Features of inventory accounting

Materials (materials and materials) can be delivered to the enterprise's warehouse by purchase, gratuitous transfer, in the form of a contribution to the authorized capital, or in another way. To account for purchased materials, account 10 “Materials” is used.

The cost of inventories upon receipt at the warehouse can be taken into account as follows:

- at actual cost on account 10;

- at discounted prices. To form the cost of inventories, an additional 15th account is applied.

The selected option for accounting for inventories must be specified in the accounting policy.

If the balance is debit on account 16, then account 16 is written off as follows:

Debit 20,44,23,26 Credit 16 Amount (Calculation of the amount is the formula below) - Overexpenditure is written off to those accounts where materials were written off at accounting prices.

Formula for calculating the write-off amount:

(Debit balance on account 16+Debit turnover on account 16)/(Debit balance on account 10+Debit turnover on account 10)=Coefficient, This coefficient must be multiplied by the amount of the posting debit 20 Credit 10 (Amount* coefficient).

Example (let's use previous example 1).

JSC "Tredax" bought bricks at a price of 100 rubles in the amount of 10 pieces (registering price 90 rubles per unit). The delivery cost was 1500 rubles. Consulting services amounted to 5,000 rubles. Bricks are written off for production 5 pcs. Balance at the beginning on account Dt 10-2500, on account 16 Dt 3500

Solution:

- Debit 10 Credit 15-900 rubles (90*10) - Materials have been received at discount prices.

- Debit 15 Credit 60-1000 rubles (10*100) - Actual cost of purchased materials.

- Debit 15 Credit 60-1500 rubles - Delivery cost reflected.

- Debit 15 Credit 76-5000 rubles - Consulting services for the purchase of materials are reflected.

- Debit 20 Credit 10-450 rubles (5*90) - Brick is written off for production. (Writes off at the book price since the brick is reflected in account 10 at the book price)

- Debit 16 Credit 15-6600 rubles (1000+1500+5000-900) - At the end of the month the difference is written off to account 16

Formula: (3500+6600)/2500+900)=2.97

7) Debit 20 Credit 16-1337 rubles (2.97 * 450) - At the end of the month, deviations are written off to account 20.

Figure 5

Account 15 in accounting

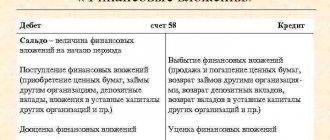

The main aspect of using account 15 is that this account summarizes information on the procurement and acquisition of inventories, which relate to funds in circulation:

The difference between the actual cost and the accounting price is called a deviation. To reflect deviations in accounting, account 16 “Deviation in the cost of material assets” is used.

Typical transactions for account 15 are presented in the table below:

| Dt | CT | Contents of operation |

| 60 | 51 (50) | The paid cost of the supplier's inventory is taken into account |

| 15 | 60 | The cost (excluding VAT) of inventories according to the supplier’s accompanying documents is taken into account |

| 19 | 60 | VAT paid included |

| 10 | 15 | The purchased goods and materials were credited to the warehouse at the discount price |

| 15 | 16 | The excess of the book price over the actual cost is written off |

| 16 | 15 | The excess of the actual price over the accounting cost is written off |

Application of 15 accounts in transactions

When using item 15 to record transactions, its debit part reflects the purchase price of the company's inventory according to the settlement documents received from the supplier.

Taking into account the source of origin of goods and materials and the nature of the costs of their production and delivery, account 15 is debited in correspondence with 60, 76, 71, 20, 23 and other accounts.

At the time of actual receipt and capitalization of inventories, they are written off as credit 15 of the balance sheet position and debit of 10 or 41 accounts.

In a situation where the book price of inventory exceeds its actual cost, the difference in the indicated entry must be reversed. In this case, the entry will look like this:

Dt 16

Kt 15 reversible.

The debit balance of account 15 at the end of the reporting period indicates the existence of PMZ in transit. As for Form No. 1 of financial statements, the balance of account 15 at the end of the reporting period is transferred to line 1210. If we are talking about the purchase of equipment for installation, which is subsequently reflected in account 07, then the balance of item 15 should be reflected in line 1190 balance sheet.

Postings using accounts 15 and 16 as an example

Example 1

TD "Zima" purchased MPZ in the amount of 2,500 pieces, the total cost of materials was 354,000 rubles, incl. VAT 54,000 rub. Materials were entered into the warehouse at a book price of 160 rubles. for one piece. 500 units were written off for the production of finished products.

Accounting entries using account 15 for inventory accounting:

| Dt | CT | Amount, rub. | Contents of operation | Document |

| 60 | 51 | 354 000 | Reflects payment to supplier for materials | Bank statement |

| 15 | 60 | 300 000 | Purchased materials are taken into account at actual cost, excluding VAT | Consignment note (TORG 12) |

| 19 | 60 | 54 000 | The amount of VAT on purchased materials is taken into account | Invoice received |

| 10 | 15 | 400 000 | Purchased materials are posted to the warehouse at the discount price | Invoice |

| 15 | 16 | 100 000 | The write-off of the excess of the book price over the actual cost is reflected. | Accounting information |

| 20 | 10 | 80 000 | Materials written off for production are taken into account (500 * 160) | Invoice for transfer of materials to production |

| 20 | 16 | 20 000 | At the end of the month we write off the amount of 20,000 rubles. ((0 + 100,000) * 80,000 / (0 + 400,000)) | Accounting information |

Reflection of the actual cost of purchasing materials and writing off the difference.

- Debit 10 Credit 15 - Materials received at accounting prices.

- Debit 15 Credit 60 - Reflection of the actual cost of materials and goods according to supplier documents.

- Debit 15 Credit 60-Transportation costs for the purchase of goods and materials are reflected

- Debit 15 Credit 76-Consulting costs for the purchase of materials.

- Debit 16 Credit 15-Write-off of overexpenditure (if the actual cost turned out to be higher than the book value).

- Debit 15 Credit 16-Write-off excess of book value over actual cost of materials (savings)

Let's look at example 1 (when there is overrun):

JSC "Tredax" bought bricks at a price of 100 rubles in the amount of 10 pieces (registering price 90 rubles per unit). The delivery cost was 1500 rubles. Consulting services amounted to 5,000 rubles. Bricks are written off for production 5 pcs.

Solution:

- Debit 10 Credit 15-900 rubles (90*10) - Materials have been received at discount prices.

- Debit 15 Credit 60-1000 rubles (10*100) - Actual cost of purchased materials.

- Debit 15 Credit 60-1500 rubles - Delivery cost reflected.

- Debit 15 Credit 76-5000 rubles - Consulting services for the purchase of materials are reflected.

- Debit 20 Credit 10-450 rubles (5*90) - Brick is written off for production. (Writes off at the book price since the brick is reflected in account 10 at the book price)

- Debit 16 Credit 15-6600 rubles (1000+1500+5000-900) - At the end of the month the difference is written off to account 16 (more about account 16 below).

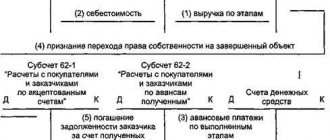

See Figure 1 (charts of accounts, “airplane”)

Let's look at example 2 (when there are savings):

JSC "Tredax" bought bricks at a price of 100 rubles in the amount of 10 pieces (registering price 1000 rubles per unit). The delivery cost was 1500 rubles. Consulting services amounted to 5,000 rubles. Bricks are written off for production 5 pcs.

Solution:

- Debit 10 Credit 15-10,000 rubles (1000*10) - Materials received at discount prices.

- Debit 15 Credit 60-1000 rubles (10*100) - Actual cost of purchased materials.

- Debit 15 Credit 60-1500 rubles - Delivery cost reflected.

- Debit 15 Credit 76-5000 rubles - Consulting services for the purchase of materials are reflected.

- Debit 20 Credit 10-5000 rubles (5*1000) - The brick is written off for production. (Writes off at the book price since the brick is reflected in account 10 at the book price)

- Debit 15 Credit 16 –2500 rubles (10000-1000-1500-5000) - Savings are written off; the accounting price exceeds the actual cost (more about account 16 below).

If you find it difficult to write the posting of account 15 and account 16 in debit or credit, then it’s very simple to look at the turnover on account 15, if the debit turnover is higher than the credit turnover, then we find the difference and write down the posting Debit 16 credit 15. If, on the contrary, Credit is greater than debit, then write it down the difference in debit 15 Credit 16. Or in simple words, account 15 needs to be closed, if to close you need to enter the difference in debit, then the posting will be Debit 15 Credit 16, if to close you need to write down the difference amount as credit, then the posting will be Debit 16 Credit 15

Figure 2 (charts of accounts).

Accounting for receipt of materials into production

If you, by the will of fate, find yourself as an accountant for a manufacturing company, or are simply planning to expand your qualifications, then you will be interested in the material presented below. Moreover, when speaking about production, I mean not only production in its pure form, such as, for example, the manufacture of furniture, plastic windows, spare parts, etc., but also a more expanded concept, such as: wood processing, tailoring , repair of household appliances, equipment, materials processing, bakery, coffee shop, etc. In a word, everything that the process of creating any final product implies. Naturally, a reasonable question immediately arises: what is necessary to produce any product?

Materials

– this is something that no manufacturing enterprise can do without, and one of the main components of production costs.

Therefore, the section will be devoted to accounting for materials in production. So, in order to start manufacturing products, you first need to purchase raw materials. Let's say it is purchased and brought to the warehouse - what are the actions of the accountant? Of course, the accounting employee should accept the materials for accounting...and, as they say, from now on, in more detail. Documents for accounting of materials in production

The basis for accepting inventories for accounting are primary documents

upon their arrival.

What do we pay attention to?

— Packing list

This can be either a unified document or a document independently developed by the supplier organization.

The main thing is to check whether all the required details are available and how correctly they are entered. The necessary information is specified in paragraph .

2 tbsp. 9 of the Law “On Accounting” - Invoice

It deserves especially close attention if you work on OSN. Without this document, it is impossible to accept VAT for deduction. It should also be carefully studied to ensure that all required fields are complete and correct. By the way, check out my article “Invoice”, it describes in detail how not to miss a single mistake when filling out and checking an invoice.

Alternatively, the set of documents from the supplier may include invoices, supply or sales agreements, and, if necessary, certificates.

Of course, if the above documents are available, the data in them should be comparable to the information in the primary documents.

Principles of accounting for the procurement and acquisition of materials

You have the right to accept materials for accounting in one of two possible ways:

1.

Upon receipt, materials are valued at the actual cost of acquisition (procurement).

See schematically what the actual cost

.

In short, these are all costs actually spent on purchasing or procuring your own materials.

2.

Received inventories are accounted for at discount prices.

Some large manufacturing companies use special prices

the actual cost

and

the accounting price

is adjusted . This option makes sense for large and frequent deliveries and an extensive range of inventories, when purchase prices for materials or transport services are variable.

Be sure to indicate in your company’s accounting policy the chosen method of recording the receipt of materials!

Postings by materials

Accounting and operational accounting of materials in production will depend on the chosen method. In particular, if the company reflects the receipt of inventories at actual cost

, then the accountant applies

account 10 “Materials”

.

Dt 10 Kt 60

— receipt of materials

at actual cost

from the supplier organization.

The picture looks somewhat different when initially organizing the receipt of materials at accounting prices. All expenses for the purchase of materials, including the purchase price of inventories, are recorded in the debit of account 15

.

Dt 15 Kt 60

— reflects the purchase price of inventories and other expenses associated with their acquisition.

And only after that the cost of inventories at discount prices

debited to

account 10

.

Dt 10 Kt 15

– Inventory and equipment are capitalized

at accounting prices

.

And then through account 16 “Deviation in the cost of material assets”

write off the discrepancy between

the accounting

and

actual cost

.

If the discount price is exceeded

:

Dt 15 Kt 16

If the actual cost is higher

, then reverse wiring:

Dt 16 Kt 15

Calculation part

And in order not to be unfounded, let's immediately see practically with numbers how it will look in accounting.

“OOO Tables and Chairs received production materials at the warehouse at a price of 35,400 rubles. (including VAT – 5,400 rubles). Delivery cost 5,900 rubles. (including VAT – 900 rubles).” The cost of consultations on the selection of materials amounted to 2,360 rubles (including VAT 360 rubles). Accounting for raw materials and materials in production is organized at actual cost"

Let's summarize the calculation:

37,000 rubles

- this is the actual cost of the inventories And now the same example, but the company uses

accounting prices

:

As you can see, the difference is still insignificant, with the exception of the posting of materials to account 15

instead of

invoice 10.

As in the previous example, the purchase cost of materials

is 37,000 rubles

.

However, further accounting entries are determined by the accounting prices

:

1)

The cost of purchased materials at the discount price is

30,000 rubles.

2)

The accounting price for received materials

is 40,000 rubles.

Obviously, the primary accounting of materials in production has its own nuances.

Unfortunately, the scope of the article does not allow us to reveal all the subtleties, structure and organization of accounting in production, but I would recommend enrolling in the workshop course “Accounting and taxation in a manufacturing enterprise + 1C 8.3”.

Everything is in the best traditions of the RUNO educational center: a combination of theory, practice, work in 1C using the example of a real operating manufacturing company.

I can assure you that we will teach you how to work.

Author of the article: Matasova T.V.