Home — Consultations

To date, there is no consensus on the taxation of payments made to an individual to reimburse expenses incurred by him. Tax authorities consider compensation as income. If you adhere to this position, it is important to understand whether or not the compensation received relates to income not subject to personal income tax in accordance with Art. 217 Tax Code. And some experts and even the Supreme Arbitration Court of the Russian Federation believe that in such situations there is no income in principle. After all, an individual, it would seem, does not receive economic benefits. And if so, then the subject of personal income tax should not arise. Before dealing with this problem using specific examples, let us recall the fundamental norms.

When does income arise?

According to Art. 209 of the Tax Code, the object of personal income tax taxation is income received by the taxpayer. When determining the tax base, the taxpayer’s income received both in cash and in kind, or the right to dispose of which he has acquired, is taken into account (clause 1 of Article 210 of the Tax Code of the Russian Federation). And the date of actual receipt of income is defined as the day of payment of income or transfer of income in kind (clauses 1 and 2 of clause 1 of Article 223 of the Tax Code of the Russian Federation).

Who is paid for maternity leave?

Insured persons have the right to receive PBR. Citizens of the Russian Federation, as well as other persons working under employment contracts in the territory of the Russian Federation, are subject to compulsory social insurance. Foreigners, as well as stateless persons temporarily staying in the Russian Federation, can receive PBR if their employer paid insurance premiums for them at least 6 months before the start of maternity leave.

Persons engaged in private work and who have voluntarily registered their relationship with the Social Insurance Fund can acquire the right to receive PBR only if they have paid insurance premiums in full.

Under what conditions can a part-time worker count on PBR, read here.

What is income?

The general principle of determining income for tax purposes is enshrined in Art. 41 Tax Code. In accordance with this standard, income is recognized as an economic benefit in monetary or in-kind form, taken into account if it is possible to assess it and to the extent that such benefit can be assessed. At the same time, the legislator clarifies that economic benefit is determined in accordance with Chapter. 23 “Income tax for individuals” of the Tax Code. But it is not always easy to understand from it what the taxpayer’s income is.

Formally, the circle of definitions has closed, and it remains to be recognized that in relation to the calculation of personal income tax, the Tax Code does not contain a clear definition of income.

Meanwhile, the criterion of economic benefit is used in the interests of the taxpayer even in official explanations. For example, in Letter dated 05/06/2006 N 03-05-01-04/117, specialists from the Russian Ministry of Finance reported that the amounts reimbursed by the company for an employee’s travel cannot be recognized as the economic benefit (income) of the employee if his work is of a traveling nature.

True, the court classified these payments quite specifically - as compensation related to the performance of labor duties. They are directly subject to the benefits provided for in paragraph 3 of Art. 217 of the Tax Code (Resolution of the Federal Antimonopoly Service of the Moscow District dated May 27, 2008 N KA-A40/4343-08 in case N A40-49620/07-118-330).

Position of the Ministry of Finance

In letter dated October 29, 2020 No. 03-04-06/94269, the Russian Ministry of Finance interpreted the above norms in relation to the issue of taxation of personal income tax and insurance contributions on compensation for the use of remote workers belonging to them :

- equipment;

- software and hardware;

- other means to perform the work.

The Ministry of Finance has come to the conclusion that the amount of compensation for such expenses of remote employees for the use of equipment and software and hardware belonging to them does not need to be subject to insurance premiums and personal income tax. In this case, the size must be determined by the employment contract on remote work between the organization and employees.

At the same time, the amount of reimbursement for these expenses must correspond to the economically justified costs associated with actual use of personal equipment (tools) for the purposes of work.

That is, the employer must have copies of documents confirming the expenses incurred by the employee when using personal equipment (facilities) for business purposes.

Let us note that the Ministry of Finance gave similar explanations earlier. For example, letter dated 02/04/2020 No. 03-03-06/1/6672:

“At the same time, the organization must have copies of documents confirming the employee’s ownership of the property used, as well as calculations of compensation and documents confirming the actual use of the property in the interests of the employer, expenses incurred for these purposes and the amount of expenses incurred in this regard.”

However, at that time he did not specify the nature of the employee’s work. This means that the fact of working remotely does not matter in this matter.

Read also

22.06.2020

Is any payment income?

Is any amount received by an individual considered taxable income? Perhaps we have to agree with this. As a general rule, even compensation received to reimburse previous expenses is recognized as income.

The legislator specifically identified cases in which this is not the case as exceptions to the general rule.

Let's list when the actual expenses of the taxpayer, which determine the receipt of income and preceded (accompanying) it, reduce the tax base:

1) when selling property, a share in the authorized capital or when assigning rights of claim under an agreement for participation in shared construction (paragraph 2, paragraph 1, paragraph 1, Article 220 of the Tax Code of the Russian Federation);

2) on transactions with securities and with financial instruments of futures transactions (clause 14 of article 214.1 of the Tax Code of the Russian Federation);

3) if the taxpayer has the right to professional tax deductions (Article 221 of the Tax Code of the Russian Federation);

4) when the income represents a compensation payment provided for by the current legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation, decisions of representative bodies of local self-government, but within the limits established in accordance with the legislation of the Russian Federation (clause 3 of Article 217 of the Tax Code of the Russian Federation).

Note. In this case we are talking about a benefit. Compensation is recognized as income, but it is exempt from taxation.

Consequently, we have to conclude that compensation generates economic benefits on a general basis. And only in situations specifically stipulated by the legislator are these incomes not subject to personal income tax. In other cases, reimbursable expenses of an individual do not reduce the tax base for personal income tax.

Personal income tax on travel payments

The taxation of such payments depends on whether they are supported by documents and whether the established limits are not violated. The tax is calculated at the end of the month in which the advance report was approved and is withheld when paying wages. The tax must be transferred no later than the working day following the payment of wages.

Daily allowance. For daily allowances, Article 217 of the Tax Code of the Russian Federation sets limits: 700 rubles for business trips within Russia and 2,500 rubles for business trips abroad. In excess of these limits, personal income tax must be paid.

Travel compensation. Travel expenses must be supported by a ticket, receipt, receipt or boarding pass. Only in this case they are not taxed.

Reimbursement for accommodation. Similar to transportation costs, living expenses must be confirmed by a document: a check, BSO, a rental agreement and a payment document. If there are no supporting documents or they are completed incorrectly, living expenses are exempt from personal income tax only within the norms: 700 rubles per day in Russia and 2,500 rubles per day abroad.

Business trip abroad. When an employee goes abroad, the employer compensates for the visa, international passport, mandatory fees, insurance and other payments. Tax may not be withheld from these compensations if they are confirmed by a document and actually completed.

Fill out the 6-NDFL report and generate 2-NDFL certificates in the convenient cloud service Kontur.Accounting. The report is completed automatically based on accounting records and can then be quickly sent via the Internet. Keep records of salaries and other payments, calculate taxes and submit reports online. All new users can use the program for free for a month.

Reimbursement of expenses to the contractor under a civil contract

Norms of the Civil Code . In paragraph 2 of Art. 709 of the Civil Code directly states that the price of work in a work contract includes:

- compensation of contractor costs;

- the remuneration due to him.

Note. Compensation (from the Latin compencatio - to balance) implies repayment of actual costs incurred.

This approach also applies to the provision of services (Article 783 of the Civil Code of the Russian Federation). From the above formulation one could conclude that income is the difference between the contract price and the amount of costs of the contractor (performer).

Norms of the Tax Code . Tax legislation did not follow the path proposed by the Civil Code.

For the term “compensation” in the sense in which it is used in civil legal relations, there are no “norms established in accordance with the legislation of the Russian Federation,” that is, size restrictions. Therefore, the contractor’s expenses in tax legislation are subject to the benefits of clause 3 of Art. 217 of the Tax Code are not subject to. A special rule has been introduced to regulate the taxation of income of individuals - contractors.

The Tax Code deals with professional deductions, to which, in particular, taxpayers who receive income under civil contracts for the performance of work (rendering services) are entitled to receive them (clause 2, part 1, article 221 of the Tax Code of the Russian Federation). These deductions are practically compensation.

Professional deductions are provided by the tax agent in the amount of expenses actually incurred by the taxpayer and documented expenses directly related to the performance of work or provision of services (clause 2, part 1, article 221 of the Tax Code of the Russian Federation).

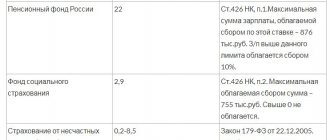

Are you taxing personal income tax payments and contributions correctly? Check our table

Accountants often face the question of whether it is necessary to withhold personal income tax from a particular payment and charge insurance premiums from it? After all, labor relations are not limited only to the payment of wages. There are also all kinds of benefits, compensation, allowances, additional payments, financial assistance and other types of income . To avoid mistakes, we suggest using our cheat sheet.

Cheat sheet for calculating insurance premiums and personal income tax from payments to individuals

| № | Personal income tax | Insurance premiums | |

| Section I. Payments related to wages | |||

| 1 | Salary (payment by the day or by the hour) - part of the wages of employees hired under an employment contract | ||

| ⇓ Payment is subject to personal income tax | ⇓ Insurance premiums are charged for payment | ||

| 2 | Prize . It can be “labor” - be part of the salary, be associated with the achievement of certain labor indicators. It can be “non-labor”, that is, not related to labor relations, but paid, for example, on anniversaries and holidays. | ||

| ⇓ “Labor” and “non-labor” bonuses are subject to personal income tax | ⇓ Contributions are calculated for “labor” and “non-labor” bonuses. But there is judicial practice, according to which “unearned” bonuses are exempt from contributions (which contradicts the position of the Ministry of Finance) | ||

| 3 | Agreement for the provision of services or performance of work (civil agreement, civil contract, civil law agreement). Payments under such an agreement are the citizen’s income from work | ||

| ⇓ Payment is subject to personal income tax | ⇓ Insurance premiums for compulsory medical insurance, compulsory medical insurance and injuries are calculated on the payment amount. Contributions to compulsory social insurance in case of temporary disability or maternity are not charged | ||

| 4 | Payment for work on holidays and weekends. For work on such days, the employee is entitled to an additional day off or additional payment. | ||

| ⇓ Additional payment is subject to personal income tax | ⇓ Insurance premiums are calculated for the amount of the surcharge | ||

| 5 | Additional payment for combination . Relies on an employee who performs additional functions in addition to those prescribed in the job description | ||

| ⇓ Additional payment is subject to personal income tax | ⇓ Insurance premiums are calculated for the amount of the surcharge | ||

| 6 | Additional payment for processing . If an employee works additional hours by order of the manager, he is entitled to an increased payment | ||

| ⇓ Payment is subject to personal income tax | ⇓ Insurance premiums are calculated on the payment amount | ||

| 7 | Payment for night work . If an employee is involved in night work, he receives increased pay | ||

| ⇓ Payment is subject to personal income tax | ⇓ Insurance premiums are calculated on the payment amount | ||

| 8 | Additional payment for hazardous working conditions . If an employee is employed in hazardous or hazardous work, he is entitled to additional payment | ||

| ⇓ Additional payment is subject to personal income tax | ⇓ Insurance premiums are calculated for the amount of the surcharge | ||

| 9 | Vacation pay . Paid for the period of paid leave | ||

| ⇓ Payment is subject to personal income tax | ⇓ Insurance premiums are calculated on the payment amount | ||

| 10 | Additional payment up to average earnings when paying vacation pay, sick leave, and business trips | ||

| ⇓ Additional payment is subject to personal income tax | ⇓ Insurance premiums are calculated for the amount of the surcharge | ||

| 11 | Income in kind (non-cash salary, payment for employees) | ||

| ⇓ Subject to personal income tax | ⇓ Insurance premiums are calculated on the payment amount | ||

| 12 | Personal income tax compensation from salary (Gross up payment). Reimbursement to the employee of the amount withheld in the form of personal income tax | ||

| ⇓ The payment is subject to personal income tax (the gross up amount is calculated taking this into account) | ⇓ Insurance premiums are calculated on the payment amount | ||

| Section II. Payments related to business trips | |||

| 13 | Payment of average earnings during a business trip | ||

| ⇓ Payment is subject to personal income tax | ⇓ Insurance premiums are calculated on the payment amount | ||

| 14 | Reimbursement for business trip expenses. Travel costs to and from the business trip, as well as accommodation. Documented | ||

| ⇓ Confirmed expenses are not subject to personal income tax. In the absence of documents confirming accommodation, amounts up to 700 rubles/day are not taxed when traveling within the Russian Federation, 2500 rubles/day when traveling abroad | ⇓ Insurance premiums are not charged on the amount of confirmed expenses. In the absence of documents confirming accommodation, contributions are not calculated from the amount of 700 rubles / day when traveling within the Russian Federation, 2500 rubles / day - abroad | ||

| 15 | Daily allowance . Paid for each day the employee is on a business trip. Daily allowance limits established by law: 700 rubles/day when traveling within the Russian Federation, 2500 rubles/day when traveling abroad | ||

| ⇓ Personal income tax is not paid on daily allowances within the limits; above them, it is paid in accordance with the general procedure | ⇓ Contributions are not accrued on daily allowances within the limits; above them, they are accrued in the general manner, except for contributions “for injuries”. These contributions are not calculated on daily allowances if they are paid within the limits established by the local regulations of the organization | ||

| Section III. Benefits | |||

| 16 | Sick leave . Benefit paid in connection with temporary disability | ||

| ⇓ Payment is subject to personal income tax | ⇓ Insurance premiums are not charged on the payment amount. If an additional payment is provided up to average earnings, see clause 10 | ||

| 17 | Sick leave due to a child's illness. Benefit paid to a parent in connection with caring for a child during illness | ||

| ⇓ Payment is subject to personal income tax | ⇓ Insurance premiums are not charged on the payment amount | ||

| 18 | One-time benefit in connection with the birth of a child. State benefits are paid in the amount of no more than 16,759.09 rubles (from February 1, 2021) | ||

| ⇓ The payment is not subject to personal income tax | ⇓ Insurance premiums are not charged on the payment amount | ||

| 19 | Benefit for women registered early in pregnancy. State benefits are paid in the amount of no more than 628.47 rubles (from February 1, 2021) | ||

| ⇓ The payment is not subject to personal income tax | ⇓ Insurance premiums are not charged on the payment amount | ||

| 20 | Maternity benefit. State benefit | ||

| ⇓ The payment is not subject to personal income tax | ⇓ Insurance premiums are not charged on the payment amount | ||

| 21 | Child care allowance up to 1.5 years/3 years. State benefit | ||

| ⇓ The payment is not subject to personal income tax | ⇓ Insurance premiums are not charged on the payment amount if benefits up to 3 years are paid within 50 rubles/month | ||

| Section IV. Material aid | |||

| 22 | Material aid, which is paid:

| ||

| ⇓ The payment is not subject to personal income tax | ⇓ Insurance premiums are not charged on the payment amount | ||

| 23 | Other financial assistance | ||

| ⇓ Payment is subject to personal income tax | ⇓ Insurance premiums are not charged for an amount not exceeding 4,000 rubles per year. For amounts over 4,000 rubles per year, contributions are calculated | ||

| Section V. Compensation | |||

| 24 | Compensation for sports activities for employees | ||

| ⇓ Payment is subject to personal income tax | ⇓ Insurance premiums are calculated on the payment amount | ||

| 25 | Mobile compensation . If the connection is used for work purposes, then these expenses can be reimbursed based on supporting documents | ||

| ⇓ If expenses are confirmed, compensation is not subject to personal income tax. | ⇓ If expenses are confirmed, no insurance premiums are charged on the amount of compensation. | ||

| 26 | Compensation for the use of a personal car. Expenses are compensated if such a condition is present in the contract, as well as confirmation of ownership of the car and its use for business purposes | ||

| ⇓ If the conditions are met, compensation is not subject to personal income tax. | ⇓ If the conditions are met, no insurance premiums will be charged on the compensation amount. | ||

| 27 | Meal compensation provided for in an employment/collective agreement (additional agreement) or local act | ||

| ⇓ Payment is subject to personal income tax | ⇓ Insurance premiums are calculated on the payment amount | ||

| 28 | Compensation for delayed payments | ||

| ⇓ The payment is not subject to personal income tax | ⇓ Insurance premiums are calculated on the payment amount | ||

| 29 | Reimbursement for moving expenses. Payment that is made in accordance with the terms of the employment/collective agreement, local act. Includes travel, baggage, accommodation costs | ||

| ⇓ The payment is not subject to personal income tax if paid within the limits established in the documents | ⇓ Insurance premiums are not charged on the payment amount if it is paid within the limits established in the documents | ||

| 30 | Reimbursement for rental housing expenses (not considered moving expenses) | ||

| ⇓ Payment is subject to personal income tax | ⇓ Insurance premiums are calculated on the payment amount | ||

| 31 | Compensation for unused vacation upon dismissal | ||

| ⇓ Payment is subject to personal income tax | ⇓ Insurance premiums are calculated on the payment amount | ||

| 32 | Compensation upon dismissal - severance pay (by agreement of the parties). Non-taxable limit - three times the average monthly salary, for workers of the Far North - six times the average monthly salary | ||

| ⇓ The payment is not subject to personal income tax if paid within the non-taxable limit (above the limit, tax is calculated in accordance with the general procedure) | ⇓ Insurance premiums are not charged on the payment amount if it is paid within the non-taxable limit (above the limit, contributions are charged in the general manner) | ||

Compensation for legal costs

Disputes involving citizens that are not related to their business activities are subject to the jurisdiction of courts of general jurisdiction (clause 1, clause 1, article 22 of the Code of Civil Procedure of the Russian Federation). In this case, the party in whose favor the court decision was made, the court awards compensation to the other party for all legal expenses incurred by the “winner” in the case (clause 1 of Article 98 of the Code of Civil Procedure of the Russian Federation).

Note. In the event of a labor dispute, the employee is exempt from paying legal costs, including state fees (Article 393 of the Labor Code of the Russian Federation).

Note. What do legal costs consist of? Legal costs consist of state fees and costs associated with the consideration of the case (clause 1 of Article 88 of the Code of Civil Procedure of the Russian Federation). The costs associated with the consideration of the case include (Article 94 of the Code of Civil Procedure of the Russian Federation), in particular: - travel and accommodation expenses of the party incurred in connection with the appearance in court; — payment for representatives’ services; — postal costs associated with the consideration of the case.

What is severance pay?

Severance pay is a certain compensation (usually in cash) that an employee can count on upon dismissal. The amount of severance pay is regulated by the Labor Code, but can be changed depending on the terms of the collective agreement. According to the law, the employer has the authority to determine the amount of this payment at its discretion.

Severance pay is a financial cushion for a person during a job change

The amount of severance pay is also influenced by the reasons why the employee was laid off. For example, some employees are entitled to receive payments for two weeks, while others are entitled to receive payments for two or even three months.

A resigning employee may qualify for two-week severance pay under the following circumstances:

- The employee resigns due to health reasons. If medical conditions no longer allow a person to perform his previous duties, then upon dismissal he must provide relevant certificates;

- dismissal due to the employee’s loss of ability to work due to a serious illness or injuries. As in the previous case, a doctor’s opinion will be required to confirm this fact;

- dismissal is caused by conscription for urgent military or alternative civilian service;

Conscription requires termination of employment contract

- the organization in which the employee is registered changes its location, and the employee himself refuses to move;

- a previous employee who was wrongfully fired sued the employer and won, resulting in his return to his previous position. To replace a new employee with a previous one, he must provide an extract from the court decision;

- the employer has made changes to the working conditions, which the employee refuses to agree to;

- dismissal of an employee involved in seasonal work due to staff reduction or liquidation of the enterprise itself.

Severance pay is paid in case of staff reduction

Employees receive benefits for two months in the following cases:

- staff reduction in the organization;

- liquidation of the enterprise (in this case, the question of whether the employer is a legal entity or an entrepreneur does not matter);

- dismissal of an employee due to gross violations contained in the employment contract. Payments are made with one condition - all violations that occurred were not the fault of the employee.

Personal income tax on compensation of legal costs

Suppose your company lost a dispute with an individual and you have to reimburse the expenses incurred by him. Are they subject to personal income tax?

Position of the Russian Ministry of Finance . Representatives of the financial department insist that reimbursement of legal costs is taxable income for an individual.

However, representatives of the Ministry of Finance of Russia do not justify their position (Letters dated 08/07/2012 N 03-04-06/6-221, dated 07/03/2012 N 03-04-05/3-827 and dated 07/02/2012 N 03-04-06 /9-189). They only state that as a result the individual receives an economic benefit. Although it is obvious that there is no material gain for the individual here.

In a number of other Letters (dated December 20, 2011 N 03-04-06/3-351 and dated December 7, 2011 N 03-04-05/3-1008), specialists from the Russian Ministry of Finance erroneously claim that clause 3 of Art. 217 of the Tax Code defines an exhaustive list of compensation payments established by the current legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation, decisions of representative bodies of local government that are not subject to personal income tax. We noted above that this is not the case.

Note. Compensation for loss of time In civil proceedings (including labor disputes), the court may even seek compensation for the actual loss of time in favor of the other party. It is used when the other party behaves in bad faith. And its size is determined by the court within reasonable limits and taking into account specific circumstances (Article 99 of the Code of Civil Procedure of the Russian Federation). But due to the absence of any legal restrictions on the amount, this compensation also forms taxable income for an individual. As a result, we must agree that any compensation is income.

Author's position . According to the author, the search for the true basis for recognizing these amounts as income should be carried out in a different plane.

The Civil Procedure Code of the Russian Federation does not limit or establish compensation (cases of payment, amounts), that is, it does not standardize them. They are awarded by the court. This is the wording of the law. Therefore, these compensations are subject to clause 3 of Art. 217 of the Tax Code does not apply.

A hint of normality . However, the taxation of legal expenses can be approached differently.

The fact is that the amount of state duty is established by federal laws on taxes and fees. This procedure is established by clause 2 of Art. 88 of the Civil Procedure Code of the Russian Federation and Art. 333.19 of the Internal Revenue Code.

Consequently, in this part of the reimbursable expenses there is still a standardized amount. Therefore, you can try to challenge the taxation of compensation for payment of duties. Although this position is vulnerable. After all, the amount of the fee is not fixed, but depends on the price of the claim.

If an organization argues with an entrepreneur . In disputes between a company and an individual entrepreneur, legal proceedings are conducted on the basis of the Arbitration Procedure Code. But similar rules on compensation are provided for in it (Articles 101, 102, 106 and 110 of the Arbitration Procedure Code of the Russian Federation).

At the same time, compensation for legal expenses awarded to an individual entrepreneur is subject to personal income tax in the generally established manner, regardless of the tax regime applied by him. After all, deriving income in the form of compensation cannot be qualified as conducting economic activity.

Personal income tax on employee bonus

Any bonuses to employees are subject to personal income tax without exception, as are salaries. Tax legislation classifies them as incentive payments. The deadline for paying tax is similar to the deadline for paying it from salary.

Fill out the 6-NDFL report and generate 2-NDFL certificates in the convenient cloud service Kontur.Accounting. The report is completed automatically based on accounting records and can then be quickly sent via the Internet. Keep records of salaries and other payments, calculate taxes and submit reports online. All new users can use the program for free for a month.

Who will withhold personal income tax from compensation of legal expenses?

A company paying taxable compensation to an individual is a tax agent and performs the corresponding duties on a general basis (clause 1 of Article 226 of the Tax Code of the Russian Federation).

But when compensation to an individual is transferred on the basis of a writ of execution according to the details of the bailiff service, the situation is somewhat different (clause 5 of the Resolution of the Federal Antimonopoly Service of the West Siberian District dated January 24, 2011 in case No. A27-4701/2010).

If compensation was paid through bailiffs without withholding personal income tax, the company must inform the tax office at the place of its registration about the impossibility of withholding tax and the amount of tax (clause 5 of Article 226 of the Tax Code of the Russian Federation).

To avoid conflicts of interest, we recommend following the clarifications of the Russian Ministry of Finance contained in Letter No. 03-04-06/3-351 dated December 20, 2011. It states that the company has the right to draw the court’s attention to the need to determine the debt subject to collection, taking into account the requirements of the legislation on taxes and fees.

Then the court, in the operative part of the decision, will indicate the amount of income to be recovered directly in favor of the individual, and separately - the amount that must be withheld as tax and transferred to the budget.

A similar position is reflected in the Letter of the Federal Tax Service of Russia dated October 28, 2011 N ED-4-3/17996.

If a citizen nevertheless received compensation on which personal income tax was not withheld, he is obliged to declare this income and pay the tax himself (clause 4, clause 1, article 228 of the Tax Code of the Russian Federation).

Payments for which personal income tax withholding depends on the content of the court decision

As a general rule, amounts awarded by a court decision in a labor dispute are subject to personal income tax in accordance with the provisions of clause 3 of Art. 217 of the Tax Code of the Russian Federation, because In this case, the former employer is recognized as a tax agent, and he is assigned responsibilities for calculating, withholding and paying the amount of personal income tax in cases where tax withholding is possible.

On the one hand, according to Article 226 of the Tax Code of the Russian Federation, the organization that is the source of payment of income to an individual is obliged to withhold personal income tax. On the other hand, if the payment is made on the basis of a court decision, and court decisions are binding on all organizations, therefore the organization must pay the individual exactly the amount specified in the court decision (clause 2 of Article 13 of the Code of Civil Procedure of the Russian Federation; clauses 1, 2 of Article 16, Articles 119, 332 of the Arbitration Procedure Code of the Russian Federation, part 1 of Article 105 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”).

In the court decision itself regarding the amounts awarded, there are two possible wording options:

- with the allocation of the personal income tax amount (for example, “... to collect 100 rubles, including personal income tax in the amount of 13 rubles.”);

- without allocating the amount of personal income tax (for example, “... collect 100 rubles.”).

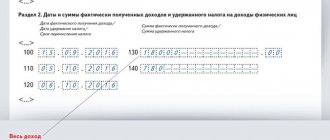

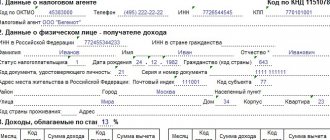

According to the official position of the Ministry of Finance of Russia (Letter of the Ministry of Finance of Russia dated September 3, 2015 N 03-04-06/50689), the Supreme Arbitration Court of the Russian Federation (Determination of the Supreme Arbitration Court of the Russian Federation dated July 27, 2012 No. VAS-6709/12 in case No. A47-4210/2011) and tax authorities, if the court did not allocate the amount of personal income tax when making a decision, the tax agent cannot withhold the tax. In this case, the organization must inform the Federal Tax Service about the impossibility of withholding tax no later than January 31 of the year (clause 5, article 6.1 of the Tax Code of the Russian Federation) in the 2-NDFL message form (clause 5.7 of the 2-NDFL form), if such an organization does not have the opportunity to withhold Personal income tax from other income of the taxpayer - individual.

Note : Previously, the position of the Russian Ministry of Finance was that the organization that is the source of the payment is obliged to withhold personal income tax if the payment is made by court decision.

Is it possible to recover the personal income tax paid for a representative from the losing party as part of legal costs?

The Ruling of the Supreme Court of the Russian Federation dated 08/09/2018 No. 310 KG16-13086 answers the question of whether the personal income tax paid for a representative - an individual can be recovered from the losing party among legal costs?

The court examined a situation in which an organization entered into an agreement for representation in court with an individual and paid personal income tax on the individual’s remuneration under the concluded agreement.

In making a positive decision on this issue, the Supreme Court of the Russian Federation justified its position with the following arguments:

- the person claiming the recovery of legal costs must prove the fact of their incurrence, as well as the connection between the costs incurred by the specified person and the case being considered in court with his participation. Failure to prove these circumstances is grounds for refusal to reimburse legal costs (paragraphs 10 – 13 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated January 21, 2016 No. 1 “On some issues of application of the legislation on reimbursement of costs associated with the consideration of the case”);

- The customer organization under an agreement for the provision of paid services concluded with an individual, being a tax agent, is obliged to calculate, withhold and pay to the budget the amount of personal income tax in relation to the remuneration (income) paid to the attracted representative under this agreement. Thus, payment of remuneration (income) to the representative is impossible without making mandatory contributions to the budget. At the same time, the mandatory contributions to the budget made by the applicant as a tax agent of the performer do not change the legal nature of the personal income tax amount as part of the cost of the performer’s services;

- The contract for the provision of legal services stipulates that the client (organization) acts as a tax agent in relation to the performer and transfers the amount of personal income tax to the tax authority at the place of registration of the latter. This condition of the contract allows us to conclude that the organization, along with paying remuneration directly to the contractor for the services provided by him, is obliged to withhold and transfer personal income tax for the contractor to the budget from the amount of remuneration. This is the rationale for classifying the disputed amount as legal costs. In addition, the fact that the organization fulfilled its duty as a tax agent was established by the courts when considering the dispute and was not disputed by the tax authority.

Thus, the costs of the organization in the amount of personal income tax transferred to the budget are directly related to the consideration of the dispute in the arbitration court and relate to the legal costs listed in Art. 106 of the Arbitration Procedure Code of the Russian Federation, and are subject to compensation in accordance with Art. 110 Arbitration Procedure Code of the Russian Federation. This means that the organization has the right to recover personal income tax paid for the representative - an individual, from the losing party among legal costs.

The article was written and posted on September 29, 2015. Added - 11/12/2015, 05/31/2016, 03/05/2017, 09/26/2018, 10/26/2018, 12/07/2018

ATTENTION!

Copying the article without providing a direct link is prohibited. Changes to the article are possible only with the permission of the author.

Author: lawyer and tax consultant Alexander Shmelev © 2001 — 2021

The only arbitration precedent

Judicial practice in favor of taxpayers is represented by one single case. This is the Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated 08/02/2010 in case No. A29-10481/2009. This document is noteworthy in that its decision is supported by the Determination of the Supreme Arbitration Court of the Russian Federation dated December 13, 2010 N VAS-16460/10.

This Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District considered a dispute between the tax inspectorate and a tax agent who did not withhold personal income tax when paying compensation for legal expenses to an employee.

The arbitrators agreed that the application of penalties to the company under Art. 123 of the Tax Code is unreasonable. They considered that the employee did not receive an economic benefit because he was merely reimbursing his costs.

The author does not share this approach and believes that there is a prospect of winning such a dispute when the costs of an individual are limited by state duty.

Useful links on the topic “Personal income tax on payments by court decision”

- Personal income tax 15%. Progressive scale

- Tax on interest on deposits

- Tax control of accounts

- Why are benefits declarative in nature?

- Personal income tax on inheritance

- Tax liability for failure to submit documents

- The procedure for obtaining confirmation of the status of a tax resident of the Russian Federation

- When and what to report to the Federal Tax Service

- Convention on the International Exchange of Tax Information

- Taxpayer personal account

- Tax benefits for pensioners - procedure for provision and sample application

- How to pay taxes online

- Should children pay taxes?

- How to get a deferment (installment plan) for paying taxes

- Tax audits

- What should a complaint to the tax inspectorate contain?

Tax return

- Complete list (list) of persons who are required to file a tax return

- Sample of filling out the 3-NDFL tax return for 2021:

- title page, sections 1, 2

- income from sources in the Russian Federation (Appendix 1);

- calculation of property tax deduction for expenses on the purchase of real estate (Appendix 7)

- calculation of property tax deductions for income from the sale of property (Appendix 6);

- calculation of social tax deductions established by subparagraphs 4 and 5 of paragraph 1 of Article 219 of the Tax Code (calculation to Appendix 5);

- calculation of standard, social, investment tax deductions (Appendix 5);

Taxes

- UTII

- Land tax

- Personal income tax (NDFL)

- Income not subject to taxation

- Who are tax residents and non-residents

- Sale of an apartment by a tax non-resident of the Russian Federation

- The procedure for calculating and paying personal income tax upon the sale of a share in the authorized capital of an LLC, shares of an OJSC, securities

- Personal income tax on payments by court decision

- Tax on the sale of currency and income on Forex

- How to reduce personal income tax when buying and selling a car

- How to reduce personal income tax when selling and buying a home

- Procedure for paying personal income tax if an employee is on a business trip abroad

Tax deductions

- Property tax deductions

- How to get a property deduction when buying a home on credit

- How to get a deduction for improving housing conditions

- When can you get a deduction of 2,000,000 rubles when purchasing a room or a share of an apartment?

- Is a non-working pensioner entitled to receive a property tax deduction in connection with the purchase of an apartment?

- List of medicines for which social tax deduction is provided

- List of expensive types of treatment for which a social tax deduction is provided (approved by Decree of the Government of the Russian Federation of March 19, 2001 No. 201)

Tax liability for:

- failure to provide documents

- failure to provide tax reporting;

- incomplete payment of taxes;

- failure to appear when called to the tax authorities

Form of receiving income in the form of compensation for legal expenses

Officials believe that due to compensation, the taxpayer receives income in kind. Allegedly, the company paid for him for work and services in his interests. This point of view is presented in paragraph 3 of Letter of the Ministry of Finance of Russia dated November 19, 2007 N 03-04-06-01/386.

The author will allow himself to disagree with her. On this path, we are faced with a discrepancy in the date of receipt of income. After all, it turns out that income was received at the time the taxpayer purchased goods, work or services paid for by him.

Meanwhile, it is obvious that at this date he does not and cannot have any economic benefit, and the outcome of the legal dispute is unknown in advance.

If economic benefit arises, it will be in monetary form at the time of payment of compensation (of course, if the compensation itself is not paid in kind).

In other words, according to the author, income in the form of monetary compensation should be recognized on the date the taxpayer receives the money.

Vacation and sick leave

Vacation and sick pay are similar to wages and are therefore subject to taxation. Personal income tax is withheld at the time of payment of vacation or sick leave and transferred to the treasury until the last day of the month.

Rolling leave. Vacation is considered transferable if its days fall in different months or even reporting periods. But for personal income tax this is not important. You must issue vacation pay three days before your vacation. Therefore, you must remit the tax no later than the last day of the month in which the payment was made.

Study leave. If you have students working for you, they periodically take time off to study. Vacation pay is calculated based on the average salary and is subject to personal income tax.

Compensation for losses is not subject to personal income tax

Let's consider another case. Let's imagine that your company damaged the property of an individual and, in this regard, compensates him for real damage. Basis - art. 15 Civil Code. There are plenty of examples from life. For example, builders, while renovating an apartment, flooded the residents on the ground floor. Or another example: while repairing the roof of a building, workers dropped a construction tool onto a car parked below.

Affected individuals can count on the favor of the tax authorities. Although, again, officials do not provide specific arguments to support their opinion. They argue that the individual did not receive an economic benefit. This conclusion was made by specialists of the financial department in Letters dated 10/07/2010 N 03-04-06/6-243, dated 05/05/2010 N 03-04-06/10-89 and dated 04/08/2010 N 03-04-05/10 -172. Accordingly, compensation amounts are not income and are not taken into account when determining the tax base for personal income tax.

But let’s assume that your company compensates for moral damages to the buyer on the basis of Art. 15 of the Law of the Russian Federation dated 02/07/1992 N 2300-1 “On the protection of consumer rights.”

The Moscow Office of the Federal Tax Service of Russia in Letter dated 05/06/2010 N 20-14/3/ [email protected] rightly explains that such compensation is not subject to personal income tax only if it is ordered by the court. This conclusion is based on the wording used in the Law of the Russian Federation of 02/07/1992 N 2300-1.

Personal income tax on salary

When paying wages, the employing organization withholds personal income tax and transfers the payment to the treasury on the next business day after the money is issued. The Ministry of Finance published letters with clarifications on controversial issues.

Deposited salary is payment for work that was not posted on time. Tax is withheld when paid from the amount of transferred income no later than the next day.

Is it possible not to withhold personal income tax from the minimum wage? Even if the employee’s salary is equal to the minimum, the tax will still have to be withheld.

Delay in issuing salary. For late payment of wages, the employer is obliged to pay compensation (Article 236 of the Labor Code). In this case, personal income tax is not withheld from this amount. Letter of the Ministry of Finance of the Russian Federation N 03-04-05/11096 dated 02/28/2017.

What is due to an employee upon dismissal?

According to the Labor Code of the Russian Federation, a resigning employee has the right to certain types of payments:

- last month's salary;

- financial compensation for unused vacation (partial or full, depending on the circumstances);

- financial compensation due in case of premature termination of an employment contract;

- severance pay (due in case of layoff);

- The average monthly salary due to a former employee during the period of searching for a new job.

After dismissal, the employer provides the employee with certain monetary compensation

The first two options for monetary compensation are due to employees upon termination of an employment contract, regardless of the context. The remaining three points are specific and apply only to situations where staff are being reduced by force.

TK guarantees

Article 178 of the Labor Code of the Russian Federation includes all cases in which dismissed employees are entitled to severance pay.

Such grounds for payment may include the following reasons for dismissal:

Liquidation

If an employee quits due to the actual or legal termination of the enterprise’s activities, and the entry in the work book corresponds to reality, then, according to Article 81 of the Labor Code of the Russian Federation, he is entitled to payment of severance pay in the amount of the average monthly salary.

In addition, the average monthly salary will be paid to the dismissed person for two calendar months from the date of termination of the TD. If an employee contacted the employment service no later than two weeks after the termination of the employment contract, and the state body was unable to employ him for three months, then the enterprise that fired this employee is obliged to pay him wages within three months.

Reduction

When the staff of an enterprise is reduced, Article 81 of the Labor Code of the Russian Federation applies, and, based on its text, benefits are paid to the dismissed employee on the same principle as during the liquidation of the enterprise.

Refusal of an employee to transfer to another job

If an employee, for medical reasons confirmed by the conclusion of a medical commission, cannot perform the job functions provided for by his job description, management is obliged to provide him with another position.

In the absence of one or if the mercenary refuses the transfer, in accordance with Article 77 of the Labor Code of the Russian Federation, the employer terminates the employment contract with him on his own initiative, with the payment of severance pay in an amount corresponding to the average salary for two weeks.

Call for service

In cases where an employee is called up from the military registration and enlistment office for military or alternative service, the employment contract is terminated under Article 83 of the Labor Code of the Russian Federation with the mandatory payment of severance pay in the amount of average earnings for two weeks.

Recovery

If an employee who entered into a labor contract took the place of a previously illegally dismissed employee, and he was reinstated at work by decision of the labor commission or judicial authority, then, according to Article 83, management is obliged to pay him RP in the amount of average earnings for two weeks, regardless of how much he worked.

Translation

According to Article 77 of the Labor Code of the Russian Federation , if the employer transfers the actual location of production facilities to another area, and the employee refuses to be transferred with him, then the termination of the employment contract is accompanied by the payment of severance pay in the amount of two weeks' salary.

Inability to perform job duties

If an employee is declared incapable of performing work activities on the basis of documents issued by a medical institution in the manner prescribed by law, then, according to Article 83 of the Labor Code , termination of the employment contract is accompanied by the payment of severance pay in the amount of two weeks’ salary.

Changes in terms and conditions

If the terms of the employment contract concluded between the employee and the employer have changed, with which the employee does not agree and refuses to continue performing his job duties, then according to Article 77 of the Labor Code of the Russian Federation, upon his dismissal, severance pay is paid in the amount of the average salary for two weeks.