specifics of the organization (structural divisions), the documentation used, where the storage periods are indicated for each document. The specification of the conditions and procedure for storing documents is established by the accounting policy of the organization (since the time sheet refers to primary documentation).

Documents of temporary storage (more than 10 years) are stored in the archive of the organization (creating an archive in the organization is not an obligation, documents can be stored in structural divisions), time sheets refer to documents of temporary storage (less than 10 years - 5 years), with the exception of time sheets at enterprises with harsh working conditions (permanently stored - 75 years).

Thus, the formation of a case based on timesheets that are constantly stored requires the following requirements:

- binder (binding)

- pagination

- certification sheet

- internal inventory of documents

- making clarifications on the cover (name of organization, index, dates, title).

Temporary storage cases (5-year storage records) may not be completed in full:

- documents are not organized

- do not number sheets

- do not write statements of assurance

In case of temporary (up to 10 years) storage at the end of the storage period, documents must be destroyed only after an annual examination of the values of the documents is mandatory (Order of the Ministry of Culture of the Russian Federation dated March 31, 2015 N 526).

Rules for the movement of timesheets within the company

Companies are required to take into account not only the shelf life of time sheets, but also correctly organize its movement. At the same time, it is necessary to monitor its safety at all stages.

Reference

The path of passing the time sheets may consist of the following stages:

- document execution;

- compilation control;

- signing;

- transfers to the accounting department;

- storage organization.

Each stage should be reflected in the existing document flow schedule, because the latter is an element of the organization’s accounting policy. When indicating each stage, it is necessary to reflect the performers, paper and electronic versions, the number of originals/copies, and other important factors, including how long the timesheet needs to be kept.

The justification for the provided procedure is considered to be:

clause 4 art. 9 of Law 129-FZ dated November 21, 1996, clause 4 of the Accounting Regulations “Company Accounting Policy” PBU 1/2008, approved by Order of the Ministry of Finance 106n dated October 6, 2008; clause 15 of the Regulations on accounting and reporting, approved by order of the Ministry of Finance dated July twenty-ninth, 1998 34n.

When forming a document flow schedule, it is necessary to take into account the specifics of document preparation, and not just the storage period for time sheets. This means detailed accounting:

- duration of preparation;

- making marks throughout the month according to supporting documents;

- late submission of papers.

Due to the fact that the document must be submitted to the accounting department within a strictly allotted time, and data on the reasons for the absence of the organization’s employees often reaches the timekeeper later, it may be necessary to make corrections not only before delivery, but also after it. Therefore, it is better to provide for the opportunity for timekeepers to submit the original timesheet to the accounting department and make adjustments. Since the shelf life of time sheets is five years or more, the accounting department needs to organize a place where the papers will be stored.

Where are timesheets stored?

The head of the organization decides for himself how and where time sheets are stored (Articles 13, 17 of Law No. 125-FZ of October 22, 2004).

But it is necessary to distinguish current storage from archival storage. The current involves the use of documents from the moment of creation until transfer to the archive. It is possible in two types: storage during execution and storage of executed documents. Executed papers must be formed into files in accordance with the nomenclature (clause 3.1 of GOST 7.0.8-2013, approved by order of Rosstandart dated October 17, 2013 under No. 1185-st).

The law does not regulate where time sheets should be kept, but in the event of inspections they must be accessible. If it is discovered that documents were disposed of ahead of schedule, proceedings will be initiated, which will lead to the imposition of fines.

After closing, the time sheet is submitted to the organization’s accounting department, where it is used as a primary document for payroll calculation. After which the accountant organizes its storage. Usually the papers remain in the company’s department, but if there is no space there, after three years or less they can be transferred to the archives. The timing, as well as the procedure for transferring time sheets and other primary documents to the archive, are regulated by a local act of the organization, so there are no uniform conditions. Timesheets subject to storage for 75 years can be transferred from the enterprise archive to specialized archival institutions if an agreement has been concluded with them.

In the place where the time sheet is stored, all conditions must be met so that the information remains in readable form. The papers should not be exposed to sunlight or moisture, otherwise they will quickly become unusable. It is especially important to properly organize the storage of time sheets, which are subject to destruction only after 75 years.

Storage of documents in electronic document management

In the case of electronic document management in an organization, the conditions for storing electronic documents include:

- 2 copies – archived on different devices

- Availability of tools and software for reading and monitoring their status

- provision of storage

- Electronic documents are transferred to the archive – in PDF/A format.

- To ensure storage, it is necessary to rewrite documents onto new media and formats

- When storing such documents in the archive, control must be carried out once every 5 years

Answers to common questions

Question No. 1 : What document will confirm the fact that the time sheets were stored for 5 years?

Answer : The expert commission annually organizes an examination of the value of documents and draws up a standard act that reflects the affairs of the organization with an expired storage period as of January 1 of the year of the examination and the acts are approved by the director. Documents are sent for destruction using the delivery note.

Question No. 2 : Is there a need to follow the procedure for the current storage of documents that are still in the paperwork cycle?

Answer : Storage of documents in progress is carried out in cabinets or safes in the personnel department (at the discretion of management, they can be stored in the accounting department on the basis of local documents of the organization). These documents contain confidential employee data, so you need to ensure they are protected.