Features and types of expenses

A business trip means a business trip at the initiative of the employer. Its peculiarity is a clear time limit and execution through an order .

During this journey, the assigned employee performs a job assignment of a specific nature. A business trip has nothing to do with an increase in salary, voluntary dismissal or layoff of an employee.

The reporting documentation consists of papers relating to various aspects of the trip. A business trip involves monetary expenses related to the physical needs of the employee. They collect documents throughout the entire duration of the forced trip and then transfer them to the accounting department.

The start of a business trip is the date and time of departure of the authorized person, the end is the moment of arrival home.

The labor legislation of the Russian Federation regulates the reimbursement of certain types of expenses, including:

- Renting an apartment, room or hotel room;

- Fare;

- Additional payments for living in a foreign city;

- Expenses directly related to travel needs and made under the supervision of the employer.

The conditions of the work trip are regulated by the collective agreement and orders of the head of the organization. These include:

- Categories of citizens eligible for travel;

- Duration;

- Additional settings.

In some cases, when compiling documentary records, an organization is guided by local regulations.

Post-trip reporting

Travel allowances for employees are paid only if all supporting documents are presented. To receive compensation, you will have to account for every expense. Documents confirming accommodation in hotels are required. If the documents are drawn up incorrectly or are missing, the accounting department will refuse to reimburse travel expenses.

Table of reporting documents after a business trip

| Document's name | Design features |

| Employment agreement | It is not necessary to occupy a hotel room; you can rent a room or an apartment. The contract is drawn up in accordance with the requirements of Chapter 35 of the Civil Code. |

| Agreement for the provision of hotel services | The contract must comply with the requirements approved by Government Decree No. 1085 of 10/09/2015. The name of the performer and information about registration in the Unified State Register of Legal Entities are written. The room category, list of services and their cost are indicated. Check-out and check-out times will be confirmed. |

Residence documents must be drawn up correctly. If a person loses his tickets, the period of the business trip will be determined according to the accommodation agreement.

When do you need to submit documents?

When a business need arises to send an employee on a short or long-term business trip, the first step of management is to identify a suitable candidate for this. The task assigned to him can only be performed by a highly specialized specialist, if such is the specific nature of the business trip.

According to the content of the official legislation, only an employee who has an official working relationship with the company can be sent. If a certain person works with a company within the framework of a civil contract, then sending him on a business trip is impossible. The situation is similar with an employee who does not have any documented relationship with the company.

If there is an urgent need for a trip, it can be carried out after the fact. However, a huge drawback will be the refusal to reimburse expenses; all monetary expenses are not recognized as expenses by the tax authorities (Article 264 of the Tax Code). The only way out in this situation is for the employer to pay the costs in an “envelope”.

Formally, only persons who have previously entered into an employment contract with a specific company can go on business trips.

In practice, this point is neglected; managers often save on taxes and resort to tricks. They send the following categories of people on the trip:

- Representatives of companies with which partnerships have been concluded;

- Employees registered under an agreement, under a civil law contract;

- Freelance employees.

In the above examples, travel documents are not issued and the trip is not officially processed. In this case, the reporting papers are collected by the business traveler, since the organization takes into account the expenses and then reimburses them. The procedure for compensation payments in this case is provided in advance, in accordance with the type of work performed. An employee who is sent on a work trip must find out all the conditions so that upon his return he is not faced with an unpleasant surprise in the form of the inability to receive personal funds spent on the trip.

Nuances of accommodation

Housing rental costs are one of the main expenses when traveling on a business trip. After the end of the work trip, the employee is required to provide reporting documents for accommodation. They should be taken seriously; the accounting department cannot accept incorrectly executed documents.

Supporting documentation for the hotel

The best and most convenient accommodation option for your trip is a hotel. It is recommended to look for options and book a room in advance.

The hotel issues reporting documents for business travelers to confirm the fact of their stay at the hotel. Letter of the Ministry of Finance of the Russian Federation dated February 25, 2015 No. 03-07-11/9440 indicates that in the case when the hotel does not use cash register payments, the accommodating party is obliged to draw up a strict reporting form developed independently.

This form can have any name, for example, an invoice or a hotel check. Along with it, many hotels provide a cash receipt, which is issued after payment is made. It serves as confirmation of the costs to be reimbursed.

Problems rarely arise with the acceptance of such documents for accounting.

Hotel bill

To pay for hotel accommodation, one strict reporting form No. 3-G “Account” established for hotels is sufficient.

The invoice must reflect the following information:

- hotel details;

- Title of the document;

- number and date of its registration;

- information about the visitor (full name, passport details, registration address);

- date of arrival and departure;

- calculation of the cost of a room with allocated VAT;

- company seal and administrator signature.

If breakfast is included

Breakfast costs, indicated on the invoice as a separate line, are not recommended to be included in your stay. A budget organization will not pay for such expenses.

Letter of the Ministry of Finance dated October 14, 2009 No. 03-04-06-01/263 explains that if the cost of food is allocated as a separate item, the employee receives income in kind. According to the Ministry of Finance, compensation for food does not apply to reimbursement of living expenses, and therefore may be subject to personal income tax and insurance payments.

Other hotel services

According to clause 12 of clause 1 of Art. 264 of the Tax Code of the Russian Federation, additional hotel services are subject to payment, with the exception of meals in bars and restaurants and the use of recreational and health facilities. The most commonly used additional service is room reservations for employees. These costs must be reimbursed.

Some other services may require proof of economic viability for reimbursement.

Service apartment

Some enterprises have office apartments in other cities, or rent housing for posted employees. In this case, expenses are borne directly by the organization and reporting documents for daily living in an apartment are not provided.

Feasibility of a service apartment:

- a separate unit in another city, constant trips there;

- Frequent business trips of employees to one destination.

Rent from owner

Renting an apartment from a private person is not the best option. Problems often arise with documents, especially in budget organizations. For a posted worker, this option is only suitable when it is impossible to find other accommodation. It is necessary to draw up a written agreement with the owner, indicating the passport details of both parties. Be sure to review the ownership documents.

Parameters for concluding a contract:

- deadlines;

- cost of living;

- additional services (if available).

Nowadays “hotel in apartment” services are especially popular. Many real estate agencies provide them. Such housing can be found everywhere.

The main advantages of this type of hiring:

- low cost (you can meet the budget norm);

- large selection and territorial accessibility;

- you can save on food by using the kitchen;

- provide a package of documents.

There are no problems with reimbursement of costs in such apartments.

List of documents confirming expenses:

- rental agreement;

- certificate of completion;

- cash receipt or other payment documents.

Spending limits

The organization has the right to set limits on reimbursement of expenses for a posted employee. It is not always possible to meet the specified amount; a situation may arise when the limit of allocated funds is exceeded. In this case, when providing documents for the full cost of expenses, personal income tax is not withheld from the employee (paragraph 10, paragraph 3, article 217 of the Tax Code of the Russian Federation).

Master list of documents

The complete package of documents expanded in 2017-2018 includes:

- A travel order (a type of management order), which is prepared in advance using a standard form. The form must be filled out in format No. T-9 or No. T-9a in the case of several business travelers;

- Advance report . In its absence, a report on the funds spent drawn up by the business traveler is used;

- A time sheet for a calendar month or another period of time at the discretion of the accounting department, which indicates the days spent on the trip;

- Service note (required if traveling by your own car or other means of transport). Example for download;

- Travel certificate . Currently, this document is not mandatory. It is issued if, for example, the enterprise’s internal regulations provide for its mandatory nature;

- Service assignment in format No. T-10a. Another one of the documents that is not always necessary. If for some reason the task was generated, then the seconded citizen must fill out a report on it after returning.

Nuances

There is a group of workers whose duties are traveling in nature. For example, couriers. No separate documentation is required for travel. The order does not have to be issued. The rule was approved by Part 1 of Art. 166 of the Labor Code.

To register a trip, an organization can issue a certificate. An employee's lack of identification is not a violation. Previously, IDs were needed to show the date of departure to the destination and the date of departure.

Employees are also not required to file a trip report. There is no need to write a task for employees and check its completion.

The manager has the right to approve his own procedure for recording travel documents. This opportunity is provided by Part 1 of Art. 7 of the Labor Code. Employees draw up the documents approved by the employer.

The basis for filling out additional documentation for a business trip is an act adopted by the enterprise.

So, what documents are approved by the manager, these are the ones that employees will have to fill out. If there is a local act, then fill out the certificate and the official assignment.

Documents after the end of the trip

For financial reporting of his expenses and for further preparation of an advance report, the travel employee must provide the following set of documents:

- Official confirmation of living expenses;

Among them is an agreement with the hotel, an invoice or cashier's check issued and paid, it must bear a company seal, the details of the host party and the personal data of the guests must be included. When renting an apartment, you must provide a certificate of services performed, a lease agreement, and a receipt. An invoice and contract are usually provided for office space.

- Transport documents (tickets, receipts, travel passes, gas station receipts);

- Cash receipts for meals and purchases of necessary goods;

- Documentary evidence in the form of receipts for other expenses (communications and Internet, currency exchange, for example).

The organization will not pay for entertainment expenses, for example, services in cafes and restaurants, spa services, swimming pools. All expenses must be documented, and the paperwork must comply with the standards established by law.

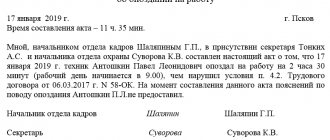

After an employee returns from a business trip, he needs to confirm that all assigned tasks have been completed in full. Otherwise, he may be fired from his place of work, citing various reasons - from absenteeism to inadequacy for the position held.

The following may serve as supporting documents:

- Certificate of participation in any event of a training nature;

- Documents confirming training, including a schedule of activities carried out and their clear plan;

- Diploma or papers on advanced training.

Many employers request a written report from the employee, where he sets out in free form the features of the skills and knowledge acquired during the trip. Often he needs such information for further work in the organization.

There are time limits; this package of documents must be submitted no later than 7 days from the date of arrival.

If an employee does not provide official evidence of travel expenses, the accounting department may refuse to pay compensation payments. All cash costs are entered into the database and displayed in accounting reports (monthly and annual). Any documents related to monetary expenses are filled out either on official letterhead or on simple ones, but with the obligatory indication of the details of the company where a particular employee works.

How to prove costs

Documents confirm how much time a person spent on a trip. Not everyone travels by train or plane. Often workers travel by their own car or motorcycle. Before the trip, a memo is written stating the period of absence. Drawing up a note is allowed in any form. Together with supporting documents, the note is presented to the head of the company. The note must be attached to the expense report.

On a business trip abroad, you also need to collect supporting documents. The time spent abroad is verified by the marks made in the passport. To confirm a work trip, you need to photocopy your passport with stamps. Documents for a business trip in 2020 in the CIS countries are travel documents. Tickets are used to check the date of border crossing.

Duration of business trip, categories of citizens

According to paragraph 4 of the Regulations on Business Travel, its terms are set by the employer. This takes into account the complexity of the upcoming task, the actual amount of work that needs to be completed, and other nuances of the assignment. Currently, the deadlines for official travel are not established by law; everything depends on the decision of the head of the organization.

The moment of departure is the date and time of departure of transport from the place of work. The day of arrival is considered the time and date of arrival of the vehicle at the actual address of the organization from which the employee was sent. If the vehicle leaves before 24 hours, then the current day is considered the day of departure. Starting from 00 o'clock, the day of dispatch is the next day.

The Labor Code of the Russian Federation provides for some restrictions that the employer must pay attention to. There are several categories of citizens who cannot be sent:

- If an employee works under a student contract and the trip disrupts the educational process (for example, it does not allow him to attend an exam), in this case he can leave after completing his studies or for a time not related to the need to be present at the university;

- Pregnant women do not go on business trips, regardless of the stage of pregnancy;

- Minor workers, with the exception of creative individuals or representatives of professions such as journalists or athletes;

- Women who have young children have the right to refuse a business trip without giving written consent to the trip.

The employer must warn the employee in writing that he has the right to refuse a business trip. This point applies to those raising a child alone (mothers and fathers), guardians of children under 5 years of age, persons raising a disabled child and workers caring for seriously ill relatives.

According to Article 166 of the Labor Code of the Russian Federation, other categories of employees are required to go on a business trip if management considers it necessary. Otherwise, the refusal is regarded as a deliberate violation of labor discipline. This may result in disciplinary action.

Supporting documents

note

If you are planning a business trip abroad, you should worry about obtaining a foreign passport in advance. We will tell you what documents you will need for this in this article.

Since, according to the Labor Code of the Russian Federation, reimbursement of expenses during a business trip is made only with supporting documents, the employee is required to provide reporting documentation.

Reporting documents for business travelers are divided into two main categories: confirming travel and confirming the employee’s accommodation. The first of these includes travel tickets and boarding passes.

To confirm the second type of expenses, you must provide:

- checks for hotel accommodation;

- cash account for food and other necessary goods;

- invoice;

- lease contract;

- receipt for the provision of various services.

If an employee lived with a private person during a business trip (renting an apartment or room), he must be provided with a rental agreement.

Watch the video about the specifics of arranging a business trip:

News 2021, design features and requirements

If an employee went on a business trip and upon returning only partially completed the task given to him, the head of the organization has a legal basis to reduce his salary and refuse to pay daily allowance. No fines are imposed if the task is not completed due to an emergency or unforeseen circumstances that are not the fault of the employee.

Updates to legislation in 2021 allow you to go on such a trip without a travel certificate . Such documents are not used in all organizations, but only in those where this is provided for by the charter.

Travel allowances

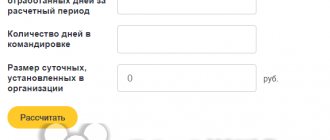

To determine the final amount of the travel allowance, it is calculated how many days the employee spent on the trip. Taking this into account, the number of calendar days that the traveler would have worked in his position and received an average salary is calculated.

The average salary is calculated based on preliminary calculations, taking its amount for the previous 12 months. If earnings a year ago were significantly less than current earnings, the employer can compensate for this difference in the process of paying travel allowances. In this case, he is guided by the collective agreement, and the corresponding internal documents are drawn up.

Frequent business trips should not affect the employee’s financial well-being. The legislation approves the amount of daily allowance, which is not subject to personal income tax. 700 rubles for trips within the Russian Federation and 2,500 rubles when traveling abroad. Additional tax is withheld if the payment amount is higher than these figures.