Business trip: paperwork in 2021

Since travel certificates have been cancelled, documenting business trips has become much easier.

We will tell you in our article about the rules for registering business trips that are in effect in the current 2021 and will “work” in the next 2021. We will explain what documents need to be completed and what amount of daily allowance a company (entrepreneur – employer) is entitled to pay when sending its employee on a business trip.

Travel certificates

This type of document, such as a travel certificate, was abolished back in 2015. The obligation to draw up a job assignment, in which we previously described the purpose of the business trip, has been cancelled.

To be precise, the obligation has been cancelled, but the very right to draw up the above documents has not been canceled. Therefore, if the employer believes that he needs such a document, then he has the right to draw it up.

Daily allowance

Each company has the right to set its own daily allowance. As a rule, the conditions for issuing and the amount of daily allowance are stipulated in the collective labor agreement. But it should be remembered that, based on Article 217 of the Tax Code of the Russian Federation, the maximum amount of daily allowance on which personal income tax is not charged is:

1) for business trips in Russia – 700 rubles,

2) for foreign business trips – 2500 rubles.

As noted in paragraph 3 of Article 217 of the Tax Code of the Russian Federation, when the employer pays the taxpayer expenses for business trips both within the country and abroad, the income subject to taxation does not include daily allowances paid in accordance with the legislation of the Russian Federation, but not more than 700 rubles per day. each day you are on a business trip in the Russian Federation and no more than 2,500 rubles for each day you are on a business trip abroad.

Procedure for issuing travel allowances

Let us present you with step-by-step instructions on the procedure for completing documents:

1. Deciding on the need for a business trip. The proposal can be formalized by a memo from the director of the enterprise or his decision.

2. Issuing an order to go on a business trip.

3. Making marks on the working time sheet.

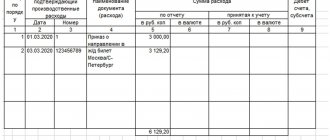

4. Receiving an advance report and a report on the work done from the employee.

5. Reimbursement of expenses incurred “in excess” of the advance payment given to the employee.

How to issue an order correctly?

Any business trip must be formalized by order on Form T-9 or another form approved by the director. The order is issued based on the manager’s decision before the employee’s departure. It states:

- Full name, position, structural unit of the traveler;

- destination (country, city, company);

- duration and dates of travel;

- target;

- funding organization;

- basis for issuing the order.

The document is endorsed by the director. It is also necessary to familiarize the employee sent on a business trip with it.

Additional compensation for foreign business trips

An employee who is sent on a business trip to the territory of a foreign state is additionally reimbursed for:

a) costs for obtaining a foreign passport, visa and other travel documents;

b) mandatory consular and airfield fees;

c) fees for the right of entry or transit of motor transport;

d) expenses for obtaining compulsory medical insurance;

e) other obligatory payments and fees.

Advance report – submission deadline

Upon returning from a business trip, the employee must submit to the employer within 3 working days:

– documents on the rental of residential premises;

– documents on actual travel expenses (including payment for services for issuing travel documents and providing bedding on trains) and other expenses related to the business trip.

Rules for accommodation on a business trip

An employee’s business trip always begins with the preparation and signing of a business trip order - a document confirming the employee’s action in the interests of the company, and not for the realization of personal goals. This document is signed by both the employer and employee.

Upon returning from a trip, the company reimburses the employee for accommodation on a business trip, as well as other expenses incurred during the trip. The limits and procedure for issuing compensation are determined by the internal rules enshrined in the local acts of the organization.

It is important to remember that:

- Expenses for temporary housing during a business trip must be reimbursed from the employer's budget.

- Paying for accommodation on a business trip requires the employee to have documentation confirming the fact of staying at a hotel or inn - these can be certificates, receipts, invoices indicating the date of arrival, departure and cost of accommodation.

- It is impossible to refuse to pay a posted worker for accommodation during a business trip if there is an order and supporting documents - regardless of the type of organization, compensation is made in accordance with local regulations.

- The head of the company can set limits on funds for reimbursement of accommodation - in budget companies such limits are set in order to save public funds.

Please note that expenses for an employee's accommodation on a business trip are accepted for reimbursement in full according to the provided invoices or receipts for payment of the room. The Tax Code of the Russian Federation does not establish restrictions on the limit of travel expenses, however, during the next audit, the tax authorities may be interested in compensation for accommodation in hotels with increased comfort. To avoid disputes and fines, the living conditions of employees of different departments and positions should be specified in detail in the local regulations of the organization, for example, in the Business Travel Regulations.

In companies with a large volume of business trips, the risk of missing trips with exceeded accommodation or transport limits due to human factor increases. Automating business trips, for example, using the Hamilton Business Travel online application, can help prevent this. All company limits and policies are easily included in the application logic, so when registering a business trip online, both the seconded employee and his manager immediately see the violation icon.

GO TO APPLICATION

Business trip without documents

R. Yaroshenko, tax lawyer

Anything can happen to a posted worker on the road. For example, he may lose documents confirming travel and accommodation. How, in this case, can you compensate for his expenses and not end up on taxes?

How to confirm travel?

Expenses of a posted employee must be supported by supporting documents. The only exception to this rule is per diem. They are paid for each day you are on a business trip, and their total amount is recorded only in the advance report. No reporting documents on spent daily allowances need to be attached to the advance report.

Another thing is travel costs. They are confirmed by air or train tickets. But what to do if an employee has lost his tickets? He can write a statement that the tickets are lost and ask for reimbursement of expenses incurred. But paying such compensation will have certain tax consequences for both the enterprise and the employee.

First of all, we note that it will most likely not be possible to compensate the entire amount of travel expenses incurred by the employee. The fact is that, according to paragraph 19 of the instructions of the Ministry of Finance of the USSR, the State Committee for Labor of the USSR and the All-Union Central Council of Trade Unions dated April 7, 1988 No. 62 “On official business trips. ", payment for travel in the absence of supporting documents is carried out at the minimum cost (hereinafter referred to as instruction No. 62).

In other words, if an employee loses his tickets, the head of the company has the right to decide to reimburse expenses at the cost of the cheapest transportation to the place of business trip and back.

Thus, the basis for reimbursement of travel costs will be an application from a posted worker with a manager’s visa and an indication of the amount of compensation determined at the minimum cost, which must be confirmed by a certificate from the transport service.

The amount of compensation paid upon application cannot be accepted in tax accounting. And all because there is no primary document - therefore, there is no documentary evidence. And it is the main condition for accounting for expenses when calculating income tax (clause 1 of Article 252 of the Tax Code of the Russian Federation).

There is no need to accrue unified social tax and insurance contributions to the Pension Fund on the amount of compensation. After all, unified social tax is not subject to payments that do not reduce the taxable profit of the organization (clause 3 of article 236 of the Tax Code of the Russian Federation). Insurance contributions to the Pension Fund are calculated on the same payments as the Unified Social Tax. This is established by paragraph 2 of Article 10 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation”.

Business trip expenses

The posted worker is paid:

- daily allowance;

- expenses for renting residential premises;

- travel expenses (which ones are specified in clause 12 of the Regulations approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749);

- other expenses (for example, communication or postal services, visas and passports, consular and airport fees, etc.) made with the knowledge of the company.

As for reimbursement of travel expenses, in addition to travel to the final destination and back, the Federal Tax Service of the Russian Federation allowed reimbursement of expenses for public transport at the place of business trip. Of course, the business traveler must confirm them with tickets and checks, and the company must provide for reimbursement of such travel expenses in the collective agreement or regulations on business trips (letter of the Federal Tax Service of the Russian Federation dated July 12, 2011 No. ED-4-3/11246).

Daily allowance for a business trip

Per diems are usually used to pay for food and other personal needs of the posted worker. They are paid for each day he is on a business trip, including weekends and holidays, as well as days the posted worker is on the road. The amount of daily allowance paid to employees sent on a business trip is established by a collective agreement or local regulation (for example, by order of the manager).

Comparison: with and without documents

If you have documents:

If the employee (taxpayer) provides the employer with all the necessary documents for housing expenses, then he pays the employee everything except the daily allowance. For example: in one day, he can pay an employee located within the country no more than 700 rubles, and outside the country no more than 2,500 rubles per day in 2021. Plus expenses for travel and other services, including for renting residential premises (paid baggage allowance, communication services and similar secondary expenses).

If there are no supporting documents:

If the employee (taxpayer) does not submit papers confirming the expenses for housing, since there are none, then the amounts of all the above payments for accommodation without supporting documents on a business trip are immediately exempt from any taxation. The rest remains the same: within the country, the employer can pay no more than 700 rubles, and outside the country no more than 2,500 rubles per day in 2021. But you can hardly expect money for additional expenses, but sometimes you can.

Here you can clearly see that only the payment for the conditions of being on a business trip changes.

Failure of a seconded employee to provide documents confirming housing costs

An employee of the organization returned from a business trip to the territory of the Russian Federation. The business trip was carried out as part of the organization’s commercial activities. Upon returning from a business trip, the employee demanded reimbursement of expenses for paying for living quarters, but did not provide documents confirming his expenses for renting living quarters. What amount, not confirmed by documents, can an organization compensate an employee for paying for housing for each day he is on a business trip in the Russian Federation? How much of the cost of paying for accommodation on a business trip, not documented, but reimbursed to the employee, is exempt from personal income tax? What amount of expenses for paying for accommodation on a business trip, not documented, but reimbursed to the employee, can be attributed to expenses for the purpose of calculating income tax?

Content

Regarding personal income tax. According to paragraph 3 of Art. 217 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), all types of compensation payments established by the current legislation of the Russian Federation (within the limits established in accordance with the legislation of the Russian Federation), related, in particular, to the performance by the taxpayer of labor duties (including reimbursement of travel expenses).

Paragraph 10 of this paragraph stipulates that when the employer pays the taxpayer expenses for business trips both within the country and abroad, the income subject to taxation does not include actually incurred and documented targeted expenses, in particular, for the rental of residential premises.

If the taxpayer fails to provide documents confirming payment of expenses for renting residential premises, the amount of such payment is exempt from taxation in accordance with the legislation of the Russian Federation, but not more than 700 rubles. for each day of a business trip on the territory of the Russian Federation and no more than 2,500 rubles. for each day you are on a business trip abroad.

Thus, if an employee of an organization fails to provide documents confirming payment for housing while on a business trip on the territory of the Russian Federation, the amount of reimbursement by the organization for these expenses is exempt from personal income tax up to 700 rubles. for each day you are on a business trip.

Amounts of reimbursement by the organization of the employee's expenses for renting housing that exceed the amounts established in paragraph. 10 clause 3 art. 217 of the Code are subject to personal income tax in the prescribed manner.

Regarding income tax. According to Art. 168 of the Labor Code of the Russian Federation, the employer reimburses an employee sent on a business trip for travel expenses, expenses for renting living quarters, daily allowances and other expenses incurred with the permission or knowledge of the employer.

The procedure and amounts for reimbursement of travel expenses are established in a collective agreement or local regulation.

In accordance with clause 26 of the Regulations on the peculiarities of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 N 749, upon returning from a business trip, an employee is obliged to submit to the employer within 3 working days an advance report on the amounts spent in connection with the business trip and make final payment for the advance payment for travel expenses issued to him before leaving for a business trip. Attached to the advance report is a duly executed travel certificate, documents on the rental of accommodation, actual travel expenses (including an insurance premium for compulsory personal insurance of passengers on transport, payment for services for issuing travel documents and the provision of bedding on trains) and other expenses related to the business trip, a report on the work performed on the business trip, agreed upon with the head of the employer’s structural unit, in writing.

In accordance with paragraphs. 12 clause 1 art. 264 of the Code, other expenses associated with production and sales include travel expenses. These expenses take into account the costs of travel to the place of business trip and back to the place of permanent work, rental of living quarters, daily allowances, registration and issuance of visas, passports, vouchers, invitations and other similar documents, consular, airfield fees, fees for the right of travel, passage and other similar fees and charges.

In this case, travel expenses must comply with the requirements of Art. 252 of the Code.

According to paragraph 1 of Art. 252 of the Code, expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Code, losses) incurred (incurred) by the taxpayer.

Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form.

Documented expenses mean expenses supported by documents drawn up in accordance with the legislation of the Russian Federation.

Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

If the expenses incurred do not meet these requirements, then on the basis of clause 49 of Art. 270 of the Code, such expenses are not taken into account for income tax purposes.

Thus, if the costs of renting residential premises by a posted worker are not documented, then the organization does not have the right to reduce the tax base for income tax for these costs.

Reason: Letter of the Ministry of Finance of the Russian Federation dated April 28, 2010 N 03-03-06/4/51

A selection based on materials from the Financier information bank of the ConsultantPlus system. Compiled by Kashirskaya E.V.

Legal documents

- Art. 217

- Art. 168

- Decree of the Government of the Russian Federation of October 13, 2008 N 749

- Art. 264

- Art. 252

- Art. 265

- Art. 270

- Federal Law of December 3, 2008 N 241-FZ

Accommodation without supporting documents

If there are no papers that can confirm all the expenses for renting housing at the place of business trip, this does not mean that the employee does not receive compensation, since now, in 2021, very often everything is decided in favor of this employee.

And so it is clear that when leaving, an individual must have somewhere to live, and the organization for which he worked is simply obliged to give him at least some part of the funds to cover such expenses. It happens that these funds can be written off from an advance already issued. The organization itself allocates the amount, and its value will still be less than the actual cost of the employee.

Important! If possible, you can request the average price for renting housing from a real estate agency and proceed from this average price in all other proceedings.

What is it for? In court proceedings without documents, guided only by words (if it comes to this), the judge will not understand, and the case will come to nothing.

Travel allowances , of course, will be paid, but with these third-party costs for housing, without documents, it will not be possible to expect anything more.

Lack of documents for renting housing from private individuals

Documentation

Renting an apartment, room from a private person or living together with him also requires a written agreement (document), which must indicate: rental payment (cost), term (for which it is rented), responsibilities and various rights of the landlord.

And to conclude an agreement, you only need the passport of both persons. It is highly recommended to check all the landlord’s documents and make sure that this is his apartment or room, ask for an extract and a document on ownership rights. Problems with all this should not arise if the landlord turns out to be a conscientious person, and even if this is not the first time he is renting out an apartment, then he is already accustomed to such questions and requests and this is normal for him.

Accountants who represent the organization in which the person taking the hire works want him to be sure to issue all powers of attorney to conclude an agreement in the name of that very organization. But more often than not, this is not necessary. If there is an order specific to this topic from the director of this company, which states why, where and for what purpose the employee went, for what job, etc., and a housing rental agreement, which is given for a certain time (how long it is valid given order), the accountant will not have any claims against you.

Payment

It would be better to pay for rental housing on a business trip using the owner's receipt and cash. The receipt will be able to confirm what the expenses were, all this to facilitate the work of the accounting department, plus, everything will be accepted by the tax inspectorate.

All expenses for accommodation on a business trip without supporting documents that were reimbursed by the director or employer will not be subject to personal income tax, but insurance premiums will not be charged either.

All you need to do is collect all the required documents and ask them to fill them out, because in the future they will be able to confirm all payments for accommodation.

Writing off expenses for accommodation on a business trip

Hello. I am a beginning manager of LLC USN (income-expenses), I am going on a business trip to buy equipment in the city where my son has housing. I will live with him for 3-4 days. Is there some document according to which I can “write off” some amount (for example, 1000 rubles per day) as expenses to reduce taxes without providing any documents other than train tickets.

Regards, Yuri.

Quote: Living without documents. The letter of the Ministry of Finance of Russia dated 04.28.10 No. 03-03-06/4/51 discusses the situation when an employee returned from a business trip and demands reimbursement for living expenses, but he does not have documents indicating the living expenses he incurred.

In our opinion, it is quite possible to refuse such an employee. According to Art. 168 of the Labor Code of the Russian Federation, in the event of being sent on a business trip, the employer is obliged to reimburse the employee, including the costs of renting living quarters. However, the expenses must be made with the permission or knowledge of the employer. And if there are no documents confirming the expenses, how can the employer give permission for expenses if he has no idea about them?

In addition, in accordance with clause 26 of the Regulations on the specifics of sending employees on business trips, approved. By Decree of the Government of the Russian Federation dated October 13, 2008 No. 749, upon returning from a business trip, an employee is obliged to submit to the employer within 3 working days an advance report on the amounts spent in connection with the business trip. Attached to the advance report are, among other things, documents on the rental of residential premises. Agree that expenses that are not supported by documents cannot be included in the expense report.

However, the employer may still agree to pay the costs of renting housing according to the posted worker.

In this case, the employee will not even have to pay personal income tax if the compensation amount is less than 700 rubles. when traveling around Russia. This is expressly stated in paragraph 3 of Art. 217 Tax Code of the Russian Federation. For compensation above this amount, personal income tax will have to be paid.

As for income tax, everything is sad here. The employer will have to show generosity exclusively beyond the scope of tax expenses.

On the one hand, in accordance with paragraphs. 12 clause 1 art. 264 of the Tax Code of the Russian Federation, other expenses associated with production and sales include travel expenses. These expenses include, among other things, the costs of renting residential premises.

On the other hand, all tax expenses are subject to the requirements of Art. 252 of the Tax Code of the Russian Federation. According to paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, expenses are recognized as justified and documented expenses incurred by the taxpayer. No documents - no expenses

Legal Aid Center We provide free legal assistance to the population

Lack of documents for hotel accommodation

Documentation

We sorted out the rental of housing, but what happens if the person who lived in a hotel on a business trip does not bring any documents: no check, no receipt, etc.?

Of course, if the documents were accidentally lost, you can easily request a certificate or any other document that confirms the fact of residence by calling the hotel.

There is one thing that is worth paying attention to - the certificate from the hotel must describe in detail what services the hotel provided, etc., but the company that sent the employee must provide documents that will establish how long the employee was on site, and exactly what hotel he was in.

Accommodation expenses on a business trip – you can’t do without documents

Accommodation expenses on a business trip are one of the significant components of the costs of employee business trips. In addition to paying for travel to the business trip, the company also pays for hotel accommodation. Accounting for expenses for the purpose of calculating income tax is carried out on the basis of primary documents, just like accounting. What documents can a business traveler confirm that he used the hotel’s services and paid for them?

Accounting documents

Hotels usually issue guests an invoice for services. But not every account is suitable for confirmation. Many hotels still continue to use the outdated form of the strict reporting form “Account” (Form No. 3-G). Previously, indeed, he confirmed both hotel accommodation and payment for it. Now this form is not used and the organization to which the employee brought such a document cannot take into account the cost of accommodation on a business trip when calculating the amount of income tax. The Ministry of Finance has repeatedly confirmed this position, directly indicating this in its letters (No. 03-01-15/8-400 dated 08/07/2009 and No. 03-03-06/1/556 dated 08/18/2010).

Employees of the Ministry of Finance write that, as stated in paragraph 3 of the Regulations approved by Resolution No. 359, an organization can independently develop a strict reporting form and the hotel can use such forms for issuance to clients. If such a document contains all the required details, then the expenses indicated there can be taken into account when calculating income tax. Hotels that use cash registers will issue a cash receipt as proof of payment. When paying for hotel services with a bank card, the posted employee must also be given either a strict reporting form or a check. The card account statement will not be enough to record the amount as expenses. The Ministry of Finance wrote about this in letter No. 03-03-06/1/666 dated October 16, 2009.

On the application of the VAT deduction, employees of the Russian Ministry of Finance wrote letters No. 03-07-11/638 dated December 21, 2007 and No. 03-07-11/323 dated December 23, 2009. In these letters they clearly state that the VAT amount should be indicated as a separate line in the hotel invoice, drawn up on a strict reporting form in accordance with all the rules. In this case, the organization can safely accept the allocated VAT for deduction.

Extra comfort

Often executive employees of companies stay in luxury or junior suites, the so-called superior rooms. Often such cases attract the attention of tax officials. But if such a possibility is provided for in management’s employment contracts, then there should be no claims from the tax authorities. You can also write this down in the collective agreement with employees, providing increased comfort for management.

Almost all hotels provide meals to guests. Whether it's a restaurant, a cafe, or breakfast included in the bill, the organization faces the question of whether to include food costs in the cost of accommodation on a business trip. Here you need to carefully analyze the submitted documents. Daily allowances are provided to business travelers to pay for food. Therefore, if the hotel has highlighted the cost of food in the bill as a separate line, the company will not be able to take it into account in the amount of living expenses and will have to pay personal income tax on it (letter of the Ministry of Finance of the Russian Federation No. 03-04-06-01/263 dated October 14, 2009).

The letter from specialists from the Ministry of Health and Social Development of Russia (No. 2538-19 dated 08/06/2010) gives an answer to a similar topic - are the cost of hotel services subject to insurance premiums if the price list includes the cost of breakfast in the room price? Officials say that in such a situation, contributions are not assessed. In this case, breakfast is usually not mentioned in the bill at all, and if it is indicated, then without highlighting its cost. Apparently, if you had to pay for breakfast separately, the opinion of experts would be different.

If there is no documentary evidence

The same letter provides an explanation of another issue - the imposition of insurance premiums on the costs of renting accommodation on a business trip. If expenses are not documented, they are subject to insurance premiums.

What about other taxes if an employee, reporting on a business trip, did not confirm payment for accommodation with documents? But such situations are not uncommon, especially in large organizations. For example, a posted worker lost his hotel account or stayed with relatives while on a business trip.

When calculating income tax in such situations, the usual rule applies - there is no document confirming that the posted employee lived in a hotel, and there is no expense for income tax. This means that the company will not be able to reduce the income tax by the amount of payment for accommodation, even if it paid the employee this amount according to the advance report.

But regarding the accrual and payment of personal income tax on unconfirmed expenses, there is a very specific answer in the Tax Code of the Russian Federation (clause 3, article 217).

If the organization has not submitted documents confirming payment of housing rental costs, the amount of such payment is not subject to personal income tax, but in the amount of no more than 700 rubles for each day of a business trip in Russia and no more than 2,500 rubles for each day of a business trip abroad. Cost of services

About accommodation services provided by the company itself

It may be that business trips from the company are always assigned to the same place, and for this the company rents an entire apartment building or separate, multi-room apartments.

In this case, the company itself pays for all accommodation, but the following question may arise: does the organization take into account all taxes for the costs and profits of renting apartments? The answer will be yes, but only for a certain period of actual residence.

If the contract is concluded, for example, for a year, then the period for all employees participating in the business trip, who take turns living in this place, will be 11 months, and the remaining twelfth month will be considered an unreasonable expense of the company.

Features of payment for business trips in a budget organization

An employee who goes on a business trip must receive compensation for the following expenses:

- Directions;

- Renting residential premises for further residence;

- Optional costs that do not relate to the place of accommodation on a business trip;

- Other expenses previously agreed upon with the employer.

In the Soviet Union, employees were also sent on official trips. They had to follow the approved instructions of the USSR Ministry of Finance.

Government Resolution No. 749 came into force . It indicates the features that need to be taken into account when sending an employee on a business trip. The new document made it possible to clarify the wording and supplement a number of requirements that had already been approved in Instruction No. 62. The official regulation supplemented the definition related to business travel.

How is a business trip paid without supporting documents?

The employer has the right to pay all employee expenses that are taxable. Per diems are not included in this category. However, he is obliged to pay 700 rubles daily if the employee’s business trip is within the country. Employees sent abroad will have to pay 2,500 rubles daily. Additionally, it is worth taking into account documented expenses that relate to the target trip.

These are:

- Travel to the place of temporary work;

- Additional fees for airport services;

- Commissions and expenses for the station and airport;

- Baggage transportation;

- Renting premises;

- Visa payment, as well as expenses incurred as a result of cash currency exchange.

Often employees do not provide all the documents that confirm their expenses. In this case, the employer can calculate the average number of days spent at the hotel, transport ticket, etc. After the average value is calculated by the accountant, the employee is given funds. The amount is also taxable.

Amount of payment for accommodation on business trips

Sometimes an employer cannot pay the full cost of accommodation on a business trip due to the lack of a strict reporting document. Today, every hotel has a similar official document, which contains a number of requirements. If at least one condition is not met, the document cannot be submitted to the BSO. Therefore, if an employee brings such a document as confirmation, he may have problems with calculating travel allowances in the absence of taxation.

The document must contain all the details, the list of which is presented in Government Regulations under number 359, without the use of cash register equipment. Such a document must contain the following details:

- Title of the official paper;

- A series of documents;

- Name of the organization that provides the services;

- Actual address and stamp.

To receive the full amount for your hotel stay, you must provide the appropriate official paper. Please note that this official paper cannot be produced on a simple computer. Automated systems must be used. They have strict security and retain documentation for at least five years.