The job description of an accounts payable accountant is a document that allows the applicant for the position to study his responsibilities in detail, as well as independently determine whether he is suitable for this position. It should be taken into account that the job description is not only an introductory document for applicants, but also one of the main ones for regulating the work procedure. Read also → “Job description of the chief accountant of the organization in 2021“

Example of a job description for a accounts payable accountant

Provides managers, creditors, investors, auditors and other users of financial statements with comparable and reliable accounting information on issues related to commodity accounting.

Participates in the development and implementation of activities aimed at maintaining financial discipline and rational use of resources.

This job description has been developed and approved on the basis of an employment contract with an accountant and in accordance with the provisions of the Labor Code of the Russian Federation and other regulations governing labor relations in the Russian Federation, as well as ___.

For committed offenses, the accountant faces disciplinary, administrative and criminal liability, established by the relevant regulations of the enterprise and articles of codes. The employee must comply with all legal requirements when preparing documentation and performing other job duties.

Participates in the development and implementation of activities aimed at maintaining financial discipline and rational use of resources.

Make proposals for improving work related to the responsibilities provided for in these instructions. Quarterly reconciliation with debtors and creditors in writing with the obligatory receipt of original reconciliation reports.

Performs work on the formation, maintenance and storage of a database of accounting information, makes changes to reference and regulatory information used in data processing. 3.29. Conducts settlements with suppliers. 3.30.

If the specialty is not specialized, then the time of work related to accounting and financial activities should be from three to five years. A specialist is hired according to generally accepted standards: with the conclusion of an official contract and the issuance of a corresponding order from the director.

Employee rights. Examples

The minimum rights of an accountant for settlements with suppliers are presented in the regulatory documents of the Russian Federation. The employer does not have the right to infringe on the employee’s rights, but can expand them through this clause of the job description. An employee’s rights can be expanded due to his work experience, competencies, knowledge and position.

As examples, you can study the following rights granted to an accountant by an employer:

- An accountant can put forward proposals for improving and optimizing the quality of work within his competence.

- An accountant has the right to receive various types of information, including confidential information, if it is required for the successful performance of work.

- The accountant is given the right to demand assistance or assistance from the company's management in resolving emerging problems related to the implementation of job responsibilities.

The rights provided by the employer and specified in the job description cannot subsequently be reduced, infringed or not fulfilled, therefore it is recommended to be careful in the development and drafting of this clause.

Helpful information

The functions of this document are to approve the list of job responsibilities for a primary accountant. The employee will be aware of what actions his scope of activity will be limited to, what rights he will have and what sanctions will be imposed for making mistakes on his part.

The company itself decides what job responsibilities the employee will have, since the position of primary accountant is not in the Qualification Directory, approved. Resolution of the Ministry of Labor of Russia dated August 21, 1998 No. 37, and in the All-Russian Classifier of Professions, approved. Resolution of the State Standard of the Russian Federation dated December 26, 1994 No. 367.

The range of labor functions can be prepared on the basis of the professional standard “Accountant”. It is fixed by Order of the Ministry of Labor of Russia dated February 21, 2019 No. 103n. In the document you can find those actions that can be entrusted to a primary accountant, and it is on the basis of them that a job description can be drawn up.

General provisions of the job description (JI)

General provisions - the first section of the DI includes the following information:

- the name of the department in which the specialist will work;

- to whom will he report (usually the accountants are supervised by the chief accountant or his deputy);

- procedure for hiring and dismissal;

- knowledge and skills required by the employee;

- required qualifications;

- a list of legislative and local acts that an accountant must follow when performing his duties, etc.

The section should not be too voluminous or loaded with secondary information. The main goal is to quickly orient a potential employee whether he is suitable for the employer according to the established criteria, to briefly familiarize him with the basic rules of labor regulations and the personnel structure of the enterprise.

Who should develop DI?

The development of job descriptions is entrusted to the heads of structural units to which accounting employees report. In practice, DIs are designed as part of collegial commissions, which include:

- head of the enterprise;

- Chief Accountant;

- his deputy and head of the personnel department.

The working group often includes a full-time lawyer who corrects the legal provisions of the document.

Instructions are approved by order or stamp of the head of the organization. He has the right to delegate the powers of controlled structures, imposing on them the obligation to develop job descriptions, regardless of the hierarchy of subordination. For example, DI of all departments can be designed by the head of the personnel department.

Accountant for third party services

Employer: World of Packaging

Responsibilities:

- Accounting for settlements with suppliers, contractors of works and services

- Accounting for costs associated with production and sales of products (works, services)

- Accounting for other income and expenses

- Keeping records of transportation costs and maintenance costs for your own fleet of vehicles

- Reflection of transactions for accounting for services of third-party organizations (including transport services), services of group companies, deferred expenses

- Reflection of transactions on settlements with accountable persons

- Keeping records of banking and cash transactions, preparing supporting documents for submission to the bank

- Accounting for assets and liabilities, the value of which is expressed in foreign currency

- Participation in conducting complete inventories of goods and materials in warehouses

- Active participation in the process of transition to 1C 8.3, debugging, checking processes related to the automation of reflection of services of third-party organizations, services of group companies, settlements with accountable persons, deferred expenses, accounting of banking and cash transactions

- Keeping records of accounts 20, 25, 26, 44, 50, 51, 52, 60, 71, 76, 91, 97 and controlling account data

- Preparation of statistical reports

- Quarterly reconciliation of payments with suppliers and contractors

- Quarterly archiving of primary documents

- Maintaining a purchase book

- Carrying out instructions from the chief accountant

Requirements:

- Higher specialized education, higher economic education or any higher education + retraining in accounting and tax accounting

- Knowledge of Excel, Word, 1C 8.2, 8.3

- Knowledge of the tax and accounting legislation of the Russian Federation in terms of accounting for the services of third-party organizations, group of companies, deferred expenses, settlements with accountable persons, accounting for banking and cash transactions, accounting for foreign trade activities, accounting for international transportation, agency transactions, knowledge of the requirements for primary documentation in terms of accounting for the services of third-party organizations, deferred expenses, settlements with accountable persons, accounting for banking and cash transactions, accounting for foreign trade activities, accounting for international transport, accounting for transportation costs, expenses for maintaining one’s own fleet of vehicles, knowledge of the general principles of accounting for all areas

- ?Experience in a manufacturing company is an advantage

- Professional competencies, responsibility, attentiveness, accuracy, ability to work with large volumes of information, high speed of information processing, ability to work in a team, initiative, desire for professional growth and development, honesty, stress resistance.

Conditions:

- Registration according to the Labor Code of the Russian Federation

- Work schedule: 5 days, days off. — Sat., Sun., from 09.00 to 17.30

- Place of work: Sertolovo, delivery from the metro station. Ozerki (20 min.)

- Free food provided

- Comfortable office

Company: World of Packaging

April 25, 2016

Requirements for employee knowledge and skills

The work of accounts payable accountants, like many other positions, requires not only the knowledge gained through professional training, but also certain personal characteristics to successfully perform the job. To study this point in more detail, consider the following table:

| Knowledge/Skill/Characteristic | Content |

| Education Requirements | Higher education in accounting and auditing. Applicants who have completed advanced training courses or professional seminars have a particular advantage. |

| Knowledge of regulations and documents | Ideally, an accountant should be fluent in the accounting legislation of the Russian Federation and the 1C program, understand the labor code, and also have a perfect knowledge of this job description and other regulations of the enterprise. |

| Personal qualities | Stress resistance, ability to work with large volumes of information and documents, desire to work in a team, experience in the proposed field are an advantage. |

The employer has the right to impose additional requirements in this paragraph. For example, if a company is engaged in construction activities, then preference will be given to those candidates for the position who have experience working in a construction company or a sufficiently deep understanding of this activity.

Design rules

The document is prepared on an A4 sheet with the logo of the organization in accordance with the requirements of GOST R 7.0.97-2016. Under the preamble “I approve” the following are listed:

- name of company;

- name and position of the manager;

- date of approval.

The director puts his signature here.

The structural part consists of 4 sections:

- general provisions;

- job responsibilities;

- rights;

- responsibility.

At the end, the signature of the head of the structural unit and a note about familiarization by the employee are placed.

General provisions

The “General Provisions” reflect the conditions of labor interaction and qualification requirements. The first paragraph states that this instruction defines the functional duties, rights and responsibilities of an accountant. Structure in numbered list order:

- level of subordination - reports directly to the chief accountant, his deputy;

- requirements for professional training, education, work experience;

- a list of knowledge and skills, for example, “must know”: methods and forms of accounting, organization of document flow, economic analysis;

- procedure for replacing other employees during a period of temporary absence.

The regulations on which the specialist relies are listed. These include:

- local ON;

- job description;

- orders and instructions from management.

Responsibilities

When developing this section, the functional features of the employee’s activities are taken into account, taking into account his qualifications. Provides a list of actions aimed at ensuring labor functions. The main ones include:

- accounting of property, business transactions;

- reception and control of primary documentation;

- identification of sources of material losses during operating activities;

- account planning and development of documentation forms;

- participation in financial inventory;

- conducting economic analysis.

An accountant's responsibilities also include:

- participation in the development of innovative accounting methods;

- ensuring the safety of documents;

- providing reliable information about the status of accounts;

- transfer of taxes;

- generating a report on commodity and property turnover.

Rights

Legal guarantees of a specialist are designed taking into account Art. 21 of the Labor Code of the Russian Federation, as well as the peculiarities of conducting labor activities.

Among them:

- obtaining the necessary materials and documents;

- making proposals for improving work;

- attraction and interaction with other structural divisions;

- social package provided for by labor legislation;

- advanced training, attending training courses.

Employees have the right:

- demand compliance with and clarification of safety and labor protection rules;

- make independent decisions;

- endorse documents within your competence.

Responsibility

In the course of professional activities at the place of work, the accountant is responsible for:

- causing material and property damage;

- evasion or improper fulfillment of obligations;

- offenses committed in the course of work;

- providing false information and concealing information;

- violation of labor discipline, safety and internal regulations.

Failure to comply with these requirements will result in disciplinary, administrative or criminal liability.

Responsibility of the employee for the position

Accounts payable accountants' responsibilities are a detailed list of actions for which the official is called responsible and receives certain, pre-agreed sanctions. The amount of responsibility depends on how high a position the employee holds, how many subordinates he has, and what responsibilities he has.

The main responsibility of the accounts payable accountant is failure to perform or improper performance of official duties. In addition, the employee may be held liable for violating internal regulations; failure to comply with current instructions (including official instructions); offenses under the legislation of the Russian Federation; causing moral or material damage within the organization to one of its employees or property.

If the liability clause does not specify the sanctions provided for certain offenses, then the employee will be punished in accordance with the current legal framework of the Russian Federation.

Sample of a typical job description for an accountant

A job description, developed in accordance with generally accepted professional standards and the specifics of a particular enterprise, helps to understand what is included in the scope of his immediate responsibilities. What types of bonuses are there for employees? Types of bonuses to employees can be allocated according to different criteria. Below we will review the most common classifications and tell you in more detail about those that have been established...

The following sections can be distinguished in the job description: general provisions; functional area; submission and accountability; list of processed documents; education and/or work experience; special knowledge and skills; responsibilities; responsibility.

Moscow “_” 2000 In order to increase the efficiency of management activities, I ORDER: 1. To approve for the Company’s employees: A standard form of labor...

The chief accountant is generally responsible for the accounting and financial activities of the company, develops economic policies, prepares tax and financial reports, and manages accounting departments.

Reflects on the accounting accounts transactions related to the movement of fixed assets, inventory and cash.

In addition, the circle of managers to whom the specialist reports must be determined, as well as a list of documents regulating his activities. Functional The range of responsibilities of an employee depends on the specifics of the enterprise’s activities and the distribution of tasks within the accounting service. The main task of an accountant working in the settlement area is to record mutual transactions with counterparties.

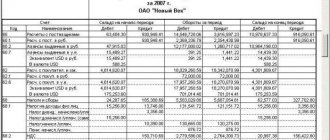

Accounting for settlements with suppliers and contractors - postings

Active-passive account. 60 “Settlements with suppliers and contractors” is intended for in-depth accounting and generation of postings for suppliers. It maintains both synthetic and analytical accounting in the context of counterparties, goods, transactions, and types of payment. Information is summarized by:

- Received goods and materials, including uninvoiced deliveries (without settlement documents).

- Accepted/performed services and work.

- Consumed services, including the receipt of gas, electricity, steam, water and other resources.

- Services for processing/delivery of goods and materials, paid for by transferring accepted claims to the bank.

- According to planned calculations.

- For settlements secured by non-monetary means - bills, securities, etc.

- For surpluses identified during the acceptance of goods and materials/services, including over/under tariffs.

When reflecting settlements with suppliers and buyers, postings are made on the basis of supporting primary documents - commodity and transport invoices, certificates of services/work performed, payment requests/orders, cash receipts, etc. According to Law No. 402-FZ of 12/06/11, enterprises have the right use existing unified forms or develop your own forms indicating the required details. Typical settlements with contractors are given below.

Settlements with suppliers and wiring contractors - examples

To account 60 sub-accounts can be opened for the purpose of organizing analytical accounting. The main ones include the following:

- 60.01 – according to regular settlements with suppliers.

- 60.02 – according to advance payments.

- 60.03 – for issued bills and other securities.

- 60.21, 60.22, 60.31. 60.32 – for accounting for foreign exchange transactions.

Table of transactions by suppliers:

| Household contents operations | Account debit | Account credit |

| Paid the debt to the supplier through the cash register | ||

| Paid the debt to the supplier through a bank account | 51 (52) | |

| Settlement has been carried out | ||

| Debt converted into loan | 66 (67) | |

| Equipment capitalized (non-current assets) | 07 (08) | |

| Capitalized goods and materials | ||

| VAT included | ||

| Contractor services are included in cost accounts | 20 (25, 26, 28) | |

| Goods received (VAT taken into account) | 41 (19) | |

| Reflected in sales expenses are goods delivery services | ||

| Incoming inventory items reflect the shortage identified during acceptance |

Accounting for the return of goods to the supplier is carried out depending on the reason for the return of goods and materials - due to non-compliance with quality/quantity/completeness or for independent reasons, for example, due to lack of demand (Civil Code of the Russian Federation, stat. 421). In the first case, if the transfer of ownership has already occurred, the delivery of products is reversed; in the second, a normal sale is carried out with the issuance of a delivery note and invoice.

Job responsibilities of an accountant for payments to suppliers and contractors

Job description of an Accountant for settlements with counterparties and non-budgetary activities 1. General provisions 1.1. This instruction has been drawn up in accordance with the Resolution of the Ministry of Labor of the Russian Federation dated August 21, 1998.

No. 37 “Industry-wide qualification characteristics of positions of workers employed in enterprises, institutions and organizations.” 1.2. An accountant (for settlements with counterparties and extra-budgetary activities) belongs to the category of specialists. 1.3.

This job description defines the functional duties, rights and responsibilities of an accountant (for settlements with contractors and extra-budgetary activities). 1.4.

An accountant (for settlements with contractors and extra-budgetary activities) is appointed to the position and dismissed from the position upon the proposal of the chief accountant in accordance with the order of the director of the technical school established by the current labor legislation. 1.5.

They are divided into:

- Accounting for fixed assets and consumables (the job description of an accountant for settlements with service providers also involves maintaining general business expenses and partly production costs associated with the use of the purchased service).

- Acceptance of primary documentation and its implementation in a specialized accounting program (programs are more often used). This is done by processing received primary documents, monitoring the correctness of their execution, and mandatory reflection in the sales and/or purchases book.

Job Description Accounts Payable Accountant: Sample

2.2.

Must know: - mission, corporate standards and business - company plan; — organizational structure of the auto center, — legislative acts, regulations, orders, orders, guidelines, methodological and regulatory materials on the organization of accounting; — forms and methods of accounting at the enterprise; the procedure for documenting and reflecting on accounting accounts transactions related to the movement of fixed assets, inventory and cash; — plan and correspondence of accounts; organization of document flow in accounting areas; - tax law.

Example of a job description for a accounts payable accountant

Performs work on the formation, maintenance and storage of a database of accounting information, makes changes to reference and regulatory information used in data processing. 3.29. Conducts settlements with suppliers. 3.30. Registers accounting entries and posts them to accounts. 3.31.

Important

Maintains an atmosphere of politeness and friendliness in the workplace. 3.32. Performs other assignments of the technical school management that are not included in this job description, but arise in connection with production needs.

4. Rights The accountant (for settlements with counterparties and extra-budgetary activities) has the right: 4.1. Receive from technical school employees the information necessary to carry out their activities. 4.2. Demand that the management of the technical school provide assistance in the performance of their official duties 4.3. Improve your skills. 4.4.

Attention

Refusal to accept for execution documents on transactions that contradict current legislation, registration in violation of the rules. 2. Submitting claims to suppliers and contractors in case of discrepancy in the quality, quantity of goods, works and services supplied with the permission of the head of the FEO after drawing up the relevant act.

3. Providing the Head of the FEO with his proposals for improving accounting. 4. Use of documents from other services and departments necessary for accounting and control. 4. RESPONSIBILITY: The employee benefits accountant is responsible FOR: 1. Inaccurate execution and preparation of documents, untimely transfer of them for reflection in accounting and reporting, as well as for the unreliability of the data contained in the documents. 2. Acceptance of unreliable, unformed, unapproved primary documents. 3.

Results

The job description of an accounts payable accountant in many aspects is characterized by fundamental similarity with similar instructions for other positions in the company, but it also contains a large number of specific provisions. It is extremely important for the firm's management and its HR department to reflect such provisions in the DI in order to ensure effective interaction with the accounts payable accountant.

You can study other nuances of personnel records management that are characteristic of modern Russian enterprises in the articles:

- “Regulations on official business trips - sample 2020”;

- “Internal labor regulations - sample 2020.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Why create a CI?

A skillfully compiled DI will greatly simplify life for both the employee and the employer. The employee will adapt to the workplace faster and will perform his duties more responsibly, and the employer will be able to clearly monitor the quality of the employee’s performance of job functions.

In addition, if labor disputes arise with an employee, a well-executed DI will help the employer defend its rights. For example:

Decision in favor of the employer

Refusal to hire without explanation

The applicant does not meet the qualification requirements of DI

Termination of the contract at the end of the probationary period

The employee does not fulfill the duties prescribed in the DI

Dismissal for reasons of inadequacy for the position held (the results of the certification did not confirm qualifications)

The employee does not meet the qualification requirements of DI

Dismissal due to loss of confidence (material damage)

The employee did not comply with the provisions of the DI and the terms of the liability agreement

Job Description for Accountant

Create entries in the sales book, compile a journal of issued invoices. 2.1.5. Monitor timely confirmation by counterparties of receipt of equipment and/or work (services), i.e. receipts in the accounting department of invoices and financial statements signed by counterparties. 2.1.6. Compile and process reconciliation reports with customers as necessary during the year and with all customers at the end of the year.2.1.7. Prepare and provide the deputy chief accountant with data on accounts receivable and advances received. 2.1.8. Carry out capitalization on the basis of primary documents of goods (equipment intended for sale). 2.2. The accountant is obliged to: 2.2.1. Continuously improve your professional level.2.2.2. Honestly and conscientiously fulfill the duties assigned to him.2.2.3. Keep official and commercial secrets.2.2.4. Comply with the rules of internal labor regulations, labor protection, safety, fire protection, as well as the provisions of the collective agreement ___.

3. Rights3.1. The accountant has the right: 3.1.1. Get acquainted with the draft decisions of ___ management related to its activities.3.1.2. Receive from heads of services, specialists ___ information and documents on issues within his competence.3.1.3. Report to the head of the financial service and the chief...

Vacancy description

Job responsibilities

— Settlements with service providers (maintaining 60 accounts). — Processing of primary documents (invoices, acts), compliance and control of the correct execution of documents in accordance with regulations, monitoring compliance with contractual obligations. — Interaction with suppliers and contractors on missing documents and corrections. — Keeping records of current accounting transactions under contracts, acts of completed work and services. — Attribution of expenses in accordance with accounting and tax accounting. — Conducting regular reconciliations with suppliers. — Participation in the process of preparing for the annual audit of your site. — Attribution of expenses in accordance with accounting and tax accounting. — Maintaining 97, 76 accounts: accounting for property insurance transactions.

Qualification Requirements

— Work experience of at least 2 years in a similar area, in a company with at least 200 people, which has separate divisions and branches. - Economic Education. — Experience in the program 1C 8.2, 1C 8.3. — Analytical mind, learning ability, initiative, responsibility.

Working conditions and compensation

— Work in a stable, developing company — Registration in accordance with the Labor Code of the Russian Federation — Social package — Work schedule 5/2, from 9.00 to 18.00

Published 04/24/2015. Valid until 05/13/2015.

The vacancy is archived: recruitment has been completed. Refer to other options in our catalog.

Below is a typical sample document. The documents were developed without taking into account your personal needs and possible legal risks. If you want to develop a functional and competent document, agreement or contract of any complexity, contact professionals.

This job description has been developed and approved on the basis of an employment contract with an accountant and in accordance with the provisions of the Labor Code of the Russian Federation and other regulations governing labor relations in the Russian Federation, as well as ___.

1. General provisions An accountant belongs to the category of specialists. A person with a specialized secondary (economic) education and experience in financial and accounting work of at least ___ is appointed to the position of accountant. Appointment to the position of accountant and dismissal from it is made by order ___. In his activities, the accountant is guided by: legislative, regulatory and methodological materials on issues related to the work performed; Charter ___; internal labor regulations; orders and instructions ___; orders of the chief accountant and his deputy; Regulations on the financial service ___; this job description. An accountant must know: legislative acts, regulations, instructions, orders, guidelines, methodological and regulatory materials on organizing accounting of property, liabilities and business transactions and reporting; accounting forms and methods ___; plan and correspondence of accounts; organization of document flow in accounting areas; the procedure for documenting transactions related to the sale of goods (work, services) in accounting accounts; labor legislation; rules and regulations of labor protection. The accountant reports directly to the chief accountant and deputy chief accountant ___. During the absence of an accountant (illness, vacation, business trip, etc.), his duties are performed by a person appointed in the prescribed manner, who is responsible for the proper performance of the duties assigned to him and acquires the corresponding rights.

2. Job responsibilities 2.1. The accountant must: 2.1.1. Issue invoices to customers for payment for goods, works, and services. 2.1.2. Issue documents to buyers for the sale of goods, works, services (acts, delivery notes, invoices, etc.). 2.1.3. Generate accounting and tax accounting entries for the sale of goods, works, and services. 2.1.4.

General provisions

This section describes the employee’s place in the structure of the enterprise and the requirements for his qualifications. It answers the following questions:

- to whom the employee reports (usually the chief accountant);

- who performs its functions during vacations and sick leave;

- who appoints the accountant to the position (CEO).

The first section indicates which documents the specialist is guided by in his work. Among others are listed:

- provisions of the Tax Code of the Russian Federation;

- articles of the Civil Code of the Russian Federation and the Code of Administrative Offenses of the Russian Federation;

- PBUs approved by the Ministry of Finance and regulating the procedure for reflecting settlements with suppliers in accounting;

- accounting policy of the organization;

- local acts of the company regulating internal rules.

The profession of an accountant requires qualifications, therefore the instructions state that the positions are accepted for persons with a specialized education of at least secondary education and with relevant experience of at least 3 years.

Tags: asset, accountant, personnel, loan, tax, order, expense

Basic provisions of the instructions

The section describing the main provisions of the instructions for the accountant on accounts payable and on primary documentation may include the following points:

- an accountant is appointed to this post by order issued by the general director and is dismissed in the same way;

- a proposal for his appointment or dismissal is submitted by the chief accountant of the company;

- This employee reports to the same official;

- the requirements for this accountant and the knowledge he needs are also indicated; they will be discussed below in the corresponding section of this article;

- it is prescribed that during the period during which the employee is absent, a person is appointed to his position to temporarily perform his duties, and he receives all rights in relation to payments to suppliers and bears due responsibility for them.

A list of regulatory sources that a specialist must follow is also provided. It includes:

- various legislative acts, orders, regulations and instructions:

- materials of a methodological and regulatory nature, which contain standards for the organization of accounting at an enterprise in relation to the company’s property, its obligations, as well as the rules for drawing up reporting documents;

- regulatory acts of a local enterprise, including labor regulations;

- orders and instructions of the general director of the company and the chief accountant as the immediate supervisor;

- the instructions themselves.

Responsibilities and tasks

The following is a list of the responsibilities and tasks of a accounts payable accountant.

At various enterprises it can be copied or shortened, excluding items from it whose content is irrelevant for a given company.

Accountant for payments to suppliers and primary documentation:

- primarily carries out direct settlements with suppliers;

- in addition, takes part in activities the purpose of which is to ensure discipline in the enterprise in financial matters and the reasonable use of funds;

- accepts from those who compiled and draws up documents that are considered primary, certifying events related to the economic life of the company;

- detects situations in which responsible employees committed violations of the document circulation schedule within the company or violations of the rules governing the transfer of accounting documents classified as primary;

- systematizes these documents drawn up during the ongoing reporting period on the basis of the approach adopted at the enterprise to their accounting;

- based on primary documents, compiles summary documents for general accounting;

- prepares the sending of accounting documents classified as primary to the archive, makes copies of them, including documents that are subject to seizure in accordance with the regulations of the Russian Federation;

- supplies the enterprise with information intended for conducting an inventory study of its capital and liabilities on the basis of existing accounting regulations;

- enters into accounting accounts all transactions for payment of goods from suppliers;

- monitors compliance with obligations towards suppliers in due time;

- makes entries in the sales book and purchase book;

- checks and registers invoices intended for payment, checks their compliance with contracts and sends them to the heads of the organization's structural divisions for approval;

- compares the calculation results with similar results obtained from suppliers;

- summarizes the facts of the economic and business activities of the enterprise;

- calculates account balances and results for analytical and synthetic accounting;

- collects information for the purpose of preparing the general ledger and balance sheet;

- draws up explanations, collects the required documents for the purposes of organizing internal control, auditing by departments within the enterprise and external organizations, as well as during a tax audit or audit of documents;

- transfers accounting registers to employees of departments authorized to seize them in accordance with Russian laws;

- deals with the systematization of accounting registers related to the reporting period, and also completes them.

- sends the accounting registers subject to this to the archive;

- creates copies of accounting registers at the request of departments entitled to receive them;

- enters into documents a description of the differences found between the information entered in the accounting registers and the actual state of affairs;

- provides factual information and comparable information related to product accounting to enterprise managers and other persons entitled to do so, in particular investors, creditors and employees of the audit company and others;

- makes proposals regarding the details of items used for accounting purposes;

- takes part in the development of primary documents for those types of operations for which there are no standard documents;

- also takes part in the development of documents intended for internal reporting;

- takes part in inventories;

- collects information in the field of accounting, which was entrusted to him;

- ensures the preservation of accounting documents;

- sends documents to the archive;

- creates a database containing accounting information that falls within the scope of his responsibility, maintains this database and is engaged in its preservation;

- changes regulatory and reference information that is used when performing operations with data.

Every week, a accounts payable accountant is required to submit:

- balance sheets for the previous week must be submitted by noon on Wednesday of the following week;

- The sales and purchases ledger for the previous week must be submitted by noon on Friday of the following week.

Every month the accountant is required to submit:

- balance sheets for the previous month - until the 12th of the next month;

- book of sales and purchases for the previous month - until the 16th of the following month.

Documents for download (free)

- Sample job description for accounts payable accountant

Requirements for a specialist. What should he know

The following requirements are put forward to the accountant for payments to suppliers based on primary documentation:

- higher or secondary vocational education in economics;

- Duration of work in the specialty for at least three years.

An employee applying for this position must have knowledge in the following subjects:

- legislation of the Russian Federation on accounting, tax legislation, regulatory legal acts in the field of pensions, social insurance and medical insurance;

- civil, customs and labor legislation;

- domestic law enforcement practice in the field of accounting and development of accounting documents related to primary ones;

- internal documents of the enterprise, which describe: the procedure for operations with accounting documents classified as primary;

- the procedure for assessing accounting objects;

- aspects of employee remuneration;

- details related to the grouping of data present in primary accounting documents;

What is the employee responsible for?

The Accounts Payable Accountant is responsible for:

- for improper performance of the duties assigned to him, described in these instructions;

- for other violations. including administrative, criminal, labor and civil legislation, in particular those related to causing material damage to the organization.

This video contains interesting and useful advice from Irina Khakamada on how to become a truly successful accountant and how to build a career in this field.