Income tax (or personal income tax) is withheld monthly from accrued income, but it is not always collected. In what cases and on what amount income tax is not taken will be discussed in this article.

This information will be useful to many, since the amount of remuneration that an employee can spend on his needs is considered minus the tax transferred to the state budget.

About tax

Tax base and personal income tax rate

The main tax levied on wages is personal income tax (or, as it is also called, income tax).

Tax base (income subject to taxation). The tax is levied on literally all income: for example, wages paid for work, a percentage of winnings or dividends. But there are also times when income is not taxed.

These include:

- sick pay;

- child care benefits;

- other types of preferential and compensation charges.

Tax rate. It differs for different categories of citizens, but for the majority of residents it is customary to charge 13% of their income. If resident status is not assigned, then this percentage increases.

To obtain this status, you must stay on the territory of the Russian Federation for at least 183 days annually, while the right of non-stay is retained, but for no more than six months (they can be spent on rest, study, etc.).

To calculate what net salary you will receive, it is recommended to do the following: subtract 13 percent from your estimated income. This will be pure income that you can count on.

What percentage of salary and other income is income tax?

How much income tax will be in the end depends on the rate at which an individual’s income is taxed. Art. 224 of the Tax Code of the Russian Federation provides for 5 interest rates for personal income tax:

- 9% on the amount of income in the form of interest on mortgage-backed bonds issued before 01/01/2007. The same rate is established on the amounts of income of the founders of trust management of mortgage coverage received on the basis of the acquisition of mortgage participation certificates issued before 01/01/2007.

- 13% personal income tax on the amount of income of individuals (salaries, remunerations under civil contracts, income from the sale of property, etc.). Since 2015, the same rate applies to dividends. The tax base for dividends must be calculated by separating it from other income, which is taxed at a rate of 13%.

- 15% of the amount of dividends received by non-resident individuals from equity participation in Russian organizations. From 01/01/2021 - from annual income exceeding 5 million rubles.

- 30% on the amounts of all other income received by non-resident individuals.

- 35% from the amounts of winnings, prizes and participation in any competitions, amounts of interest on deposits in banks (in terms of exceeding the established rates of the Central Bank of the Russian Federation), amounts of savings on interest from loans received, etc.

Since 2015, special rules have been in force regarding the payment of advance tax payments from foreigners who operate on the basis of a patent tax system. When receiving or renewing a patent, they must make an advance payment based on the amount of 1,200 rubles, multiplied by the deflator coefficient established for the corresponding year, and by a coefficient taking into account the characteristics of the regional labor market. When subsequently calculating personal income tax for such an employee, the advance payments paid by him must be taken into account.

Standard tax deductions

Parts of income that are not subject to personal income tax are called tax deductions. The tax base is reduced by the amount of tax deductions when calculating the amount of tax payable.

There is a category of persons who enjoy deductions from the tax base:

- preferential categories (clauses 1 and 2 of clause 1 of Article 218 of the Tax Code of the Russian Federation)

- parents; having the status of guardians (clause 4, clause 1, article 218 of the Tax Code of the Russian Federation);

- mothers raising children alone (clause 4, clause 1, article 218 of the Tax Code of the Russian Federation);

- working pensioners.

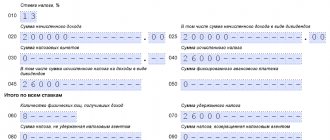

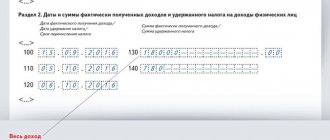

Calculation of income tax in 2021 with example

Income tax calculation for 2021 is as follows:

1. All employee income is summed up, including bonuses, incentives, and additional payments. 2. The amount of the deduction is determined. 3. Deductions are deducted from the entire amount of income. 4. The interest rate of income tax is determined depending on the status of the employee: resident 13% or non-resident 30%. 5. The amount of tax payable to the federal budget is calculated.

Example 1:

It is necessary to calculate the personal income tax for the month of work of a resident of the Russian Federation with 3 children.

The employee's monthly income was 75,000 rubles.

The deduction for three children will be 1400 + 1400 + 3000 = 5800 rubles.

Personal income tax for such an employee will be:

(75,000 – 5800) X 13% = 8,996 rubles.

For this employee, the possibility of applying the tax deduction for children will end when his total income reaches 350,000 rubles.

Example 2:

Let's look at how to calculate personal income tax at a rate of 15%, introduced on January 1, 2020, for high wages.

The director of ION LLC receives a salary of 500,000 rubles per month. As of October 2021, the director has been paid 5 million rubles since the beginning of the year. Personal income tax on income for January-October 2021 amounted to 650,000 rubles. (10 months x RUB 500,000 x 13%). At the same time, the tax rate on this income was used in the amount of 13%. Starting from November 2021, a personal income tax rate of 15% will be applied to tax the director’s income. Consequently, during these last two months of 2021, 150,000 rubles were paid to the budget. (2 months x RUB 500,000 x 13%).

Many personal income tax payers believe that they can receive a tax deduction in the form of monetary amounts. This is completely false. In reality, the income received is reduced by the amount of the tax deduction, and then the personal income tax payable is calculated.

If there are no changes in 2021, which we will discuss below, then the example of calculating income tax described above in the text will be relevant in 2021.

Calculation for pensioners who continue to work

If a citizen continues to work upon retirement, then the legislation in this regard is quite strict. When a citizen is officially employed, tax is withheld on a general basis.

Corresponding entries are made in the work book, and withheld contributions are transferred to the Social Insurance Fund. In this case, a tax of 13 percent is withheld on a general basis.

At the same time, working pensioners have the right to all types of deductions provided to working citizens who have not reached retirement age (related to preferential categories, for children).

An example of calculating personal income tax from wages

Let's consider options for withdrawing personal income tax from your monthly salary.

For a citizen of the Russian Federation who worked for a month (22 days) at the daily wage rate (1,560 rubles per day) and received a monthly bonus:

| Type of income | Amount of income (RUB) | Type of retention | Withholding amount (RUB) | Amount of salary in hand (RUB) |

| Salary | 34320 | Personal income tax 13% | 4851,6 | 32468,4 |

| Prize | 3000 | |||

| Total income | 37320 |

For a resident (citizen of the Russian Federation) who worked for less than a full month (15 working days) at the daily tariff rate (1,560 rubles per day), and was on sick leave for 5 days (the insurance period is enough to pay sick leave in the amount of 100% of average earnings):

| Type of income | Amount of income (RUB) | Type of retention | Withholding amount (RUB) | Amount of salary in hand (RUB) |

| Salary | 23400 | Personal income tax 13% | 4056 | 27144 |

| Sick leave | 7800 | |||

| Total income | 31200 |

For a non-resident (foreigner) who has worked at the daily wage rate (RUB 1,300) for 22 days:

| Type of income | Amount of income (RUB) | Type of retention | Withholding amount (RUB) | Amount of salary in hand (RUB) |

| Salary | 28600 | Personal income tax 30% | 8580 | 20020 |

| Total income | 28600 |

Important : despite the fact that the formula for calculating personal income tax is simple, to determine the amount of contributions to the budget, it is not enough to know only your tariff rate; you also need to correctly calculate your monthly income.

There are no other mandatory deductions from employee salaries. At the same time, employers pay additional insurance premiums for each employee.

Tax on minimum amount

Is personal income tax levied on the minimum wage?

The minimum wage is equal to the minimum wage and is annually indexed depending on the level of inflation. As a rule, at the end of the accounting year the minimum wage is established, and the minimum wage is calculated for the year. Moreover, each region has its own minimum wage and it may differ.

The cost of living and the minimum wage are two different things and should not be confused. The minimum wage is exactly the amount that an employer can set for a low-skilled employee per month.

Since tax deductions are levied on all individuals, they are also withheld from the minimum wage, that is, the tax amount is 13%.

How to calculate income tax on salary?

In order to correctly calculate income tax on monthly wages, you need to know:

- form of remuneration (tariff rate, piecework);

- availability of bonus payments for the current month;

- grounds for payment for work on non-working days, weekends, as well as at night and in the evening;

- amount of vacation pay and sick pay.

All these payments affect the employee's income. It is this income that is ultimately multiplied by the personal income tax rate, and the employer receives the amount of tax that must be withheld from the employee’s salary and transferred to the budget.

Important: when determining the income of a part-time worker, the employer is obliged to include in the calculation all tariff, bonus and compensation payments for a part-time position. When combining, the additional payment for the additional amount of work is included in the citizen’s pay slip at the main place of work. This is the defining difference between a combination and a part-time job, although it is far from the only one.

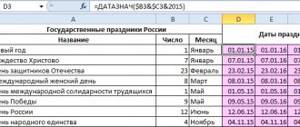

If you work at a tariff rate (hourly or daily), then first of all you need to obtain information about how many tariff units (hours or days) you worked in the reporting month. When it comes to tariff days, a month can have 20, 21, 22 working days and, accordingly, a different number of working hours (8 × 20, 8 × 21, 8 × 22). The monthly tariff salary depends on this.

Tip: Find out how to write an application for annual paid leave.

When paying piecework, you need to obtain reliable information about production standards, prices and the orders you closed. If during the month the employee had sick leave, basic or additional leave, then the monthly earnings depend on the calculation of the average monthly salary. If there were vacations without pay, then such days are simply not taken into account when determining monthly income.

See also: How to view the balance of a Sberbank card via the Internet or telephone?

Who doesn't need to pay tax

Income tax is not withheld from certain types of payments:

- from pensions - these are social benefits;

- from sick leave;

- when calculating maternity benefits;

- when a woman is on maternity leave;

- from alimony.

If a citizen is not employed and no entries are kept for him in the work book, then there will be no income tax withholding either. At the same time, funds for insurance will not be transferred to the Social Insurance Fund, and the period of work will not be included in his work experience.

On what income is tax paid?

Pay taxes and contributions in a few clicks in the Kontur.Accounting service! Get free access for 14 days

Tax is paid not only on wages. The tax base includes all incentives, bonuses and other additional payments, including material benefits and income that the employee received in kind. The tax is calculated as follows:

- sum up all employee income;

- deduct official expenses from this amount;

- We charge a tax of 13, 15 or 30% on the received balance.

Certain types of income, which are listed in Art. 217 Tax Code of the Russian Federation. These are state benefits (except for unemployment benefits), pensions, donor rewards, alimony received, lump-sum assistance amounts and other payments. Since 2021, this list has been supplemented with compensation; compensation for travel on vacation and back has been separately allocated for workers from the Far North and equivalent areas.

How to find out if a company pays taxes for employees

Your salary is completely “white”, and this is very good. But, alas, this does not guarantee that your management is honest with you. Honestly in the sense that it may “forget” to pay the required taxes for the employee, thereby saving itself a little money. And the most negative thing is that such an act of his does not affect him, but the future employee. For example, he will have a small pension.

Please note! There are ways to help you find out if your employer is contributing to your future pension:

- through government services;

- through the pension website;

- personally.

Let's look at these methods in more detail.

What taxes does an individual entrepreneur pay for employees?

Everyone who is an individual entrepreneur is required to pay taxes both for the employee and for themselves - personal income tax, pension and Social Insurance Fund.

But there is one problem - the entrepreneur himself does not have a salary. Therefore, payments will have to be calculated based on the amount of direct income.

As an example, consider an income of up to 300 thousand per year. In this case, he will have to pay:

- for pension – 23,400 rubles;

- in social insurance – 4590 rubles.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

If the income exceeds the specified three hundred thousand, then another 1% of the amount that exceeds must be added to the indicated amounts.

But by paying the minimum amount in social security, an individual entrepreneur will not be able to count on receiving sick leave. To do this, he will need to pay at least 2,610 rubles. in year. It seems like a little, but many refuse.

But employees working for an individual entrepreneur have the same conditions as employees of other companies. After all, the entrepreneur in this case acts as an employer. And its employees are obliged to pay everything that is required by law.

Checking through the State Services website

This is very easy to do - you need to register on the portal (if it doesn’t exist), then order a statement about the status of your pension account. There is no need to do anything special, since everything happens automatically.

So, log in and find . Click the “receive service” button, then fill in the required data.

After this, in a couple of minutes you will receive the requested statement, which the system will send to your personal account. From the statement you can find out whether your employer pays contributions for you and from what salary all this occurs.

You can also access the pension fund website through your personal account on the government services portal. To do this, in your personal account (public services) we find the following section “About formed pension rights”. This section contains all the information on the issue you are interested in.

Watch the video. Personal income tax in the activities of individual entrepreneurs:

How to calculate personal income tax

If the amount of the tax bases that we talked about above (listed in paragraph 2.1 of Article 210 of the Tax Code) is less than 5 million, then the tax will be equal to 13% of the amount of these tax bases.

If the amount of these tax bases is more than 5 million, then the tax is calculated as follows (we quote the draft):

“...as the amount of 650 thousand rubles and an amount equal to the ad valorem tax rate established by paragraph three of paragraph 1 of Article 224 of the Tax Code (15%), a percentage share of the amount of tax bases reduced by 5 million rubles.”

Now tax agents consider personal income tax on income as a cumulative total of previously calculated tax. But this rule does not apply to income from equity participation (dividends). According to them, tax is calculated separately for each payment.

This dividend exemption is now being removed. Tax agents will calculate personal income tax for dividends using the same algorithm as for salaries.