Internal movement of inventory items

The limit is set by the head of the organization or an employee appointed by his order (for example, the head of a structural unit).

As a rule, such a limit is set to ensure uninterrupted production.

The maximum quantity of materials that can be released from the warehouse is indicated in the “Limit” column.

Excessive supply of materials or changing the limit is permitted only with the permission of the head of the organization (or a person authorized by him).

The accountant draws up a card for each item of materials in 2 copies:

the first copy is transferred to the consumer of the materials (for example, to the workshop);

the second copy is transferred to the warehouse.

The employee receiving the materials presents his copy of the card to the storekeeper. The storekeeper must indicate on all copies of the card the date of release, the quantity of materials issued, as well as the remaining limit. After this, the storekeeper signs the card of the employee receiving the materials. The employee receiving the materials signs a copy of the card kept by the storekeeper.

When filling out the card, in the column “Accounting unit of production”, indicate the name of the finished product for the production of which the material was released, and its accounting unit (piece, kilogram, liter, etc.).

In the card you can indicate the nomenclature number of the materials (column “Nomenclature number”). To do this, you can use the All-Russian Classifier of Economic Activities, Products and Services (OK 004-93) or develop your own encoding.

However, it is not necessary to fill out this column.

When filling out the “Unit of Measurement” column (“Code”/”Name”) in the map, you can use the All-Russian Classifier of Units of Measurement (OK 015-94). This document provides codes for all units of measurement used in Russia.

After the limit specified on the card has been used (but at least once a month), the storekeeper hands over the card to the accounting department. The storage period for the card in the organization’s archive is 5 years.

Based on the card, the accountant must make the following entry:

Debit 20 (23, 29) Credit 10 - materials transferred for the needs of the main (auxiliary, servicing) production.

An example will show you how to fill out the card.

Date added: 2015-06-25; ; Copyright infringement?;

One of the most common warehouse accounting operations is the internal movement of inventory within an enterprise. In this case, the transferred values do not leave the enterprise, but only arrive from one structural unit to another. For example, in a manufacturing enterprise, raw materials and materials can be transferred from a materials warehouse to a production warehouse; in a trading company, goods are transferred from a central warehouse to a warehouse of a specific retail outlet, etc.

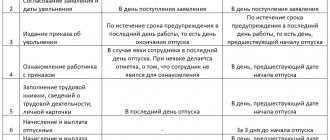

The nuances of dismissing a financially responsible person

According to the general procedure for dismissal, the employee first writes a corresponding letter of resignation of his own free will. However, he must notify the employer of his desire to terminate the employment relationship no later than 2 weeks in advance. Next, you are required to work 14 calendar days from the date of application.

On the last day of work, the personnel department transmits a work book, a 2-NDFL certificate, extracts from some reports (for example, extracts from the calculation of insurance contributions about the length of service, SZV-M and SZV-STAZH), a certificate of payment of benefits and, if there is a written application from the employee - a copy of the dismissal order. All documentation is issued on the last day of work.

A prerequisite for the dismissal of those financially responsible!

As soon as the application for dismissal of the financially responsible person has been signed, the organization should conduct an inventory within 14 days, after which the former employee transfers the entrusted property to the enterprise under the act to the new financially responsible person. This procedure was approved by Order of the Ministry of Finance dated December 28, 2001 No. 119N and dated June 13, 1995 No. 49. If within a 14-day period the organization has not found a replacement for the employee, material assets are transferred to the official with temporary performance of the duties of the departing employee.

Registration

Entering new and editing existing documents is carried out in the window shown in Fig. 8.8.

Rice. 8.8. Entering and editing a document for internal movement of goods and materials

The procedure for working in this window is the same as in the editing windows for other shipping documents.

Let us only note that in the Sender and Recipient fields the names of the sending warehouse and the receiving warehouse of the valuables for this document are indicated, respectively.

In the fields Shipping account. (BU) and Receipt Account. (BU) the accounting accounts are indicated, respectively, for the write-off and capitalization of inventory items according to this document.

To print a document, you need to click the Print button and in the menu that opens, select the printed form of the document Movement of Goods (this form is offered by default) or TORG-13 (Invoice for internal movement).

In Fig. 8.9 shows a document in the “TORG-13” form.

8.9. Invoice for internal movement according to the form “TORG-13”

As for the default form “Movement of goods”, this is a simplified form of the document. In this case, it will look something like in Fig. 8.6 (only it will indicate the sender and recipient of the values).

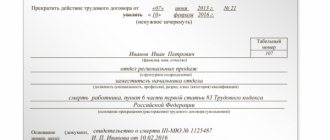

Document form

The standard form of an order to change a financially responsible employee is not currently established at the legislative level.

That is, enterprise employees can write a document based on their own ideas about it and guided by the needs of the organization. The only thing that is important to consider is that the structure, composition and style of the order comply with the norms of administrative documentation.

In addition, if the company has its own document template, developed and approved by management, then when creating all other orders, you need to focus on it.

Similar chapters from other works:

Audit of inventory items

1.1 The concept of inventory items

Accounting for inventories at enterprises is organized in accordance with accounting standard No. 7 “Accounting for inventories”, which defines the scope of the standard...

Accounting for material assets

Valuation of material assets

Inventories are accepted for accounting at actual cost. The procedure for forming the actual cost of inventories when registering them depends on the channels of receipt of material assets...

Accounting for material assets

6.1 Accounting for receipt of material assets

Accounting for the receipt of materials can be carried out at the actual cost of their acquisition (procurement) or at accounting prices.

The method of accounting for materials adopted by the organization is enshrined in its accounting policies...

Accounting for material assets

6.2 Accounting for disposal of material assets

The main task of accounting for materials when they are disposed of as a result of sale, write-off, transfer for free, etc. is to reliably determine the results from the sale (sale) and other disposal of materials...

Accounting at OJSC "Korelsky Okatysh"

2.2. Accounting for material assets.

Material assets (materials) are objects of labor that are consumed in one production cycle and transfer their value to the cost of finished products...

Documentation and organization of materials accounting

1.2 Valuation of material assets

According to the Instructions for accounting of inventories, approved by the resolution of the Ministry of Finance of the Republic of Belarus dated November 12, 2010. No. 133 materials are assessed at actual cost and at book value...

Operational accounting of material assets

1.2 Concept and classification of material assets

To carry out its main activities, in addition to premises and equipment and other fixed assets, the enterprise must have certain inventories...

Operational accounting of material assets

1.4 Methods for assessing material assets

Material assets are accepted for accounting at actual cost. The actual cost of material assets acquired for a fee is the sum of the organization’s actual costs for the acquisition...

Organization of accounting

Agreement on gratuitous transfer of property sample

A property loan is otherwise called gratuitous use and is often found in everyday life. Many people, at least once in their lives, have borrowed from friends items they needed at the moment, but there was no point in buying them.

When an item is inexpensive, there is no need to formalize the transaction on paper.

It’s a different matter if we are talking about real estate or a car - in this case, it would be reasonable to formalize the procedure for the relationship between the parties in writing and this must be done correctly.

Agreement on the gratuitous transfer of property under the Civil Code of the Russian Federation

A loan agreement is a legal agreement that stipulates the rules for the owner to provide property to another person - the recipient of property for free. It is regulated by Chapter 36 of the Civil Code of the Russian Federation and has the following mandatory features:

- There is no fee for the provided property;

- The borrower is not required to take retaliatory steps;

- The transaction is temporary or indefinite;

- The borrower has no right to transfer the rights of use to another person.

At its core, it is similar to a lease and loan agreement, so it is important to know their main differences:

- According to Chapter 34 of the Civil Code, rent. In addition, the tenant must carry out only current repairs, while the recipient assumes obligations for both current and major repairs. There may be an exception if the agreement provides for another option.

- Chapter 32 of the Civil Code states that when provided for free use, a change of owner occurs, that is, the time period is not clearly defined, and the same object of ownership is subject to return.

- The loan is regulated by Chapter 42 of the Civil Code. It states that in return the borrower can return the money or real estate.

The required information to be provided is as follows:

- Data of the lender and borrower;

- Information about the donated object;

- The purpose of the action;

- Duties and responsibilities of the parties to the transaction;

- Cost assessment and documentary confirmation of the object;

- Costs of the borrower for repairs and maintenance;

- Additional terms;

- Signatures.

This agreement can be drawn up for different purposes, between parties of different types, and accordingly the samples will vary. A lawyer will tell you exactly how to draw up an agreement in a particular case. Find a professional in your area. List of applicants:

agreement for the gratuitous transfer of property

Agreement on gratuitous transfer of property between legal entities - sample

In business, it often happens that the provision of goods without payment is carried out with the participation of legal entities. At the same time, according to Art. 575 of the Civil Code of the Russian Federation, the gift of property between legal entities is prohibited by law. The transfer of gifts in this case is possible, but these can be gifts worth no more than 3 thousand rubles.

If one of the parties is a legal entity and the other is an individual, a free transfer of property agreement can be concluded without restrictions on value. A sample loan agreement between participants, one of which is an organization, must contain the obligations of the parties for repairs.

Download the agreement for the gratuitous transfer of property between legal entities

Agreement on gratuitous transfer of property into municipal ownership - sample

The transfer of any object to municipal ownership can be carried out both from federal property, as well as by a legal entity and an individual. However, this procedure does not require the consent of the municipality. The presented process is carried out in accordance with the provisions of the law.

In the case of gratuitous transfer of an object for use to a separate municipality, it is necessary to draw up an appropriate agreement. The contents of the document must reflect all the information as in the standard form of the act.

Download the agreement on the gratuitous transfer of property into municipal ownership

Agreement on the gratuitous transfer of property to a budgetary institution - sample

Providing real estate or other type of property without charging a fee to a budget organization is becoming quite popular. In this case, the owner acts as a lender, and the budgetary institution as a borrower in accordance with Article 288 of the Civil Code of the Russian Federation.

A sample of this document contains the same clauses as the standard form of agreement for the provision of property for free. If the property is real estate, the budgetary institution must be provided with all the necessary documents for the property. The presented sample complies with all the rules, but it is necessary to note key points specific to this case.

agreement for the gratuitous transfer of property to a budgetary institution

Agreement for the gratuitous transfer of property for charity - sample

Many large organizations provide assistance to certain categories of citizens in need. This procedure must be fixed on paper; the procedure for carrying out such activities is regulated by federal legislation.

Such a document can be concluded both between legal entities and between individuals, and its feature is the tax exemption of the receiving party and the expenditure of funds for strictly limited purposes.

The list of categories of items that can be donated for charitable purposes is strictly limited. However, you should know that real estate is included in this list.

In this case, it is necessary to draw up an appropriate agreement between the parties to the transaction. The form of such an agreement is not strictly regulated and may be subject to change by the parties.

You just need to remember to check the sample document by an experienced lawyer.

agreements for the gratuitous transfer of property for charity

Agreement on the transfer of property for free temporary use - sample

Quite often, the owner fears and doubts that the receiving party will return the transferred object honestly and on time. In this case, you can protect yourself by drawing up an agreement for free temporary use.

This document can be compiled in two ways:

- Use the standard agreement form, indicating only the return period. This method will cost you less than a visit to a notary;

- Drawing up an agreement with a notary. This method is used when the cost of the item is high. The downside is the simultaneous presence of the parties at the notary and the cost of specialist assistance.

In the case of a temporary transfer of property, in addition to basic data, it is necessary to indicate the terms, rights and obligations of the parties, possible fines for damage to the item and for delay. After the transaction is completed, a transfer and acceptance certificate is signed. Both documents are drawn up in several copies and remain with the participants.

agreement on the transfer of property for free temporary use

Agreement on the transfer of property for free, perpetual use - sample

The preparation of a document on the provision of free, unlimited use is regulated by Art. 689 of the Civil Code of the Russian Federation.

In this case, the document indicates that the user receives the right to use the property indefinitely. This document is drawn up according to a sample or in any form.

The most important thing is that it be certified by signatures on both sides. If the participants in the action have a desire, it can be notarized.

In some cases, both parties may refuse the agreement. These cases are described in Art. 699 Civil Code of the Russian Federation. In this case, the party wishing to terminate the agreement must notify of its intention no later than 1 month.

agreement on the transfer of property for free, perpetual use

When concluding any transaction between the parties, especially when it comes to property, the law requires that such a procedure be formalized. To do this, the agreement must be drawn up in writing and notarized. Such a process will ensure the preservation of the interests of each party.

If you have questions, consult a lawyer. You can ask your question in the form below, in the online consultant window at the bottom right of the screen, or call the numbers (24 hours a day, 7 days a week):

- 8

— all regions of the Russian Federation.

Source: https://mirjur.ru/darenie/dogovor-peredachi-v-bezvozmezdnoe-polzovanie-imushhestva-osobennosti-oformleniya.html

Accounting for the movement of material assets

Accounting for material assets

The main documents regulating the procedure for accounting for material assets are: - Accounting Regulations “Accounting for Inventories” (PBU 5/2001)…

Organization and maintenance of accounting at the enterprise Slavyanka LLC

Accounting for material assets

In Slavyanka LLC, material and production inventories are accounted for at actual cost. According to accounting rules, the actual cost of materials purchased for a fee includes all the company’s expenses...

Organization of accounting for receipt of material assets and settlements with suppliers

1.2 Synthetic accounting of material assets

Synthetic accounting of inventories is kept, as already noted, on synthetic accounts 10 “Materials”, 11 “Animals for growing and fattening”, 14 “Reserves for reducing the cost of material assets”, 15 “Procurement and acquisition of material assets”...

Technology for conducting and registering inventory

Inventory of inventory items

Before carrying out an inventory of inventory items, it is necessary to check the condition of warehouse cards and the accuracy of the commodity report...

Accounting for materials upon disposal and release into production

2.1 Internal movement of materials within an organization

In accordance with paragraph 90 of the Methodological Instructions, the release of materials for production means their issue from a warehouse (storeroom) directly for the manufacture of products (performance of work, provision of services)…

Accounting for material assets in the warehouse and in the accounting department

2.1 Receipt of material assets to the warehouse

To accounting as inventories, according to the Accounting Regulations “Accounting for inventories”, raw materials, supplies, and other assets used in the production of products...

Agreement on transfer of property for free use: sample

In economic practice, there are common cases when organizations transfer various property to each other free of charge.

The parties draw up an agreement for the gratuitous transfer of property between legal entities (it is also called a loan agreement).

The article will discuss the procedure for preparing this document and some of the nuances of the current legislation regarding the transfer of material assets.

What does the legislation say about the gratuitous transfer of property?

The procedure is regulated by the Civil Code of the Russian Federation. In accordance with it, the gratuitous transfer of property means the transfer by one business entity to another of something without receiving reciprocal compensation.

From a legal point of view, this implies a double interpretation, since a thing can be transferred both into ownership and for temporary use. In this case, the transfer will be a loan, since organizations do not have the right to give each other anything (clause.

4 tbsp. 575 of the Civil Code of the Russian Federation).

Before drawing up an agreement on the transfer of property for free use, entrepreneurs should familiarize themselves with the following articles of the Civil Code of the Russian Federation:

- Art. 423 (here is the definition of a gratuitous agreement between the parties);

- all articles of Chapter 36 (here we talk about the features of drawing up a loan agreement).

Preparation of contract

An agreement on the gratuitous transfer of property into ownership (loan agreement) is a guarantee of legal relations between the parties. Correct execution of the document is of great importance for legal entities who, after concluding an agreement, have new tax obligations.

Under an agreement on the gratuitous transfer of property, the lender undertakes to transfer any item with all accessories (technical documentation, passport, instructions, etc.).

) to the borrower for temporary use with the condition of return in the same condition in which it was received, taking into account its normal wear and tear.

The Civil Code of the Russian Federation prohibits organizations from transferring material assets to persons who are their managers, founders, or participants. Ownership of the property does not pass to the borrower.

Regardless of the motives of the party transferring property to another organization, at some point it may decide to return it back. Such a turn of events may occur before the expiration of the contract. In this regard, the document must list the grounds for early termination of the agreement.

A sample agreement for the gratuitous transfer of property will be presented below.

What sections need to be included in the contract?

The document consists of the following sections:

- subject of the agreement;

- rights and obligations of the parties;

- transfer of rights to an object;

- transfer of object;

- liability of the parties;

- duration of the agreement;

- final provisions;

- legal addresses and details of the parties.

The grounds for early termination of the loan agreement are given in Art. 450-451, 698 Civil Code of the Russian Federation:

- agreement of the parties;

- if some essential circumstances of the agreement have been changed;

- if one of the parties refused to fulfill the terms of the agreement;

- at the request of the lender, if the borrower has arbitrarily transferred the property to a third party, does not maintain the property in proper condition, uses it for other purposes, or worsens its condition;

- at the request of the borrower, when the property he received turned out to be unsuitable for use, its significant shortcomings were discovered, he was not warned about the rights of third parties to this property, or the lender did not transfer the due property.

The contract of transfer for free use must be drawn up at a notary's office. To conduct a transaction, representatives of legal entities must prepare accompanying documents: an acceptance certificate, copies of title papers, a description and list of transferred material assets.

What property can be transferred free of charge?

- real estate,

- land,

- property complexes,

- equipment (industrial, commercial, etc.),

- vehicles,

- other property.

You can download an agreement on the transfer of property for free use, a sample of which entrepreneurs can take as a basis when drawing up a similar agreement, below.

Source: https://spmag.ru/articles/dogovor-peredachi-imushchestva-v-bezvozmezdnoe-polzovanie-obrazec

Your account has been created!

- M-8 is a limit-withdrawal card, which is used only if there are limits on the supply of inventories

- M-11 – requirement-invoice required for accounting of inventories within the company

- M-15 – invoice for the release of materials to the party, which is issued to account for the supply of materials from one’s own enterprise to other farms

- M-17 – material accounting card, which is issued to record material and production assets in the warehouse: by grade, type, size, item number

- M-35 – act of recording mat. valuables, necessary only if they are obtained as a result of dismantling and dismantling of buildings and structures.

In warehouses, instead of M-17 cards, a warehouse accounting book can be maintained.

Administration of Vasilievsky rural settlement | On the transfer of property for free use

Close

Chapter 2. Classification of information products

Article 6. Classification of information products

Information about changes:

Federal Law No. 139-FZ of July 28, 2012 amended Part 1 of Article 6 of this Federal Law

See the text of the part in the previous edition

1. Classification of information products is carried out by its producers and (or) distributors independently (including with the participation of an expert, experts and (or) expert organizations that meet the requirements of Article 17 of this Federal Law) before the start of its circulation on the territory of the Russian Federation.

2. When conducting research for the purpose of classifying information products, the following are subject to assessment:

1) its theme, genre, content and artistic design;

2) features of the perception of the information contained in it by children of a certain age category;

3) the likelihood of the information contained therein causing harm to the health and (or) development of children.

GUARANTEE:

On determining the age limit for the main television program, taking into account the content of the ticker messages, see the information of Roskomnadzor dated January 22, 2013.

Procedure for filling out an invoice for internal movement

Submit a request Name Enter name E-mail Enter e-mail City MoscowSt. PetersburgSamara Phone Enter phone Comment In this case, it is convenient to use the order scheme to move goods. It allows you to control the passage of “goods in transit,” when the processes of shipment of goods from one warehouse and arrival at another warehouse are separated in time. In order to complete this operation in the Warehouse and delivery section, the following checkboxes must be selected: Order warehouses, Goods movement, Goods movement statuses.

To use the order scheme when moving goods, it is necessary that in the card of warehouses between which the movement will take place, signs of using the order scheme for the shipment and receipt of goods must be established. The use of incoming and outgoing order statuses should also be included. In this case, the movement of goods is processed in several stages.

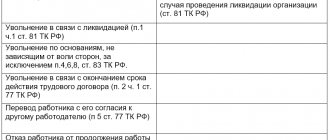

Dismissal of a financially responsible person during a protracted inventory count

The dismissal of a financially responsible person ends after 14 calendar days, and during this period some organizations are not able to conduct an inventory. According to the Labor Code of the Russian Federation, the employer does not have the right to delay payments and the issuance of documentation to a former employee. Then the organization acts according to 2 types of the following action algorithms:

- Dismiss the employee on the last working day, and if there is a shortage, go to court with a claim for compensation for material damage.

- Agree with the employee to terminate the employment relationship by agreement of the parties (Article 78 of the Labor Code of the Russian Federation). In this agreement, employers stipulate the date of dismissal at the end of the inventory, and the amount of severance pay. This method is considered an alternative for both parties.

We suggest you read: Compulsion to resign at your own request

How to move goods between warehouses

Important

Thus, you can fill in prices both for the entire product moved by this document, and only for manually selected lines. And, as the 1C: Retail program, edition 2.2 allows, a document for the movement of goods can be created directly on the basis of the invoice for its purchase, which is located in the “Supply” menu of the section of the same name. Particular attention should be paid to the fact that for the documentary movement of goods to storage locations, the 1C Retail program provides an order system.

This means that its quantity remains unchanged in the warehouses after the transfer document has been processed.

Certificate of acceptance of documents by the employee

The act of acceptance and transfer of affairs allows you to remove the responsibility of the new employee for the actions of his predecessor. The head of the organization must organize the inspection and create conditions for its conduct. The procedure takes place after the order is issued. The act is drawn up by its parties. The procedure and form of the act are not regulated by law. The document is drawn up in any form on an A4 sheet. Usually it takes the form of an accounting inventory of documents.

Data indicated in the document:

- Date and place of compilation.

- Details of the order on the basis of which cases are transferred.

- Name of company.

- Full name and position of the parties to the procedure.

- List of transferred cases.

- Detected errors in accounting and reporting.

- Information about trial witnesses.

- act of acceptance and transfer of cases upon dismissal

- act of acceptance and transfer of cases upon dismissal

The act of acceptance and transfer of cases is signed by the parties to the transfer and members of the commission. Then he is approved by the head of the company.

Programs

Sometimes a company needs to move goods or material assets from one structure to another, but even such minor movements must be kept in the documents in order not to damage the reporting. In any case, for internal movements, a document is drawn up that serves as a guarantee that the goods have been transferred and accepted by the other party. Depending on the goods being transferred, there are different forms of invoices.

Let's take a closer look at this issue. What is internal movement? Internal movement is the movement of certain goods or services that occurs within a single legal entity. It can be carried out between various financially responsible persons or structural divisions. Goods, materials, core values, etc. can be transferred.

e. To the warehouse: accounting for the receipt of goods An example of registering the receipt of goods in the Class365 system Try the warehouse program for free Unified forms of primary accounting documentation are the basis for reflecting operations for the receipt of goods. The transfer of goods from the supplier to the buyer is formalized by shipping documents: invoices, invoices, railway invoices, waybills, invoices. If goods are purchased for subsequent resale, they can be delivered to the enterprise's warehouse or accepted directly by a trading organization outside of its own warehouse. If the goods are accepted outside the buyer's warehouse, and, for example, at the supplier's warehouse, at a railway station, pier, at the airport, then receipt carried out by the financially responsible person under a power of attorney from the organization granting this right.

The process of collecting shortages of property

If, based on the results of the inventory, it is discovered that some material assets are missing, the shortage may be recovered from the person responsible for their safety. In general, this procedure is performed in the following order:

- First of all, an order is issued to conduct an inventory of a specific area. In this case, an inspection commission must be formed.

- Then the inventory procedure itself is implemented, in which the financially responsible person also takes part.

- If discrepancies are identified, written explanations are taken from the relevant employee about the reasons for the shortage. If he refuses to do this, then a corresponding act is prepared.

- An internal investigation is being conducted into the absence of the required volume of inventory items. A special commission is being created for this purpose. During this procedure, the perpetrators whose unlawful actions led to the shortage are identified.

- The final stage is the issuance of an official order from the manager to recover damages caused by the fault of the financially responsible person. This must be done within a month from the moment the full amount of damage caused is determined.

The culprit must be familiarized with the order against signature. The established amount can be withheld from the employee’s salary (if it does not exceed the average monthly salary) or paid to him separately.

Thus, the fact of transfer of inventory items in connection with the dismissal of a financially responsible person must be carried out on the basis of an order from the head of the organization. There is no single sample of such a document. Each business entity develops its standard form independently.

The acceptance certificate of inventory items (TMT) is written in a free form, in which all goods are scrupulously noted, displaying the quantity, valuation, parameters and defects. Today, existing legislation offers a unified template for the acceptance certificate of goods and materials.

It is regulated by Resolution No. 66 of the State Statistics Committee of the Russian Federation dated August 9, 1999, which approved the MX-1 form.

At the same time, each type of economic activity is documented in a primary accounting document, which is reflected in Article 9 of Law No. 402-FZ “On Accounting”. The provisions of the Law give institutions the right to draw up templates for primary accounting acts themselves.

In the life of enterprises, circumstances often arise when it is necessary to organize the transfer of products due to various reasons, for example, vacation, illness, business trip, dismissal of a financially responsible employee. This action must be documented in an acceptance certificate.

Moving goods between warehouses, which document should I fill out?

Attention

The invoice is drawn up in triplicate and signed by the financially responsible persons of the structural divisions of both the receiving and the transferring parties. Data on the movement of fixed assets is entered into the book of accounting of fixed assets (OS-6) or into the inventory card. From a warehouse: registration of inventory disposal Example of registration of sales in the Class365 system Try the program for a warehouse for free The release of materials into production is carried out on the basis of established limits, respectively, registration of the operation involves the use of a limit-fence card (M-8) in two copies, which is also used for control over compliance with established product release limits.

We transfer cases

The handover process involves not only a report on the status of work, but also verbal recommendations on how to perform job responsibilities. The order is created to convey the boundaries of responsibility and job responsibilities as accurately as possible. It is compiled by the head of the company in any form.

Information contained in the order:

- Information about the organization.

- Number and date of compilation.

- Full name and position of the receiving and transferring parties.

- The reason and timing of the acceptance and transfer.

- List of cases that will be transferred.

- Composition of the commission and information about its chairman.

- Effective date.

- Additional instructions: conduct an inventory, audit, etc.

- The person responsible for the procedure.

- order on the acceptance and transfer of cases in connection with dismissal

- order on the acceptance and transfer of cases in connection with dismissal

The order to accept cases in connection with dismissal is signed by the general director. The persons mentioned in the order must also sign.

How is movement different from translation?

Very often, the relocation of an employee is confused with a transfer. This is not accidental, since Art. is devoted to both movement and translation. 72.1 Labor Code of the Russian Federation. What are the main differences between displacement and translation?

- the employee remains to work for his employer;

- the employee’s labor function remains the same;

- working conditions do not change;

- the employee remains to work in his locality;

- the employee’s consent is not required;

- there is no need to make an entry in the work book;

- In this case, there is no need to draw up an additional agreement to the employment contract.

Accounting for free OS received

The recipient company is obliged to reflect the receipt of new fixed assets in its accounting. The basis for this is:

- Availability of all documents required by law for this case.

- Conducted market assessment of the initial cost of the fixed assets.

Registration of gratuitous fixed assets must be reflected by recording the following entries:

- Dt08/Kt98 with a record of the market value of the fixed assets.

- Dt08/Kt23, 60, 26, 76 – additional costs associated with transportation and commissioning.

- Dt01/Kt08 – acceptance of the object for accounting as fixed assets.

- Dt20, 25, 23/Kt02 – depreciation calculation for this fixed asset.

- Dt98/Kt91 – deferred income in depreciation.

Free transfer of an inventory item in 1C - the topic of the video below:

How to properly arrange a move

The relocation is formalized by an order for the relocation of the employee, a sample of which you will find in this article. There is no need to fill out any further documents. Therefore, it is much more convenient and simpler for the employer to process the transfer.

order to move an employee

But there are pitfalls here too. To ensure that the movement of an employee is not regarded as a transfer, it is necessary to thoroughly study the employment contract. If the employment contract specifies the structural unit where the employee is being hired, then if the structural unit changes, it is necessary to formalize the transfer of the employee. The employee must be notified in advance of the transfer and his consent must be obtained. So we are not talking about any efficiency in this case. If the employment contract does not indicate a structural unit and the employee’s job function does not change, this will be considered a transfer of the employee to another workplace.

For example, in connection with organizational and staffing measures, it was decided to transfer the manager of the sales department to administration. At the same time, labor functions do not change. If the sales department is specified as the place of work in the employment contract, then the employee must be transferred with his consent, and if the contract does not contain such details, the transfer can be formalized without the employee’s consent.

A similar situation arises with the place where the employee’s labor function is performed. If an enterprise has an extensive network of departments located at different addresses within the same city, it is better to indicate the name of the locality as the place of work in the employment contract. Then a change in the unit in which the employee works within the city will be considered a relocation of the employee. For example, a cashier is transferred from one store to another, located in another area of the city. If the contract specifies the specific address of the store where the cashier works, then it is necessary to formalize the transfer of the employee; if only the city is specified, the transfer can be formalized.

Accounting for free OS received

The recipient company is obliged to reflect the receipt of new fixed assets in its accounting. The basis for this is:

- Availability of all documents required by law for this case.

- Conducted market assessment of the initial cost of the fixed assets.

Registration of gratuitous fixed assets must be reflected by recording the following entries:

- Dt08/Kt98 with a record of the market value of the fixed assets.

- Dt08/Kt23, 60, 26, 76 – additional costs associated with transportation and commissioning.

- Dt01/Kt08 – acceptance of the object for accounting as fixed assets.

- Dt20, 25, 23/Kt02 – depreciation calculation for this fixed asset.

- Dt98/Kt91 – deferred income in depreciation.

Free transfer of an inventory item in 1C - the topic of the video below:

If the employee refuses to move

Movement is always operational and tactical in nature. Refusal to move is a disciplinary offense and may result in liability for the employee. However, employers often violate the law by filing a transfer as a transfer. In this case, the employee’s working conditions and work function change. It must be remembered that a transfer can only be carried out with the consent of the employee, but such consent is not required for relocation. However, it must be remembered that the Labor Code of the Russian Federation contains a direct ban on the movement of an employee if such work is contraindicated for him due to health reasons.

Features of legal relations

Not every employer has the right to conclude an employment contract in such a way that the employee bears full financial responsibility. This form of legal relations can be established in relation to:

- Deputy Director/Head;

- chief accountant of the company;

- employees holding certain positions or having a certain functionality (their complete list is contained in Resolution of the Ministry of Labor of the Russian Federation No. 85 of December 31, 2002).

The absence of listed positions means that the employee cannot bear full financial responsibility. Even if the employer concludes such an agreement with him, it will be considered invalid. If financial responsibility is assigned to the employee’s position by law, then the parties can stipulate in the contract all the features of such responsibility. When drafting it, one should be guided by Art. 243 – 244 Labor Code of the Russian Federation.

If it is impossible to conclude a full liability agreement with a specific employee, then the only way out is to enter into a limited liability agreement. Then the amount of compensation will be calculated based on average monthly earnings.

When the employer initiates dismissal, he can first conduct an inventory and then talk about severing the employment relationship. If the employee himself expressed the desire to resign, then the situation becomes more complicated. The issue of inventory is especially acute in organizations where the MOL manages a large amount of valuables.

- 14 days – if a non-term employment contract was concluded;

- 3 days – if the employee was on a probationary period or worked under a fixed-term contract.

In such a situation, the employer may wonder what the right thing to do is to dismiss the employee without conducting an inventory or detain him until the inspection is completed? Here you need to remember a number of important points:

- Dismissal without an inventory of employees with financial responsibility is not permitted. The employer, upon receiving a letter of resignation, must immediately begin the inventory procedure. If there is a replacement, all cases are transferred to him, otherwise - to the acting one. The procedure for carrying out the transfer is enshrined in Order of the Ministry of Finance No. 119N dated December 28, 2001.

- The employer has no right to detain an employee for more than the period established by law - this is a direct violation of the law.

This leads to a controversial situation: how to fire an employee if 14 days of work have passed, but the company did not have time to complete the inventory? You can act in two ways:

- Sign the dismissal order and finish the inventory afterwards. If during the process a shortage is discovered, then you will have to go to court for compensation and, moreover, prove the guilt of the former employee.

- Try to negotiate with the employee to withdraw the application and, after completing the inventory, immediately dismiss him by agreement of the parties, without waiting another 14 days. Moreover, you can conclude an agreement in advance, stipulating that the dismissal will occur immediately on the day the inventory is completed. You can motivate such a step by offering the employee severance pay or a bonus. True, an employee who knows about the existence of a shortage is unlikely to take such a step.

Inventory is initiated by drawing up the appropriate order. The document must specify the composition of the inventory commission (members, chairman). It also indicates which values should be subject to inventory. The results are recorded in a separate act.

Unfortunately, identifying shortages is not uncommon. If a shortage of money or goods and materials is discovered, the employer records it in documents, and the employee can appeal the shortage at any stage. The employer also requires an explanation from the employee as to why the shortage occurred. These reasons and circumstances are recorded in the act along with the amount of damage.

The most difficult thing in such a situation is to collect funds if we are talking about a very large amount. It is good if the employee himself agrees to compensate for the damage. If he refuses to pay, then the employer will have to resolve the issue in court.

Damage is not always associated with loss of valuables. Sometimes the value of an item may decrease due to deterioration in condition due to improper use or storage.

It is noteworthy that MOLs undergoing a probationary period sometimes refuse to bear responsibility for damage precisely because they are not full-time employees. Such a reason is not a basis for exemption from compensation. If the parties entered into an agreement and the newly hired employee received inventory items or other forms of valuables under his own responsibility, then from the moment the documents are drawn up, he is the one responsible for them.

Why is transfer of cases necessary?

Transferring cases under the act to a successor is a good way to distinguish between time periods when responsibility for the correct completion of documentation and safety of assets lies with the person being dismissed, and when with the newly hired person.

Before drawing up the act, the commission carries out an inspection and inventory. Their results are reflected in the final document, which makes it possible to accurately identify the amount of work performed by the employee.

To start the process of transferring job functions from a dismissed employee to his successor, the head of the enterprise issues an order on the transfer of affairs upon dismissal. This document confirms the fact that the leaving specialist transferred documentation and material assets; the company has no claims against him. We list the essential elements of the order:

Articles on the topic (click to view)

- What to do and where to go if you are not paid upon dismissal

- What to do if you are laid off at work

- What to do if the employer does not want to fire at his own request

- What to do if the date of the dismissal order is later than the date of dismissal

- What to do if the employer does not give the work book after dismissal

- What to do if you didn’t work officially, you were fired, you didn’t get paid

- What is the employer obliged to give the employee on the day of dismissal?

- Date of preparation;

- place of publication;

- registration number of the form;

- listing of positions and full names. responsible persons;

- the essence of the order, the motives for initiating the inspection;

- director's signature and company seal.

The procedure for transferring cases allows you to solve the following problems:

- ensuring continuity of work in all segments;

- checking for the presence of all necessary documentation;

- analysis of the quality of work activity of the dismissed employee;

- assessment of the volume of upcoming work of a newly hired specialist.

When transfer of cases is required

Documentary confirmation of the fact of acceptance and transfer of cases is necessary if the released position involves financial liability. This norm is relevant for cashiers and storekeepers. You cannot do without an official procedure for transferring cases in a situation where:

- the director of the company announced his desire to resign;

- the position of chief accountant is released (in such a situation, it is recommended not to limit oneself to the act of accepting and transferring cases, but to conduct a full audit of financial statements and accounting, and you can involve an independent auditor);

- The personnel inspector or the head of the personnel department, who is charged with ensuring the safety of personnel documentation, resigns.

How to correctly fill out an order for the transfer of affairs upon dismissal of a chief accountant according to the sample?

The dismissal of a chief accountant is not an ordinary event; an order for the transfer of affairs must be issued for the enterprise.

When is such an order issued, in what form, what should be contained in the body of the document, who is obliged to sign the paper?

You will find answers to all these questions in this article.

We will also study in detail when and what document is issued and under what conditions.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

Dismissal of a financially responsible pensioner

According to the law, the dismissal of a financially responsible pensioner does not provide for two weeks of work. Pensioners are dismissed within the time period specified in the application. If it is impossible to resign immediately due to financial responsibility, he, like other officials, warns the employer 14 working days in advance of his intention to terminate the employment relationship.

The dismissal of a financially responsible pensioner is completed with the issuance of work and medical records (if available). Upon dismissal, the company undertakes to pay arrears of wages, severance pay, and vacation payments.