Payment of sick leave from 2021

From 01/01/2021, temporary disability benefits (for illness or injury) throughout the country are paid according to the rules of the “pilot” project:

- the employer issues benefits for the first 3 days of illness;

- The employee receives the rest from the Social Insurance Fund.

In cases of sick leave:

- caring for a sick family member;

- for quarantine of an employee, his child under 7 years old attending kindergarten, or an incapacitated family member of the employee;

- for prosthetics for medical reasons in a hospital;

- when providing follow-up treatment to an employee in a sanatorium-resort organization on the territory of the Russian Federation immediately after providing him with medical care in a hospital,

The Social Insurance Fund pays benefits in full starting from the first day.

In order for social insurance to calculate benefits, the employer must send it a register of sick leave and the documents necessary for the calculation. You will find a list of such documents for all types of benefits in ConsultantPlus. You can view the material by getting free trial access to the system.

The benefit is accrued no later than 10 calendar days from the date of receipt of sick leave from the employee. The employer issues the money on the next day after the settlement date established for the payment of wages. Social insurance pays funds within 10 calendar days from the date of receipt of documents (information) or a register of information from the employer.

For example, if an employee submitted sick leave on January 15, and the salary payment deadlines are on the 5th and 20th of each month, then the benefit must be paid no later than February 5.

Until 2021, we recall that payment for sick leave was carried out in 2 ways: by the employer with subsequent reimbursement of Social Insurance benefits or directly by the social insurance department - depending on whether the region in which the insurer operated was included in the Social Insurance pilot project.

Registration and payment of sick leave in 2021

It should be noted that sick leave can be issued to an employee in case of illness or as a result of an injury. In this case, the injury can be both industrial and domestic.

In addition, sick leave can be issued in the following situations:

- due to a child’s illness;

- during quarantine (when there is reason to believe that the employee is infected);

- for the patient’s recovery after surgery;

- caring for an adult close relative;

- on pregnancy and childbirth.

Please note that the number of sick days may vary and depends on certain factors. For example, sick leave for caring for an adult can only be accrued for the first three days.

Maternity sick leave is paid for everything from 140 to 194 days. The number of days of paid maternity leave depends on the characteristics of the pregnancy and childbirth. Maternity benefits are a big topic and will be covered in our other article. Let's look at the main points here.

Maternity benefits are not paid to unemployed women, with the exception of:

- female students studying full-time;

- unemployed women dismissed due to the liquidation of an enterprise or registration of termination of the activities of an individual entrepreneur;

- unemployed women who are wives of conscripts with an officially registered marriage.

Domestic injuries must be paid on the sixth day of illness. After the operation, the period of sick leave cannot exceed 12 months (if there is a conclusion from the VKK).

Types of disability and rules affecting the procedure for calculating benefits

The rules for calculating sick leave in 2021 generally remain the same as in previous years. However, they must be applied taking into account the fact that the values of the parameters influencing the determination of the maximum and minimum benefits have become different.

Let us remind you that for the calculation of benefits it matters:

- number of days of sick leave;

- average daily earnings (ADE), calculated for a certain period preceding the sick leave, and its maximum and minimum possible amounts;

- the maximum period for which sick leave can be paid;

- the presence or absence of the need to use coefficients.

Situations in which an employee is issued sick leave can be divided into the following groups, each of which has its own features for calculating the amount of benefits:

- ordinary disability of the employee not related to work-related injuries;

- incapacity for work due to caring for a sick relative;

- woman's incapacity for work caused by going on maternity leave (Maternity leave);

- disability caused by a work injury.

Recommendations from ConsultantPlus experts will help you fill out sick leave correctly. Get free access and go to the Ready Solution.

Despite the fact that the issues of providing benefits for the first three groups and the last are regulated by different laws (“On compulsory social insurance...” dated December 29, 2006 No. 255-FZ and “On compulsory social insurance...” dated July 24, 1998 No. 125-FZ), the procedure for their calculation is the same (Clause 1, Article 9 of Law No. 125-FZ). Therefore, for each of the listed situations, the general principles on which the calculation is based are valid:

- equal length of the period taken to determine the data (2 years);

- the same requirements for income (they must be subject to insurance premiums) and the actual number of days of the calculation period (not all days can be taken into account);

- the presence of restrictions on the maximum and minimum possible payment amounts.

The differences between the selected groups are due to the fact that for some of them special rules of determination apply:

- the total number of days characterizing the full billing period;

- the amount of the maximum possible benefit;

- number of paid days on sick leave;

- the magnitude of the reducing factors applied to the calculated amount.

In addition, there are differences in who (partially the employer or 100% Social Insurance Fund) pays the benefit, as well as the possibility of paying it after the employee’s dismissal and the need to withhold personal income tax from the benefit. These points do not have a fundamental impact on the calculation itself, so we will not consider them.

Read about the rules for taxation of sick leave payments with personal income tax in the material “Is sick leave (sick leave) subject to personal income tax?”

Calculation of sick leave in 2021 for a part-time worker

To calculate sick leave payments for a part-time worker, it is necessary to take into account the amount of income from all places of his work. The benefit is accrued according to the document from the main place of work. To do this, the employee must bring to the organization or enterprise a certificate of income, Form 4H, from all companies where he has worked for the past two years.

A part-time worker who has worked at the same enterprises for more than two years is paid benefits for all organizations (enterprises). Each organization must provide the original sick leave certificate.

If the payment limit has been exceeded, the benefit is calculated based on the limit amounts that are established for the current year.

If a part-time worker worked for two years in only two companies, and at the time the sick leave was issued, he began working in several more organizations, then the benefit can be paid only in one company (of choice).

In order for the payment to be accrued, it is necessary to bring not only a certificate of income from each company, but also a certificate that confirms the fact of non-receipt of payment of this benefit from all organizations.

Formula for calculating sick leave payments and maximum benefit amount

How to calculate sick leave in 2021? The formula for calculating sick leave payments in 2021 is still the number of days of sick leave to be paid, multiplied by the SDZ determined for the billing period, and by a reducing factor, if its application is necessary (clauses 4, 5 of Article 14 of Law No. 255-FZ).

For each of the above four groups, the two full calendar years preceding the year of sick leave are taken as the calculation period for which the SDZ will be calculated. In general, the number of days in them is considered to be 730 (Clause 3, Article 14 of Law No. 255-FZ).

Does leap year affect the calculation of sick leave benefits? You will find the answer to this question in the Ready-made solution from ConsultantPlus. Trial access to the system can be obtained for free.

To calculate sick leave according to BiR, days will have to be counted according to the fact, i.e., taking into account the increase in their number in leap years (clause 3.1 of Article 14 of Law No. 255-FZ). And since this calculation allows (due to the lack or insufficiency of income) the replacement of one or two years from the period with the years preceding them, the duration of the calculation period for leave under the BiR may be equal to 731 or 732 days (FSS letter dated 03/03/2017 No. 02 -08-01/22-04-1049l).

To determine the value of SDZ, the income received during the billing period must be divided by the total number of days in it. But neither the income nor the number of days can include values related to payments that are not subject to insurance contributions to the Social Insurance Fund (i.e., for example, days on sick leave and payments for it will not be included in the calculation).

It should be borne in mind that payment for sick leave for an industrial injury is made at the expense of “accident” contributions, calculated according to the rules reflected in Law No. 125-FZ. That is, the list of income covered by these contributions may differ from that given in the Tax Code of the Russian Federation for contributions to insurance for disability and maternity.

The maximum amount of income taken into account in all calculations, except for that made in connection with an industrial injury, for each year is limited to the amount with which the Social Insurance Fund was required to pay contributions for disability and maternity insurance. For 2021, we will be interested in the following values:

- 2020 — 912,000 rub. (Resolution of the Government of the Russian Federation dated November 6, 2019 No. 1407);

- 2019 — RUB 865,000. (Resolution of the Government of the Russian Federation dated November 28, 2018 No. 1426).

Knowing the value of the maximum income makes it possible to determine the amount above which the SDZ cannot be used to calculate sick leave issued not in connection with a work-related injury. For 2021 it will be:

(865,000 + 912,000) / 730 = 2434.25 rubles.

The number of days for the billing period in this formula is always equal to 730, even if we are talking about vacation according to the BiR (Clause 3.3 of Article 14 of Law No. 255-FZ).

The income subject to “unfortunate” contributions is not limited. But the maximum possible amount is also established for benefits accrued in the event of a work injury. True, it is defined differently: as four times the maximum monthly insurance payment (Clause 2, Article 9 of Law No. 125-FZ). The value of the latter from 02/01/2021 is 83,502.90 rubles, and its fourfold value is 334,011.59 rubles. (in 2021 it was 79,602.38 rubles and 318,409.52 rubles, respectively).

Sources of payment for sick leave

The following persons have the right to receive benefits for the period of incapacity:

- Employees of legal entities and individual entrepreneurs hired under open-ended employment contracts.

- Persons hired by an employer under fixed-term or part-time contracts.

- Persons who voluntarily make contributions to the Social Insurance Fund.

The sources of payments are funds from the employer and the social insurance fund. The number of days paid from the employer's income depends on the reason for issuing the ballot.

What is the minimum amount of sick leave and what minimum wage do you need to take for it?

There is also a limitation for the minimum amount of SDZ involved in calculating benefits. Regardless of the cause of disability, it is calculated from the same value - from the federal minimum wage valid on the date of opening of sick leave (clause 1.1 of Article 14 of Law No. 255-FZ).

In what situations is the minimum wage used to calculate sick leave in 2021? They focus on it when (clause 6 of article 7, article 8, clause 3 of article 11, clause 1.1 of article 14 of law No. 255-FZ):

- the employee’s total work experience is short (less than six months);

- there is no income in the billing period or the calculation from it gives a benefit amount that is less than that calculated from the minimum wage;

- illness or injury caused by intoxication;

- while on sick leave, the regime prescribed by the doctor is violated.

The federal minimum wage for calculating sick leave in 2021 from 01/01/2021 is equal to 12,792 rubles. (Article 1 of the Law “On the Minimum Wage” dated June 19, 2000 No. 82-FZ).

We described in detail how to calculate sick leave from the minimum wage in this article.

In regions with a regional coefficient of wages, the minimum wage in the calculation should be applied taking into account this coefficient (Clause 6, Article 7 of Law No. 255-FZ).

Limitation on paid sick time

In terms of the terms limiting the period subject to payment, all four of the above types of disability have significant differences. Sick leave for an industrial injury will be paid in full, regardless of the duration (Clause 1, Article 9 of Law No. 125-FZ). And for the other three types of disability, despite the clause contained in Law No. 255-FZ (Clause 1, Article 6) that all days of sick leave are subject to payment, there are restrictions:

- For regular sick leave, they are established (clauses 2–4 of Article 6): for follow-up treatment at a resort (24 calendar days);

- for persons who have received disability (4 months in a row or 5 months in total in a calendar year), except for those ill with tuberculosis (the period is not limited here);

- employees registered under a fixed-term employment agreement (75 calendar days), except for those sick with tuberculosis.

- if the child is under 7 years old, then wherever he is treated, the entire period will be paid, but not more than 60 (for certain diseases - 90) calendar days per year;

Read more about the time limits for regular sick leave and sick leave for long-term care here.

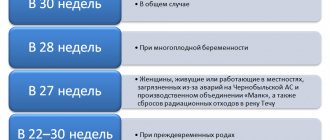

- The number of days of sick leave issued in connection with BiR is established by law and depends on the number of children being carried and the presence of complications during childbirth (clause 1 of Article 10): With one child and no complications, 70 calendar days are given before and after childbirth. Complications add another 16 days to the second part.

- Multiple pregnancy increases these periods to 84 and 110 calendar days.

- If a child is adopted as an infant (up to 3 months old), then the woman will receive only the second part of such sick leave, but based on the same number of days (70 or 110).

- Residence of a pregnant woman in areas of radioactive contamination increases the first part of the leave to 90 days (Clause 6, Article 18 of the Law “On Social Protection...” dated May 15, 1991 No. 1244-I).

If a woman who has received sick leave under the BiR continues to work, then the paid period of incapacity for work for her will be reduced to the number of days of actual use of such sick leave.

For information about who has the right to benefits under the BiR, read the article “When is sick leave given for pregnancy and childbirth?”

How to apply for sick leave

The certificate of incapacity for work confirms that the person was absent from the workplace for a valid reason.

Based on sick leave, the employer accrues benefits for temporary disability or pregnancy and childbirth. Sick leave certificates are issued by medical institutions that have the appropriate license.

The ballot can be issued in one of two ways:

- On paper.

- Electronically (with the written consent of the insured person, that is, the employee).

When filling out a sick leave certificate on paper, you must follow the rules set out in the Issuance Procedure, approved by Order of the Ministry of Health dated September 1, 2020 No. 925n (hereinafter referred to as Procedure No. 925n). All letters must be capitalized and printed, the pen must be gel, capillary or fountain pen, the ink must be black, etc.

Doctors create an electronic certificate of incapacity for work (ELN) in the unified integrated information system “Social Insurance” online. The person is given not the ballot itself, but a coupon with an ELN number, without a signature or seal.

Next, the employee informs the employer of this number, the accountant finds the electronic newsletter in the system and pays for it.

Work with electronic sick leave according to new rules

IMPORTANT. To work with electronic electronic signature, an organization must complete the following steps: enter into an appropriate agreement with the regional office of the Social Insurance Fund, purchase an enhanced qualified electronic signature and install the necessary software. This is a right, not an obligation of the company. If management refuses to take these actions, there will be no fine. In this case, the medical institution is obliged to cancel the electronic newsletter and replace it with a paper one.

Receive an enhanced qualified electronic signature certificate in an hour

Coefficients used when calculating sick leave (by length of service and others)

The procedure for calculating sick leave in 2021 still requires the use of reduction factors in the calculation. However, they will be valid only for ordinary and sick leave issued in connection with the departure. Such coefficients do not apply to benefits for work-related injuries and employment and economics (Clause 1, Article 9 of Law No. 125-FZ, Clause 1, Article 11 of Law No. 255-FZ). The only mandatory form of reducing payments for accounting and labor is to calculate it from the minimum wage if the pregnant woman’s total work experience has not reached six months (Clause 3, Article 11 of Law No. 255-FZ).

Reducing factors are primarily related to the length of the employee’s insurance coverage. Their values applied to the amount of SDZ are as follows (Clause 1, Article 7 of Law No. 255-FZ):

- 0.6 - with less than 5 years of experience;

- 0.8 - with experience from 5 to 8 years;

- 1.0 - with over 8 years of experience.

The first of the coefficients (0.6) also applies when calculating benefits to a resigned employee who falls ill within 30 calendar days after dismissal (Clause 2, Article 7 of Law No. 255-FZ).

The duration of the insurance period when calculating sick leave in 2021, taken into account with the above values of the coefficients, also plays a role in calculating benefits for the care of children receiving treatment in a hospital, and for other family members treated on an outpatient basis (clauses 3, 4 of Article 7 of the law No. 255-FZ). A special procedure for reducing accruals applies when calculating benefits for caring for a child undergoing outpatient treatment. Here, for the first 10 calendar days of illness, accruals are made taking into account generally established coefficients for length of service, and subsequent days are paid at the rate of half the amount of SDZ (subclause 1, clause 3, article 7 of Law No. 255-FZ).

How to calculate sick leave in 2021: examples

Let's look at examples of calculating sick leave in 2021.

Let’s assume that Semenova E. A. is an employee of Gamma LLC, has been working there since 2021, and this place of work is her first, i.e. for regular sick leave and sick leave for care, a reduction factor of 0.6 will be applied to SDZ . The regional coefficient does not apply in the region.

For sick leave issued by E. A. Semenova in 2021, the billing period will be 2021 and 2021. Income for 2021 amounted to 380,000 rubles, and for 2020 - 370,000 rubles. In 2021, she was on sick leave for 10 days, and payments for it in the total amount of income amount to 10,000 rubles. Total income is:

380,000 + 370,000 = 750,000 rub.

However, the SDZ calculation will take into account a smaller amount (minus sick leave payments that occurred in 2021):

750,000 – 10,000 = 740,000 rub.

We have already calculated the maximum possible SDZ, calculated from the 2019 and 2021 income limits limiting the calculation of insurance premiums. It is equal to 2434.25 rubles.

The minimum SDZ, calculated from the minimum wage, is 12,792 × 24 / 730 = 420.56 rubles.

Example 1

In February 2021, Semenova E.A. fell ill and went on sick leave for 12 days.

SDZ for calculating benefits will be determined as:

740,000 / 730 = 1,013.70 rubles.

This amount is less than the maximum possible SDZ value and more than that calculated from the minimum wage, i.e. it must be taken into account.

The benefit amount will be equal to:

1,013.70 × 0.6 × 12 = 6,690.42 rubles.

Example 2

In March 2021, Semenova E. A. received a work injury and was on sick leave for 12 days because of it.

The SDZ here will also be equal to 1,013.70 rubles, but the reduction factor will not be applied to it (based on length of service), i.e. the amount of the benefit will be:

1,013.70 × 12 = 12,164.40 rubles.

This amount will not exceed the maximum established for injury benefits in 2021 and therefore will not be limited.

Example 3

In April 2021, Semenova E. A. took sick leave to care for a child under 7 years of age who was receiving outpatient treatment. The duration of sick leave was 12 days, and this was the first sick leave for care in 2021.

SDZ in this situation will also be 1,013.70 rubles. And the benefit amount will be made up of two values due to the fact that the sick leave period will be divided into parts due to the application of different coefficients to SDZ (0.6 for the first 10 days and 0.5 for the last 2 days):

1,013.70 × 0.6 × 10 + 1,013.70 × 0.5 × 2 = 7,095.90 rub.

Example 4

In May 2021, Semenova E. A. goes on leave for labor and labor for 140 days (70 days before and 70 days after childbirth).

SDZ in this case will be calculated as follows:

740,000 / 721* = 1,026.35 rubles.

*When calculating benefits for employment and labor, calendar days for periods of temporary disability, leave for employment and child care, as well as the period of release of an employee from work with full or partial retention of earnings are excluded from the calculation (clause 3.1 of article 14 of law No. 255-FZ ). Because Semenova E.A. in 2021 there were 10 days on sick leave, then out of 731 (taking into account the fact that 2021 is a leap year), this period must be excluded. Accordingly, the amount of earnings should be divided not by 731, but by 721 days (731 - 10).

This figure will also not exceed the maximum and minimum possible SDZ values. The reduction factor based on length of service will not be applied here.

The benefit amount is:

1026.35 × 140 = 143,689.32 rubles.

Calculation of sick leave in 2021 according to the minimum wage

The exact amount of earnings cannot always be calculated based on the amount of wages. In this case, you can use the minimum wage rate. Thus, it is necessary to take into account the workload of the sick employee in terms of a full month.

It should be borne in mind that if an employee works part-time, then 50% of the minimum wage is taken into account.

The minimum income according to the minimum wage applies in the following situations:

- no official work experience (no entries in the work book);

- work experience is not enough to calculate the amount of income;

- the employee does not have earnings on the date of issue of the document or the amount of wages is below the permissible rate (in terms of a full working month);

- On the day of illness, the employee has a record in his work book about full-time study at an educational institution (he has been working in the organization for less than 6 months).

To calculate the minimum wage, use the following formula:

Minimum earnings = minimum wage x 24 / 730, where:

Minimum wage is the minimum rate taking into account all regional coefficients and allowances on the date of issue of the sheet. From January 1, 2021 - 6,204 rubles, from July 1, 2021 - 7,500 rubles. As of January 1, 2017, the minimum wage remained the same - 7,500 rubles, from July 1, 2021 - 7,800 rubles. From January 1, 2021, the minimum wage is 9,489 rubles. From January 1, 2021, the minimum wage has been increased to 11,280 rubles. The minimum wage in 2021 will be 12,130 rubles.

- 24 - number of months in the period;

- 730 is the number of days in the period (731 for a leap year).

Results

Calculation of sick leave in 2021 is still done according to a formula that prescribes the amount of benefits to be determined by multiplying the SDZ calculated for the billing period by the number of days of sick leave. SDZ values must be within its maximum and minimum possible values. Reducing factors may be applied to the calculated amount of SDZ in the case of regular sick leave and sick leave for care.

Sources:

- Federal Law of December 29, 2006 No. 255-FZ

- Federal Law of July 24, 1998 No. 125-FZ

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation dated January 24, 2019 No. 32

- Decree of the Government of the Russian Federation of November 28, 2018 No. 1426

- Decree of the Government of the Russian Federation of November 15, 2017 No. 1378

- Decree of the Government of the Russian Federation of June 15, 2007 No. 375

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.