Pension contributions from wages are mandatory and systematic payments that the employer transfers to the budget. The amount of future maintenance for a subordinate in old age depends on the integrity of the employer.

Insurance coverage for citizens is an obligation borne by Russian employers. Everyone: companies, government agencies, and merchants are required to pay insurance premiums for their subordinates. And entrepreneurs are also obliged to pay for themselves.

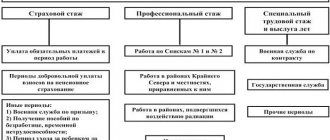

The structure of insurance premiums is provided for by Chapter 34 of the Tax Code of the Russian Federation and Law No. 125-FZ. For each employee the following must be transferred:

- OPS - pension provision - the lion's share of the total amount of payments. The future pension is formed from contributions to compulsory pension insurance;

- Compulsory medical insurance is the second most important payment. At the expense of compulsory medical insurance, citizens receive free medical care in health care institutions;

- VNiM is a fund from which sickness benefits, maternity benefits, child care benefits and other payments are paid;

- NS and PP - the amount of payment depends on the main type of activity of the employer. The funds provide benefits for work-related injuries, accidents and occupational diseases.

It is impossible to refuse insurance coverage. Deductions must be transferred to the pension fund from your salary on a monthly basis - before the 15th day of the month following the reporting month.

How does this happen?

If you are officially employed, then when paying your wages, your employer automatically withholds a small part of it and pays it to various funds. This money that was withheld from you is called income tax.

This fee is the main one, and it is displayed in all official documents, in particular in the certificate in form 2-NDFL. It is believed that the employee voluntarily makes part of the deductions from his income, and the employer in this situation is only a tax agent who helps him with the transfer. In fact, the role of the employee is very small, because the amount of money is charged without taking into account his opinion.

It is noteworthy that not all income is taxable. The exceptions are:

- unemployment benefits,

- maternity benefit,

- severance pay upon retirement, dismissal,

- all kinds of compensation - for damage to health, for unused vacation days, etc.

Please note that you have the right to return part of the tax paid if you paid for your children’s education, medical services, or purchased real estate. We talk more about this deduction in this article.

The higher your salary, the higher the deductions will be. It is this money that will become your pension in the future. You yourself should be interested in finding a job with official employment as early as possible, as well as with a “white” salary in order to ensure a comfortable old age.

Contribution to the Pension Fund - features

Pension contributions must be paid monthly. This responsibility is legally assigned exclusively to the employer. Citizens themselves do not have to calculate the exact amounts, because everything is done by the enterprise, and specifically by its accounting department. The current rules require that a certain share of the payroll fund be transferred to the Pension Fund (as the wage fund is called for short). These funds are then transferred to the personalized accounts of employees in the compulsory pension insurance system. As you can easily see, the algorithm is very simple in principle.

The funds that must be contributed by the employer are subsequently used to pay current pensioners, and the majority ends up in the account of a specific employee. The amount of contributions directly depends on a person’s salary. Simply put, the more a citizen receives for work, the higher the contributions paid to the Fund and, accordingly, the more substantial the pension will be paid upon reaching the appropriate age. Those who did not take care of official employment are subsequently assigned minimum payments.

The contributions that employers pay to the Fund are used in two ways by law - they go to pay an insurance pension or a mixed one.

The accumulative species, although there is a lot of talk about it, is still frozen. However, there is a chance that the situation will change in a certain way next 2021.

Insurance premiums

In addition to tax contributions, which appear directly on your statement and significantly affect the final amount you receive, there are also insurance contributions made by the employer. These amounts are paid by the management themselves, and they go towards pension, medical and social insurance.

How is the calculation made? Based on the salary amount indicated in your 2-NDFL certificates. What rates are used for this? They are shown in the table below:

So what percentage goes towards payments?

Today, only income tax of 22% is withheld from employees to the Pension Fund. Please note that his employer pays; in fact, the employee does not see this money, it is only in the reporting.

The contribution to the Pension Fund, amounting to 22% of the employee’s salary, consists of:

- insurance (16%) part,

- savings parts (6%).

Six percent of the individual tariff (the funded part) can be managed independently: transferred to a non-state pension fund, management company or invested.

We have collected original reviews on this topic here, reviews from real people, many comments, worth reading.

For some industries in Russia, there are reduced percentages of contributions to the Pension Fund (in particular, for IT companies). Also, some categories of workers, on the contrary, have an increased rate, which is provided by their employer. This applies to those categories of workers who are engaged in heavy work or work with hazardous working conditions.

Taxation for certain categories of citizens is also interesting:

- Individual entrepreneurs who do not make payments to other individuals (self-employed, when there is only 1 person in the company), starting from 2021, began to pay a fixed amount, which is calculated based on the result of the calendar year. Previously, calculations were carried out according to the minimum wage.

- Workers who do not have Russian citizenship, but live on the territory of the Russian Federation, must also pay taxes. If they are highly qualified workers - 13%, if the patent is a fixed amount, specialists from the Eurasian Economic Union - 13%, and refugees also pay 13%.

How to find out how much money is in a retirement account

Each employee is issued a SNILS card - it also contains a personal account number. Using it, it is easy to register on the Pension Fund website. In this case, you will be able to get all the relevant information in your personal account. The Gosuslugi portal provides a similar opportunity.

For those who do not have access to the Internet, we recommend that you go to the nearest branch of the Foundation and request the information you need there. Take your SNILS number, passport with you and write an application.

Attention! Within our portal, you can get advice from a corporate lawyer completely free of charge. Ask your question in the form below!

Indexing

The funded pension is not indexed by the state, unlike the insurance pension. In 2012, the funded part was temporarily frozen, as there were not enough funds in the Pension Fund and it was necessary to allocate money from the National Welfare Fund and the Federal Budget.

Now 6% of the wage fund is allocated to the payment of pensions, rather than to savings. Such an operation allowed saving about 500 billion rubles in the budget for 2013-2014.

Due to the difficult economic situation, the moratorium has been extended until the end of 2018. Only citizens born before 1967 will not be able to withdraw the funded portion. This decision does not apply to others.

Example of accounting entries for settlements with extra-budgetary funds

Let's look at accounting for insurance premiums in accounting using an example.

Books LLC sells printed materials. Salary for February amounted to 120,000 rubles. The employee provided sick leave in the amount of 5,600 rubles. (of which 2,300 are at the expense of the employer, 3,300 are at the expense of the Social Insurance Fund). We will reflect all transactions with accounting entries:

Dt 44 Kt 70 - 120,000 rub. - wages accrued.

Dt 70 Kt 68.01 “NDFL” - 15,600 rubles. — personal income tax is withheld from wages.

Dt 44 Kt 69.01 - 3,480 rub. (120,000 × 2.9%) - an insurance contribution to the Social Insurance Fund has been charged.

Dt 44 Kt 69.02 - 26,400 rub. (120,000 × 22%) - an insurance premium has been charged to the Pension Fund.

Dt 44 Kt 69.03 - 6,120 rub. (120,000 × 5.1%) - reflects the insurance contribution to the FFOMS.

Dt 44 Kt 69.11 — 240 rub. (120,000 × 0.2%) - a contribution for “injuries” has been added.

Dt 44 Kt 70 - 2,300 rub. — accrual for sick leave is reflected.

Dt 69 Kt 70 — 3,300 rub. — the calculation for sick leave was accrued in the part reimbursed by the Social Insurance Fund.

Dt 69.01 Kt 51 — 180 rub. (3480 – 3300) — contributions to the Social Insurance Fund have been paid.

Dt 69.02 Kt 51 - 26,400 rub. — contributions to the Pension Fund have been paid.

Dt 69.03 Kt 51 - 6,120 rub. — contributions to the FFOMS have been paid.

Dt 69.11 Kt 51 — 240 rub. — the “injury” contribution has been paid.

What to choose: NPF or Pension Fund?

Today, many people prefer to keep their money not in the state pension fund (PFR), but in a non-state one. The reasons are quite clear and understandable - they offer a larger amount of profitability.

What are the additional benefits? You are free to choose the company that will manage your funds. You will find out in advance in which sectors savings are invested, what percentage of income the organization has shown in recent years, you will be able to track the status of your account via the Internet, etc.

In addition, savings are inherited. And don’t worry about the safety of your money - your payments from employers will be guaranteed by the state, i.e. even if the NPF loses its license for some reason, your funds will be transferred to the Pension Fund.

In order to choose a non-state pension fund , we recommend that you familiarize yourself with the following data:

- Fund reliability rating;

- General rating of non-state pension funds.

How to calculate pension using the new formula?

To do this, we advise you to watch a special video tutorial:

An individual pension is formed precisely from 16 percent of contributions to the pension fund. Read what will happen to your pension in 2021 in this article.

Question-answer section:

2019-12-25 23:37

Irina Alexandrovna

Hello, please tell me, can I withdraw my funded part of my pension from the Non-State Pension Fund if I am already a pensioner? And the second question. Is there any interest in the PF from my pension?

View answer

Hide answer

Answered by Elena Sharomova, expert on credit and financial products

Irina, if you transferred your funds to a non-state pension fund, then the Russian Pension Fund no longer has anything to do with you, and no interest goes there. As for withdrawing part of your pension, you need to call your fund’s hotline, everyone has their own conditions in this regard

2019-10-15 22:19

Alfia

Hello! My husband is a citizen of Kazakhstan, worked for some time in Russia, can he withdraw his pension savings???

View answer

Hide answer

Answered by Elena Sharomova, expert on credit and financial products

Alfiya, you can withdraw pension savings only upon retirement, and only if this is provided for in his agreement with the NPF

2019-09-09 01:02

Denis

Hello. I'm interested in this question. Can I withdraw savings from my pension fund? If I am a disabled person of the 3rd group

View answer

Hide answer

Answered by Elena Sharomova, expert on credit and financial products

Denis, call your pension fund, in which you are a member, find out if they have such an opportunity. All funds have different rules

2016-10-01 14:37

Tansulpan

I retired, but I continue to work, will they continue to deduct a contribution to the Pension Fund from my salary?

View answer

Hide answer

Answered by Elena Sharomova, expert on credit and financial products

Tansulpan, if you are officially employed, then of course, contributions to various funds will continue to be deducted from your salary

2019-04-08 07:45

Andrey Anatolyevich

Now my pension contributions are transferred to a non-state pension fund, I want to switch to a state one. The NPF assures me that when I switch, I will lose part of my savings. Can you explain this?

View answer

Hide answer

Answered by Elena Sharomova, expert on credit and financial products

Unfortunately yes. If you change your pension fund more than once in 5 years, then part of your accumulated funds is lost. So it's better to wait until this period passes

View all questions and answers ⇒

10/27/2018 Information about the authors | Category: Pension funds

Accounting for settlements with extra-budgetary funds

For accounting of settlements with extra-budgetary funds, account 69 “Settlements for social insurance and security” is provided. Sub-accounts are opened for each type of payment.

Let's look at typical transactions for calculating contributions to funds:

| Account Dt | Account name | CT | Contents of operation |

| 20,25,26 | "Primary production" | 69.01 “Settlements with the Social Insurance Fund for contributions in case of temporary disability and maternity” 69.02 “OPS” 69.03 “Settlements with the Federal Compulsory Medical Insurance Fund” 69.11 “Calculations for compulsory social insurance against accidents at work and occupational diseases” | Calculation of contributions depending on the type at a manufacturing enterprise |

| 44 | "Sale expenses" | Calculation of contributions in a trade organization | |

| 08 | "Fixed assets" | Calculation of contributions during construction, when the salaries of workers form the initial cost of the object | |

| 69 | 51 “Current account” | Payment of contributions (by subaccounts) | |

| 69 "Penny" | 51 “Current account” | Payment of fines | |

| 69 | 70 “Wages of employees” | Benefit reimbursed from the Social Insurance Fund |

As a rule, on a monthly basis we pay all contributions calculated according to the above formula. But if you have accrued sick leave or an employee went on maternity leave, the situation will change.

Accounting for settlements for social insurance and security is reflected by posting Dt 69 “Contributions” Kt 70 “Calculations for wages”. With this posting you will accrue sick leave (for those days paid by the Social Insurance Fund) - accordingly, the payment at the end of the month will not be the insurance premium calculated from the salary, but the account balance 69 at the end of the month. Here you have two options:

- You pay the fully calculated contributions, submit documents to the Social Insurance Fund and, after the money arrives in the current account, you formalize this by posting Dt 51 Kt 69.

- Or you immediately, within one calendar year, reduce the amount of accrued insurance premiums by the amount of calculated sick leave.

Find out how to offset and refund insurance premiums in ConsultantPlus. Get trial access to the system and get expert explanations for free.

Read how benefits are paid in the regions where the FSS pilot project is being conducted.